Principles of Econ Key Concepts

1/117

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

118 Terms

What does consumer surplus measure?

The economic measure of the benefit that consumers receive when they pay less for a product than what they were willing to pay

How do you calculate consumer surplus?

The difference between what a buyer is willing to pay and what they actually pay.

What does willingness to pay mean?

The maximum amount a buyer is willing to spend on a good

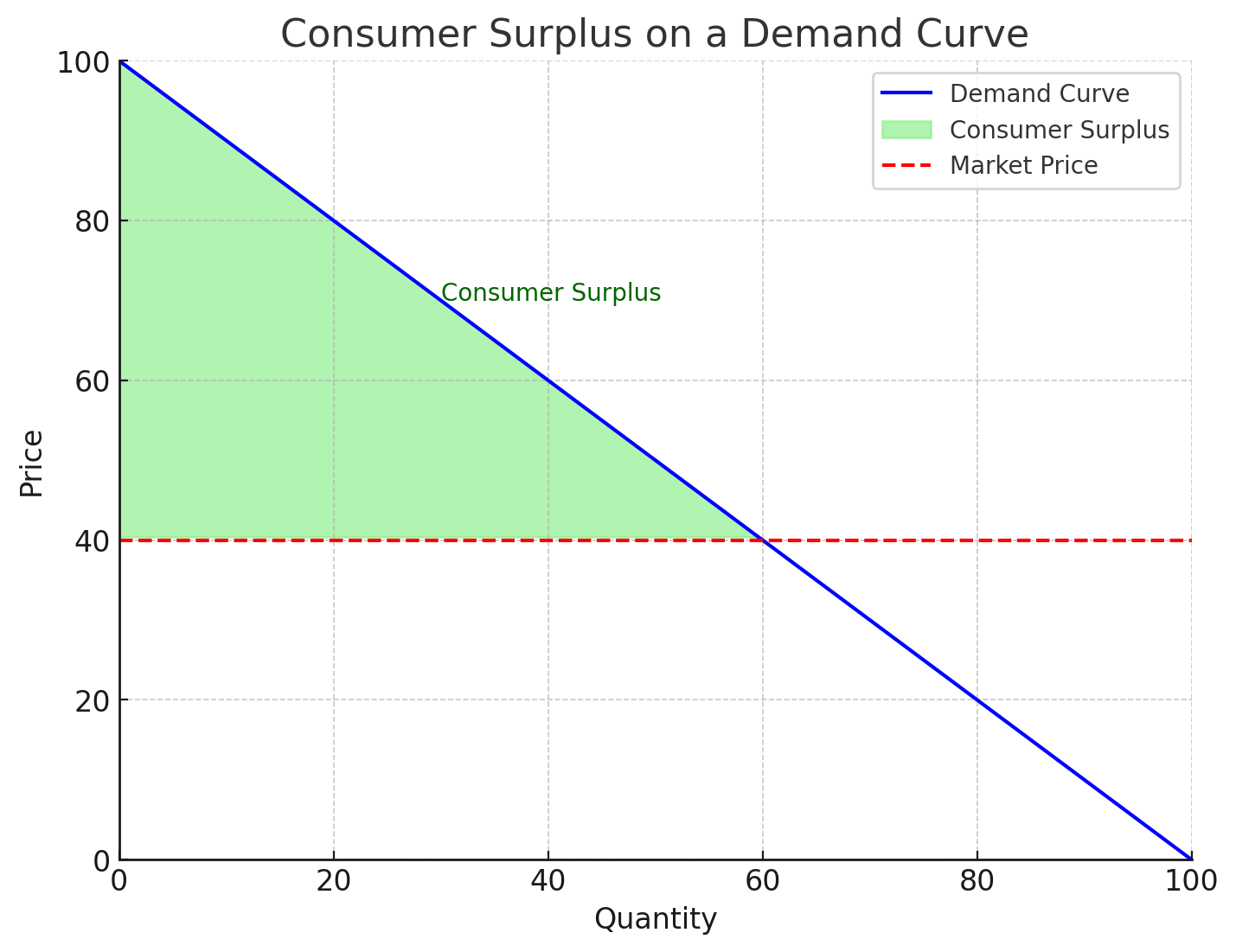

What does the height of the demand curve represent?

