Understanding Interest Rates and Financial Instruments

1/355

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

356 Terms

What is the present value (PV) formula?

PV = FV / (1 + i)^n.

What is the present value of $250 to be paid in 2 years at an interest rate of 15%?

$189.04.

Why is a dollar paid in the future less valuable than a dollar today?

Because you can deposit a dollar today and earn interest, making it worth more in the future.

What is the present value of a $1 million lottery payment received in one year at a 10% interest rate?

$909,090.

What are the four types of credit market instruments?

1. Simple loan 2. Fixed payment loan 3. Coupon bond 4. Discount bond.

What characterizes a simple loan?

A lender provides an amount of funds that must be repaid at maturity along with interest.

What is a fixed payment loan?

A loan that requires the borrower to make the same payment, consisting of principal and interest, every period for a set number of years.

What is a coupon bond?

A bond that pays fixed interest payments until maturity, when the face value is repaid.

What are the four pieces of information that identify a coupon bond?

1. Bond's face value 2. Issuer (corporation or government agency) 3. Maturity date 4. Coupon rate.

How is the coupon rate calculated?

Coupon rate = coupon payment / face value.

What is a discount bond?

A bond bought at a price below its face value, repaid at face value at maturity, without interest payments.

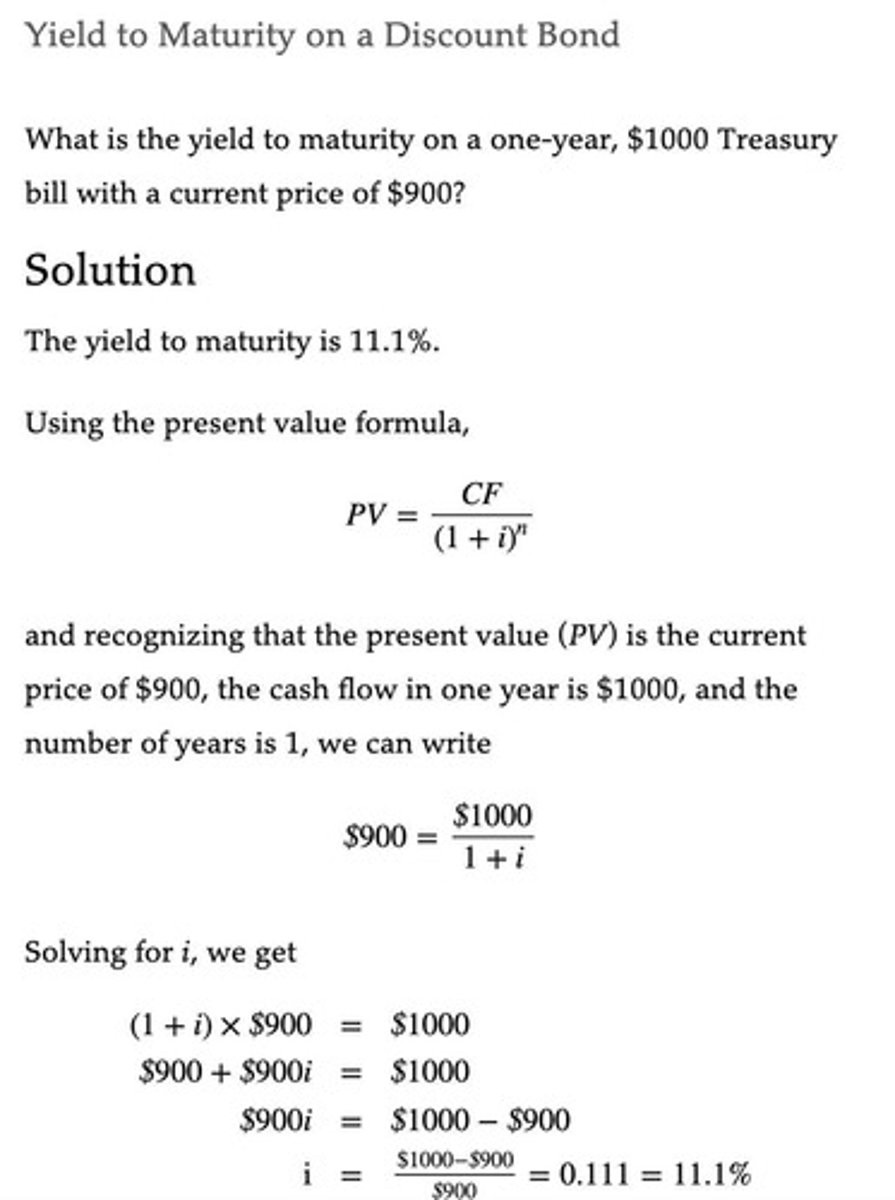

What is the yield to maturity (YTM)?

