Accounting PYP

1/34

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

35 Terms

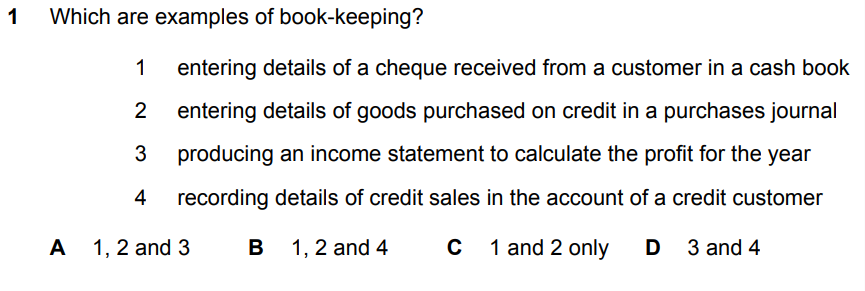

Ans: B

Booking keeping is to record details like 1,2, and 4.

Anything related to Income Statement is an accountant’s job

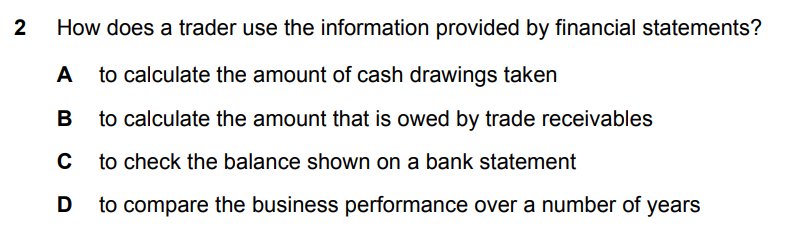

Ans: D

A- use a Drawings acc to calculate

B- use T.receivable acc to cal

C- use Bank Statement to cal

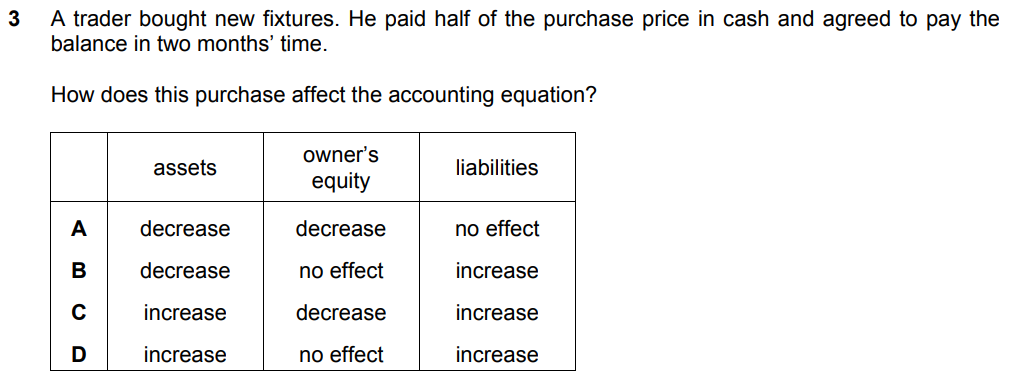

Ans: D

Trader paid half for the goods,

So he gained assets because he already paid, but he gains liability for the other half that has yet to be paid.

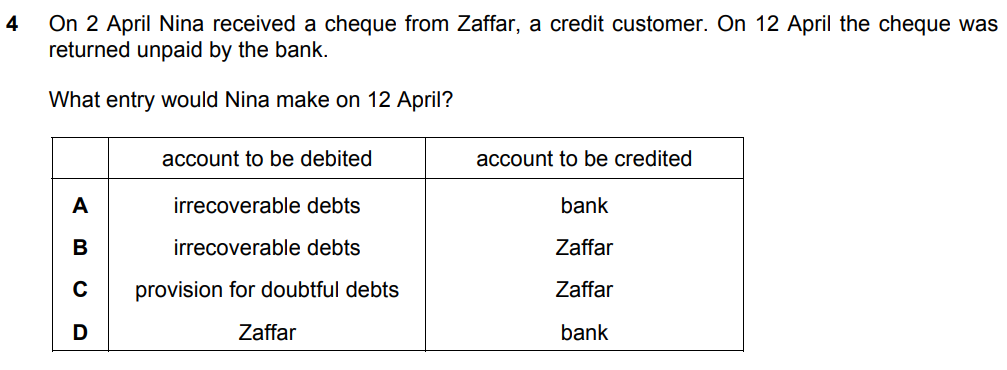

Ans: D

When a check is returned unpaid,

it indicates that the funds were not available in the payer's account, resulting in a debit to the payee's account.

Returned unpaid by the bank = bank was credited.

