F5 Investments, Statement of Cash Flows, and Income Taxes

1/112

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

113 Terms

What are some examples of financial assets?

Cash

Ownership interest in an entity

Contract to receive cash/financial instrument or exchange other financial instruments on potentially favorable terms

What is a financial liability?

Contract to either:

deliver cash or another financial instrument

exchange other financial instruments on potentially unfavorable terms

What is a fair value option?

Ability to measure eligible (i.e. recognized) financial instruments at fair value

Unrealized gains and losses reported in earnings

Irrevocable and applied individually

Which financial instruments are not eligible for fair value option?

Investments in subsidiaries or VIEs

Pension benefit assets or liabilities

Financial assets or liabilities under leases

Deposit liabilities of financial institutions

Financial instruments classified as equity

What is the treatment of financial liabilities other than derivative liabilities under the fair value option?

Portion of change in fair value related to change in instrument-specific credit risk is recognized in OCI

Upon derecognition of liability, any accumulated gains/loses in OCI is recognized

When can fair value option be elected?

Date when:

entity first recognizes eligible financial instrument

investment becomes subject to equity method of accounting

entity ceases to consolidate investment in subsidiary/VIE

What is a debt security?

Any security representing creditor relationship with entity (e.g. corporate bonds, redeemable preferred stock, convertible debt)

What is not included in debt securities?

Options, futures, or forward contracts

Lease contracts

Accounts and notes receivable

What are the three categories that debt securities can be classified into?

Trading securities

Available-for-sale debt securities

Held-to-maturity debt securities

What are trading securities?

Debt securities bought and held for purpose of selling in near-term (within 12 months of purchase date)

Objective is to generate profits in the short-term

Recorded at fair value and generally reported as current assets

What are available-for-sale debt securities?

Securities that do not meet the definition of trading or held-to-maturity securities

Reported as either current or non-current asset

What are held-to-maturity debt securities?

Debt securities that entity has positive intent and ability to hold until maturity

Reported as current or non-current asset depending on time to maturity

When can held-for-maturity classification not be used?

If intent to hold security for indefinite period but not to maturity

If security can be paid or settled such that the holder can not recover substantially all of its investment

How are available-for-sale and trading debt securities reported?

Reported at fair value

Changes in fair value result in unrealized gains or losses

Presented on balance sheet in one net amount

Realized gains/losses recognized when sold

Loss recognized if AFS security is impaired

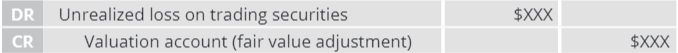

What is the accounting for unrealized gains and losses of trading securities?

Recognized in net income

What is the accounting for unrealized gains and losses of available-for-sale debt securities?

Recognized in OCI

How are held-to-maturity debt securities reported?

Reported at amortized cost

Unrealized gains/losses are not recognized

What is the accounting for reclassification of debt securities?

Occur only when justified, generally rare

Accounted for at fair value

Any unrealized gain/loss depends on category

What is the accounting for unrealized gain/loss reclassifying from trading category?

Unrealized gain/loss already recognized in earnings and shall not be reversed

What is the accounting for unrealized gain/loss reclassifying to trading category?

Unrealized gain/loss at date of transfer recognized in earnings immediately

What is the accounting for unrealized gain/loss reclassifying from held-to-maturity to available-for-sale?

Unrealized gain/loss at date of transfer reported in OCI (i.e. difference in amortized cost versus fair value)

What is the accounting for unrealized gain/loss reclassifying from available-for-sale to held-to-maturity?

Unrealized gain/loss at date of transfer already reported in OCI

Unrealized gain/loss should be amortized over remaining life in income statement as interest revenue/payment

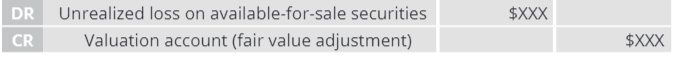

What is the accounting for interest income from investment in trading/available-for-sale securities?

Reported on the income statement

What is the accounting for available-for-sale and held-to-maturity debt securities under the CECL model?

