Lesson 1.5: Public Goods and Externalities

1/13

Earn XP

Description and Tags

Flashcards made from a presentation segment created as a lesson on governmental public goods and economic externalities.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

14 Terms

Public goods

A shared good for which it would be inefficient or impractical to make consumers pay individually and exclude those who did not pay

Schools, roads, bridges, parks, mail delivery

Externality

An economic side effect of a good or service that generates benefits or costs to someone other than the person deciding how much to produce or consume

Taxes

Funds collected by the government to spread the cost of public goods across all citizens who would benefit from it, allowing greater overall benefits

Infrastructure

Constructed systems created to aid efficiency, most seen in road construction projects for greater economic growth and better product distribution

Cost-benefit criteria

Creating a public good requires two of these:

The benefit to each individual is less than the cost to all if provided privately

The total benefits to society are greater than the total cost

Free-rider problem

When a person consumes a particular good or service that they did not contribute to, like a park offered to non-residents — illustrates the effect of a government not collecting taxes

Market failure

An inefficiency in the market to provide a good; public goods are examples of these demonstrating how free enterprise systems may require governmental intervention

Road construction may have limited profit motive in rural areas

Lack of competition may lead to price gouging

Positive externalities

Benefits given to a third party as a result of consumption of a good

Sidewalk usage reduces congestion and pollution

Negative externalities

Harms done to a third party as a result of the consumption or production of a good

Chemical production pollution can lead to a loss of fish, leading to lower income for fishermen

Governmental intervention

Used to aim for more positive than negative externalities like reducing pollution and improving education; this practice has been debated by economists

Poverty

Created as a result of uneven wealth distribution in a free market

Poverty threshold

Thresholds used for statistical purposes to estimate the number of Americans in poverty each year

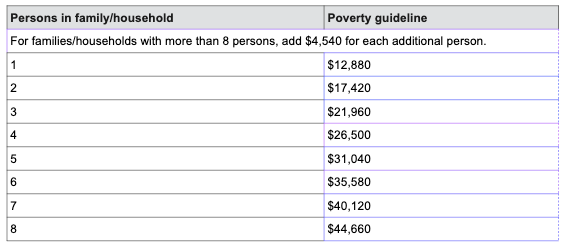

Poverty guidelines

Guidelines that simplify the poverty thresholds for administrative purposes, like determining aid eligibility

Aid programs

Governmental programs that redistribute wealth to raise the standard of living for the less fortunate, such as welfare, cash transfers, in-kind benefits, Medicaid, and grant money