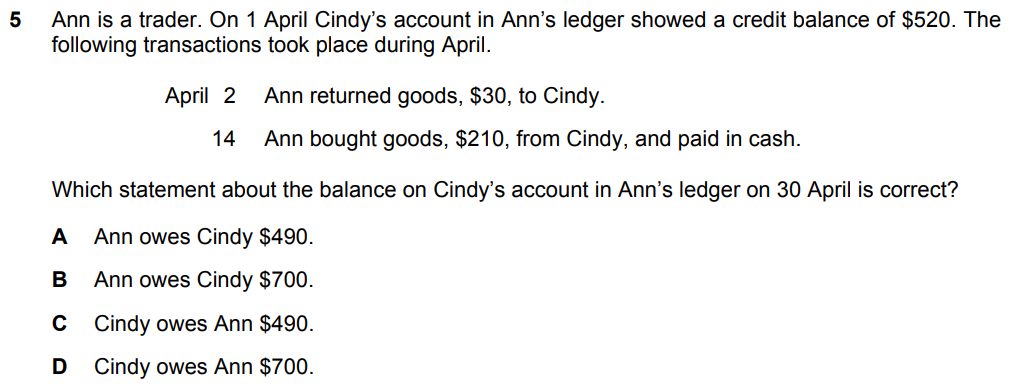

Ans: A

$520 = Anna’s liability to Cindy (-520)

$ 30 = Anna returning goods (+30)

$210 = Anna bought goods in cash. (-0)

Anna owed = (-520+30) = $490

Reason: the negative indicates a negative, means that Anna owes money to Cindy.

Anna paying in cash means that she won’t owe any $ for the goods she had bought

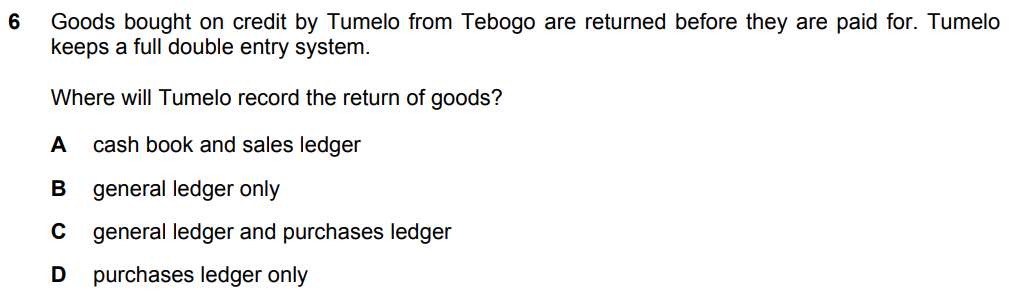

Ans: C

Tumelo = Customer

Tebogo = Supplier

General Ledger = Purchase return acc

Purchase Ledger = Tebogo’s acc [T.payable]

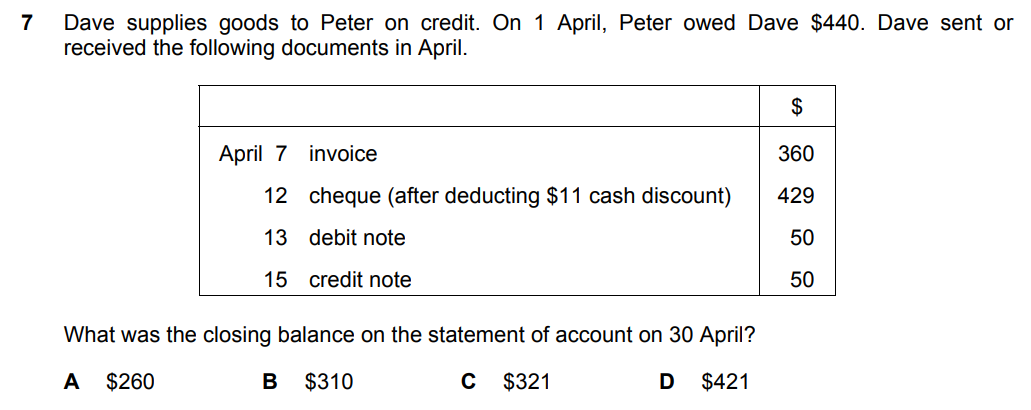

Ans: B

Invoice = another sale

debit note = only a request

credit note = returning / reduction is confirmed, reduce liability

Peter(buyer) owed Dave(supplier) $440

(440+360-11-429-50= $310)

$11 = a deduction of $11 free, no need to pay that amount

cheque = Peter paying

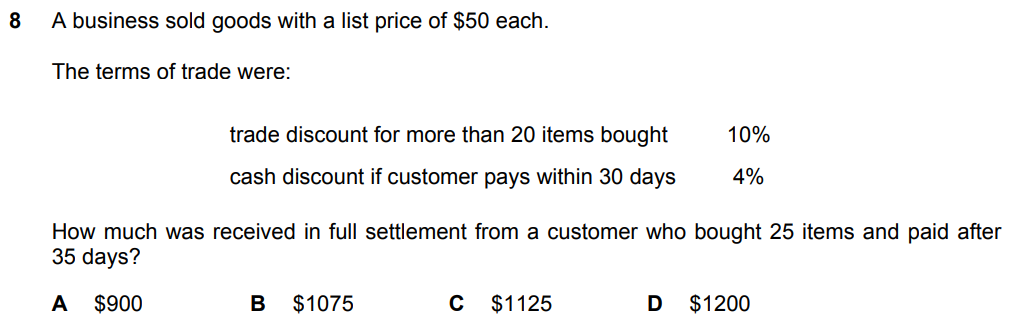

Ans: C

25 × 50 = 1250 = total $

1250 × 10% = 125

1250 - 125 = $1125

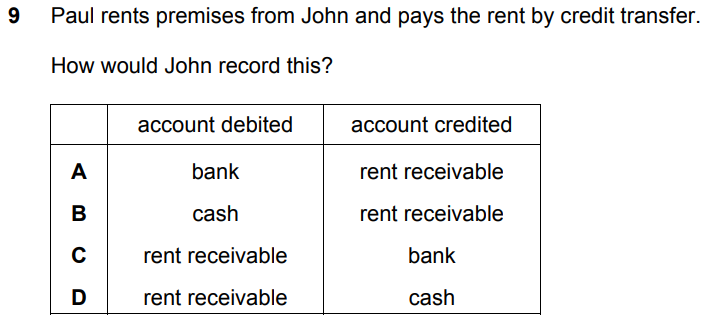

Ans: A

John = Supplier

credit transfer = transfer by bank

Therefore, John would receive money from the bank to his Rent Receivable Account since he is the Supplier

