The Financial System Explained in 18 Minutes -- FCs

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

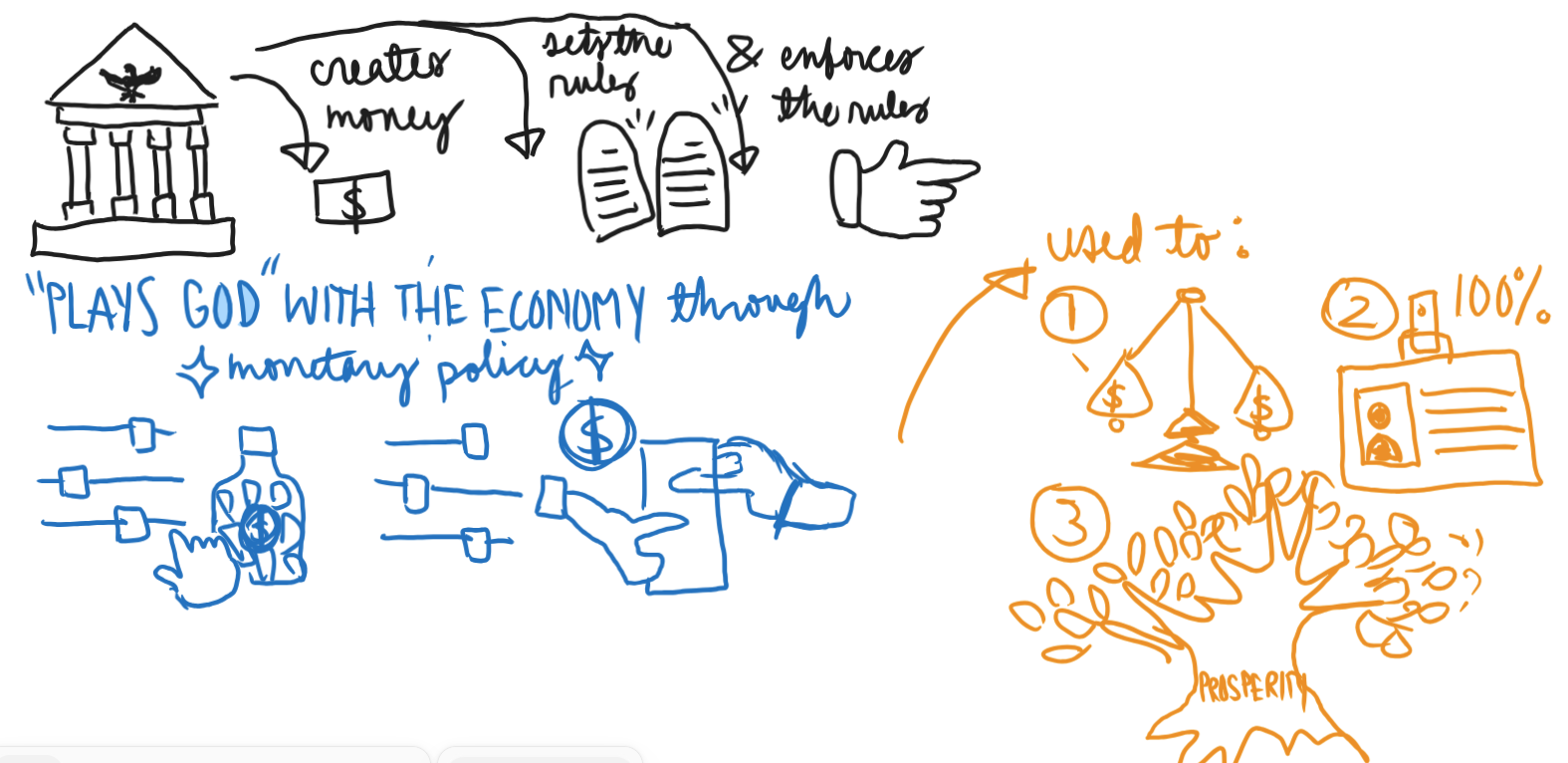

What do central banks do? What is their purpose?

Purpose of central banks

- The central banks are where money gets created; they are the arm of the government within the financial system who is part of the team that sets the rules and enforces them;

- Almost all countries have their own central bank

What central banks specifically do

- They "play God with the economy" through monetary policy, which is:

- Controlling the amount of money in the economy

- Controlling the interest rates

- They use these tools to:

- Maintain price stability (manage inflation)

- Keep full employment

- Maintain overall economic prosperity for the nation

What do central banks do, more specifically?

