Chapter 16: Working capital management – accounts receivable and payable

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

24 Terms

Why do businesses sell on credit?

What is the downside of selling on credit?

What does a credit policy help manage?

What two factors must be balanced when setting credit levels?

Why should a firm have a credit policy?

What is a potential risk of a lenient credit policy?

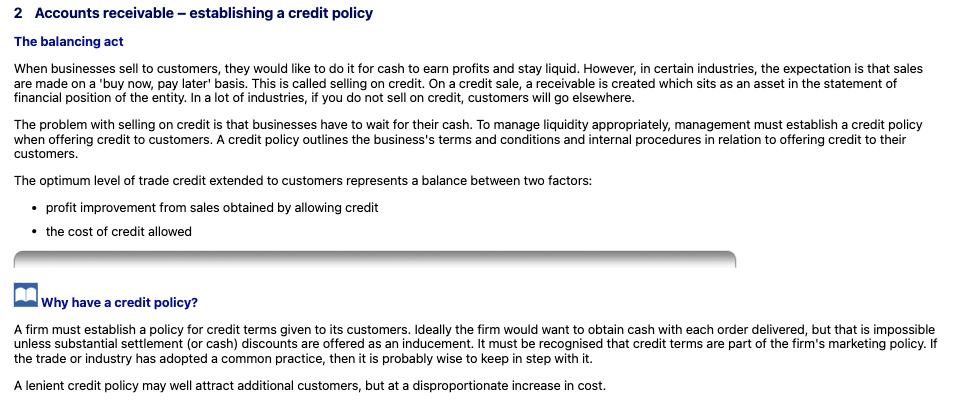

What is the receivables balancing act?

Why is the receivables balancing act important?

What are some common examples of payment terms?

What factors must be considered in payment terms?

What are common methods of payment?

What factors influence an entity’s credit policy for accounts receivable?

What are the 4 key aspects of receivables management?

When should creditworthiness be assessed?

What are sources of creditworthiness information?

Why should an entity assess the creditworthiness of customers?

What are key sources of creditworthiness information?

What two limits should be set when determining credit terms?

What factors influence the risk associated with a customer's credit status?

How should risk affect credit terms offered to customers?

What are the six example customer credit categories?

What should a company do if a customer’s credit status doesn’t improve?

What should be monitored before granting more credit?

Why is prompt invoicing essential in credit sales?

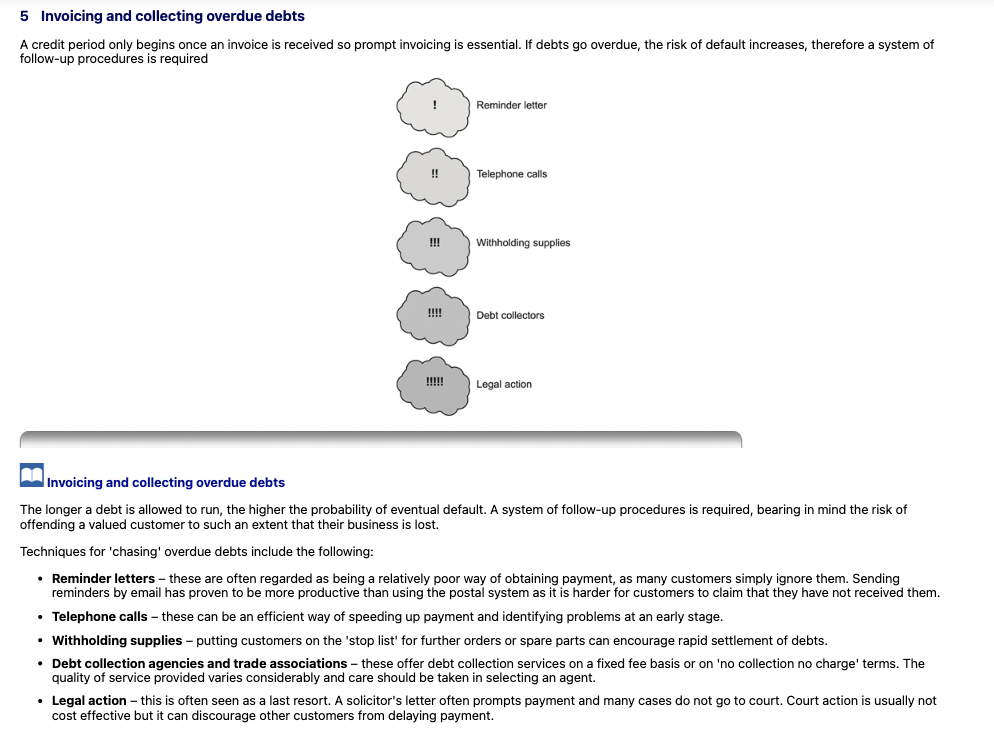

What are the five escalating steps in chasing overdue debts?