Reported at expected amount to be collected net of allowance for expected credit losses

Credit loss recognized as current period expense offset by allowance for credit loss

Changes in expected credit loss reflected in period incurred

What is the accounting for impairment of held-to-maturity securities?

If all amounts due will not be collected (i.e. if amortized cost > present value to be collected):

Report at present value of principal and interest expected to be collected

Credit loss is difference between present value and amortized cost

What is the accounting for impairment of available-for-sale debt securities?

Impairment if fair value < amortized cost:

Credit loss recognized in income statement and limited to amount of present value below amortized cost (i.e. purchase price)

Any additional loss reported as unrealized loss in OCI

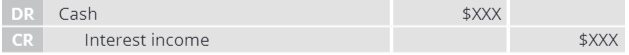

What is the accounting for sale of trading security?

Realized gain/loss is difference between adjusted cost (original cost plus unrealized gains or minus unrealized losses) and selling price

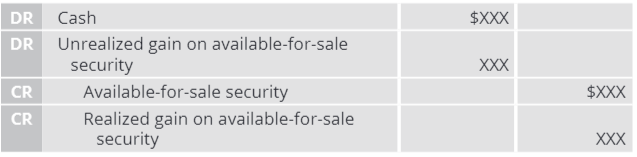

What is the accounting for sale of available-for-sale security?

Realized gain/loss difference between selling price and original cost

Any unrealized gains/losses accumulated in OCI must be reversed

What is an equity security?

Ownership interest in an enterprise or right to acquire/dispose of ownership interest in an enterprise (e.g. common stock, stock warrants, put options)

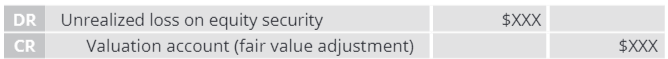

How are equity securities reported?

At fair value through net income

Unrealized gains/losses included in earnings immediately in the period incurred

What is the practicability exception?

If equity investment does not have a readily determinable fair value:

measured at cost less impairment, plus/minus observable price changes of identical or similar investments from the same issuer

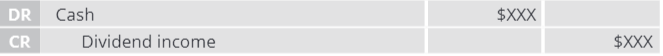

What is accounting for dividend income of a non-liquidating dividend?

Recognized in net income

What is accounting for dividend income of a liquidating dividend?

Portion of dividend not in excess recognized as dividend income

Return of capital decreases investor’s basis in investment

What is the qualitative impairment assessment for equity securities without a determinable fair value?

Heightened concerns regarding investee’s ability to continue as going concern

Significant and adverse changes in investee’s environment

Significant decline in earnings, business prospects, asset quality, or credit rating of investee

Offers to buy from investee same or similar investment less than carrying value

What is the accounting for impairment of equity investment without determinable fair value?

Cost basis of security written down to fair value

Amount of write-down accounted as realized loss and included in earnings

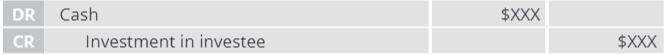

What is the accounting for sale of equity security?

If all changes in fair value have been reported as unrealized gains or losses:

No gain or loss (DR cash, CR equity security)

If changes in fair value were not reported:

Gain/loss equal to difference between adjusted cost (original cost plus unrealized gains or minus unrealized losses) and selling price

DR cash, CR equity security, DR/CR loss/gain

What must be disclosed for available-for-sale and held-to-maturity securities?

Aggregate fair value

Gross unrealized gains/losses

Amortized cost basis

Information about contractual maturities

What must be disclosed for equity securities?

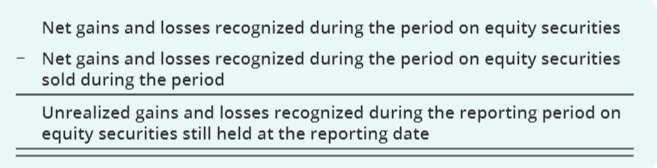

Portion of unrealized gains/losses

How are financial assets and liabilities disclosed?

On balance sheet or in notes

Grouped by measurement category

What must be disclosed for fair value information?

