Lecture 11: Business Plans and Financial Accounting

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

15 Terms

Financial Accounting

Concerned with recording/analyzing the financial data of a business

Includes revenue and expenses, its resources and claims on those resources (for managers, investors, creditors)

Managerial Accounting

Concerned with costs and benefits of activities of an enterprise

Provides information to managers for decision-making

Engineers often play a part in cost-accounting

Every organization has _____ and _______

assets and liabilities

Assets

Assets: items to which the organization has legal title

Current assets can be converted into cash within one year

Fixed assets (capital assets) have a life greater than one year

Liabilities

Liabilities: debt owed (suppliers, employees, government)

Current liabilities - debt normally paid within a year (accounts payable, taxes, wages payable, bank loan payable…)

Long-term liabilities - debt normally paid beyond current year

Owner’s Equity

The difference between assets and liabilities is a means of measuring what the organization is worth - it’s equity:

Assets - Liabilities = Owner’s Equity

Often appears as two components in a balance sheet:

Stock, or shares

Retained earnings

As equity builds up, the better off are the owners (eg, a sole proprietor, partnership or shareholders)

The Balance Sheet

The Income Statement

Income statement summarizes revenues and expenses over a specified accounting period.

Major components: Revenue, Expenses, Profits

Revenues increase owner’s equity

Usually from sales of goods/services

Expenses decrease owner’s equity

Cost of goods sold, rent, insurance, wages, depreciation

Profits before taxes is revenue - expenses

After deducting taxes we arrive at net profit

Estimated values in financial statements

Financial statements are often estimates - they may not reflect market values - use cost principle of accounting

Assets are valued on the basis of their cost (book value)

Land is listed as the price paid, not its market value

Plant and equipment is listed at the price paid less accumulated depreciation

depreciation on equipment computed using depreciation model

Finished goods inventory - manufacturing cost

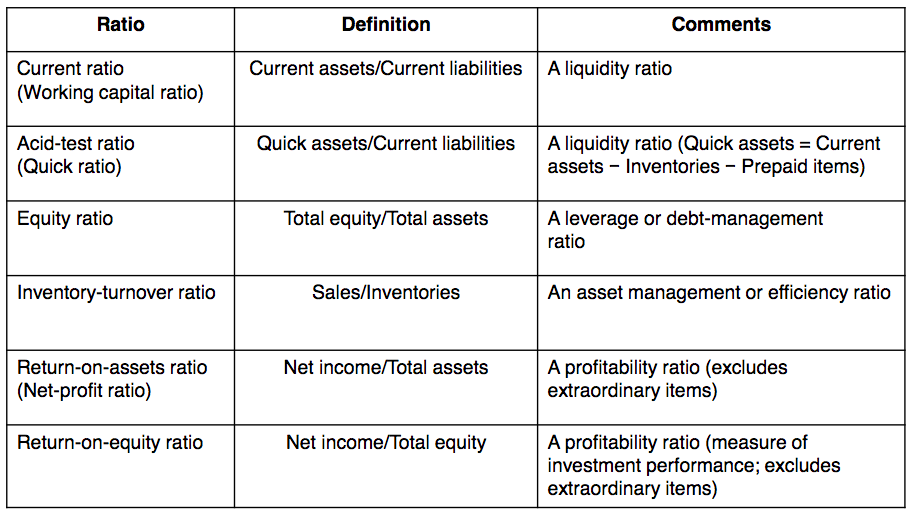

Financial Ratio Analysis

Financial ratios calculated from items on the income statement and balance sheet are a key performance measure

In interpreting ratios, analysts should calculate the ratios over a number of periods to do a trend analysis

Ratios should also be compared to industry standards

Financial Ratios - Liquidity Ratios

Assess firm’s ability to meet short term financial obligations and weather fluctuations in cash flows

Reserve of cash and liquid assets called working capital

Working capital = current assets - current liabilities

Current ratio = current assets / current liabilities

A current ratio of 2 is considered adequate

Acid test ratio = quick assets / current liabilities

An acid test ratio of 1 is considered adequate

Financial Ratios - Debt Management Ratios

The extent firm relies on debt

Equity ratio = total equity / (total liabilities + total equity)

= total equity / total assets

Smaller the ratio, the more dependent a firm is on debt and the higher the risk of not being able to manage debt

Financial Ratios - Efficiency Ratios

Assess efficiency of use of its assets

Inventory turnover ratio = sales / inventories

Financial Ratios - Profitability Ratios

Productive assets have been employed in producing a profit

Return on assets = Net income / total assets

Return on equity = Net income / total equity

Summary of Financial Ratios and Definitions