Chapter 13: Monetary Policy: Conventional and Unconventional

1/60

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

61 Terms

Monetary Policy

refers to actions that the Federal Reserve System takes to change interest rates and the money supply. it is aimed at affecting the economy.

Money

•is at one point in time: how much is in your wallet

income

is over a period of time: how much you earn per hour/year

•Board of Governors : 7 members

•Appointed by the president with the advice and consent of the Senate to a 14 year term

•Chairperson serves 4 year term: Jerome Powell

•Federal Open Market Committee: F O M C

•12 members: 7 governors of the Fed, President of the New York Fed, 4 district banks presidents

•Short term interest rates and size of money supply

•Central bank independence

•Central bank's ability to make decisions without political interference

•Proponents: Independence keeps politics out

•Fed can take longer term view, and maintain low and stable inflation

•Opponents: Independence is undemocratic

•Why let a small group of bankers and economists make decisions that affect everyone?

•

•High inflation of 1970s and 1980s

•Maastricht Treaty (1992), Japan (1998)

•

•Independence and accountability

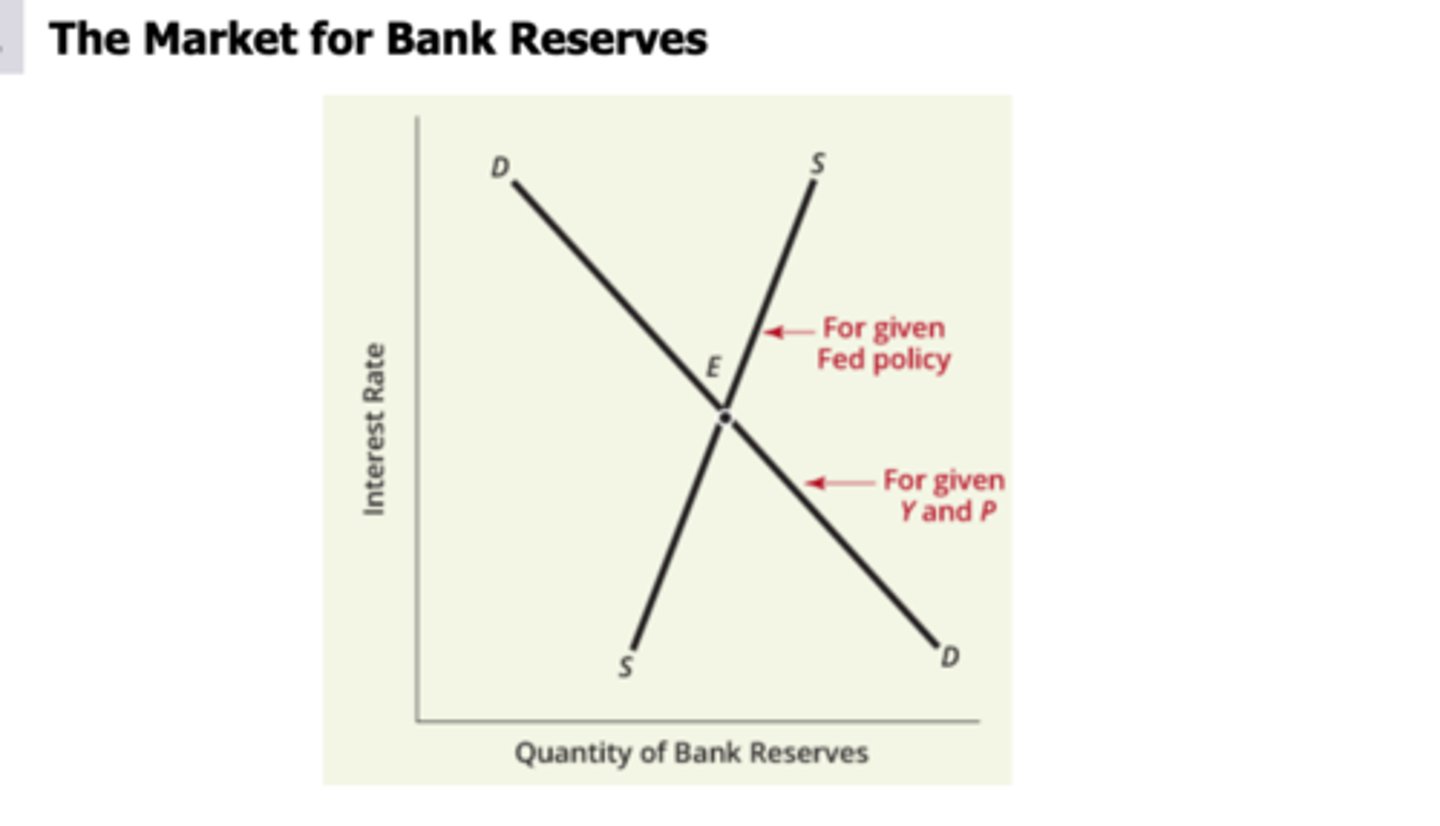

•Why is there a reserve market?

•Some banks may be short of reserves so would borrow

•Some banks may have excess reserves so would lend

•Important since allows reserves to flow where needed

•

•Why does the demand for reserves slope down?

•As the funds rate rises, borrowing looks more expensive, so fewer reserves demanded

•

•Why does the supply of reserves slope up?

•As the funds rate rises, lending out your excess reserves becomes more attractive

•Putting it all together: Expansionary policy

•If the Fed wants the money supply to increase and interest rates to fall, they make an open market purchase.

•Banks excess reserves will increase, so the money supply expands.

•By buying bonds, the Fed causes the prices of bonds to rise so interest rates fall

•Putting it all together: Contractionary policy

•If the Fed wants the money supply to decrease and interest rates to rise, they make an open market sale.

•Banks excess reserves will decrease, so the money supply contracts.

•By selling bonds, the Fed causes the prices of bonds to fall so interest rates rise

•

•Quantitative Easing

•Open market purchases of assets other than Treasury bills

•Longer dated (5 or 10 year) Treasury bonds, not short term (3 month) Treasury bills

•Other assets such as mortgage backed securities