Classification level of measurement hierarchy

If measured at amortized cost, fair value should be disclosed in accordance with exit price

Exceptions:

Payables and receivables due within one year

Deposit liabilities with no defined maturities

Equity investments reported under practicability exception

What must be disclosed if practicability exception is elected?

Carrying amount of investments without determinable fair values

Any impairment charges

Upward or downward adjustments to carrying amount

What are concentrations of credit risk?

Possibility of loss due to failure of another party to perform according to terms of contract

Occurs when entity has contracts of material value with one or more parties in same industry/region or having similar economic characteristics

Must be disclosed

What is market risk?

Possibility of loss from changes in market value due to changes in economic circumstances

Not required to disclose

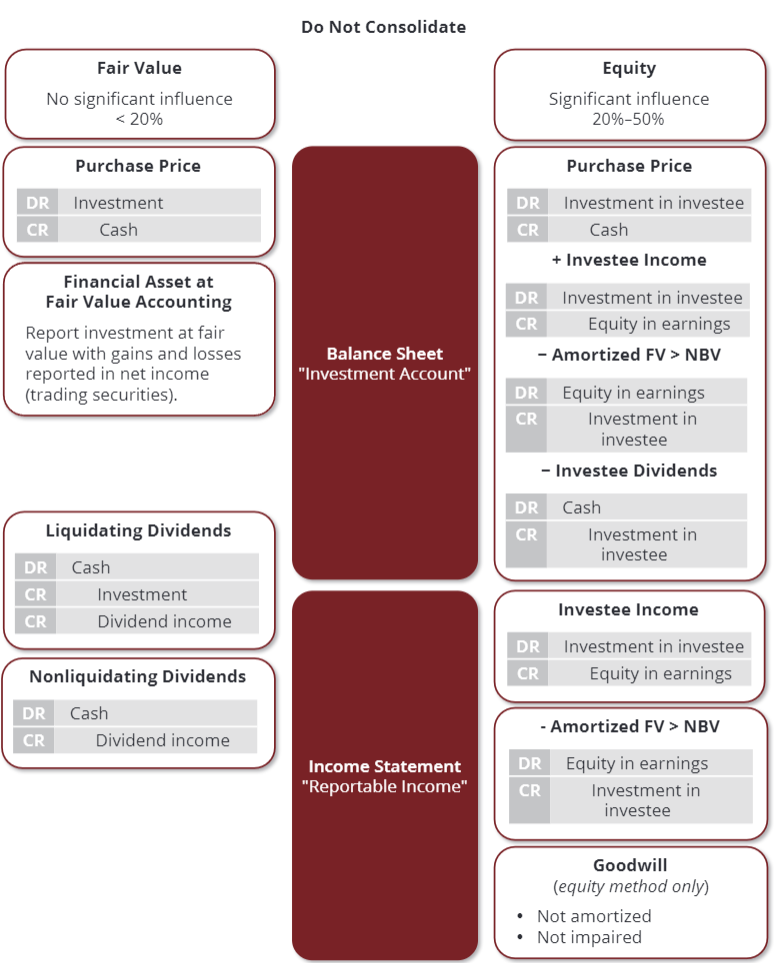

When should equity method be used?

If significant influence can be exercised by investor over investee

When should consolidated statements be presented under the equity method?

If ownership is greater than 50% and there is control over investee

What is significant influence in regards to the equity method?

Parent company owns 20% - 50% of voting stock of another investee

Must use equity method in consolidated financial statements not of that investee or unconsolidated parent financial statements

When is the equity method not appropriate?

