2.6.2 Demand side policies

1/96

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

97 Terms

* Fiscal policies

In recent years (through the BoE) what are the 2 main monetary policy instruments has the UK government used to influence the economy?

Interest rates

Quantitive easing

What is the rate of interest?

The cost of borrowing

How does the interest rate affect the economy?

Through it’s influence on AD - the higher the interest rate, the lower the level of AD

What can the interest rate affect? (6)

Consumer durables

Housing market

Wealth effects

Saving

Investment

Exchange rate

CHEWIS

How can the interest rate affect consumer durables? (3) (Chain of analysis)

Many consumers buy consumer durables (e.g furniture, cars, etc) on credit

The higher the interest rate, the greater the monthly repayments will have to be for any given sum borrowed

Hence, high interest rates lead to lower sales of durable goods and hence lower consumption expenditure

How can the interest rate affect the housing market? (3)

Houses are typically bought using a mortgage

The lower the rate of interest, the lower the mortgage repayments on a given sum borrowed, therefore making houses more affordable

This encourages people to buy/move their house (trading for a nicer house or down-sizing)

(The housing market) What are three ways in which lowering the rate of interest can increase AD?

Leads to new houses being built as new housing is classified as investment in national income accounts. Increase investment leads to increased AD

Moving house stimulates the purchase of consumer durables, increasing consumption

Moving house may release money which can be spent. A person downsizing to a cheaper house will see a release of equity tied up in their house purchase and this may be consumed

How can interest rates affect wealth effects? (3) (Chain of analysis)

A fall in rates of interest may increase assets prices

Falling rates may lead to an increase in demand for housing, which then pushes up the price of houses. If house prices rise, all homeowner are better off because their houses have increased in value. This may encourage them to increase their spending

Raises government bonds. They’re are sold to individuals, assurance companies, pension funds and others who receive interest on the money they have loaned the government. The rises in the price of bonds will increase individuals/businesses financial wealth, which again may have a positive impact on consumer expenditure

* Higher the %IR, the greater the reward for differing spending to the future and reducing spending now

* Leads to a fall in AD at the present time

How can the rate of interest affect investment? (3) (Chain of analysis)

Lower the rate of interest, the more investment projects become more profitable, hence the higher the level of investment and AD

Equally, a rise in consumption which leads to a rise in income will lead to a rise in investment

Firms will need to invest to supply the extra goods and services being demanded by consumers

How can the rate of interest affect the exchange rate? (4) (Chain of analysis)

Leads to a fall of the domestic currency (exchange rate)

For the UK, a fall in the value of the pound means foreigners can now get more pounds for each unit of their currency

However UK residents have to pay more pounds to get the same number of (e.g) Euros, meaning the goods priced in pounds become cheaper for foreigners to buy, whilst foreign goods are more expensive

This leads to a decrease in imports (M) and increase in exports (X) which boosts AD

WPIDEC

What is quantitative easing?

A monetary policy instrument where the central bank buys financial assets in attempt to increase the money supply

Following the financial crisis, what did the BoE realise?

That many people prefer to keep their money in reserves rather than lending it out

Therefore the BoE bought securities or bonds from private sector institutions such as insurance companies, pension funds and banks

* The money supply increases

* Commercial banks lower their interest rates

1. Why do asset prices rise? (1)

2. What are the benefits of this? (2)(Chain of analysis)

* Benefits:

* Positive wealth effect since shares, houses etc are worth more so people will increase their consumption.

* Moreover, the cost of borrowing will decrease as higher asset prices mean lower yields, making it cheaper for households and businesses to finance spending

1. Why does money supply increase AD? (1)(Chain of analysis)

2. What’s the benefits of this? (2)(Chain of analysis)

* Benefits:

* It may also push asset prices higher

* Banks have higher reserves, meaning they can increase their lending to households and businesses so both consumption and investment increase as people can buy on credit

1. Why do interest rates lower? (1)

2. What’s the benefits of this? (3)(Chain of analysis)

* Benefits:

* The increased money supply will mean that the price of money falls; interest rates are the price of money

* This will encourage borrowing, and therefore increase investment and consumption so increase AD

* If many banks decide to lower their interest rates, the same mechanisms will apply as those following a reduction in the base rate.

What are the problems with quantitive easing? (5)

Could lead to high Inflation or even hyperinflation

It only leads to increased demand for Second hand goods

There’s no guarantee that higher asset prices lead into higher consumption through the Wealth effect

Increase in share prices and a large effect on the Housing market

Banks and economies are too Dependent on quantitive easing

(Quantitive easing)

Why is an increased demand for second hand goods bad?