The interest rate that equates the present value of cash flows from a debt instrument with its current value.

How does the simple interest rate relate to the yield to maturity for simple loans?

For simple loans, the simple interest rate equals the yield to maturity.

What is the yield to maturity on a simple loan of $100 that requires $110 repayment in one year?

10% YTM.

What is an example of a fixed payment loan?

A mortgage where the borrower pays a fixed amount every period until the loan is paid off.

What is the difference between simple loans and discount bonds compared to fixed payment loans and coupon bonds?

Simple loans and discount bonds make payments only at maturity, while fixed payment loans and coupon bonds make periodic payments.

What is the formula to calculate the yield to maturity for a simple loan?

PV = FV / (1 + i)^n.

What is the significance of present value in finance?

It reflects the current worth of future cash flows, accounting for interest rates.

What is an example of a coupon payment for a bond with a $1000 face value and a 10% coupon rate?

$100 per year.

What happens to the value of future payments if interest rates increase?

The present value of future payments decreases.

Why is understanding interest rates important in finance?

They affect the cost of borrowing and the return on investments.

What is the relationship between the price of a coupon bond and its yield to maturity (YTM)?

The price of a coupon bond and YTM are negatively related; when the price rises, the YTM falls.

When is the YTM equal to the coupon rate for a coupon bond?

The YTM equals the coupon rate when the bond is priced at its face value.

What happens to the YTM when the bond price is below its face value?

The YTM is greater than the coupon rate when the bond price is below its face value.

What happens to the YTM when the bond price is above its face value?

The YTM is less than the coupon rate when the bond price is above its face value.