Bankruptcy of subsidiary

Investment in subsidiary is temporary

Lawsuit or complaint is filed

“Standstill agreement” (i.e. investor surrenders significant rights)

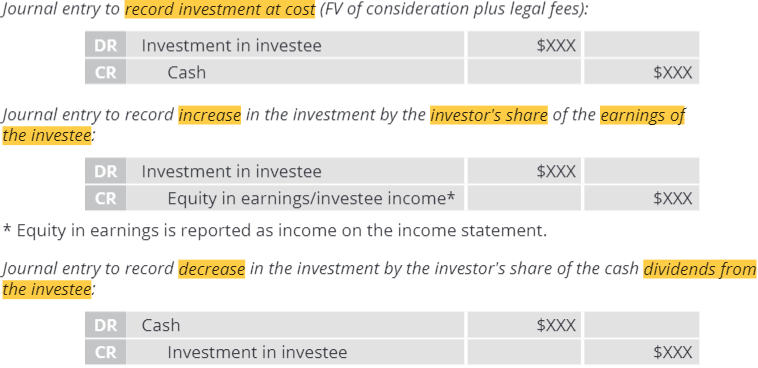

What is the accounting for the equity method?

Investment is originally recorded at price paid to acquire investment

Investment account is increased by share of earnings of the investee

Investment account is decreased by cash dividends from the investee

Under the equity method, what happens if investor owns both common and preferred stock?

“Significant influence” test is used on common stock only

Consolidated income statement of subsidiary will include subsidiary’s:

Preferred stock dividends

Earnings available to common shareholders (Net Income - Preferred Dividends)

How is the difference between purchase price of investment and net book value of investee’s net assets accounted for?

Excess of asset’s fair value over book value is amortized (except land), causing investment to decrease

Any excess fair value (i.e. goodwill) is not amortized

Total equity method must be annually tested for impairment

Which conditions must occur for equity method investment to be impaired?

Fair value of investment falls below carrying value

Decline in fair value is not temporary

How is impairment loss in equity method investment reported?

Recorded on income statement

Carrying value is reduced to lower fair value

Impairment reversal is not permitted

Illustrate the difference between fair value and equity method

What must be done when changing from fair value to equity method?

Add cost of acquiring additional interest to carrying value of investment

Adopt equity method as of date when investment qualifies for equity method. No retroactive adjustments required

In transitioning from either fair value or equity method, how are equity securities without readily determinable fair values handled?

If transitioning to equity method:

Investment remeasured immediately before transition

If transitioning from equity method:

Investment remeasured immediately after transition

In a parent-subsidiary relationship, when must consolidated financial statements be prepared?

Parent has control over investee; or

parent owns more than 50% of voting stock

What is the difference between controlling vs noncontrolling interest?

Controlling interest owns more than 50% and has controlling interest

Noncontrolling interest is portion of subsidiary’s equity not attributable to parent

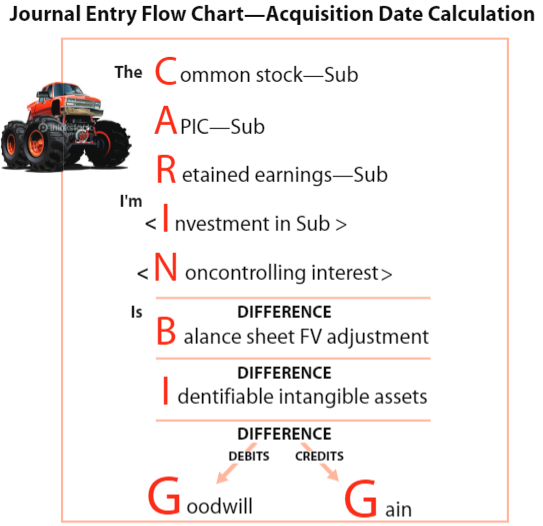

What are the two distinct accounting characteristics under the acquisition method?

100% of net assets acquired are recorded at fair value with excess creating goodwill

Subsidiary’s entire equity is eliminated (not reported)

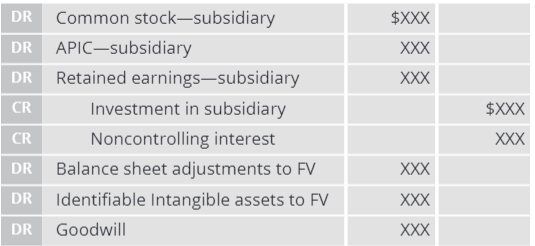

What must be adjusted in consolidation? (CAR IN BIG)

Common stock - eliminated

APIC - eliminated

Retained earnings - eliminated

Investment - eliminated

Noncontrolling interest - created

Balance sheet - adjusted to fair value

Intangible assets - adjusted to fair value

Goodwill - any excess of fair value of subsidiary over net assets creates goodwill

What is year-end consolidating journal entry?