The height of the curve at a particular point indicates the maximum price someone is willing to pay for that specific quantity

Where is consumer surplus found on a graph?

The area below the demand curve and above the price level.

What happens to consumer surplus when price falls?

It increases for two reasons:

Existing buyers get more surplus by paying less

New buyers enter the market because the price is now below their willingness to pay. Total consumer surplus in the market increases

What does producer surplus measure?

The benefit that producers receive when they sell a product for a price higher than their minimum acceptable price

How do you calculate producer surplus?

The amount a seller is paid for a good minus the seller’s cost of producing it

Define seller’s cost of production

The producers’ opportunity cost of production: the actual out-of-pocket expenses plus the value of the producers’ time

The cost of production is the minimum amount a seller is willing to accept in order to produce the good.

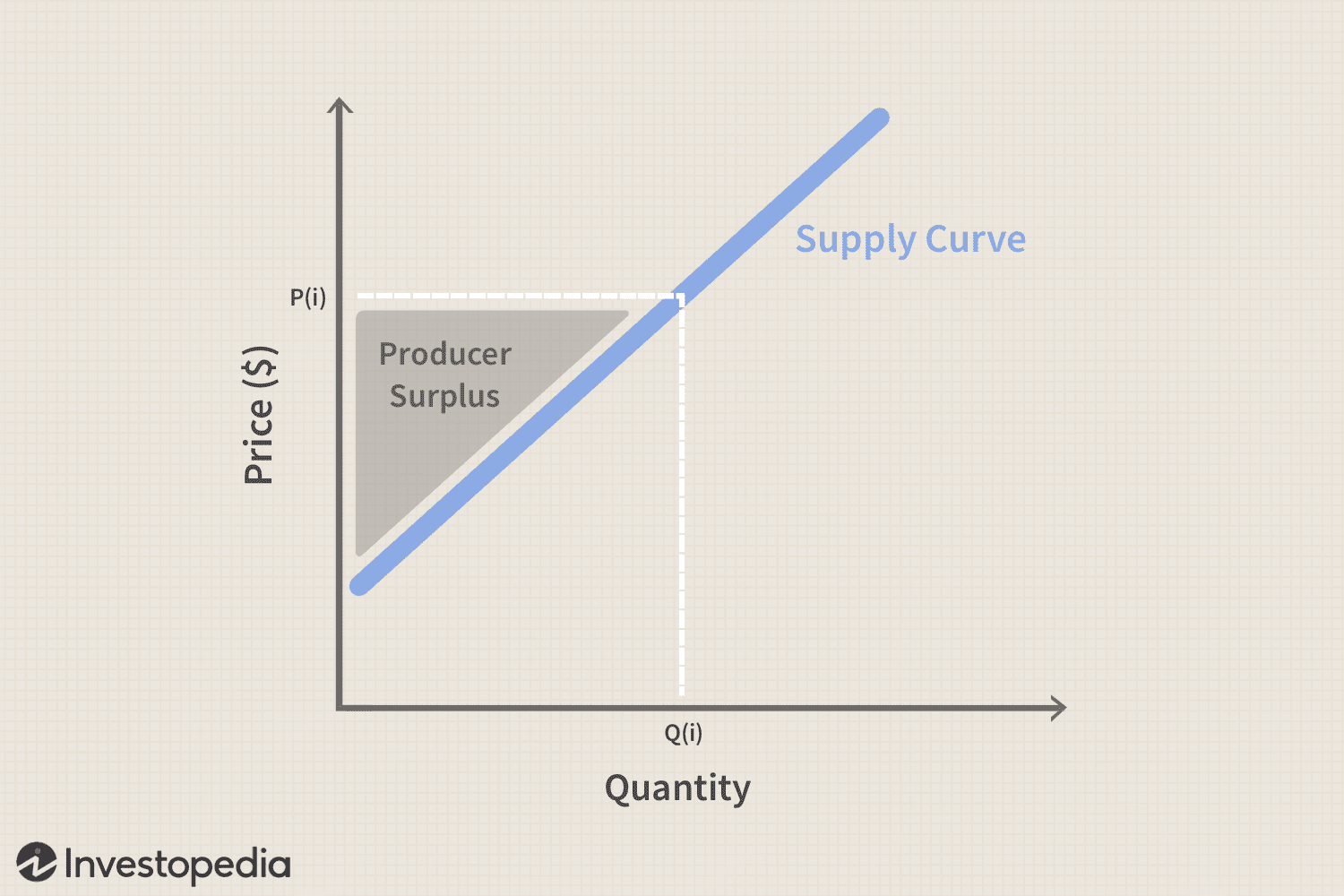

