Financial Accounting Ch. 11

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

54 Terms

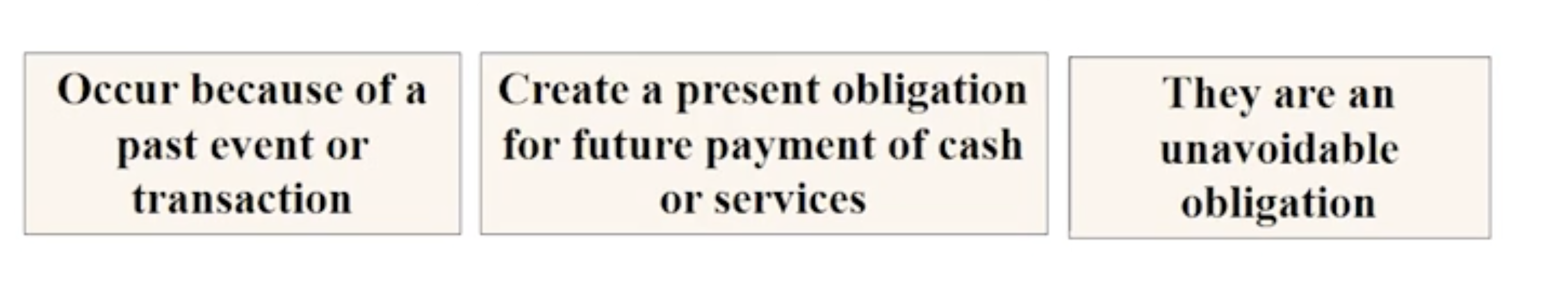

How are current liabilities of known amounts accounted for: 3 main characteristics of a liability

How are current liabilities of known amounts accounted for: The two sections of a Liability

Current & Long - Term

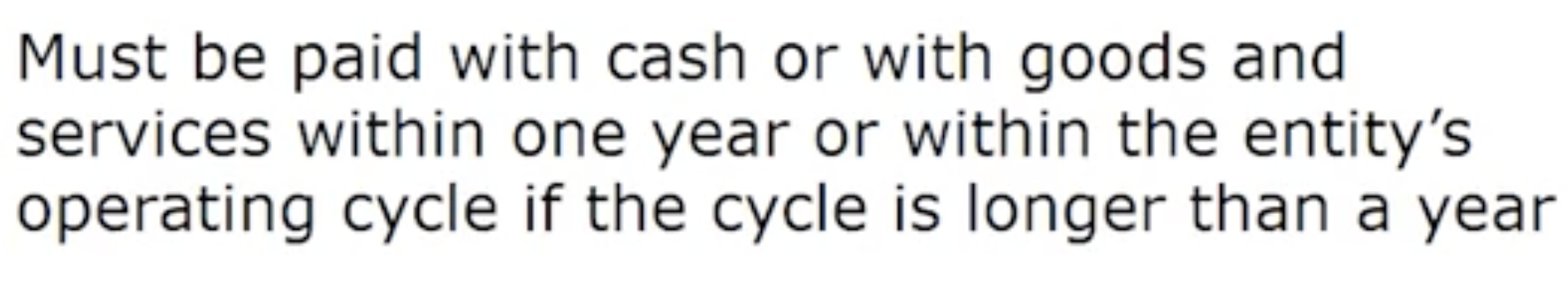

How are current liabilities of known amounts accounted for: Current Liability

Examples: Acc payable, notes payable, salaries payable, interest payable and unearned revenue

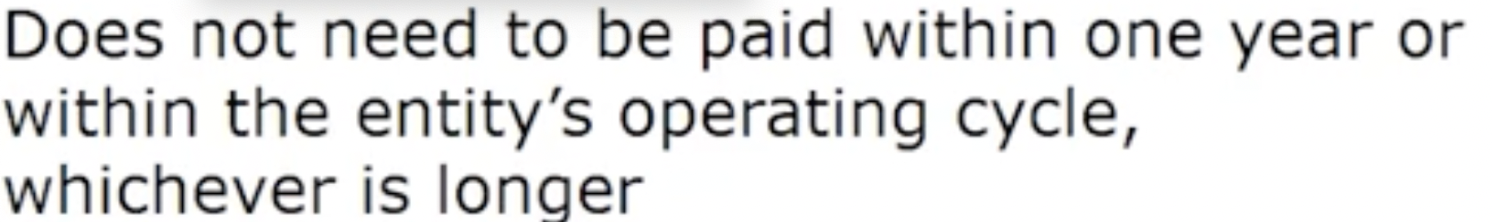

How are current liabilities of known amounts accounted for: Long - Term Liability

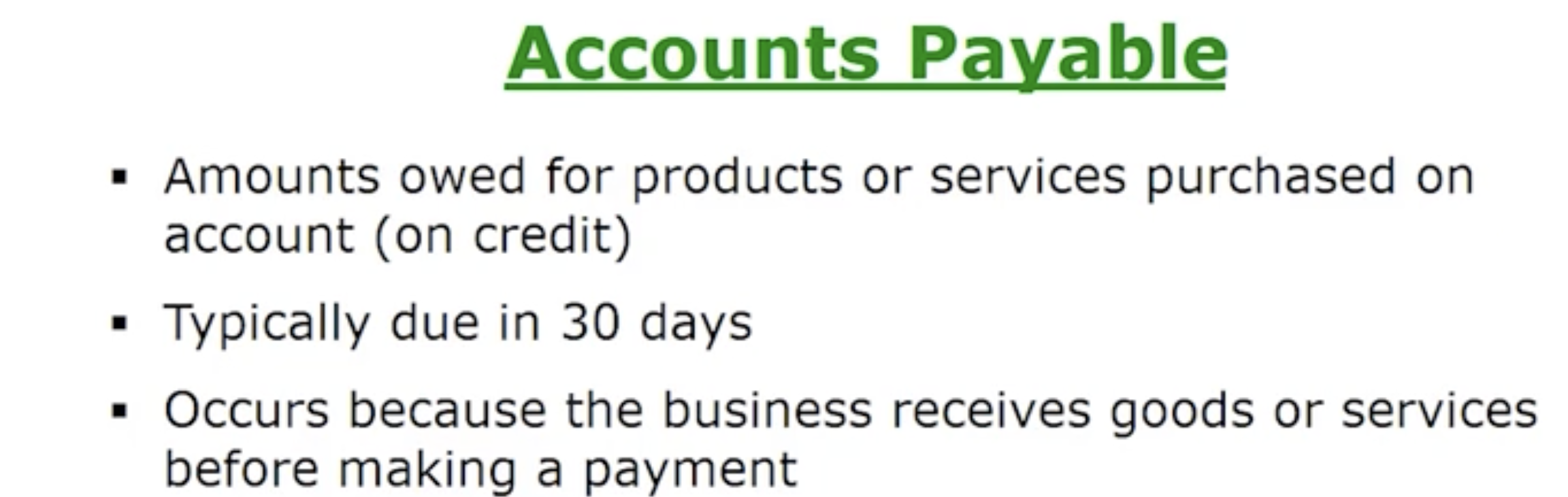

How are current liabilities of known amounts accounted for: Accounts payable

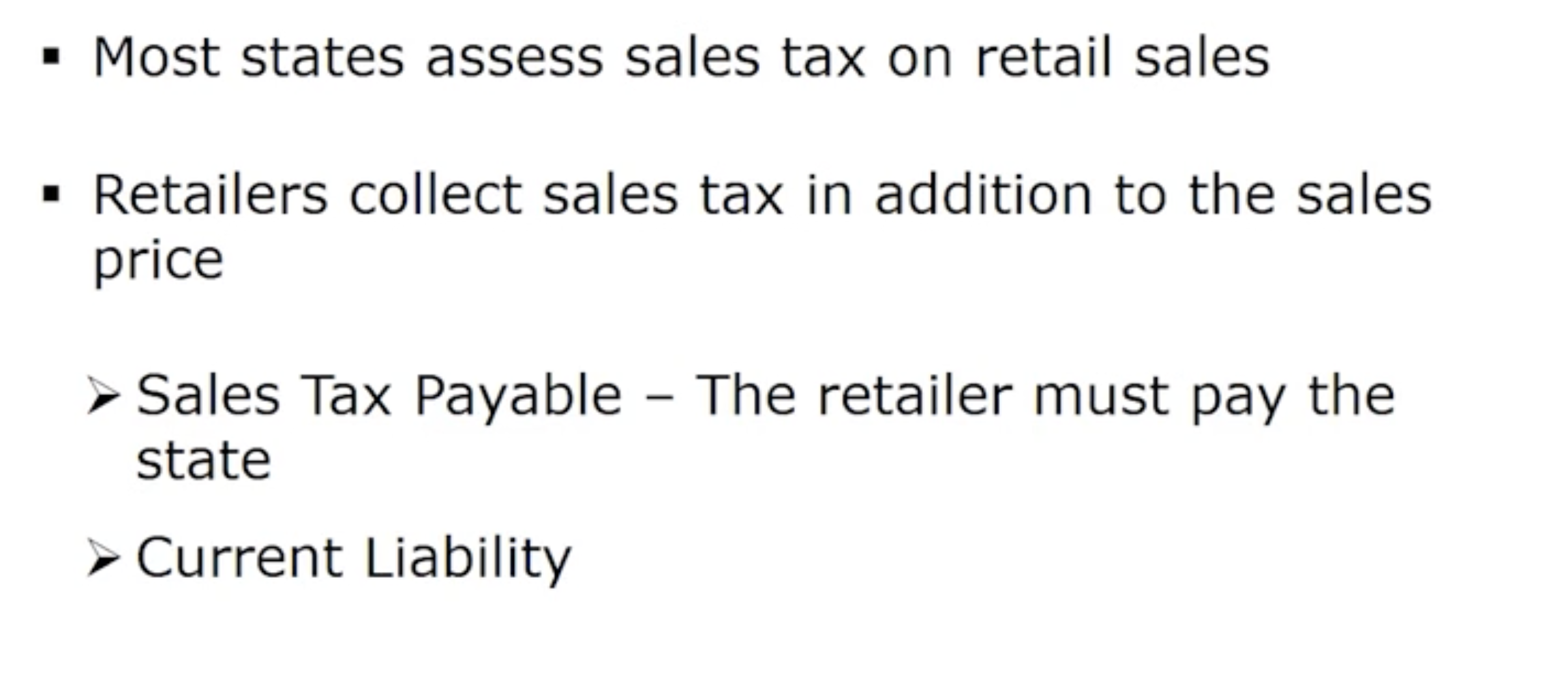

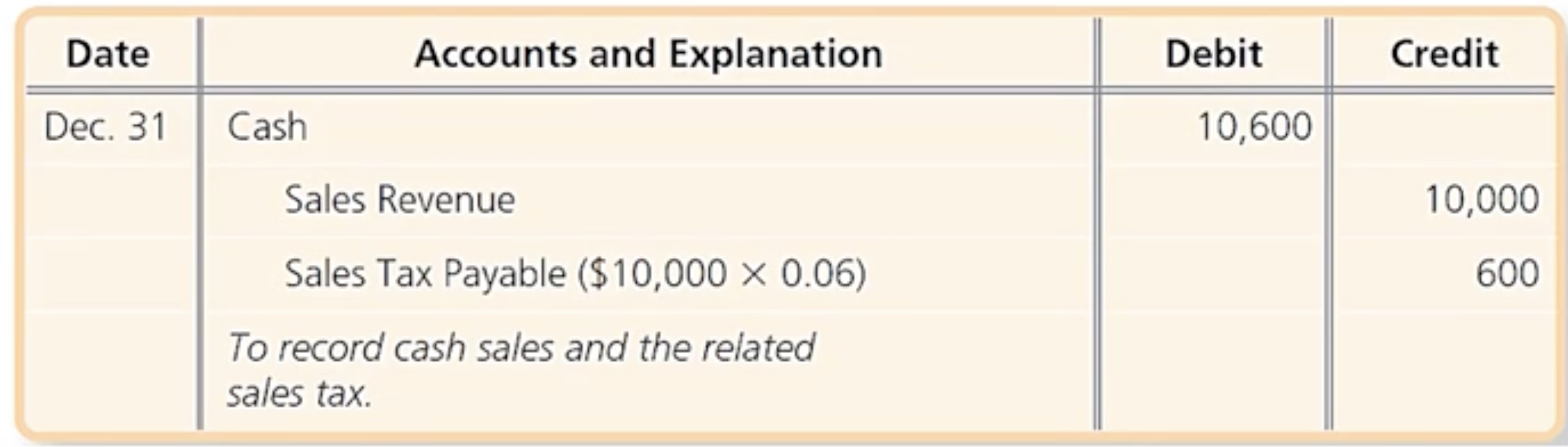

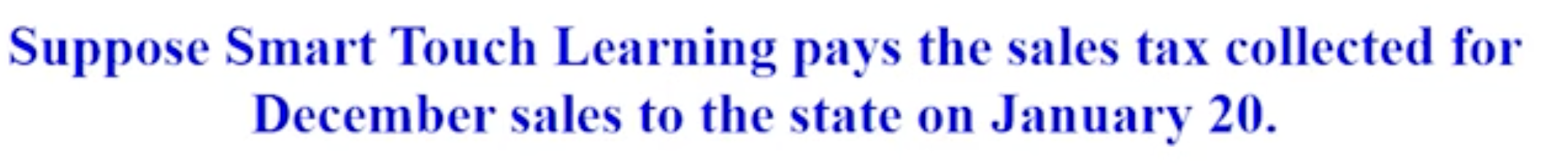

How are current liabilities of known amounts accounted for: Sales Tax payble

How are current liabilities of known amounts accounted for:

How are current liabilities of known amounts accounted for:

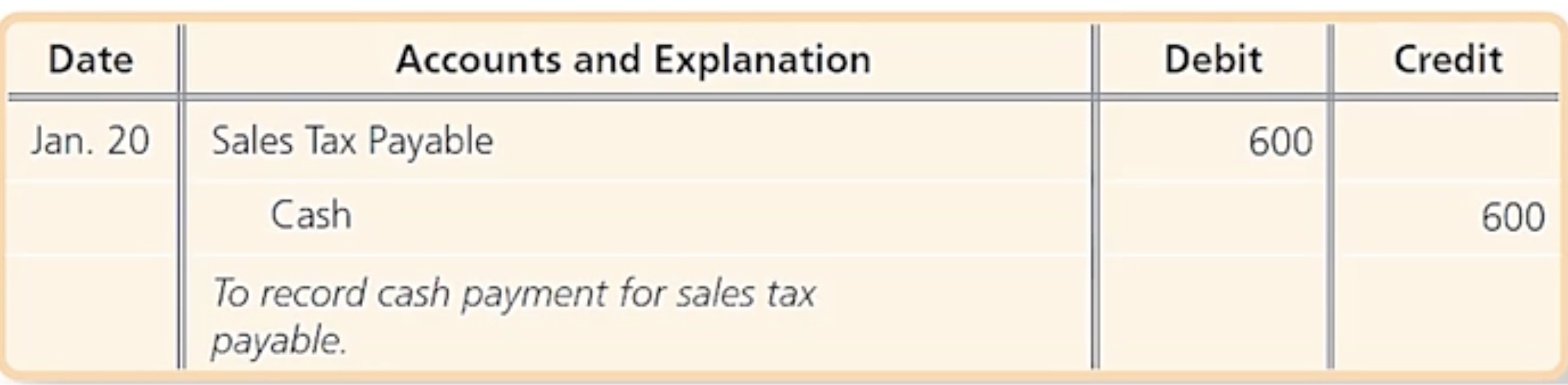

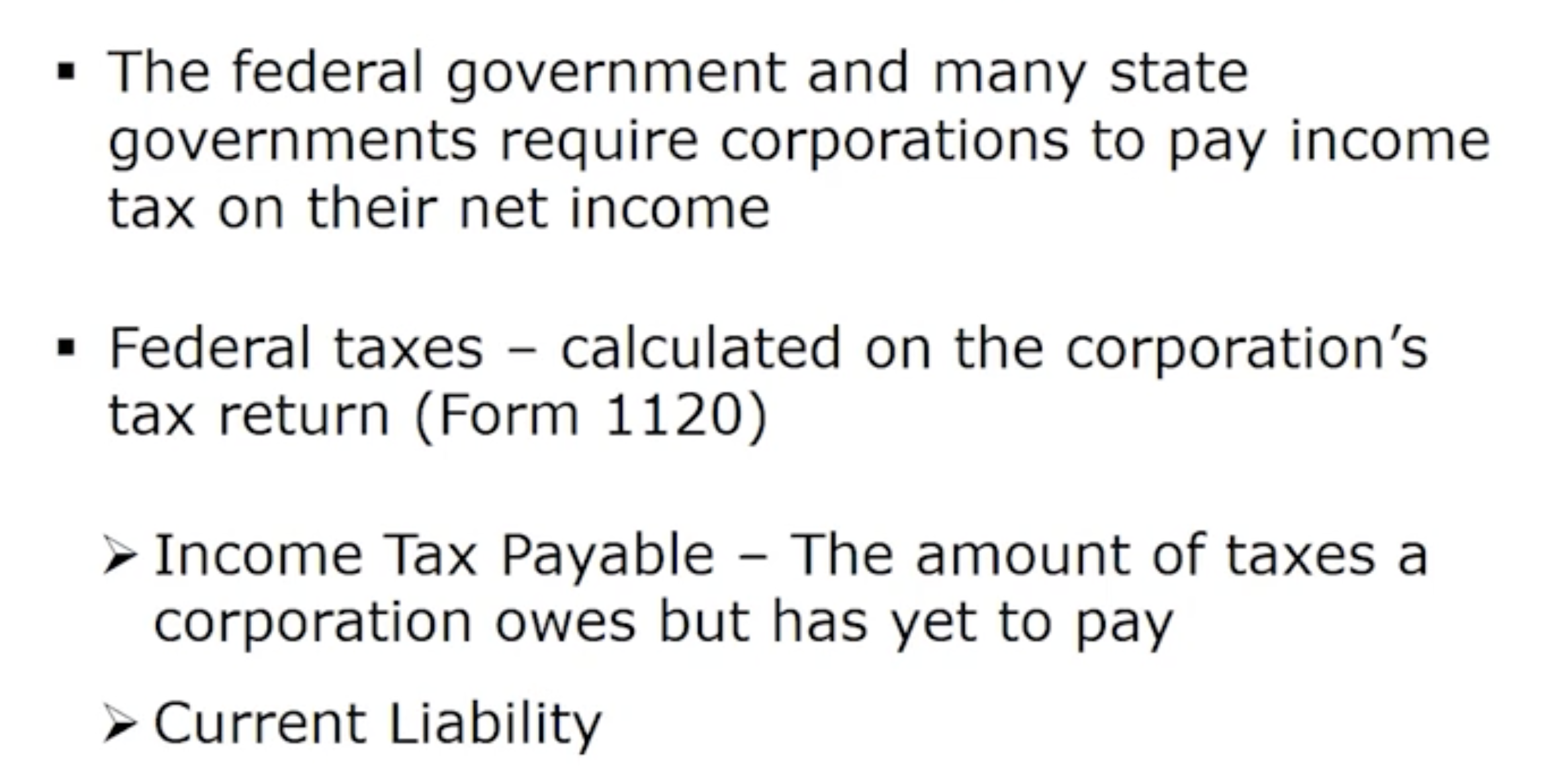

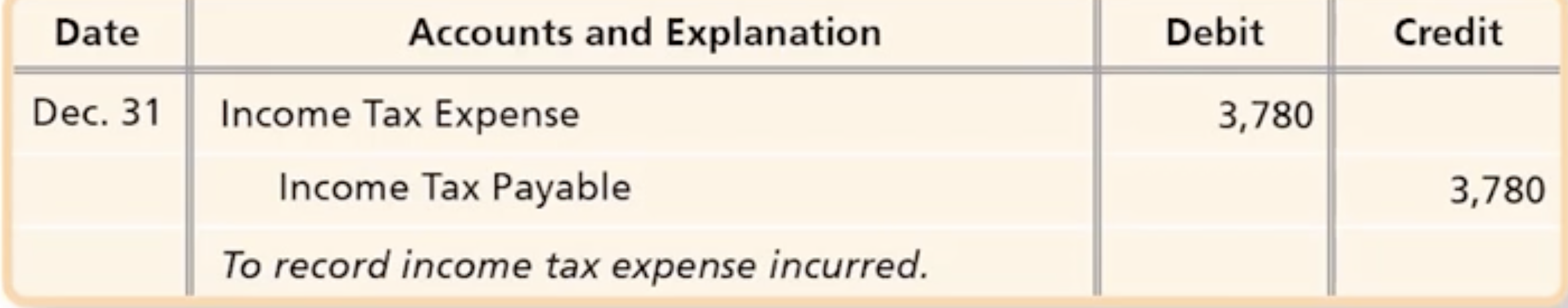

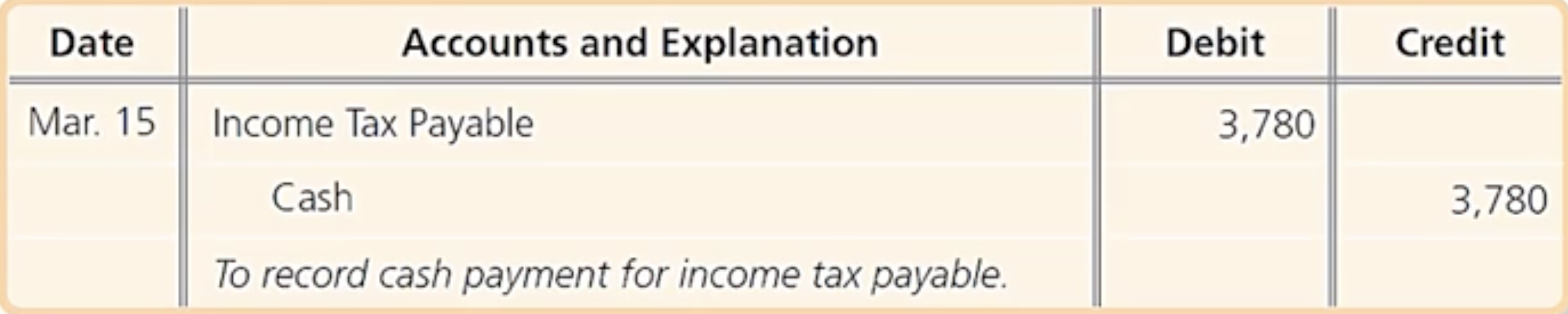

How are current liabilities of known amounts accounted for: Income Tax payable

How are current liabilities of known amounts accounted for:

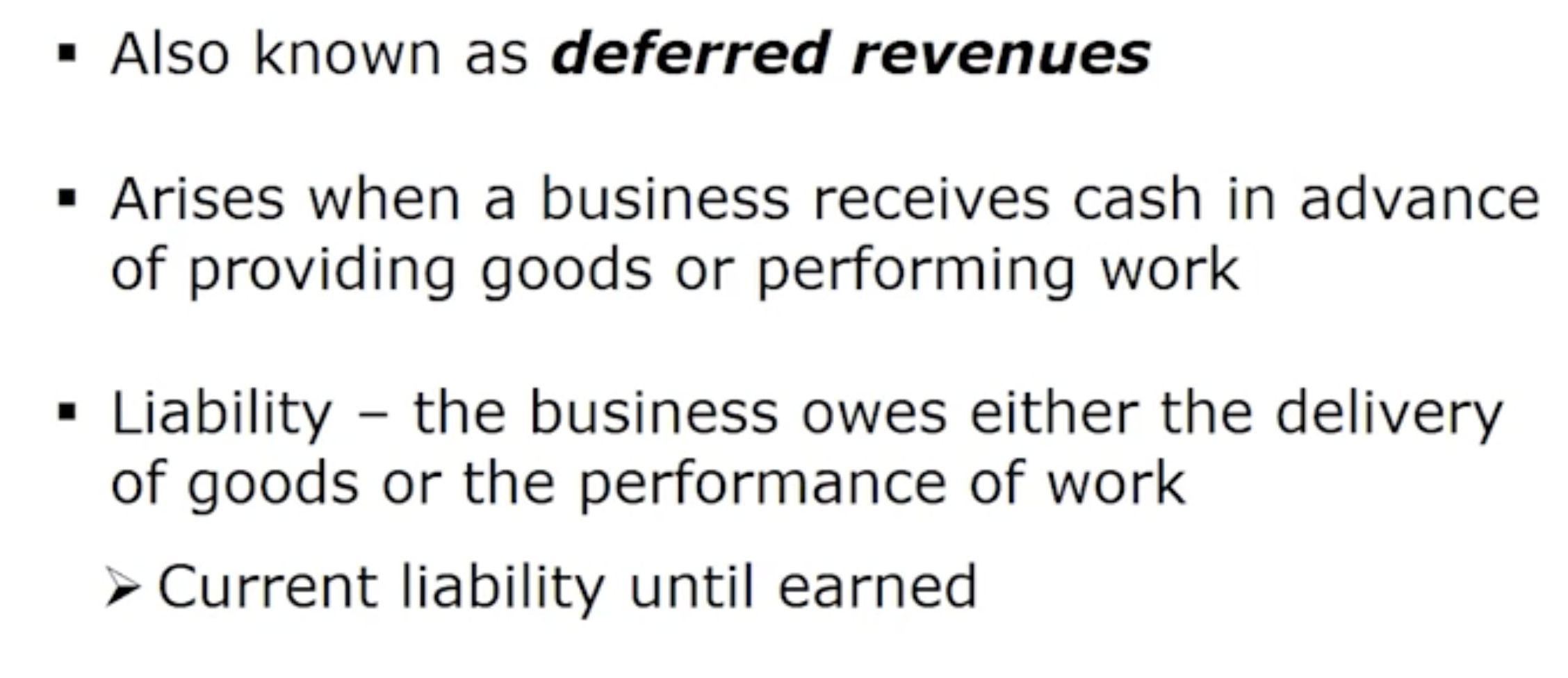

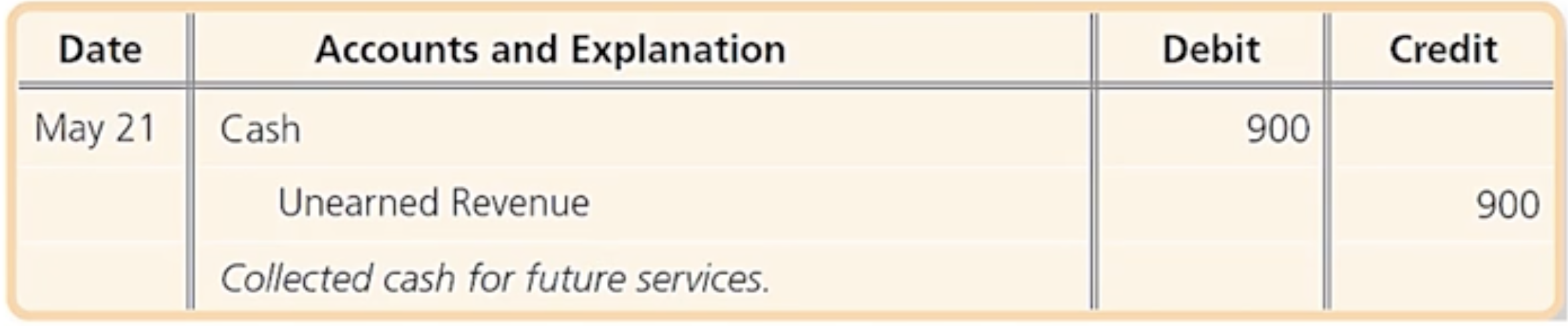

How are current liabilities of known amounts accounted for: Unearned Revenue

How are current liabilities of known amounts accounted for:

How are current liabilities of known amounts accounted for:

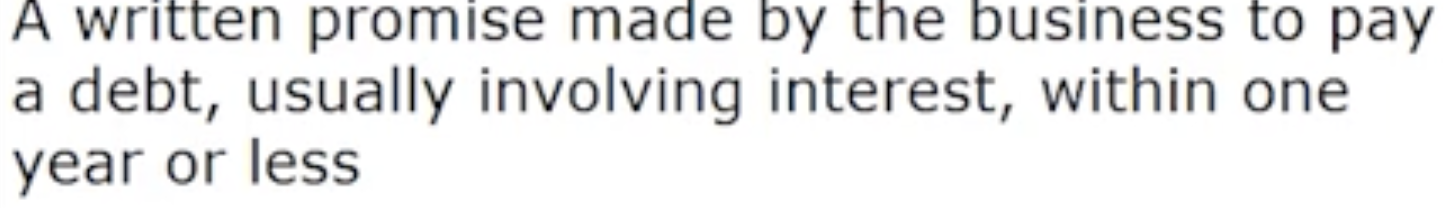

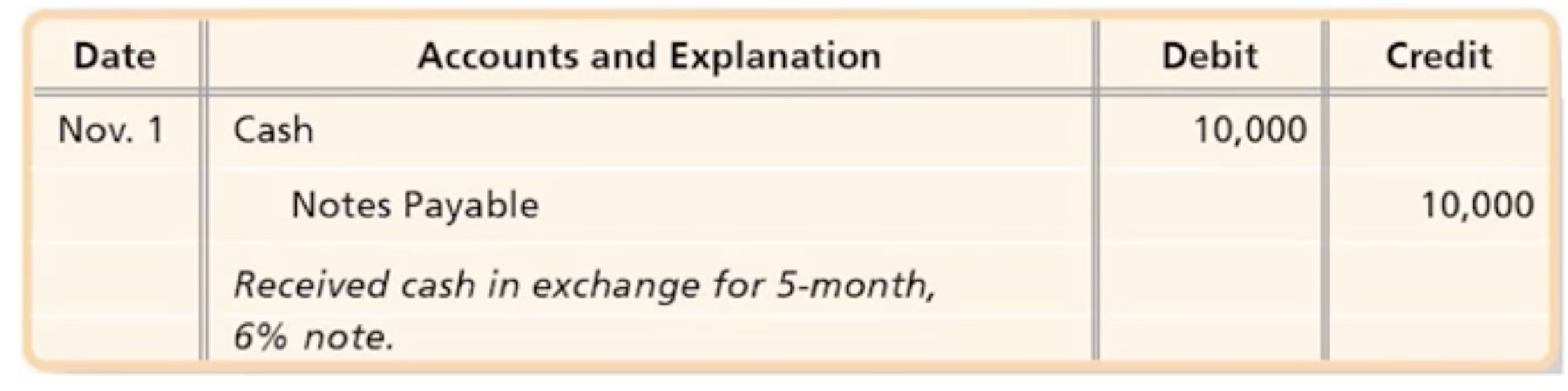

How are current liabilities of known amounts accounted for: Short term notes payable