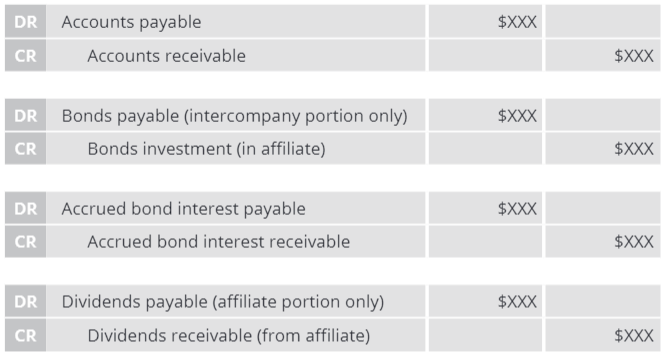

What are the balance sheet intercompany eliminations?

What are the income statement eliminations?

Interest expense/Interest income

Gain on sale/Depreciation expense

Sales/Cost of goods sold

What is the journal entry for eliminating intercompany merchandise transactions?

Eliminate intercompany sale (debit sales, credit COGS)

Eliminate intercompany profit (allocated in ending inventory [sales/ending inventory] and COGS [1 - sales/ending inventory])

![<ul><li><p>Eliminate intercompany sale (debit sales, credit COGS)</p></li><li><p>Eliminate intercompany profit (allocated in ending inventory [sales/ending inventory] and COGS [1 - sales/ending inventory])</p></li></ul><p></p>](https://knowt-user-attachments.s3.amazonaws.com/7f0a1bec-d318-4697-a32b-31bdceb5f728.png)

How are intercompany bond transactions accounted for?

Gain/loss on extinguishment of debt is recognized via an elimination entry

Eliminate intercompany interest expense, interest income, interest payable, and interest receivable

Elimination amortization of discount/premium and unamortized discount/premium

Elimination for realized but unrecorded gains/loss adjusted to retained earnings

How are intercompany sale of land accounted for?

Gain/loss unrealized until land is sold to a third-party (selling price - original cost)

Eliminate intercompany gain/loss and adjust land to original cost

Retained earnings debited and land credited

How are intercompany profit on sale of depreciable fixed assets accounted for?

Gain/loss unrealized until sold to third-party

Eliminate intercompany gain/loss, adjust asset to original balance and, depreciate as if the sale had not occurred

What is included in a consolidated balance sheet?

100% of parent’s and subsidiary’s assets and liabilities (after eliminating intercompany transactions) included but subsidiary’s equity not included

Subsidiary’s PP&E must be reported at net book value (fair value - accumulated depreciation); subsidiary’s accumulated depreciation is zeroed out

If non-wholly owned, portion of subsidiary’s net income attributable to noncontrolling interest reported in retained earnings

What is included in consolidated income statement?

100% of parent’s revenues and expenses and all of subsidiary’s revenues and expenses after date of acquisition

Subsidiary’s pre-acquisition revenues and expenses not included

Separately stated consolidated net income. net income attributable to noncontrolling interests, and net income attributable to parent company

What is included in consolidated comprehensive income?

Consolidated comprehensive income

Comprehensive income attributable to noncontrolling interest

Comprehensive income attributable to parent company

What is included in consolidated statement of changes in equity?

Reconciliation of beginning-of-period and end-of-period carrying amount of total equity

Equity attributable to parent

Equity attributable to noncontrolling interest

How to prepare consolidated statement of cash flows?

Net cash spent or received in acquisition must be reported in investing section

Assets and liabilities of subsidiary on acquisition date must be added to parent’s assets and liabilities at beginning of the year to determine change in cash

In subsequent periods, how is consolidated statement of cash flows prepared?