•Goal was to push down interest rates in general, and stabilize mortgage markets

A central bank is best thought of as:

A bank located in the middle of the financial district.

A bank owned by the central government.

A bank used by other banks.

A bank that buys and sells stocks or equities.

A bank used by other banks.

Central bank independence

refers to the central bank's ability to make decisions without political interference.

Open-market operations

refer to the Fed's purchases or sales of government securities, normally Treasury bills, through transactions in the open market.

When the Federal Reserve wants to lower interest rates, it purchases U.S. government securities in the open market. It pays for these securities by creating new bank reserves, which lead to a multiple expansion of the money supply. Because of fluctuations in people's

desires to hold cash and banks' desires to hold excess reserves, the Fed cannot predict the consequences of these actions for the money supply with perfect accuracy. However, the Fed can always put the federal funds rate where it wants by buying just the right volume of securities.

When bond prices rise, interest rates fall because the purchaser of a bond spends more money than before to

earn a given number of dollars of interest per year. Similarly, when bond prices fall, interest rates rise.

An open-market purchase of Treasury bills by the Fed not only raises the money supply but also drives up T-bill prices and pushes their interest rates down. Conversely, an open-

-market sale of bills, which reduces the money supply, lowers T-bill prices and raises interest rates.

Riskier borrowers pay

higher interest rates than safer borrowers, in order to persuade lenders to accept the higher risk of default.

risk premium, or sometimes just the “spread”

Market interest rates generally include a risk premium (or "spread" over Treasuries) to compensate the lender for the probability of loss if the borrower fails to repay the loan in full or on time.

Treasury security is called the risk premium, or sometimes just the “spread” (over Treasuries), on that bond:

Treasury security is called the risk premium, or sometimes just the “spread” (over Treasuries), on that bond:

When the perceived risk of default increases, risk spreads

widen. When the perceived risk of default decreases, risk spreads narrow.

The discount rate

is the interest rate the Fed charges on loans that it makes to banks.

Unconventional monetary policy

is a generic term referring to unusual forms (or volumes) of central bank lending and to unusual types of open-market operations.