What does the height of the supply curve represent?

The height of the supply curve at a particularly quantity represents the minimum price a seller is willing to accept for that quantity

Where is producer surplus found on a graph?

producer surplus in a market is the area below the price and above the supply curve

How does a price increase affect producer surplus?

Existing sellers get more surplus (they sell at a higher price)

New sellers enter the market as price now covers their cost. Total producer surplus in the market increases.

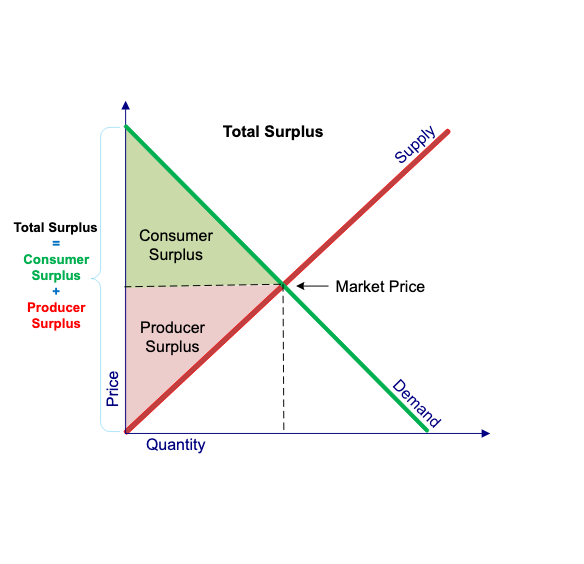

What is total surplus?

the sum of consumer and producer surplus; measures economic well being or total benefit to society from market transactions

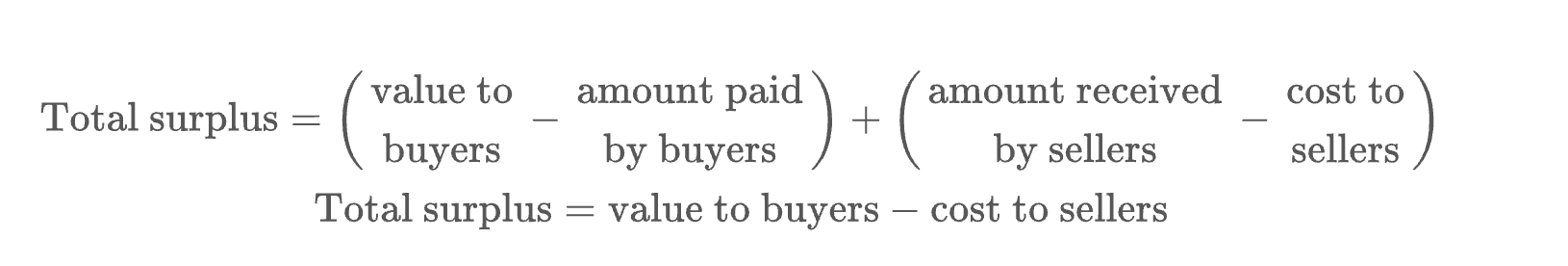

How do we calculate total surplus?

Graphically total surplus is …

The area below the demand curve and above the supply curve.

What is free market equilibrium and why is it efficient?

Free market equilibrium, where supply equals demand, is efficient because it maximises total surplus

How do free markets ensure efficient allocation?

