ECO 202 Module 5: Externalities, Environmental Policy, and Public Goods

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

29 Terms

externality

a benefit or cost that affects someone who is not directly involved in the production or consumption of a good or service

cause a difference between a private cost and a social cost and interfere with economic efficiency

cause a difference between a private benefit from consumption and a social benefit

ex) pollution, negative externality, people not involved in production or consumption face negative consequences

ex) medical research, positive externality, people not directly involved in producing medical research can benefit from it

private cost (of production)

the cost borne by the producer of a good or service

social cost (of production)

the total cost of producing a good or service, including both the private cost and any external cost

negative externalities raise the social cost

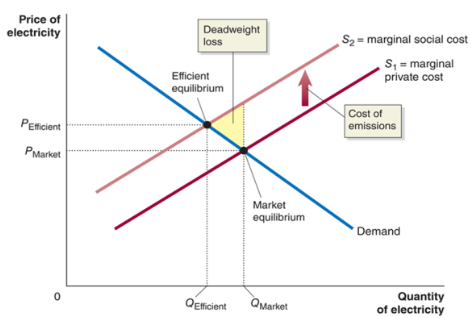

when there is a negative externality in producing or consuming a good or service, too much of the good or service will be produced at market equilibrium

marginal social cost is effectively ignored, and energy is produced at market equilibrium, resulting in deadweight loss

private benefit (of consumption)

the benefit received by the consumer of a good or services

social benefit (of consumption)

the total benefit from consuming a good or service, including both the private benefit and any external benefit

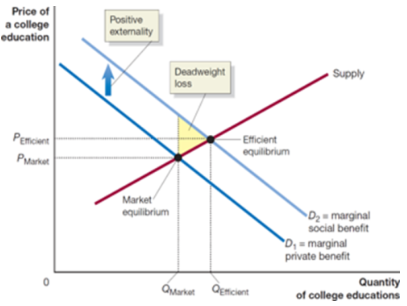

positive externalities increase the social benefit

when there is a positive externality in producing or consuming a good or service, too little will be produced at market equilibrium

market failure

a situation in which the market fails to produce the efficient level of output

overproduction with negative externalities and underproduction with positive externalities

there will be deadweight loss

the larger the externality, the great is likely to be the size of the deadweigh loss — the extent of the market failure

what causes externalities?

incomplete property rights or from the difficulty of enforcing property rights in certain situations

ex) free use water will be polluted because there is no incentive to enforce clean use

property rights

the rights individuals or businesses have to the exclusive use of their property, including the right to buy or sell it

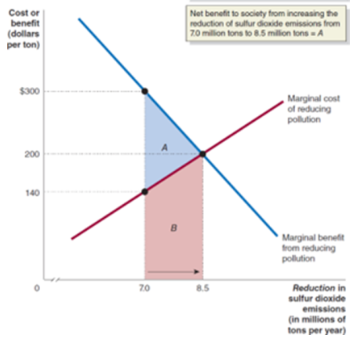

benefits of reducing pollution

increasing reduction from 7 to 8.5 results in total benefits equal to the sum of areas A and B

the total cost is equal to area B

the total benefits are greater than the total costs by area A

transaction costs

costs in time and other resources that parties incur in the process of agreeing to and carrying out an exchange of goods and services

when many people are involved, transaction costs are often higher than net benefits from reducing an externality

Coase Theorem

private parties can solve the externality problem through private bargaining provided:

property rights are assigned and enforcable, and

transaction costs are low, and

parties have full information about the costs and benefits involved

all parties are willing to accept a reasonable agreement

it DOES NOT matter to whom preperty rights were assigned

government politcies to deal with externalities

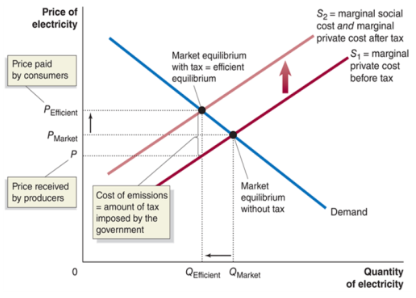

externalities cause inefficiency by moving the level of production away from the efficient level. taxes also cause inefficiency by moving the level of production away from the efficient level.

a tax of just the right size could cause these two effects to cancel out, returning us to an efficient level of production

ex) utilities do not bear the cost of pollution, so they produce too much. if the government imposes a tax equal to the cost of the pollution, the utiliites will internalize the externality, the supply curve will shift right, and the market equilibirum quantity falls to the economically efficient level

taxes and externalities

taxes work to solve negative externalities because negative externalities caused too much to be produced while taxes reduced the amount of output

when there is a positive externality, too little will be produced, so taxes won;t work