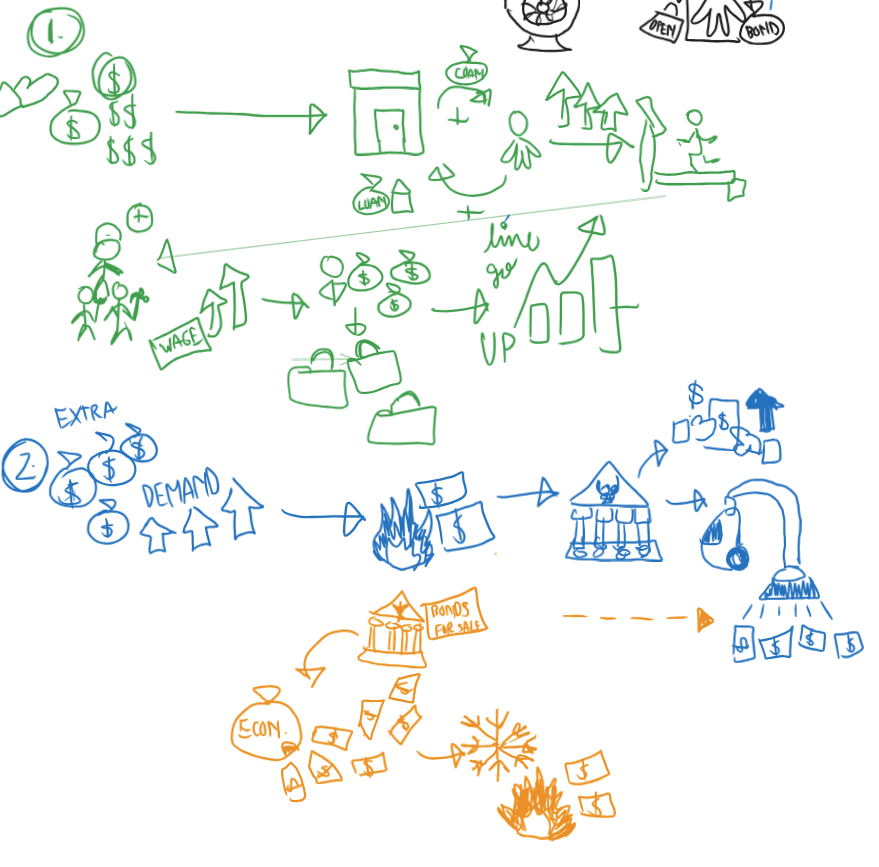

How it works:

Let's say the economy is moving too slowly; thus, a central bank will use expansionary monetary policies, such as:

Cutting interest rates

Pumping cash into the system through:

Printing more money

Open market operations (buying/selling securities in the open market) such as quantitative easing and bonds

This means borrowing money becomes really cheap, so businesses take out more loans to expand and people take out more mortgages.

This productivity means we need more workers and higher wages -- if people have more money that means they will spend more, which creates a cycle that leads to a booming economy.

The catch to all of this

Extra money and demand in the economy will cause extra inflation.

To ensure inflation doesn't keep getting out of hand, central banks will use contractionary monetary policies such as:

Increasing interest rates

Sucking money out of the economy through quantitative tightening

What is quantitative easing?

Buying large amounts of government bonds / other assets from the open market

What is a bond?

An IOU in which you lend money to a government or company for a set time, and they promise to pay you back the original amount (principal) plus regular interest payments (coupons) until the bond "matures" or ends

What is a mortgage?