Buyers who value the good most (WTP ≥ price) get it → maximises consumer surplus

Sellers with the lowest cost (cost ≤ price) sell it → maximizes producer surplus

Produces the quantity of goods that maximizes the sum of consumer and producer surplus or total surpluls

What is market failure?

The inability of some unregulated markets to allocate resources efficiently.

What are the two main causes of market failure?

Market power: ability of buyers or sellers to become too powerful and unfairly control prices like a monopoly

Externalities: side effects on third parties not involved in the transaction like pollution

Why do market power and externalities cause inefficiency?

Market power distros prices and quantities away from equilibrium

Externalities the full cost or benefit of a good isn't reflected in the market price

Negative externality

Market ignores harm to others so too much is produced

Positive externality

Market ignores benefit to others so too little is produced

What is a deadweight loss from a tax?

The reduction in total surplus that results from a tax, which prevents some mutually beneficial trades between buyers and sellers

How do taxes affect prices and quantities for buyers and sellers?

Buyers pay more, leading to a reduced quantity demanded

Sellers receive less, resulting in a reduced quantity supplied

What determines the size of the deadweight loss from a tax?

The elasticities of supply and demand. The more elastic they are, the larger the deadweight loss.

Why do elastic supply and demand increase deadweight loss?

Buyers and sellers respond strongly to price changes. A tax makes buyers pay more and sellers receive less, so both reduce how much they trade. This drop in quantity causes a larger deadweight loss as more beneficial trades are lost.

What is the main source of deadweight loss in the U.S economy?

The tax on labour, including income taxes and Social Security taxes.

How do labour taxes cause deadweight loss?

They discourage work, cause some to work fewer hours, retire early, ore move to the underground economy, especially if labour is elastic.

How does deadweight loss change as taxes increase?

Deadweight loss rises faster than the tax; it increases with the square of the tax rate

Example of how deadweight loss increases with tax size

If a tax is doubled, deadweight loss quadruples; if tripled, deadweight loss grows 9 times

How does tax revenue change as tax size increases?

At first, tax revenue increases because each unit is taxed more. Eventually it decreases as tax size continues to rise, because high taxes discourage economic activity, causing a reduction in the quantity of goods or services exchanged, and ultimately lowers the amount of tax collected.