Ans: C

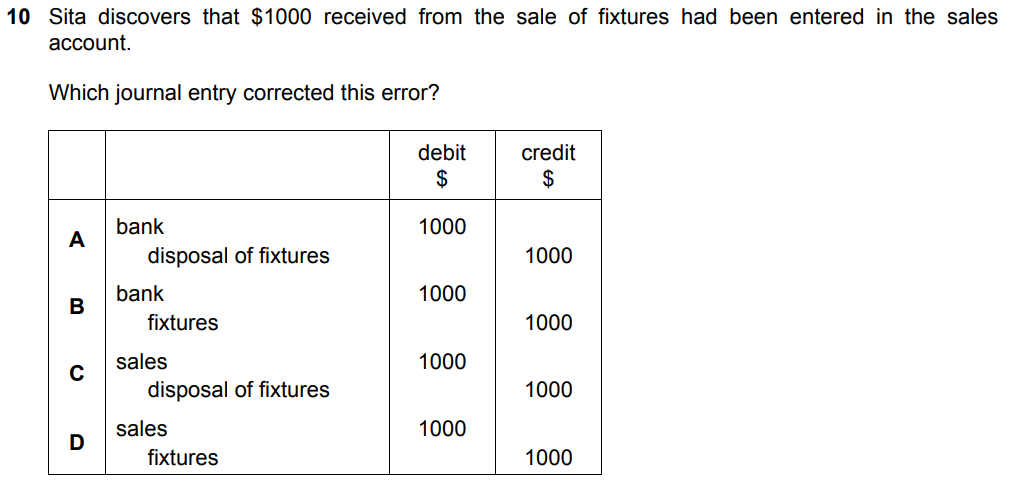

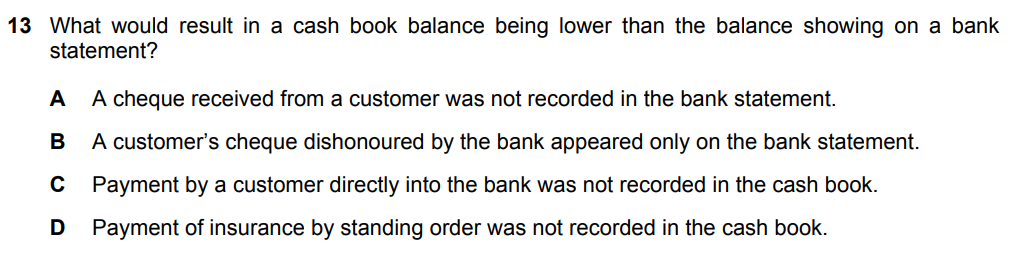

Ans: B

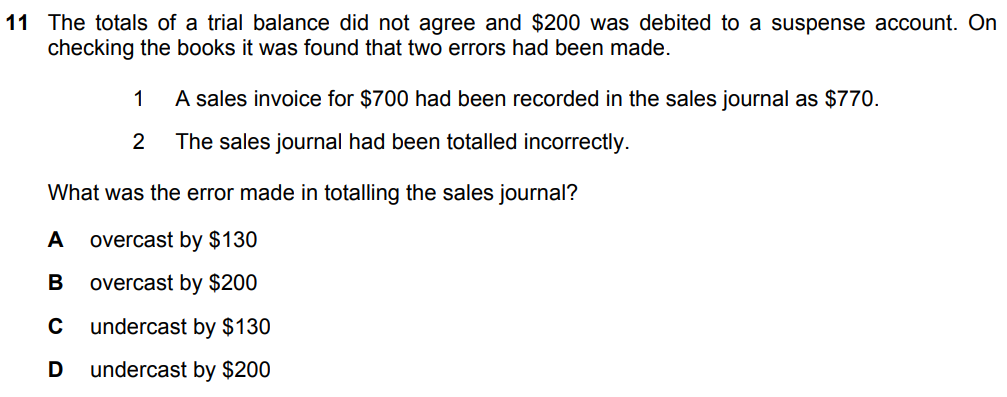

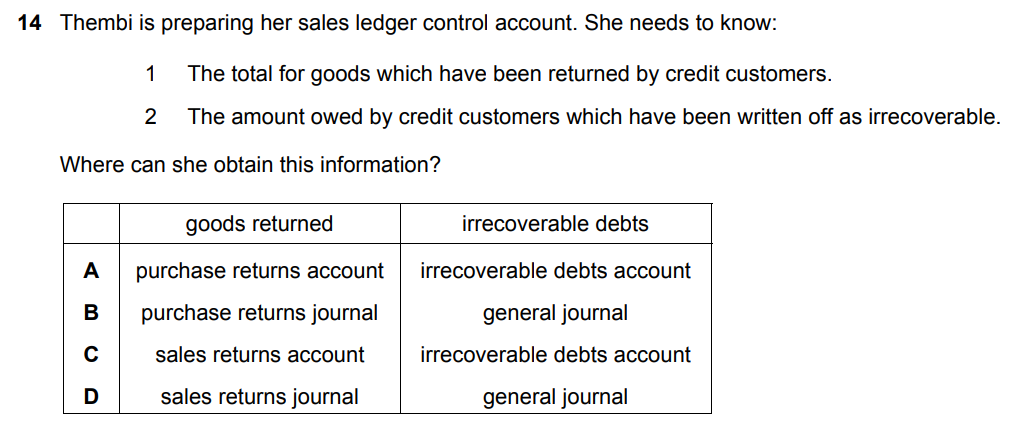

Ans: C

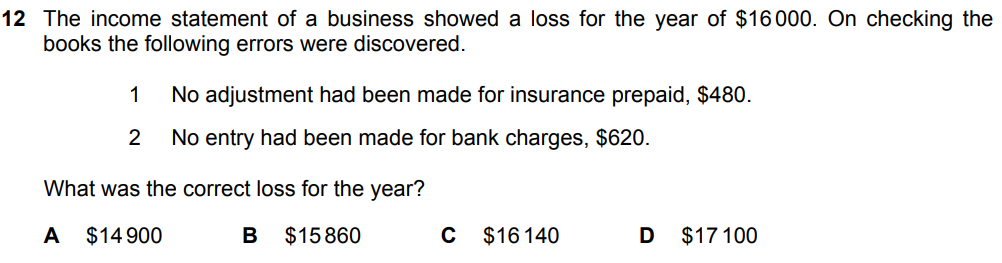

