International Mgmt test 1

1/154

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

155 Terms

International Business

a business whose activities are carried out across

national borders

Foreign Business

Operations of company outside home or domestic market

Multidomestic company (MDC)

An organization with multicounty affiliates, which formulates its own business strategy based on perceived market differences.

Global Company

A company that standardizes and integrates operations worldwide for all functional areas.

International Company

Either a global or multidomestic company

3 Environmental forces on international business

Domestic

Foreign

International

Differences of domestic business from intrnatl

Deals with the domestic market. May face foreign competition in the domestic market.

Influence of external and internal Enviromental forces

Environment

all forces surrounding and influencing the life and

development of the firm.

Uncontrollable Forces

external forces over which management has no direct

control, although it can exert an influence.

Controllable Forces

internal forces that management administers to adapt to

changes in the uncontrollable forces.

External force

Competitive

Distributive

Economic

Socioeconomic

financial

Legal

Physical

political

Sociocultural

Labor

Technological

Competitive EF

Types of competitors, their number, their activities, locations

Distributive EF

Agencies available for distributing goods and services

Economic EF

GNP, GDP, unit labor cost, personal consumption variables that

impact a firm’s ability to do business

Socioeconomic EF

Characteristics and distribution of the human population

Financial EF

Variables such as interest and inflation rates, taxation, etc.

Legal EF

Laws governing international operations and MNCs

Physical EF

Elements of nature such as topography, climate, government structure, and international organizations

EF 8.Political

Local political climate, government structure, international organizations

Sociocultural EF

Culture, attitudes, values, beliefs in local environment

Labor EF

Composition, skills, attitude of local labor

Technological EF

Technical skills and equipment converting resources products

Domestic Environment

All uncontrollable forces originating in the home country that surround and influence the firms life and development

Foreign Environment

All uncontrollable forces originating outside the home coutry that influence and surround the firms life and development

International Environment

Interaction between domestic and foreign environmental forces or between sets of foreign forces.

Difference in forces between domestic and foreign environment

Forces have different values

– Forces can be difficult to assess

– Forces are interrelational

International Interactions

Domestic and foreign

environmental forces

Between the foreign

environmental forces of

2 countries when the

affiliate of 1 does

business with customers

in another

International organizations that effect international environment

Worldwide Bodies –

World Bank, WTO

• Regional Economic

Groupings – NAFTA,

EU

• Organizations Bound by

Industry Agreements -

OPEC

Self-reference criterion

Managers tend to

ascribe their own

cultural values,

preferences, taste,

opinions to the host

country.

International company facts

\\64,000 transnational corps.

account for:

• 25% of global output

• 66.6% of world trade

• 866,000 foreign

affiliates

• 53,000,000 employed,

IB

• 700% sales growth

>1990

Globalization

The tendency toward an international

integration of goods, technology,

information, labor and capital, or the

process of making this integration happen.

Drivers of globalization

Political Drivers

• Technological Drivers

• Market Drivers

• Cost Drivers

• Competitive Drivers

Arguments for globalization

Enhances socioeconomic

development

• Promotes more and better

jobs

Arguments against globalization

Uneven results across

nations and people

• Deleterious effects on labor

and labor standards

• Decline in environmental and

health conditions

Motives for entering foreign markets 1 Increase Profits & Sales:

– Enter new markets

– Create new markets

– Access faster-growing markets

– Availability of improved communications

– Obtain greater profits

– Generate greater revenue

– Lower cost of goods sold

– Seek higher overseas profits

Motives for entering foreign markets 2 Product markets, profits and shares

Protect Domestic Markets by Following Customers Overseas

– Attack in Competitor’s Home Market

– Use Foreign Production to Lower Costs

– Protect Foreign Markets

– Respond to lack of foreign exchange

– Respond to local production by competitors

– Develop downstream markets

– Respond to protectionism

– Guarantee supply of raw materials

– Acquire technology and management know-how

– Diversify Geographically

– Satisfy management’s desire for expansion

7 dimensions for globalizing a business

1. Product

2. Markets

3. Promotion

4. Value-added

5. Competitive strategy

6. Use of non-home-country personnel

7. Extent of global ownership in firm

Volume of international trade

All global exports exceeded $19.5 trillion in 2008.

• The dollar volume of world exports is greater than the

GNP of every nation in the world except the U.S.

