Efficiency Ratios

1/4

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

5 Terms

Efficiency Ratios definition-

Efficiency ratios, also known as activity financial ratios, are used to measure how well a company is utilizing its assets and resources.

Asset Turnover Ratio

asset turnover ratio measures the efficiency of a company's assets in generating revenue or sales. It compares the dollar amount of sales to its total assets as an annualized percentage.

shows how efficiently a company is using its owned resources to generate revenue or sales.

Measures a company’s ability to generate sales from assets, how efficiently a company uses its assets to generate sales revenue.

FORMULA:

= Net sales (or total revenue) / total assets

Inventory Turnover Ratio

Measures how many times a company’s inventory is sold & replaced over a given period

measures how efficiently a company uses its inventory

This ratio is a good indicator of inventory quality (whether the inventory is obsolete or not), efficient buying practices and inventory management.

low inventory turnover ratio might be a sign of weak sales or excessive inventory, also known as overstocking. Thus could indicate a problem with a retail chain's merchandising strategy or inadequate marketing.

FORMULA:

= Cost of Goods Sold / Average Inventory

Days Sales in Inventory Ratio

Measures the average number of days that a company holds on to inventory before selling it to customers

metric used to evaluate how efficiently a company manages its inventory by measuring the average number of days it takes for a company to sell its entire inventory

FORMULA:

= 365 (days in a year) / Inventory Turnover Ratio

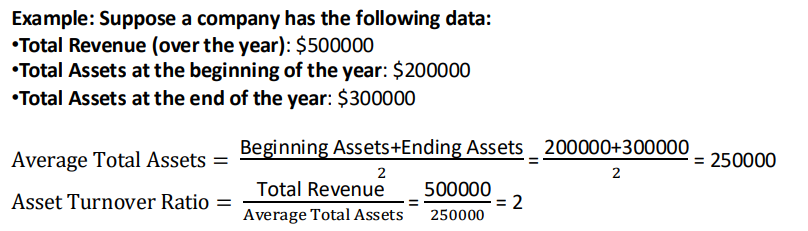

Example Asset Turnover Ratio

Interpreting the Ratio:

A higher Asset Turnover Ratio indicates that the company is using its assets efficiently to generate sales.

A lower ratio suggests that the company might not be using its assets effectively to produce revenue.

If a company has an Asset Turnover Ratio of 2, it means that for every dollar of assets, the company is generating $2 in revenue.