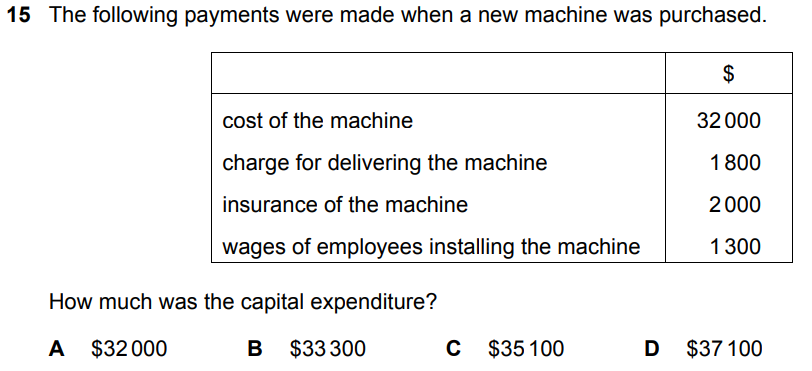

Ans: C

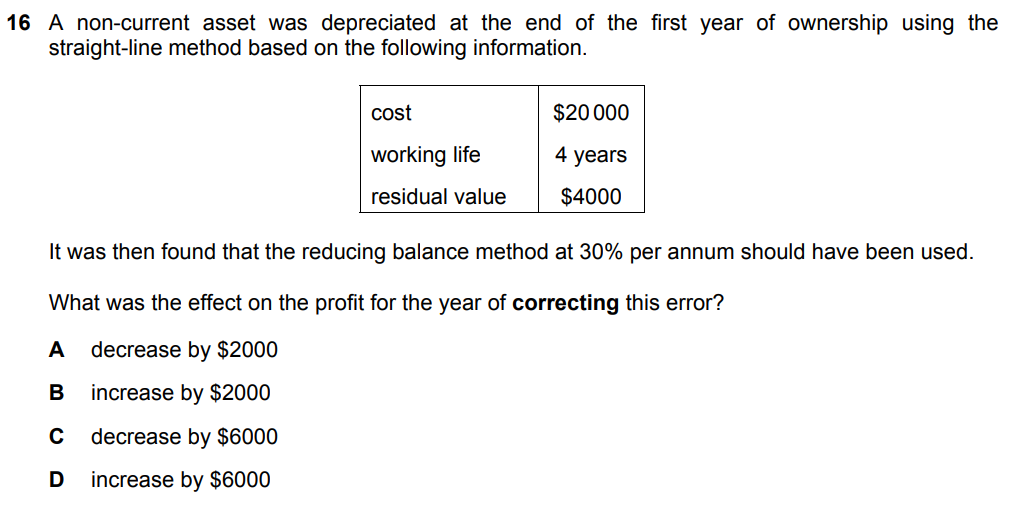

Ans: D

Ans: C

Ans: A

Ans: A

Ans: B

Ans: A

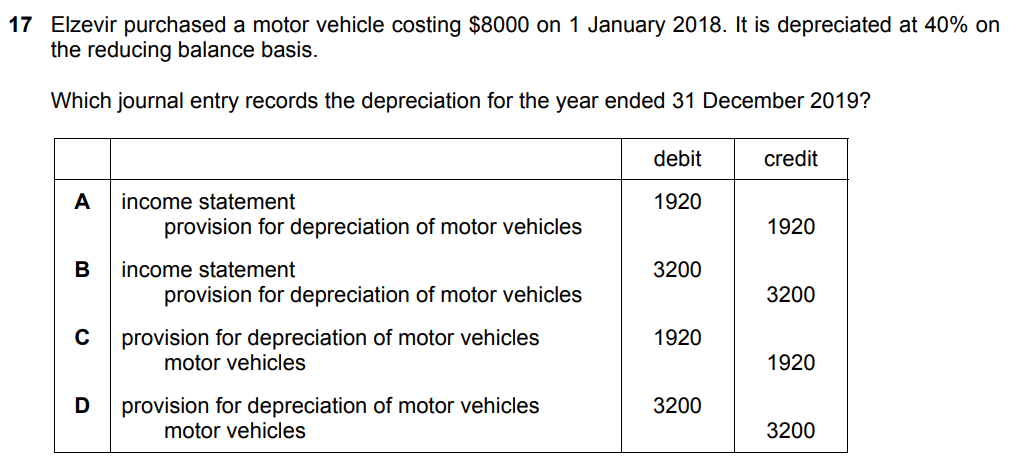

Ans: D