Why are reminder letters often ineffective?

How do telephone calls help with overdue debts?

What is the purpose of withholding supplies?

What is the risk of using debt collection agencies?

Why is legal action considered a last resort?

What is a collection target in credit control?

Who can collection targets be set for?

When will collection targets act as motivators?

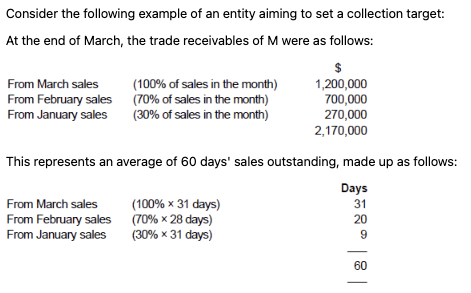

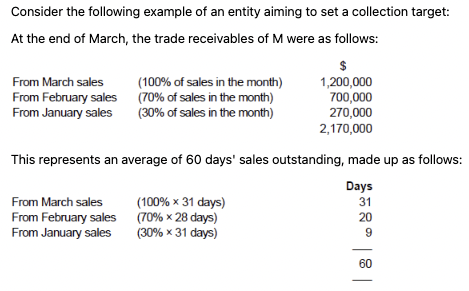

What were the trade receivables at the end of March in the example?

How is the 60 days’ sales outstanding calculated?

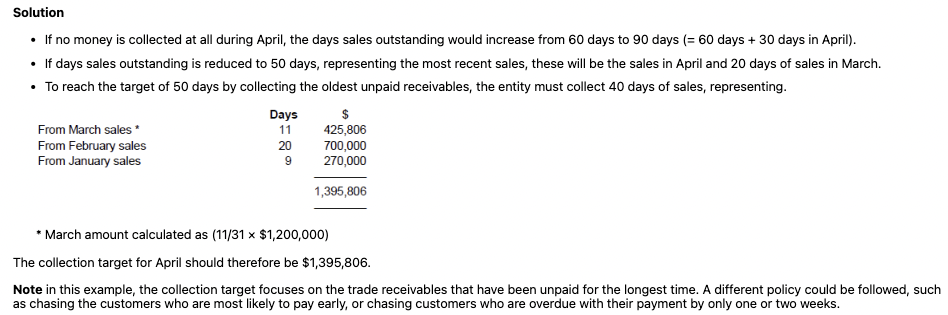

Calculate the collection target that should be set for staff.