Quantitative easing

refers to open-market purchases of assets other than Treasury bills.

expansionary monetary policy

(an open-market purchase of T-bills)

contractionary monetary policy

(an open-market sale)

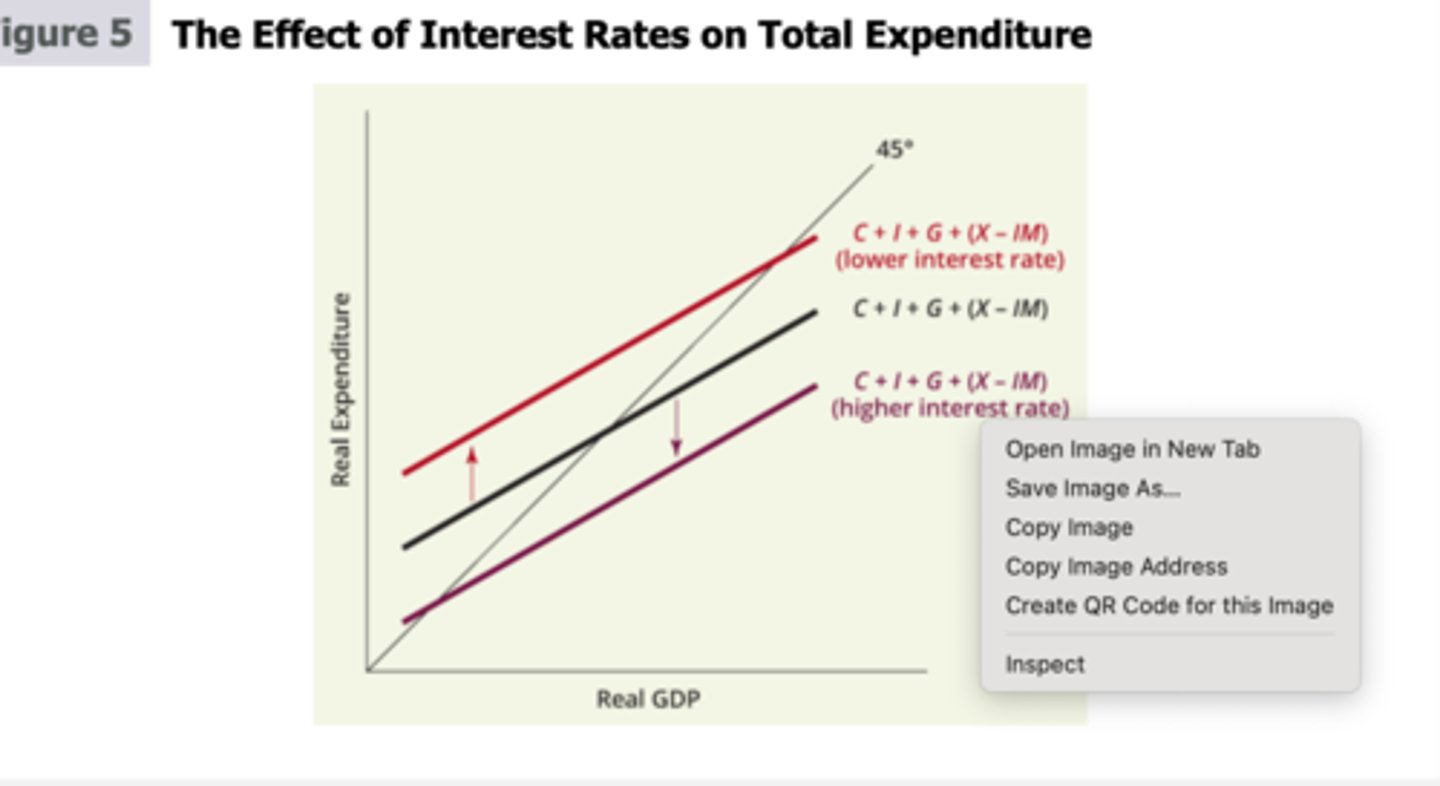

Higher interest rates lead to lower investment spending. But investment is a component of total spending, . Therefore,

when interest rates rise, total spending falls. In terms of the line diagram of previous chapters, a higher interest rate leads to a lower expenditure schedule. Conversely, a lower interest rate leads to a higher expenditure schedule.

Expansionary monetary policy leads to lower interest rates (r), and these

ower interest rates encourage more investment spending , I which has multiplier effects on aggregate demand.

The effect of monetary policy on aggregate demand depends on the sensitivity of interest rates to open-market operations, on the responsiveness of investment spending

to the rate of interest, and on the size of the basic expenditure multiplier.