A loan used to purchase real estate, such as houses / commercial properties

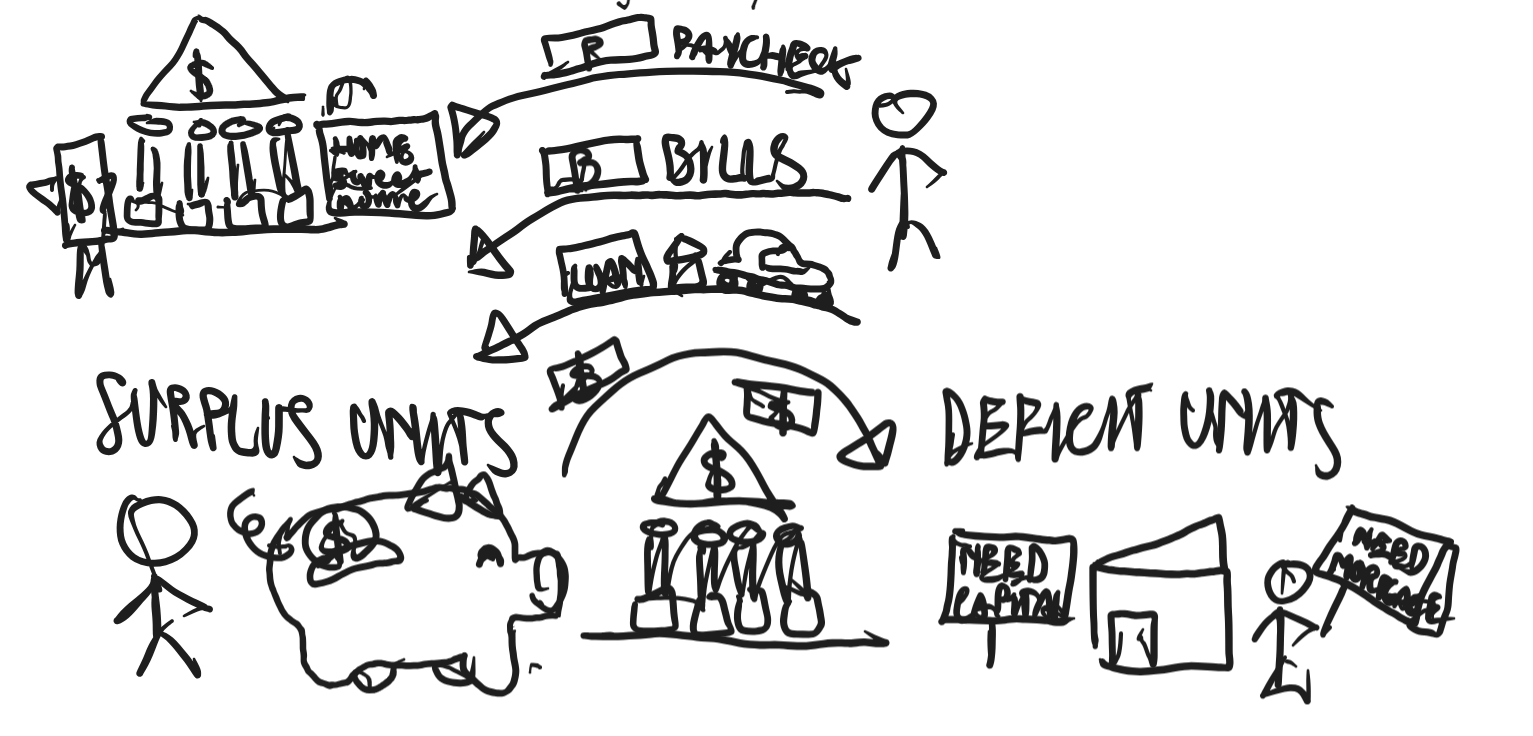

What do commercial banks do?

They are the “workhorses” of the economy.

They are where most people's money lives:

Your paycheck lands there

You pay your bills from there

You may take out a mortgage/car loan through them.

Their main role: moving money from savers to borrowers

They sit between surplus units and deficit units

On one side, you've got surplus units, or people with a surplus of money. This can include:

People with cash sitting in their accounts

Retirees with pension payments

Companies with excess profits

On the other side, you've got deficit units (entities that spend more money than they earn or receive), which include:

Startups needing capital

Homebuyers looking for mortgages

Businesses needing to expand

Banks sit in the middle:

They pull the unused money from savers.

They lend that money out to people/companies that can put it to work.

This keeps money always flowing through the economy rather than just sitting down.

What is the TWIST to what commercial banks do?

Banks DO NOT JUST lend out the exact deposits they receive.

When they issue a new loan, they actually create new money -- they are lending you money they don't actually have.

But THEY CANNOT just loan out an infinite amount of money -- there are things such as capital requirements and liquidity rules that determine how much they can lend.

liquidity: how easily and quickly an asset (resource controlled by an individual, company or government that has economic value) can be converted to cash without losing significant value

What is liquidity?

