CHAPTER 10 - Corporation Tax

1/45

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

46 Terms

Jug plc has made two disposals in its year ended 31 January 2025.

For each of the two disposals select how the resulting gains should be treated in the computation of Jug plc's chargeable gains.

Gain of £19,000 on the disposal of goodwill, created in May 2003

Exempt/Chargeable Gain

Exempt

Jug plc has made two disposals in its year ended 31 January 2025.

For each of the two disposals select how the resulting gains should be treated in the computation of Jug plc's chargeable gains.

Gain of £4,500 on the sale of an antique vase. The vase originally cost £500

Exempt/Chargeable Gain

Exempt

Goodwill for a Company is

Goodwill for a company (but not an individual) is an exempt asset if created after 1 April 2002.

Goodwill for an Individual

is a chargeable gain

Paddle plc has made two disposals in its year ended 31 December.

For each of the disposals select how the resulting gains should be treated in Paddle plc's chargeable gains computation.

Gain of £27,850 on the disposal of a yacht which had never been used in the business

Exempt - Wasting Chattel and not used in Business

Wasting Chattels are only exempt if:

they are not used in the business

Avocado plc was incorporated on 1 November 2024. It commenced trading on 1 January 2025 and prepared its first set of accounts to 31 March 2025.

What are the dates of Avocado plc's first accounting period for corporation tax purposes?

1 January 2025 - 31 March 2025

Which of the following statements about the calculation of chargeable gains is true?

A gain of £15,000 on the disposal of goodwill (originally purchased in 2005) by Alpha Ltd is not chargeable as the gain relates to an exempt asset

All companies and individuals are entitled to deduct an annual exempt amount (currently £3,000) from their chargeable gains

Companies pay corporation tax at 20% on their chargeable gains

For individuals, the annual exempt amount is tapered if chargeable gains exceed £100,000

A gain of £15,000 on the disposal of goodwill (originally purchased in 2005) by Alpha Ltd is not chargeable as the gain relates to an exempt asset

Which of the following statements about the calculation of chargeable gains is true?

For individuals, gains are taxed at 20%, 40% and 45%

Companies receive an annual exempt amount

A gain of £5,000 on the disposal of goodwill (originally purchased in 2006) by Samuel is not chargeable as the gain relates to an exempt asset

The disposal by a company of a racehorse held as an investment would be exempt from corporation tax

The disposal by a company of a racehorse held as an investment would be exempt from corporation tax

How are Individuals taxed with their Capital Gains?

For individuals, gains are taxed at 10% and 20%.

Are companies eligible for a capital gains exemption?

No

Which two of the following assets acquired in August 2005 are exempt assets for the purposes of calculating a chargeable gain?

A painting sold for £6,200 which had originally cost £4,500

Goodwill sold by Leonard, on disposal of his sole trader business

A vintage car worth £15,000 which had originally cost £10,000

Goodwill sold by Mug Ltd, incorporated in 2003, on disposal of the assets of the company

A vintage car worth £15,000 which had originally cost £10,000

Goodwill sold by Mug Ltd, incorporated in 2003, on disposal of the assets of the company

Identify on which two of the following there is a chargeable gain.

Joseph gifts his holiday home worth £250,000 to his son on his death

Grass plc makes a disposal of goodwill (originally purchased in 2004) in one of its businesses to Lawn Ltd, an unconnected company

Philip sells a valuable painting worth £25,000

The Willis partnership sold goodwill worth £150,000 as part of a rearrangement of the partnership

Philip sells a valuable painting worth £25,000

The Willis partnership sold goodwill worth £150,000 as part of a rearrangement of the partnership

Vicar Ltd has adjusted trading profits of £100,000 and chargeable gains of £50,000 for its year ended 31 December 2024. It receives dividends of £20,000 from unconnected companies on 2 February 2024. It has no associated companies.

What is Vicar Ltd's corporation tax liability for the year ended 31 December 2024?

£36,441

In January 2019, Sink Ltd purchased a property for £250,000. In June 2019 Sink Ltd built an extension to the property costing £20,000, however this was subsequently demolished in 2020 and replaced with a larger extension costing £35,000. In September 2024 Sink Ltd sold the property.

What is the total allowable cost of the factory in computing Sink Ltd's chargeable gain?

