study unit 5 part 1

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

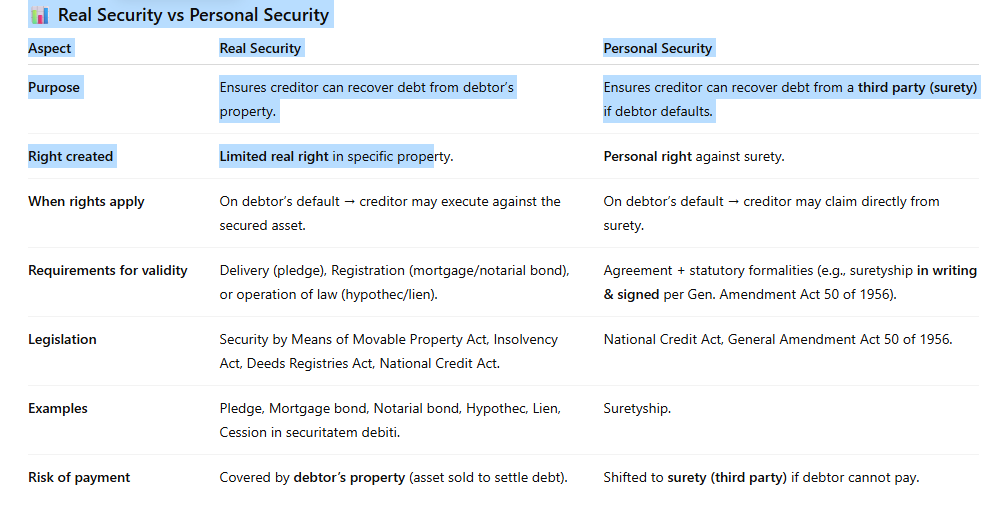

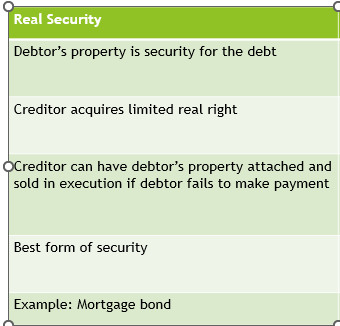

real security

personal security

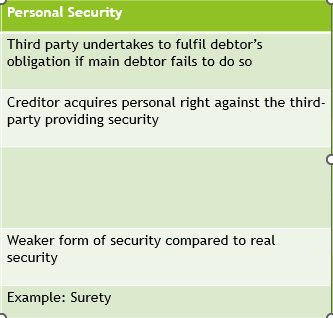

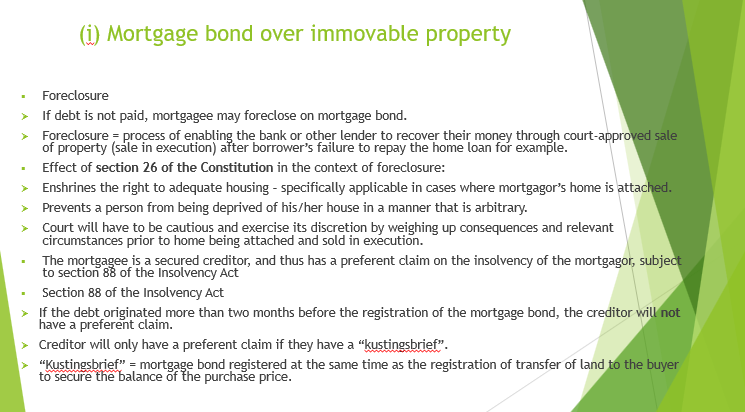

mortgage bond over immovable property

Mortgage bond over immovable property foreclosure

different types of mortgage bonds

Mortgage bonds: Secure existing and future debts.

Covering bonds: Secure future debts, function like mortgage bonds, can apply to movables (then called notarial covering bonds).

Participation bonds: Another type of bond used as an investment. Investors lend money to an investment company, which then lends it to third parties. Loans are secured by bonds in the company’s (nominee’s) name.

real security over movable property: pledge

Definition: A form of security over another person’s movable property (e.g., diamond ring pledged for a debt).

Regulation: Governed by the National Credit Act.

Creation: By agreement → debtor (pledgor) delivers movable property to creditor (pledgee).

