ECON 2105 - Exam 4 "Final" (Ch. 16, 17, & 18)

1/94

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

95 Terms

What is the main source of government revenue?

Taxes

What are government outlays?

All government spending and transfer payments

Which programs make up the largest portion of government outlays?

Social Security and Medicare

What is government debt?

the cumulative sum of all annual deficits

Fiscal policy

The use of government’s budget tools, government spending, and taxes to influence the macroeconomy.

What does expansionary FISCAL policy look like?

Government increases spending or decreases taxes to stimulate or expand economy; leads to government deficits

What does contractionary FISCAL policy look like?

Government decreases spending or increases taxes to attempt to slow economy; serves the function of reducing government debt and keeping the economy from expanding beyond long run capabilities

Explain how government spending changes in expansionary fiscal policy

the government will increase spending to expand the economy; Increasing government spending will increase AD (since G is one component of AD), which increases GDP

Explain how taxes change in expansionary fiscal policy

taxes decrease to raise disposable income and increase consumption (since C is also a component of AD, GDP will increase)

What was the Economic Stimulus Act of 2008?

Legislation signed by President George W. Bush, tax rebate for Americans, typical 4-person family received $1800 dollar, total legislation $168 billion, goal: to increase consumption and stimulate the economy

What was the American Recovery and Reinvestment Act of 2009

Legislation signed by President Obama, focused on government spending rather than consumption spending, $787 billion stimulus, goal: increase aggregate demand

Which of the following is an example of expansionary fiscal policy?

a) increase in taxes

b) stimulus package

c) increasing the money supply

d) lowering interest rates

b) stimulus package

What happens when government spending increases AND taxes decrease?

Budget deficit grows

Expansionary fiscal policy inevitably leads to __________ during economic downturns

increased budget deficits and more national debt

Explain contractionary fiscal policy and its goals

Decrease government spending and/or increases taxes with the goal of: 1) paying off debt accrued during bad times due to expansionary fiscal policy 2) slow down an economy that is “overheated” from too much spending, leading to inflation; unfortunately, contractionary fiscal policy is not sustainable in the long run; tries to reduce upward pressure on price level; still interested in “smoothing” out cycles (countercyclical fiscal policy)

Which of the following is an example of contractionary fiscal policy?

a) decreasing the money supply

b) increasing the interest rate

c) increasing government spending

d) increasing taxes

d) increasing taxes

Countercyclical fiscal policy

Fiscal policy that seeks to counteract business cycle fluctuations; uses expansionary fiscal policy in recessions and contractionary fiscal policy in expansions

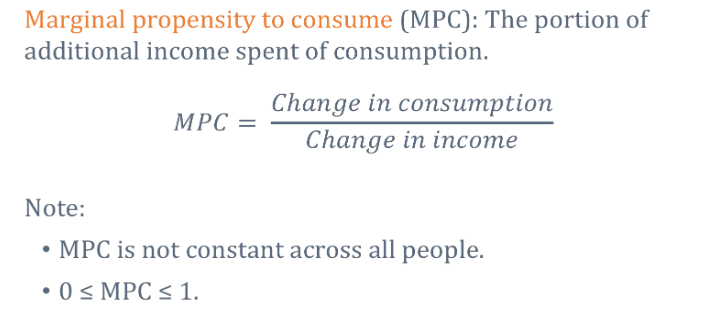

Marginal propensity to consume (MPC)

the portion of additional income spent on consumption; change in consumption over change in income

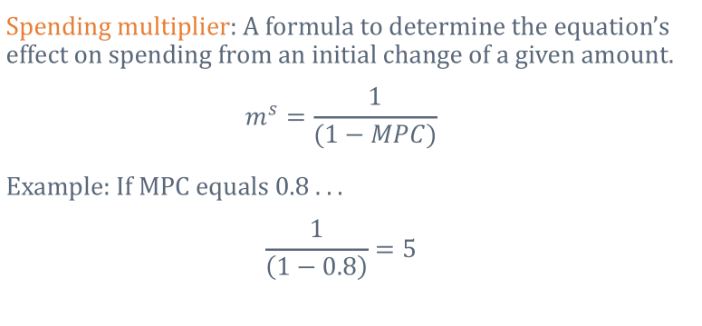

Spending multiplier (ms)

a formula to determine the effect on spending from an initial change of a given amount

Suppose the MPC is 0.9; what will the total GDP impact be from a $400 billion increase in government spending?