£285 000

Pineapple plc sold an antique writing desk which had been purchased in January 2018 for £18,000. It was sold for £3,200 in January 2025. The proceeds were received net of selling fees of £400.

£(12 400)

Sold for less than £6,000, so £6 000 is used

6 000 - 18 000 - 400

= (12 400)

Gain of £24,000 on the disposal of a rare African snake which had not been used in the business.

A Chargeable gain

B Exempt

B Exempt

Gain of £1,100 on the sale of an antique chair. The chair originally cost £5,000.

C Chargeable gain

D Exempt

C Chargeable gain

Pumpkin Ltd purchased a plot of land in August 2018 for £60,000, incurring legal fees of £3,000 on acquisition. Work to improve drainage was carried out on the land in 2019 at a cost of £25,000. The company sold the land in November 2024 for proceeds of £80,000, incurring selling costs of £1,750.

£(9 750)

Party Ltd purchased a building for investment purposes in January 2018 for £150,000. The property was redecorated at a cost of £24,000 and the single glazed windows were replaced with double glazing costing £40,000 in December 2018. The company sold the building in September 2024 for £425,000.

What is the gain in Party Ltd's corporation tax computation for the year ended 31 December 2024?

£275 000

When profits are below the lower limit, what percentage of gains must companies pay for corporate tax?

19%

Tractor Ltd realised a chargeable gain of £16,000 on disposal of a building in January 2025. Tractor Ltd has augmented profits below the lower limit.

£3,040

Lettuce Ltd was incorporated on 11 May 2024. It opened an interest-bearing building society account on 1 July 2024 and began trading on 1 January 2025. It will make up its first set of accounts to 30 September 2025 and annually thereafter.

1 July 2024 – 31 December 2024

Which of the following statements about corporation tax is true?

A A company which is centrally managed and controlled in the UK will always be liable to UK corporation tax on its worldwide profits.

B A company which is incorporated in the UK will only be liable to UK corporation tax on its worldwide profits if it is also centrally managed and controlled in the UK.

C A company which is incorporated abroad and centrally managed and controlled abroad, will still be liable to UK corporation tax on its worldwide profits.

D A company which is incorporated abroad will never be liable to UK corporation tax on its worldwide profits.

A A company which is centrally managed and controlled in the UK will always be liable to UK corporation tax on its worldwide profits.

Airedale Ltd was incorporated on 11 June 2024. It opened an interest-bearing building society account on 1 August 2024 and began trading on 1 February 2025. It makes up its first set of accounts to 30 September 2025 and annually thereafter.

What are the dates of Airedale Ltd's first accounting period for corporation tax purposes?

A 1 August 2024 – 31 July 2025

B 11 June 2024 – 31 January 2025

C 1 February 2025 – 30 September 2025

D 1 August 2024 – 31 January 2025

D 1 August 2024 – 31 January 2025

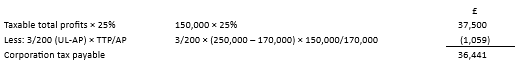

Papillon Ltd has taxable total profits of £150,000 for its three-month accounting period to 31 December 2024. Papillon Ltd did not receive any dividends, and has no associated companies.

What is Papillon Ltd's corporation tax liability for the three months ended 31 December 2024? Papillon Ltd's corporation tax liability

£37,500

Standard rate of Corporation Tax

25%

Loss of £5,900 on the sale of two cars used in the business; each car cost and was sold for more than £6,000

Exempt

Gain of £86,000 on the sale of an investment property:

Chargeable Gain

Lam Ltd began trading on 1 February 2023 and had the following periods of account:

• 1 February 2023 to 31 July 2024

• 1 August 2024 to 30 April 2025 (when the trade ceased)

Its first corporation tax accounting period was:

A 1 February 2023 to 31 July 2023

B 1 February 2023 to 31 January 2024

C 1 February 2023 to 30 April 2024

D 1 February 2023 to 31 July 2024

B 1 February 2023 to 31 January 2024

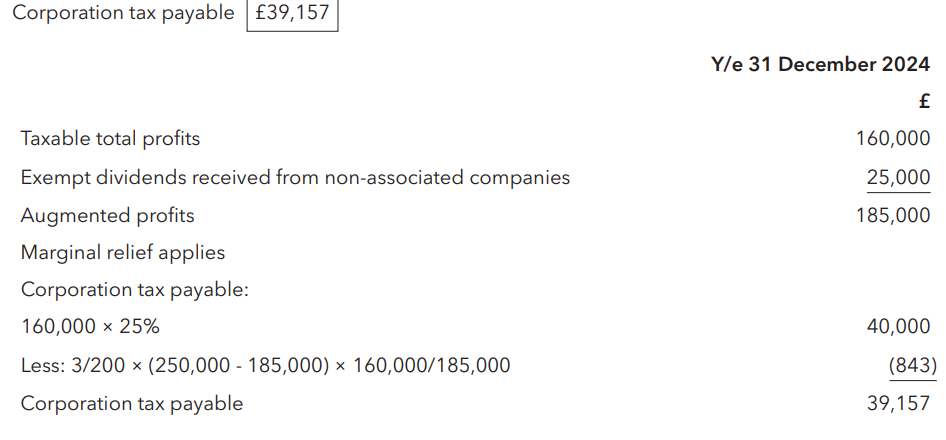

Jam Ltd has taxable total profits of £160,000 for the year ended 31 December 2024. Jam Ltd received dividends from unconnected companies of £25,000. It has no associated companies.

What is the corporation tax payable by Jam Ltd for the year ended 31 December 2024?

£39,157

Drisko Ltd has taxable total profits of £1,450,000 for the year ended 31 March 2025. During the year ended 31 March 2025 it received exempt dividends from UK companies of £135,000 of which £20,000 were received from an 80% subsidiary.

What are Drisko Ltd’s augmented Profits for the year?

£1,565,000

What are Augmented Profits?

augmented profits are taxable total profits plus exempt dividends received from unrelated companies

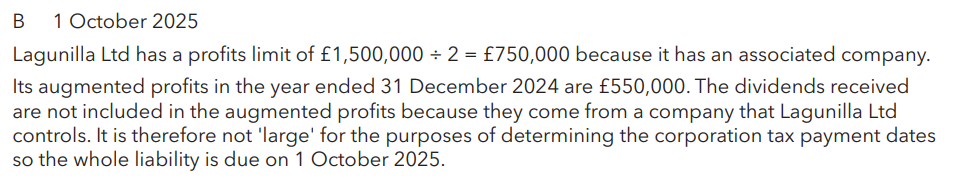

Lagunilla Ltd has paid its corporation tax in quarterly instalments for many years. It has one 80% subsidiary. In the year ended 31 December 2024 Lagunilla Ltd has taxable total profits of £550,000. In December 2024 it received exempt dividends of £300,000 from its subsidiary. When is the payment due?