How are current liabilities of known amounts accounted for:

How are current liabilities of known amounts accounted for:

How are current liabilities of known amounts accounted for:

How are current liabilities of known amounts accounted for:

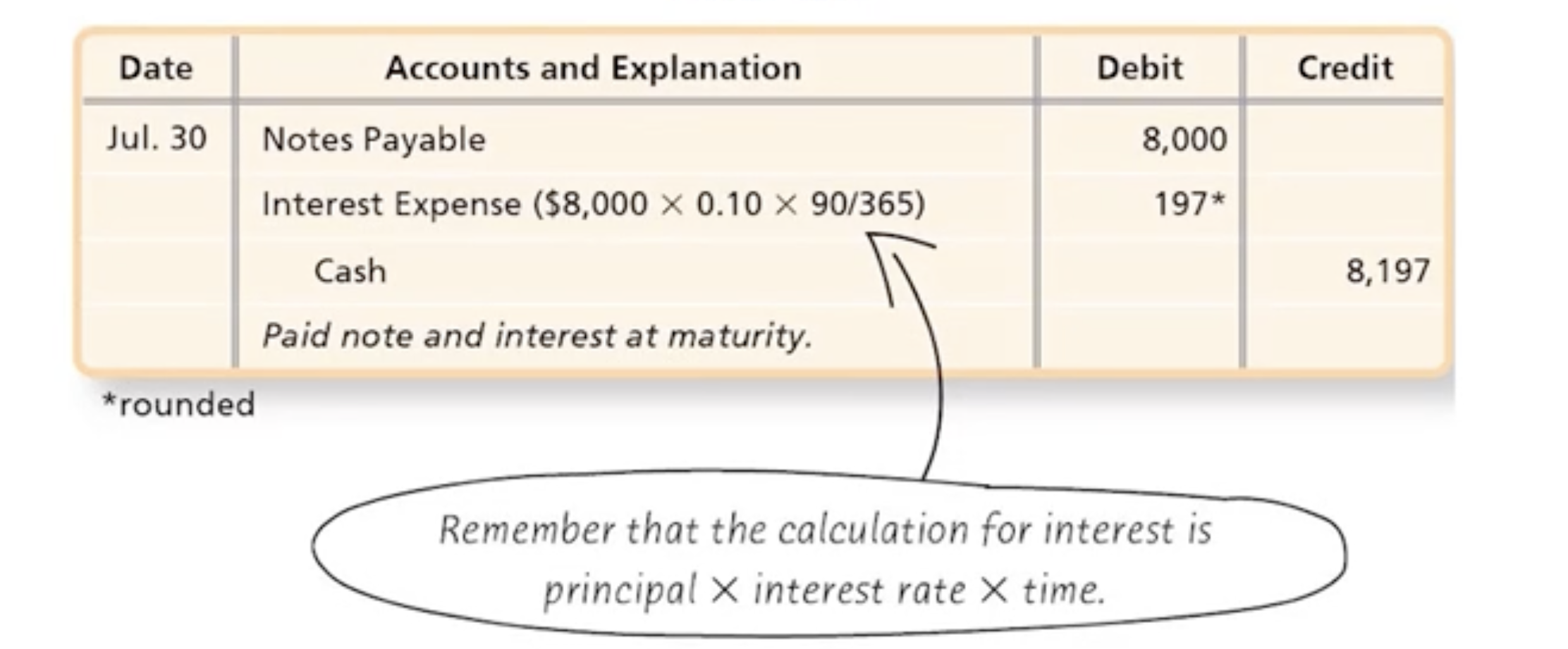

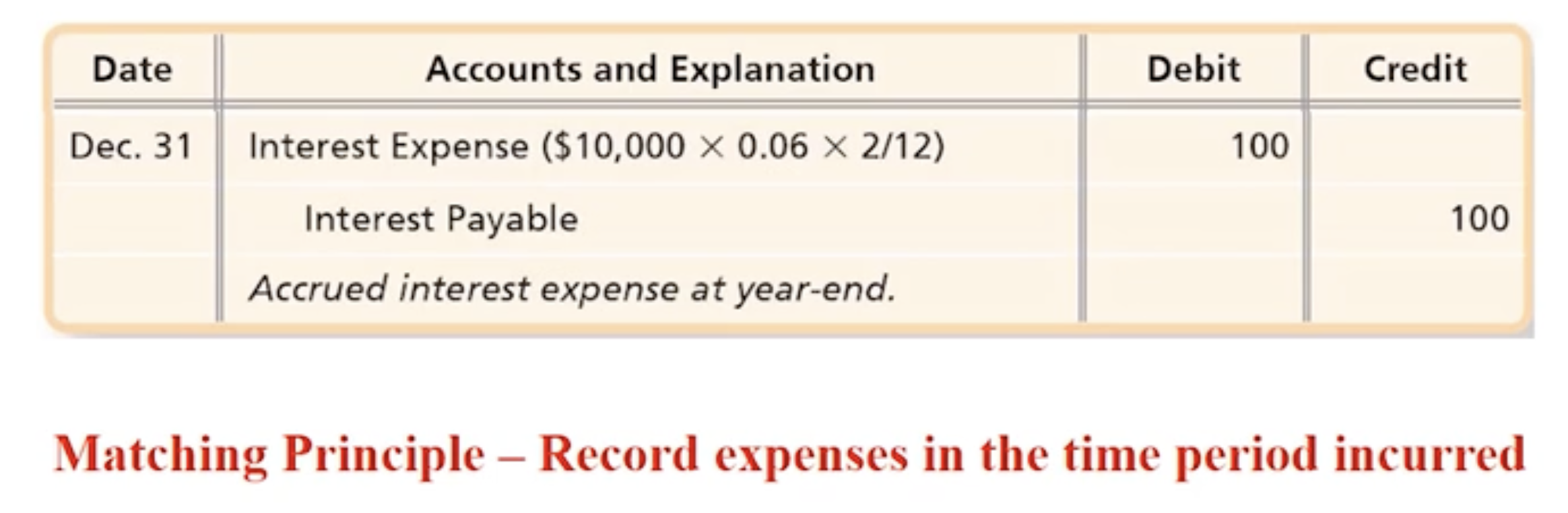

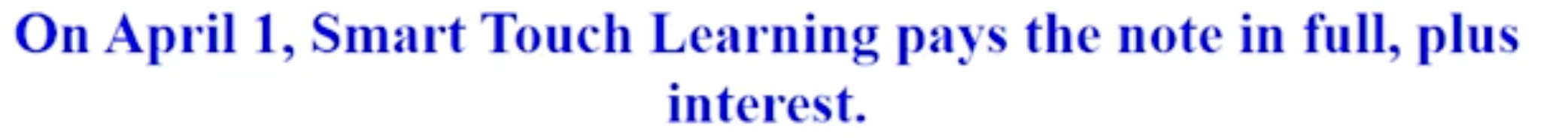

Interest payable example, match the journal entry

How are current liabilities of known amounts accounted for:

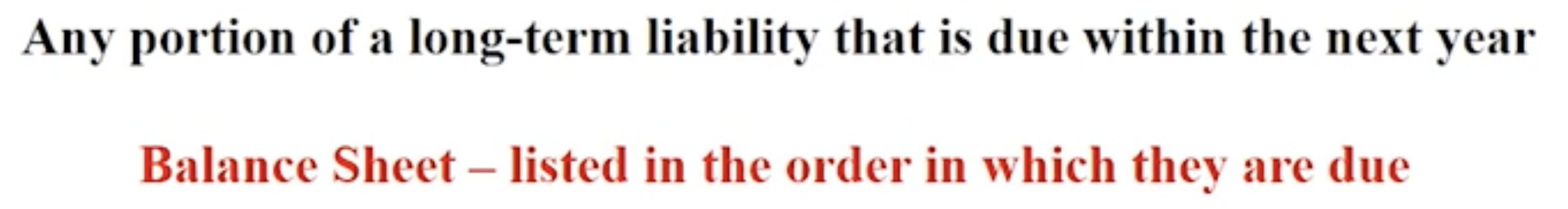

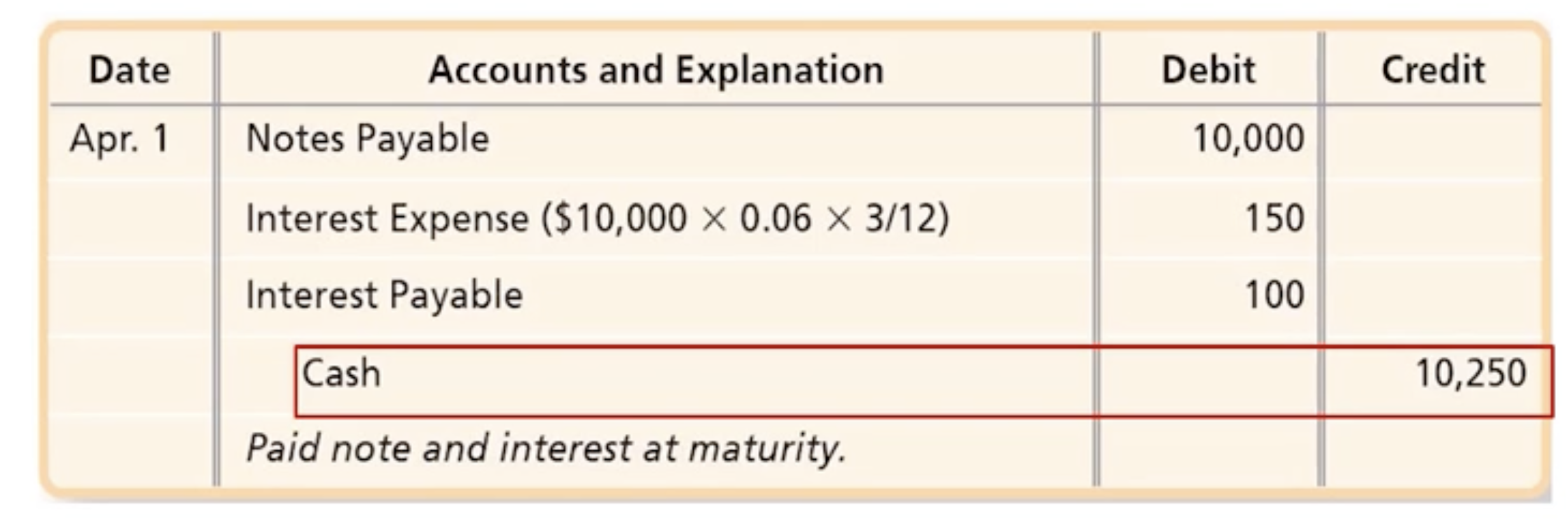

How are current liabilities of known amounts accounted for: Current portion of long term notes payable