$4 trillion

What are the three main shortcomings of fiscal policy?

1) time lags

2) crowding out

3) savings adjustments

Recognition time lag

It is difficult to determine when the economy is turning up or down; GDP data is released quarterly and later revised; unemployment rate data lags even further; growth is not constant

Implementation time lag

It takes time to implement fiscal policy because it must pass through Congress and the President before it can be implemented by the bureaucracy

Impact time lag

It takes time for effects of policy to materialize; multiplier effects occur over time.

Automatic stabilizers

Government programs that naturally implement counter-cyclical fiscal policy in response to economic conditions; can eliminate recognition and implementation lags

What are some examples of automatic stabilizers?

Progressive income tax rates, corporate profit taxes, unemployment compensation, welfare programs

Which of the following is an example of an automatic stabilizer?

a) federal reserve interest rates

b) discretionary outlays

c) progressive income tax rates

d) education subsidies

c) progressive income tax rates

Crowding out

When private spending falls in response to increases in government spending; reduces the ability of government spending to stimulate aggregate demand

What are some of the serious implications of crowding out?

overall spending may not increase, government would now have a higher deficit and debt

Explain how crowding out works

Lets say government spending increases by $100 billion; this money is borrowed, which means someone had to save it ($1 borrowed = $1 saved); the demand for loans (investment) increases due to government spending, which raises the interest rate; a higher interest rate decreases private spending (investment) and increases private saving; in this example, private spending has essentially been overtaken/replaced by government spending; NOT good

Savings adjustments

new classical critique: increases in government spending and decreases in taxes are largely offset by increases in savings; dilutes the effect and mitigates the purpose of initial fiscal policy

Supply side fiscal policy

the use of government spending and taxes to effect the production (supply side) of the economy; targets the LRAS curve; increases incentives for productive activities; policies often take time, so supply proposals are emphasized as long-run solutions for growth

What are some examples of supply-side fiscal policy initiatives?

Research and development tax credits, education policies (subsidies or tax breaks), lower corporate profit tax rates, lower marginal income tax rates

Currency

the paper bills and coins used to buy goods and services

Money

Any generally accepted form of payment

What are the three basic functions of money?

1) Medium of exchange

2) Unit of account

3) Store of value

Medium of exchange

what people trade for goods and services; most modern economies have a common medium of exchange established by the government

Barter

the trade of a good or service in the absence of a commonly accepted medium of exchange; inefficient due to a double coincidence of wants (in order for a transaction to occur, each party must have what the other party desires)

Commodity money

the use of an actual good for money; historically the first medium of exchange in an economy; think back to our example of nuts

Commodity-backed money

money you can exchange for a commodity at a fixed rate; solves transportation problem of using commodity money

Fiat money

money with no value except as a medium of exchange; no inherent or intrinsic value

Compare the differences between commodity money and fiat money

Commodity money:

Links money to something tangible

Limits inflation

fluctuations in the commodity value changes all prices

new gold/resource discovery leads to inflation

Fiat money:

not backed with a commodity

not subject to macroeconomic risk by changing commodity value

subject to rapid monetary expansion and inflation

Today in the United States the dollar ($) is:

a) intrinsically-valued money

b) fiat money

c) commodity money

d) commodity-backed money

b) fiat money

Unit of account

the measure in which prices are quoted; creates a common understanding for unit of measurement; enables people to make accurate comparisons between items; creates a consistent method of record-keeping

Store of value

a means for holding wealth

M1

the money supply measure composed of currency and checkable deposits

M2

money supply measure that includes everything in M1 along with savings deposits, money market mutual funds, and small-denomination time deposits (CDs).

Why is M2 currently a more monitored measure of the money supply than M1?

a) ATMs have allowed easier access to savings deposits

b) M2 doesn’t include coins, which may be obsolete in the future

c) banks pressured the FED to include savings deposits in the money supply measure

d) people have increased their use of credit cards

a) ATMs have allowed easier access to savings deposits

Explain credit cards as they relate to money supply measures

Credit cards are NOT considered part of the money supply as they are essentially “loans made at the cash register.”

