Comprehensive Review of Accounting Principles, Processes, and Business Types

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

37 Terms

Analyzing

Transactions entered, documentary evidence.

Recording

The effect of the transaction.

Classifying

Sorting/grouping of similar transactions/events > account titles.

Summarizing

Accounts are grouped into assets, liabilities, owner's equity, revenue, cost and expenses.

Reporting

Financial statement (Income statement, balance sheet and cash flows statement).

Interpreting

Step that directs attention to the significance of various matters and relationships.

Merchandising/Trading

Buying of goods and selling the same without change in form.

Service

Doing work for others.

Business Entity

Business enterprise is separate from its owner/investor (exception in the case of paying for someone related to the company).

Monetary unit

Amounts should only be a single monetary unit (can't change from pesos to another currency, can make exception in case of foreign owner or investor).

Time period

Financial statements must have divided time periods (financial statements annually or expenses reported from only a specific time).

Objectivity

Financial statements must have supporting evidence.

Cost

Accounts should be recorded initially at cost (ex. buying a cash register, it must record its price when purchased).

Asset

Economic resources owned by the business for future gain, property and rights of value owned by the business.

Current Asset

Go away quickly; includes cash on hand/bank, accounts receivable, notes receivable, inventories/supplies, prepaid expenses, accrued income, short term investment, petty cash fund.

Non-Current Asset

Properties that don't just go away; includes property, plant, equipment, long term investment - ex. insurance, intangible assets.

Liabilities

Debts and obligations of the company to another entity.

Current Liabilities

Fall due within one year after year end date (short term).

Accounts Payable

Things to be paid on account.

Notes Payable

Promissory notes.

Accrued Expenses

Used up but not paid for yet.

Income Tax Payable

Paid at the end of the month once there is tax.

Non-Current Liabilities

Cannot be realized (long term); includes loans payable, notes payable, mortgage payable.

Equity

Residual interest of the owner from the business.

Capital

Money you will put into your business, value of cash and other assets invested in by the business by the owner.

Drawing

Money from the business, debited for assets withdrawn by the owner for personal use.

Income

Net increase in assets in a given accounting period.

Expenses

What you spend for your business costs of business during their operation, decreases in assets or increases in liabilities.

Branches of Accounting

Includes management accounting, tax accounting, and auditing.

Management Accounting

Analysis and communication of financial information to the managers of an organization to achieve internal goals and make well-informed decisions.

Tax Accounting

Focus on taxes rather than public financial statements.

Auditing

Formal examination of an organization or individual accounts or financial situation.

Father of Accounting

Luca Bartolomeo de Pacioli, first to publish about the double entry system of bookkeeping.

Sole Proprietorship

One owner (small business), easier decision making, limited budget, no definite life/term of existence.

Partnership

Two or more owners, less requirements, depends on degree, some exempted from income tax, unlimited liability/no control of partner.

Corporation

Five or more owners (amount of shares), unlimited life, limited liability, bigger capital, activities limited by articles of corporation.

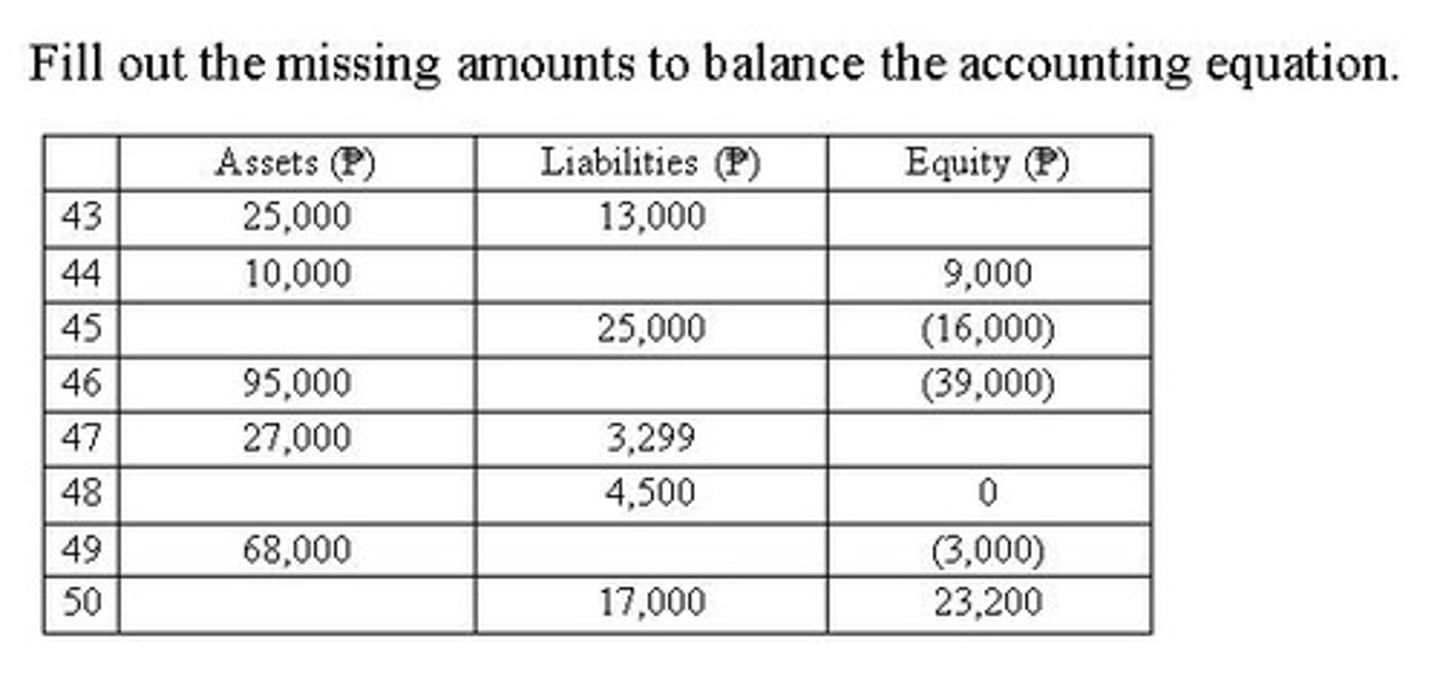

Accounting Equation

Financial worksheet/Analyze the effects.