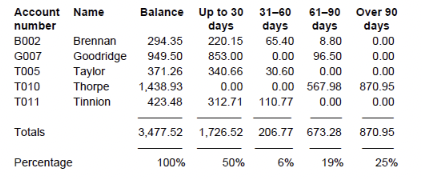

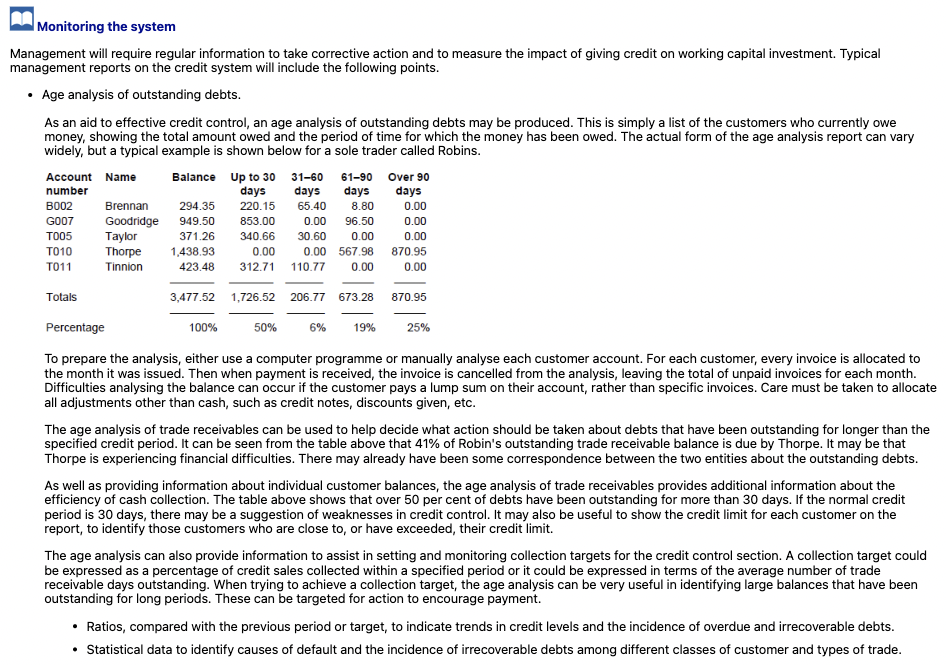

What is the purpose of an age analysis of outstanding debts?

What key information is shown in an age analysis report?

What does the age analysis of Robins show about Thorpe?

Why must care be taken in allocating balances in age analysis?

How can the age analysis support management?

What ratios can the age analysis help calculate?

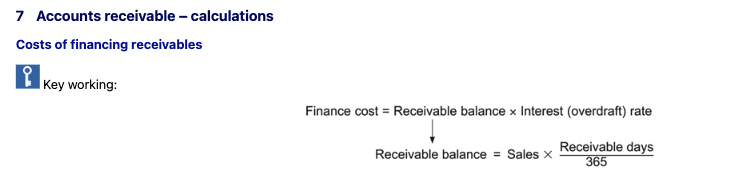

How is the finance cost of receivables calculated?

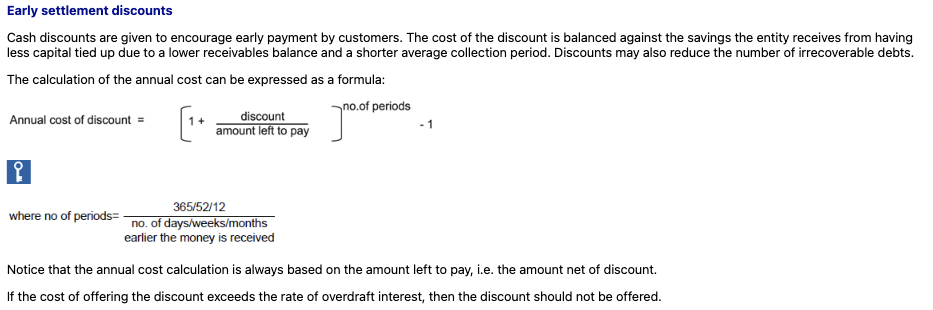

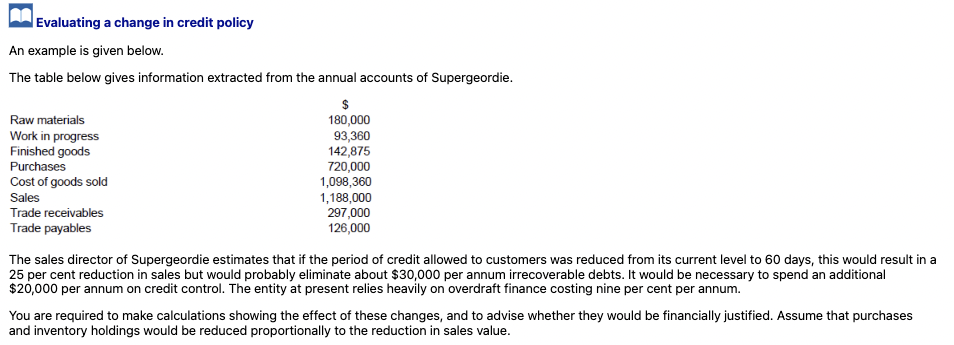

How is the annual cost of offering an early settlement discount calculated, and when should it be avoided?

