Macroeconomic aims and issues: inflation and deflation

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

22 Terms

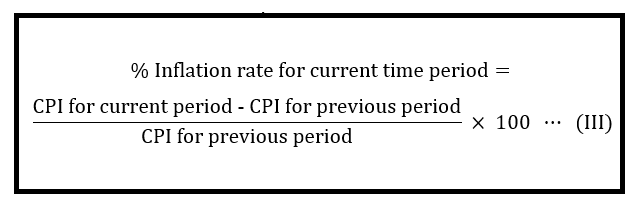

what is inflation and how is it calculated

sustained increase in the GPL

calculated using a percentage change in the country’s CPI

on average, prices are rising for a sustained period of time

what is mild/low inflation

inflation rate that is single digit and does not distort relative prices severely

CB typically target about 2-3%

what is galloping inflation

price level increasing at a higher rate at double or triple digits

cause money to lose its value at a rapid rate

what is hyperinflation

extremely high (more than triple digit) rate of inflation

people lose confidence in the currency

→ currency ceases to function as a medium of exchange

people may resort to barter trade

what is disinflation

slowing rate of price increases or falling inflation

what is deflation

falling prices or negative inflation wh

what is stagflation

a period of

rising prices

coupled with no or negative growth in real GDP/GNP

and high or rising unemployment

what is anticipated inflation

effect of anticipated inflation on individuals and businesses

inflation rate that is steady and expected

when inflation is anticipated, individuals and businesses are able to accurately predict the inflation which will take place

what is unanticipated inflation

effect of unanticipated inflation on individuals and businesses

inflation that is volatile and unexpected

occurs when economic agents (households, firms, government) make errors in their inflation forecasts

and actual inflation ends up well below or significantly above expectations

difficult for individuals and businesses to correctly predict the rate of inflation for the near future

what does CB do with regards to inflation

monitors inflation rate ti ensure an environment of low inflationary pressures conducive to sustainable economic growth

outline inflation in SG

what about SG makes it prone to inflation

impact of inflation in SG

SG: small and open economy, import reliant

exposed to global events

eg strong recovery in global growth and demand with the arrival of covid-19 vaccines

increase in price of gas and oil on the back of a SS crunch and geopolitical tensions

pandemic-related disruptions to the world’s supply chains

covid 19 border curbs → tighter labour market → increase in wages → increase in CoP

Impact

CoL increase

local i/r

bank loans affected by i/r hikes overseas

GST hike

rise in GPL due to rise in COP

outline the causes of inflation

demand-pull inflation

cost-push inflation

explain cause of demand pull inflation

caused by persistent rises in AD

associated with booming economy

reflected by continuous shifts of the AD curve to the right

Sources of DD-pull inflation

non-GPL factors that cause an increase in autonomous C, I, G and NX

eg monetary or fiscal stimulus

positive expectations about future income/sales

rising property prices

expectations about inflation

economic growth in other countries

etc

explain price adjustment process for demand-pull inflation

eg increase in NX; assume economy is operating along intermediate range of AS curve

increase in AD as NX is a component of AD

rightward shift of AD curve from AD0 to AD1

shortages in the economy created as current spending exceeds current production levels at initial GPL P0

firms respond to the rise in demand partly by raising prices and partly by increasing output

because as economy approaches full employment, fewer idle FoPs like labour and raw materials

competition for fewer idle FoPs becomes greater → firms bid up factor prices

As each additional unit of output becomes costlier to produce, prices have to increase to ensure that production remains profitable

increase in RNY from Y0 to Y1 is accompanied by an increase in GPL from P0 to P1

what can cause inflation to persist

taking example of the export boom

export boom → households and firms have greater confidence in the future

expect income and sales to continue to increase in the future

households and firms have incentive to buy more and invest more in current time period

→ increase in autonomous C and autonomous I

→ AD increases further (another rightward shift of AD curve)

GPL will increase further

higher demand pull inflationary pressures

what does extent of increase in GPL depend on

how much spare capacity economy has

whether economy is operating on horizontal range of AS curve, intermediate range of AS curve or vertical range of AS curve

extent of increase in GPL if economy is operating on horizontal range of AS curve

Case 1: horizontal range, low levels of RNY/output

a lot of available spare capacity

firms can easily expand output (increase production) to meet increases in demand without increasing prices

firm can increase production without firms bidding up prices of FoPs to hire more FoPs

output rises without pressure on price to increase, firms don’t have to pass on any increase in CoP to consumers

extent of increase in GPL if economy is operating on intermediate range of AS curve

fewer idle FoPs

firms compete and bid up prices of factor inputs

the closer to Yf, resources become decreasingly idle → GPL rises faster

each additional unit of output becomes much costlier to produce

the closer to Yf, price increases by a increasingly greater extent for a given increase in AD

extent of increase in GPL if economy is operating on vertical range of AS curve

full employment level reached

impossible increase output

only pressure on price to increase

what is cost-push inflation

sustained increase in GPL caused by persistent falls in AS, independent of level of AD

continuous upward shifts on AS curve

and/or leftward shifts of AS curve

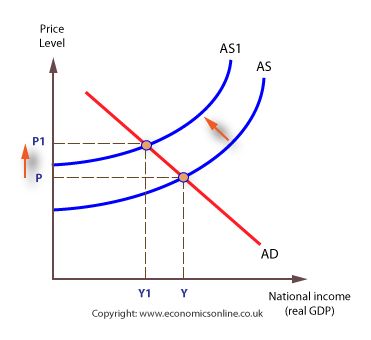

explain price adjustment for cost-push inflation

if there is an increase in the CoP due to eg an increase in the price of oil

AS will fall

AS curve shifts upwards from AS0 to AS1

shortages at prevailing price level P0 and firms will take the opportunity to raise prices

outline sources of cost push inflation