AP Macroeconomics Unit 3

1/48

Earn XP

Description and Tags

Just some useful notes for the AP Macro...

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

49 Terms

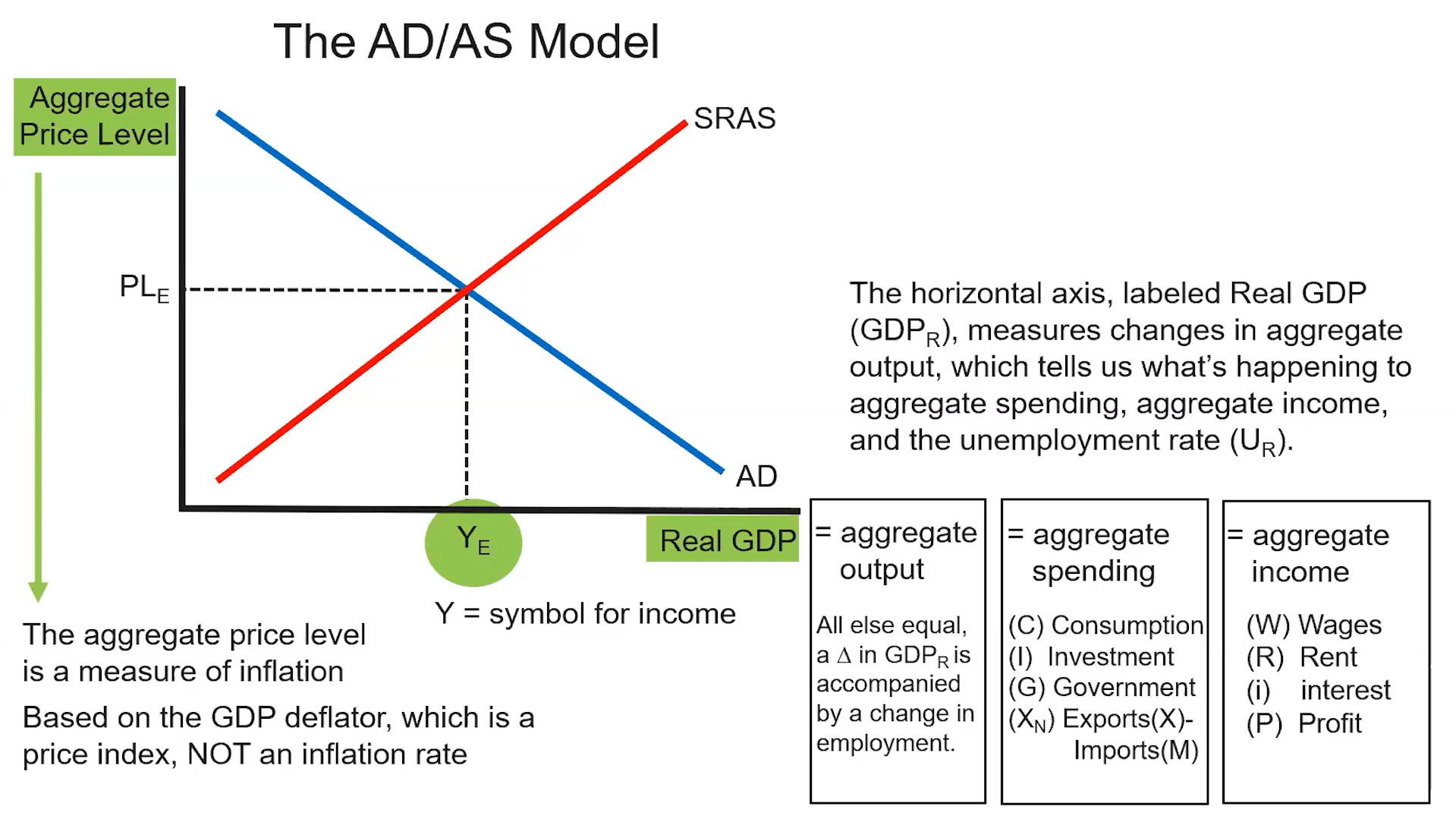

(3.1) What is aggregate demand (=aggregate spending/expenditures)?

Sum of demand for all goods and services in an economy by C, I, G and Xn

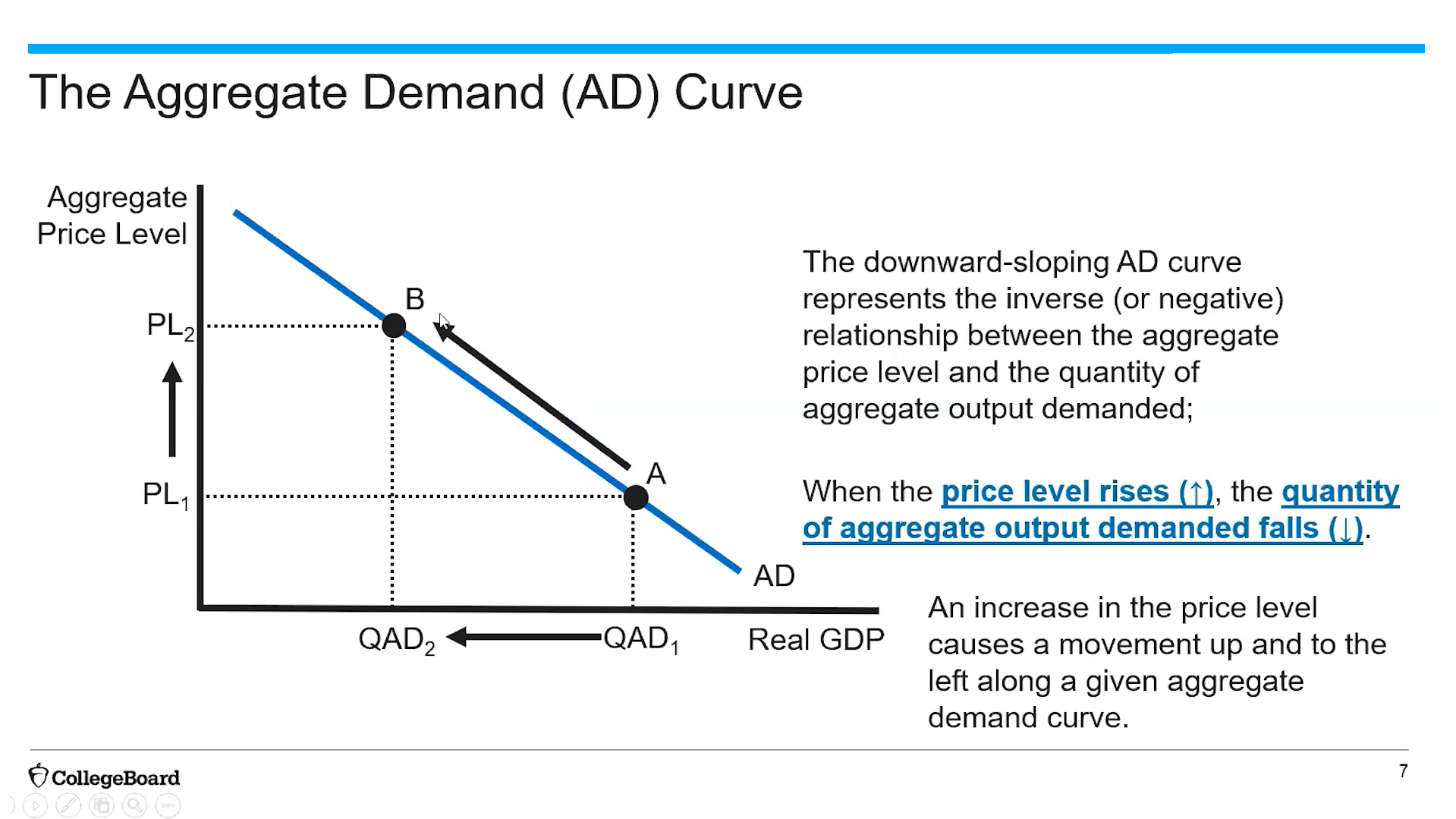

(3.1) What is the downward-sloping aggregate demand curve used to depict?