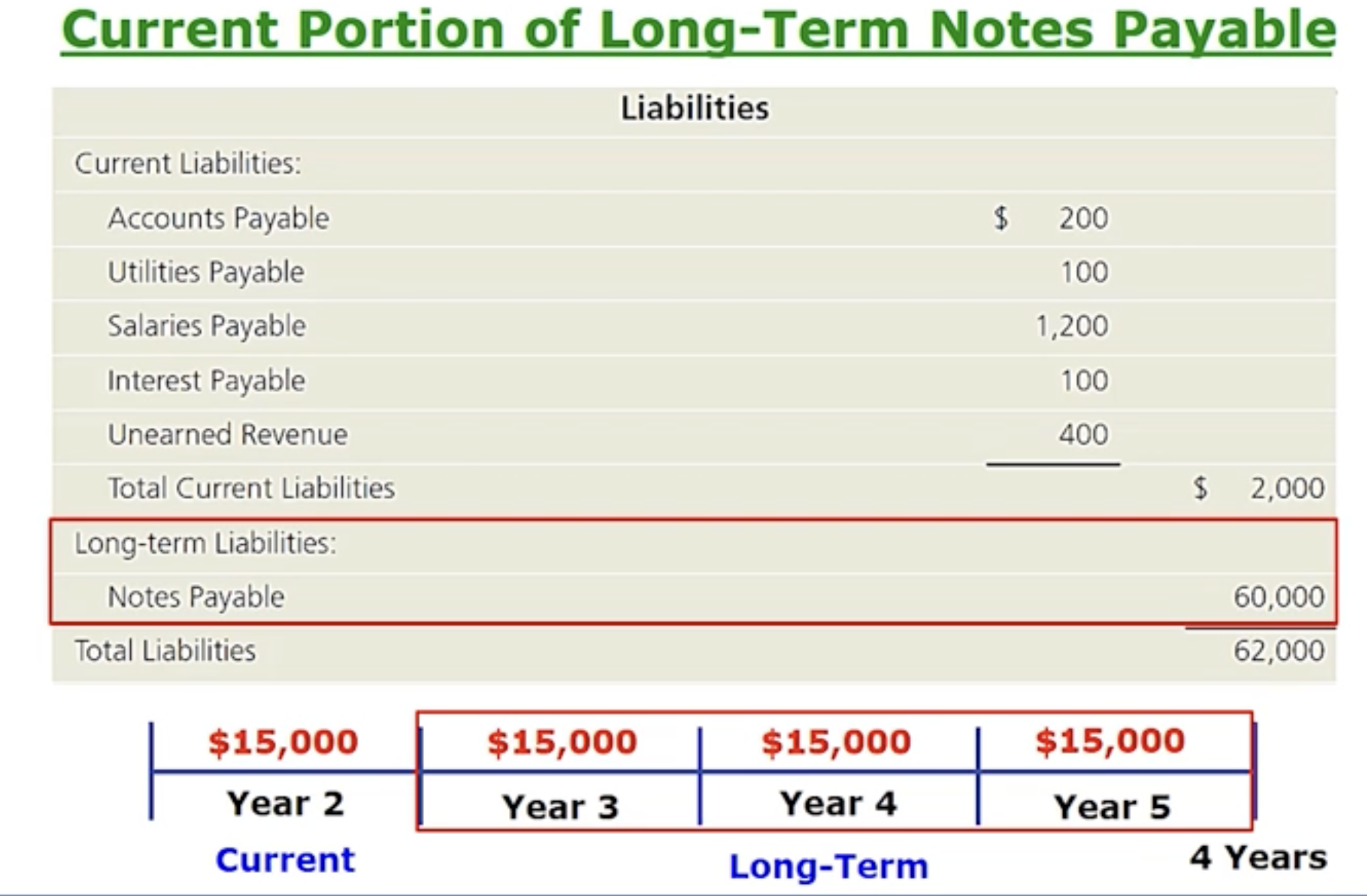

How do companies account for and record payroll: Payroll

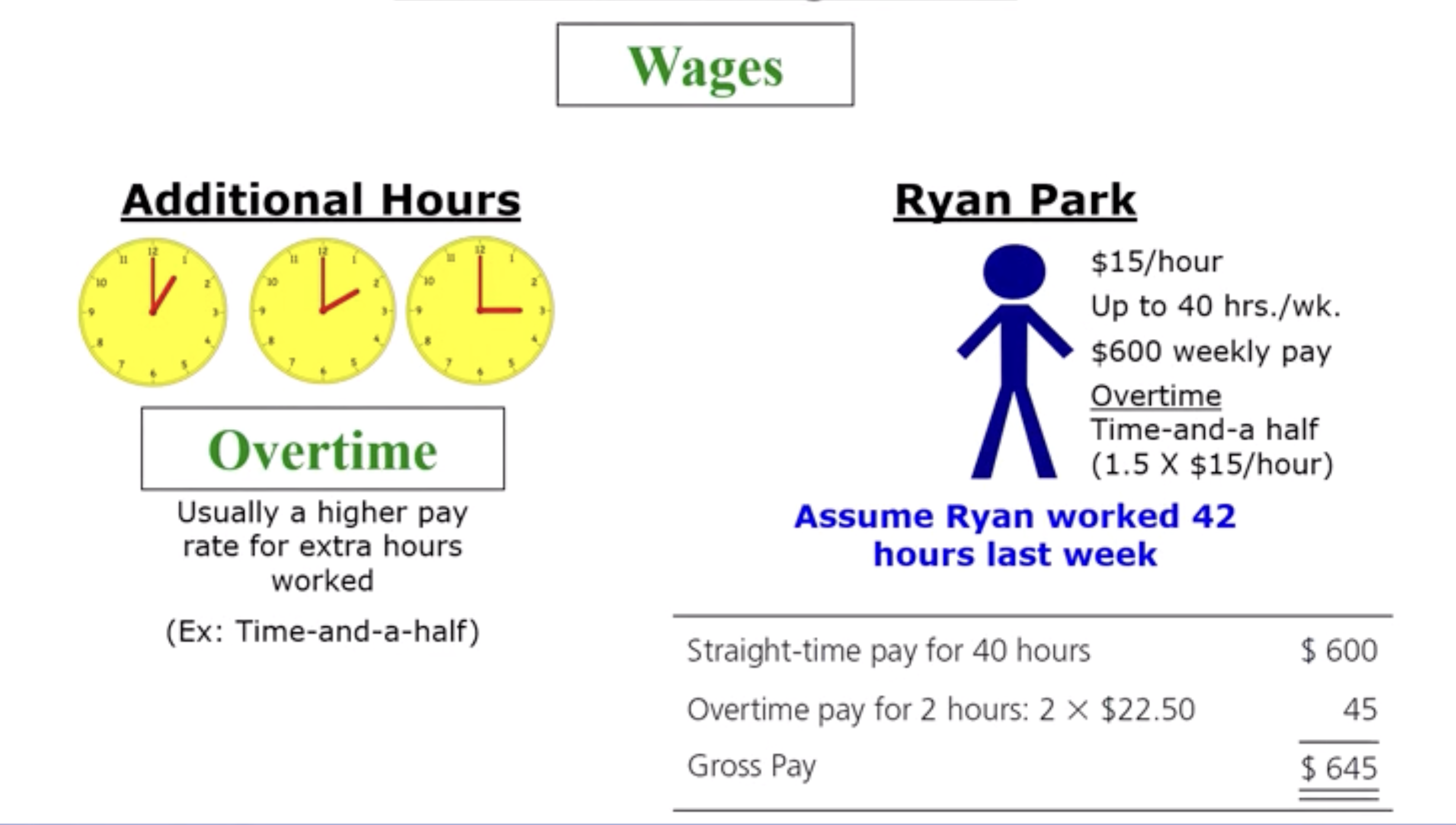

How do companies account for and record payroll: Straight time

How do companies account for and record payroll: Gross pay

How do companies account for and record payroll: Net pay

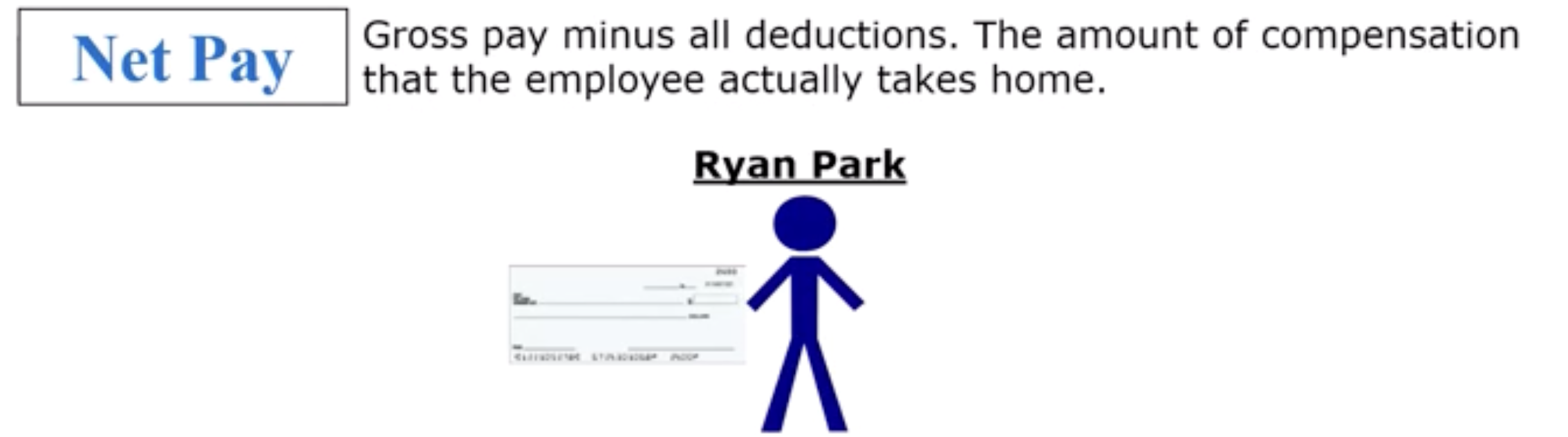

How do companies account for and record payroll: Withholding deductions

Amounts withheld from paychecks like insurance companies or investments that gets deducted from a employee paycheck.

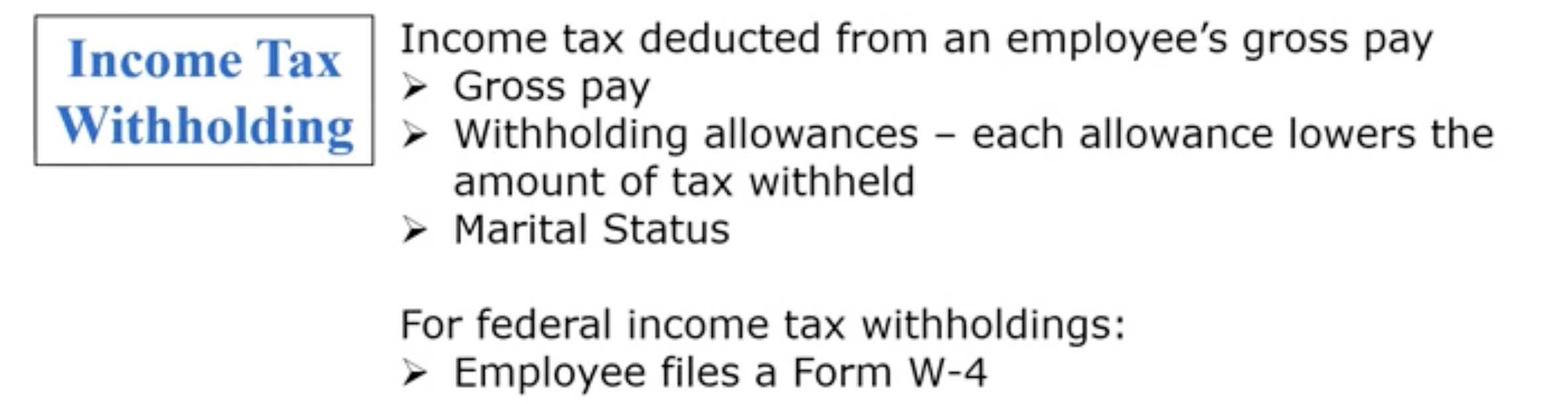

How do companies account for and record payroll: Income Tax Withholding

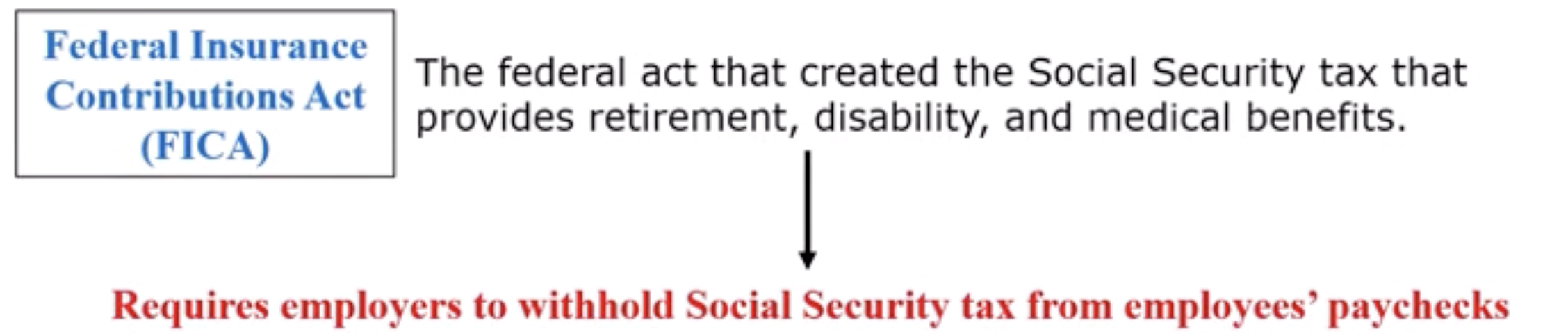

How do companies account for and record payroll: Withholding for employee social security tax (FICA, Federal Insurance contributions act)

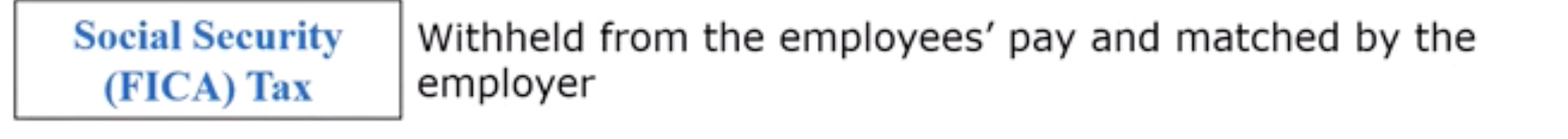

How do companies account for and record payroll: Withholding for employee social security tax (FICA Tax, Social Security)