• 25% of everything made or grown world-wide is

exported.

• 70% of developed nations exports go to other

industrialized nations, not developing countries.

Export manufactured goods

To developing nations

for raw materials

– To other

industrialized nations

The Relevance of Major Trading

Partners to Management

1. Favorable business climate in importing nation

2. Regulations are “workable”

3. No cultural objections to buying that nation’s goods

4. Satisfactory transportation facilities exist

5. Experienced import channel members (merchants,

banks & customs brokers)

6. Available foreign exchange

7. Government pressure on importers to buy from

countries that are established customers

Mercantilism

1. “A nation’s wealth depends on

accumulated treasure, usually gold, and

2. To increase wealth, government policies

should promote exports and discourage

imports.”

Theory of absolute advantage

Country “A” has absolute advantage when it can produce a

larger amount of goods or services for the same amount of

inputs as country “B” or when “A” can product the same

amount using fewer inputs than “B.”

Theory of comparative advantage

Country “A” has a absolute DISADVANTAGE in production of

goods in respect to country “B,” who has a comparative or relative

advantage in the production of the good in which its absolute

disadvantage is less.

Exchange rates on trade

Exchange rates help determine the

advantage: buy locally or import?

– The exchange rate is the price of one currency stated in terms of the

currency of another country.

– Example: If the prevailing rate is 1$ = 8 yuan, the yuan is worth

0.125 USD:

Influence of Exchange Rates

Exchange rate fluctuations shift the

demand and flow of goods and

services between countries.

• Countries keep or regain competitive

position through currency devaluation –

the lowering of a currency’s price in terms

of other currencies.

New Explanations for direction of trade

Differences in Resource Endowments

• Overlapping Demand

• National Competitive Advantage from

Regional Clusters

Differences in

Resource Endowments

Some countries have abundant resources

when compared to other countries:

– Chile – abundant supplies of copper

– U.S. – large supply of fertile farmland

– Saudi Arabia – extensive quantities of crude oil

• Differences in resource endowments suggest

developed countries would trade with

developing countries with different

endowments than with developed countries

with similar endowments.

Overlapping Demand

• Consumers in several countries demand

the same goods or services, because:

– Customers’ taste, and market demand are affected by a

nation’s per capita income.

Therefore:

– Goods are exported to countries with similar levels of per

capita income and market demand for comparable products.