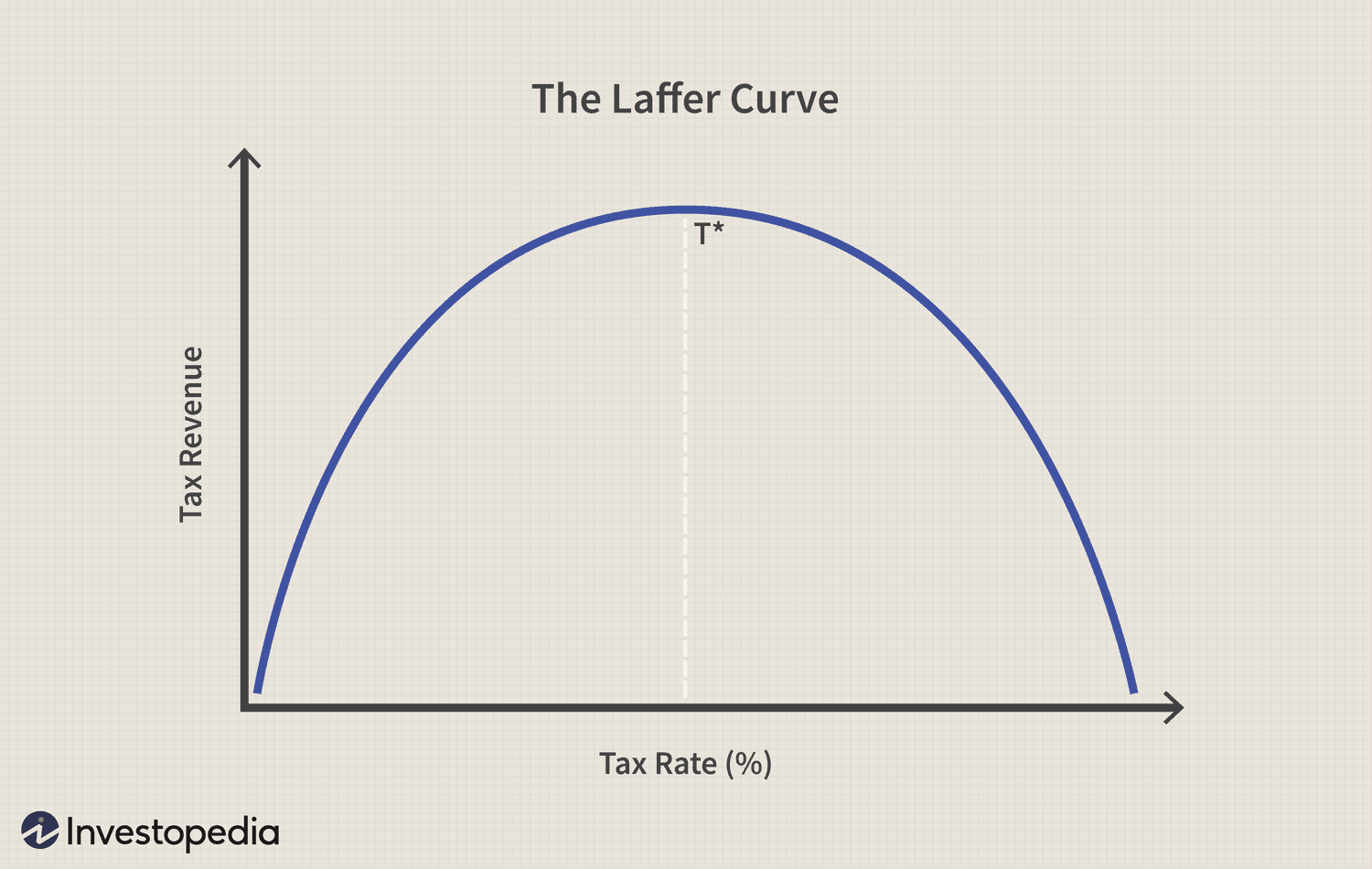

What is the Laffer Curve?

A graph showing that as tax rates rise, tax revenue first increases, then falls after a certain point due to reduced market activity

Key insight of the Laffer Curve

When tax rates are very high, cutting taxes might actually increase revenue

What are the two main costs taxes place on market participants?

Buyers and sellers lose part of their money to the government through taxes

Fewer goods are produced and sold causing society to lose some of the benefits of efficient markets.

What happens in the market in the absence of international trade?

The market operates solely based on domestic supply and demand. The equilibrium price and quantity are determined by the intersection of the domestic supply and demand curves.

What is the world price?

The price of the good that prevails in the world market for that good

How can comparing the world price and domestic price before trade help?

It shows whether a country has a lower opportunity cost (and thus a comparative advantage) in producing a good

If the world price is above the domestic price for a good..

The country has a comparative advantage in the production of that good and that good should be exported if trade is allowed

If the world price is below the domestic price for a good..

Foreign countries have a comparative advantage in the production of that good and that good should be imported if trade is allowed.

What does it mean for a country to be a price taker in world markets?

It accepts the world price as given and cannot influence it.

What happens if the world price is higher than the domestic price before trade?

Domestic producers realize they can sell goods at higher price internationally

Export their goods

Domestic supply decreases

Scarcity drives up prices until it matches higher world price

Who gains and loses when a country becomes an exporter?

Domestic producers are better off

Receive more for their product than their minimum accepted price

Domestic consumers are worse off

Consumers now have to pay higher world price

Trade increases the economic well-being of a nation because

The gains of the winners exceed the losses of the losers

What happens if the world price is lower than the domestic price before trade?

Domestic producers prefer importing from international markers due to lower price

Increase imports flood into domestic market

Domestic producers face competition and lower their prices

Domestic price falls until matches world price

Who gains and loses when a country becomes an importer?

