BUS 206 FINAL

1/121

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

122 Terms

Elasticity

measure of responsiveness of one variable to a change in another variable

price-elasticity of demand

a measure of the responsiveness of quantity demanded of a good to a change in its price when all other influences on a buyer’s plans remain the same

measures the percentage change in Qd compared to the percentage change in the price of the good

elasticity units

none!

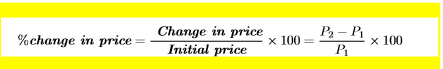

% change in price (not midpoint)

just replace p with q for quantity

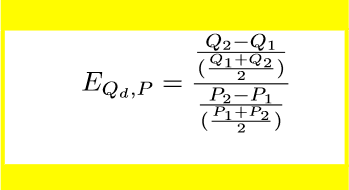

price elasticity of demand equation

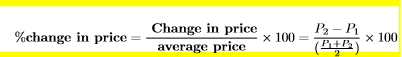

% change in price OR quantity using midpoint formula

just replace p with q for quantity

why is price elasticity of demand always negative?

because P and Qd move in opposite directions

necessities have _____ substitutes, so the demand for them is _______

poor, inelastic

luxuries have _______ substitutes, so the demand for them is _______

many, elastic

The more time that passes after the price of a good changes, the _____ elastic the demand is for the good

more

along a linear demand curve, elasticity _______ as the price falls

decreases

elastic demand

|Ed| > 1

a given change in price results in a greater change of Qd

inelastic demand

|Ed| < 1

a given percentage change in price results in a smaller percentage change in Qd

unit elastic

|Ed| = 1

percentage change in price = percentage change in Qd

perfectly elastic

Ed = ∞

small percentage change of price and big percentage change of Qd

horizontal supply/demand curve

Perfectly inelastic

Ed = 0

vertical supply/demand curve

If price increases and total revenue increases

price increase is stronger than Qd decrease

% change P > % change Q

|Ed| < 1

Inelastic

if price increases and total revenue decreases

Qd decrease stronger than P increase

% change Q > % change P

|Ed| > 1

elastic

if price increases and no change to total revenue

Q decrease as strong as P increase

% change Q = % change P

If EQxPy > 0 then x and y are __________

substitutes

If EQxPy < 0 then x and y are __________

complements

If EQxPy = 0 then x and y are _________

unrelated

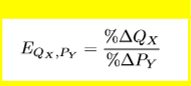

cross price elasticity of demand

measures the percentage by which Qd of one good changes in response to a 1% change in the price of another good

income elasticity of demand

the percentage change in Qd of a good when a consumer’s income changes divided by the percentage change of the consumers income

cross price elasticity of demand equation

if Eqdm < 0 then

good is inferior

if Eqdm > 0 then

good is normal

if 0 <Eqdm < 1

good is inelastic

if Eqdm >1

good is elastic

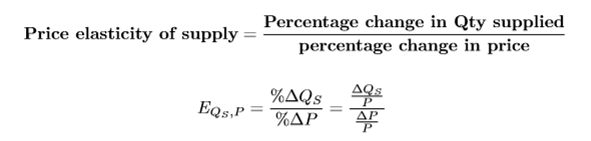

price elasticity of supply

measures the percentage change in quantity supplied that occurs in response to a 1 percent change in price

price of elasticity of supply equation

productive efficiency

producing the maximum possible output

allocative efficiency

situation in which quantities of goods/services produced are those that the people value most highly

which point on the PPC is the best?