Natural competitive advantage for geographic region

3 Reasons for Geographic clusters:

1. Advantages from pooling a common labor force

2. Gains from the development of specialized labor

suppliers

3. Benefits from sharing technological information

and increased rate of innovation

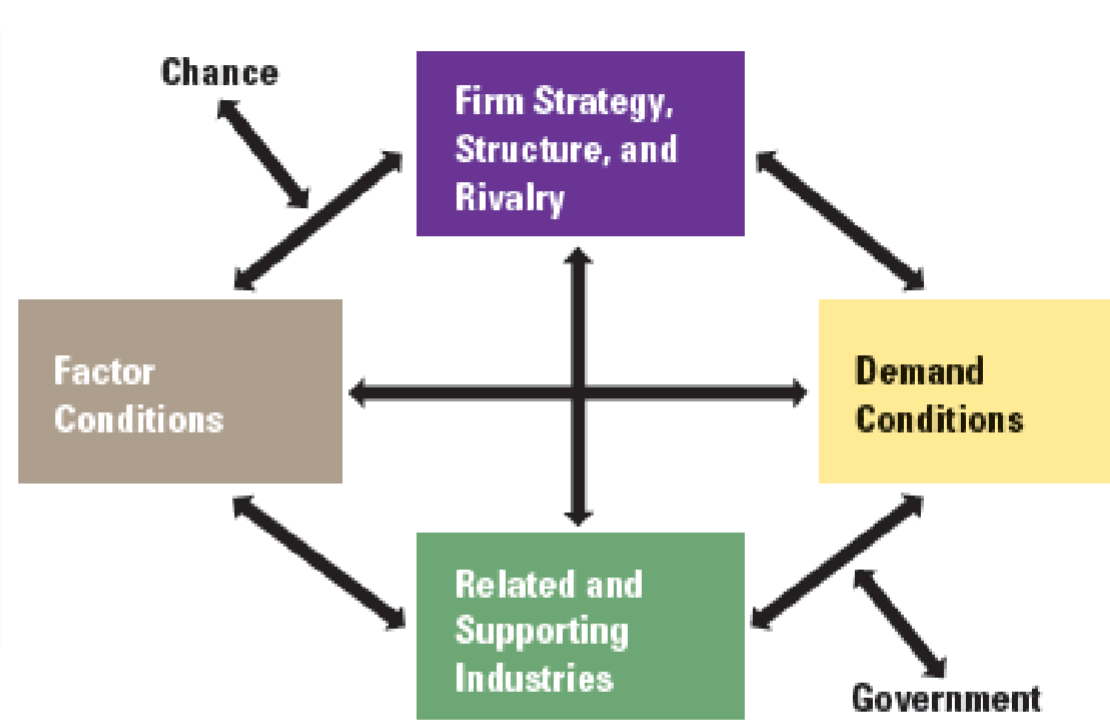

Michael

Porter’s

Diamond

Model of

National

Advantage

Summary of international trade theory

• International trade occurs because of relative

price differences among nations.

• Differences stem from differences in

production costs which result in:

1. Differences in endowments of the factors of production

2. Differences in levels of technology that determine the factor

intensities used

3. Differences in efficiencies with which factor intensities are

used

4. Foreign exchange rates.

Foreign investment

Portfolio and direct investment

Portfolio Investment

The purchase of

stocks and bonds for

obtaining ROI for

profit

Direct Investment

Investment to

participate in

management and

ownership of the firm

and ROI

Foreign investment in the U.S.

– $6.2 billion in stocks

and bonds in 2007

• Includes $2.9 billion in

corporate stock

– Represents a four fold

growth since 1997

U.S. Foreign Investment

$6.8 billion in 2007

• Includes $5.2 billion in

corporate stock

– 380% of 1997 level

Foreign Direct Investment Outstanding stock of FDI

The Outstanding Stock of FDI

– The book value (value of total outstanding

stock) of worldwide FDI was $16.2 trillion

in 2008

– Of this, the U.S. invested $3.2 trillion

abroad

Foreign Direct Investment (FDI)

Annual Outflow of FDI

$1.2 trillion in 2000

– Global economic decline resulted in outflow

fluctuations

• Decline to $647 billion in 2002

• Increase to $2.1 trillion in 2007

• Decline to $1.9 trillion in 2008

Motivation to buy existing foreign companies.

1. U.S corporate restructuring = saleable U.S. assets

2. Foreigners want rapid access to U.S. advanced technology

3. Easier U.S. market success with established U.S. brands

4. Increasing global competition = restructuring &

consolidation = saleable foreign assets

Where does fdi go

70% to developed

countries

– Down to 57%, 2008

– Regional fluctuations

exist; must be studied

before FDI made.

Where does fdi come from

Impossible to value, but,

if a country or region’s

FDI is increasing:

• The investment climate must be

good

• Political forces are attractive for

FDI

• Profit potential is greater than

in other areas

• Other reasons for investment

exist

Factors Affecting TDI Score Developing countries

Developing countries

have low scores due

to lags in:

– Physical infrastructure

– Human capital

– Financial intermediation

– Institutional quality

– Economic & Social well-

being

– Trade performance

Do Trade and Investment Affect

Economic and Social Development?

• YES! The United Nations Conference on Trade and

Development (UNCTAD):

“All economies are increasingly open in today’s

economic environment of globalization. Trade plays a

vital role in shaping economic and social performance

and prospects of countries around the world, especially

those of developing countries, No country had grown

without trade. However, the contribution of trade to

development depends a great deal on the context in

which it works and objectives it serves.”

Factors Affecting TDI Score Developed countries

Developed countries

have high scores due

to:

– No lags in

—Physical infrastructure

– Human capital

– Financial intermediation

– Institutional quality

– Economic & Social well-

being

– Trade performance

– Trade liberalization exists

in these countries

Factors Influencing a Nation’s

TDI Export Performance External

Market access

conditions:

• Transportation costs

• Geography

• Physical

infrastructure

• Trade barriers

• Competition

• Other demand-

influencing factors

Factors Influencing a Nation’s

TDI Export Performance Internal

– Internal supply

conditions:

