Chapter 28

0.0(0)

0.0(0)

Card Sorting

1/31

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

1

New cards

Monetary Policy

Intelligent management of the money supply performed by the central bank

2

New cards

fiscal policy

where the government has to decide how to adjust their budget balance

3

New cards

When was the Federal Reserve Banking System made and for what reason?

Founded in 1913 to assist in the banking problems in the US

4

New cards

The Board of Governors consists of ____ board members and each serves for ____ years and are appointed by the _________. Every ____ years, one of the members is replaced.

7, 14, President, 2

5

New cards

How many Federal Reserve banks are there?

12

6

New cards

What relation do Federal Reserve Banks and the Central Bank have?

They’re the same

7

New cards

Quasi-public banks

Owned by private banks but take care of the public

8

New cards

Banker’s bank

Banks can borrow money from federal reserves

9

New cards

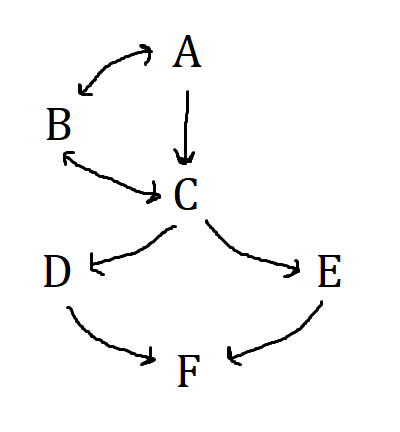

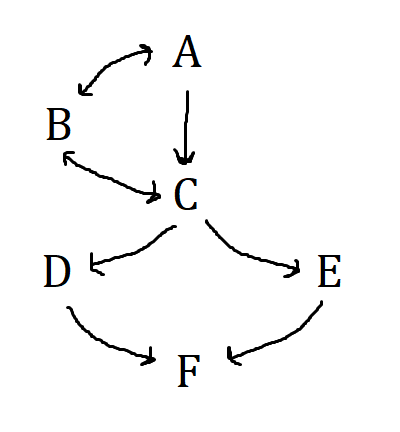

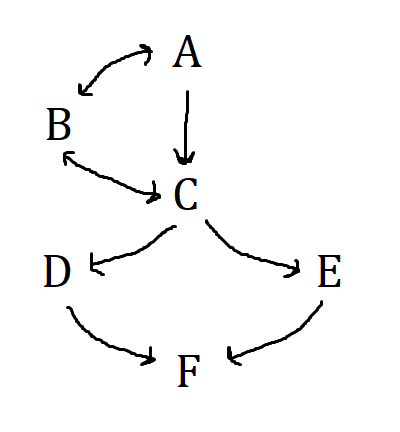

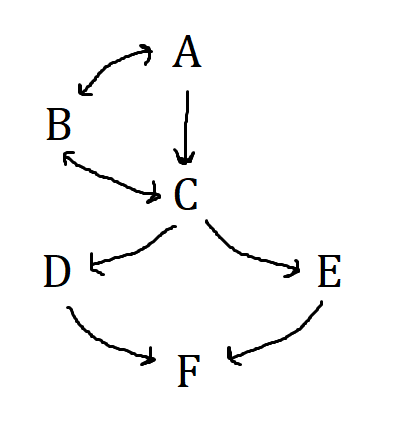

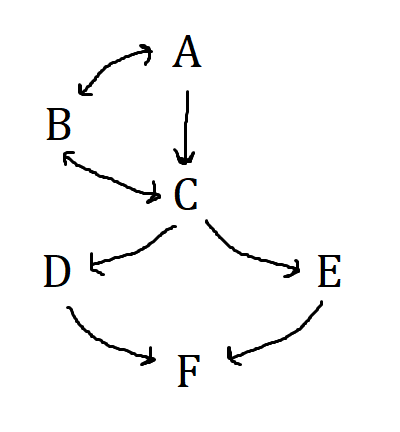

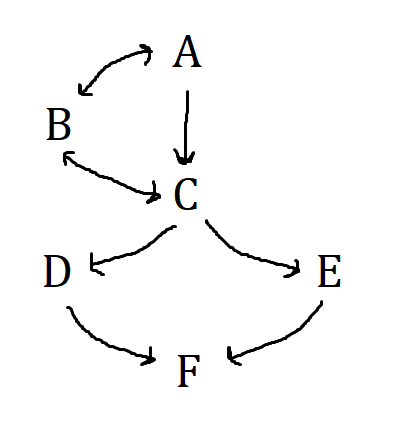

What does A stand for?

Board of Governors

10

New cards

What does B stand for?

Federal Open Market Committee

11

New cards

What does C stand for?

12 Federal Banks

12

New cards

What does D stand for?

Commercial Banks

13

New cards

What does E stand for?

Thrift Institutions(Savings + Loan Associations, mutual savings banks, credit unions)

14

New cards

What does F stand for?

The public(households and businesses)

15

New cards

What is the Federal Open Market Committee?

Also known as FOMC, this is where monetary policy decisions are made.

16

New cards

The Federal Open Market Committee was created by ___________ and ___________ . There are _____ members in total. _____ consist of those on the first committee and _____consist of those on the second committee.

Board of governors, 12 federal banks, 12, 7, 5

17

New cards

What does the FOMC do?

Aids Board of Governors in setting monetary policy, conducts open market operations

18

New cards

What does it mean to conduct open market operations?

Where the FOMC either buys/sells security/federal bonds to the public

19

New cards

If the FOMC is buying bonds, what happens?

The government will need to pay the public, which increases the money supply

20

New cards

If the FOMC is selling bonds, what happens?

The public needs to pay the government, which decreases the money supply

21

New cards

What tools are implemented for monetary policy?

Federal open market committee, changing reserve requirements, and changing the discount rate

22

New cards

What does a decreased required reserve ratio mean?

Banks can lend more money to the public, leading to an increase in the money supply

23

New cards

What does an increased required reserve ratio mean?

Banks can’t lend as much money to the public, leading to a decrease in the money supply

24

New cards

What is the discount rate?

This is the interest rate paid by banks to the federal reserve

25

New cards

What does decreasing the discount rate do?

Banks not having to pay as much to the reserve means interest rates lower in commercial banks, leading to an increase in the money supply

26

New cards

What does increasing the discount do?

Banks have to pay more to the reserve means interest rates increase in commercial banks, leading to a decrease in the money supply

27

New cards

Does the Federal Reserve issue currency or print money?

Issues currency

28

New cards

What significance does the federal reserve have to banks?

They’re a lender of last resort

29

New cards

When is expansionary monetary policy used?

During a recession to increase money supply. Called quantitative easing

30

New cards

When is contractionary monetary policy used?

During inflation to decrease money supply

31

New cards

What is the Central Bank’s most important task?

Determining the quantity of money in the economy

32

New cards

Does the Federal Reserve decide interest rates?

No