3.10 - demand side policies -> monetary policy

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

demand-side policies (demand management)

focus on

changing aggregate demand

shifting the aggregate demand in the AD AS diagram

to counteract the effects of economic fluctuations

types of demand side policies (2)

stabilization policies

monetary policy

fiscal policy

****in practice: the most the policies can do is lessen the severity of business cycle

monetary policy

set by central banks

to control the money supply and interest rates

in order to manage economic stability and influence aggregate demand.

commercial bank

financial institutions that are to

hold deposits

make loans

transfer funds

buy government bonds

for their customers

central bank

a governmental financial institution with several important responsibilities

has a degree of independence

ensures that monetary policy can be conducted in the best long-term interest of the economy

without interference from political pressure

central bank responsibilities

banker to the government

banker to commercial banks

regulator to commercial banks

conduct monetary policy

goals of the monetary policy

low and stable rate of inflation (~2%)

low unemployment

controling cyclical unemployment during deflationary gap

reduce business cycle fluctuations

promote a stable economic environment for long-term growth

external balance

balance between exports revenue and imports spending

inflation targeting

monetary policy framework that aims to

maintain a specified level of inflation, typically around a target rate

advantages of inflation targeting

achievement of low and stable rate of inflation

improved ability of economic decision-makers to anticipate future fluctuations

greater co-ordination between monetary and fiscal policy

knowledge about inflation targets allows government to plan fiscal policies

disadvantages of inflation targeting

reduced ability of the central bank to pursue other macroeconomic objectives

reduced ability of the central bank to respond to supply-side shocks

to control cost-push inflation/ stagflation it may have to sacrifice its inflation goal

a too low target may lead to higher unemployment

interest rate

a percentage of the amount borrower is charged by a lender for the use of funds on top of the normal payment

