Investments Exam 1 Study Guide

1/84

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

85 Terms

_______ portfolio construction starts with selecting attractively priced securities.

Bottom-up

Which of the following are financial assets?

1. Debt securities

2. Equity securities

3. Derivative securities

1, 2, and 3

Asset allocation refers to _______.

The allocation of the investment portfolio across broad asset classes.

Security selection refers to the _______.

Choice of specific securities within each asset class.

The value of a derivative security _______.

Depends on the value of another related security.

_______ portfolio construction starts with asset allocation.

Top-down

The average rate of return on U.S. Treasury bills since 1926 was _______.

less than 4%

Money market securities are characterized by:

1. Maturity less than 1 year

2. Safety of the principal investment

3. Low rates of return

1, 2, and 3

An investment adviser has decided to purchase gold, real estate, stocks, and bonds in equal amounts. This decision reflects which part of the investment process?

Asset allocation

Suppose an investor is considering one of two investments that are identical in all respects except for risk. If the investor anticipates a fair return for the risk of the security he invests in, he can expect to _______.

Pay less for the security that has higher risk

If you thought prices of stock would be rising over the next few months, you might want to _______ on the stock.

purchase a call option

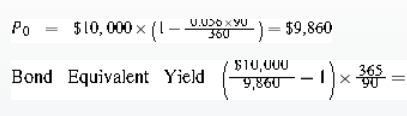

An investor buys a T-bill at a bank discount quote of 5.60 with 90 days to maturity for 9,860.00. The bill has a face value of $10,000. The investor's bond equivalent yield on this investment is _____.

5.76%

A bond issued by the state of Alabama is priced to yield 6.30%. If you are in the 20% tax bracket, this bond would provide you with an equivalent taxable yield of _________.

7.88%

A stock quote indicates a stock price of $72 and a dividend yield of 3%. The latest quarterly dividend received by stock investors must have been ______ per share.

$0.54

Money market securities are sometimes referred to as cash equivalents because _______.

They are safe, marketable, and offer low returns

The most marketable money market securities are _______.

Treasury bills

An investor in a T-bill earns interest by _______.

Buying the bill at a discount from the face value to be received at maturity

TIPS are _______.

Treasury bonds that protect investors from inflation.

Ownership of a put option entitles the owner to the _______ to _______ a specific stock, on or before a specific date, at a specific price.

right; sell

The Standard & Poor's 500 is _______ weighted index.

a value-

You short-sell 200 shares of Tuckerton Trading Company, now selling for $50 per share. What is your maximum possible loss?

Unlimited

Purchases of new issues of stock take place _______.

in the primary market

An order to buy or sell a security at the current price is a _______.

market order

The _______ price is the price at which a dealer is willing to purchase a security.

bid

The difference between the price at which a dealer is willing to buy and the price at which a dealer is willing to sell is called the _______.

bid-ask spread

Assume you purchased 500 shares of XYZ common stock on margin at $40 per share from your broker. If the initial margin is 60%, the amount you borrowed from the broker is _______.

$8,000

You sold short 300 shares of common stock at $30 per share. The initial margin is 50%. You must put up _________.

$4,500

You short-sell 100 shares of Tuckerton Trading Company, now selling for $44 per share. What is your maximum possible gain, ignoring transactions cost?

$4,400

The _______ price is the price at which a dealer is willing to sell a security.

ask

Which one of the following statements about IPOs is not true?

IPOs generally provide superior long-term performance as compared to other stocks.

Advantages of investment companies to investors

Low-cost diversification

Record keeping and administration

Professional management

Which of the types of funds are usually most tax-efficient?

ETFs

The NAV of which funds is fixed at $1 per share?

Money market funds

Rank the following fund categories from likely most risky to likely least risky:

1. Equity growth fund

2. Balanced fund

3. Sector fund

4. Money market fund

3, 1, 2, 4

Which of the following result in a taxable event for investors in mutual funds?

1. Short-term capital gain distributions from the fund

2. Dividend distributions from the fund

3. Long-term capital gain distributions from the fund

1, 2, and 3

The primary measurement unit used for assessing the value of one's stake in an investment company is _______.

net asset value (NAV)

Which type of fund invests specifically in stocks of fast-growing companies?

Growth equity funds

_______ funds stand ready to redeem or issue shares at their net asset value.

Open-end

Mutual funds that hold both equities and fixed-income securities in relatively stable proportions are called _______.