1st October 2025

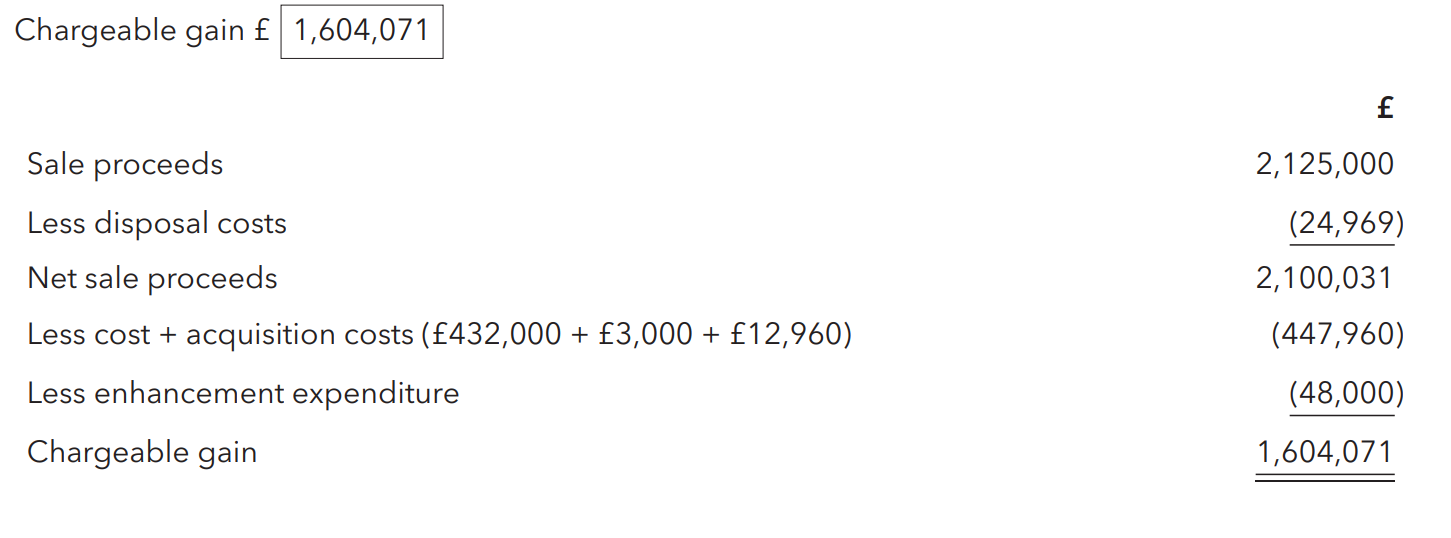

Pasta plc sold one of its warehouses on 1 July 2024 for £2,125,000. The warehouse originally cost £432,000 in February 2018. On disposal Pasta plc paid estate agents fees of £24,969. At acquisition legal fees were £3,000 and stamp duty land tax was £12,960. During its ownership Pasta plc added solar panels to the building at a cost of £48,000.

What is Pasta plc's chargeable gain on this disposal?

£1,604,071

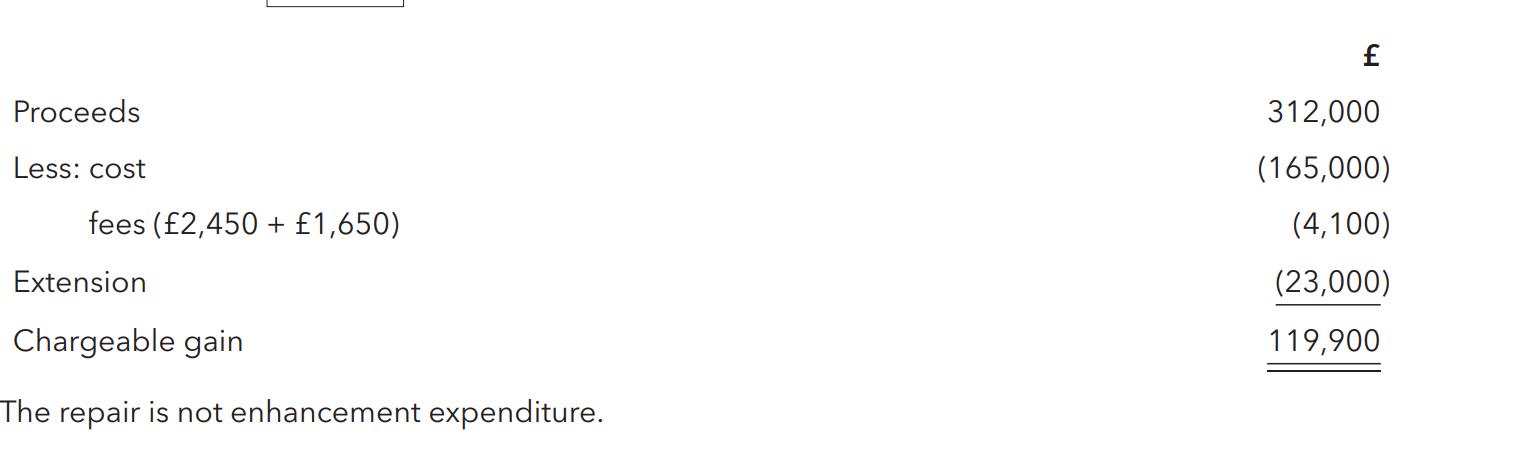

Ardent Ltd bought a factory on 12 February 2019 for £165,000. At acquisition, professional fees were £2,450 and stamp duty land tax was £1,650. In May 2019 an extension was added to the factory at a cost of £23,000. In October 2024 Ardent Ltd sold the factory, which had always been used in its trade, for £312,000. Prior to the sale, Ardent Ltd repaired water damage on one wall at a total cost of £3,000.