How do companies account for and record payroll: 2 components of FICA Tax

OASDI & Medicare

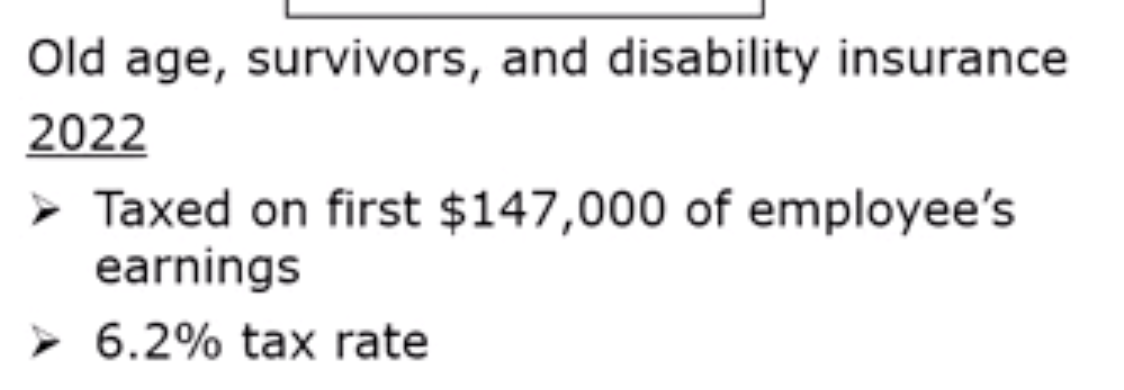

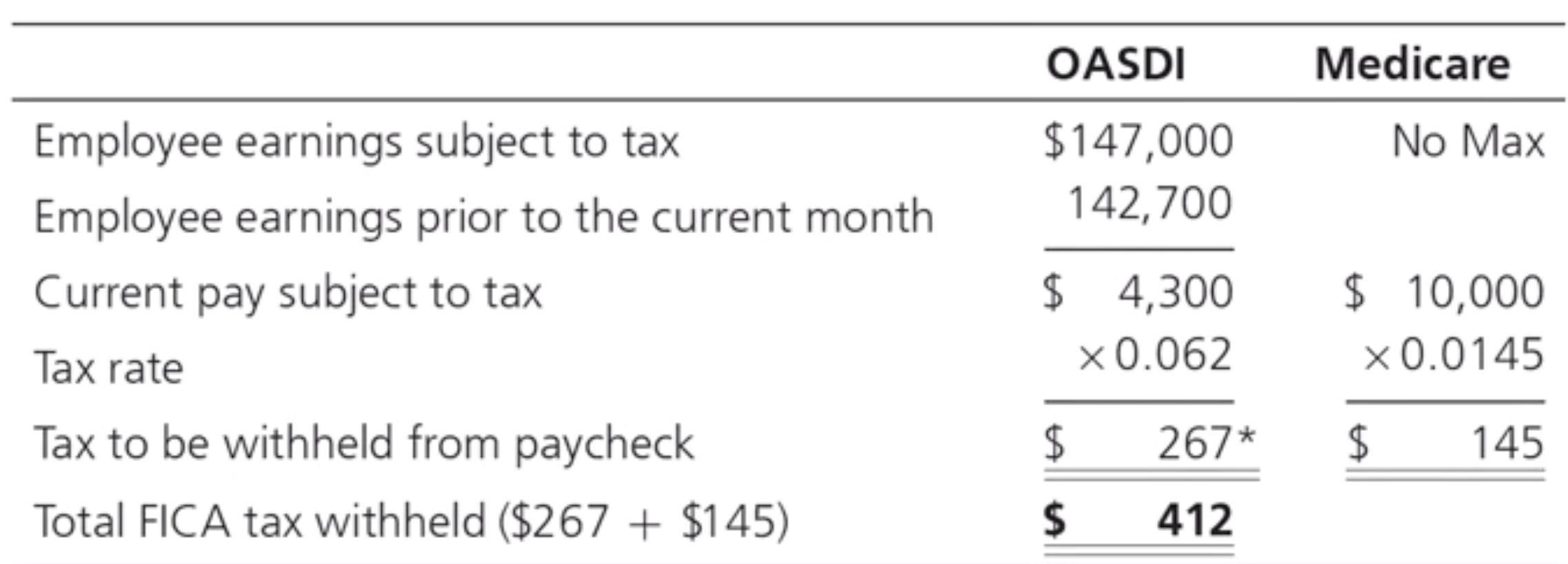

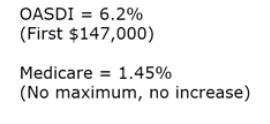

How do companies account for and record payroll: OASDI

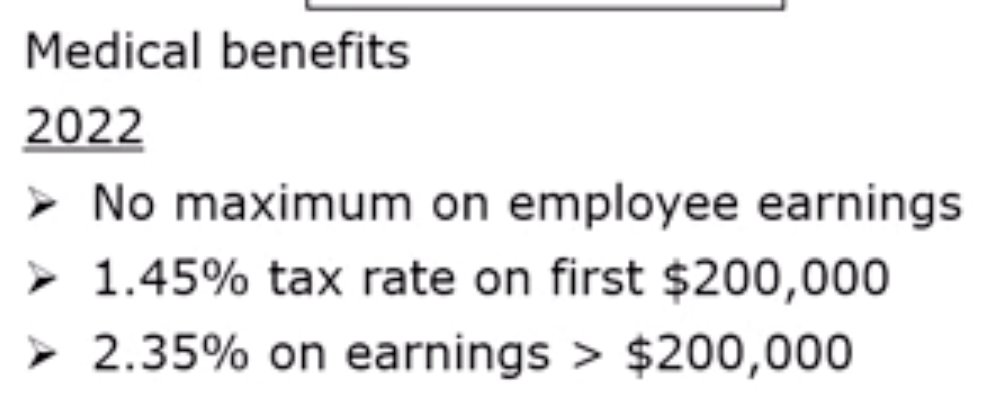

How do companies account for and record payroll: Medicare

How do companies account for and record payroll:

FICA Tax ex

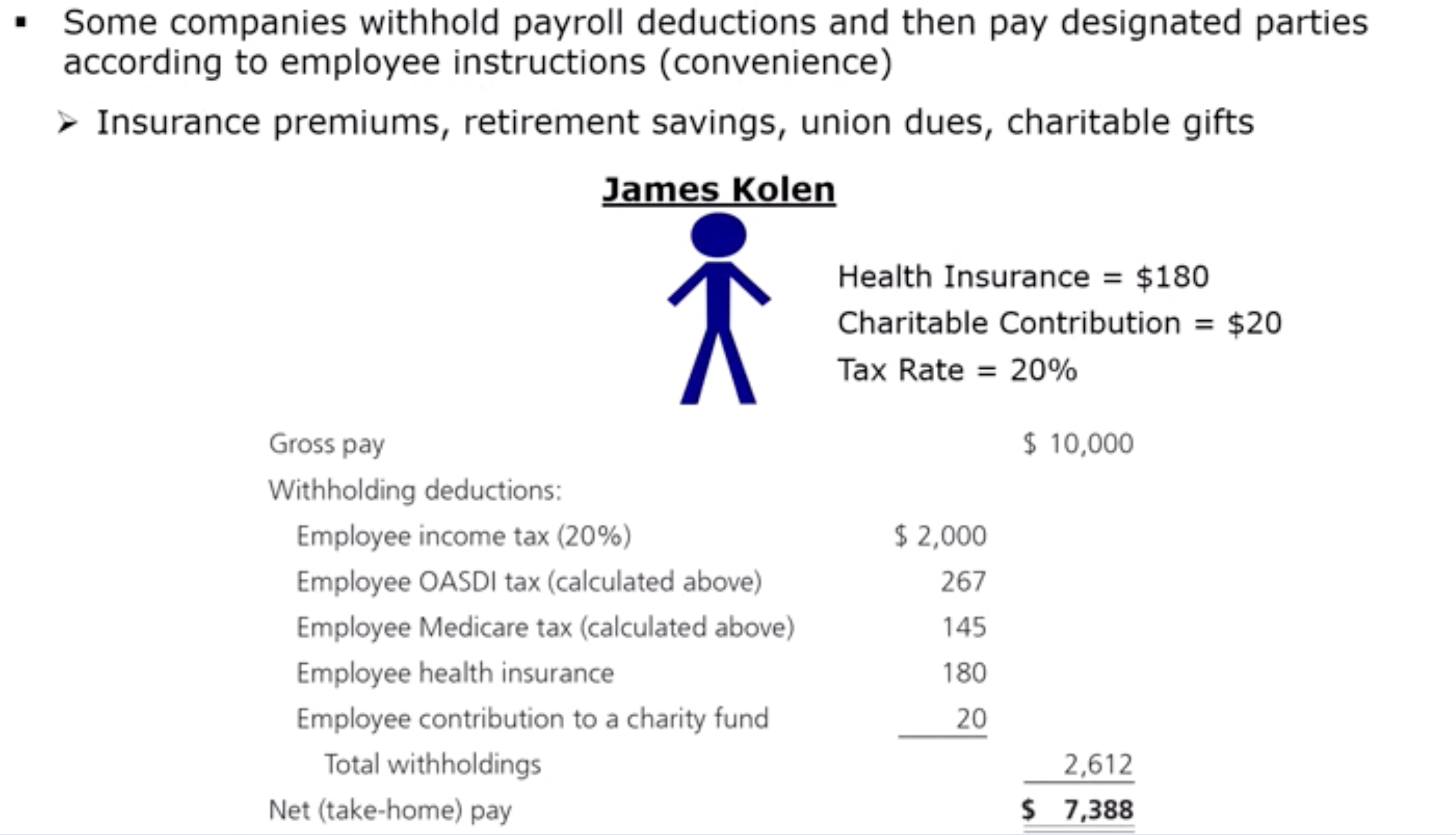

How do companies account for and record payroll: Optional withholding deductions example

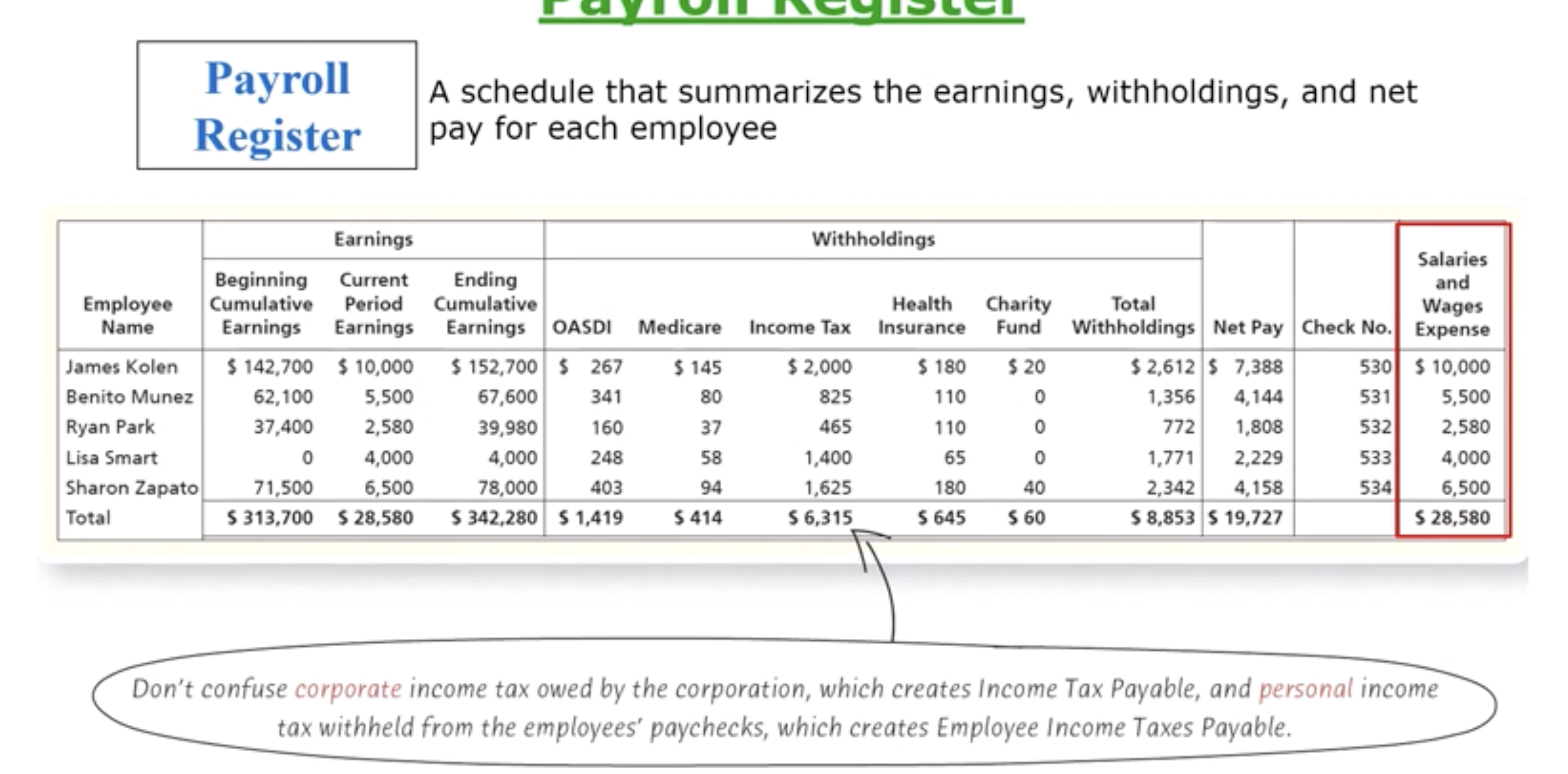

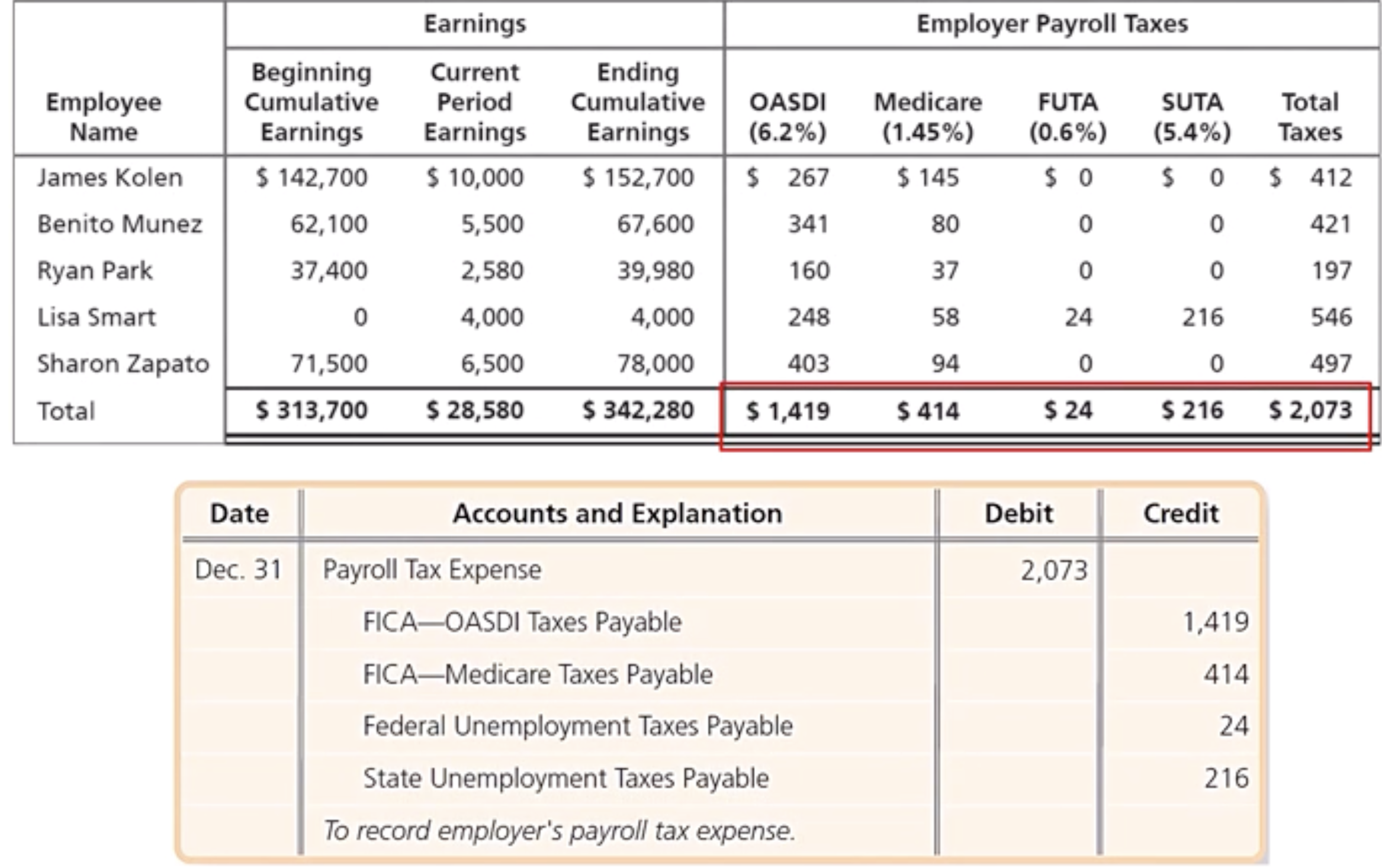

How do companies account for and record payroll: Payroll register

Salaries & wages expense correlates with the current period gross earnings of each employee