How easily and quickly an asset (resource controlled by an individual, company or government that has economic value) can be converted to cash without losing significant value

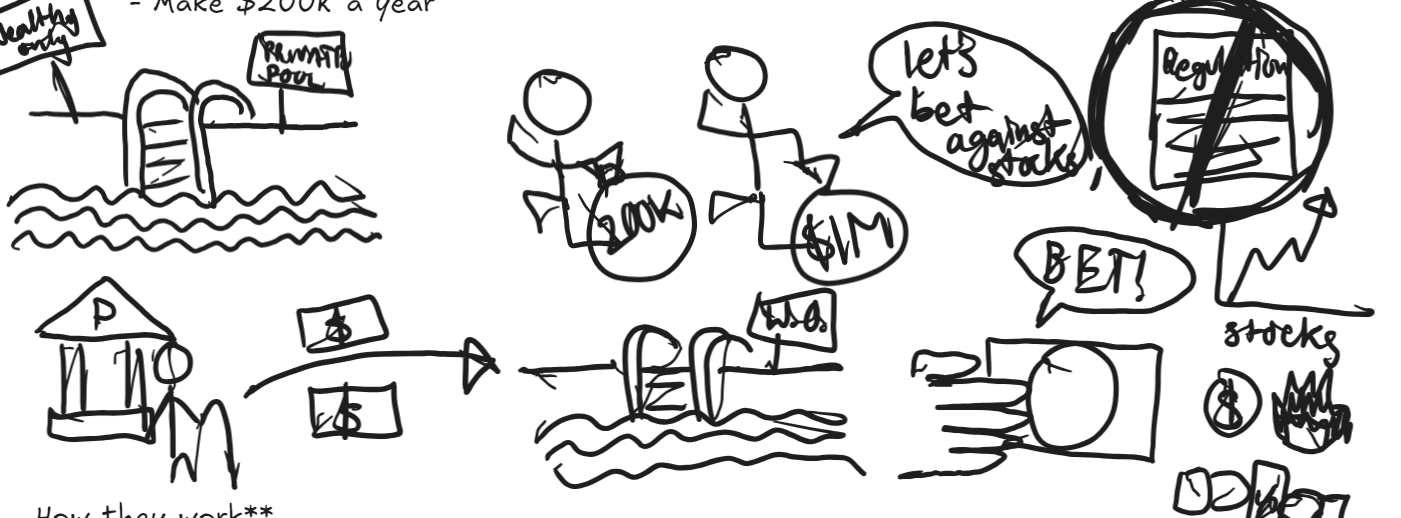

What are hedge funds? How do they work?

Private investment pools for wealthy investors, managed by professionals who use often risky strategies (e.g. borrowing money, betting against stocks) to generate high returns.

They are only open to accredited investors, which are investors who either:

Have at least a million dollar net worth (NOT including your house)

Make $200K a year

How they work

They raise a bunch of cash from pension funds and wealthy individuals and then use it to place bets in finance

They bet on literally anything (stocks going up/down, currencies crashing, interest rates moving, oil prices, crypto, election winners)

They do so with far fewer regulations, which is what makes them risky for ordinary people

