AP Microeconomics Unit 2 Test Study Guide

1/38

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

39 Terms

Demand

The different quantities that consumers are WILLING and ABLE to buy at different prices.

Law of Demand

There is an inverse relationship between price and quantity demanded. (As one increases, other decreases)

Why does the Law of Demand occur? 1. The Substitution Effect

If the price goes up for a product, then consumers will be more likely to by a substitute more. (Lucky Charms vs. Marshmellows and Stars)

Why does the Law of Demand occur? 2. The Income Effect

As a products price decreases, a consumer's purchasing power increases (they can buy more)

Why does the Law of Demand occur? 3. The Law of Diminishing Marginal Utility

The more you buy of any good the less satisfaction you receive.

5 Shifters of DEMAND

1. Tastes & Preferences

2. # of Consumers

3. Price of Related Goods

4. Income

5. Future Expectations

*PRICE ONLY ACCOUNTS FOR MOVEMENT ALONG THE CURVE*

Normal vs. Inferior Goods

Normal Goods

- luxury cars, jewelry

- As income increases, demand increases (positive)

Inferior Goods

- ramen, used clothes

- As income increases, demand decreases (inverse)

Supply

The different quantities of a good that sellers are willing and able to produce/sell at different prices

Law of Supply

There is a direct/positive relationship between price and quantity supplied (As one increases, so does the other)

5 Shifters of SUPPLY

1. Prices & Availability of resources

2. # of sellers

3. technology

4. Government actions (taxes & subsidies)

5. Expectations of future sales

Surplus

When the quantity supplied > quantity demanded

Shortage

When quantity supplied < quantity demanded

(price will usually increase)

Equilibrium

quantity supplied = quantity demanded

Double Shift Rule

If TWO curves shift at the same time,

EITHER price or quantity will be

indeterminate (ambiguous).