What are the two important roles of banks in the economy?

1) critical participants in the loanable funds market

2) play a role in determining the money supply

Assets

the items a firm owns

Liabilities

the financial obligations a firms owes to others

Owner’s equity

the difference between a firm’s assets and liabilities

Reserves

the portion of bank deposits that are set aside and not loaned out

Fractional reserve banking

when banks hold only a fraction of deposits on reserve

What are the two reasons banks hold deposits?

1) to accommodate withdrawals by depositors; avoiding bank runs

2) they are legally bound to hold a fraction of their deposits on reserve (NO LONGER TRUE AS OF MARCH 26, 2020)

Federal Deposit Insurance Corporation (FDIC)

government program that insures bank deposits (1933), goald: increase bank stability and decrease bank runs; created moral hazard situation

Moral hazard

lack of incentive to guard against risk

Banks increase the money supply by:

a) printing (minting) money

b) controlling interest rates

c) lending out funds to borrowers

d) storing the money of savers

c) lending out funds to borrowers

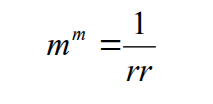

Simple money multiplier (mm)

the rate at which banks multiply money when all currency is deposited into banks and they hold no excess reserves; represents maximum size of money multiplier

With a reserve requirement of 5% and an initial deposit of $400, what is the total amount of money that could be in the money supply?

a) $420

b) $780

c) $4,000

d) $8,000

d) $8,000

The Federal Reserve (FED)

the central banking system of the United States

What are the three responsibilities of the FED?

1) monetary policy

2) central banking

3) bank regulation

Explain the FED’s role as a “bank for banks”

it holds federal funds, which are deposits that private banks hold on reserve at the FED; banks keep reserves at the FED because the FED clears federal funds loans: loans between banks;

Federal funds rate

the interest rate on loans between private banks

Discount loans

loans from the FED to private banks

Discount rate

the interest rate on the discount loans made from the FED to regular banks

What are the four main tools the FED can use to alter the money supply?

1) Open market operations

2) Quantitative easing

3) Reserve requirements

4) Discount rates

Open Market Operations

The purchase or sale of bonds by a central bank (the FED); when performing OMO, the FED usually buys and sells short-term Treasury securities because the FED’s goal is to get funds directly into the loanable funds market and the market for Treasury securities is big enough where the FED can buy or sell without difficulty

Quantitative easing

The targeted use of open market operations in which the central bank buys securities specifically targeting certain markets; ex: in 2008, the FED injected almost $2 Trillion worth of new funds, $1.25 Trillion of which were in mortgage-backed securities

What are the 5 properties of money?

1) Recognizable

2) Durable

3) Portable

4) Divisible

5) Scarce

When and where was the Federal Reserve founded?

1913; Jekyll Island, Georgia

Describe the makeup of the Federal Reserve

7 members of Board of Governors, appointed by POTUS and confirmed by Senate; 5 FED Bank presidents out of 12 FED banks, along with the 7 BoG members serve on the Federal Open Market Committee (FOMC), which decides monetary policy.

Expansionary monetary policy

when a central bank acts to increase the money supply in an effort to stimulate the economy; typically through open market purchases; when money supply increases, bank reserves increase (ergo, interest rates fall); with lower interest rates, firms decide to invest; aggregate demand shifts to the right (increases)

Explain the real and nominal effects of expansionary monetary policy

Monetary policy can have real effects such as increasing

output and reducing unemployment.

However, the new money devalues the entire money supply,

because prices rise.

As prices adjust in the long run, the effects of the new money

wear off;

In the long run, effects of monetary policy dissipate

completely.