Resource Allocation Methods

market price *

command *

majority rule

contest

1st come 1st served

sharing equally

lottery

market price resource allocation

people who can afford it will buy it

command resource allocation

government controls how much money you an have via taxes

taking from someone to give to someone else

marginal benefit

benefit people receive from consuming one more unit of a good/service

willingness to give up

principle of decreasing marginal benefit

the more we have of any good or service, the smaller our marginal benefit for it is

direction of MB curve

downward

how is marginal benefit measured

by what you are willing to give up

what are allocation decisions based of off

marginal benefit and marginal cost

marginal cost

the opportunity cost of producing one more unit of a good or service

what you must give up

how is marginal cost measured?

by the slope of the PPC

what direction is the marginal cost curve

upward

Efficient allocation

resources are allocated efficiently only when MB=MC

point on PPC where MB and MC intersect

chose level of activity where MB>MC and stop where MB<MC

what do if MB>MC

increase activity level

what do if MC>MB

decrease activity level

deadweight loss

the reduction in economic surplus resulting from a market not being at competitive equilibrium

Best/Efficient Choice

obtained where MB=MC

as big as total benefit can be where MB>MC

value

what we get and the price we pay

2 building blocks of market efficiency

consumer surplus

producer surplus

An MB curve is also a ________ curve

demand

consumer surplus

difference between price consumers would be willing to pay for a good (MB) and the price they actually have to pay

individual consumer surplus

net gain to an individual buyer from the purchase of a good

willingness to pay - price paid

total consumer surplus

area below demand curve but above market price`

welfare economics

includes consumer/producer/total surplus, deadweight loss, and market failures

individual producer surplus

net gain to an individual seller from selling a good

price received - seller’s cost

marginal cost curve is also ________ curve

supply

total producer surplus

area below market price and above the supply curve

total surplus

CS + PS

free competitive markets are _________

efficient

competitive equilibrium condition

MB=MC (D=S)

when is economic surplus maximized in a competitive market with many buyers and sellers and no government restrictions?

when the market is at competitive equilibrium

underproduction

production in market is smaller than equilibrium

market failure

situation in which the market delivers an inefficient outcome

is market capitalism omnipotent?

no! market failure happens

equity

fairness

equality

everyone gets the same thing

Can consumer surplus be negative? If so, when?

Yes, when you buy something with a price higher than the original amount you were willing to pay cause you really want it

why can’t healthcare be a free market?

because there are not many sellers of health insurance and they would have too much market power

2 broad reasons for market failure

overproduction and underproduction

what occurs when there is over or underproduction

deadweight loss

producer surplus on a unit

price - marginal cost

reasons for market failure

externalities *

public goods and common resources *

price/quantity regulations

taxes and subsidies

monopoly

high transaction cost

externality

cost or benefit that affects someone other than the seller or buyer

public good

benefits everyone and no one can be excluded from its benefits (national defense)

causes free-rider problem

common resource

owned by no one but used by everyone (atlantic salmon in alaska)

types of price regulations

price floor

price ceiling

excise taxes

based on quantity

gas

ad valorem taxes

percentage of value

tarrifs

do free markets exist

no, they’re the ideal benchmark

type of quantity regulation

quota

price ceiling

a maximum price that can be legally charged for a good/service

4 bad results of price ceilings

shortage

increased search activity

inefficiently low quality

shadow market/ illegal activity

binding price ceiling

price ceiling < equilibrium price

effective

creates shortage because of underproduction

nonbinding price ceiling

price ceiling > equilibrium price

ineffective

inefficiently low quality

sellers offer low quality goods at a low price even though buyers are willing to pay more

price floor

a legally established minimum price for a good or service

binding price floor

price floor > equilibrium price

effective

creates surplus

nonbinding price floor

price floor < equilibrium price

ineffective

price support

government buys surplus goods brought on by price floor

how does minimum wage cause unemployment

quantity of workers supplied > quantity of workers demanded

characteristics of public goods

nonrivalry

nonexcludable

free-rider problem

characteristics of private goods

rivalry

excludability

bad effects of price floor

inefficiently low quantity demanded

inefficient allocation of sales among sellers

wasted resources

inefficiently high quality

shadow market

Pigouvian tax

a tax or charge levied on the production of a product that generates negative externalities

will offset overallocation/overproduction

negative externalities are associated with ________allocation

over

positive externalities are associated with _________allocation

under

Pigouvian subsidy

A payment designed to encourage activities that yield external

benefits.

3 options for correcting positive externalities

subsidies to buyers

subsidies to producers

government provisions