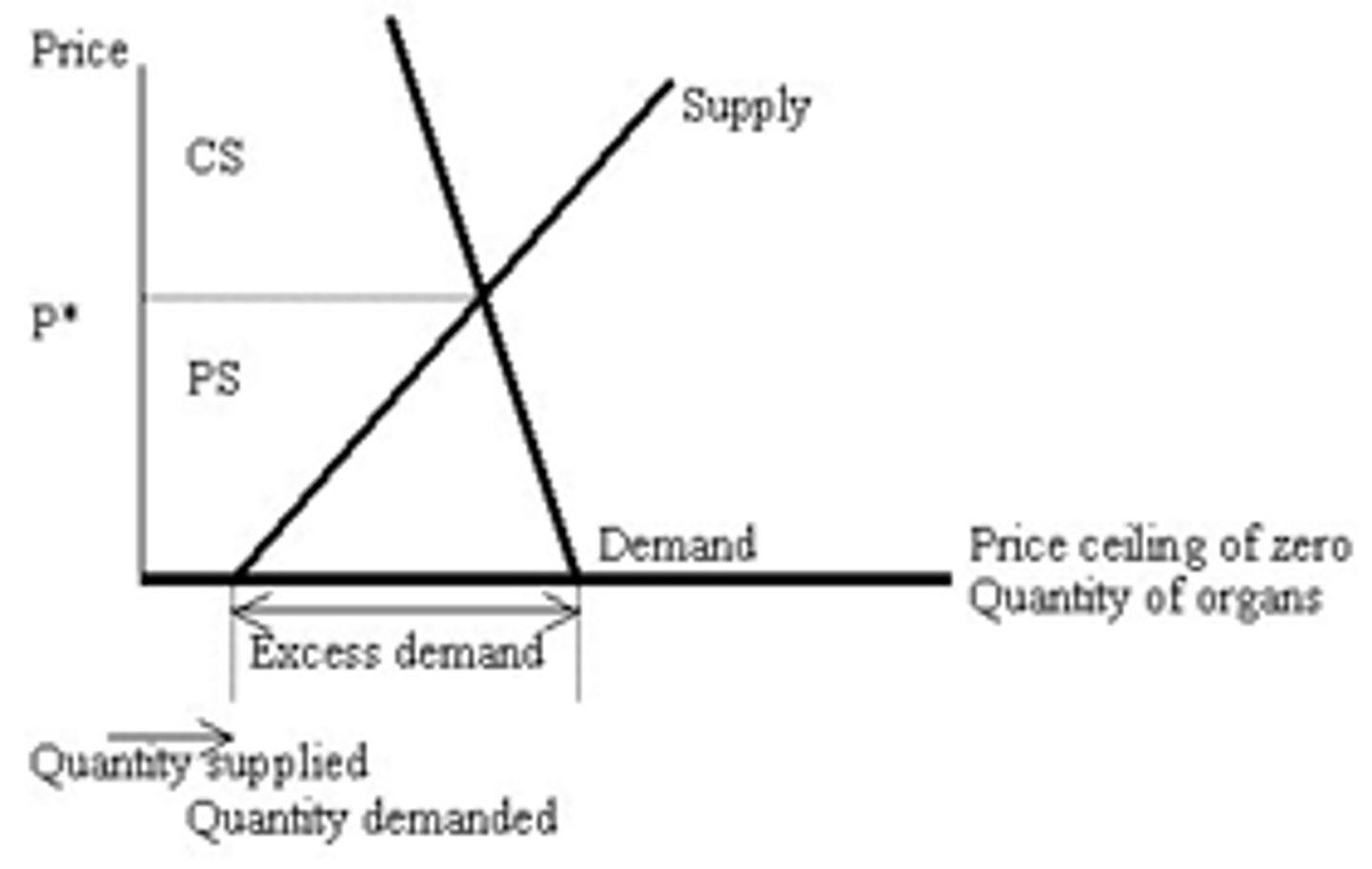

Consumer Surplus

The difference between

what you are willing to pay and what you

actually pay.

CS = Buyer's Maximum - Price

Producer's Surplus

The difference between

the price the seller received and how much

they were willing to sell it for.