• Raw materials

• Labor costs

• Capital costs

• Access to technology

• Economic policy

• Institutional

environment

• Limited access to

foreign markets

FDI influences

The composition of

exports

– The technological content

of exports

– The development of

export supply capacity in

knowledge-based

industries

FDI impact on export performance

FDI has a significant and positive impact on export performance

For FDI to work

best, country

trade policy

should integrate

with:

—Political initiatives

– Social initiatives

– Economic initiatives

– Building transportation

infrastructure

– Enhancing macroeconomic

stability

Does FDI lead to trade

Yes! Global business environment

changes:

– Fewer government trade barriers

– Increasing global competition

– New production technologies

– New communications technologies

– Greater integration of the global supply chain and

production

– Push to identify global business opportunities

Theories of

International Investment

Monopolistic advantage theory and Internationalization theory

Monopolistic advantage theory

FDI is made by firms in oligopolistic industries possessing

technical and other advantages over indigenous firms.

International Theory

To obtain a higher ROI, a firm will transfer its superior

knowledge to a foreign subsidiary rather than sell it in the

open market.

Theory of dynamic capabilities

Dynamic capabilities from knowledge or resources must be

created and transferred to foreign markets to create competitive

advantage.

Eclectic theory of international production

For a firm to invest overseas, it must have 3 kinds of advantages:

ownership specific,

location specific, and

internationalization.

Commonality in the OLI model

Empirical tests show

majority of FDI is

made by large,

research-intensive

firms in oligopolistic

industries.

• All 3 theories

provide reasons for

company

profitability through

overseas investment.

What are institutions

organizations of groups, societies, or cultures to achieve a common goal

To provide stability and meaning to social life

Why are institutions helpful

They provide a collection of norms that regulate the relations of individuals to each other

New institutional theory

Societal constructs: norms that structure relations between people

Societal expectations: basic rules and social expectations of groups, written and unwritten

Formal institutions

Influence behavior through laws and regulations

City, state, natl gov, EU

Operate through laws and rules

Informal institutions

Influence behavior through norms, values, customs, and ideologies.

Normative: Set standards: NGO and professional orgs

Cognitive: shared conceptual ideas

United Nations (UN)

192 member countries dedicated to world peace and stability

• Fosters global business relationships • Helps write international law

• Helps stabilize global economy

• Headquartered in New York City

UN center for trade facilitation and electronic business (UN/CEFACT)

Technical standards and norms

STandardized trade documents

STandards for E-data exchange

UN educational Scientific and cultural org (UNESCO)

Investment in emerging economies

Development in health, education, governance and political stability

UN agencies deal with downsides to globalization like

Terrorism

Crime

Drugs

Arms Traffic

UN environmental Program (UNEP)

CLimate control convention

Kyoto protical

Sustainable business practices

The global compact

Education and health issues needing private industry/developing nation partnerships

UN economic and social council promotes

Social justice

Human rights

Labor rights

UN global compact

Framework for businesses committed to aligning operations and strategies

10 universally accepted principles regarding Human and Labor rights, the environment, and anticorruption

UN organization: 5 working bodies,organs

General assembly

UN security council

Economic and social council (ECOSOC)

International court of justic (ICJ)

The secretariat

General assembly

Adopts resolutions

Decisions reflect world opinion

Decisions not legally binding

UN security council

Maintains international peace and security

15 members 5 permanent members

Economic and social counsel (EOCSOC)

Economic and social issues

• Trade & Transport

• Industrialization • Economic development

• Population growth

• Children

• Housing

• Women's rights • Racial discrimination

• Illegal drugs & crime

• Social welfare & youth

• The human environment

International court of justice

15 judges

worldwide jurisdiction

legal decisions between national governments

The secretariat

UN staff

40000 people worldwide

headed by secretary general

International Monetary institutions

Coordinates and enforces international monetary rules

World bank

lends money for developmental projects

World Trade Org (wto)

Deals with rules of trade between nations

WTO principles

Trade without discrimination (MFN principle)

Freer trade through negotiation

Predictability through binding and transparency

Promoting fair competition

Encouraging development and economic reform

Doha development agenda

Promotes market access to least developed nations

Duty and quota free imports on manufactured goods

Agriculture hard to agree on

Trade related intellectual property rights (TRIPS)

Copyright, trade secret, trademarks, and intellectual property protection

Free trade area (fta)

Tariffs among members terminated'

external tariffs remain