AP Macro Unit 4

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

44 Terms

barter system

a system of exchange in which goods or services are traded directly for other goods or services without the use of money.

fiat money

currency who's value derives entirely from its official status as a means of exchange

commodity money

objects that have value in themselves and that are also used as money

3 functions of money

1. medium of exchange (easily buy goods)

2. unit of account (measures the value of goods)

3. store of value (money allows you to store purchasing power for the future)

Types of Money

1. M1 (high liquidity)- Coins/cash/checkable deposits The Money Supply

2.M2 (Medium liquidity)- M1 plus savings deposits/time deposits/ mutual funds below $100 K

M1 money supply

the most narrowly defined money supply, equal to currency in the hands of the public, time deposits & checkable deposits (demand deposits)

checkable deposits (demand deposits)

any deposit in a commercial bank or thrift institution against which a check may be written (a checking account)

M2 Money Supply

Includes all of M1 money supply plus most savings accounts, money market accounts, and certificates of deposit.

Monetary Base

the sum of currency in circulation and bank reserves

Liquidity

the ease with which an asset can be converted into cash

asset

Anything of monetary value that is owned by a firm or individual

liability

a requirement to pay money in the future

Loans

amounts of money borrowed which will accumulate interest

bonds

type of loan, when originally buying a bond the purchaser is loaning money to the issuer of the bond

coupon (of a bond)

interest rate of a bond

Stock

asset that signifies ownership in a corporation and represents claim on part of the corporations assets and earnings

financial intermediaries

financial institutions through which savers can indirectly provide funds to borrowers. Example: Banks hold your savings, then loan it out to others

bank reserves

the money deposits held in banks or at the FED

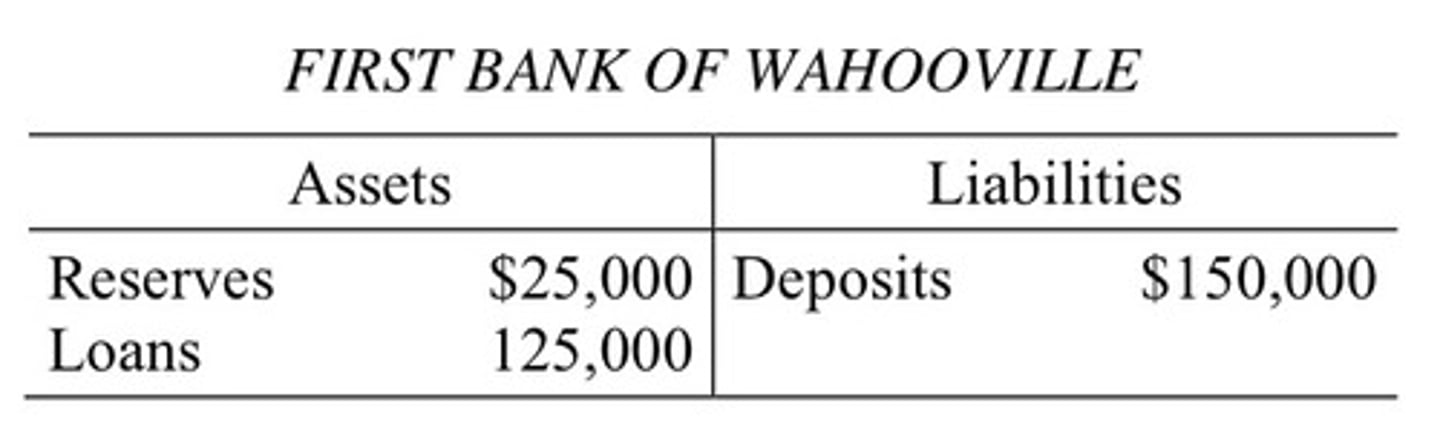

T-account

bank balence sheet

reserve ratio

the fraction of deposits that banks hold as reserves

reserve requirement

the percentage of deposits that banking institutions must legally hold in reserve

excess reserves

a bank's reserves over and above its required reserves

Total Reserves

required reserves + excess reserves

monetary policy

Government policy that attempts to manage the economy by controlling the money supply and thus interest rates.

Tools of Monetary Policy

reserve requirement, discount rate, open market operations (bonds)

federal funds rate

the interest rate at which banks make overnight loans to one another

discount rate

Interest rate the Federal Reserve charges for loans to commercial banks

open market operations

the buying and selling of government securities (bonds) to alter the supply of money. Buying bonds = bigger bucks, Selling bonds = smaller bucks

medium of exchange

Any item generally accepted to pay for a good or service; money; a convenient means of exchanging goods and services without engaging in barter.

unit of account

A standard unit in which prices can be stated and the value of goods and services can be compared

store of value

an asset that serves as a means of holding wealth

Money Supply Curve

shows the relationship between the quantity of money supplied and the interest rate. This curve is vertical and can only shift because of monetary policy

Money Demand Curve

a graphical representation of the negative relationship between the quantity of money demanded and the interest rate; the money demand curve slopes down because, other things equal, a higher interest rate increases the opportunity cost of holding money

Opportunity Cost of holding on to your money

Potential interest earned

demand for money

how much money people would like to hold in their "pockets" - access to liquid assets

expansionary monetary policy

Federal Reserve system actions to increase the money supply, lower interest rates, and expand real GDP

contractionary monetary policy

the federal reserve's decreasing the money supply to increase interest rates to reduce inflation and real GDP

loanable funds market

The market in which the demand for private investment (loans) and the supply of household savings intersect to determine the equilibrium real interest rate.

demand for loanable funds

inverse relationship between real interest rate and quantity of loans demanded. How much money firms, individuals & governments what to borrow

supply for loanable funds

Direct relationship between real interest rate and loanable funds supplied. People will invest more at higher interest rates. The amount of savings made available to be loaned out

real interest rate formula

nominal interest rate - inflation rate

crowding out

a decrease in investment that results from an increase government borrowing, causing an increase in interest rates

National Savings (Closed Economy)

Total amount of private and public savings. Closed economy means there is no trade occurring.

National Savings (Open Economy)

Total amount of private and public savings, plus net capital inflows (money coming in to country - money going out of the country). Open economy means trade is occurring.