It is used to depict the inverse relationship between the quantity of aggregate output demanded and the aggregate price level; PL↑QAD↓.

(3.1) Identity of Real GDP

Real GDP = aggregate demand = aggregate spending (C, I, G, Xn)

(3.1) AD/AS Model?

(3.1) AD Curve?

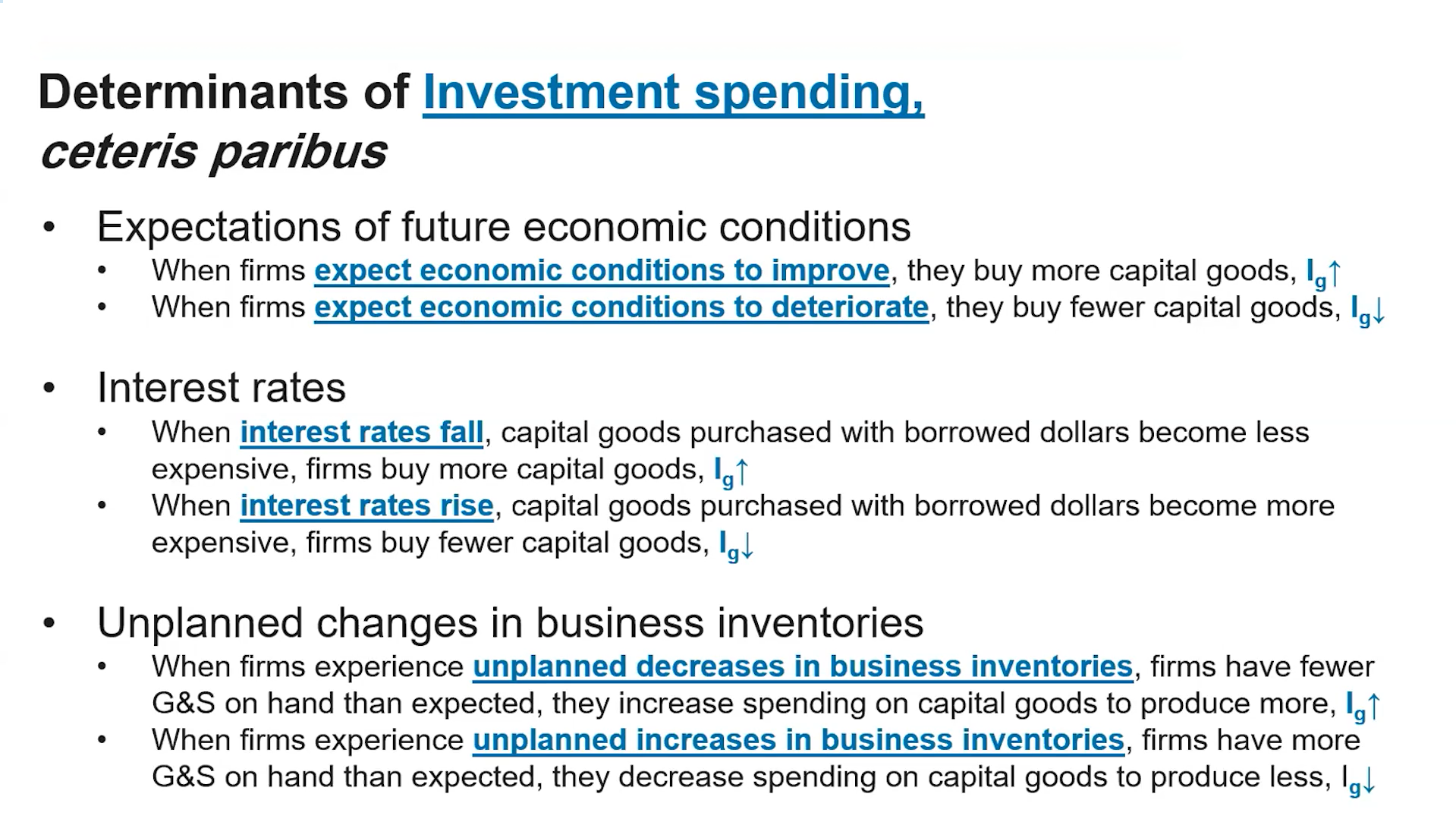

(3.1) What is included in investment spending (Ig)?

Expectations of economic conditions, interest rates, unplanned changes in business inventories.

(3.1) Reasons for the downward slope of AD curve?

Real Wealth Effect (Price Level↑ Purchasing Power↓ QAD↓ And Vice Versa)

Interest Rate Effect (Price Level↑ Money Demanded due to people’s need to purchase goods↑ interest rate↑ Cost of goods with borrowed money↑ QAD↓ And Vice Versa)

Exchange Rate Effect (Price Level↑ Domestic goods becomes more expensive to foerign purchasers, leading to decrease in quantity of agg. output demanded - QAD↓)

(3.1) Determinants of Consumption

Wealth (that which is owned) (positive)

Income (that which is earned) (positive)

Income Taxes (inverse)

Expectations of economic conditions (positive)

(3.1) What are interest-sensitive components of consumption?