PS = Price - Seller's Minimum

Dead weight loss

The lost CS and PS= inefficient

Elasticity

Shows how sensitive quantity is to a change in price

Price Elasticity of Demand

A measurement of CONSUMER'S response to a change in price

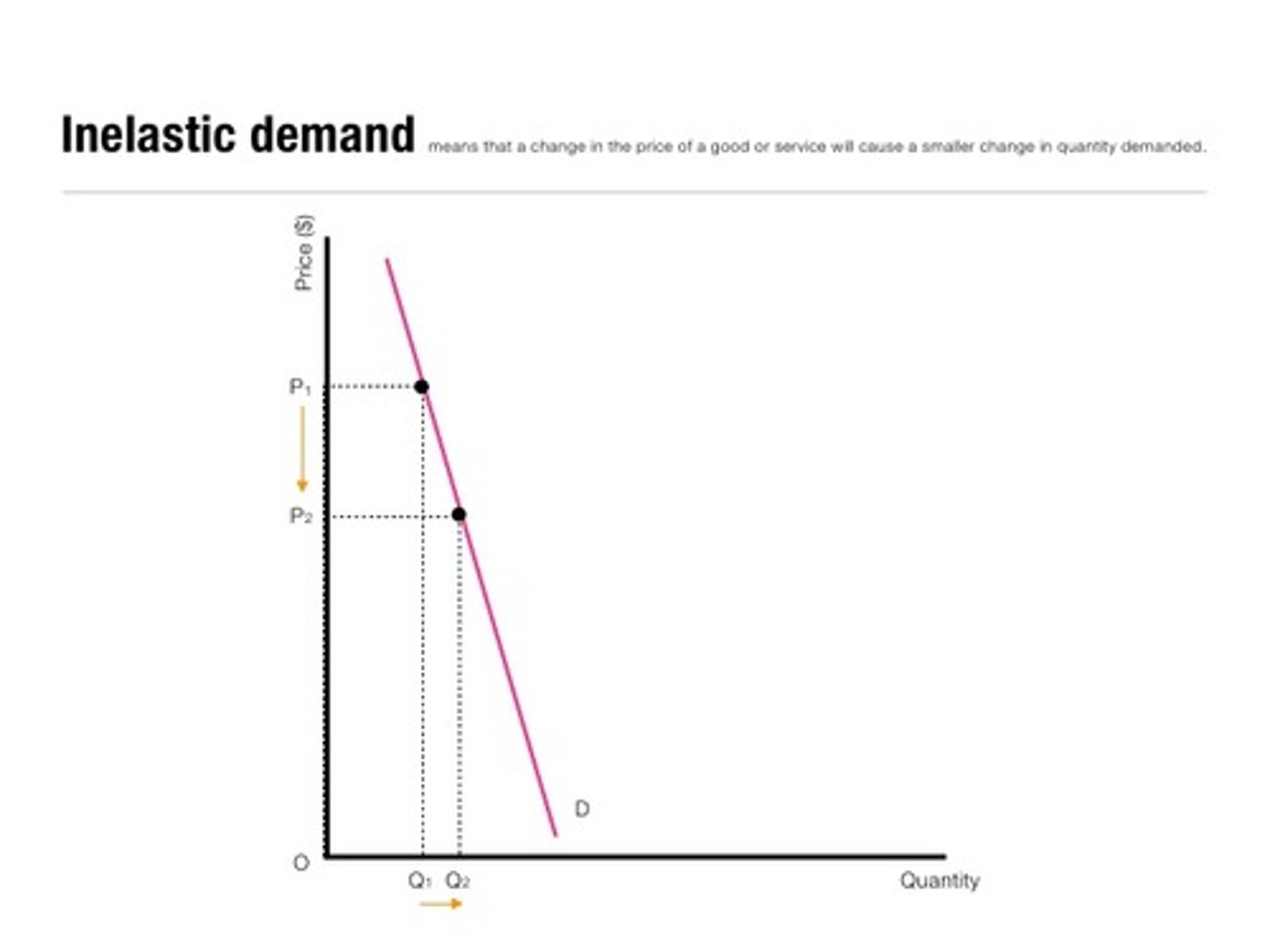

INelastic Demand

- Quantity is INsensitive to a change in price.

- Price increases, quantity demanded decreases a little

- The curve is steep

- Elasticity coefficient < 1

Elastic Demand

- Quantity is sensitive to a change in price

- Curve is flat

- Elasticity coefficient >1

- If price increases a little, quantity demanded decreases a lot

What makes a good inelastic?

- There aren't many substitutes

- It's a necessity

- Required now rather than later

- Small part of income

What makes a good elastic?