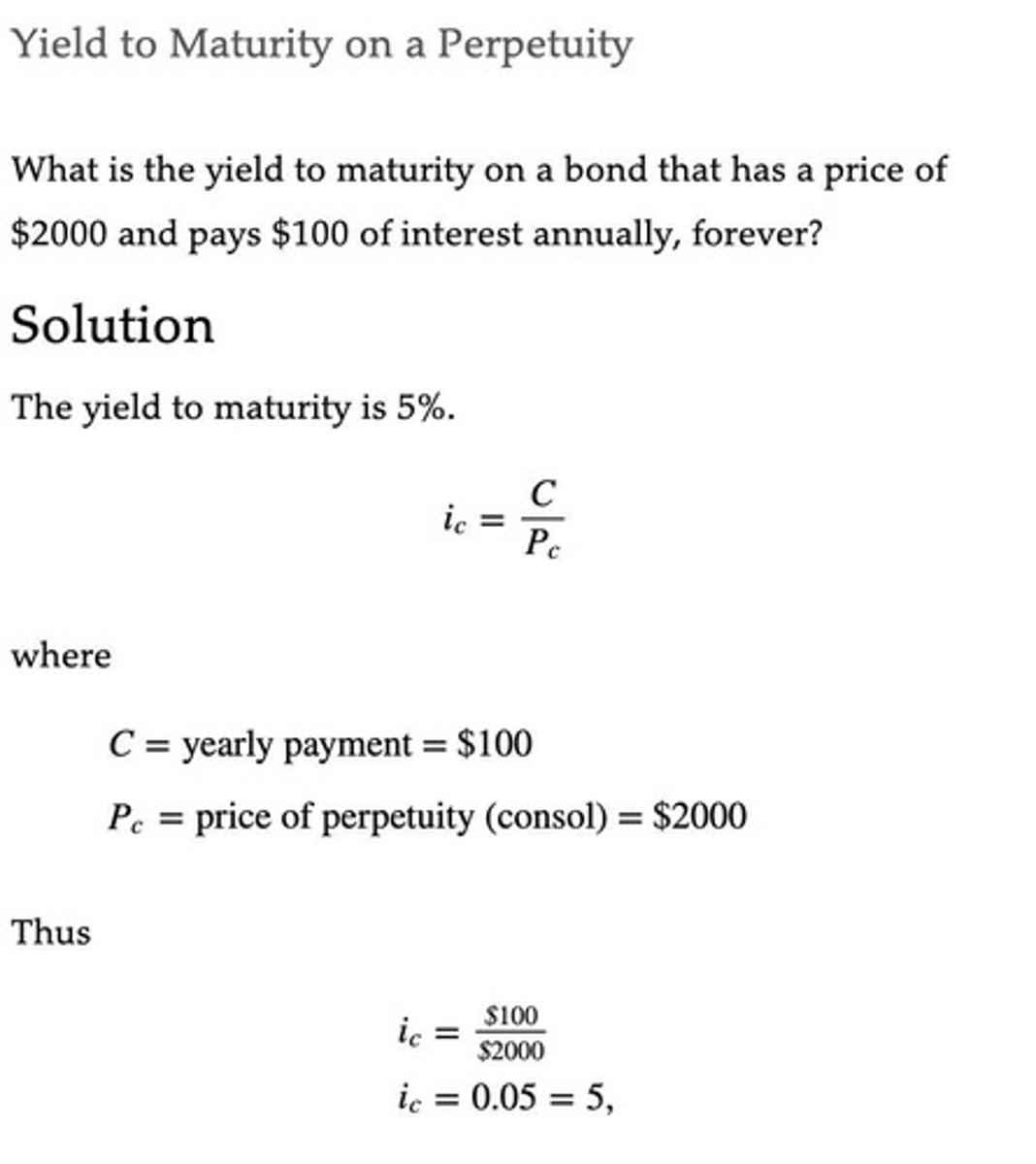

What is a consol or perpetuity?

A perpetual bond with no maturity date that makes fixed coupon payments of $C forever.

How is the price of a perpetuity calculated?

The price of a perpetuity (Pc) is calculated as Pc = C / ic, where C is the yearly payment and ic is the YTM of the perpetuity.

What happens to the price of a perpetuity when the interest rate increases?

As the interest rate (ic) increases, the price of the perpetuity falls.

What is the YTM of a bond that has a price of $2000 and pays $100 of interest annually?

The YTM is 5%, calculated as YTM = $100 / $2000.

What is the relationship between the YTM and the current bond price for discount bonds?

The YTM is negatively related to the current bond price; a rise in YTM results in a fall in bond price.

What is interest rate risk in the context of long-term bonds?

Interest rate risk is the potential change in returns associated with fluctuations in interest rates.

When is there no interest rate risk for a bond?

There is no interest rate risk when the bond's maturity equals the holding period.

What happens to the price at the end of the holding period for bonds with no interest rate risk?

The price at the end of the holding period is fixed at the face value.

What is the effect of a rise in YTM on the price of a bond?

A rise in YTM leads to a fall in the price of the bond.

What is the effect of a bond price increasing from $900 to $950?

This indicates a smaller increase in its price at maturity to the face value of $1000.

What is the formula for calculating the YTM of a perpetuity?

The formula is ic = C / Pc, where C is the yearly payment and Pc is the price of the perpetuity.

What is the significance of the relationship between YTM and coupon rate?

When YTM equals the coupon rate, the bond price equals its face value.

How does the volatility of long-term bonds compare to short-term bonds?

Prices and returns for long-term bonds are more volatile than those for shorter-term bonds.

What is the implication of a bond's maturity being greater than its holding period?

When maturity is greater than the holding period, there is interest rate risk.

What does it mean when the YTM is less than the coupon rate?

It means that the bond price is above its face value.

What does it mean when the YTM is greater than the coupon rate?

It indicates that the bond price is below its face value.