Present cash inflows and outflows of consolidated entity except cash flows between parent and subsidiary

When reconciling net income to net cash from operating activities, total consolidated income should be used

Financing section should report dividends paid by subsidiary to noncontrolling interest only

Investing section may report acquisition of additional subsidiary shares by parent if acquisition was open-market purchase

What is the journal entry on the partnership books for the purchase/sale of an existing partnership interest?

No journal entry except for change of name on capital account

How are contributions to a partnership recorded?

Assets at fair value

Liabilities at present value

Equity is difference between fair value of assets and present value of liabilities

What is the ‘exact method’ regarding partnerships?

When purchase price is equal to book value, no goodwill or bonuses are recorded

What is the ‘bonus method’ regarding partnerships?

When purchase price is more or loss than book value, bonuses are adjusted between old and new partners’ accounts and do not affect partnership assets

If interest is less than amount contributed, difference as bonus to old partner(s)

If interest is more than amount contributed, difference as bonus to new partner and capital balances of old partner(s)’ needs to be adjusted downwards

How is goodwill recognized regarding partnerships?

Determine implied total capital of the partnership (new partner’s contribution divided by interest share)

Difference in implied total capital and actual total capital is goodwill

Goodwill is adjusted upwards to old partner(s) according to old partnership profit ratios

How are profit and loss distributed regarding partnerships?

Accordance with agreement

If agreement is absent, profit and loss is shared equally

All payments for interest on capital, salaries, and bonuses deducted prior to distribution

What is the accounting for a withdrawal of a partner under the bonus method?

Difference between balance of withdrawing partner and amount that partner paid is the bonus

Bonus is allocated among remaining partners in accordance with remaining profit and loss ratios

Withdrawing partner’s assets may be revalued at fair value but goodwill is not recorded

What is the accounting for a withdrawal of a partner under the goodwill method?

Record the implied goodwill and allocate to all partners in accordance with profit and loss ratios

Balance in withdrawing partner’s capital account should equal amount that person is expected to receive in final settlement

What is the order of preference regarding distribution of assets in liquidating a partnership?

Creditors

Partners’ capital

How are losses accounted for in liquidating a partnership?

Do not distribute any cash until maximum potential losses have been taken into consideration

Losses are charged to partners in accordance with agreement; absent an agreement, losses are shared equally

What is a capital deficiency?

A debit balance in a partner’s capital account that the partnership has a claim against for that amount

What is the right of offset regarding capital deficiency?

If partner with a capital deficiency has a loan account, the partnership can use the payable to offset the deficiency

What happens if a capital deficiency still exists?

