3.7.2 Role, value & limitations of Financial ratios

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

8 Terms

What is Ratio analysis?

It involves the comparison of financial data to gain insights into business performance

What questions does Ratio analysis help to answer?

Why is one business more profitable than another?

What returns are being earned in investment in a business?

Is a business able to stay solvent? (ability to pay off debts)

How effectively is a business using its assets?

What is the importnce of comparison and trends?

Calculating just one ratio is rarely enough if you are to gain useful insights into financial performance of a business

Effective ratio analysis means you :

Need to compare with competitors

Need to analyse over time (trends)

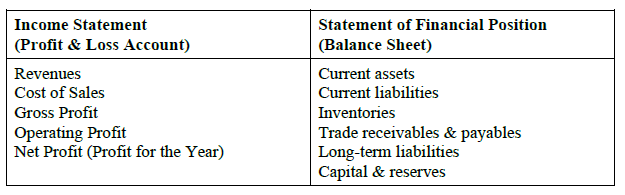

Where does information for Ratio analysis come from?

Financial accounts are the source of info you need for ratio analysis

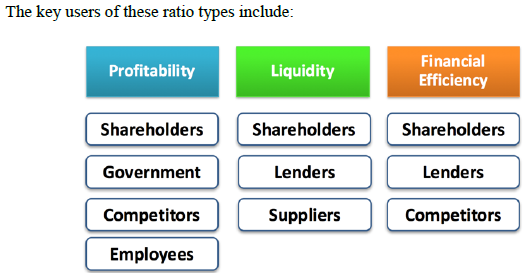

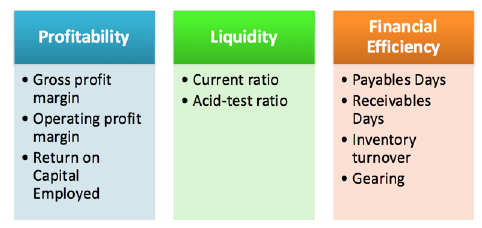

Ratios perform diff purposes, what 3 main types are they grouped into?

Profitability

Liquidity

Financial effiency

What are limitations of Ratios?

One data set is not enough → ratio data over a period of time is much better

How reliable is the financial data?

Ratios are based on past → not predictor of future

Comparability → be careful with comparing ratios, e.g. between diff industries

Why might the financial data used in ratios not be wholly reliable?

Financial info involves making subjective judgements

Diff businesses have different accounting policies

Potential for manipulation of accounting info (e.g. window-dressing)

What do financial ratios not measure?

They are concerned with financial data

So they don’t tell you directly about how well a business is performing in areas such as :

Competitive advantages e.g. brand strength

Quality

Ethical and CSR reputation

Human resource management