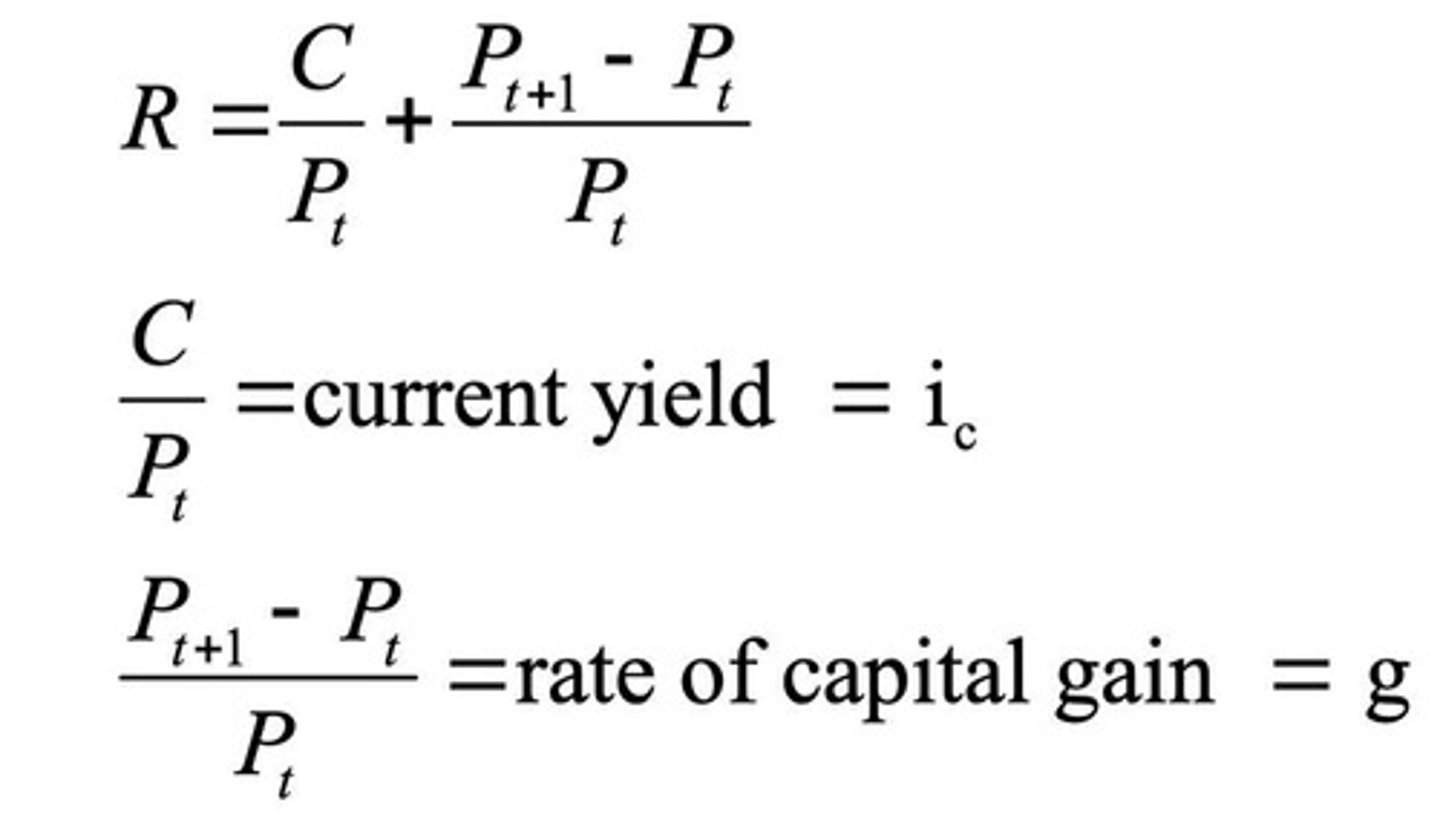

What is the formula for rate of return on a bond?

Rate of return = (coupon payments + change in bond's price) / bond's initial price.

How is current yield calculated?

Current yield = coupon payment / bond's initial price.

What is the relationship between interest rates and bond prices?

Higher interest rates lead to lower bond prices, resulting in capital losses for bonds with terms to maturity greater than the holding period.

What happens to bond prices when interest rates rise?

Bond prices fall, which can result in capital losses for bondholders.

What is capital gain in the context of bonds?

Capital gain = change in bond's price / initial bond's price.

What is the effect of a bond's maturity on its price volatility?

Long-term bonds are more volatile in price compared to short-term bonds.

When do returns on bonds equal their initial yields to maturity?

Returns equal initial yields to maturity when the holding period equals the time to maturity.

What is reinvestment risk in bond investing?

Reinvestment risk occurs when the term to maturity of the bond is less than the holding period, benefiting from rising interest rates and being hurt by falling rates.

What is the impact of a bond's maturity on the rate of return when interest rates rise?

The more distant a bond's maturity date, the lower the rate of return that occurs as a result of an increase in interest rates.

What is the formula for total return on a bond?

Return = current yield + rate of capital gain.

What does it mean if a bond's return turns out to be negative?

A bond's return can be negative if interest rates rise significantly after purchase.

What happens to the price of a bond if the holding period is equal to its maturity?