Remaining partners must absorb deficiency according to profit and loss ratios

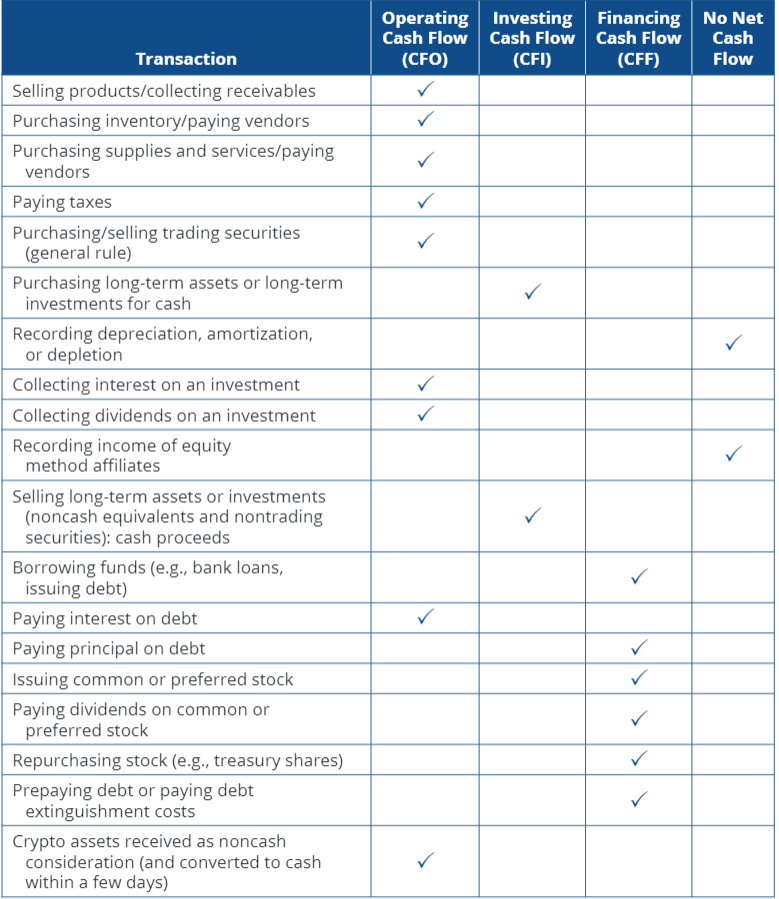

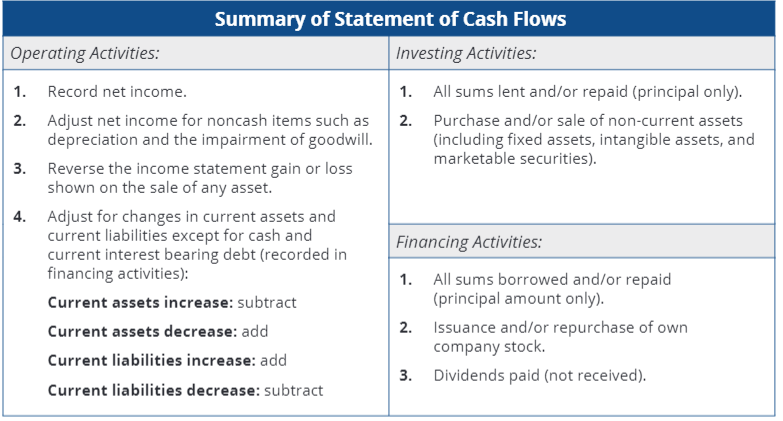

What do each of the cash flows (i.e. operating, investing, and financing) provide infromation about?

Cash receipts and disbursements of:

Operating: income statement transactions and current assets and liabilities

Investing: non-current assets

Financing: debt

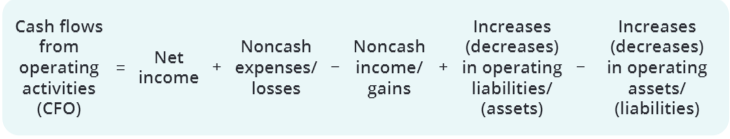

What is the indirect method for preparing the statement of cash flows?

Report operating net cash flows indirectly by adjusting net income

How is net income adjusted under the indirect method? (CLAD)

Current assets and liabilities (change in debit = inverse; change in credit = direct)

Losses and gains (gains subtracted, losses added)

Amortization and depreciation (added)

Deferred items (subtract)

What is included in the supplemental disclosure regarding the indriect method?

Cash used to pay income tax and interest

Illustrate the segments of the statement of cash flows

What is allocated in intraperiod tax allocation? (IDA-PUFI)

Income/loss from:

Income from continuing operations

Discontinued operations

Accounting principle change (retrospective)

Pension funded status change

Unrealized gain/loss on AFS debt securities

Foreign translation adjustment

Instrument-specific credit risk

How do we calculate the amount of income tax expense/benefit allocated to continuing operations?

Tax effect of pretax income/loss from continuing operations plus/minus tax effects of changes in tax laws or rates, expected realization of a deferred tax asset, or tax status of the entity