They use huge leverage, which is borrowing a bunch of money to speed up trades

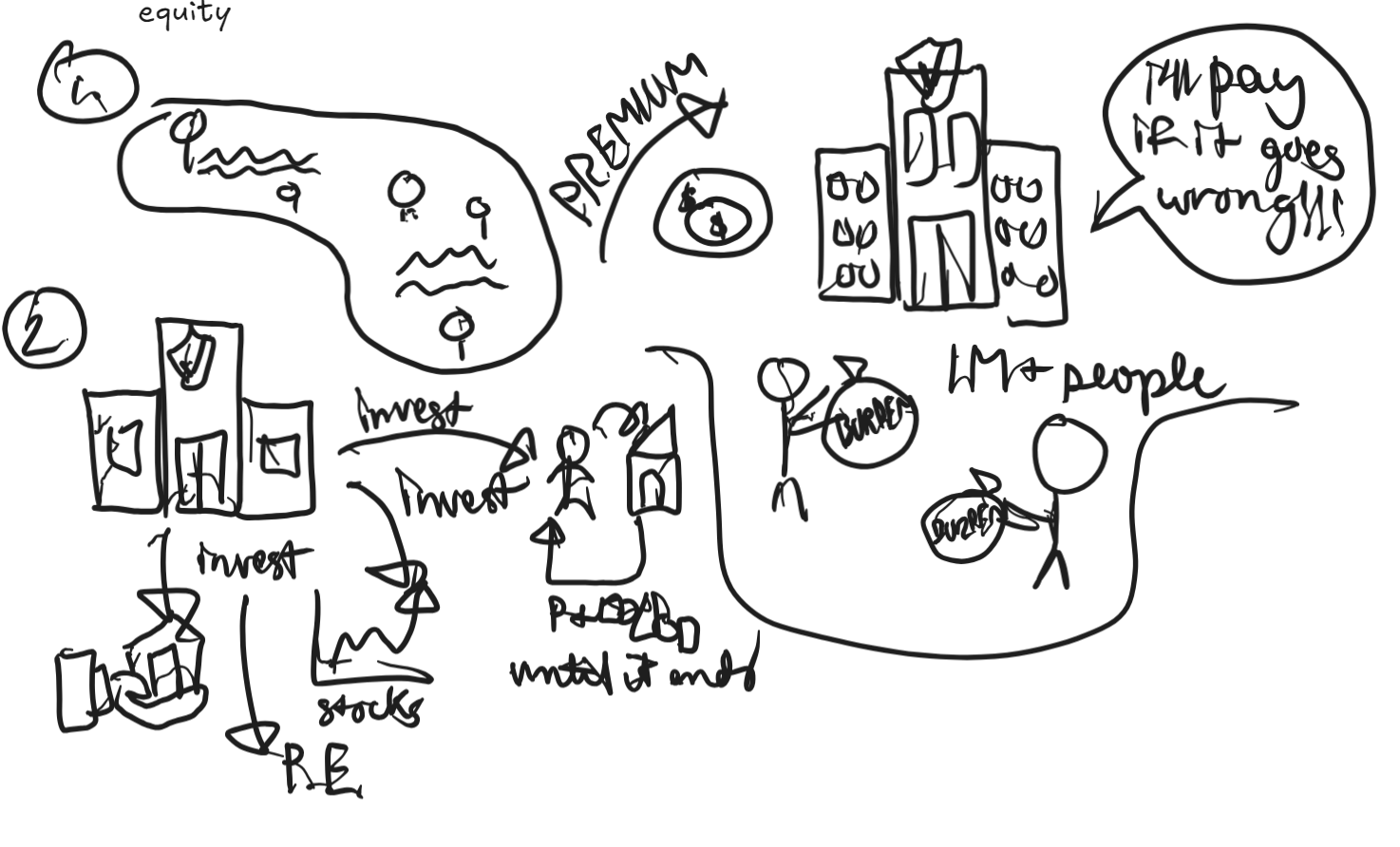

What do insurance companies do?

Take in premiums (prices paid for goods and services that are above and beyond the item's intrinsic value) from a large pool of people and in return promise to pay if something bad happens.

Because the chances of everyone getting hit with a disaster simultaneously are small, insurance companies redistribute the burden across millions of people.

They invest leftover cash, they invest in bonds, stocks, real estate, and even private equity

What do investment banks do?

Trade

Lend to hedge funds

Sell bonds

Make companies public

When a private company wants to go public, they call an investment bank.

The investment bankers figure out how much the company is worth, do some paperwork, and show it to investors so that the stock sells.

Mergers and acquisitions

If one company wants to buy another, they have to value the target, negotiate terms, and deal with financial documents.

Raise money

When companies need more cash than they can get from a normal bank loan, investment banks help:

Issue corporate bonds

Arrange massive loans

Sell more shares

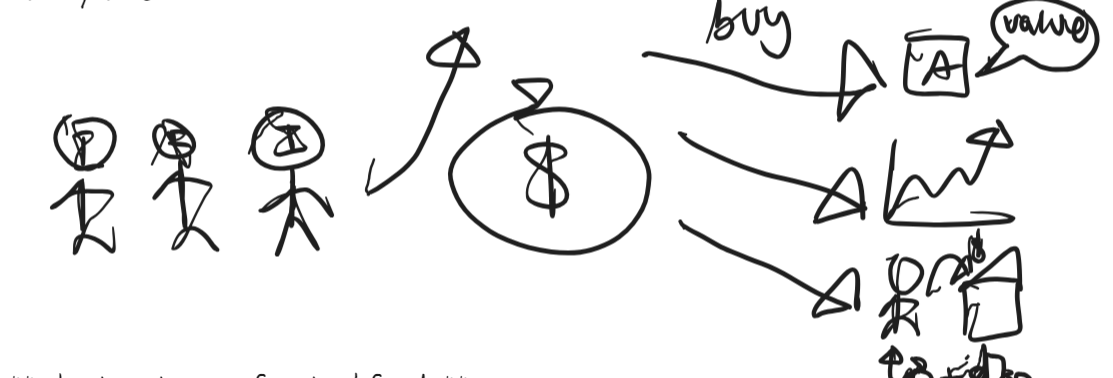

What are mutual funds and what do they do?

