L8: Liquidity Risk

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

Liquidity Risk

Inability to meet short-term obligations as they become due and payable, or only being able to do so at unsustainable cost

Solvency risk

Inability to meet long-term obligations as they become due and payable, or only being able to do so at unsustainable cost

systemic, individual, technical/timing

3 sources of liquidity risk - SIT

Systemic Risk

Market-wide risks external to the company such as market disruptions, etc.

A company cannot influence these factors, but has to accept them and align its risk taking according to these risks

E.g. pandemic

Inflationary economy ->BSP -> price stablity

Higher interest rate = lower consumer spending

individual or idiosyncratic

Originates from something specific to the company

Event or crisis-driven, instead of market-wide

Ex. ABS-CBN shutdown

Technical/timing

The problem is the timing of cashflows

There is a mismatch in cashflow sources and needs

The balance sheet shows sufficient liquidity due to large expected inflows in distant time periods

first step

why manage LR?

Cash is king

The company needs to fulfill its short-term obligations

Choose suppliers that have different due dates

Liquidity is the ___ step to achieving long-term objectives

reduces

benefits of LRM

____ overall cost of borrowing or funding

Provides available funding for emergency needs

Enhances the overall ERM system

Funding, trading

2 types of LR

Funding LR

Refers to a company’s ability to raise the necessary cash to roll over its debt and meet short-term working capital requirements

trading LR

Risk that an institution will not be able to execute a transaction at the prevailing market price because there is temporarily no appetite for the deal on the other side of the market

sources of LR

LRM Process for FUNDING 1] Identify

Assess each type of asset or transaction and the liquidity risk embedded in them

Goal is to create the “____ of Liquidity Risk” report

Wholesale funding risk: uutang ka for a corporation

The risk that an institution cannot raise funds from large-scale external sources (like institutional investors) to meet its financial needs, especially during market stress.

Retail funding risk: uutang for an individual

The risk that an institution cannot secure funds from individual depositors or retail customers, often due to decreased confidence or market volatility.

Intraday liquidity risk: utang and pay the same day

The risk that a financial institution cannot meet its payment obligations during the day due to delays or insufficient liquidity, impacting its daily operations.

Intragroup liquidity risk

The risk related to transferring liquidity between entities within a group (e.g., subsidiaries), which may be restricted due to regulatory or operational barriers.

Cross-currency liquidity risk: difference in currency rates

The risk that an institution cannot convert liquidity across currencies when needed, potentially due to market disruptions or unfavorable exchange rates.

Off-balance sheet liquidity risk:if you have contingent liabilities that are not reflected in the books

The risk associated with commitments or guarantees not reflected on the balance sheet (e.g., credit lines), which may require cash outflows if unexpectedly drawn upon.

Funding concentration risk: look at the sources of your financing (cos yung iba mataas charges) ; short term vs long term risk

The risk of relying on a limited number of funding sources or counterparties, which could lead to liquidity issues if those sources become unavailable.

Funding cost risk: based on the interest rate (fixed vs variable – good if fixed)

The risk that an institution’s cost of obtaining funds increases, potentially due to market conditions or deteriorating creditworthiness.

Correlation risk - sumasabay ba yung assets and liabilities mo

The risk that multiple sources of risk become correlated, especially during market stress, amplifying liquidity shortages.

Asset risk: type of asset that you have (liquid vs illiquid assets)

The risk that assets held by an institution cannot be easily converted to cash or have lost value, limiting liquidity in times of need.

Liquid Assets

These assets can be quickly converted to cash with minimal impact on their value.

Cash and Bank Deposits

Stocks (especially large-cap stocks)

Government Bonds

Mutual Funds and ETFs

Money Market Funds

Treasury Bills

Foreign Currencies (major ones like USD, EUR, etc.)

Certificates of Deposit (CDs) (depending on maturity and penalties)

Precious Metals (like gold, but depends on market demand)

Illiquid Assets

These assets are harder to sell quickly without significantly affecting their price.

Real Estate

Private Equity Investments

Collectibles (art, antiques, etc.)

Venture Capital Investments

Small Business Interests

Hedge Fund Shares (often have lock-up periods)

Intellectual Property (patents, trademarks, etc.)