When the maturity equals the holding period, the price equals the face value and there is no interest rate risk.

How does a change in interest rates affect long-term bonds compared to short-term bonds?

Long-term bonds respond more dramatically to changes in interest rates than short-term bonds.

What is the effect of a rise in interest rates on existing bondholders?

Existing bondholders may face capital losses due to falling bond prices.

What is the relationship between bond price changes and interest rate changes?

The more distant a bond's maturity date, the greater the percentage price change associated with an interest rate change.

What is the significance of the holding period in relation to bond returns?

If the holding period is less than the bond's term to maturity, the bond may benefit from rising interest rates.

What is the formula for calculating the rate of capital gain on a bond?

Rate of capital gain = change in bond price / bond's initial price.

What is the implication of a bond having a substantial initial interest rate?

Even with a substantial initial interest rate, the bond's return can be negative if interest rates rise.

What does it mean for a bond to have substantial interest rate risk?

Long-term debt instruments have substantial interest rate risk, while short-term instruments do not.

How can fluctuations in bond prices affect returns?

The return can differ from the interest rate if the bond experiences substantial capital gains or losses due to price fluctuations.

What is the relationship between coupon payments and bond returns?

Coupon payments contribute to the current yield, which is part of the total return on a bond.

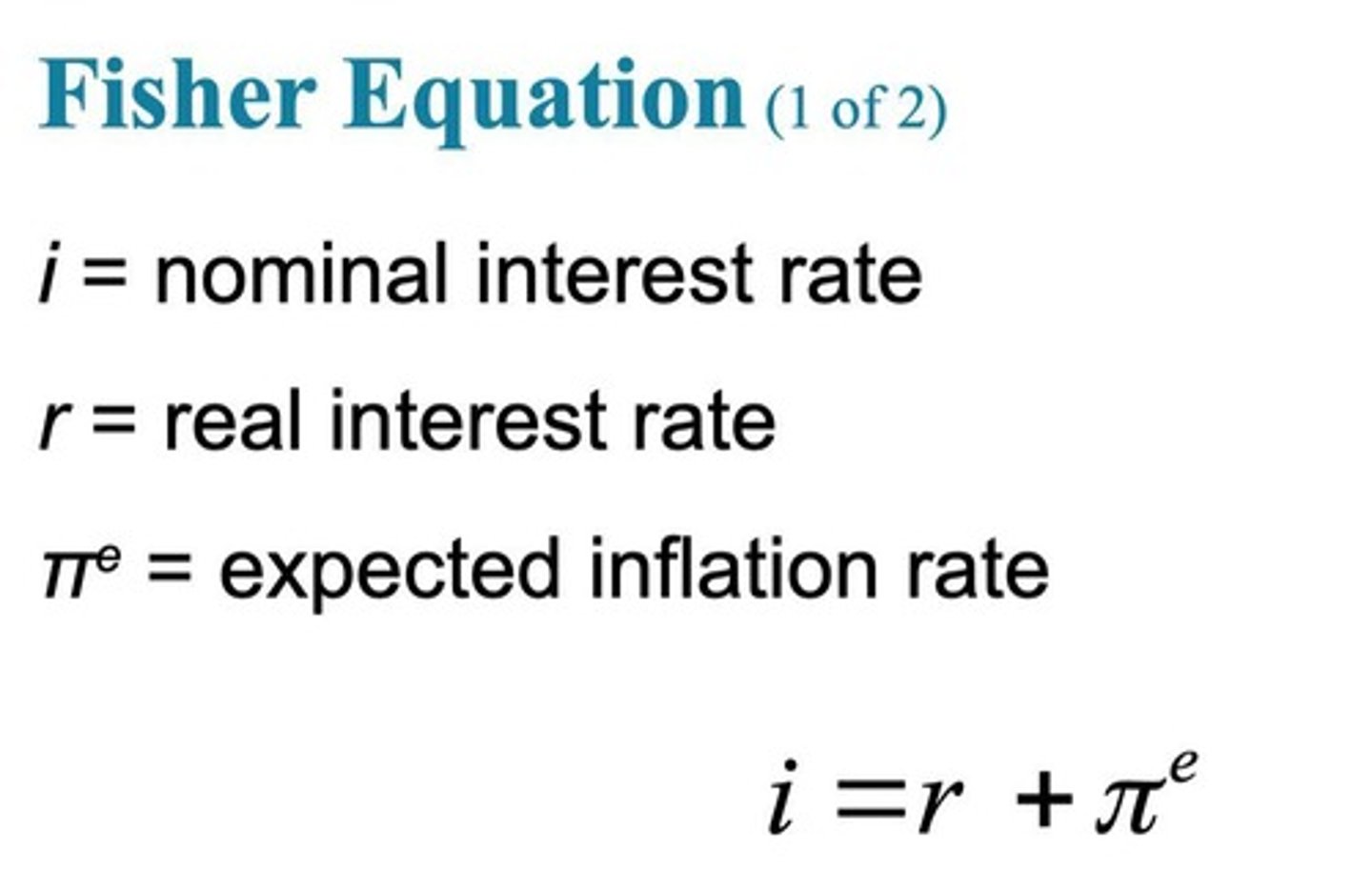

What is the difference between nominal and real interest rates?

Nominal interest rates do not account for inflation, while real interest rates adjust for changes in the price level.

What is the ex-ante real interest rate?