Consumer goods and services paid for with borrowed dollars

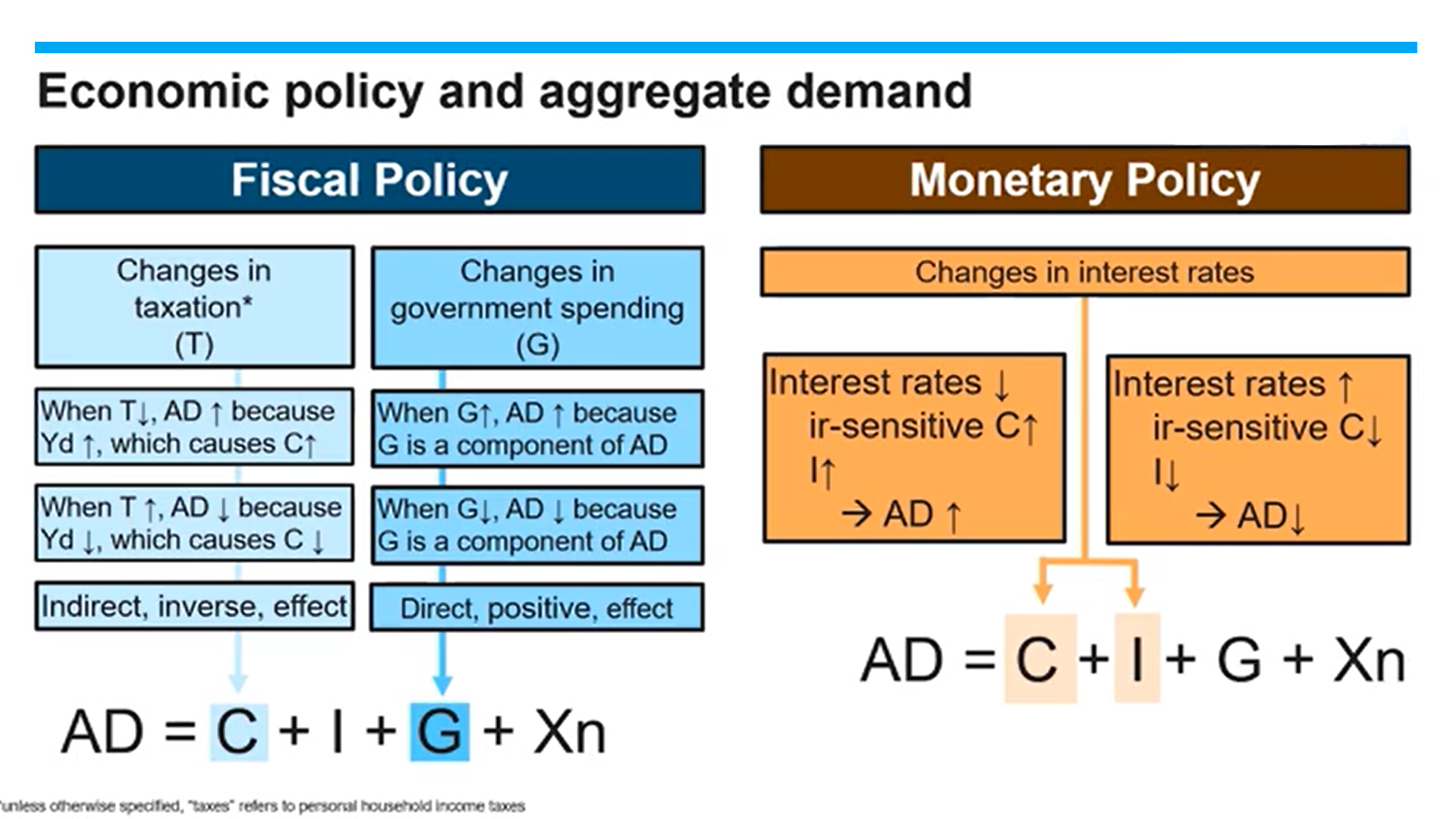

(3.1) Economic Policy and Aggregate Demand

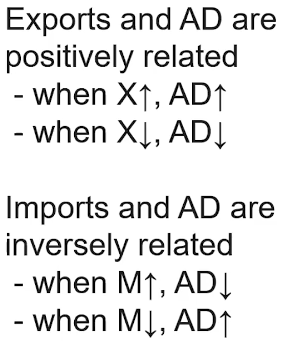

(3.1) What is the relationship between exports and aggregate demand, imports and aggregate demand, respectively?

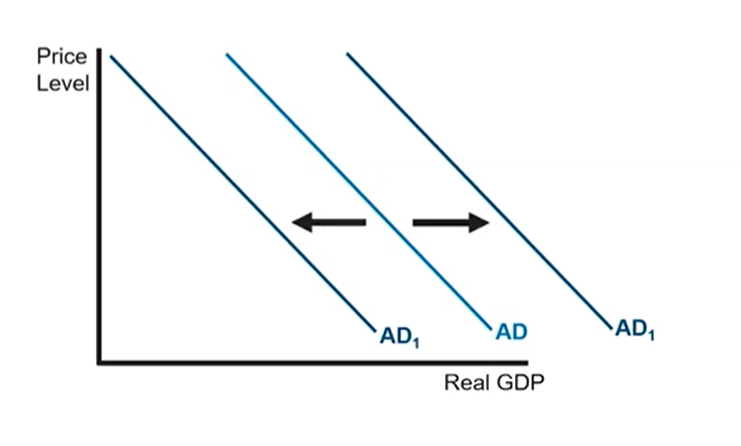

(3.1) What shifts the AD curve?

Increase in C, I, G, or X will shift it right; decrease will shift it left

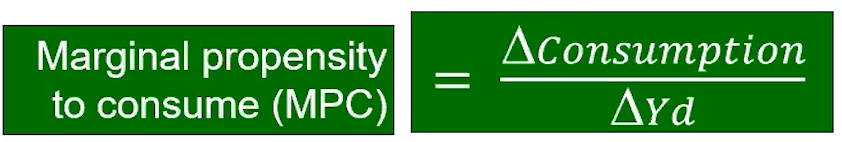

(3.2) Marginal Propensity to Consume (MPC) Formula?

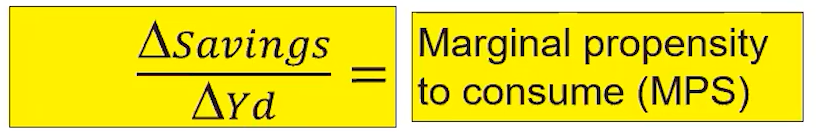

(3.2) Marginal Propensity to Save (MPS) Formula?

(3.2) What is autonomous spending?

Autonomous spending is spending that is independent of income.

(3.2) What is a function of the MPC?

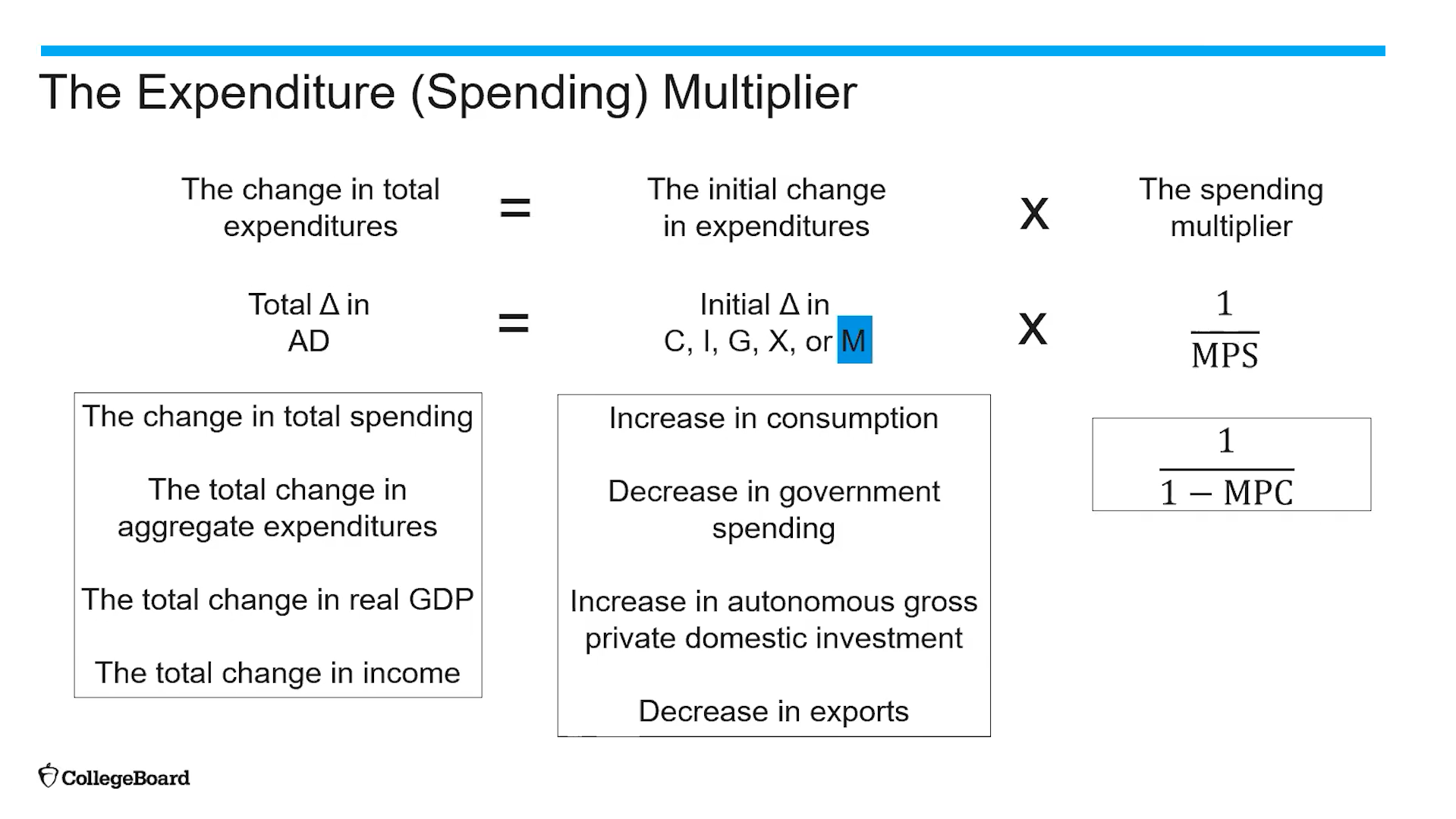

The amount by which AD changes as a result of change in autonomous expenditure is a function of the MPC

(3.2) A $1 change in autonomous expenditures leads to…

A $1 change in autonomous expenditures leads to a total change in AD greater than $1 because one person’s spending is another person’s income.

(3.2) MPC + MPS = ?