Pushes up prices but doesn't increase AD

E.g: it would not lead to more new houses being built but only second hand houses becoming more expensive

(Quantitive easing)

Why is there no guarantee that higher asset prices lead into higher consumption through wealth effect?

(Quantitive easing)

What is the large effects on the housing market and share prices?

Large effect on housing market by stimulating demand leading to rapid price rises since 2013, worsening the issues of geographical mobility

Large effect on share prices which increases inequality, since the rich grow richer whilst the poor see none of the gains

Which place is particularly too dependent on quantitive easing?

What are ‘securities’?

How do people buying securities cause monetary supply fall? (2) (chain of analysis)

* This means banks need to reduce their lending so monetary supply will fall

1. In normal times what did the rise in rate of inflation indicate?

2. What would the MPC do in this case?

3. What would the MPC do if the inflation fell towards 0?

1. Indicate excess demand in the economy

2. Increase %IR to reduce AD.

3. The MPC would cut %IR to boost AD and nudge inflation back up to its target level

* 0.5% (again)

1. What did the MPC recognise?

2. What has the MPC become focused on? (2)

1. That inflation above 2% was most unlikely caused by excess demand (which was because economic growth was weak and unemployment high)

2. Boosting economic growth and boosting employment

* 5 from BoE including the governor of the BoE

* 4 who are independent outside experts, mainly economists

* Defence

* Education

* Roads

(Fiscal policy)

What is the government responsible for? (2) DELETE

40%-50% of national expenditure

Transferring large sums of money around the economy through its spending on social security and national insurance benefits

* A fall in government spending

* The biggest source of revenue for the government, around 25% of all tax revenue

* Paid as a % of income

* The basic rate is 20% and higher is 40-45%

* Standard rate its 20%

* Some aren’t taxed, e.g: food and children's clothes

* Domestic fuel/power is charged 5%

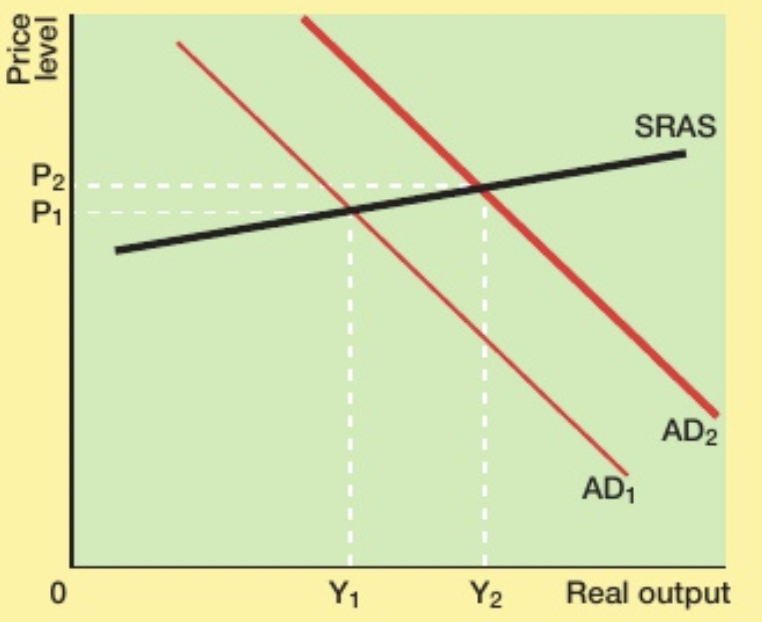

* The rise in AD is shown by the right shift in the AD curve leading to a high equilibrium level of national output (OY2)

* In the short run, equilibrium output will rise from P1 to P2

* Constant G → ↓T → ↑AD

* ↓T → ↑disposable income → ↑C, ↑M

* Cutting VAT/excise duties, ↓in price of consumer goods

* ↓T on company profits → ↑I

What happens when expansionary fiscal policy occurs?