Formalities: None required.

Creditor’s Rights

Cannot use pledged property.

On delivery → gains a limited real right.

Before delivery → only a personal right.

If debtor becomes insolvent → creditor has a secured claim on proceeds of sale.

Enforcement

Normally → pledged property sold in execution after court judgment and order.

Parate executie clause:

Allows immediate sale without court order.

Constitutionality questioned under Section 34 (right to due and fair process).

Bock v Dubororo Investments: Clause not unconstitutional and valid if not against public policy.

Special notarial bond over movable property

Security over specific movable property.

Creates real right if registered in Deeds Office (Act 57 of 1993).

Debtor keeps using property (no delivery like a pledge).

Creditor = secured on insolvency, shares in sale proceeds.

⚠ Only applies to corporeal movables (not intangible assets).

Contrast

General Notarial Bond: covers all movables, but no real right, only preferent claim in insolvency.

Pledge: delivery of property required for real right.

real security over movable property: Cession in securitatem debiti

Security over incorporeal property (personal rights with economic value).

→ e.g. shares, book debts, insurance claims.Creation: Agreement + transfer of personal right (cession).

🔹 Types

Out-and-out cession:

Full transfer of right to creditor.

Creditor must re-cede once debt is paid.

Cession by way of pledge:

Normal pledge principles apply (debtor retains underlying interest).

⚠ Problem: Uncertainty in law whether security cession = pledge or outright transfer.

security obtained by operation of law: tacit hypothec of the lessor and credit grantor

Lessor’s Tacit Hypothec

Arises automatically by law when rent on immovable property is overdue.

Covers movables brought onto leased premises (even in transit).

Real right only after attachment by sheriff.

Lessor gets preferent claim at sale in execution → but only for rent arrears.

If lessee insolvent → lessor = secured creditor with preference.

Statutory Hypothec (Credit Grantor)

From National Credit Act 34 of 2005.

Applies to goods under instalment sale agreements.

If debtor’s estate sequestrated → creditor gets hypothec over goods (per Insolvency Act s84).

Grants secured creditor status + preference.

security obtained by operation of law: lien

Definition

Automatic legal right to retain movable or immovable property of another until compensated.

When?

Creditor has spent money, labour, or services on property.

Exists only while in possession of property.

Examples

Mechanic keeps car until repair bill is paid.

Legal Effect

Under Insolvency Act → holder of lien = secured creditor with preferent claim.

Debtor-creditor lien → no real right, only personal right (contract-based).

Types

Salvage/Improvement liens: arise where money spent on preserving or improving another’s property.

Only valid if improvement is essential or useful.

Suretyship is a form of personal security

Definition

Third party promises to perform debtor’s obligation if debtor defaults.

Effects

Once surety pays → gains right of recourse against principal debtor (debt + costs).

Co-sureties: multiple sureties for one debt.

Can be surety + co-principal debtor → loses some defences (e.g., excussion) but keeps recourse right.

⚠ Not the same as delegation (where debtor replaced by another).

Creation

By agreement between surety + creditor.

Must satisfy contract law validity requirements.

Formalities (General Amendment Act 50 of 1956)

Must be in writing and signed by all parties.

Amendments also in writing.

Can be cancelled informally.

If married in community of property → requires spouse’s written consent (unless in ordinary course of business/occupation).

Surety key legal principles

Nature: Credit guarantee → National Credit Act applies.

Public policy: Must be commercially justified.

Creditor’s right: Only a personal right against surety.

Accessory contract: Depends on validity of main obligation.

Defences: Surety can raise any defence debtor had (e.g., rescission).

Liability: Arises only when debtor defaults.

Benefits:

Before payment → surety may claim excussion (creditor must first proceed against debtor).

Termination: Suretyship ends when:

Debt is settled, or

Linked time period lapses.

Suretyship – Recourse & Co-sureties

Right of Recourse

If surety pays full debt → entitled to cession of creditor’s action against debtor or co-sureties.

⚠ If surety fails to use a valid defence against creditor → loses right of recourse.

Co-sureties

Each co-surety pays only their pro rata share (benefit of division).

Surety who pays full debt has recourse against co-sureties:

Based on agreement, or

If no agreement → based on enrichment.

aspects to consider