MPC + MPS = 1

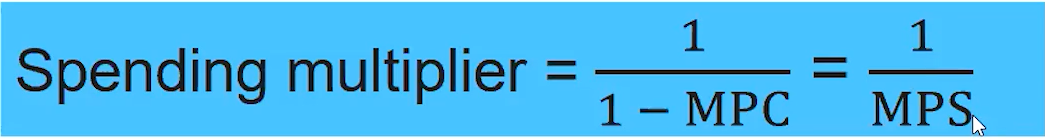

(3.2) Spending multiplier formula?

(3.2) Notes about the spending multiplier…

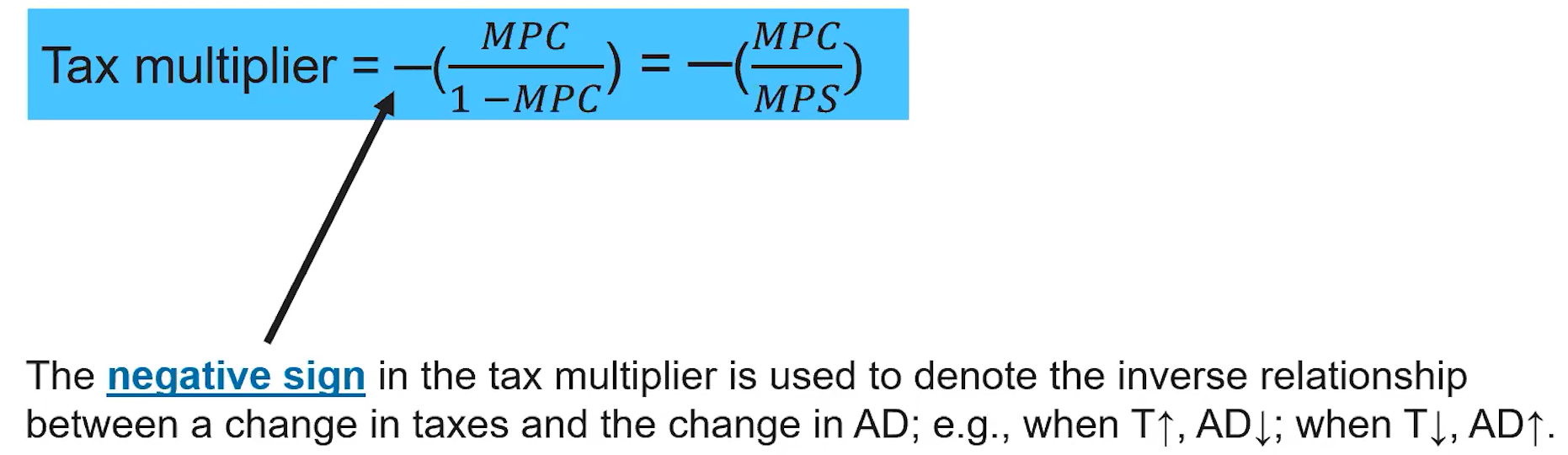

(3.2) Tax Multiplier Formula & Transfer Multiplier Formula?

Note that if its a transfer multiplier (same formula) there is no need for the negative sign as it is a positive relationship…

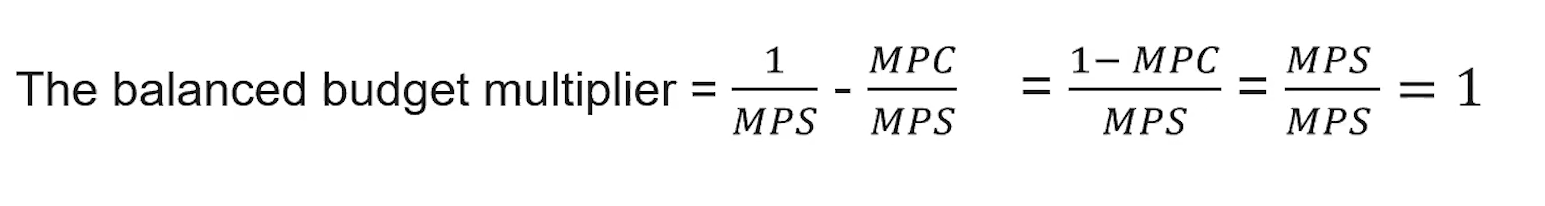

(3.2) Balanced Budget Multiplier Formula

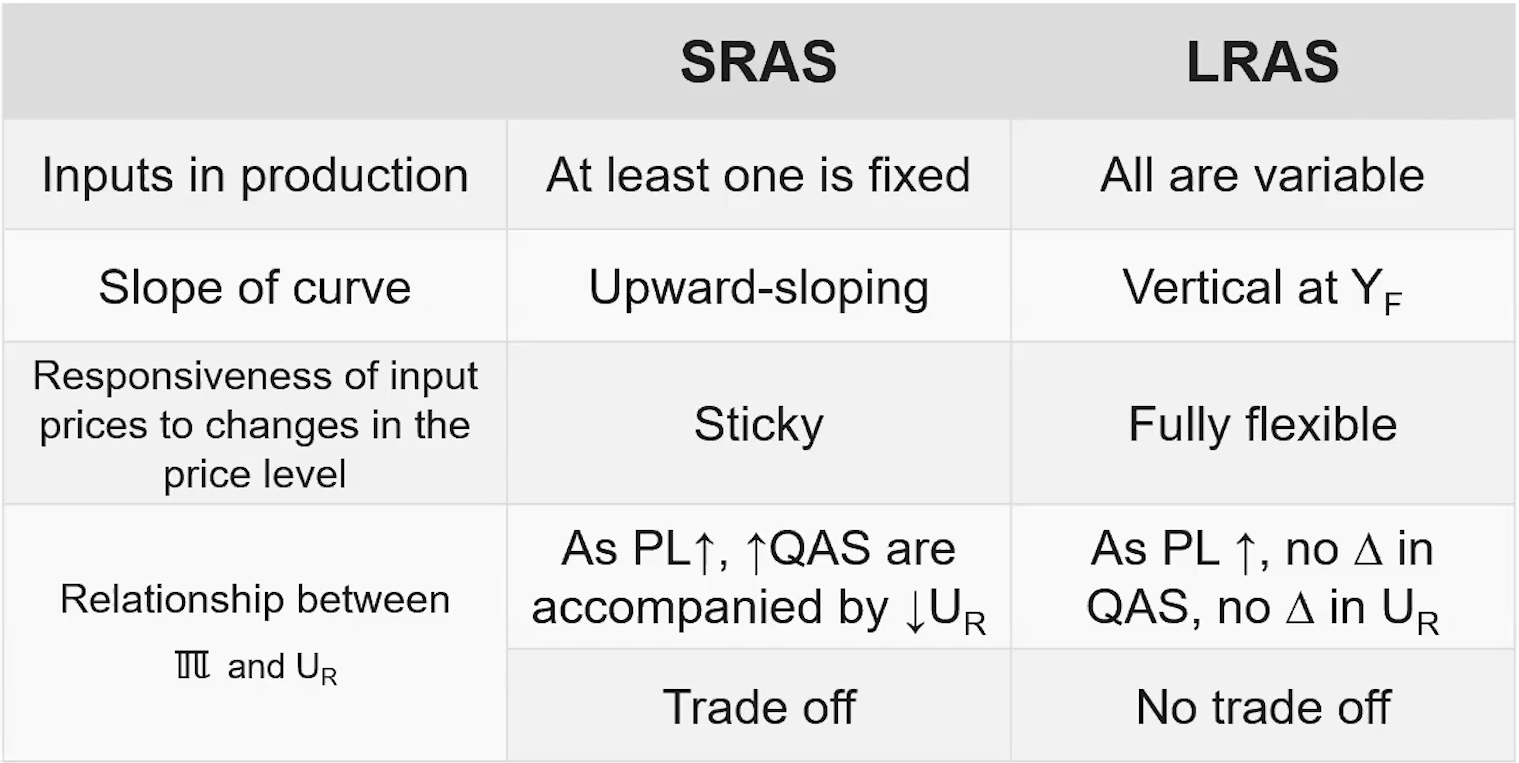

(3.3) What is meant by sticky input prices and the short run?