Fiscal policy loosens as a result

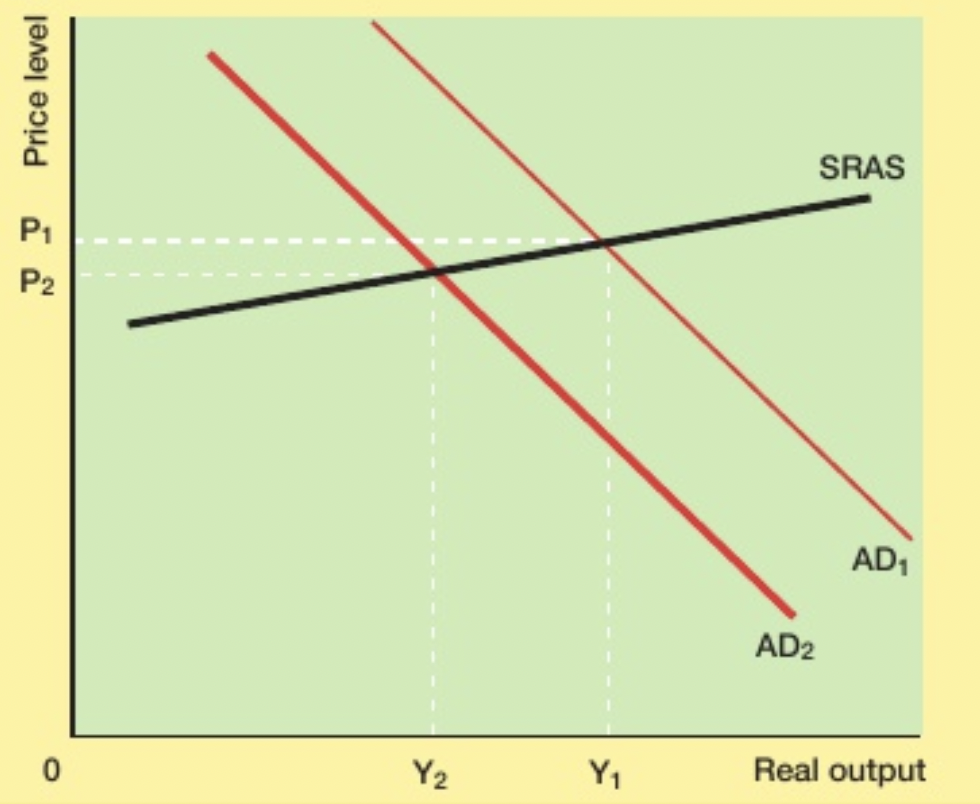

* If the shift to the left were caused by tighter fiscal policy, equilibrium real output would fall from OY1 to OY2

* Therefore the fiscal stance/budget position of the government could be expansionary or contractionary

* Equally could be neutral

* In the short run, equilibrium output will fall from Y1 to Y2 but there will also be a fall in price level from P1 to P2

* Monetary

and

* Fiscal

To be used:

* When the economy is in recession

or

* When the economy is growing so fast that inflation begins to increase

* Taxes and Spending have an impact on **I**nequality and incentives

* **P**olitical issues

* Expansionary fiscal policy is difficult to undertake during a period of **A**usterity

* Impact of fiscal policy is dependent on the **M**ultiplier

If government spending got cut what happens to things like education?

Why does taxes and spending have an impact on inequality and incentives (2)

* High taxes may reduce incentives

Why might political issues be a problem with fiscal policy?

Why might expansionary fiscal policy be difficult to undertake during a period of austerity?

Why is the Impact of fiscal policy is dependent on the multiplier?

What do classical vs Keynesian economists say about the multiplier?

* Classical economists argue that the multiplier is almost zero

* Keynesian economists argue that it can be large if targeted correctly

What are the issues of demand side polices? (10)

* On a Keynesian LRAS, the impact on AD depends on where the economy is operating

* Time lags

* Size of the multiplier

* Some economists think during a recession with high unemployment %%contractionary%% fiscal policy and %%expansionary%% monetary policy should be used

* Increase in the size of National Debt

* After the financial crisis, many banks reduced IR to 0% and found it had little impact on AD

* Quantitive easing may be ineffective

* Expansionary policy is inflationary

* Deflationary policy brings unemployment

* They need to be focused on changing AD within a very short period of time to be effective in responding to problems in the economy today

* Argue that the multiplier is virtually zero in the short term and so extra government spending forces out private sector spending

* Cuts in tax financed by the government borrowing mean that that private sector can borrow less money

* An increase in the budget deficit financed by printing money only leads to inflation, not extra output

__Keynesian economists:__

* The multiplier is positive and can be large if the government spending and tax charges are carefully targeted

* E.g: a large scale unemployment in the construction industry, extra government spending on building new social housing could work its way quickly through the economy to increase AD

Why do classical economists believe that any demand management, whether fiscal or monetary, will have no effect on long-run output?