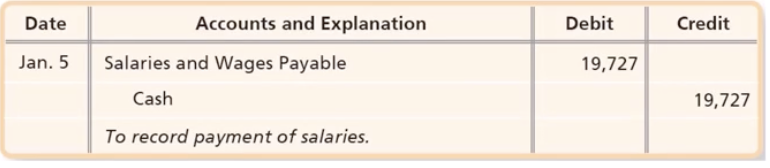

How do companies account for and record payroll: Payday Journal entry

How do companies account for and record payroll: The 3 different payroll taxes

FICA Tax, Unemployment Compensation Tax: 2. Federal Unemployment Tax (FUTA) & 3. State Unemployment Tax (SUTA or SUI)

How do companies account for and record payroll: FICA Tax

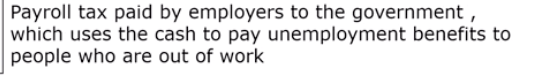

How do companies account for and record payroll: Unemployment Compensation Tax

Includes the two unemployment tax

How do companies account for and record payroll: Payroll tax Journal entry

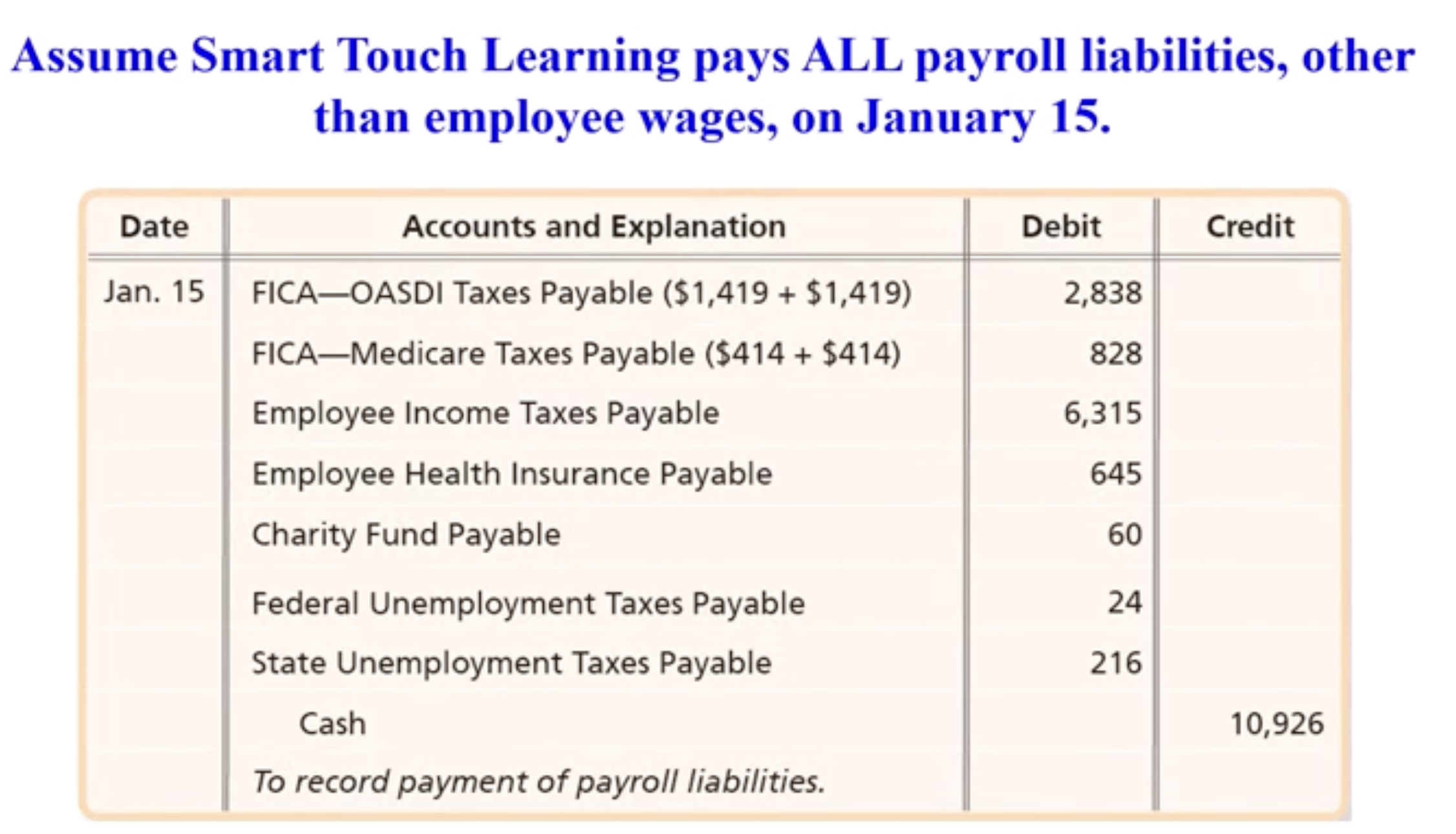

How do companies account for and record payroll: Journalizing payroll liability payments

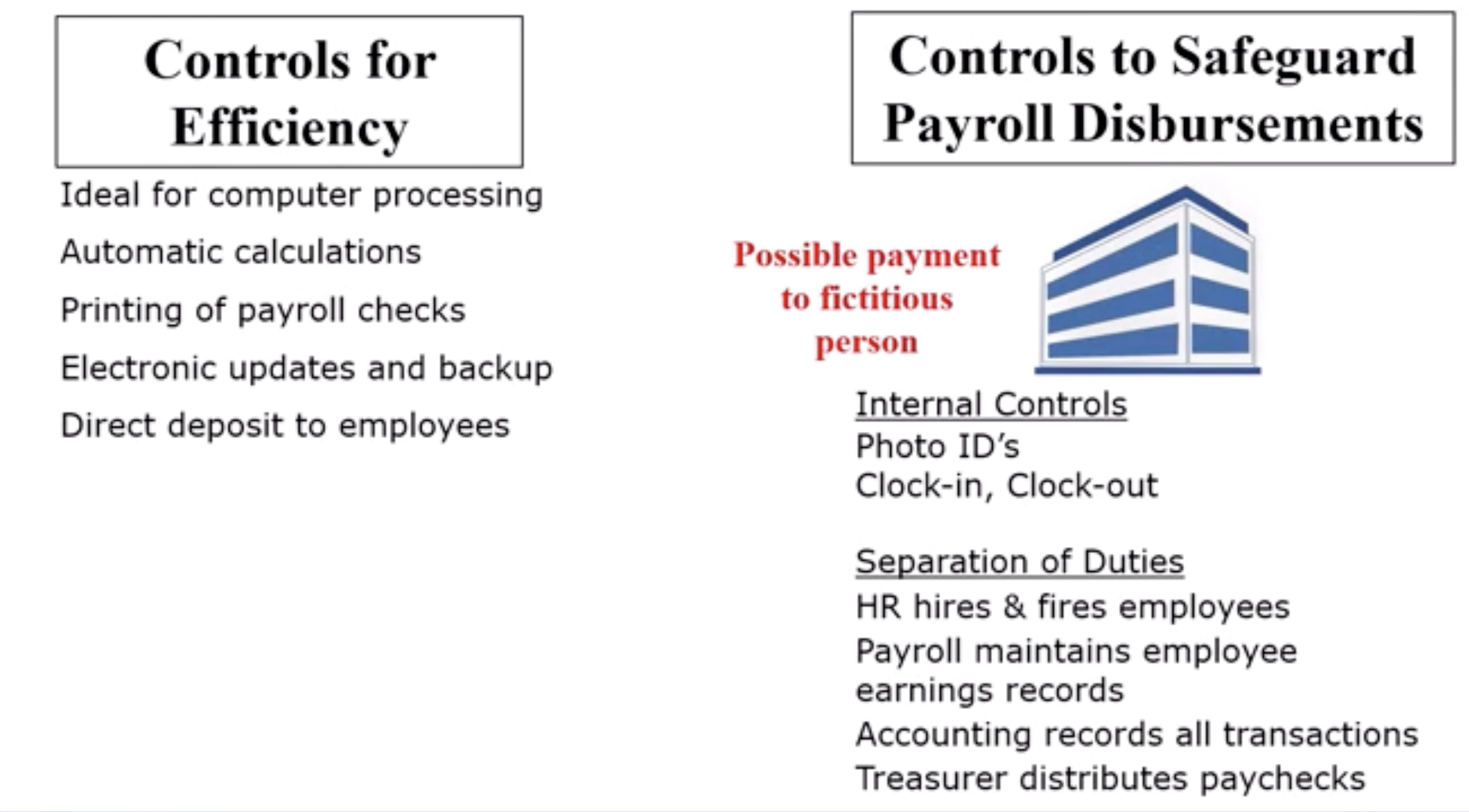

How do companies account for and record payroll: What are the 2 main controls for payroll

Controls for efficiency & Controls to Safeguard payroll disbursements

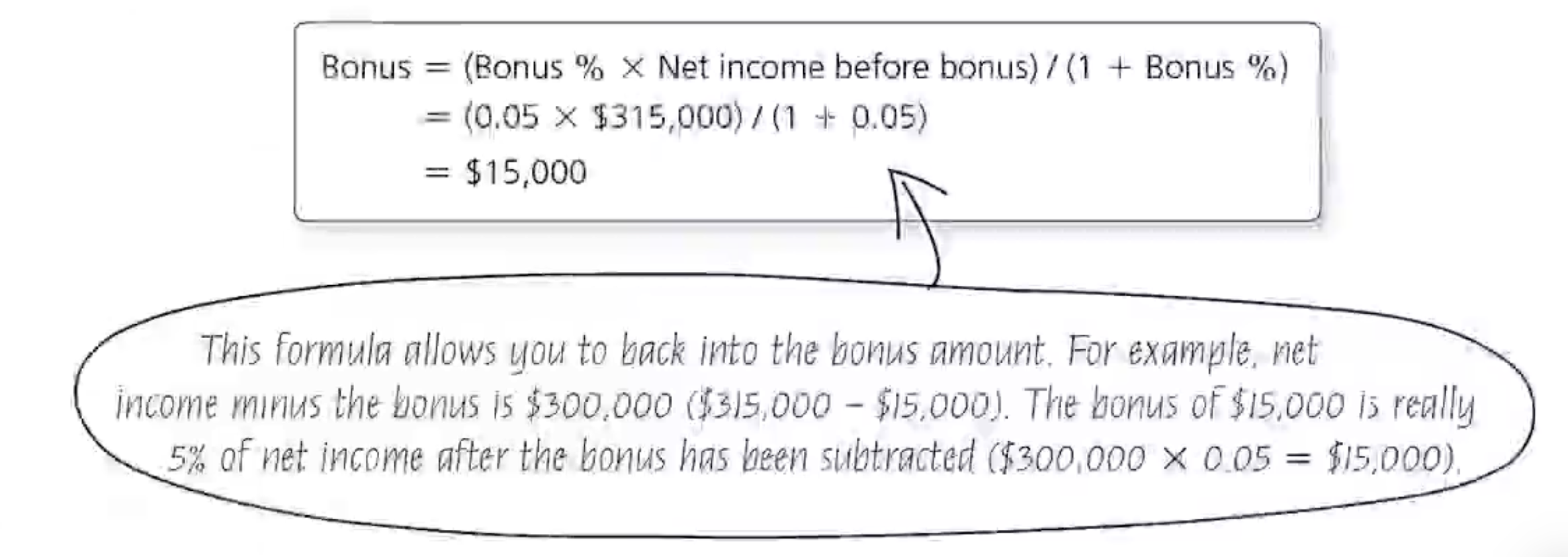

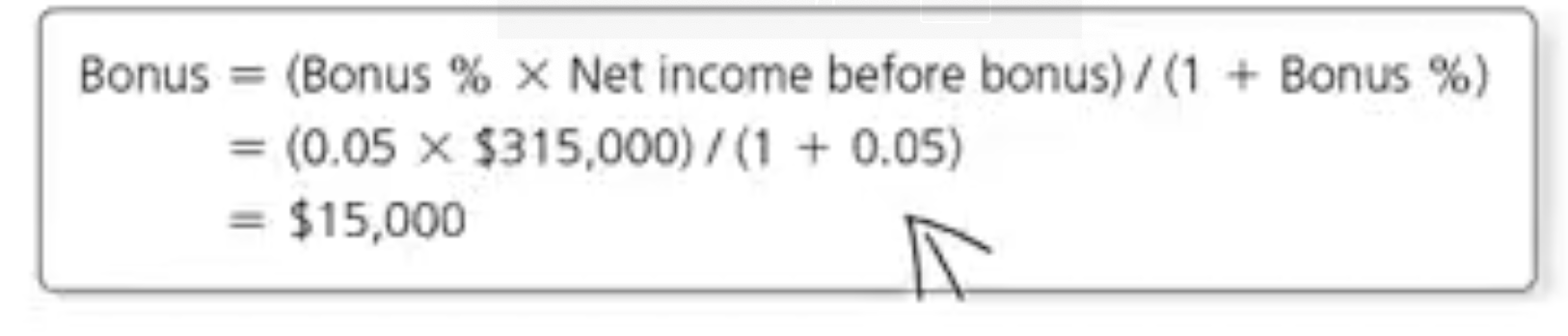

How are current liabilities that must be estimated accounted for: Bonus plans

How are current liabilities that must be estimated accounted for:

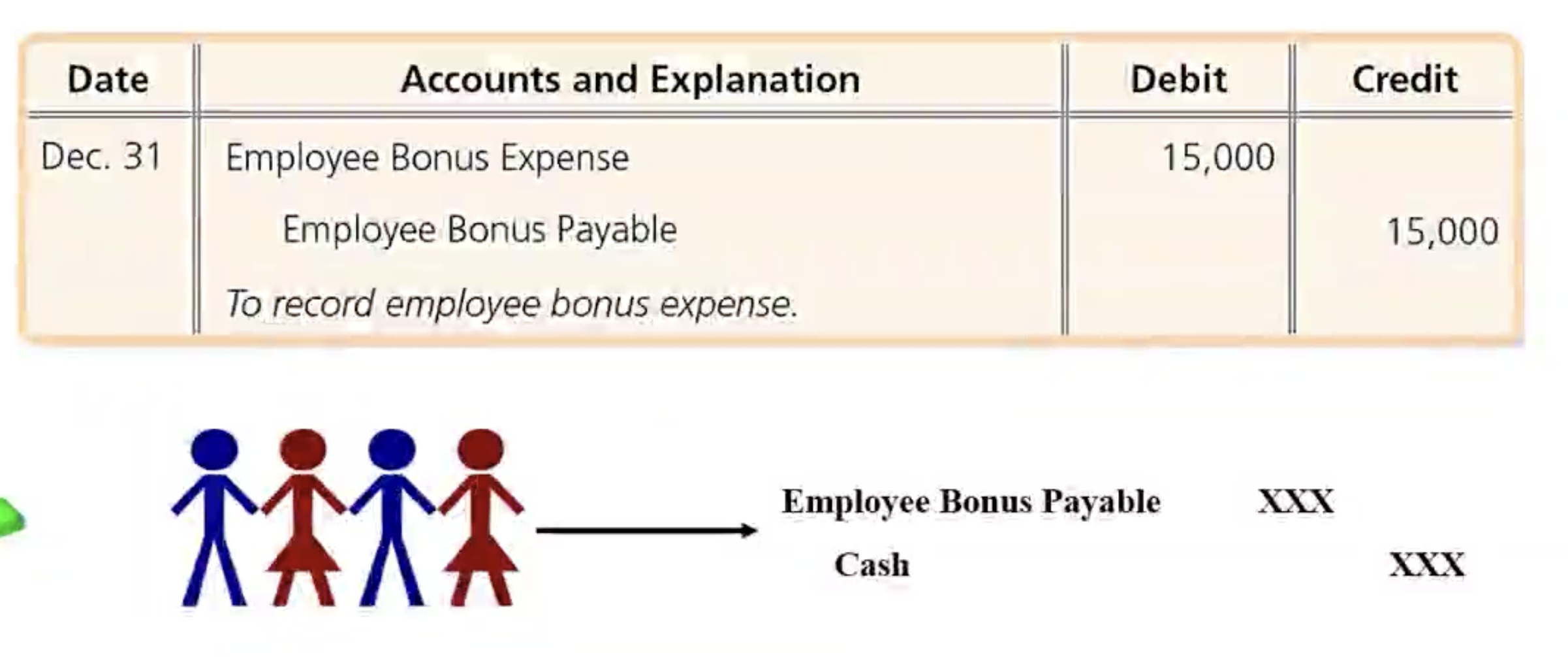

How are current liabilities that must be estimated accounted for: Adjusting entry example