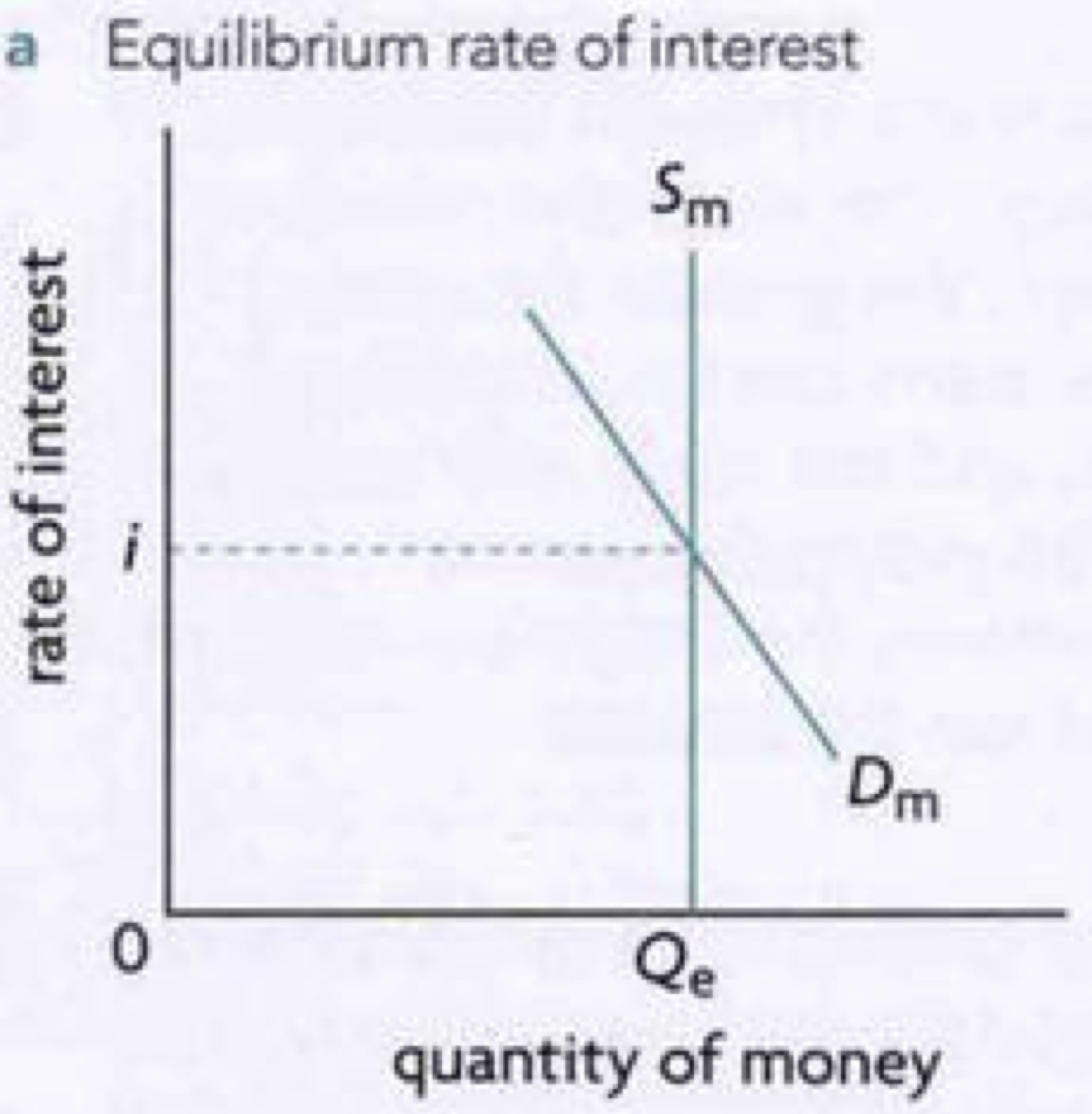

supply of money (Sm)

the total amount of monetary assets available in an economy at a specific time

fixed level decided upon by the central bank

it is a vertical line as it doesn’t depend on the rate of interest

changing the money supply is to influence AD

demand for money (Dm)

interest rates fall = increase in holding money demanded by the public

*the higher the interest rate the less attractive it is for you to hold money, and better off to put into banking account that earns interest