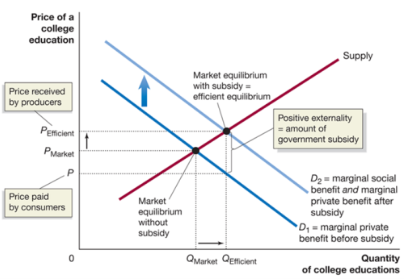

subsidies

amounts paid to producers of consumers to encourage the production of consumption of a good

may solve the problem of positive externalities

consumers will internalize the externality, demand curve shifts right, and equilibrium price and output increase

Pigovian taxes and subsidies

taxes and subsidies used to solve the externality problem

increase efficiency while bringing in tax revenue. allows for inefficiency-causing taxes in other markets to be reduced (a double dividend of taxation)

command-and-control approach

policy involving the government imposing quantitative limits on the amount of pollution firms are allowed to emit or requiring firms to install specific pollution control devices

ex) requiring car manufacturers to equip cars with catalytic converters

BUT, what if firms have very different costs of reducing pollution? it may not be efficient for them to reduce pollution by the same amount

cap-and-trade system

the government establishes an allowable amount of emissions

emissions allowances are distributed

firms can trade emissions allowances

firms with high costs of reducing pollution will buy allowances from firms with low costs of reducing polluiton, ensuring that pollution is reduced at the lowest possible cost

the market is used to achieve efficient pollution reduction (market-based approach)

effective but needs political backing to be successful

criticism: gives firms “licenses to pollute,: but pollution allows for cheap production BUT resources are scare and trade offs exist

carbon tax

market-based policy to reduce carbon dioxide emissions

the marginal social cost of CO2 emissions is estimated at $49/metric ton

the tax would replace other regulations and rely on market to respond to an increase in the price of products that result in CO2 emissions

would push people to less-polluting alternatives, but would disadvantage US firms if not adopted globally

rivalry

situatino that occurs when one person’s consumption of a unit of a good means no one else can comsume it

ex) I eat a Big Mac, no one else can eat it

excludability

the situation in which anyone who does not pay for a good cannot consume it

ex) if you don’t pay for a Big Mac, McDonald’s can exclude you from consuming it

four categories of goods

1) private good

2) public good

3) quasi-public good

4) common resource

private good

good that is both rival and excludable

ex) food, clothing, haircuts, etc.

markets tend ot be good at providing efficient levels of private goods because the person making decisions about how much to purchase tends to be the only one benefiting from the good, so only their preferences matter

public good

good that is both nonrival and nonexcludable

ex) national defense

leads to free riding, or benefitting from a good without paying for it

quasi-public good

good that is excludable but not rival

ex) Netflix and toll roads, one person’s use doesn’t interfere with anothers

profit-maximization tends to lead too many people to be excluded from quasi-public goods

common resource

goods that are rival but not excludable

ex) forest land, if one person cuts down a tree, no one else can use that tree

people have little incentive to conserve common resources, leading them to be overconsumed

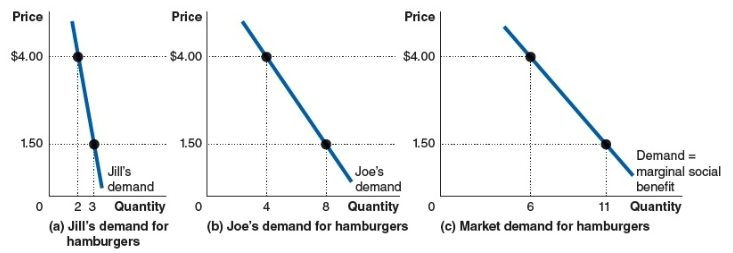

demand curve for private goods

determined by adding horizontally the quantity of the good demanded at each price by each consumer

a) Jill demands 2 hamburgers when the price is $4

b) Joe demands 4 hamburgers when the price is $4

a quantity of 2+4=6 hamburgers at a price of $4

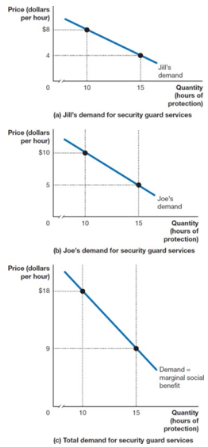

demand curve for a public good

determined by adding up the price at which each consumer is willing to purchase each quantity of the good. add individual demand curves vertically

a) Jill is willing to pay $8 per hour for a security guard to provide 10 hours of protection

b) Joe is willing to pay $10 for that level of protection

c) the prive of $18 per hour and the quantity of 10 hours will be a point on the demand curve for security guard services

optimal quantity of a public good

found where the demand and supply curves intersect

but finding the demand curve can be difficult because consumers may not have incentives to reveal their willingness to pay for public goods

tragedy of the commons

tendency for a common resourse to be overused

people cannot be excluded from the resource, but their consumption is rival, depleting the resource for other people