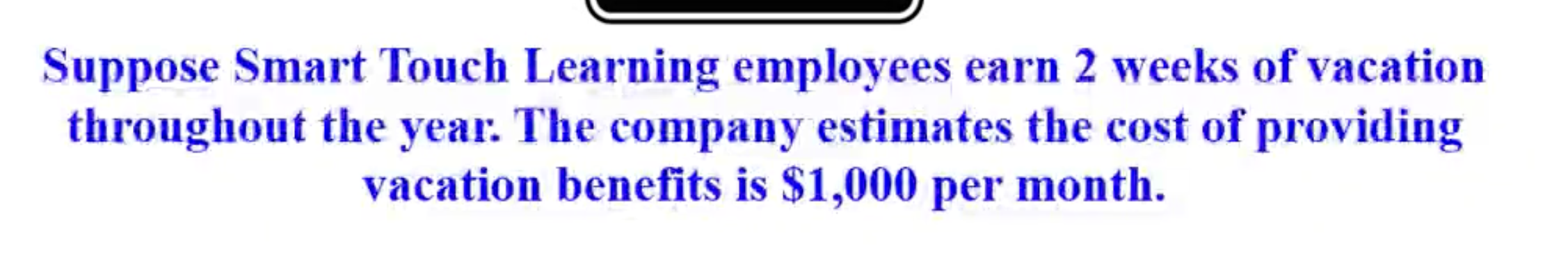

How are current liabilities that must be estimated accounted for: Vacation, Health, and Pension benefits

How are current liabilities that must be estimated accounted for:

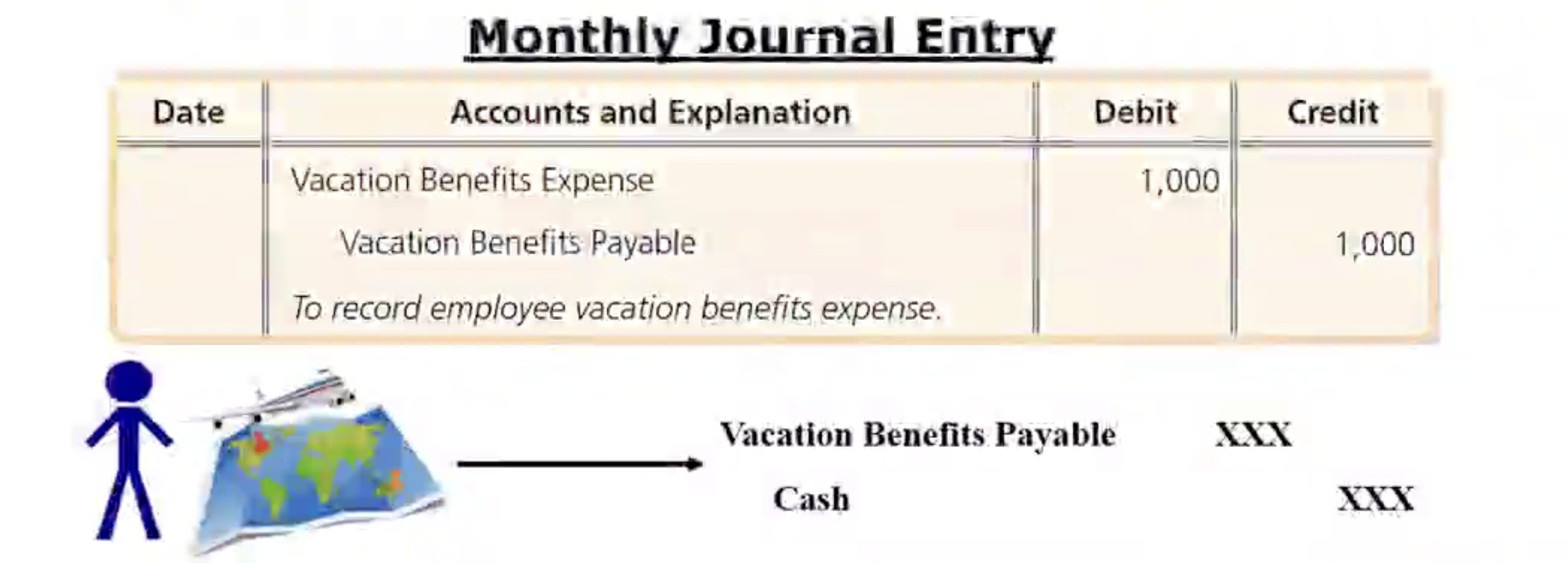

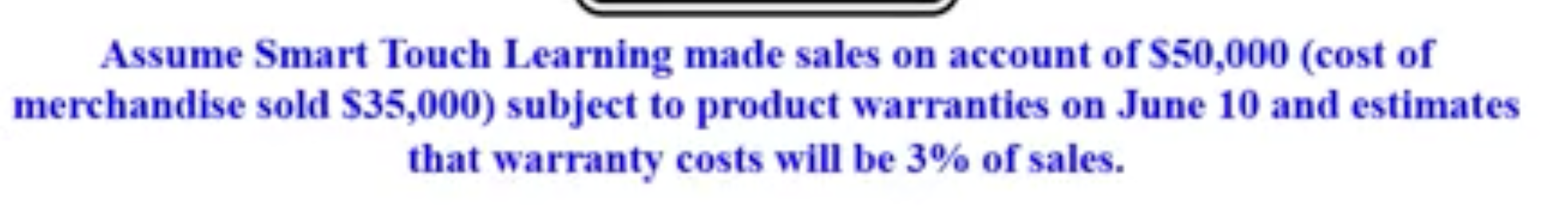

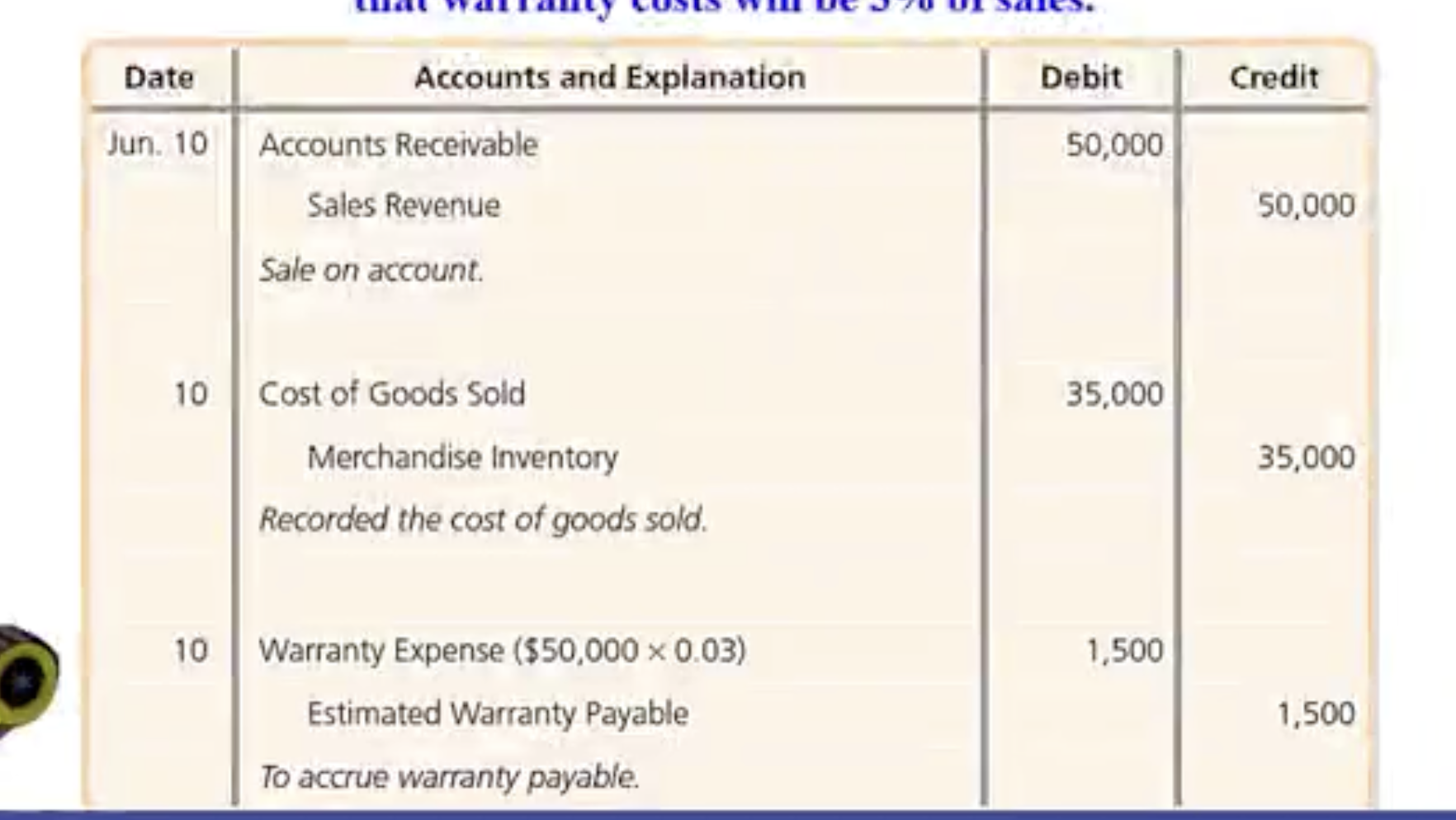

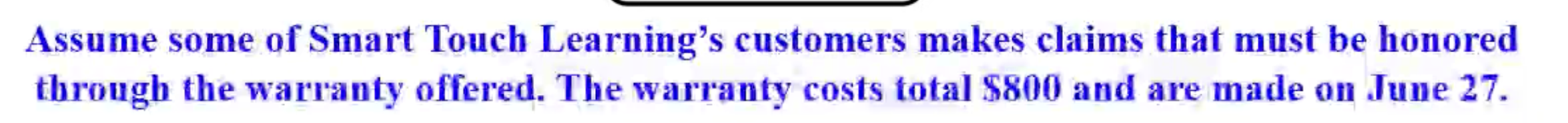

How are current liabilities that must be estimated accounted for: Warranties

An agreement that guarantees a companys product against defects

Have to record estimate warranty expense, same time period as sale

How are current liabilities that must be estimated accounted for:

How are current liabilities that must be estimated accounted for:

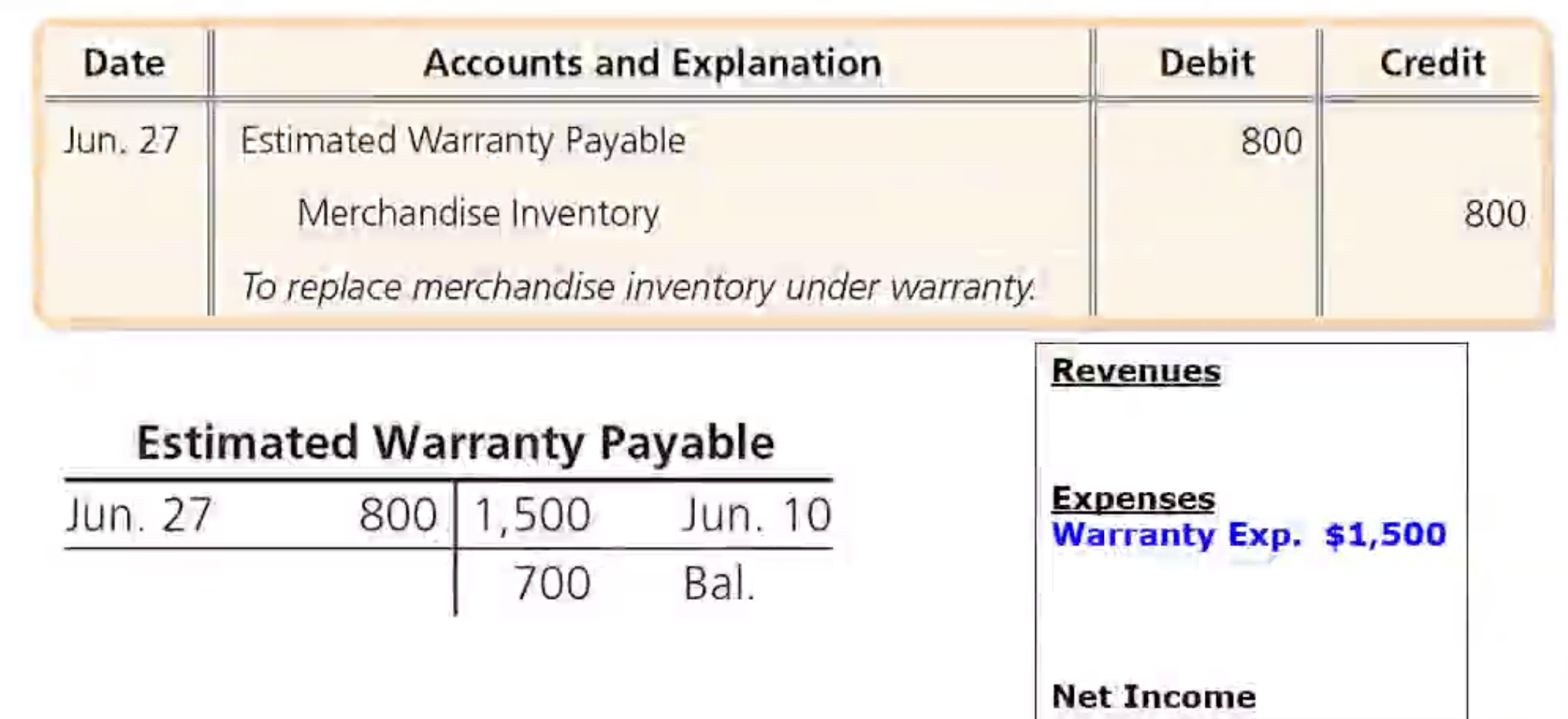

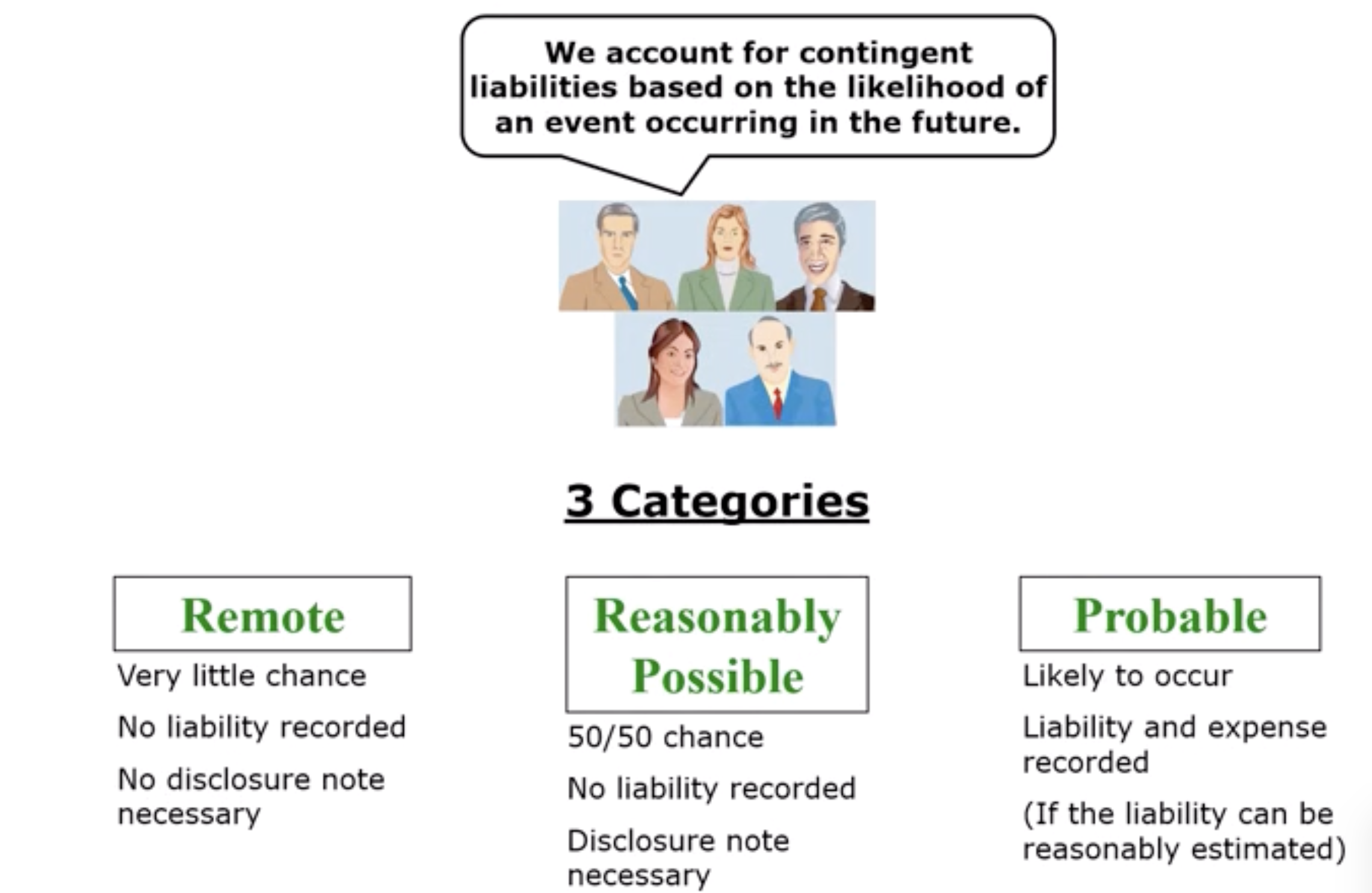

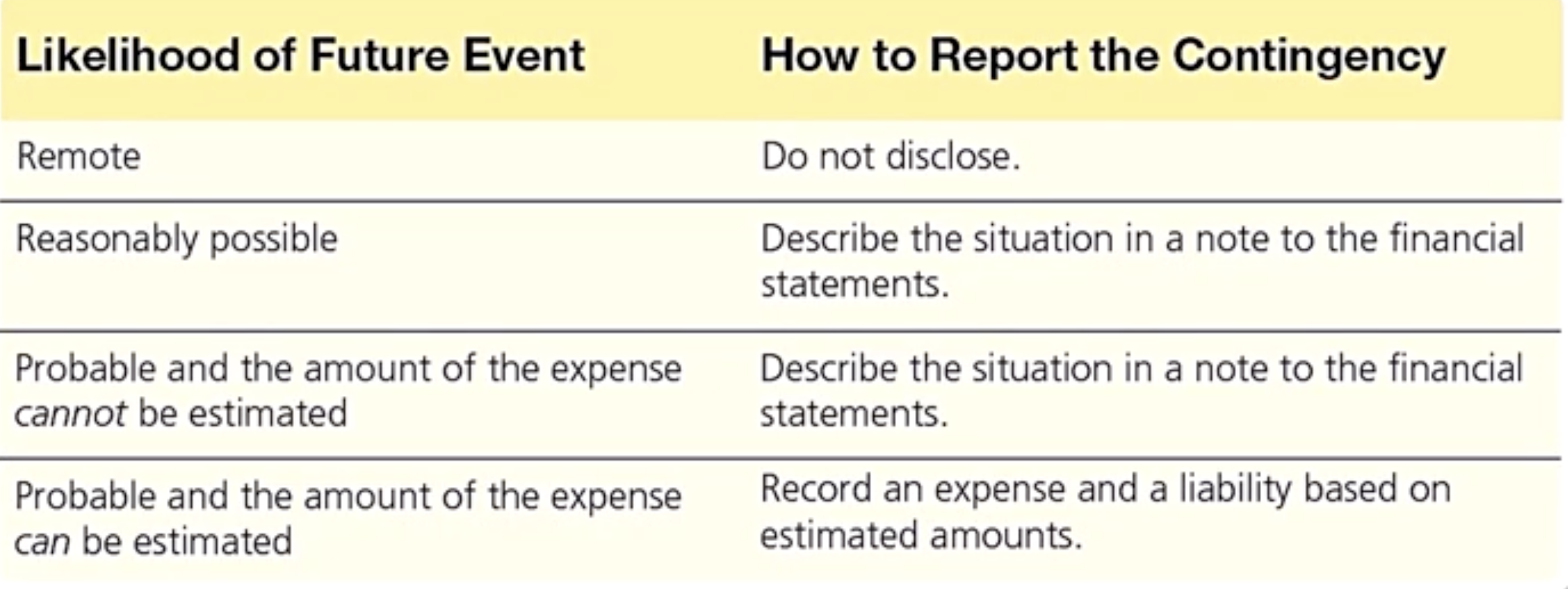

How are contingent liabilities accounted for: Contingent Liability

A potential liability that depends on a future event.

How are contingent liabilities accounted for: The 3 categories of future event

Remote, Reasonably Possible, and Probable.

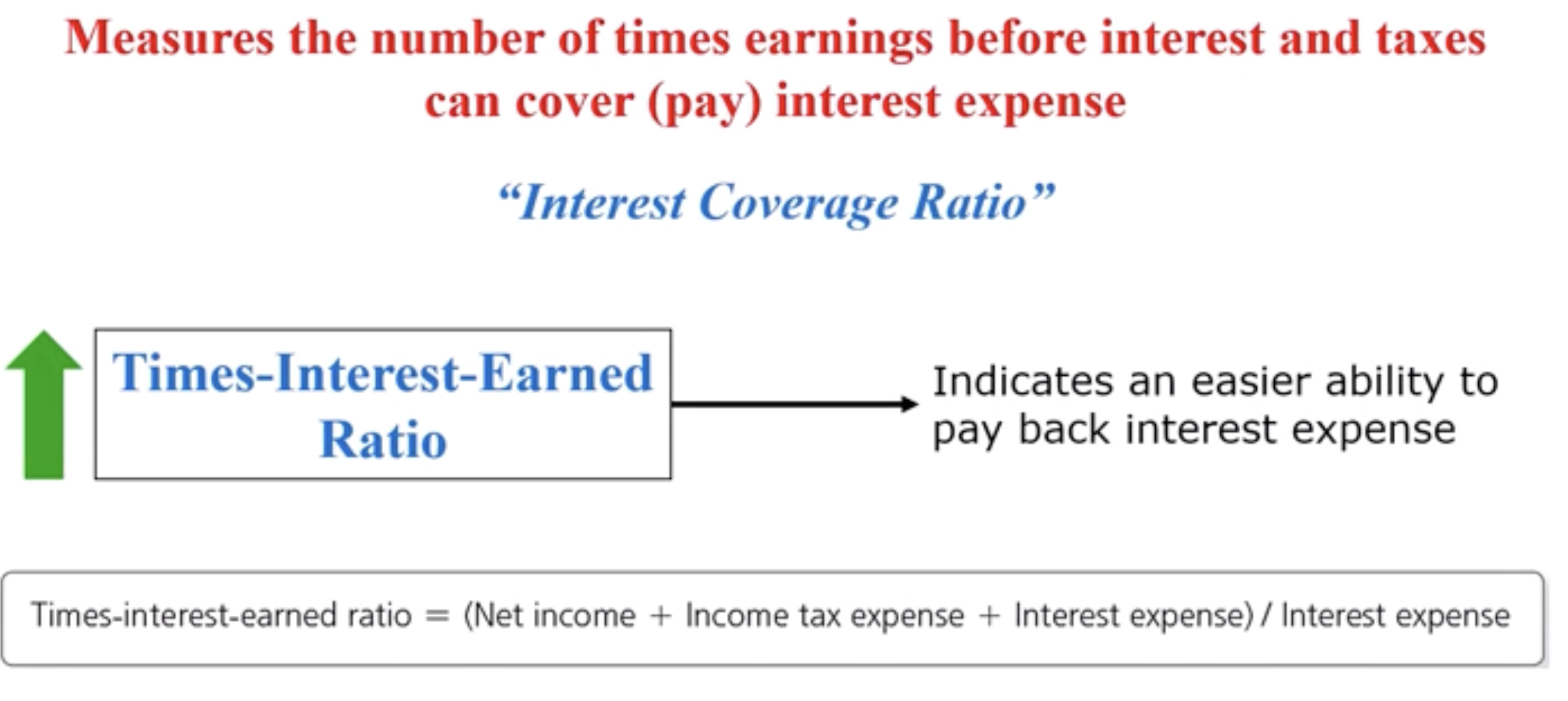

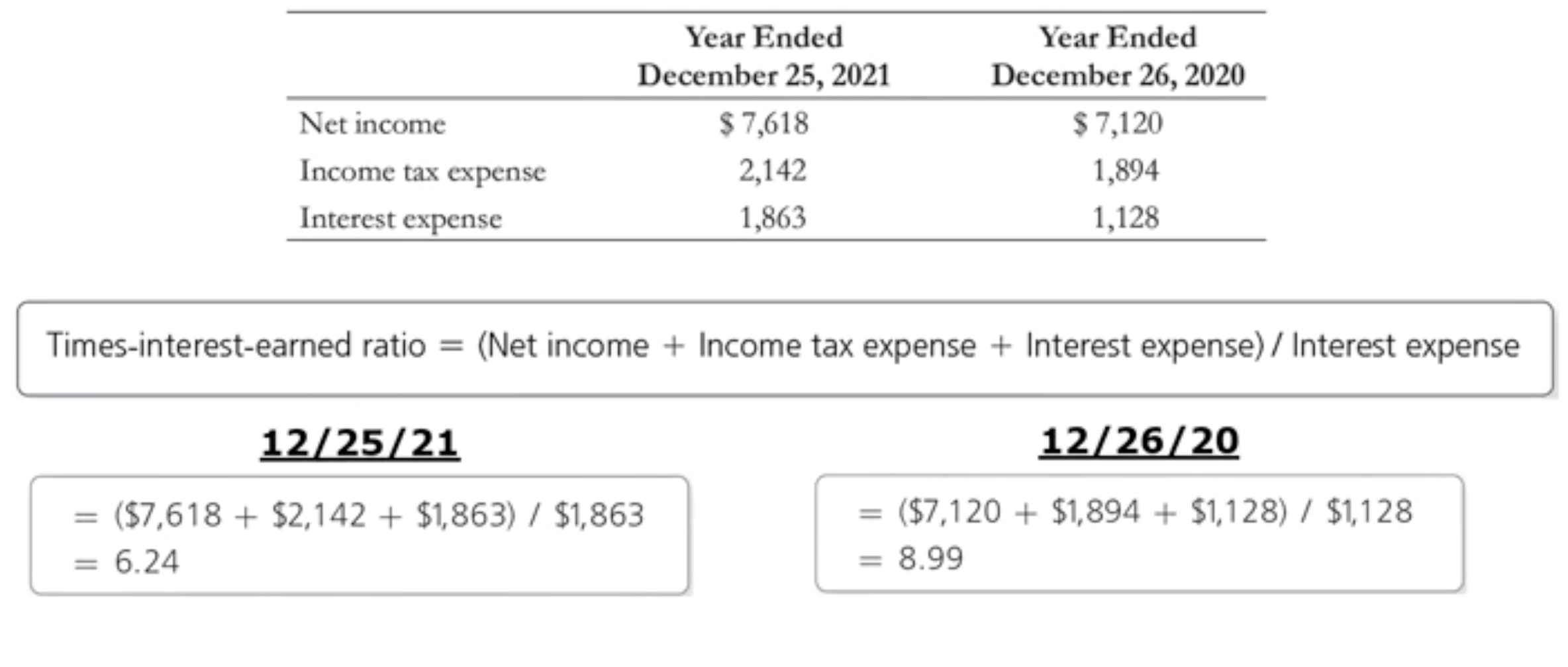

How do we use the times - interest earned ratio to evaluate business performance: Times - Interest earned ratio

Evaluates a business’s ability to pay interest expense.

How do we use the times - interest earned ratio to evaluate business performance: Times - Interest earned ratio Example

Not a good sign from pepsi if we like to see this ratio improve year to year.