**money itself doesn’t earn interest

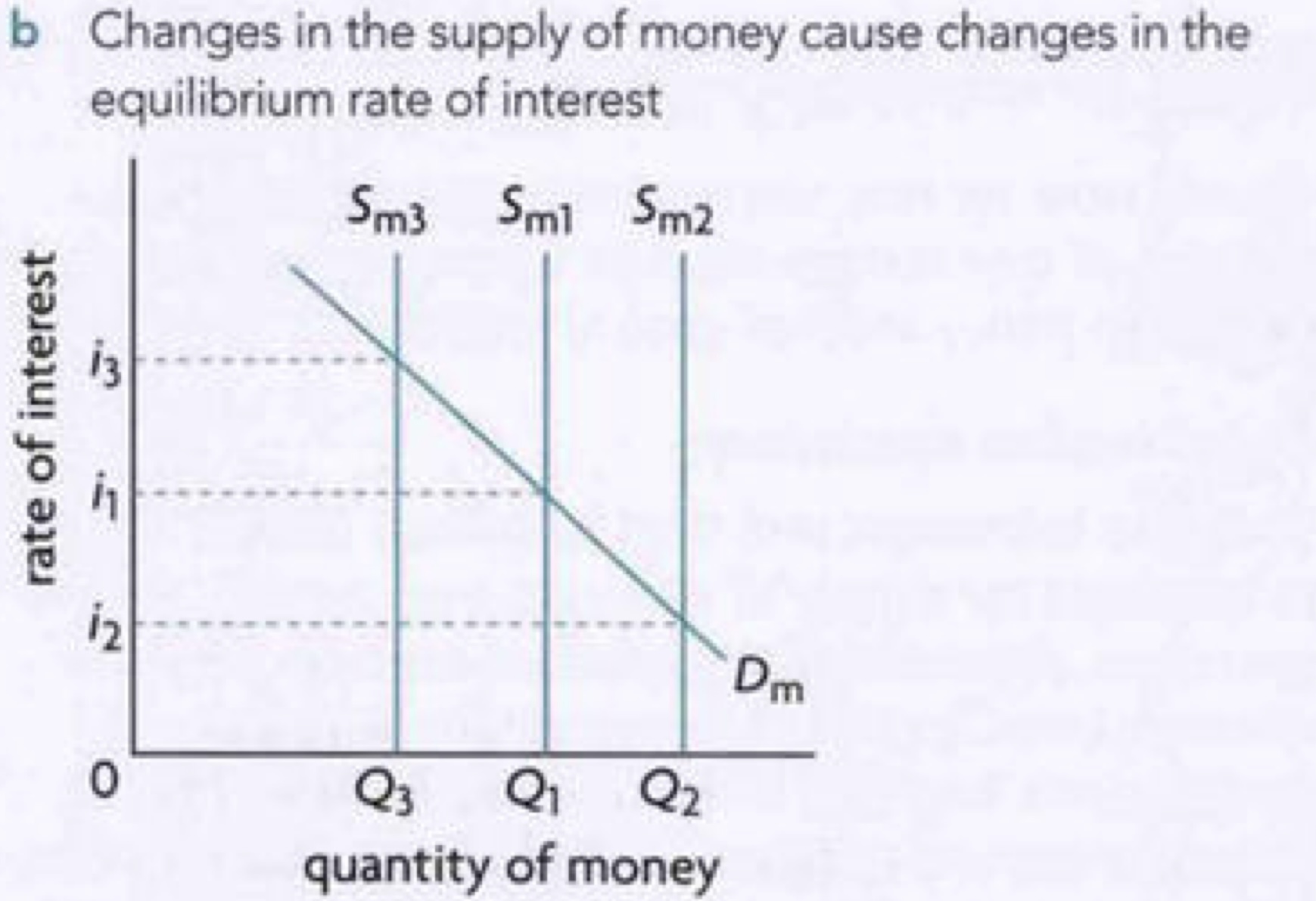

shift of Sm

if central changes the money supply Sm curve shifts

this determines a new rate of interest

demand for holding money changes

setting a target interest rate

central bank sets a target interest rate it wants to achieve

then takes steps to adjust the money supply so that the actual equilibrium interest rate will become equal to the target interest rate

minimum reserve requirement/ required reserve ratio

funds that the central bank must legally keep, which are a fraction of total deposits

excess reserves

funds that banks hold beyond the required reserve ratio, which can be used for lending and investing.

monetary multiplier

monetary multiplier = 1 / required reserve (as a percentage of deposits)

fractional reserve system → amount of new loans/ new money created

(1/minimum reserve requirement )x excess reserves

*it is the maximum amount that can be created

tools of monetary policy to influence the supply of money

open market operations

minimum reserve requirements

changes in the central bank’s minimum lending rate

quantitative easing

open market operations (operations by use of bonds)

to lower the interest rate (increase money supply) the central bank will:

buy government bonds from commercial banks

increase excess reserves in commercial bank

ability to make more loans

thus increasing money supply

* do opposite for decreasing money supply

minimum reserve requirement

to lower the interest rate (increase money supply) the central bank will:

lower minimum reserve requirements

increasing excess reserves in commercial banks

thus increasing money supply

*do the opposite for decreasing money supply

changes in the central bank’s minimum lending rate

minimum lending rate = the interest rate at which the central bank lends to commercial banks.

to lower the interest rate (increase supply of money) the central bank will:

lower minimum lending rate

higher commercial bank excess reserves

thus increasing money supply

*do the opposite to decrease supply of money

quantitative easing

central banks buy huge quantities of assets that commercial banks have or own

to pay for those assets central bank creates reserves electronically for the commercial banks

commercial banks end up with many more reserves which they can use to make a lot of loans, increasing AD

to lower the interest rates (increase money supply) the central bank will:

create new reserves electronically

increased excess reserves in commercial banks

increased money supply

nominal interest rate

the stated interest rate before adjustment for inflation.

real interest rate

the nominal interest rate adjusted for inflation

reflects the true cost of borrowing and the true yield to lenders

effect of changing interest rates/ money supply on AD

affects

investment

consumption

higher interest rate = more saving = less consumer and business borrowing/ spending = left shift of AD (fall)