- Many subs

- It's a luxury

- There is time to decide if you want it or not

- Large part of income

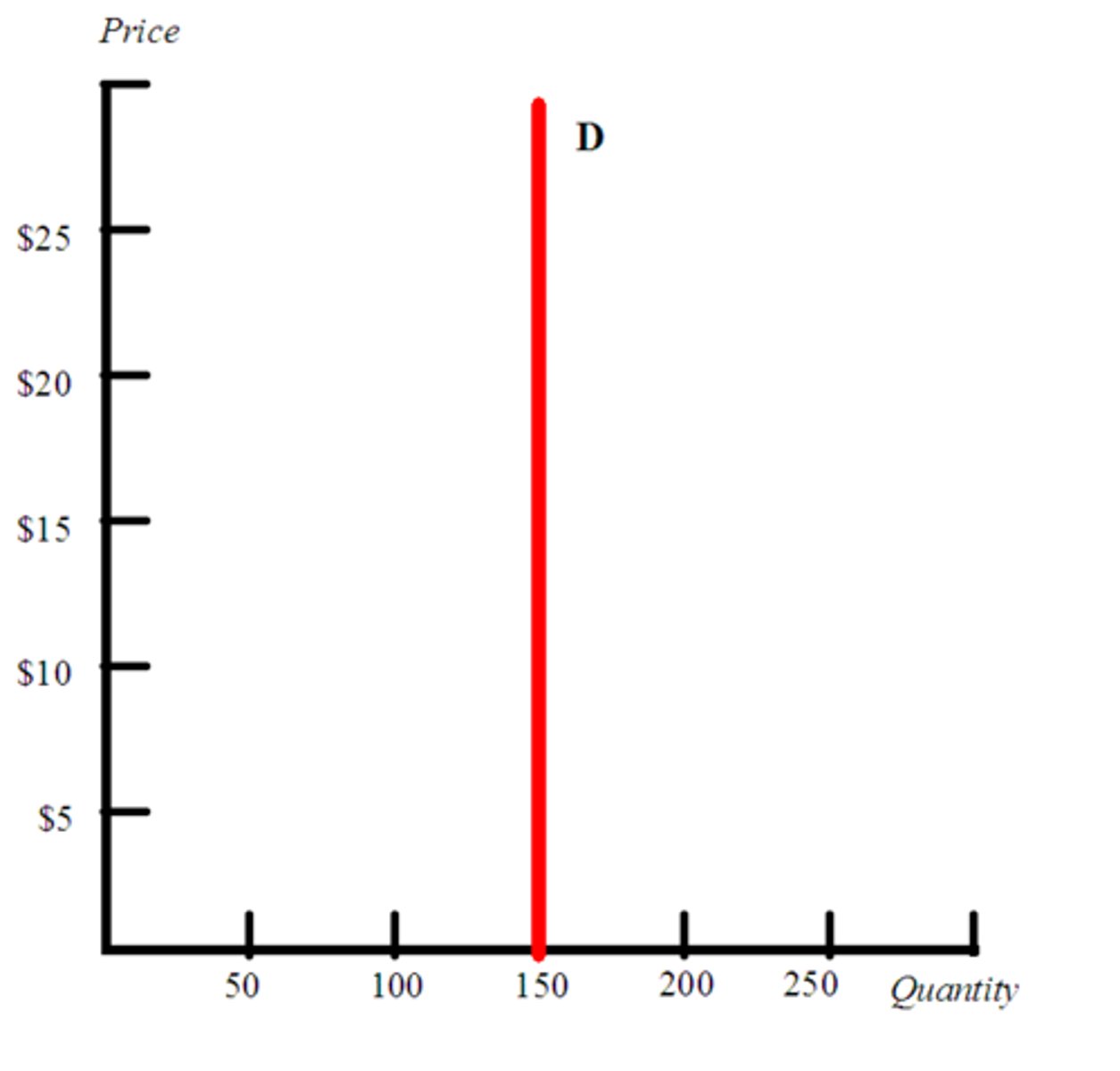

Perfectly INelastic

- The quantity demanded stays the same for any price

- Elasticity coefficient of 0

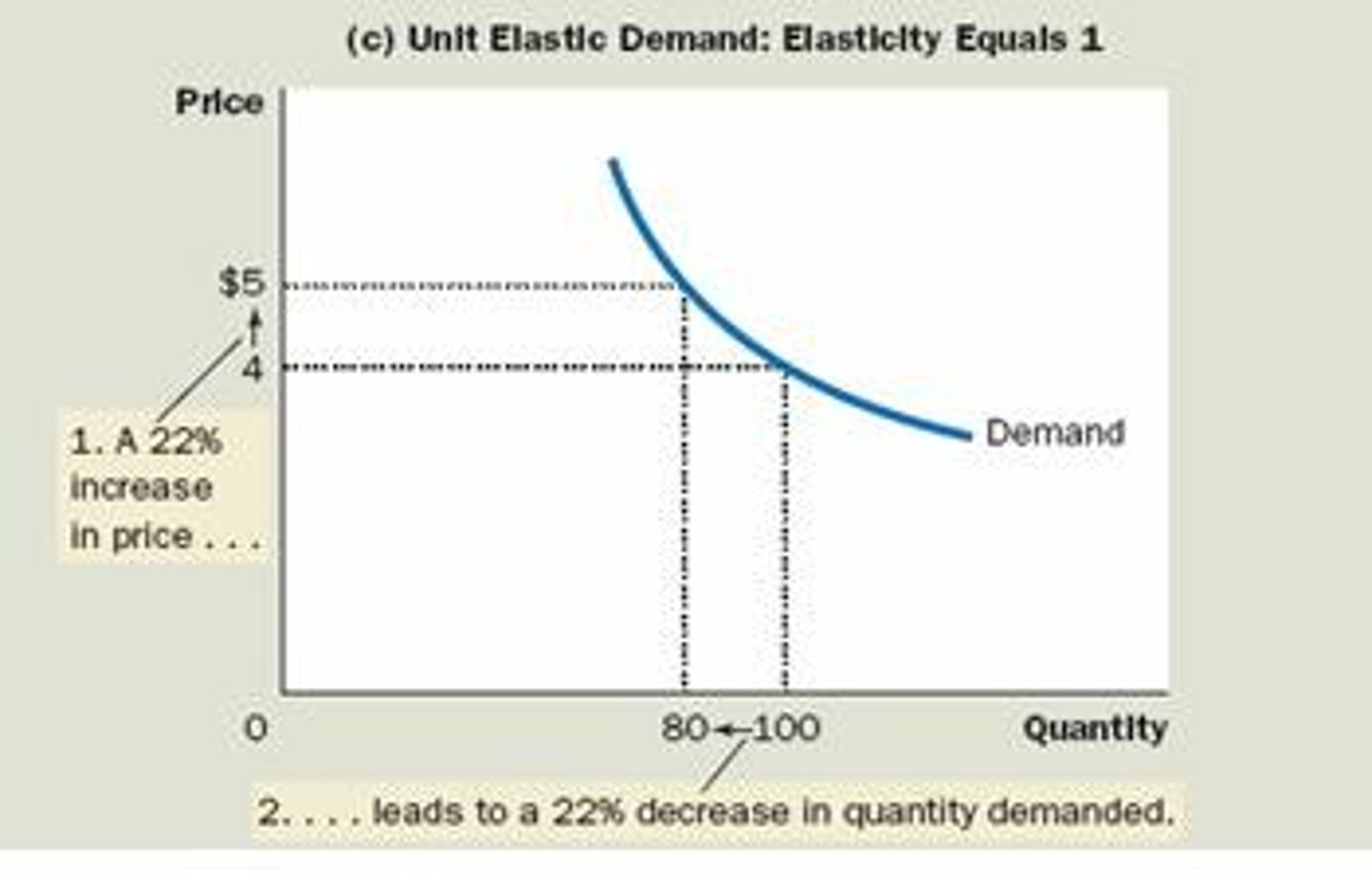

Unit Elastic

- % change in quantity demanded and % change in price are =

- Elasticity coefficient is 1

Perfectly Elastic

- The price stays the same for any quantity

- Coefficient is infinity