What do they think should be used instead?

* If the economy is in short-run disequilibrium, it will quickly return to long run equilibrium

* Believe **supply side polices** should be used instead

Why do some economists think during a recession with high unemployment contractionary fiscal policy and expansionary monetary policy should be used? (2)

* Fiscal policy has no impact on AD and so raising taxes and cutting government spending is not contractionary

Why would the majority of economists argue national debts can be bad?

Why could quantitive easing be ineffective?

* Households and firms borrow money but (e.g) instead buying new houses they buy second hand houses, pushing up their price but not increasing AD

How did the Great Depression occur?

Was set off by the Wall Street Crash of 1929 when there was a sharp fall in share prices on the New York Stock Exchange

What could’ve caused the Great Depression? (4)

Loss of consumer and business confidence: shareholders lost money in the crash, others became worries about what would happen, and firms cut back investment which led to a downward spiral in AD

US banking system: Banks lent too much during the 1920s, creating an unstable boom and the system was unable to deal with issues following the crash. Government allowed banks to crash, decreasing consumer confidence further and reduced loans = fall in AD

Protectionism: Reduced world trade, decreasing AD and consumer confidence. Firms involved in exporting no longer able to pay bank their loans, causing US bank failures. US decreased imports, causing retaliation

Gold standard: UK also affected by its commitment to fixing its currency to the value of gold. Left gold standard in 1914 but rejoined in 1925. Caused rapid appreciation, exports fell and there UK went into the Great Depression

What were the policy responses in the UK in regards to the Great Depression?

Balancing the government budget and borrowing money would prevent the private sector from doing so. Introduced an emergency budget which cut public sector wages and unemployment benefit by 10% and raised income tax. Reduced AD at a time when it needed to be increased

Pound came under attack from speculators and needed to be defended to prevent the UK being forced out of the gold standard. Balanced budget meant the UK didn’t have to borrow from abroad, helping the exchange rate as did the high interest rates used to defend the high exchange rate. However high IR% caused demand to decrease

UK was forced to leave the gold standard due to continued speculation. Caused value of pound to drop by 25% compared to other currencies and allowed BoE to cut IR% by 2.5%. Helped increase AD by increasing exports or increasing I/C

There was recovery in London and the South East but Wales, the north and Scotland did not reach full employment until 1941

What were policy responses in the USA? - DELETE

The US government originally had the same view as UK over a balanced budget

However Roosevelt Neal deal promised public sector investment, work schemes for the unemployed and fiscal stimulus

USA reached full employment in 1943. Roosevelt’s new deal was an example of Keynesian expansionary fiscal policy, but can be argued wasn’t large enough to be successful (although has a large impact as the US unemployment figure was so high)

What were the causes of the global financial crisis?

Mortgage lending in USA.

At this same time, banks had been grouping ‘prime’ mortgages and ‘sub prime’ mortgages and selling packages to other banks and investors as if they were prime mortgages.

When this was revealed there was a fall in confidence and banks stopped lending between each other, fearing they would lose money if the other bank were to collapse

What was the issued in mortgage lending in the USA?

Government and banks encouraged poor to take mortgages and buy their own homes (moral hazard - bankers saw higher bonuses for selling more mortgages)

Low IR% for first few years, but many no longer able to continue paying with higher repayments

Houses were repossessed, d fell, and prices fell meaning the value of the houses was now less than the mortgage of the house (negative equity)

What did grouping prime mortgages and sub prime mortgages together do? (risk)

Aim was to reduce risk since it meant no bank was highly dependent on risky mortgages

Yet, increased risk as many were now holding assets worth less than they had paid for them; it spread the effects of the housing crash and the unpaid loans

What were the policy responses in the UK and USA for the global financial crisis?

Both governments were forced to nationalise banks and building societies and guarantee savers their money in order to prevent the chaos of a collapsed banking system

E.g: British government bought Northern Rock and most of Royal Bank of Scotland and Lloyds Bank

Used expansionary monetary policies with record low IR% and QE. BoE said the QE led to lower U and higher growth than would otherwise have been the case

However, USA government had a more expansionary fiscal policy and this is perhaps why it recovered faster. In 2010, the UK prioritised reducing National Debt over providing a fiscal stimulus, but USA didi’t make this decision until 2013