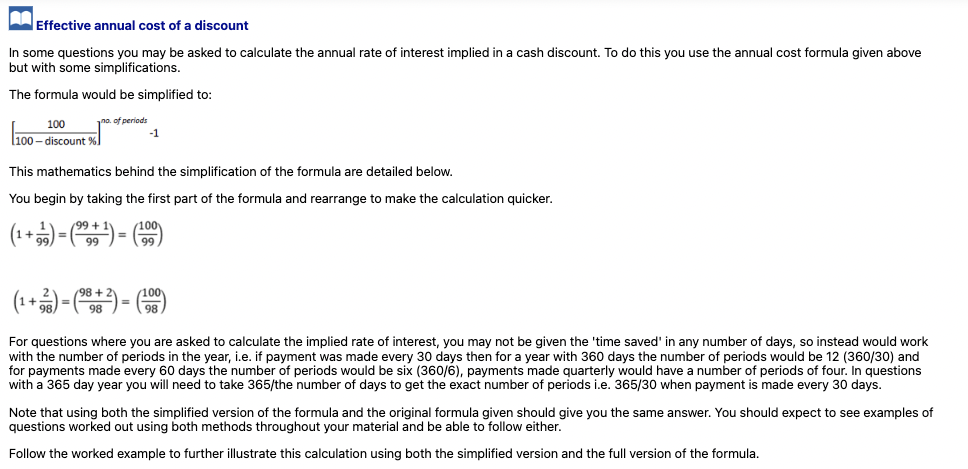

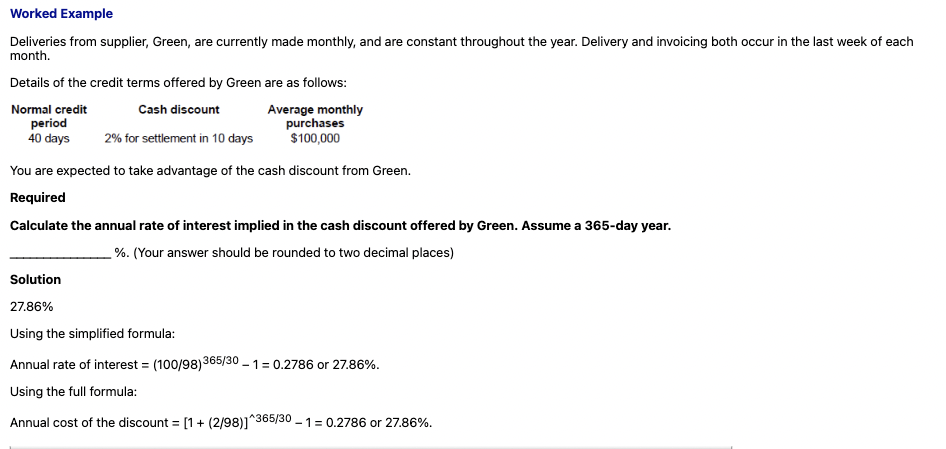

What is the simplified formula to calculate the effective annual cost of a cash discount?

Worked example

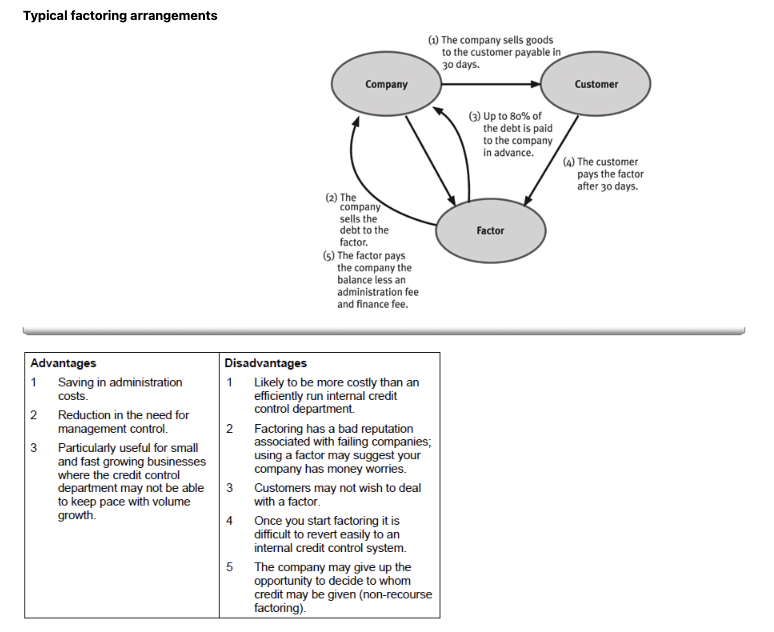

What is factoring and what are the main services offered by a factor?

Who benefits most from factoring?

How does factoring improve cash flow, and what financing does it offer?

What’s the difference between recourse and non-recourse factoring?

Who benefits most from factoring?