The ex-ante real interest rate is the forecasted interest rate used to adjust for expected changes in the price level.

What is the post-ante real interest rate?

The post-ante real interest rate is adjusted for actual changes in the price level.

What happens to borrowing incentives when the real interest rate is low?

There is a greater incentive to borrow when the real interest rate is low.

How do low-interest rates affect lending incentives?

Low-interest rates reduce the incentive to lend, as lenders earn less interest on loans.

How is the nominal interest rate calculated?

The nominal interest rate is calculated as the real interest rate plus the expected rate of inflation (i = r + pi).

How is the real interest rate calculated?

The real interest rate is calculated as the nominal interest rate minus the expected rate of inflation (real interest rate = nominal interest rate - expected rate of inflation).

What is the after-tax real interest rate formula?

The after-tax real interest rate is calculated as nominal interest rate (1 - income tax rate) minus the expected rate of inflation.

What does it mean if the real interest rate is negative?

If the real interest rate is negative, the lender earns a negative interest, meaning the borrower is better off in real terms.

What is the real interest rate if the nominal interest rate is 8% and the expected inflation rate is 10%?

The real interest rate would be -2% (8% - 10%).

What do stockholders own in a corporation?

Stockholders own an interest in the corporation equal to the percentage of outstanding shares.

What rights do stockholders have?

Stockholders have the right to vote and are residual claimants, meaning they receive what's left during liquidation after debtors are repaid.

How often do stockholders typically receive dividend payments?

Stockholders may receive dividend payments periodically, such as every quarter.

Who sets the level of dividends for a corporation?

The Board of Directors sets the level of the dividends.