£119,900

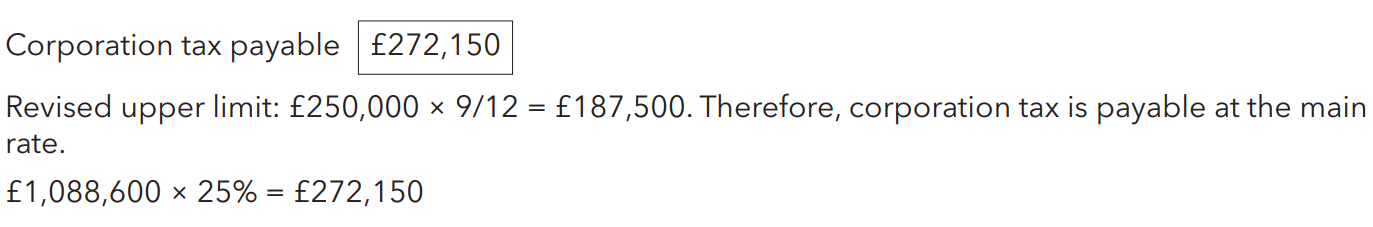

Rhodes Ltd has taxable total profits for the nine-month period ended 31 March 2025 of £1,088,600. Rhodes Ltd has no associated companies and received no dividends

What is the corporation tax payable by Rhodes Ltd for the period ended 31 March 2025?

£272,150

In the year ended 31 March 2025, Sky Ltd has taxable total profits of £30,000. It receives dividends of £12,000 from unconnected companies.

£5 700

The augmented profits are below £50 000, so 19% rate to be used.