Elasticity types and coefficients

Relatively inelastic: <1

Perfectly inelastic: 0

Relatively elastic: >1

Perfectly elastic: infinity

Unit elastic: 1

Total Revenue Test

(Price x Quantity)

Uses elasticity to show how changes in P effect total revenue

Inelastic demand- Price increases, TR increases

Elastic- Price increases, TR decreases

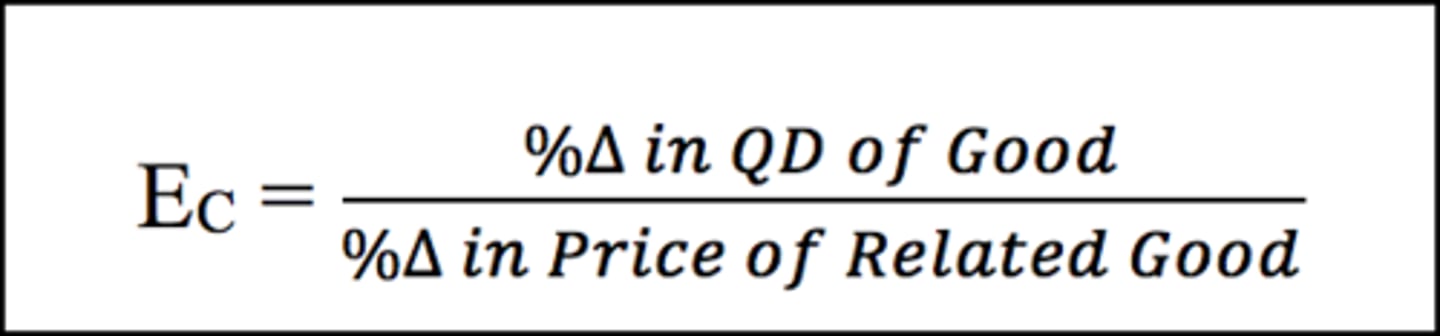

Cross Price Elasticity of Demand

Shows how sensitive the price of one good is in relation to the change in price of another