Long-term Loans and Bonds (especially if low credit quality)

Commodities in Specific Forms (e.g., certain types of agricultural goods)

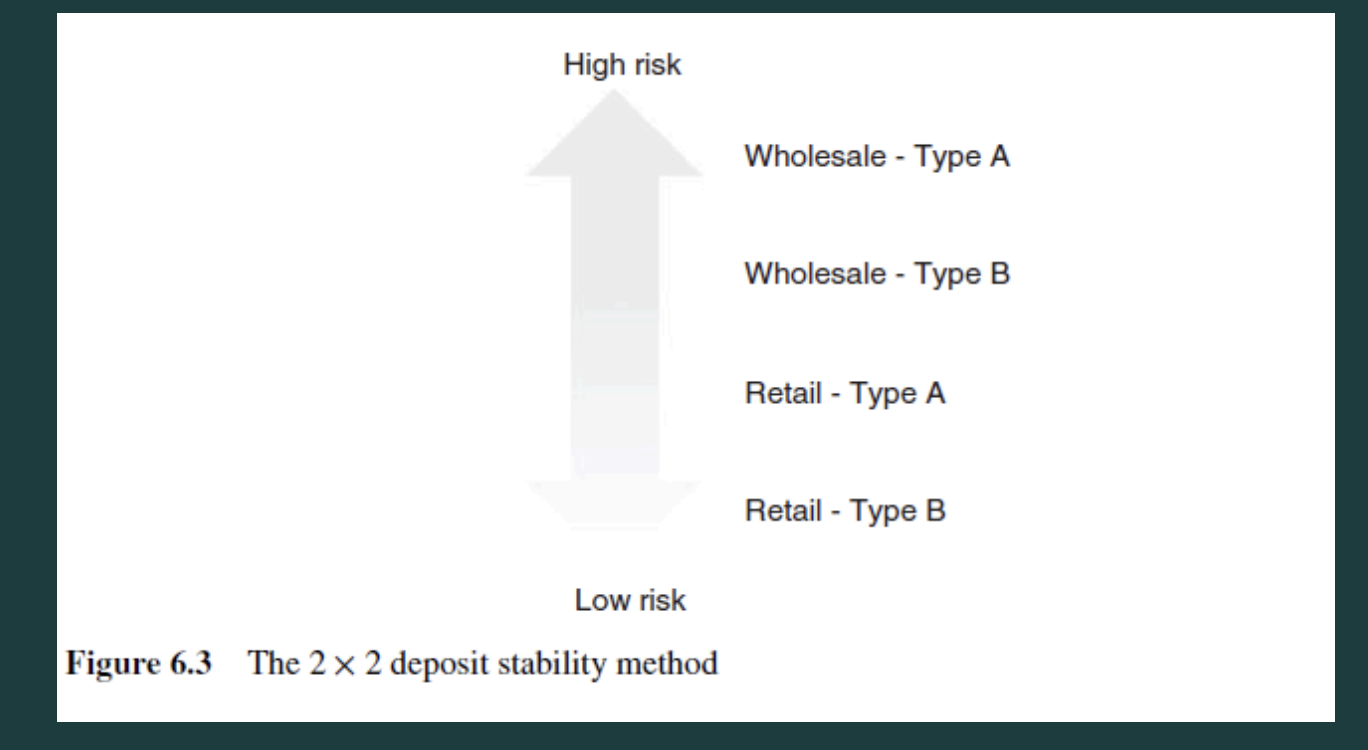

simple, scorecard

LRM Process for FUNDING 1] Identify

→ Categorize the liquidity risks identified

____ Categories

Perspective ng creditor because transactions are more complicated, mas matagal, and complex transactions