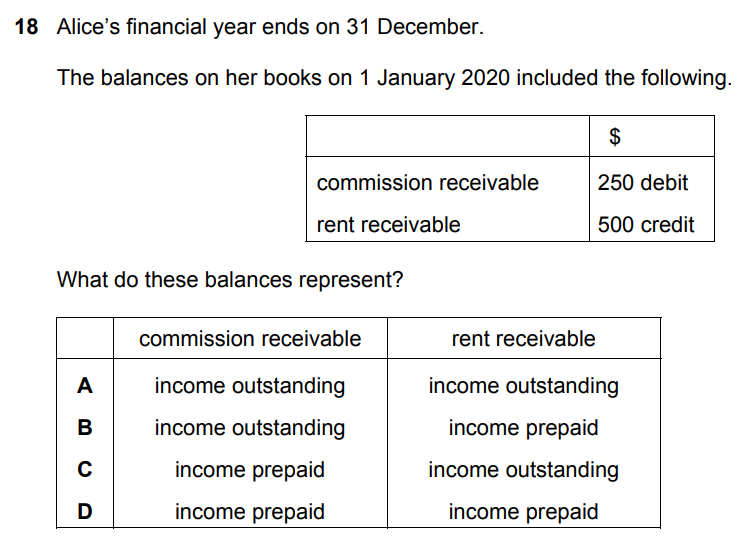

Ans: C

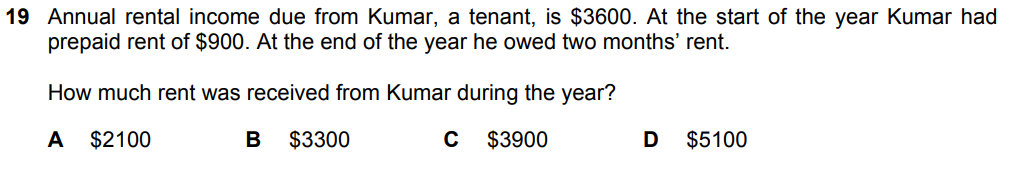

Ans: A

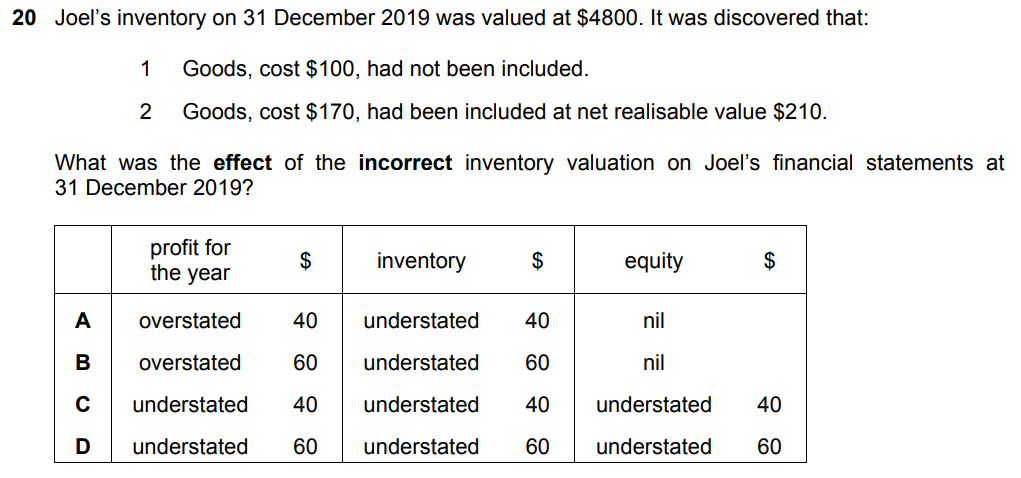

Ans: B

Ans: B

Ans: A

Ans: A

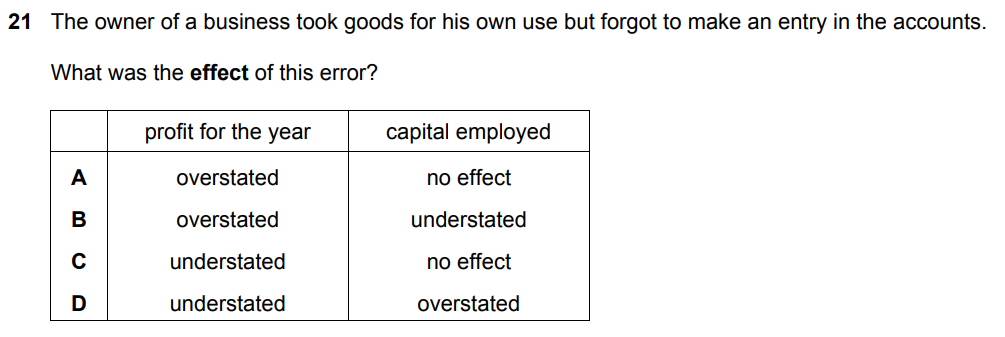

