ECO 201 exam 3

1/70

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

71 Terms

characteristics that define market structure (4)

number of firms

product differentiation (homogenous or differentiated)

can a firm influence price?

barriers to entry

firms want in perfect competition

to make the most profit possible through rational rule: Marginal Revenue (MR) = Marginal Cost (MC)

Perfectly competitive markets with lots of small buyers and sellers

There are many small buyers and sellers

No one can control the price (they're "price takers").

firms are restricted and can only charge the market price of the homogenous good being sold

Demand in a Competitive Market

Firms are price-takers: no control over market price

Firm demand: horizontal at market price (perfectly elastic)

Marginal Revenue = Price

Additional revenue from selling one more unit equals market price

Key for determining profit-maximizing output level

marginal cost

the additional cost incurred by producing one more unit of a good or service. It helps determine optimal production levels for a firm.

Marginal revenue

the additional revenue a firm earns by selling one more unit of a good or service.

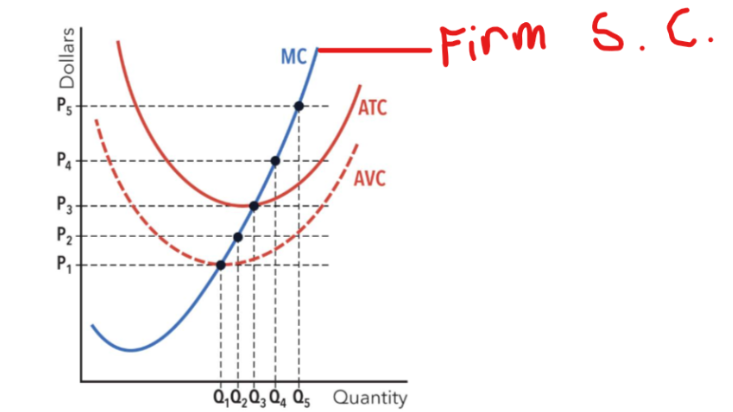

Firm Supply in a Perfectly Competitive Market

same as Marginal Cost (MC) curve. For any given market price, the firm consults its MC curve to determine the profit-maximizing quantity.

the firm always produces the quantity where what equals the market price to maximize profits.

marginal cost

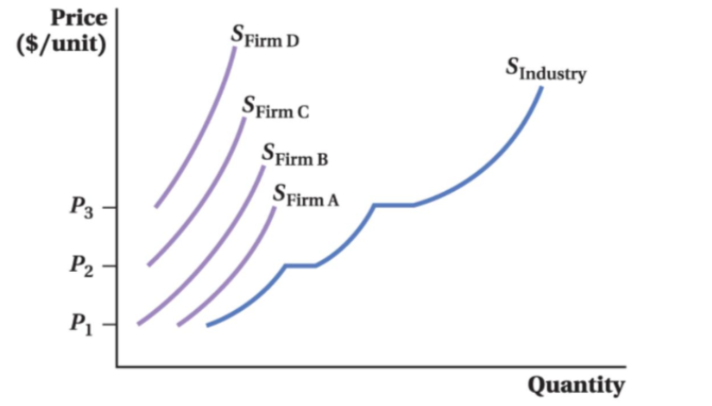

Market Supply in a Competitive Market

add up all the individual firm supply curves horizontally.

Short Run equilibrium

characterized by the absence of entry and exit. Because there are barriers, this allows firms to experience economic profits or losses in the short run. As a result, the number of firms in the market remains fixed in the short run.

Why are firms allowed to experience economic profits or losses in the short run?

there are barriers

As a result, the number of firms in the market remains _______ in the short run.

fixed

(P - AC) × Q, when P > AC

Calculating profits in the short run

Positive Economic Profits

If the market price is above the minimum of the average cost curve (P>min AC), the firm will earn this.

total economic profit

the difference between price and average cost (P-AC), multiplied by the quantity produced (Q).

(P - AC) × Q, when P = AC

formula for ZERO economic profit at minimum average cost

Zero Economic Profit

When the market price is equal to the minimum of the average cost curve (P=min AC).

In the case of what does the firm break even, as the price equals the average cost at the profit-maximizing output level?

0 Economic Profit

(AC - P) × Q, when P < AC

Calculating loss in the short run

Negative Economic Profit (Loss)

If the market price is below the minimum of the average cost curve (P<min AC).

In the short run, can a firm continue to operate even if it is incurring losses?

as long as the market price covers the average variable costs because the firm has already committed to fixed costs

Long-Run Equilibrium

Firms can enter and exit freely.

Why would a firm enter long run equilibrium?

They enter if experiencing short-run profits and exit if facing short-run losses, ultimately resulting in zero profits in long-run equilibrium.

conditions of Long-Run Equilibrium

Firms maximize profits (P = MC).

Market clears (Quantity supplied = quantity demanded).

Zero profits (Price = average cost). P = MC = AC. P = minimum average cost

Market power

extent to which a seller can charge a higher price without losing many sales to competing businesses

types of market structure

perfect competition - Lowest market power

monopolistic competition

oligopoly

Monopoly - Highest market power

To set price with market power, There's a trade-off between ________ and _______.

price, quantity

To set price with market power, it is a trade-off between _______________ versus making more money on each item.

selling a large quantity of items

firm demand curve and the marginal revenue curve

used to evaluate the trade-off between price & quantity

How does market power give firms profits?

Firms can raise prices and restrict quantity to get those profits

Problems with Market Power

Market power leads to higher prices.