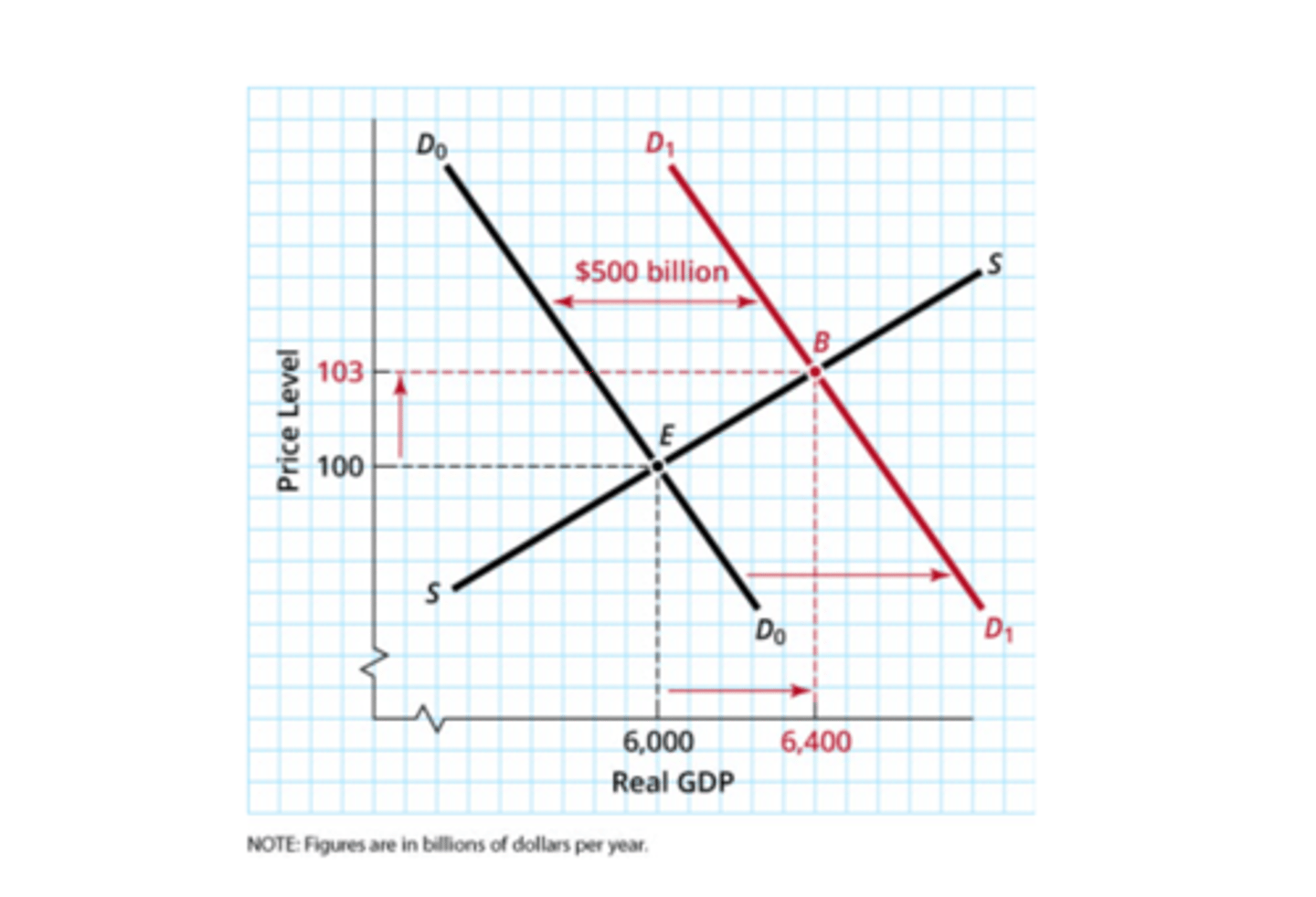

Expansionary monetary policy normally causes some inflation. But exactly

how much inflation it causes depends on the slope of the aggregate supply curve.