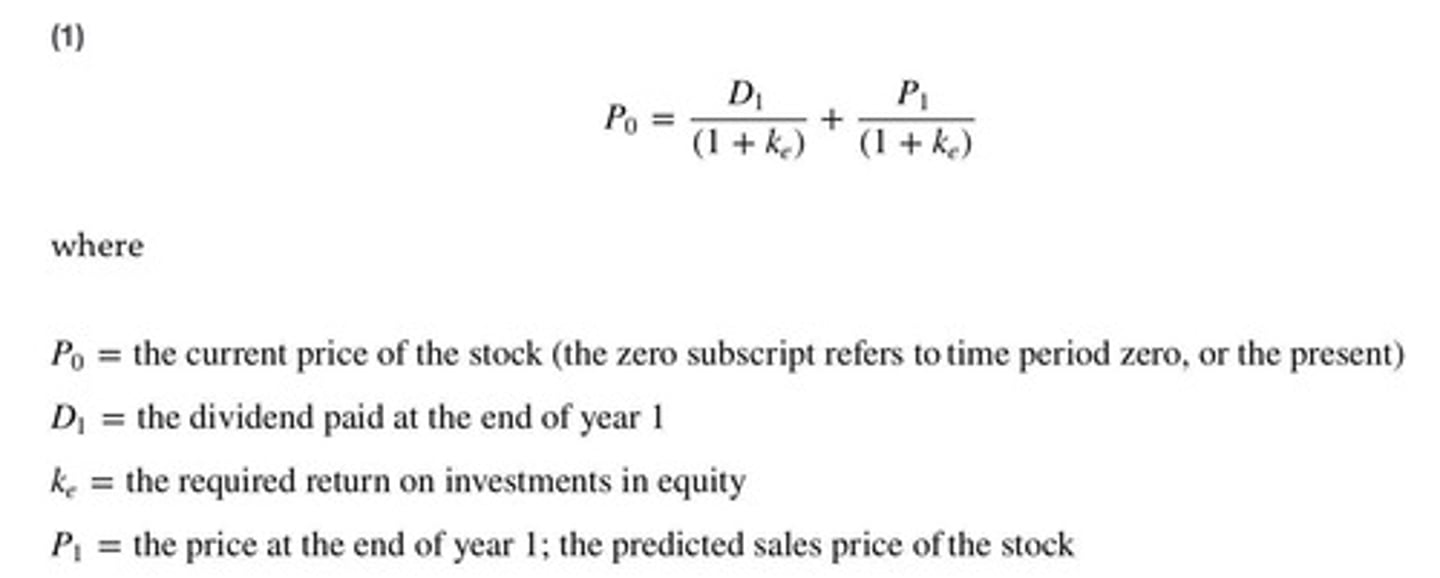

What is the One-Period Valuation Model used for?

The One-Period Valuation Model is used to calculate the present value of all cash flows from an investment.

How is the present value of a stock calculated using the One-Period Valuation Model?

The present value is calculated by summing the present value of the expected dividend and the expected selling price.

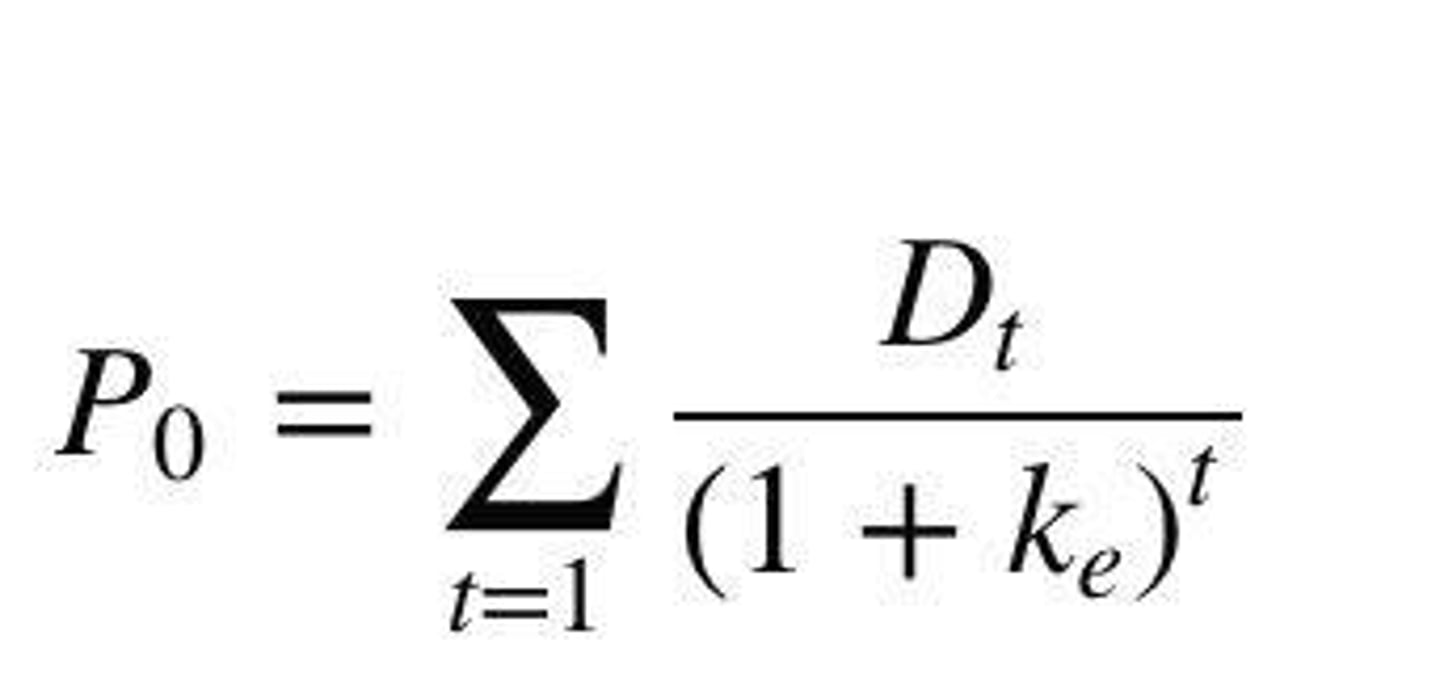

What is the Generalized Dividend Valuation Model?

