AP Micro Unit 6

0.0(0)

Card Sorting

1/31

Earn XP

Description and Tags

Last updated 8:41 PM on 4/23/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

32 Terms

1

New cards

The “Invisible Hand” of Free Markets

the government doesn’t need to get involved since the needs of society are automatically met

2

New cards

Market Failure

a situation in which the free-market system fails to satisfy society’s wants

→ (when the invisible hand doesn’t work) private markets do not efficiently bring about the allocation of resources

→ (when the invisible hand doesn’t work) private markets do not efficiently bring about the allocation of resources

3

New cards

The Four Market Failures

( 1 ) Public Goods

( 2 ) Externalities (third-person side effects)

( 3 ) Imperfect Competition (monopolies)

( 4 ) Unequal distribution of income

( 2 ) Externalities (third-person side effects)

( 3 ) Imperfect Competition (monopolies)

( 4 ) Unequal distribution of income

4

New cards

Marginal Social Benefit

the demand is the MSB of the good and its usefulness to society

5

New cards

Marginal Social Cost

the supply is the MSC of providing each additional quantity

6

New cards

What is the socially optimal quantity?

where MSB = MSC

7

New cards

What are externalities?

→ a third-person side effect

→ there are EXTERNAL benefits or external costs to someone other than the original decision maker

→ there are EXTERNAL benefits or external costs to someone other than the original decision maker

8

New cards

Why are externalities market failures?

→ the free market fails to include external costs or external benefits

→ with no government involvement there would be too much of some goods and too little of others

→ with no government involvement there would be too much of some goods and too little of others

9

New cards

Negative Externalities

situation that results in a COST for a different person other than the original decision maker; the costs “spillover” to other people or society

10

New cards

What should the government do to fix a negative externality?

tax the amount of the externality (per unit tax)

11

New cards

Positive Externalities

situations that result in a BENEFIT for someone other than the original decision maker; the benefits “spillover” to other people or society

12

New cards

What should the government do to fix a positive externality?

subsidize the amount of the externality (per unit subsidy)

13

New cards

The Tragedy of the Commons

→ goods that are available to everyone (air, oceans, lakes, public bathrooms) are often polluted since no one has the incentive to keep them clean

→ there is no monetary incentive to use them efficiently

→ result is high spillover costs

→ there is no monetary incentive to use them efficiently

→ result is high spillover costs

14

New cards

Public Sector

the part of the economy that is primarily controlled by the government

15

New cards

Private Sector

the part of the economy that is run by private individuals and companies that seek profit

16

New cards

Free Riders

individuals that benefit without paying

17

New cards

Why must the government provide public goods and services?

→ it is impractical for the free-market to provide these goods because there is little opportunity to earn profit

→ this is due to the Free-Rider Problem

→ this is due to the Free-Rider Problem

18

New cards

What is wrong with Free Riders?

→ they keep firms from making profits

→ if left to the free market, essential services would be underproduced

→ to solve the problem, the government can: ( 1 ) find new ways to punish free-riders, (2) use tax dollars to provide the service to everyone

→ if left to the free market, essential services would be underproduced

→ to solve the problem, the government can: ( 1 ) find new ways to punish free-riders, (2) use tax dollars to provide the service to everyone

19

New cards

Definition of Public Goods

( 1 ) Non-exclusionary

→ cannot exclude people from enjoying the benefits (even if they don’t pay)

( 2 ) Shared Consumption (Non-rival)

→ one person’s consumption of a good does not reduce its usefulness to others

→ cannot exclude people from enjoying the benefits (even if they don’t pay)

( 2 ) Shared Consumption (Non-rival)

→ one person’s consumption of a good does not reduce its usefulness to others

20

New cards

Antitrust Laws

laws designed to prevent monopolies and promote competition

21

New cards

Why would the government regulate a monopoly?

( 1 ) to keep prices low

( 2 ) to make monopolies efficient

( 2 ) to make monopolies efficient

22

New cards

How does the government regulate a monopoly?

price ceilings (taxes don’t work because they limit supply which is the problem)

23

New cards

Where should the government place the price ceiling?

( 1 ) Socially Optimal Price

→ P=MC (allocative efficiency)

( 2 ) Fair-Return Price (Break-Even)

→ P=ATC (normal profit)

→ P=MC (allocative efficiency)

( 2 ) Fair-Return Price (Break-Even)

→ P=ATC (normal profit)

24

New cards

Natural Monopoly

one firm can produce the socially optimal quantity at the lowest cost due to economies of scale

25

New cards

Per Unit Tax/Subsidy

affects the variable costs so MC, AVC, and ATC will shift

→ this WILL affect the quantity produced

→ this WILL affect the quantity produced

26

New cards

Lump Sum Tax/Subsidy

only affects fixed costs and so only AFC and ATC will shift

→ WILL NOT affect the quantity produced

→ WILL NOT affect the quantity produced

27

New cards

Why does the government tax?

( 1 ) Finance government operations

→ public goods-highways, defense, employee wages

→ fund programs → welfare, social security

( 2 ) Influence the economic behavior of firms and individuals

→ EX. excise taxes on tobacco raises tax revenue and discourages the use of cigarettes

→ public goods-highways, defense, employee wages

→ fund programs → welfare, social security

( 2 ) Influence the economic behavior of firms and individuals

→ EX. excise taxes on tobacco raises tax revenue and discourages the use of cigarettes

28

New cards

Three Types of Taxes

( 1 ) Progressive Taxes

( 2 ) Proportional Taxes (flat rate)

( 3 ) Regressive Taxes

( 2 ) Proportional Taxes (flat rate)

( 3 ) Regressive Taxes

29

New cards

Progressive Taxes

takes a larger percent of income from high income groups (takes more from rich people)

30

New cards

Proportional Taxes (flat rate)

takes the same percent of income from all income groups

31

New cards

Regressive Taxes

takes a larger percentage from low income groups (takes more from poor people)

32

New cards

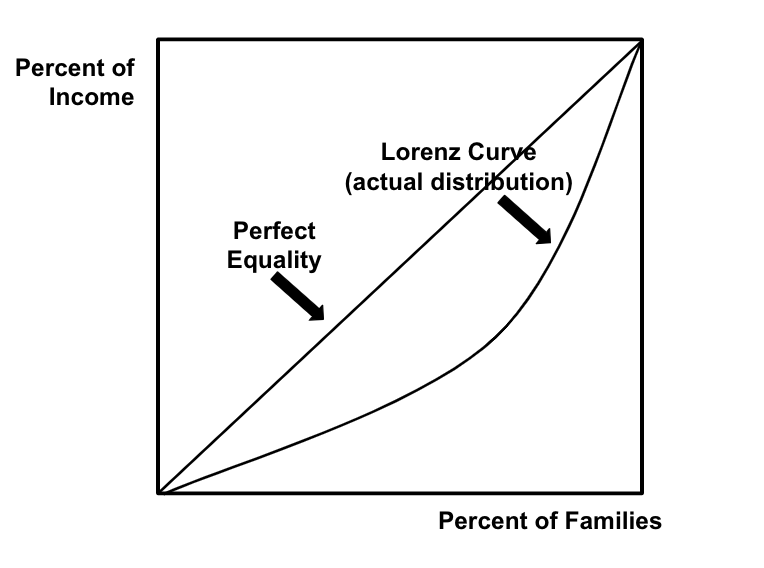

The Lorenz Curve