30 000 × 19%

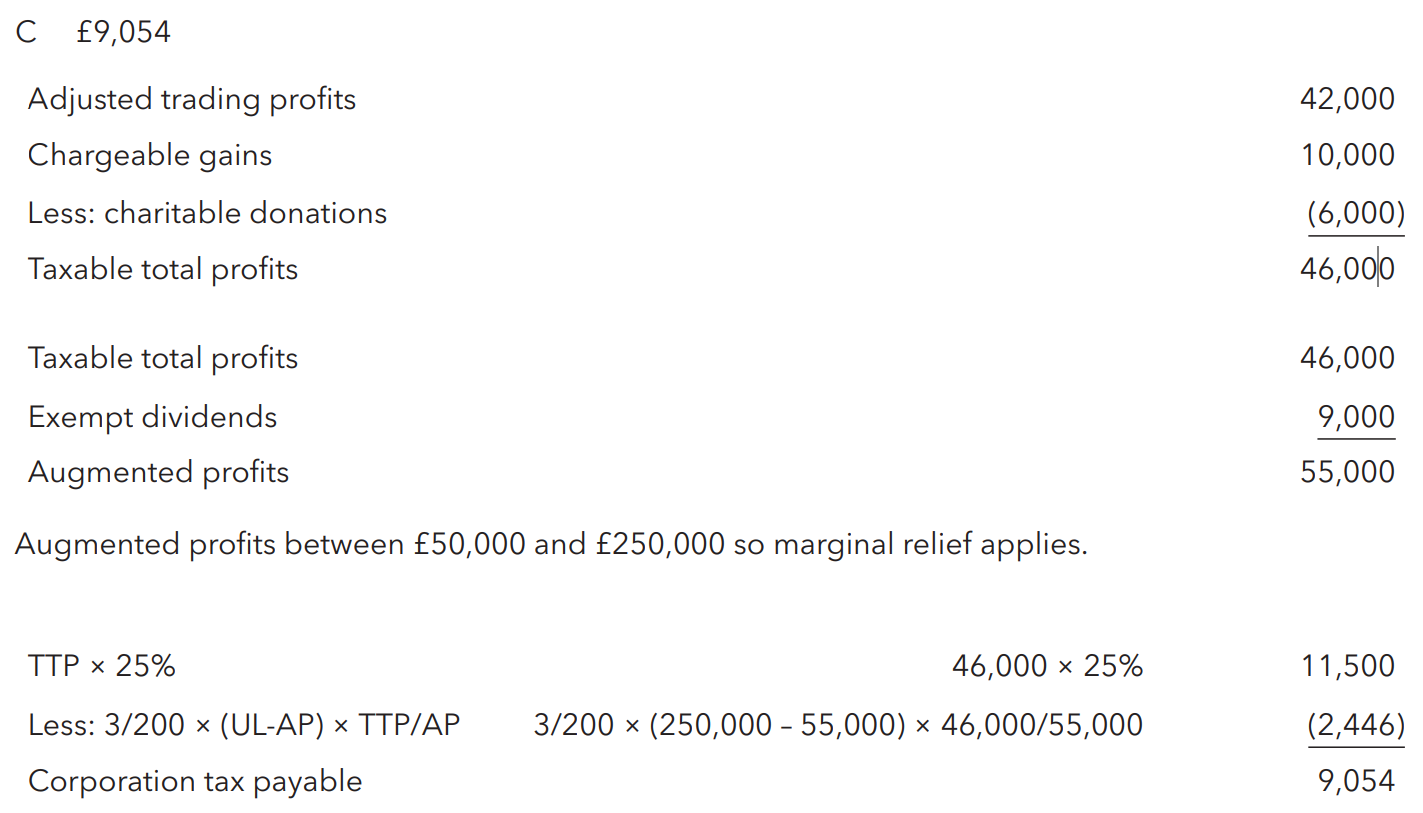

Cloud Ltd has provided the following information for the year ended 31 May 2025:

Adjusted trading profits 42,000

Chargeable gains 10,000

Dividend income 9,000

Charitable donations paid 6,000

What is Cloud Ltd’s corporation tax payable for the y/e 31 May 2025?

£9,054

Storm Ltd has taxable total profits of £190,000 and dividends received from unconnected companies of £8,000 for its 9-month accounting period to 31 December 2024.

What is the corporation tax payable?