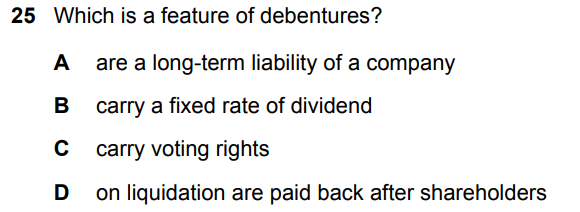

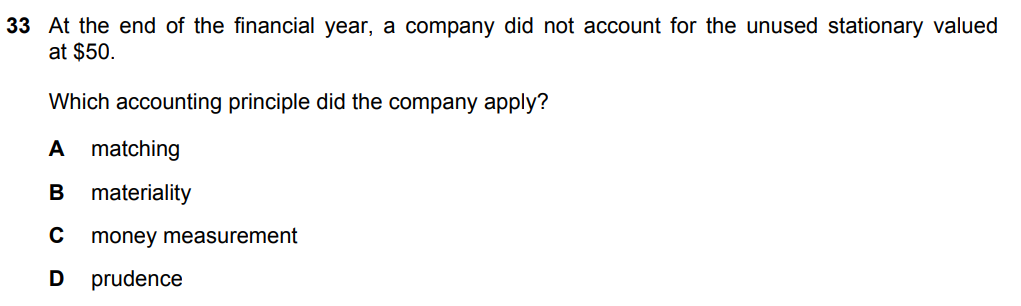

Ans: D

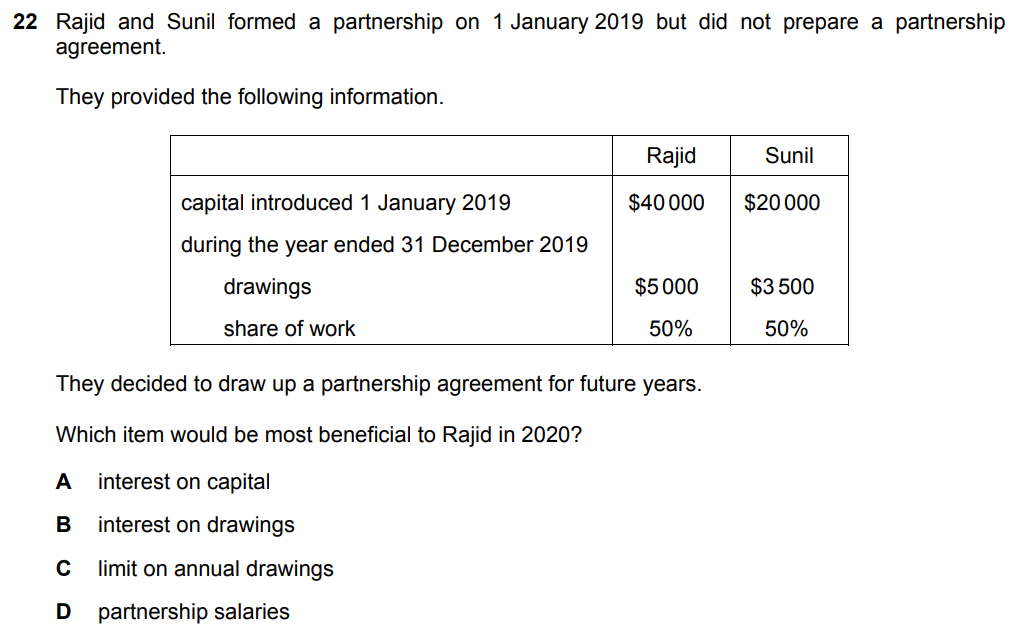

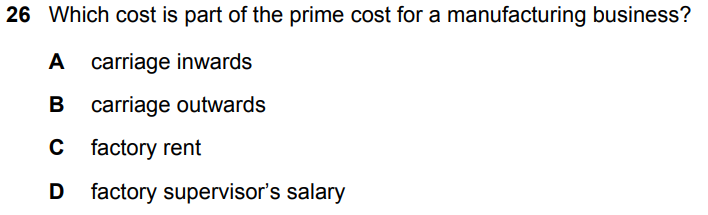

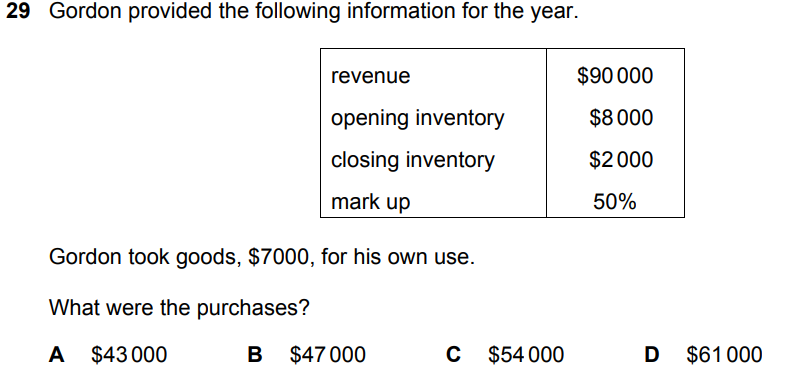