*If the number is positive, they're substitutes

*If the number is negative, they are complements

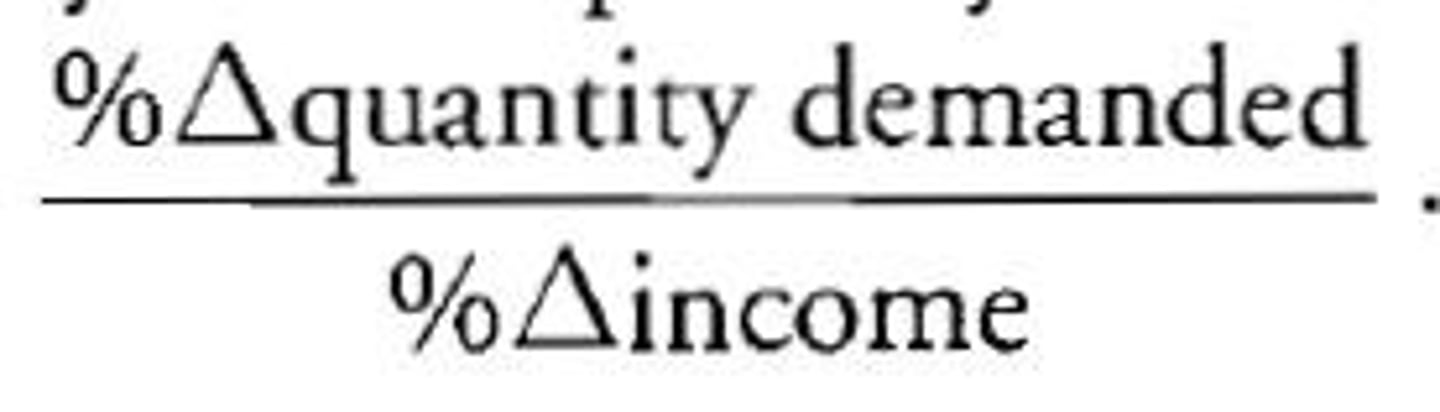

Income Elasticity of Demand

Shows if a product is sensitive to a change in income (If it's normal or inferior)

*If the number is positive, it's normal

*If the number is negative, it's inferior

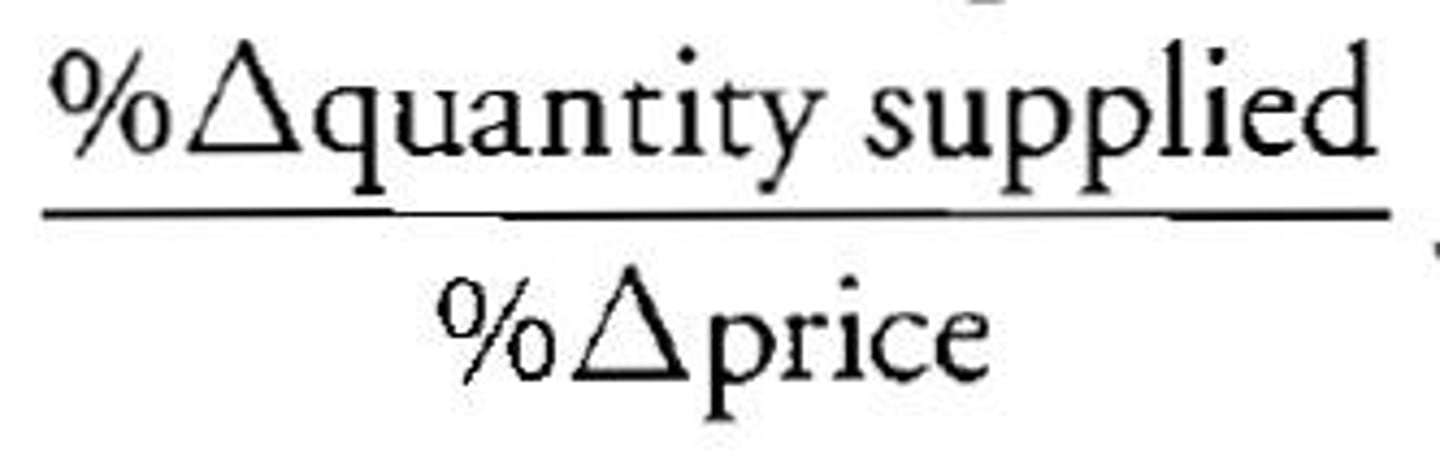

Price Elasticity of Supply

Shows sensitivity of producers to a change in price.