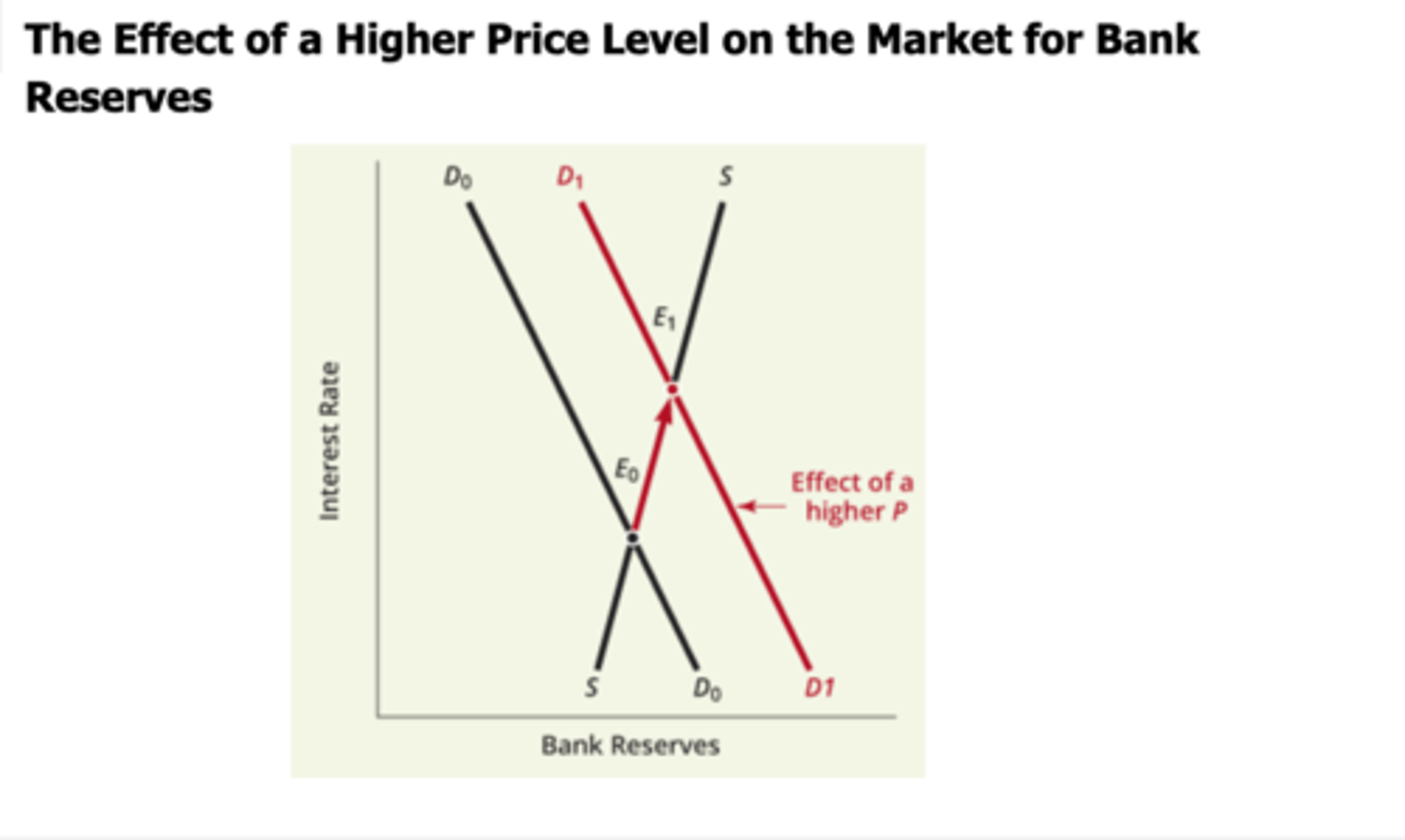

At higher price levels, the quantity of bank reserves demanded is greater. If the Fed holds the supply schedule fixed, a higher price level must, therefore, lead to higher interest rates. Because

higher interest rates discourage investment, aggregate quantity demanded is lower when the price level is higher—that is, the aggregate demand curve has a negative slope.

“Money” and “income,” though related, are two different concepts. A country’s central bank

creates its money supply. A central bank is a bank for banks.

The Federal Reserve System is America's central bank. There are Federal Reserve banks,

but most of the power is held by the Board of Governors in Washington and by the Federal Open Market Committee.

The Federal Reserve acts independently of the rest of the government. By now, many countries have decided that such central bank independence

is a good idea and have moved in this direction.