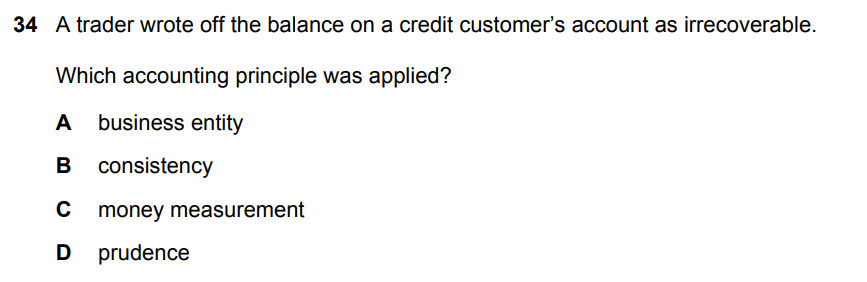

Ans: D

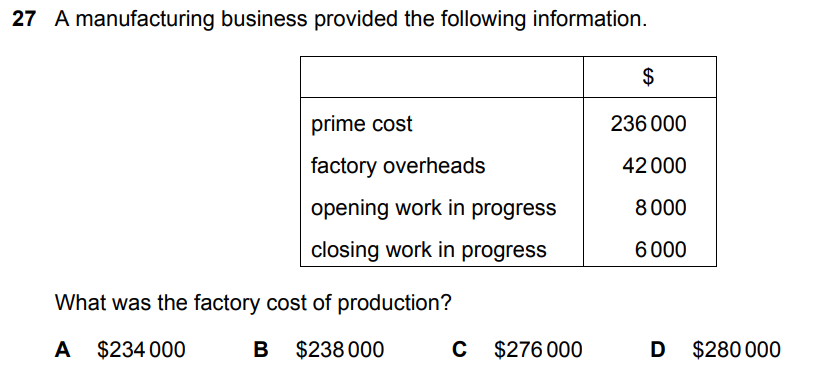

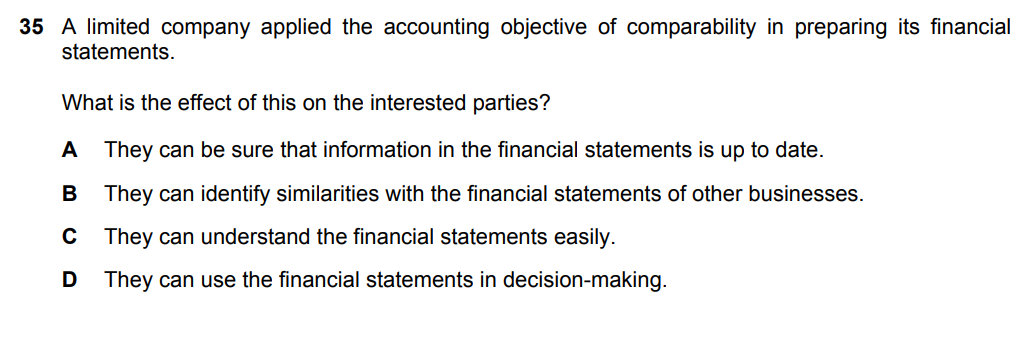

Ans: D

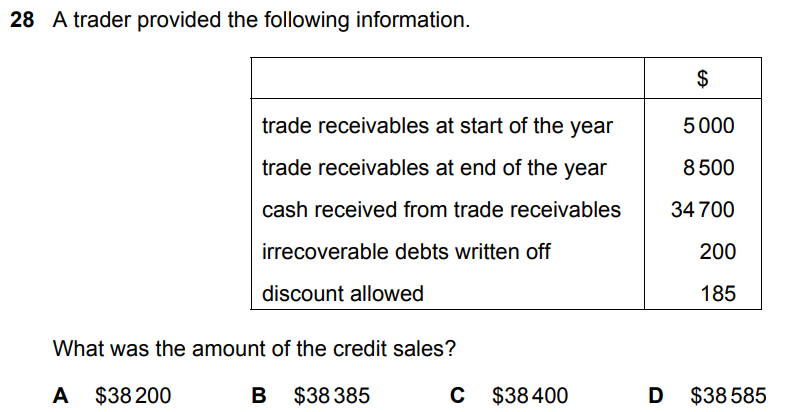

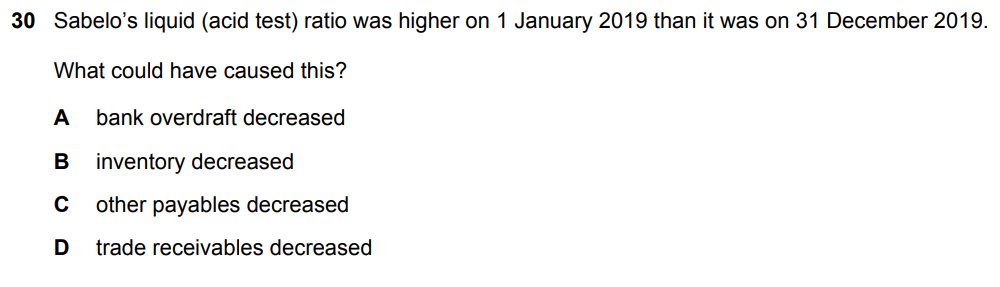