The short run is however long it takes for input prices to catch up with changes in the price level. When wages and input prices lag behind price level changes, input prices are referred to as sticky.

(3.3) Relationship between price level and aggregate output supplied? Why?

Positive Relationship. Since wages are sticky in the short run, decrease in prices level results in lower profits for firms, incentivizing them to produce less; and vice versa.

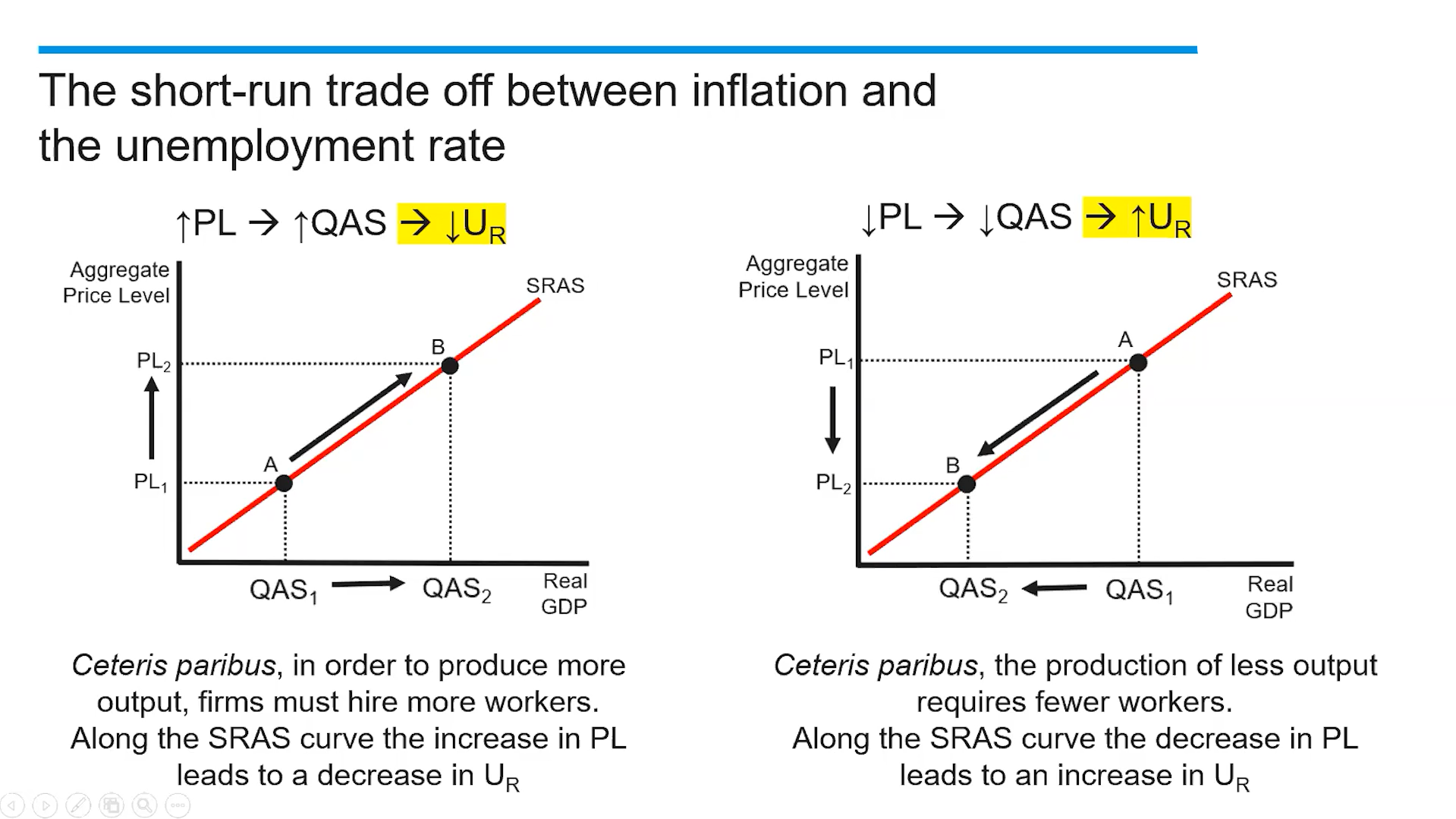

(3.3) The short-run trade off between inflation and unemployment rate?

