unit 6 econ final review

1/20

Earn XP

Description and Tags

12th grade ap microeconomics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

21 Terms

market failure

- situation in which the free market system fails to satisfy society's wants

- invisible hand doesn't work

- private markets do not efficiently bring about the allocation of resources

free riders

- individuals who benefit without paying

- keeps firms from making profits

- if left to the free market, essential services would be under produced

public goods

nonexcludable and nonrivalrous/ share consumption

nonexlusion

- everyone can use the good

- cannot exclude benefits of the good for those who will not pay

- ex: national defense

nonrivalry (shared consumption)

- one person's consumption of a good does not reduce the usefulness to others

- ex: fireworks

demand for public goods

marginal social benefit of the good determined by citizens willingness to pay

supply of public goods

marginal social cost of providing each additional quantity

externality

external benefits or costs to someone other than the original decision maker

negative externalities (spillover costs)

- results in a cost for a different person other than the original decision maker

- MSC > MPC (overallocation)

- solution: per unit tax

positive externalities (spillover benefits)

- results in a benefit for someone other than the original decision maker

- MSB > MPB (underallocation)

- solution: per unit subsidy

externality in production

2 supply curves

externality in consumption

2 demand curves

tragedy of the commons/ common pool problem

- goods that are available to everyone are often polluted

- no incentive to use them efficiently

- results in high spillover costs

antitrust laws

laws designed to prevent monopolies and promote competition

reasons for monopolies being a market failure

they have no competition

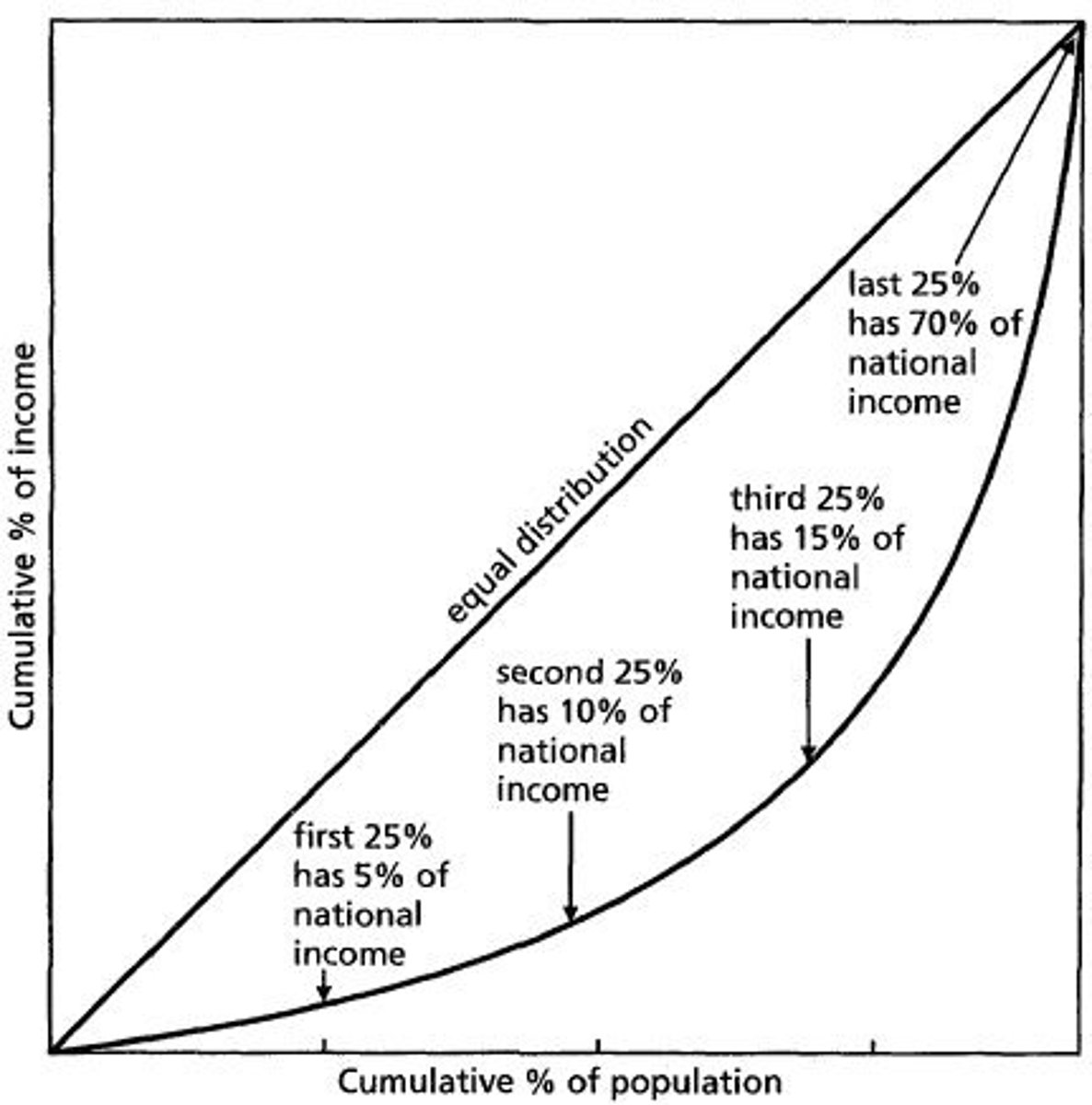

lorenz curve

- measures income distribution

- less bowed when gov redistributes income

taxes

mandatory payments made to the government to cover costs of governing

purpose of taxing

- finance gov operations (ex: public goods, fund programs)

- influence economic behavior of firms and individuals

progressive taxes

- takes more from rich people

- most effective way to fight this market failure

proportional taxes

takes the same percent of income from all income groups

regressive taxes

takes more from poor people