The only change in the long run is a higher price level

How does the FED engage in expansionary monetary policy?

a) it buys bonds from financial institutions

b) it sells bonds to financial institutions

c) it lowers the price of goods

d) it raises the interest rate

a) it buys bonds from financial institutions

If inflation is higher than expected, it hurts

input suppliers with sticky prices

workers who signed wage contracts

resource suppliers who are contracted to sell goods at a given price

ex: worker’s paycheck does not buy as many goods; house builder put a bid price too low on a house, and materials are now too expensive

If inflation is lower than expected, it hurts

demanders, who signed a fixed-price contract

employers who create wage contracts

resource purchasers who signed long-term contracts to buy goods at certain prices

ex: a bank issues a bond at 3% because it expected inflation to be 2%, but it ended up only being 1.4%

Contractionary monetary policy

When a central bank takes action that reduces the money supply in the economy; often done during times of rapid expansion to curb potential inflation; reduces money supply via open market sales; lower supply of loanable funds increases interest rates; with higher interest rates, investment falls and AD shifts left

Suppose the FED engages in contractionary monetary policy to reduce the money supply. What is the result in the loanable funds market?

a) there is a shift in demand for loanable funds

b) the amount of loanable funds increases

c) bank competition increases

d) the interest rate rises

d) the interest rate rises

What are some limitations of monetary policy?

1) diminished effects in the long run

2) effects being reduced by people’s expectations

3) effectiveness if downturns are caused by AS rather than AD

monetary neutrality

the idea that the money supply does not effect real economic variables; because all prices adjust in the long run, monetary policy does not effect real GDP or unemployment

Monetary policy has real effects only when inflation is _______

unexpected

According to models throughout the textbook chapters, monetary policy is

a) more effective in the long run

b) more effective in the short run

c) equally effective in both the long and the short run

b) more effective in the short run

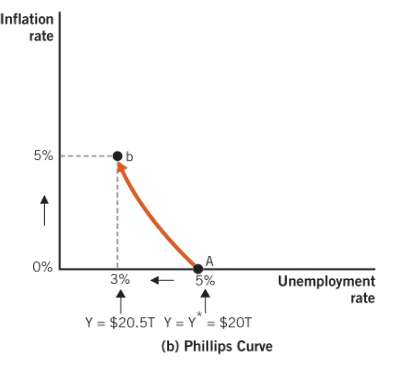

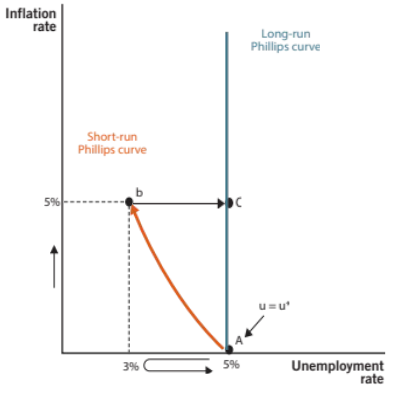

Phillip’s curve

Indicates a short-run negative relationship between inflation and unemployment rates; less unemployment ←→higher inflation, lower inflation ←→ higher unemployment

Long run phillip’s curve

vertical line, as all prices have adjusted and the effects of monetary policy will wear off, unemployment rates will return to its normal level

Adaptive expectations theory

Idea developed in the 1960s by Milton Friedman and Edmund Phelps which states that people’s expectations of future inflation are based on their most recent experience; this is important because if people begin adjusting expectations, monetary policy may not have much effect in the short run, either.

Rational expectations theory

People form expectations on the basis of all available information

When people have rational expectations about inflation, it means that they base their inflation predictions on

a) all available information

b) whether or not they have debt

c) the rate of inflation from last year

d) assuming zero inflation

a) all available information

Active monetary policy

The strategic use of monetary policy to counteract macroeconomic expansions and contractions; assumes the Phillip’s curve relationship holds in the long run; inflate during downturns, reduce inflation during booming economy; with adaptive expectations, reduces unemployment in the short run; with rational expectations, potentially no gains

Passive monetary policy

When central banks purposefully choose only to stabilize money and price levels through monetary policy; does not seek to affect real variables, like unemployment and output; this has been the direction of the FED since the 1980s

The Phillip’s curve

a) shows that inflation and unemployment are directly related

b) shows that inflation and unemployment are inversely related

c) can be effectively used in the long run

d) guarantees that the FED can create jobs by changing the money supply

b) shows that inflation and unemployment are inversely related

What is the FED’s mandate

Congress, 1977, twofold mandate of the FED

1) Maximum employment (natural unemployment)

2) price stability

Monetary policy by the FED most directly impacts

a) consumption

b) investment

c) government spending

d) net exports

b) investment

In stagflation, monetary policy is essentially ineffective. What then is typically used to address stagflation?

Fiscal policy, usually in the form of lower corporate tax rates