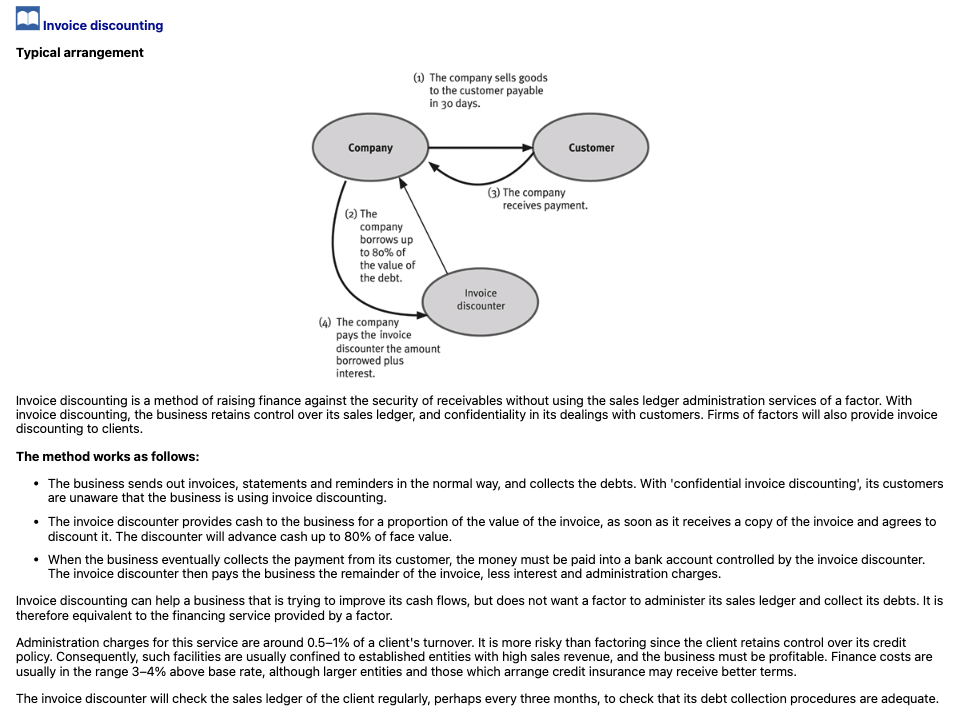

What are the key steps in a typical factoring arrangement?

What are the main advantages of factoring?

What are the main disadvantages of factoring?

What are three key benefits of factoring?

What are the main problems associated with factoring?

What is invoice discounting and how does it differ from factoring?

How do factoring and invoice discounting differ?

Feature | Factoring | Invoice Discounting |

|---|---|---|

Control of sales ledger | Factor manages (issues invoices, collects debts) | Business retains full control |

Customer awareness | Customers deal with the factor | Usually confidential (customers unaware) |

Advance rate | Up to 80% of debt | Up to 80% of invoice value |

Service scope | Financing + admin + credit insurance (optional) | Financing only |

Cost | Lower admin charges; may include credit insurance | Higher charges (0.5–1%) due to retained control |

Best for | Small, fast-growing firms or firms with limited admin capacity | Established, profitable firms with strong internal credit control |

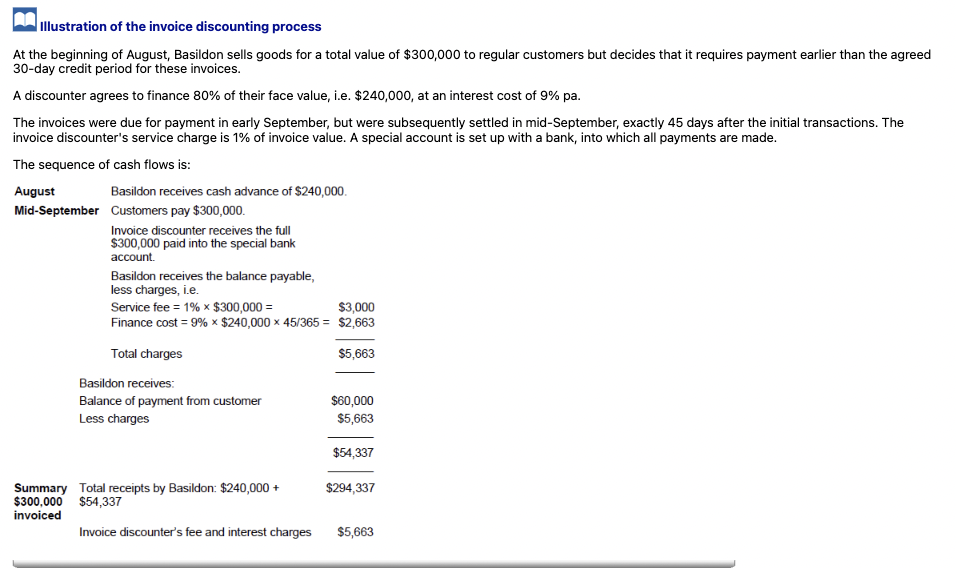

How does invoice discounting work in practice (example)?