Domestic consumers gain

Domestic producers lose

What happens to total surplus when a country becomes an importer?

Increases because gains to consumers from lower prices outweight losses to domestic producers

What might losers from trade do when compensation isn’t paid?

Might lobby their governments for protectionist measures like tariffs or quotas to limit imports and protect domestic industries

What is a tariff?

A tax on imported goods

What does a tariff do to the market?

Higher price leads to decrease in quantity of imported goods demanded by consumers

The increased price of imports makes domestically produced goods more attractive

Encourages domestic consumption; increase in domestic production and sales

Who gains and loses from a tariff?

Producers and government gain; consumers lose more than total gains, causing a deadweight loss

What are the two sources of deadweight loss from a tariff?

Imported goods are more expensive → increased domestic production even if it costs them more than buying it at world price → efficient resource allocation loss

Some people who would have bought it at original price no longer do. These are lost opportunities for mutually benefitical trades

What is an import quota?

A limit on the quantity of a good that can be imported.

What are the effects of an import quota?

Reduced imports

Higher domestic price due to reduced supply

Harms consumers who purchase less of good

Helps producers due to higher prices and less comp

Deadweight loss due to efficient production and missed trades

How does a tariff differ from an import quota?

A tariff is a tax on imported goods that generates government revenue,

An import quota is a limit on the quantity of imports that typically generates profits for those who hold the import licenses, not the government.

Define exporter

A person, company, or country that sellers goods/services to another country

Who gains the revenue under a quota by the exporter?

Foreign producers (exporters) who hold import licenses gain the revenue as they can sell the limited quantity at a higher price due to restricted supply

Why should countries avoid tariffs if they value efficiency?

Tariffs cause deadweight losses and reduce total surplus

What is the Jobs Argument against free trade?

The argument that free trade leads to job losses in domestic industries that cannot compete with cheaper foreign goods

While some jobs are lost → free trade creates more efficient jobs in export industries where the country has a comparative advantage

What is the National-Security Argument against free trade?

Some argue certain industries must be protected from imports to maintain national security

This can be misused if made by industries seeking protection rather than actual security needs?

What is the Infant-Industry Argument for trade protection?

New industries may need temporary protection from imports until they grow strong enough to compete.

Why is the Infant-Industry Argument problematic?

It’s hard to identify which industries deserve protection, and temporary protection often becomes permanent

What is the Unfair-Competition Argument against free trade?

Free trade is undesirable if other countries are giving their firms an unfair advantage, such as through subsidies or lax labor and environmental regulations.

Why is the Unfair-Competition Argument considered weak?

Even if foreign goods are unfairly cheap, importing them still benefits domestic consumers more than it harms producers.

What is the Protection as a Bargaining Chip Argument?

Countries may threaten trade restrictions to persuade others to lower theirs

What’s the risk of the Bargaining Chip Argument?

If threat fails, country must:

either follow through on the threat which would reduce its own trade and potentially harm its economy

Or back down which could damage its credibility in future negotiations.

What is the unilateral approach to reducing trade restrictions?

A country lowers its trade barriers independently, without requiring other countries to do the same.

What is the multilateral approach to reducing trade restrictions?

Countries negotiate and reduce trade barriers together, often through agreements

What is the main advantage of the multilateral approach?

It can result in more widespread free trade; but can fail if negotiations between countries break down.

What is an externality?

A cost or benefit incurred by a third party not involved in the transaction who did not choose to incur that cost or benefit

What is a positive externality?

A beneficial side effect on others

What is a negative externality?

A harmful side effect on others, like pollution or noise. The social cost exceeds the private cost.

What does a negative externality look like on a graph?

The social cost curve lies above the supply curve which represent private cost. Social value exceeds private value

How does a negative externality affect market outcomes?

Market prices only reflect private costs (costs to producer and consumer) not the costs to others

This makes harmful goods cheaper than they should be.

People buy more and produce more of the good that is socially desirable

What does a positive externality look like on a graph?

The social value curve lies above the demand (private value) curve

How does a positive externality affect market outcomes?