Time based, more time= more produced

Inelastic= steep curve

elastic= flat curve

World Price

The price to import a good from another country

Tariff

Tax on imported goods to protect domestic producers from the cheap world price

Quota

Limit on # of imports (to protect domestic producers)

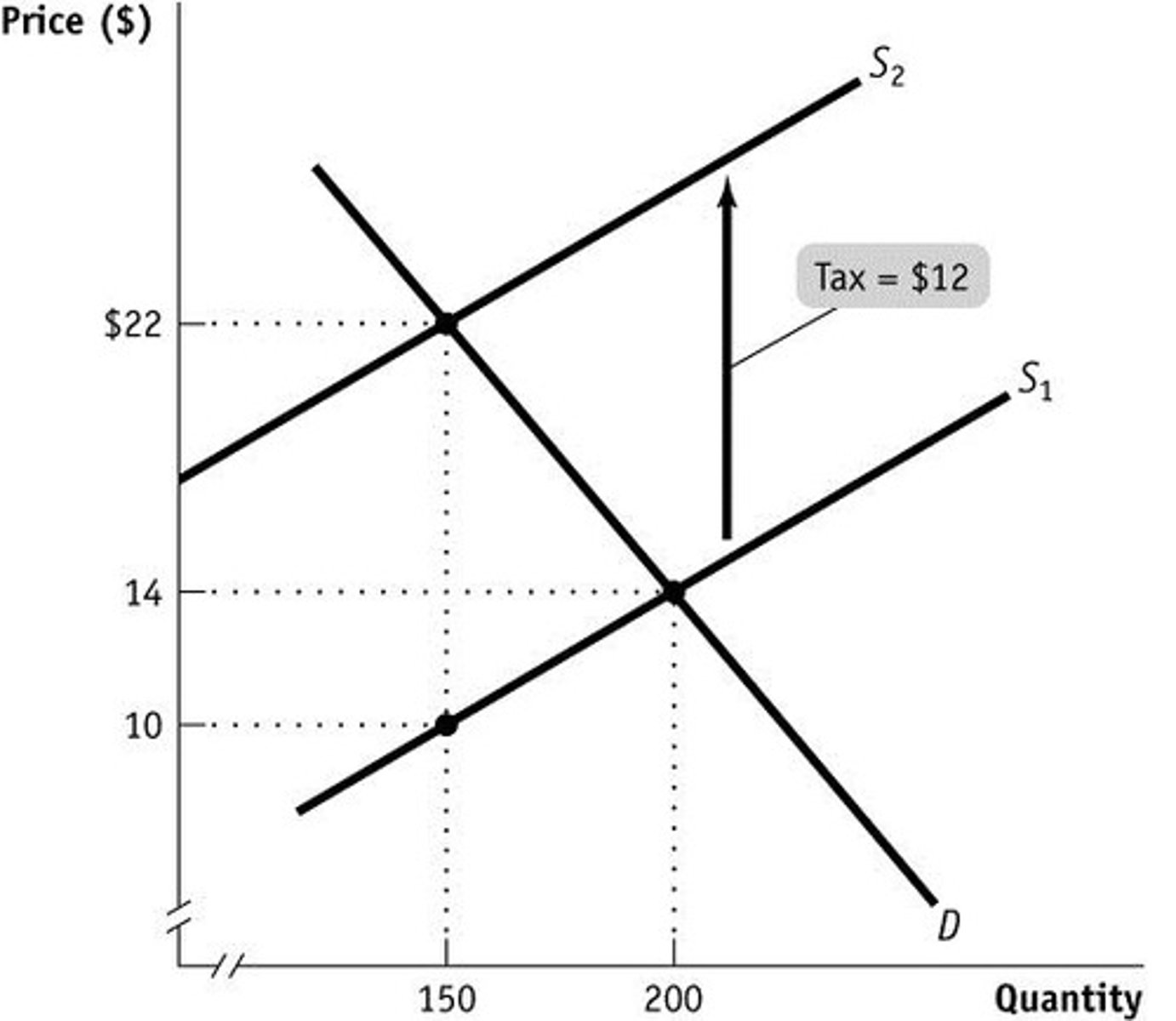

Excise Taxes

- A PER UNIT tax on producers

- goal= to make less of the goods that the government deems unwanted