In terms of collection: mas mahirap individual

Amount of loan: mas mahirap loan

_____ Approach

![<p><strong><em>LRM Process for <u>FUNDING</u> 1] Identify</em></strong></p><p><strong><em>→ </em><u>Categorize</u> the liquidity risks identified</strong></p><ul><li><p>____ Categories</p><ul><li><p><span>Perspective ng <strong>creditor</strong> because transactions are more complicated, mas matagal, and complex transactions </span></p></li><li><p><span>In terms of <strong>collection</strong>: mas mahirap individual </span></p></li><li><p><span>Amount of loan: mas mahirap loan</span></p></li></ul></li><li><p>_____ Approach</p></li></ul><p></p>](https://knowt-user-attachments.s3.amazonaws.com/40647e81-758f-4f66-b571-0f958af079a5.png)

ok

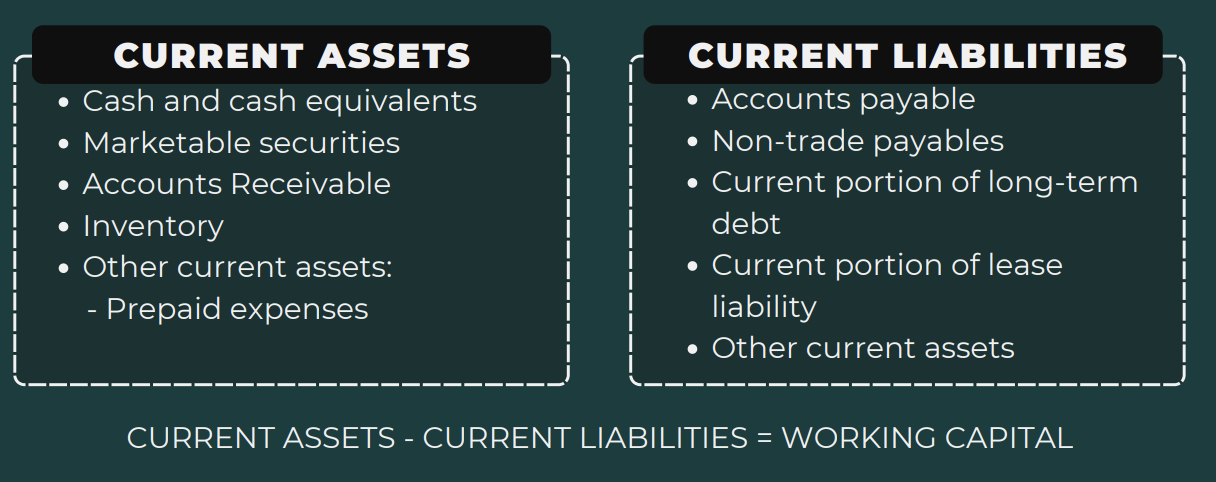

LRM Process for FUNDING 1] Identify ok

→ Compute for liquidity and solvency ratios

![<p><strong><em>LRM Process for <u>FUNDING</u> 1] Identify ok</em></strong><br><strong><em>→ </em></strong>Compute for liquidity and solvency ratios</p>](https://knowt-user-attachments.s3.amazonaws.com/c106a874-92a9-42ff-a87a-f3ca4b5f77a3.png)

current, quick, cash

3 key liquidity ratios

CA/CL

current ratio formula

(Cash + MS + AR)/CL

quick ratio formula

(Cash + MS)/CL

cash ratio formula

debt to asset, to equity

2 key solvency/leverage ratios

TL/TA

debt to asset ratio formula

TL/TE

debt to equity ratio formula

risk heat map, trend analysis, industry benchmark

LRM Process for FUNDING 2] Analyze

The comprehensive list of sources of liquidity risk should be assessed for frequency and severity

Make sense of the liquidity and solvency ratios that you computed

Know the mismatches

From current to quick ratio dapat papaliit

Use these 3 guides

COMPARE ratios to legal and contractual obligations

The proposal is ethical and legal -> inventory is relevant in the business

external

LRM Process for FUNDING 3] Response

Seek ______ funding from banks or other lending institutions

Higher interest rate in bigger banks but problem if the smaller banks could accommodate the big funding needed

Take note of short term vs long term funding

Can be from banks, non-banks, even individuals

Ex. High-Net-Worth Individual (HNWI)

capitalization

LRM Process for FUNDING 3] Response

→ You can increase _____ through

Capital infusion of owners

Issuance of common shares

Issuance of preferred shares

Issuance of debt instruments

current assets

LRM Process for FUNDING 3] Response

→ you can liquidate ___ assets to convert to cash

Liquidity Reserve

LRM Process for FUNDING 3] Response

→ Set up a ____

Liquidity available to cover additional funding needs for a defined period of time under stressed conditions T