The Generalized Dividend Valuation Model states that the value of a stock today is the present value of all future cash flows, primarily dividends.

What cash flows does an investor receive from a stock?

The only cash flows an investor receives are dividends and the final sales price.

What must be determined before using the Generalized Dividend Valuation Model?

You must find the future expected price of the stock (Pn) before using the formula.

What does the Generalized Dividend Model state about stock price determination?

The price of a stock is determined only by the present value of the dividends.

What is the significance of the present value in stock valuation?

The present value reflects the worth of future cash flows in today's terms, helping investors make informed decisions.

What does it mean for a stock to be priced below its calculated present value?

If a stock is priced below its calculated present value, it may indicate that other investors perceive greater risk or have lower estimates of future cash flows.

What is the expected return on investment in the example provided for RBC stock?

The expected return on investment is 12%.

What dividend does the Royal Bank pay per year in the example?

The Royal Bank pays a dividend of $0.16 per year.

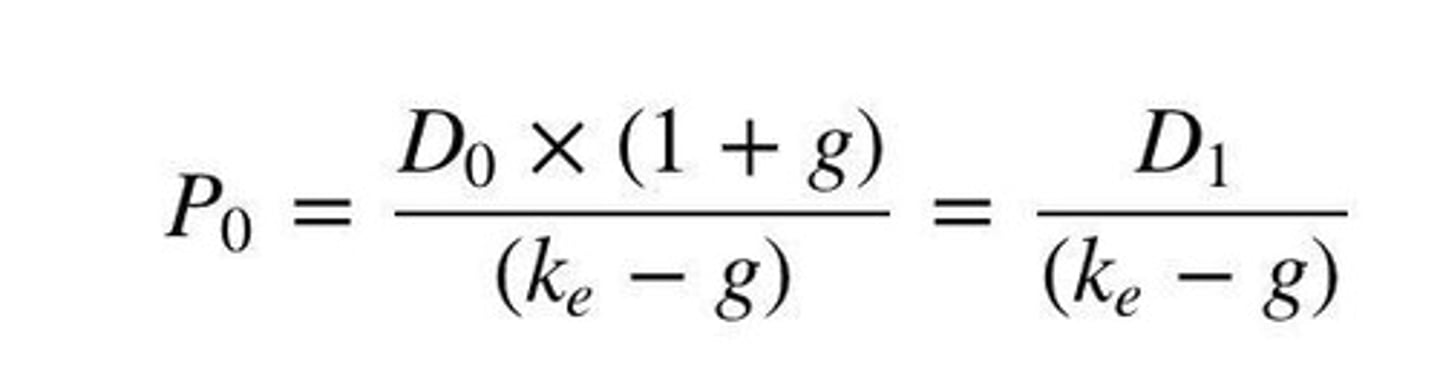

What does the Gordon Growth Model require for stock valuation?

The present value of an infinite stream of dividends.

What are the two key assumptions of the Gordon Growth Model?

1. Dividends grow at a constant rate forever. 2. The growth rate is less than the required return on equity.

Why is it problematic if the growth rate exceeds the required return on equity?

The firm would grow impossibly large in the long run.

What does D0 represent in the Gordon Growth Model?

The most recent dividend paid.

What does G represent in the Gordon Growth Model?

The expected constant growth rate in dividends.

What does Ke represent in the Gordon Growth Model?

The required return on an investment in equity.

What is the Efficient Market Hypothesis?

It assumes that prices of securities fully reflect all available information.

What is the formula for the rate of return on a security?

R = (Pt+1 - Pt + C) / Pt.

What do the variables in the rate of return formula represent?

R = rate of return; Pt+1 = price at time t+1; Pt = price at time t; C = cash payment during the period.

What is the only uncertain variable in the rate of return formula?

The price next period, Pt+1.

What does Pe represent in the context of the Efficient Market Hypothesis?

The expected price of the security at time t+1.

What is the relationship between expected return (Re) and optimal forecast of return (Rof)?

Re = Rof, meaning expected return equals the optimal forecast of return.

What is R* in the context of financial markets?

The equilibrium return, where the quantity of the security demanded equals the quantity supplied.

What does the equation Re = Rof imply?

The expected return on the security will equal the optimal forecast of the return.