- The tax is the vertical distance between the two supply lines

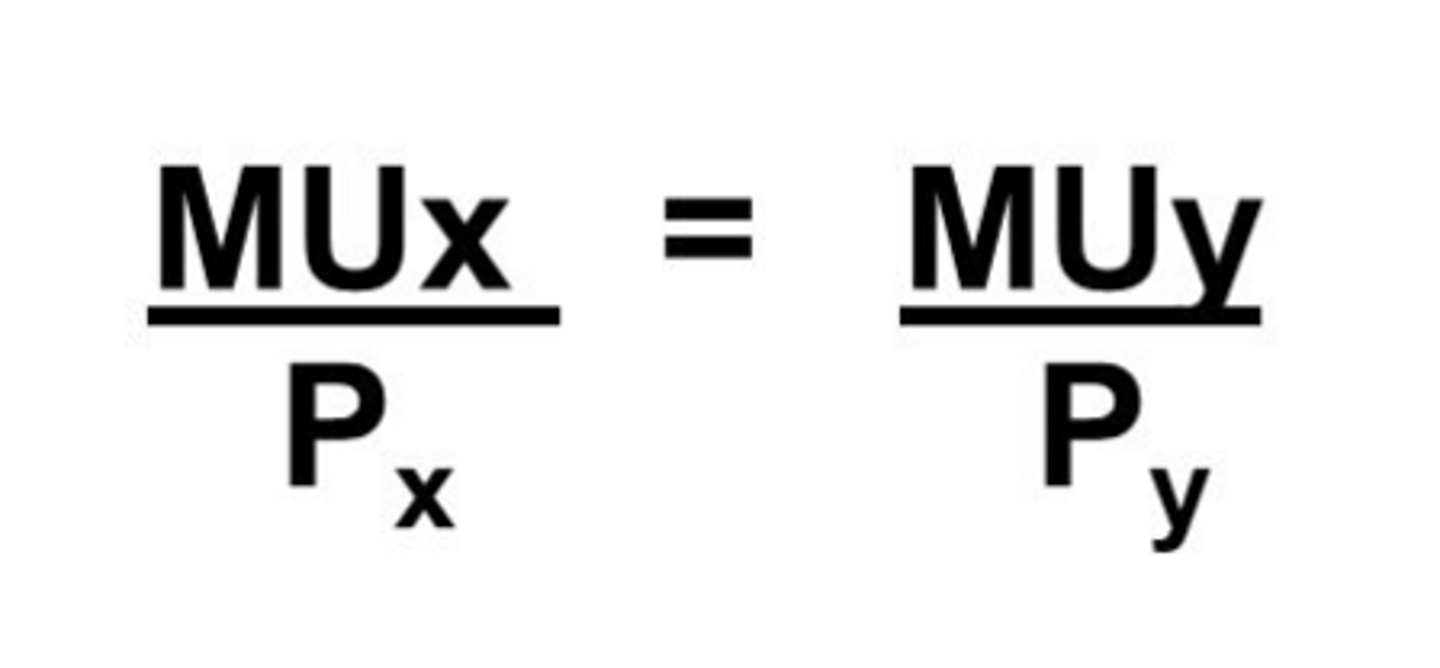

Utility Maximizing Rule

MU/P

to find the marginal utility from the total find the difference between the two marginal utilities.

Supply and Demand Sample Graph

Price ceiling

Maximum legal price a seller can charge for a product

has to be below Eq to be binding

Price Floor

Minimum legal price a seller can sell a product.