T4A - ACCOUNTS RECEIVABLES MANAGEMENT

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

AR management on profitability

money is tied up in AR

increase risk of bad debt

AR management on liquidity

efficient collection ensures steady cashflows to meet short-term payments

better liquidity as cash is not tied up in AR

5 Cs of credit selection

character, capacity, capital, collateral, and conditions

character

past payment history

capacity

ability to pay

capital

financial strength

insolvency risk

collateral

amount of assets provided as security

conditions

current economic and business climate

credit standards

minimum standard for extending credit

relaxation of credit standards (sales volume)

sales volume and profit increase

relaxation of credit standards (investment in AR and bad debts)

investment in AR and bad debts increase

profit will decrease

credit terms

repayment terms for credit customers

a/b, net c

a = cash discount

b = cash discount period

c = credit period

collection policy

procedures for collecting AR when due

tightened collection policy (sales volume)

sales volume and profit decrease

tightened collection policy (investment in AR and bad debts)

investment in AR and bad debts decrease, profit increase

tightened collection policy (collection expense)

collection expense increase, profit decrease

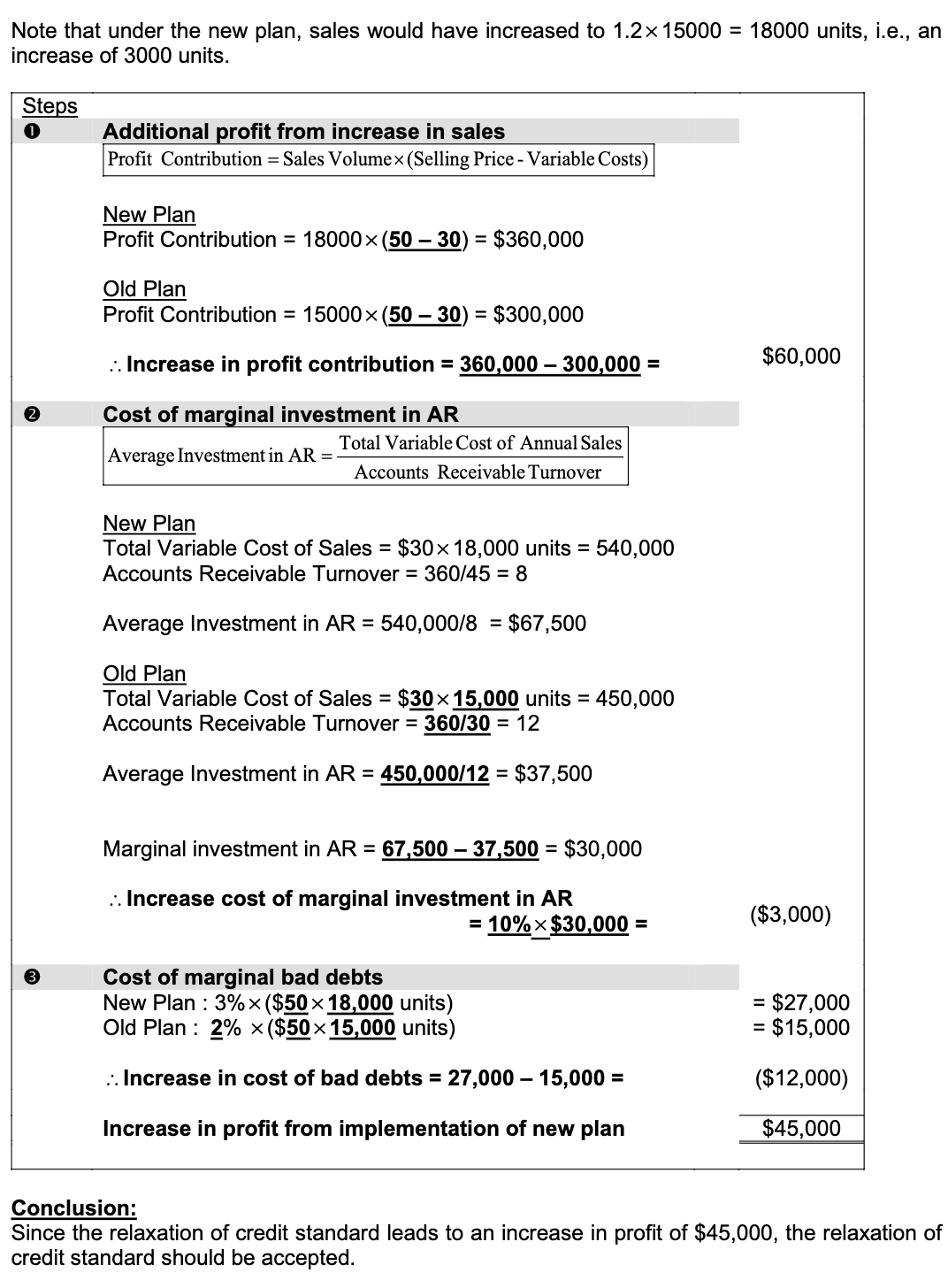

marginal analysis

incremental analysis

function of marginal analysis

comparing cost and benefits after change in credit policy

accept proposal

benefit > costs

reject proposal

costs > benefit

bad debts

bad debts % x selling price x sales volume

marginal investment

opportunity cost

marginal analysis table