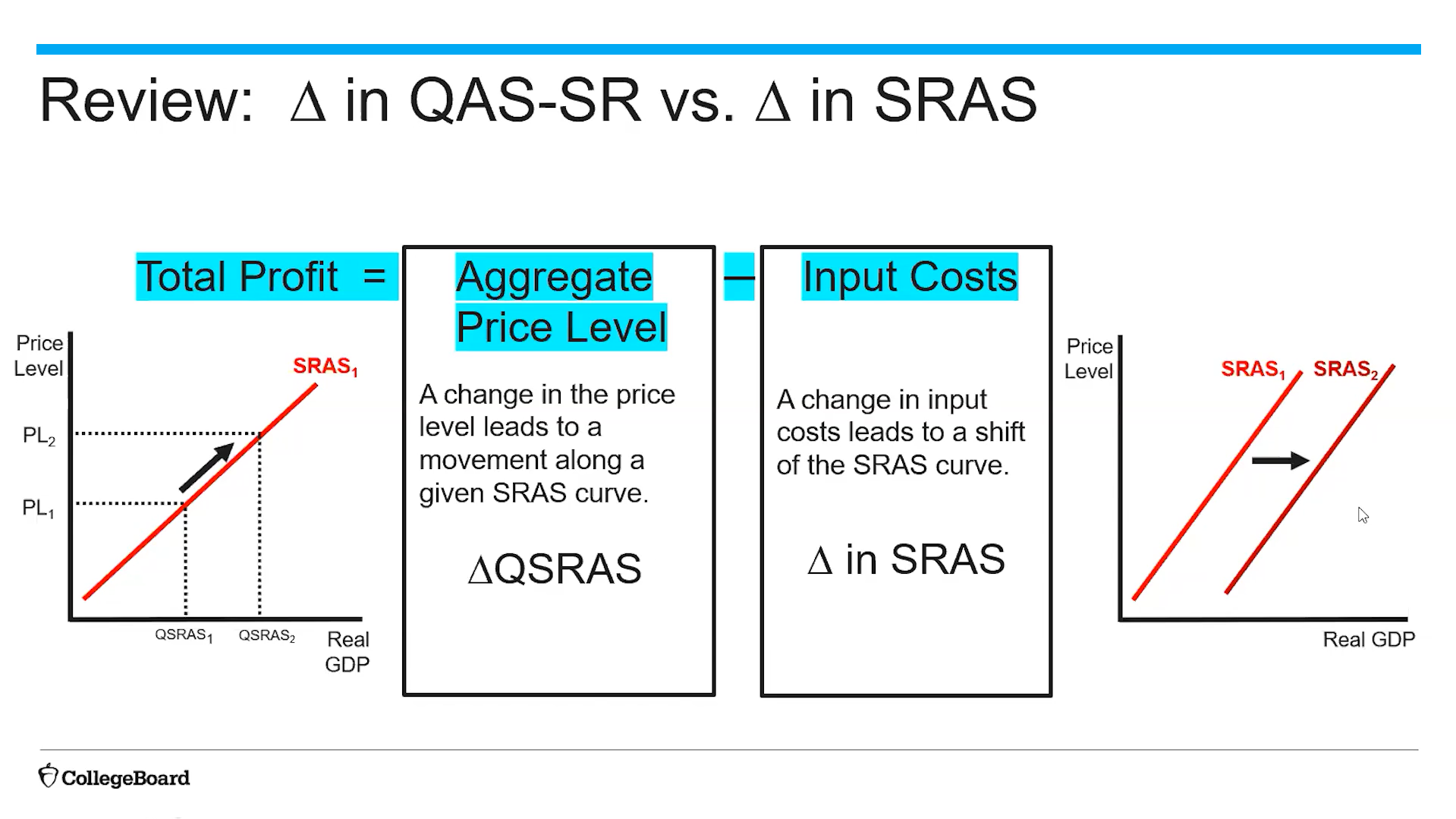

(3.3) Total Profit Formula

Total Profit = Aggregate Price Level - Input Costs

(3.3) Change in QAS-SR vs. Change in SRAS

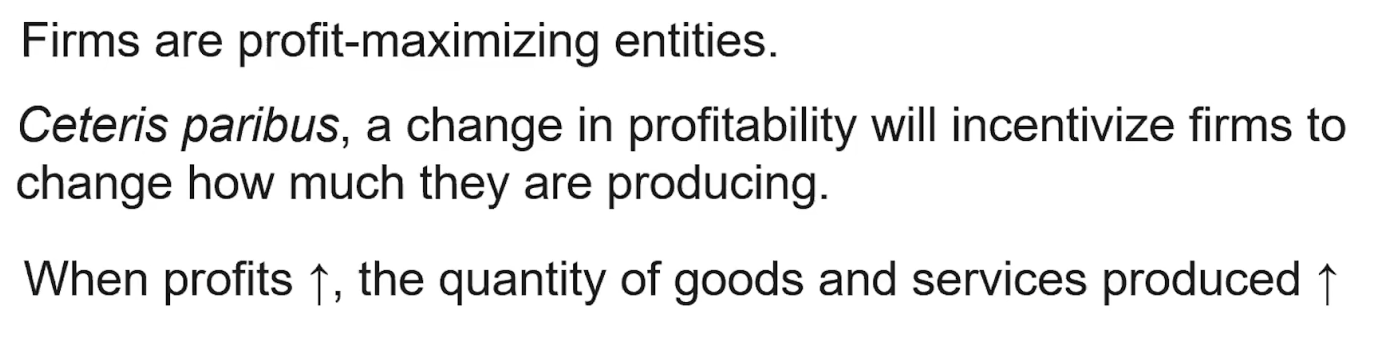

(3.4) Relationship between profitability and supply?

(3.4) Determinants of Short-Run Aggregate Supply (SRAS)?

Anything making it cheaper or easier to produce goods/services will increase SRAS

Input Costs (wage, commodity prices)

Productivity/Destruction of Resources (tech advances, natural disasters)

Government Policy (deregulation, subsidies, increased regulation, business taxes, taxes on production)

Inflationary Expectations

(3.3) Wages vs Income

(3.3) Note that you make sure you can distinguish determinants of AD and determinants of SRAS

Make sure you can distinguish determinants of AD and determinants of SRAS

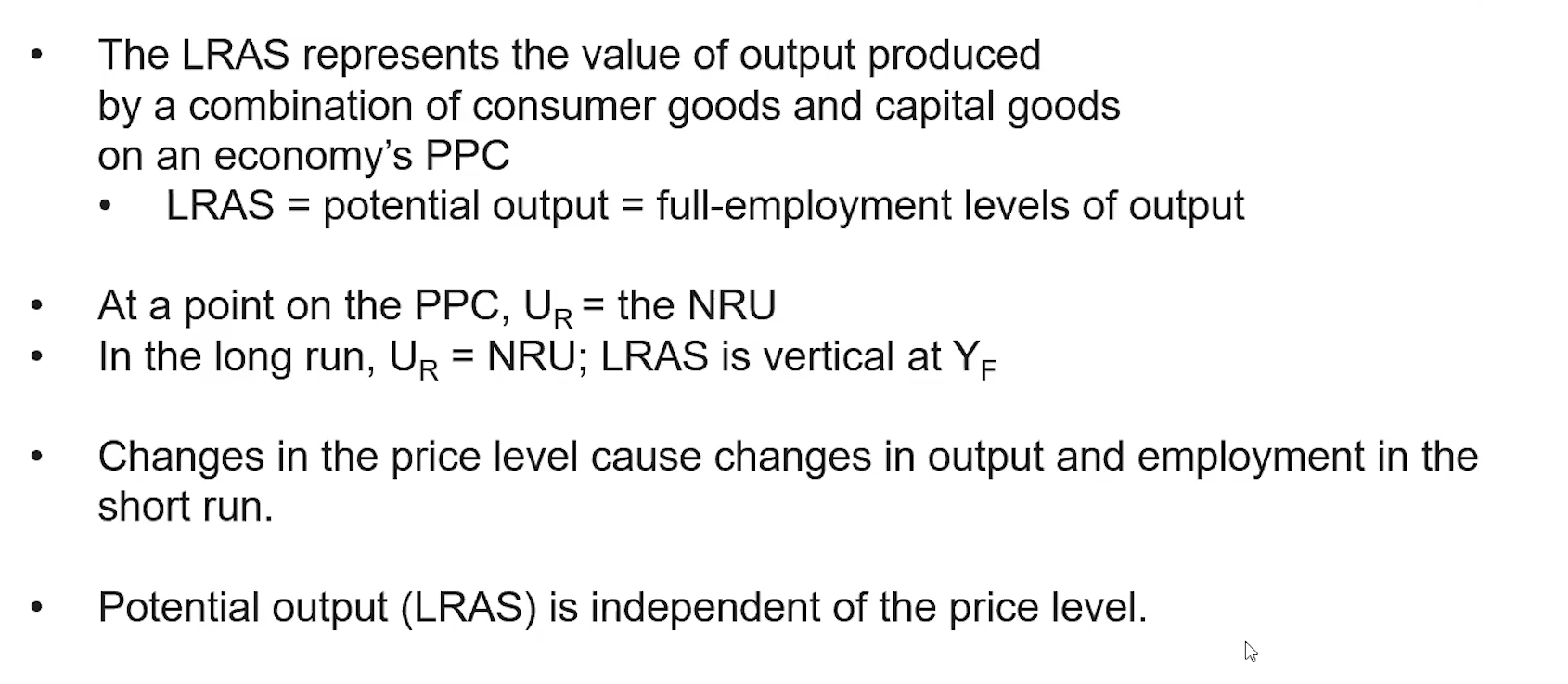

(3.4) SRAS vs LRAS.

