unit 3: national income and price determination

1/28

Earn XP

Description and Tags

Bruh

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

29 Terms

RGDP and unemployment

higher levels of RGDP → unemployment ↓

lower levels of RGDP → unemployment ↑

aggregate demand

demand for all g/s in economy

point on curve: RGDP for given PL

inverse relationship

wealth effect, interest rate effect, Xn effect

wealth effect

when PL ↑, wealth buys fewer g/s → RGDP ↓

when PL ↓, wealth buy more g/s → RGDP ↑

interest rate effect

at higher PL, nominal interest rates ↑ → investment ↓

at lower PL, nominal interest rates ↓ → investment ↑

net exports effect

at higher PL, foreign consumers purchase less of US goods → Xn ↓

at lower PL, foreign consumers purchase more of US goods → Xn ↑

shift of AD

caused by change in components of GDP

C+I+G+Xn

disposable income

$ that consumers have available to spend on g/s

personal income - taxes = DI

spending’s + savings = DI

either spend or save

MPC

marginal propensity (tendency) to consume

∆ consumption / ∆ disposable income

MPC + MPS = 1

MPS

marginal propensity (tendency) to save

∆ savings / ∆ disposable income

MPC + MPS = 1

spending multiplier

1 / MPS

initial change * multiplier = total change in GDP

tax multiplier

-MPC / MPS

| tax multiplier | = spending multiplier - 1

1 less bc impact of tax on economy is indirect

use tax multiplier with transfer payments

short-run aggregate supply

supply for all g/s in economy

direct relationship

wages and prices do not change quickly in response to changes in PL (sticky)

SRAS shifters (supply shocks)

resource prices (wages)

productivity (capital stock)

future inflation expectations

resource prices

decrease wages → ↑ SRAS

increase wages → ↓ SRAS

productivity

increase productivity → ↑ SRAS

decrease productivity→ ↓ SRAS

inflation expectations

lower prices: businesses lower prices (due to less profit expectations), workers lower wage expectations

higher prices: businesses increase prices, workers demand higher wages

long run aggregate supply

vertical at full employment output

wages flexible in long run

RGDP = YF

short-run equliibrium

at intersection of AD and SRAS

RGDP = Y1

PL * RGDP = nominal GDP

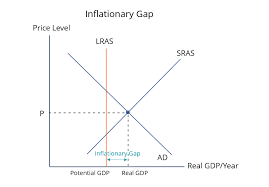

inflationary gap

current output > long-run full employment output

unhealthy: operating above full employment, overworking

recessionary gap

current output < long-run full employment output

unhealthy: high unemployment > natural rate

long-run equilibrium

current output = long run full employment output

unemployment = natural rate

cyclical unemployment = 0

long-run self adjustment

no gov. action

recessionary gap

lower prices: businesses lower prices (due to less profit expectations), workers lower wage expectations

inflationary gap

higher prices: businesses increase prices, workers demand higher wages

fiscal policy

gov tools used to combat inflation / unemployment

change in taxes and gov spending

fiscal policy - taxes

increase taxes → decrease disposable income → decrease consumer spending

fiscal policy - gov spending

gov purchases

transfer payments

increase → increase consumer spending, decrease → decrease consumer spending

expansionary fiscal policy

fight unemployment

increase gov spending/decrease taxes

contractionary fiscal policy

fight inflation

decrease gov spending / increase taxes

automatic stabilizers

limit fluctuations of business cycle

taxes

increase during expansions

decrease during contractions

transfer payments

decrease during expansions

increase during contractions