must pro rate limits to 9/12

UL = 250 000 × 9/12 = 187 500

190 000 is greater, so 190 000 × 25%

= 47 500

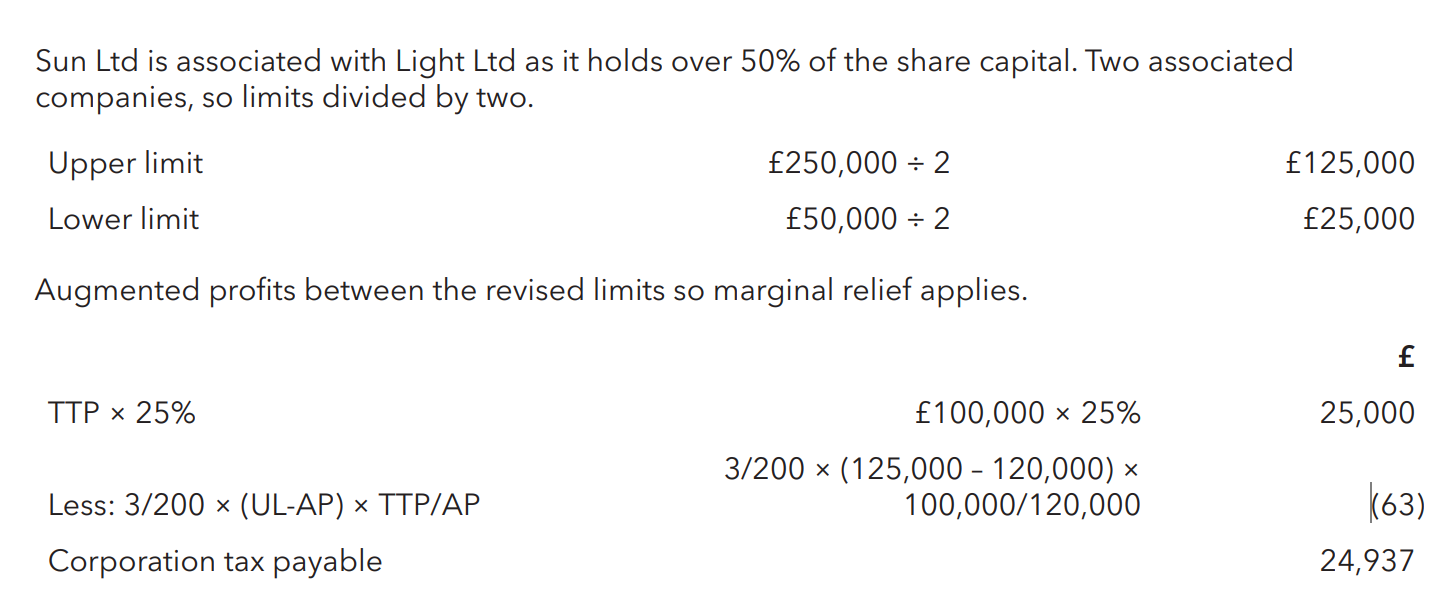

Sun Ltd has taxable total profits of £100,000 in the y/e 31 March 2025 and receives dividends of £20,000 from unconnected companies. Sun Ltd owns 60% of the shares in Light Ltd, and 45% of the shares in Dark Ltd.

24 937

Wing Ltd prepared accounts to 31 December 2025. On 1 March 2025 it purchased a print machine for £90,300 and a hybrid car with emissions of 30 g/km for £35,000. Wing Ltd has no tax written down value brought forward in the main pool at the start of the year.

What are the total capital allowances?

96 600

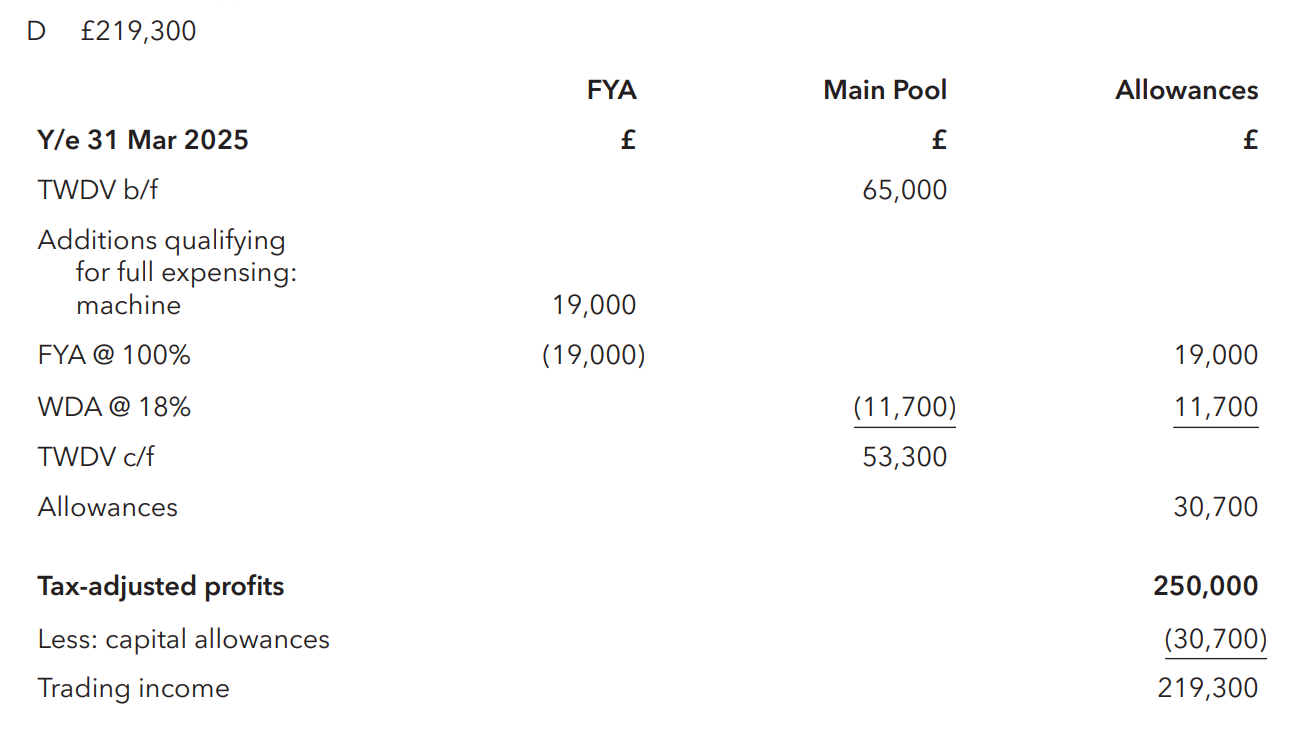

Beak Ltd has tax-adjusted trading profits of £250,000 for the y/e 31 March 2025. At 1 April 2024 it had a tax written down value of £65,000 in the main pool. On 1 May 2024 it purchased a machine for £19,000.