Balanced funds

Which type of fund generally has the lowest average expense ratio?

Indexed funds

If you want to measure the performance of your investment in a fund, including the timing of your purchases and redemptions, you should calculate the __________.

dollar-weighted return

The efficient frontier represents a set of portfolios that:

maximize expected return for a given level of risk

Which equation measures time-weighted returns and allows for compounding?

Geometric average return

Rank the following from highest average historical return to lowest average historical return from 1926 to 2019.

1. Small stocks

2. Long-term bonds

3. Large stocks

4. T-bills

1, 3, 2, 4

An investment earns 10% the first year, earns 15% the second year, and loses 12% the third year. The total compound return over the 3 years was __________.

11.32%

The reward-to-volatility ratio is given by __________.

the slope of the capital allocation line

The price of a stock is $38 at the beginning of the year and $41 at the end of the year. If the stock paid a $2.50 dividend, what is the holding-period return for the year?

14.47%

A portfolio with a 25% standard deviation generated a return of 15% last year when T-bills were paying 4.5%. This portfolio had a Sharpe ratio of __________.

0.42

Diversification is most effective when security returns are __________.

negatively correlated

A portfolio of stocks fluctuates when the Treasury yields change. Since this risk cannot be eliminated through diversification, it is called __________.

systematic risk

The loss potential when shorting stock

Unlimited

The type of account you can short stock in

Margin

This is the best case scenario with shorting stock

The stock goes to zero

Who pays the dividend when you short stock?

You

When would a margin call occur when shorting stock?

If the stock price goes up

What gives you the right to buy a stock when you think the price is going to increase?

Calls

What gives you the right to sell a stock when you think the price is going to decrease?

Puts

What is the return, on average, for cash, bonds, and stock (in that order)?

3%, 6%, 12%

When starting a new account, what is your initial equity?

What you first invest in it in cash

What is the maintenance margin requirement (MMR)?

The amount of equity as a percent of the market value that must be maintained

What does a bid value represent?

The next best value from the buyers

What does an ask represent?

The next best value from the sellers

When does a market order happen?

Immediately at the next best available price

What type of fund is the Fidelity Contrafund?

Open-ended

What types of funds are ETFs?

Closed-ended

How are most open-ended funds managed?

Actively

How are most ETFs managed?

Passively

What type of security are treasury bills?

Money market securities

Return formula

[ NAVEnd - NAVBeg + any capital gains after tax ] / NAVBeg

Optimal portfolio

Point of tangency from the linear risk free line with the efficient frontier

Dollar-weighted return

Individual return based on an investor’s transactions

Time-weighted average return

The return of the fund itself

What is the maximum loss that an investor would sustain if they

sold short one share of AAPL at 190? The annual dividend is $3.00. Ignore commissions and the cost of borrowing share.

Unlimited

The average compound return earned per year over a multiyear period when inflows and outflows are considered (also referred to as the “investor return”) is called the:

Dollar weighted average return

A call option is an agreement that:

grants the buyer the right to purchase an asset at some point in the future

Diversification involves the:

construction of a portfolio with securities that have partial correlation

Sarah deposited $5,000 of cash in her margin account to short $10,000 worth of stock. This is the only transaction in her brokerage account. According to her account balance sheet, she now has account equity of (ignoring commissions and the cost of borrowing shares).

$5,000

Which one of the following best describes the term “maintenance margin requirement”?

Amount of equity as a percent of market value that must be maintained

The market for IBM stock is 170.00 bid and 170.20 ask. There are 1000 shares on the bid and 1000 shares on the ask. If you issue an order to sell 2000 shares of IBM at the market, which of the following is true regarding the sale price. The sale price will be

less than 170.00

You purchase shares of ABCDE Fund on 1/1/17 at $10 in a taxable account. During the year the fund distributes $1.00 in short term capital gains that are taxed at 40%. The year- end NAV is $11.40. What is the total after-tax return for your investment for the year?

20%

Given the following asset classes, which is the correct order from least risky to most risky?

Cash, Bonds, Stocks

Which of the following are three key advantages of mutual funds?

professional management, low initial investments, diversification

Which of the following situations will likely result in a margin call?

you purchase stock and the price of the stock declines significantly

Which of the following portfolios would likely NOT be found on the efficient frontier?

Portfolio B – Expected Return of 13.5% with a standard deviation of 28%

Which of the following class of mutual funds typically carries the least amount of risk?

Large-cap value