(3.4) LRAS & the PPC

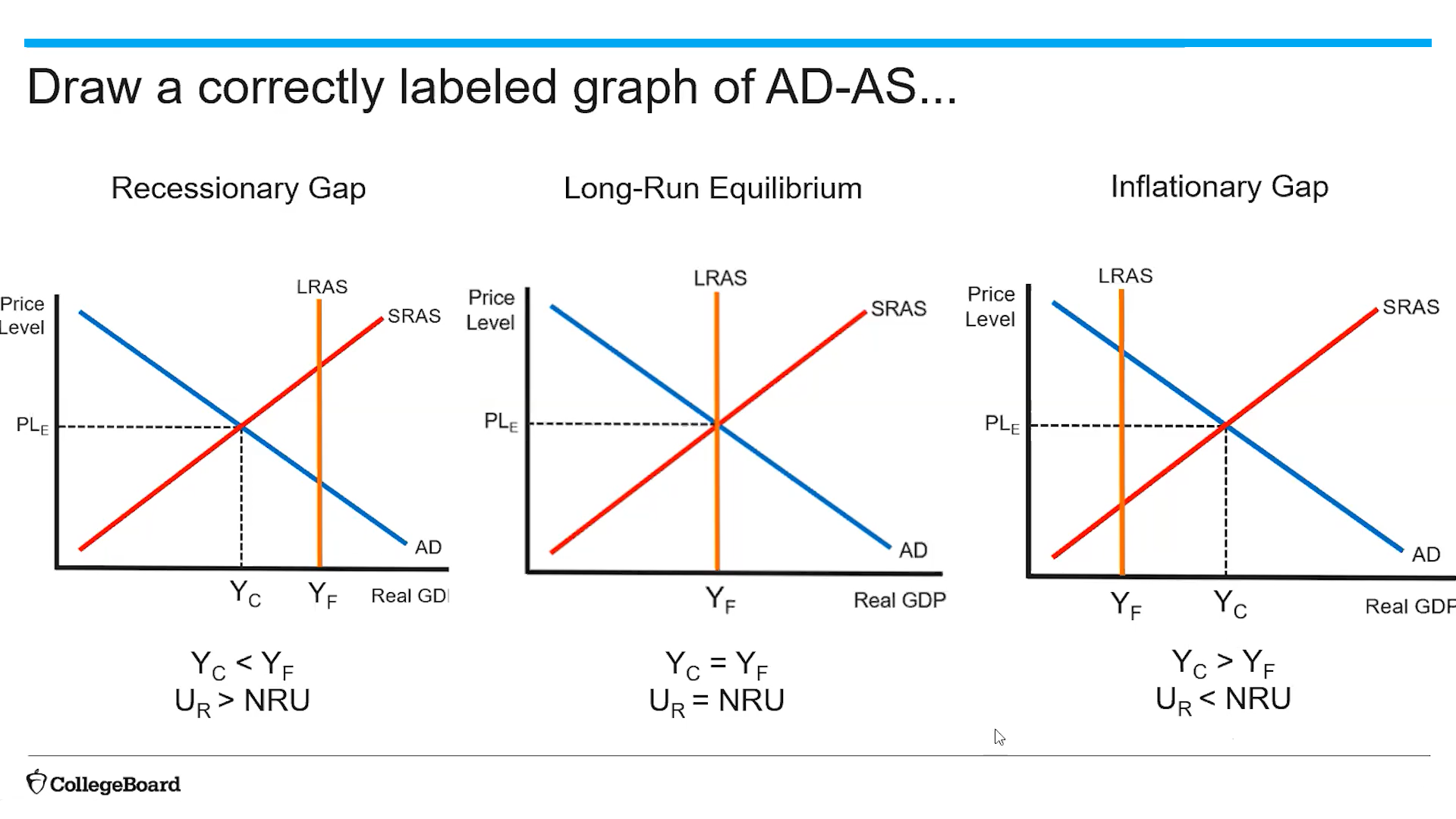

(3.5) What does a correctly labelled AD-AS model include

Axes

Curves (downward sloping AD & upward sloping SRAS)

Equilibrium points (equilibrium price level & equilibrium GDP)

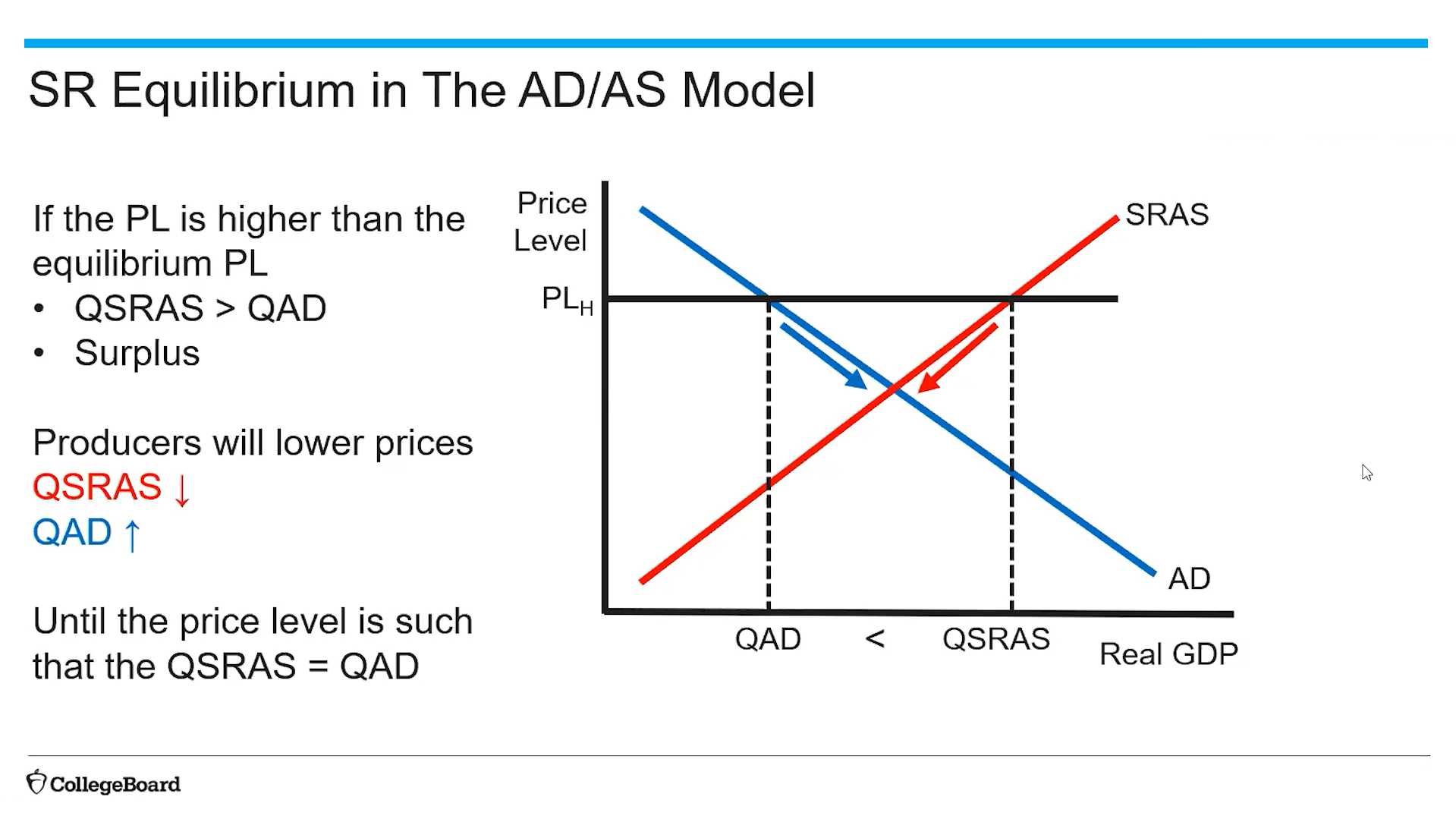

(3.5) Graph of when PL is higher than equilibrium price.