What is Beak Ltd’s trading income for the y/e 31 March 2025?

219 300

Feather Ltd prepares accounts for an 18-month period to 30 September 2025. The tax written down value of the main pool at 1 April 2024 was £96,000. Feather Ltd purchased a photocopier on 1 July 2024 for £50,000.

What are the capital allowances for each accounting period?

A 12 m/e 31 Mar 2025 £67,280, 6 m/e 30 Sep 2025 £7,085

B 18 m/e 30 Sep 2025 £75,920

C 12 m/e 31 Mar 2025 £26,280, 6 m/e 30 Sep 2025 £6,275

D 6 m/e 30 Sep 2025 £58,640, 12 m/e 30 Sep 2025 £12,725

A 12 m/e 31 Mar 2025 £67,280, 6 m/e 30 Sep 2025 £7,085

Petal Ltd began trading on 1 January 2024. On 1 May 2024 it purchased a van for £47,000. The van is used 30% of the time for private use of the managing director, and has CO 2 emissions of 40g/km.

What is the maximum capital allowance claim available to Petal Ltd for the year ended 31 December 2024?

£47 000

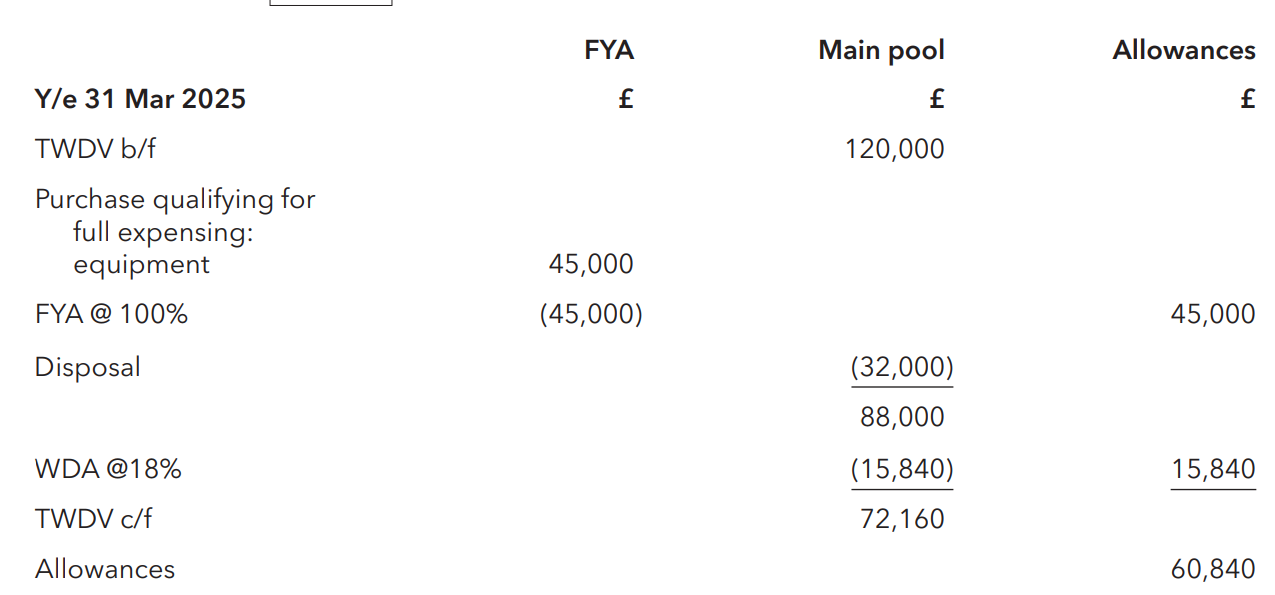

Garage Ltd has a tax written down value brought forward on the main pool of £120,000 at 1 April 2024. During the year ended 31 March 2025 the following transactions took place:

• Purchase of equipment for £45,000

• Sale of machine for £32,000

£60 840