Ans: D

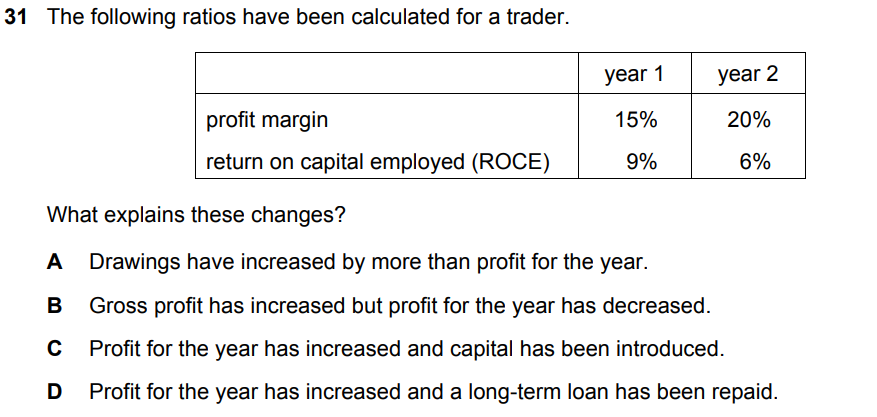

Ans: C

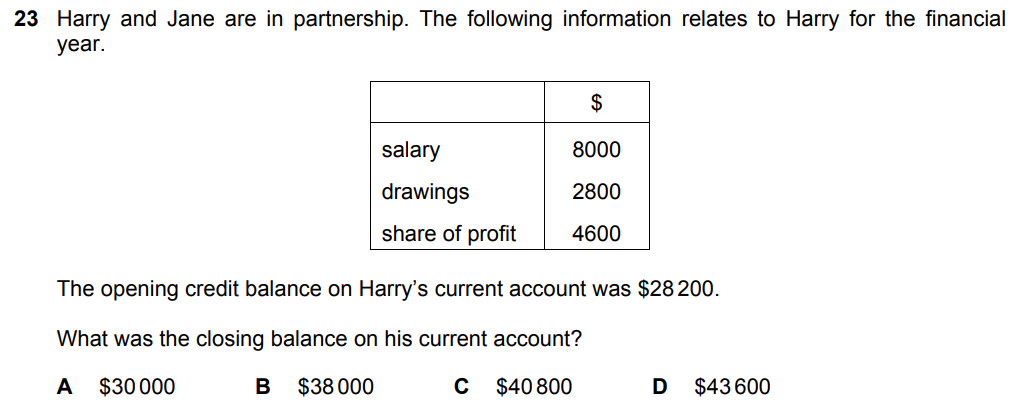

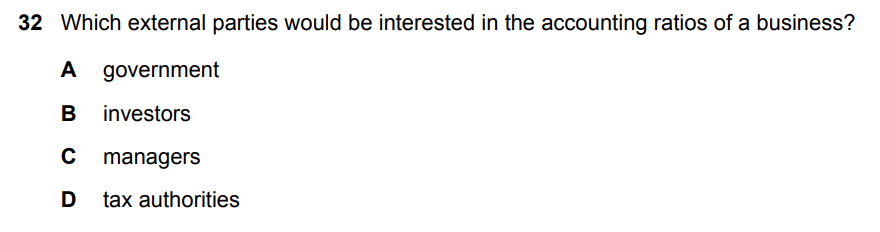

Ans: B

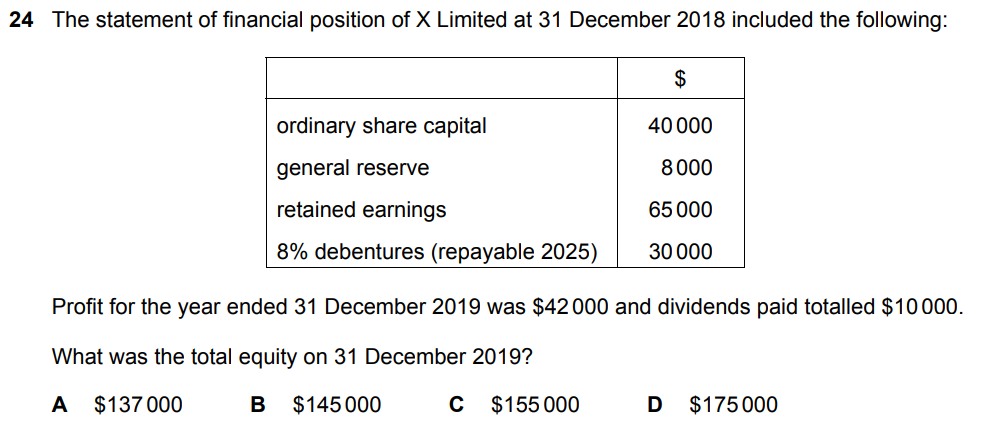

Ans: B

Ans: D

Ans: B