AP MACRO UNIT 3

1/32

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

33 Terms

Aggregate Demand (Curve)

The total demand for all goods and services in a particular market.

Real Wealth Effect

When people feel wealthier, they spend more money, which increases the flow of money in the economy

Higher price levels reduce the purchasing power of money. This decreases the quantity of expenditures

Lower price levels increase purchasing power and increase expenditures

Interest Rate Effect

When the price level increases, lenders need to charge higher interest rates to get a REAL return on their loans

Higher interest rates discourage consumer spending and business investment

Foreign Trade Effect

When US price level rises, foreign buyers purchase fewer US goods and Americans buy more foreign goods

Exports fall and imports rise causing real GDP demanded to fall (Xn Decreases)

Example: If prices triple in the US, Canada will no longer buy US goods causing quantity demanded of US products to fall.

So…price level goes up, GDP demanded goes down

the multiplier effect

shows how much spending is magnified in the economy

Expenditure Multiplier

Ratio of change in money (1/MPS)

Tax Multipier

(MPC)/1-(MPC)

Marginal propensity to consume (MPC)

Proportion of disposable income that is spent versus being saved (DI = MPS - MPC)

Marginal propensity to save (MPS)

Proportion of disposable income that is saved versus being spent (DI = MPS - MPC)

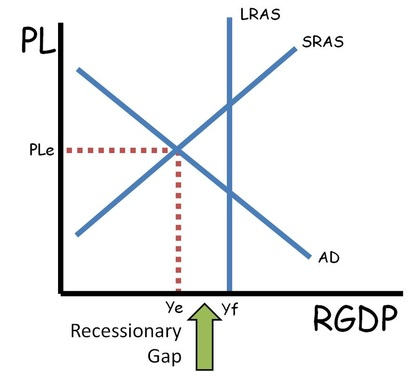

Short Run Aggregate Supply (SRAS)

Relationship between the Aggregate supply and the Aggregate demand, often falls victim to shocks.

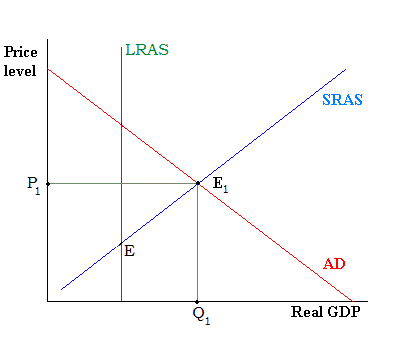

Equilibrium price level

Point where SRAS, AD, and Yf intersect, shows position in which the economy is stable and at full employment/efficiency

Equilibrium real output

Level of GDP where SRAS is equal to AD, no excess supply or demand

Sticky wages

When wages of workers stagnate and do not change with inflating economy, can make labor cheaper

Long-run Aggregate supply

represents the total output an economy can produce when all resources are fully employed, and is determined by factors like technology, labor, and capital, not by the price level.

Recessionary gap

When an economy is less than fully employed, if the base of the triangle is on the right

Output low and unemployment is more than NRU

Inflationary gap

When an economy is more than fully employed, if the base of the triangle is on the left

Output is high and unemployment is less than NRU

Positive vs. Negative Supply Shock

Sudden increases or decreases in SRAS

Demand-pull vs. Cost-push inflation

When AD shifts vs. When SRAS shifts and causes inflation

Government transfers

Payment of money by the government where no goods are expected in return (Unemployment money)

Expansionary fiscal policy

Laws that reduce unemployment and increase GDP (Close a Recessionary Gap)

Increase Government Spending

Decrease Taxes (Increasing disposable income)

Combinations of the Two

Contractionary fiscal policy

Laws that reduce inflation, decrease GDP (Close a Inflationary Gap)

Decrease Government Spending

Increase Taxes (Decreasing disposable income)

Combinations of the Two

Stagflation

inflation increases while economic growth decreases

capital stock

Machinery and tools purchased by businesses that increase their output

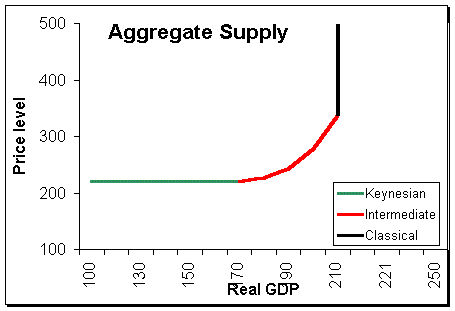

classical theory

A change in AD will not change output even in the short run because prices of resources (wages) are very flexible.

AS is vertical so AD can’t increase without causing inflation.

keynesian theory

A decrease in AD will lead to a persistent recession because prices of resources (wages) are NOT flexible.

Increase in AD during a recession doesn’t cause inflation

ranges of AS

Keynesian Range- Horizontal at low output

Intermediate Range- Upward sloping

Classical Range- Vertical at Physical Capacity

autonomous consumption

consumers will spend a certain amount no matter what, regardless of of their income

disposable income

leftover income after taxes (consumers can spend with this)

dissaving/ negative savings

If income is less than autonomous spending

fiscal policy

Actions by Congress to stabilize the economy

monetary policy

Actions by the Federal Reserve Bank to stabilize the economy

discretionary fiscal policy

Congress creates a new bill that is designed to change AD through government spending or taxation

Problem is: time lags due to bureaucracy.

Takes time for Congress to act

Ex: In a recession, Congress increase spending.

non-discretionary fiscal policy

AKA: Automatic Stabilizers

Permanent spending or taxation laws enacted to work counter cyclically to stabilize the economy

Ex: Welfare, Unemployment, Min. Wage, etc.

When there is high unemployment, unemployment benefits to citizens increase consumer spending.