They let everyday people spread their money across many investments easily, which reduces risk.

What they are:

Investment funds for regular (not super wealthy) people.

You can throw a few thousand bucks into a mutual fund and get professional management

Examples: Vanguard, Fidelity, BlackRock, etc.

How they work

They take money from thousands of everyday investors, pull it together, and then buy large baskets of assets, stocks, bonds, real estates, or whatever is needed.

It's basically like a pension fund, but it's not just for retirement; you can pull your money out at any time.

What are the two types of mutual funds?

Actively managed funds: they hire and use professional managers to pick stocks aiming to beat the market

Passively managed funds: track market indexes (benchmarks that track the performances of specific stock markets, or units of ownership in a company)

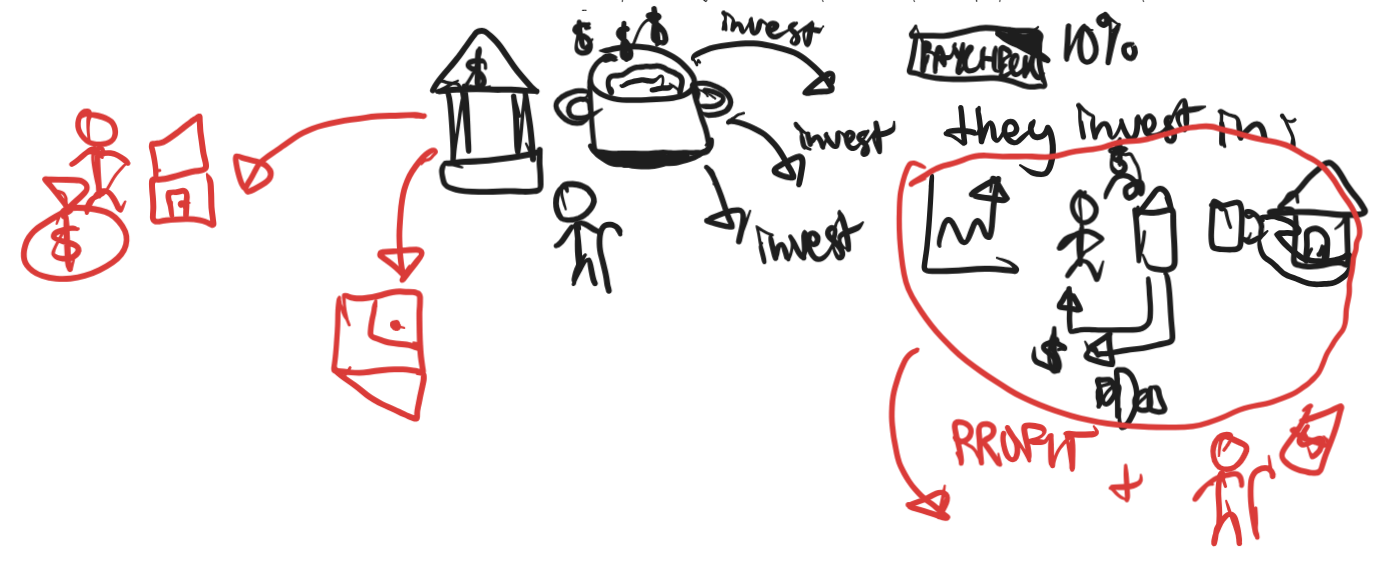

What do pension funds do?

They use retirement savings to make massive investments in major financial deals.

Although most of your paycheck lands in commercial banks, pension funds take around 10% of that paycheck before it hits your account.

Pension funds are huge, shared pots of money that are collectively invested to grow over time.

Their main function is to make sure people still get paid after they retire, basically keeping retirees from going broke.

Rather than keeping money in savings accounts and earning about 2%, they aim for earning 6-7% (lol) by investing it broadly across many types of assets (stocks, government bonds, corporate bonds, real estate) to get more profits and ensure that retirees can actually be paid.

They are the largest source of capital for PE (private equity) and VC (venture capital) firms.

What are private equity firms and what do they do?

Raise large amounts of money and just as much debt from pension funds and commercial banks

Buy businesses, fix them up, and then flip them (resell them) for huge profits.

What are venture capitalists and how does the “power law” affect them?

Venture capitalists are investors who provide capital to promising startups and small businesses with high growth potential, in exchange for an equity stake (ownership) in the company.

The power law

They raise money from pension funds, university endowments, sovereign wealth funds, and insurance companies, and they make tons of bets knowing most of them will fail.