The Fed has three major monetary policy weapons: open-market operations,

reserve requirements, and its lending policy toward banks. Normally, it relies on open-market operations, but during the financial crisis it lent massive amounts to banks.

In normal times, the Fed increases the supply of bank reserves by purchasing Treasury bills (a type of short-term government security) in the open market. When it pays banks for such purchases by creating new reserves,

the Fed lowers interest rates and induces a multiple expansion of the money supply. Conversely, open-market sales of Treasury bills take reserves away from banks, raise interest rates, and lead to a contraction of the money supply.

When the Fed buys bills or bonds, their prices rise and their interest rates fall. When the Fed s

sells bills or bonds, their prices fall and their interest rates rise.

There are many interest rates in a modern economy. In normal times, they all

rise or fall together.

Risk premiums (or “spreads”) in

interest rates reflect buyers' perceptions of the risk of loss. Riskier borrowers must pay higher interest rates in order to secure credit.

isk premiums rise sharply in a financial crisis. When that happens,

all borrowers except the U.S. Treasury may face higher borrowing costs. These higher interest rates can, in turn, depress economic activity.

In addition to conventional open-market purchases of T-bills, the Fed can also pursue a more expansionary monetary policy by allowing banks to borrow more reserves, perhaps by reducing the interest rate it charges on such loans (the discount rate) or by

reducing reserve requirements. These are the three conventional weapons of monetary policy.

None of these weapons, however, give the Fed perfect control over the money supply in the short run, because it cannot predict perfectly how far the process of deposit creation or destruction will go. The Fed can, however,

control the interest rate banks pay to borrow reserves, which is called the federal funds rate, quite precisely.

If the economy is weak for a long time, the central bank might reduce its interest rate all the way to zero, and yet still not stimulate growth sufficiently. In such a case, it might turn to one or more unconventional monetary policies. These policies include

massive lending to banks, or even to firms that are not banks, and open-market purchases of securities other than Treasury bills. The latter is sometimes called quantitative easing.

Investment spending I, including business investment and investment in new homes, is

sensitive to interest rates r . Specifically, i is lower when R is higher.

Conventional monetary policy works in the following way: Raising the supply of bank reserves leads to lower interest rates; the lower interest rates stimulate

investment spending; and this investment stimulus, via the multiplier, raises aggregate demand.

Prices are likely to rise as output rises. The amount of inflation caused by expansionary monetary policy depends on the slope of the aggregate supply curve. Much inflation

will occur if the supply curve is steep, but little inflation if it is flat.

The main reason why the aggregate demand curve slopes downward is that higher prices increase the demand for bank deposits, and hence for bank reserves. Given a fixed

supply of reserves, this higher demand pushes interest rates up, which, in turn, discourages investment.

Central Bank

a bank for banks. The United States' central bank is the Federal Reserve System.

- a central bank that would regulate credit conditions was not a luxury but a necessity

- U.S. should have not one central bank, but twelve

- the central banks are more like customers to Fed because it receives only a token share of the Federal Reserve's immense profits

- Fed is controlled by seven-member Board of Governors

Central Bank Independence

refers to the central bank's ability to make decisions without political interference

- without independence, politicians might try to force the central bank to expand the money supply too rapidly before elections -> chronic inflation

- INDEPENDENCE = LOWER INFLATION

Open Market Operations

refers to the Fed's purchases or sales of government securities, normally Treasury bills, through transactions in the open market

- occurs when the Fed wants to change interest rates

- low interest rates = more reserves

- when the fed wants to lower interest rates, it purchases U.S. government securities in the open market. It pays for securities by creating new bank reserves, which lead to a multiple expansion of the money supply

- people want cash, banks want excess reserves

The Federal Funds Rate

the interest rates that banks pay and receive when they borrow reserves from one another

- those with excess reserves lend them to those with reserve deficiencies

- rate that applies when banks borrow and lend reserves to one another

- banks with excess reserves lend them to those with reserve deficiencies, also get rid of reserves by making more loans (GOOD)

- economy is very weak -> monetary policy has already cut interest rates -> federal funds rate = zero

Open-Market Operations, Bond Prices, and Interest Rates

- more demand for T-bills = rising prices for Treasury bills (T-bills) because of falling interest rates

- when bond prices rise, interest rates fall because the purchaser of a bond spends more money than before to earn a given number of dollars of interest per year. Similarly when bond prices fall, interest rates rise

- an open-market PURCHASE of Treasury bills by the Fed not only raises the money supply but also drives up T-bill prices and pushes their interest rates down.