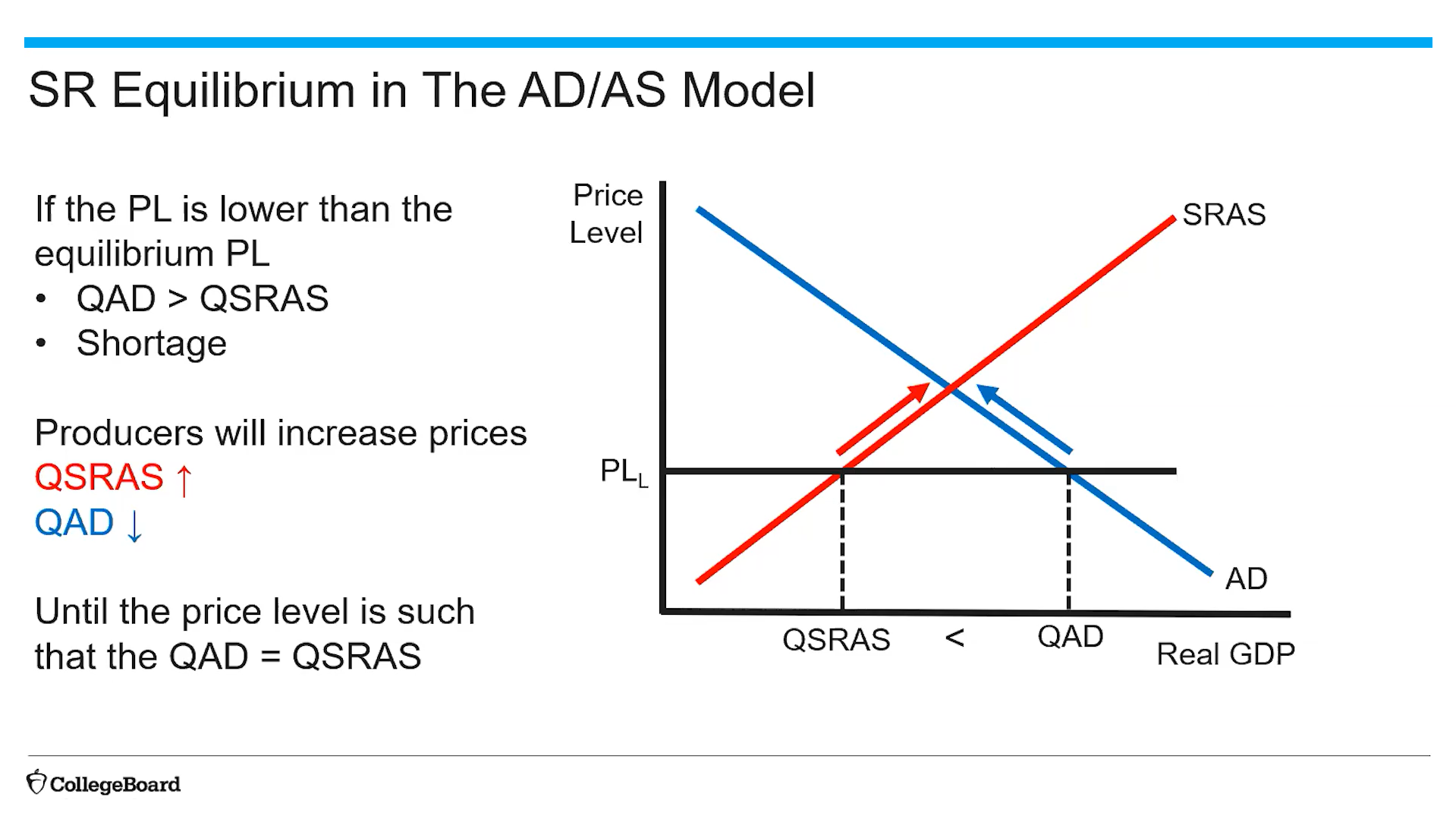

(3.5) Graph of when PL is lower than equilibrium price.

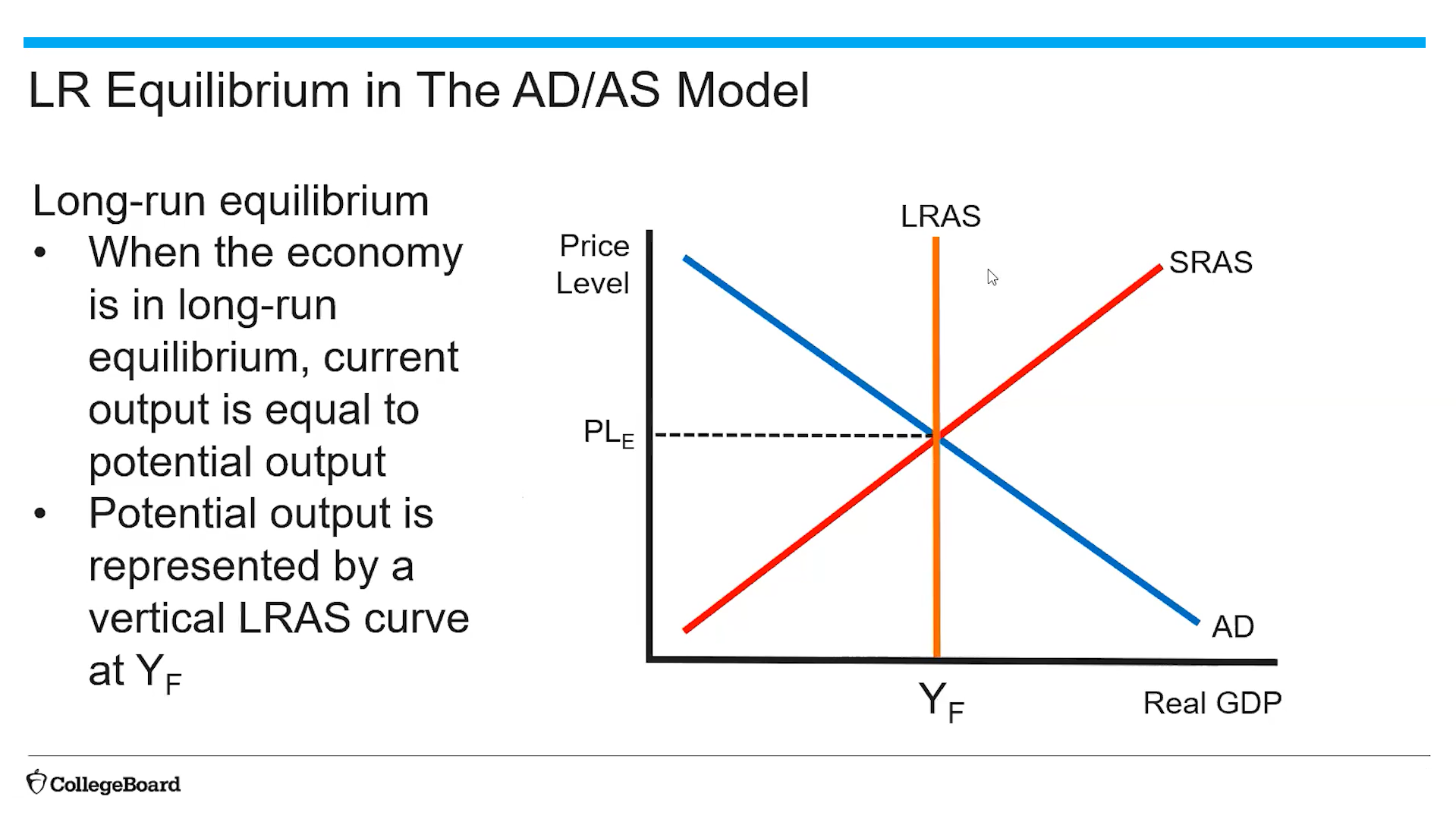

(3.5) Graph of LRAS in the AD-AS model.

(3.5) Recessionary & Inflationary Gaps?

Recessionary gap is when YC (Current Output) < YF (Potential Output)

Inflationary gap is when YC (Current Output) > YF (Potential Output)

(3.5) Key Graph to memorize: recessionary, inflationary, long run equilibrium.

(3.6) What questions should be asked when analysing and graphing economic shocks?

Which curve will this impact?

Which direction will AD shift?

What will be the result on inflation and unemployment?

(3.6) What is demand-pull and cost-push inflation

Demand-pull inflation is inflation caused by an increase in AD

Cost-push inflation (aka stagflation) is inflation caused by a decrease in SRAS

(3.7) What shifts the LRAS and PPC Curve

The LRAS and PPC only shift with changes in land, labor, capital and technology.

(3.7) What is long-run self adjustment?

With long-run self-adjustment, business and workers will adjust their price and wage expectations to bring the economy back into equilibrium.

Language surrounding this: long run self adjustment, no policy action taken, automatically adjust.

(3.7) Long-run self adjustment in a recessionary gap

When the economy is in a recessionary gap, long-run self-adjustment will occur as both prices and wages decrease, leading to an increase in SRAS. Also inflation and unemployment would decrease.

(3.7) Long-run self adjustment in a inflationary gap

When the economy is in an inflationary gap, long-run self-adjustment will occur as both prices and wages increase, leading to an decrease in SRAS. Also inflation and unemployment would increase.

(3.8) Fiscal Policy

(3.8) Relationship of the magnitude of change of aggregate demand in government spending versus taxes

Magnitude of change of aggregate demand as a result of change in government spending is greater than that of a change in taxes. Can be explained mathematically by calculating spending and tax multiplier respectively.

(3.9) What are automatic stabilisers

Policies that are already due to previous legislature: taxes, unemployment insurance, and temporary assistance. They are not discretionary fiscal policy but behave as expansionary fiscal policy during recessions and contractionary fiscal policy during periods of rapid growth.

(3.9) How are transfer payments used in recession?

Transfer payments (Government payments that assist those in need) provide more disposable income, thus increasing aggregate demand.