🧾 Scenario Overview:

A company sells $300,000 worth of goods in August.

Customers are meant to pay in 30 days, but the company needs cash sooner.

The company uses invoice discounting to get most of the money early.

🔁 Step-by-Step Explanation: Step 1: Advance Payment

The invoice discounter gives the company an advance of 80% of the invoice value right away.

80% of $300,000 = $240,000

The company gets $240,000 cash immediately in August.

Step 2: Customers Pay Later

In mid-September, customers finally pay the full $300,000 to a special bank account controlled by the discounter.

Step 3: Discounter Takes Their Cut

The discounter deducts two charges before giving the remaining money back:

Service Fee – 1% of total invoice:

1% × $300,000 = $3,000

Finance Charge – Interest for lending the $240,000 early:

Interest rate = 9% per year

Time = 45 days

Interest = 9% × $240,000 × (45/365) = $2,663

✅ Total charges = $3,000 + $2,663 = $5,663

Step 4: Final Payment to Company

Of the $60,000 still owed to the company (300k - 240k):

The discounter subtracts the $5,663 charges

The company gets the remaining $54,337

💰 Final Summary

Company receives:

$240,000 upfront

$54,337 later

👉 Total = $294,337

The discounter keeps:

👉 $5,663 as fees and interest

🧠 Why use invoice discounting?

You get cash before customers pay, which helps with cash flow.

You don’t give up control of customer relationships (unlike factoring).

What is trade credit and why is it considered important?

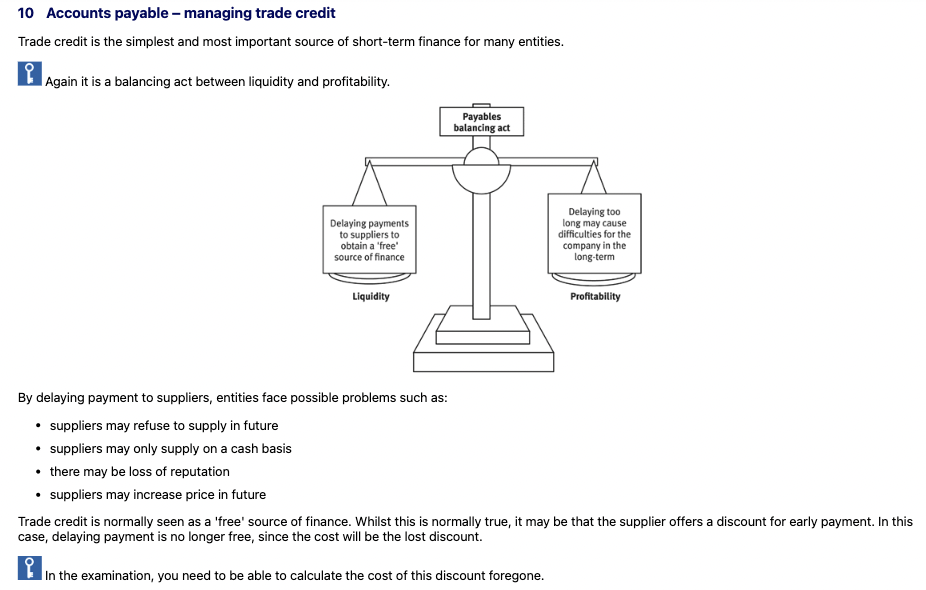

What trade-off must be considered in managing trade credit?

What are the potential downsides of delaying payment to suppliers?

When is trade credit no longer 'free'?

What should students be prepared to calculate in exams related to trade credit?

What is trade credit?

How do trade credit periods vary across industries?

What are settlement discounts and their implications?

What are the hidden costs of extended trade credit?

Why might extending the working capital cycle be risky?

What key points should management assess in an age analysis of payables?