- Conversely, an open-market SALE of bills, which reduces the money supply, lowers T-bill prices and raises interest rate

Which Interest Rate?

Relationships among interest rates broke down spectacularly during financial crisis because securities and loans differ in their risk of default

- risky borrowers pay higher interest rates than safer borrowers, in order to persuade lenders to accept the higher risk of default

The Risk of Default

on any loan or security is the risk that the borrower may not pay in full or on time

Risk Premium (spread)

market interest rates generally include a risk premium to compensate the lender for the probability of loss if the borrow fails to repay the loan in full time or on time

- Risk interest rate = risk-free (treasury) interest rate + risk premium

- when the perceived risk of default increases, risk spreads widen. When the perceived risk of default decreases, risk spreads narrow

EX: safe investments like mortgages or bonds of large banks looked far riskier than before -> risk premiums on these soared -> anxious investors demanded huge volumes of U.S. treasury securities -> security prices went up and interest rates went down

Discount Rate

is the interest rate the Fed changes on loans that it makes to banks

Other Instruments of Monetary Policy

1) Lending to Banks

- lender of last resort when risky business prospects made commercial banks hesitant to extend new loans or when banks ran into trouble

- Discount Rate - Federal Reserve officials can influence the amount banks borrow by altering the rate of interest charged on loans

ex: fed wants banks to have more reserves, it can reduce the interest rate it charges on loans -> tempting banks to borrow more

2) Changing Reserve Requirements

- varying the minimum required reserve ratio (banks holding reserves that just match their required minimum; excess reserves are zero) -> transferring previously required reserves into excess reserves

- a reduction in reserve requirements would shift the demand curve inward (because banks would no longer need as many reserves -> lowering interest rates)

- required reserves equal to 10 percent of transactions deposits

3) Quantitative Easing

- designed to fight the financial crisis and the Great Recession -> pushing federal funds rate down to virtually zero

- Conventional open market operations = fed created new bank reserves by purchasing more Treasury bills -> prices of T-bills went up

- Unconventional open market operations = do essentially the same things except that the Fed starts the process by purchasing something other than T-bills (Replace Treasury Bills with Treasury Bonds)

Unconventional Monetary Policy

is a generic term referring to unusual forms (or volumes) of central bank lending and to unusual types of open-market operations

Quantitative Easing

refers to open-market purchases of assets other than Treasury bills

How Monetary Policy Works in Normal Times

- Expansionary Monetary Policy (an open-market purchase of T-bills) -> lower interest rates

- Contractionary Monetary Policy (an open-market sale) -> raise interest rates

Investment and Interest Rates

- higher interest rates lead to lower investment spending. but investment (I) is a component of total spending, C+I+G+(X-IM). Therefore, when interest rates rise, total spending falls. In terms of the 45 degree line diagram, a higher interest rate leads to a lower expenditure schedule; a lower interest rate leads to a high expenditure schedule

Monetary Policy and Total Expenditure

- Monetary policy moves interest rates up or down

- Solution to a Recession: Fed Reserve decides to increase the supply of bank reserves by purchasing T-bills in the open market -> shifting supply schedule for reserves outward

- expansionary monetary policy leads to lower interest rates (r), and these lower interest rates encourage more investment spending (I), which has multiplier effects on aggregate demand

- the effect of monetary policy on aggregate demand depends on the sensitivity of interest rates to open-market operations, on the responsiveness of investment spending to the rate of interest, and on the size of the basic expenditure multiplier

Money and the Price Level

Aggregate Supply

Expansionary monetary policy normally causes some inflation. But exactly how much inflation it causes depends on the slope of the aggregate supply curve

Why Aggregate Demand Slopes Downwards

at higher price levels, the quantity of bank reserves demanded is greater. If the Fed holds the supply schedule fixed, a higher price level must therefore lead to higher interest rates. Because higher interest rates discourage investment, aggregate quantity demanded is lower when the price level is higher - that is, the aggregate demand curve has a negative slope