Market price only reflects private benefits and not additional benefits to society

This makes beneficial goods cheaper than they should be

The good is undervalued which leads to lower production and consumption relative to what is socially desirable

What does it mean to internalize an externality?

To adjust incentives so people consider the external effects of their actions.

How can governments internalize negative externalities?

By imposing a tax to reflect the external cost. A Pigouvian tax where individuals are charged for their harmful activities so they either reduce their harmful behavior or pay the price (e.g. carbon tax)

How can governments internalize positive externalities?

By offering a subsidy to encourage production or consumption.

What is a technology spillover?

A positive externality where innovation (e.g., robotics) benefits other firms and industries.

What are the two main types of government policy for externalities?

Command-and-control and market-based policies

What are command-and-control policies?

Regulations that restrict or require specific behaviors, like pollution limits.

What is a downside of command-and-control policies?

They require detailed knowledge of industry and tech to be efficient.

What are market-based policies?

Economic strategies that provide incentives for reducing negative externalities, such as corrective taxes or tradable permits.

What is a corrective (Pigovian) tax?

A tax designed to encourage private decision makers to take into account the social costs of their actions thus reducing negative externalities.

Why are corrective taxes considered efficient?

Lower overall cost of trying to reduce negative externalities because they let each firm decide how much to reduce based on their own costs.

Firms with lower costs of reduction can pay the tax

Those with higher reduction costs will reduce less and just pay the tax.

This flexibility avoids forcing all firms to meet the same strict rule which would be more expensive overall.

Give an example of a corrective tax.

A carbon tax imposed on businesses based on their greenhouse gas emissions.

What are tradable pollution permits?

Government issued allowances that permit a specific amount of pollution

A total limit (cap) is set on overall emissions and permits are distributed up to that cap.

Companies can buy and sell these permits in a market

How do tradable permits reduce pollution efficiently?

Firms with lower pollution reduction costs can cut more and sell their excess permits to higher-cost polluters, earning revenue

Firms with higher reduction costs can buy permits, allowing them to pollute more but with a cost

What’s the difference between a corrective tax and a tradable permit?

A corrective tax puts a set price on each unit of pollution.

Tradable permits set a total limit on pollution and let companies buy and sell the right to pollute within that limit.

Private solutions to externalities without government intervention:

Moral codes and social sanctions: people doing the right thing like not littering

Donations to charity to support socially beneficial causes

Mergers:

How do mergers solve externalities in private markets?

When firms involved in an externality merge, the externality becomes an internal consideration for the new combined entity

Example of how mergers can solve externalities in private markets

If a polluting factory merges with a fishing company whose catches are harmed by the pollution, the combined entity now has an incentive to reduce pollution as the cost of pollution (reduced fish) directly impacts their own profits

How do private contracts solve externalities?

Affected parties negotiate directly to agree on actions that lead to optimal outcomes for both.

What is the Coase Theorem?

If private parties can bargain without cost over the allocation of resources, they can solve the problem of externalities on their own. The efficient outcome can be achieved regardless of the initial assignment of property rights.

Give an example of the Coase Theorem in action.

A barking dog disturbing a neighbor can be resolved by the neighbors negotiating: either the dog owner pays the neighbor for tolerating the noise, or the neighbor pays the owner to quiet the dog, assuming low bargaining costs.

What are transaction costs?

Costs incurred in the process of making and enforcing agreements between private parties

Sources of high transaction costs:

lawyers’ fees to write the agreement

costs of enforcing the agreement

A breakdown in bargaining when there is a range of prices that would create efficiency

A large number of interested parties.

What does excludability mean in the context of goods?

It means a person can be prevented from using a good.

If a seller can stop nonpayers from accessing it → the good is excludable (e.g., food in a grocery store).

What is rivalry in consumption?

It refers to a good being diminished by one person’s use

If one person uses it, others can’t (e.g pizza)

Non-rival goods can be used by many at the same time (e.g., streetlights)

What are private goods?

Goods that are both excludable and rival in consumption, like bread or jeans. They are efficiently allocated by supply and demand in markets