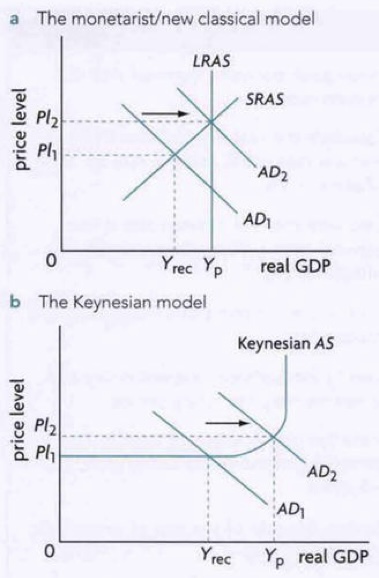

expansionary monetary policy

increase in the money supply by the central bank

to expand AD

in case of a deflationary gap

*with demand for money constant interest rate falls from i1 to i2

lower cost of borrowing

consumer and businesses more likely to borrow and spend more

increased (right shift) of AD

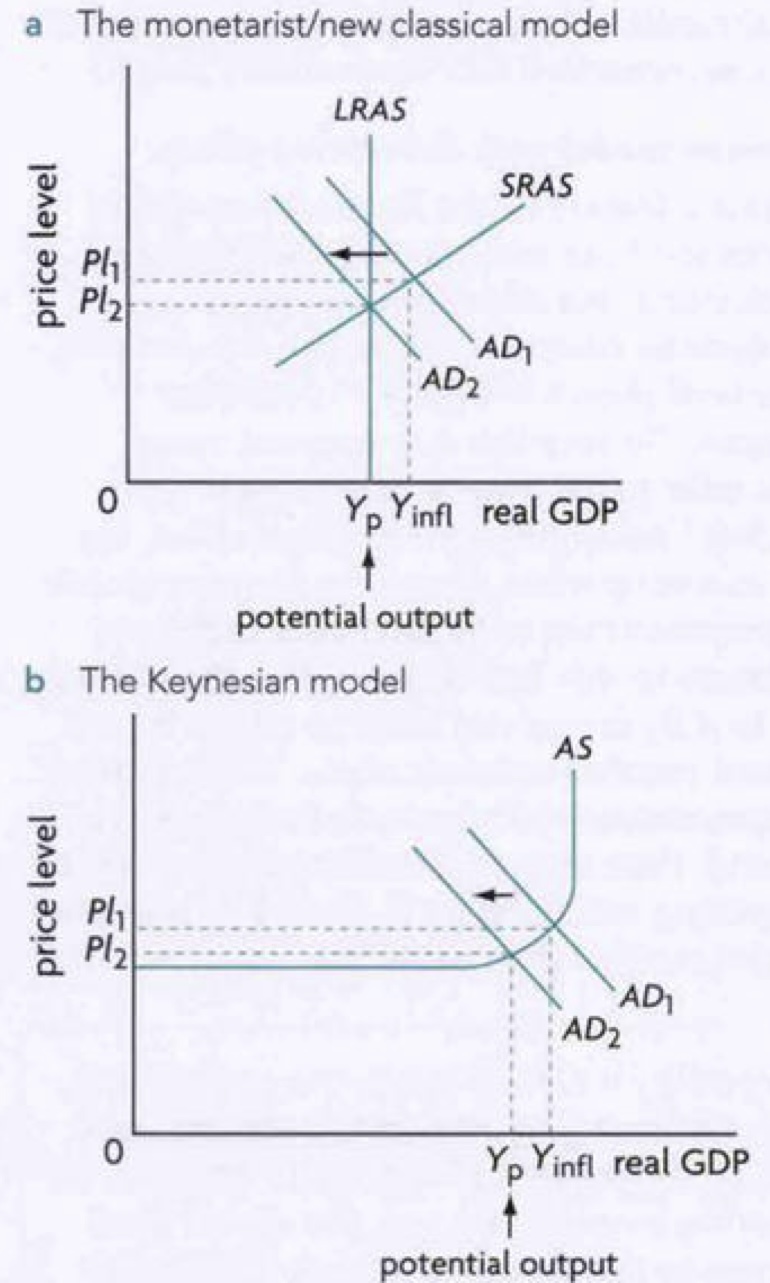

contraction monetary policy

decrease in money supply by central bank

to decrease AD

to mitigate inflationary gap

*with demand for money constant interest rate rises from i1 to i3

higher cost of borrowing

consumer and businesses more likely to borrow and spend more

increased (right shift) of AD

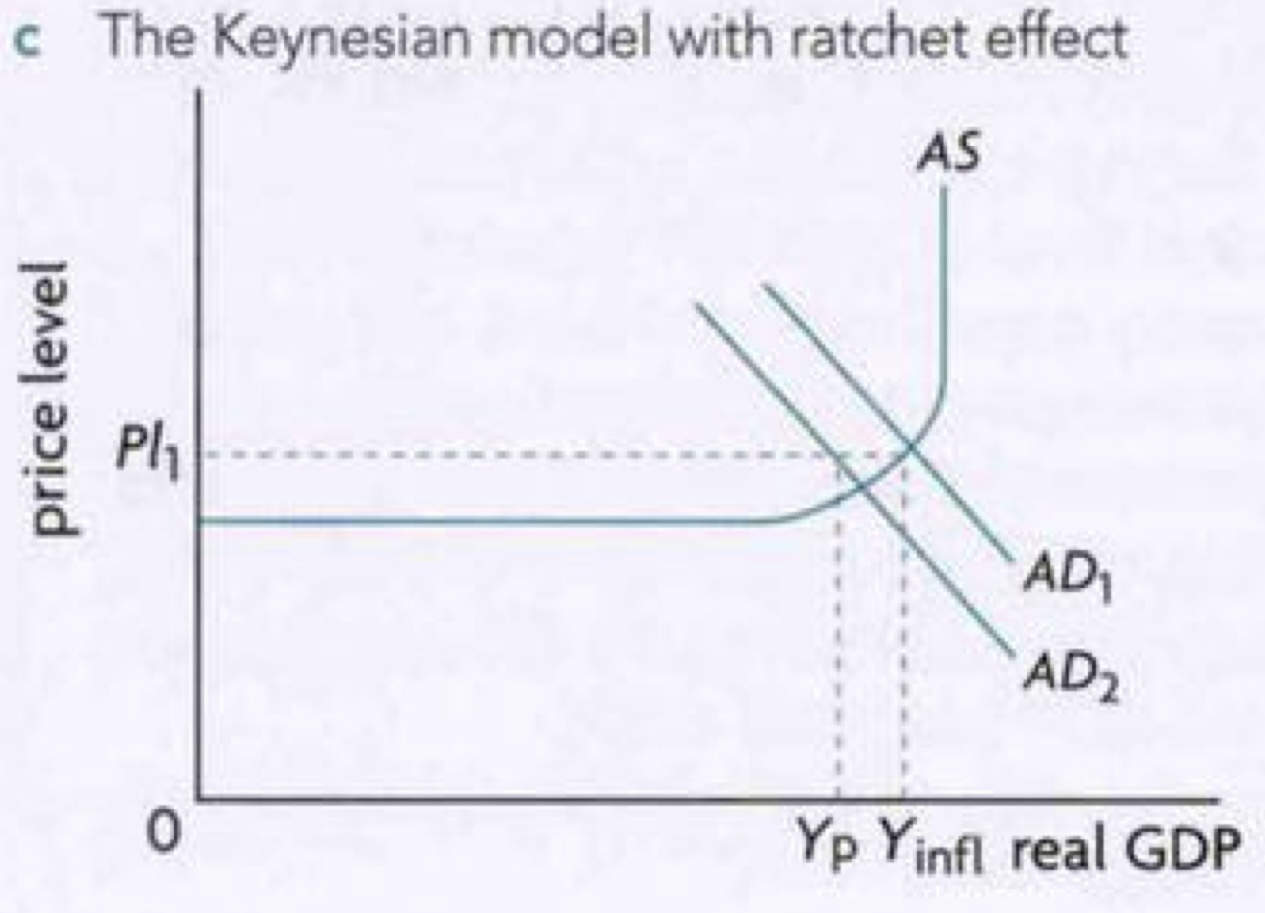

Ratchet effect on the keynesian model of contractionary monetary policy

ratchet effect

price moves up as AD moves up

price stays constant as AD moves down

more realistic representation of what happens in real world

constrains on monetary policy

possible ineffectiveness in recession

interest rates cannot fall when approaching zero

low consumer and producer confidence

banks may be fearful of lending

conflict between governmental objectives

may be inflationary

when the policy lasts too long it may push the AD over the necessary value to eliminate a deflationary gap

unable to deal with stagflation or cost push inflation

strengths of monetary policy

interest rate changes can be gradual

interest rates changes are reversible

monetary policy is flexible

relatively short time lags

days for the change to apply

central bank independence

limited political constraints

as it doesn’t involve making changes in the government budget

no budget deficit or debt

no crowding out