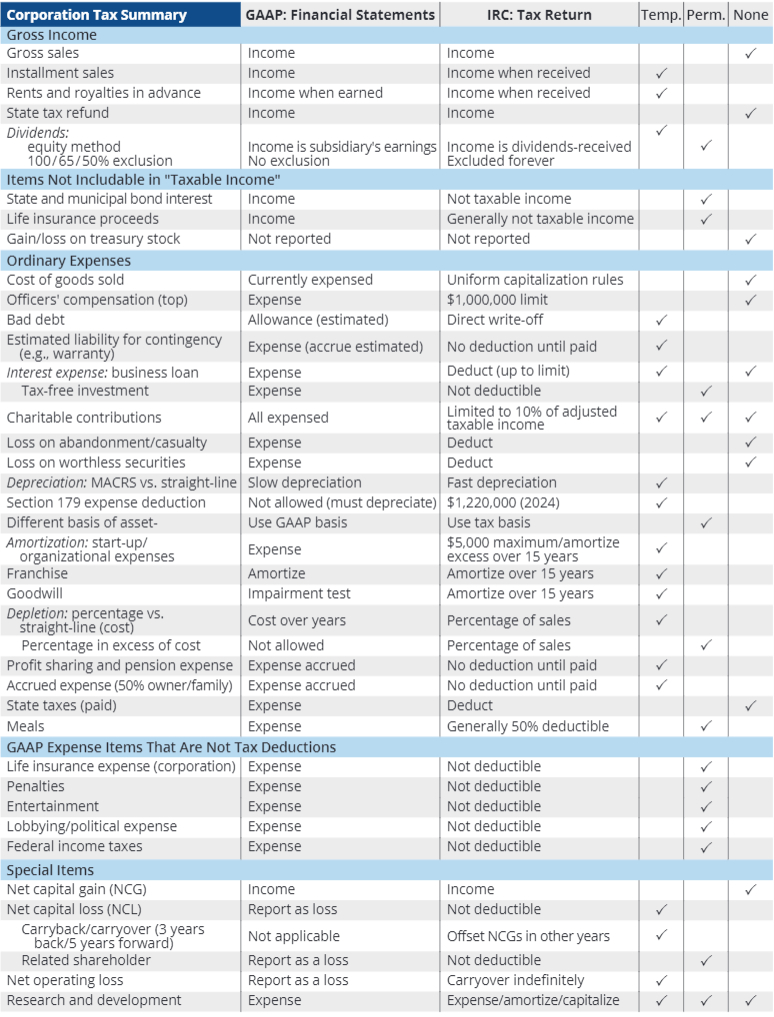

What are the characteristics of permanent tax differences?

Do not affect deferred tax computation

Only affect current tax computation

Affect only the period in which they occur

Do not affect future financial or taxable income

What are the characteristics of temporary tax differences?

Will affect deferred tax computation

Eventually will be recognized for GAAP purposes (or vice versa)

Temporary differences affect future period(s) and require:

Liability (for future taxable)

Asset (for future deductible)

Should be recognized until difference turns around completely

What is the asset and liability method (AKA balance sheet approach)?

For comprehensive allocation

Interperiod tax allocation applied to all temporary differences

Either income taxes payable or deferred tax liability be recorded for all tax consequences of current period

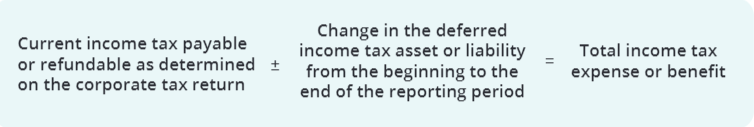

How is total income tax expense calculated?

Sum of:

Current income tax expense/benefit; and

Income taxes payable or refundable

Deferred income tax expense/benefit

Change in deferred tax liability or asset from beginning to end of period

What are some examples of permanent tax differences?

Tax-exempt interest

Nondeductible portion of meal and entertainment expense

Life insurance proceeds on officer’s key person policy

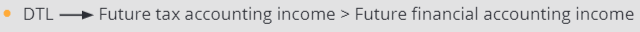

What results in a deferred tax liablity?

Revenues/gains included in financial statement income before taxable income

Expenses/losses deducted from taxable income before financial statement income

What results in a deferred tax asset?

Revenues/gains included in taxable income before financial statement income

Expenses/losses deducted from financial statement income before taxable income

When will a valuation allowance be recognized?

More likely than not (more than 50%) that part or all of deferred tax asset will not be realized

Net deferred tax asset should equal portion of deferred tax asset that is more likely than not to be realized