This is NOT for business-as-usual transactions

High Quality Liquid Assets

liquidity reserves are known as __ ___ Liquid Assets in BANKS

risk heat map

LRM Process for FUNDING 4] MOnitoring

Recheck your ______

Compute for the ratios at regular intervals

Set key performance indicators (KPIs) or trigger points

Trading LR

Arises when the company already has existing investment securities, whether debt or equity, and now needs to unwind it because the company needs cash

Applies to any type of asset

Contemplates a situation when forced liquidation of assets creates unfavorable price movements

ok

LRM Process for TRADING 1] Identify ok

Check existing investment portfolio, especially if substantial or concentrated in a certain issuer company or industry

Factors to consider:

- size and frequency of trade

Larger trades or infrequent trades can be harder to execute without affecting the asset's price. Smaller, frequent trades are generally easier to execute.

- trade completion time

The longer it takes to complete a trade, the more risk there is that market conditions will change, potentially impacting the price.

- asset type -

Some assets (like stocks of large companies) are more liquid and easier to trade than others (like niche or exotic assets), which may have fewer buyers and sellers.

trade customization

Customized trades (like options or derivatives) can be less liquid because they may not have a standard market. Standardized trades are usually more liquid.

- economic environment

In times of economic uncertainty or volatility, liquidity can dry up, making it harder to buy or sell assets without significant price changes.

- number of market trades

A higher number of trades in the market can indicate more liquidity. More trades mean more participants, which can make it easier to execute trades at desired prices.

harder

- size and frequency of trade

Larger trades or infrequent trades can be easier/harder to execute without affecting the asset's price.

longer-more

- trade completion time

The shorter/longer it takes to complete a trade, the less/more risk there is that market conditions will change, potentially impacting the price.

more-easier

- asset type -

Some assets (like stocks of large companies) are less/more liquid and harder/easier to trade than others (like niche or exotic assets), which may have fewer buyers and sellers.

less liquid

trade customization

Customized trades (like options or derivatives) can be more/less liquid because they may not have a standard market.

Standardized trades are usually more liquid.

higher-more

- number of market trades

A lower/higher number of trades in the market can indicate less/more liquidity.

More trades mean more participants, which can make it easier to execute trades at desired prices.

Spread

The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) for an asset.

low-more

A low/high bid-ask spread indicates a less/more liquid market, meaning there are many buyers and sellers, making it easier to buy or sell an asset without affecting its price significantly.

liquidity

Refers to how quickly and easily an asset can be bought or sold in the market without causing a significant change in its price.

Example: The USD is considered very liquid because it is widely traded, and transactions occur frequently, resulting in lower bid-ask spreads.

one go, staggered

LRM Process for TRADING 2] Analyze

When you consider unwinding (selling) an investment, you have two main options, either to unwind in ____ or _____

unwind all at once

Pros:

You eliminate future price uncertainty immediately, meaning you know exactly what you will receive right now for your investment.

Cons:

You may face a large bid-ask spread, meaning you might receive a worse price for your asset due to the difference between what buyers are willing to pay and what sellers are asking for. This can result in a significant loss.

staggered basis

Pros:

You face a more manageable bid-ask spread, meaning you might get better prices on individual transactions over time, as you can wait for more favorable market conditions.

Cons:

You remain exposed to price uncertainty until the full liquidation is complete, meaning the market price could fluctuate, and you may end up receiving less than expected for the remaining portions of your investment.

trading, market

LRM Process for TRADING 3] Response

Find the balance between ____ cost and ___ risk

Consider the level of need for cash in the short-term

Could depend on risk appetite

LRM Process for TRADING 4] Monistor

Monitor the same factors from Step 1

Factors to consider:

- size and frequency of trade -

trade completion time

- asset type -

trade customization

- economic environment

- number of market trades

EXPENSIVE!

Remember:

Liquidity is good, but it is _____

There is opportunity cost involved in maintaining a stable liquidity position

Remember the principle of “high risk, high return; low risk, low return”