Market power leads to inefficiently smaller

quantity.

Market power yields larger economic profits.

Businesses with market power can survive even with inefficiently high costs.

Deadweight loss equals what

What is the consequence of this failure?

market failure, room for government regulation

sophisticated pricing strategies?

Price Discrimination

Group Pricing

The Hurdle Method

profits

Price discrimination

Charging different prices for different people

Perfect price discrimination

Willingness To Pay = Pay = Marginal Cost

Requirements to Price Discriminate

Market Power

Different types of Willingness to Pay (WTP)

Ability to prevent resale

Market Power

Downward sloping firm demand (NO PC Firms)

Low WTP is ______ responsive to price changes

more

High WTP is ______ responsive to price changes

less

Ability to prevent resale

Low WTP getting low price can't resell to High WTP. ex: college spot

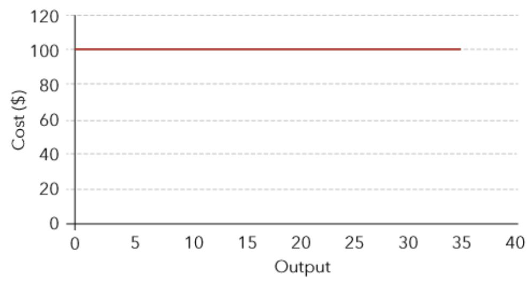

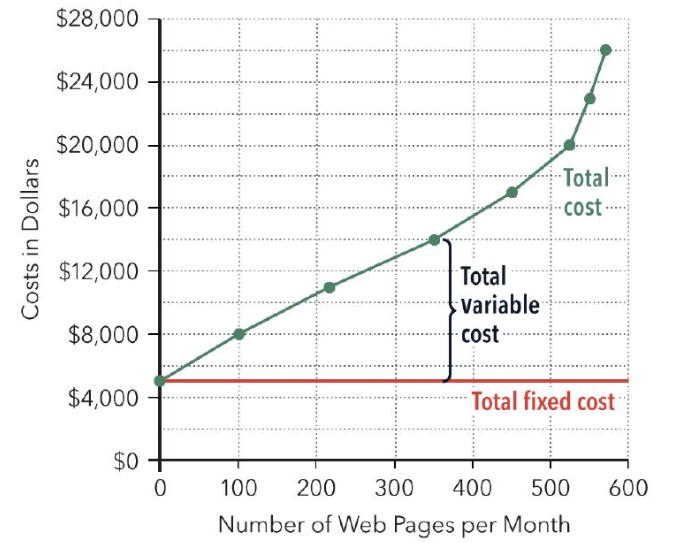

fixed costs

constant for any level of output

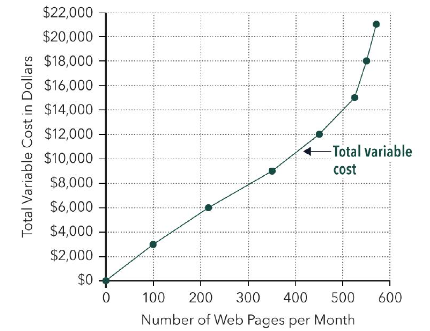

variable costs

change as output changes

Total Cost

combines variable + fixed cost for each level of output

marginal cost

used to decide how much to produce

formula for marginal cost

Change in Variable Cost/Change in Output

average cost

total cost/total output

what does it mean if MC > AC

AC must be falling

what does it mean if MC < AC

AC must be rising

what does it mean if MC = AC

AC is at its minimum

economic profits

revenue minus all costs (implicit and explicit)

implicit costs

opportunity costs like:

what could the firm be doing instead?

where else could money have been invested?

what’s the owner’s time worth when they’re not getting paid?

normal profit

next best alternative’s accounting profit

accounting profit

revenue minus explicit costs

can a firm earn positive accounting profits, but negative or even zero economic profits?

yes

this type of profit means you could be doing better in another business route

negative economic profit’s

zero economic profit

accounting profits = opportunity costs

quantity choice to maximize profits

looking for quantity such that MR= MC or P = MC

The MC curve is described as the firm's __________ because it gives the quantities that maximize profits at any given market price.

supply curve

Market Power

extent to which a seller can charge a higher price without losing many sales to competing businesses

Different market _____ lead to different amounts of market _____

structures, power

types of market structure

perfect competition - lowest market power

monopolistic competition

oligopoly

monopoly - highest market power

marginal revenue is approximated by

P - ΔPxQ

output/quantity effect

the revenue increase from selling one more unit

output effect = P

equals the new price

discount effect

the revenue loss from cutting price on ALL units sold

discount effect = ΔPxQ

equals the change in price times the original quantity

problems with market power

leads to higher prices

leads to inefficiently smaller quantity

yields larger economic profits

businesses with MP can survive with inefficiently high costs

economic surplus

total benefits minus total costs flowing from a decision

economic surplus formula

= consumer surplus + producer surplus = marginal benefit - marginal cost

consumer surplus formula

= marginal benefit - price

( ½ x base x height)

producer surplus formula

= price - marginal cost

(½ x base x height)

producer surplus

difference between the minimum price a producer is willing to accept for a good or service and the actual price they receive

represented by the area above the supply curve and below the market price.

Consumer Surplus

difference between the maximum price a consumer is willing to pay for a good or service and the actual price they pay

represented by the area below the demand curve and above the market price.