RSM483 Lecture 1 + 2

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

How is real estate different from other markets?

Real estate is immobile and durable

Real estate markets are highly regulated and have heavy government involvement

Rules about mortgage terms and tax treatment

Real estate markets are dominated by amateur investors

relationship between interest rates and real estate returns?

As interest rates rise, returns on real estate increase

Why does Just running a regression not give you a home price

Correlation does not equal Causation

Just running a regression does not give you a home price → gives price on average

There may be other variables that impact home price

Real estate is difficult to value because

It is heterogeneous in terms of location and attributes

Views, crime, school quality

There are a lot of unobserved or poorly measured attributes

It is not heavily traded in the market

Not a ton of observations.

What are the 3 approaches to value real estate

1) Cost Approach

2) Income Approach

3) Comparables Approach

Cost Approach

Sum up all the costs to build it

If old home– thing about the cost of building an old-quality building today.

Add up the cost of acquiring all components of a replacement property

Why is it important that markets are competitive?

In competitive markets, economic profits = 0, cost = close to final price

When is Cost approach used best?

Most commonly used for new development of standardized properties in competitive markets

Works best in areas where land values and the cost of all attributes are easily observed and standard

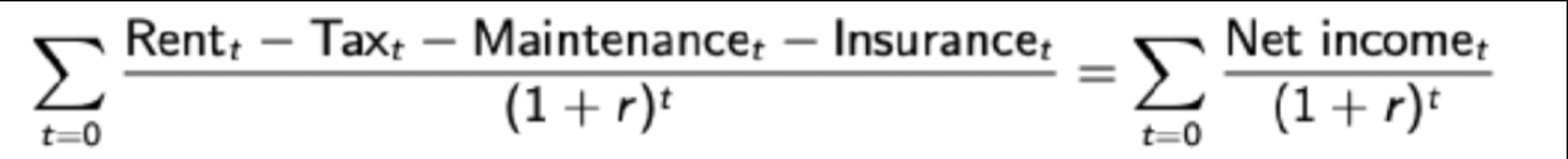

Income Approach

Most commonly used for investment properties

Simple version: the sum of discounted cash flows associated with renting out the property forever

If net income is constant = (Net Income)/r

Implies r = “Cap Rate”= (Net Income) / (Purchase Price)

The simple version ignores risk and expected capital gains/losses

Good when considering use/productivity of asset – especially if hard to sell/no comparables.

Sensitive to interest rate used.

Certain businesses might use higher r’s because their value of future rental streams is lower, leading to lower valuations by income approac

Mostly good for commercial real estate – not homes.

Comparables Approach

Most commonly used for home appraisals and by realtors

Look at recent sales of comparable homes nearby and then use adjustments as needed to the average for differences in home characteristics.

Good when lots of comparable properties and data

Repeat sales approach: when same building is selling again

Use last sale price and apply a home price index to update the price to current time period

Ex: old price x 15% growth in index = current price

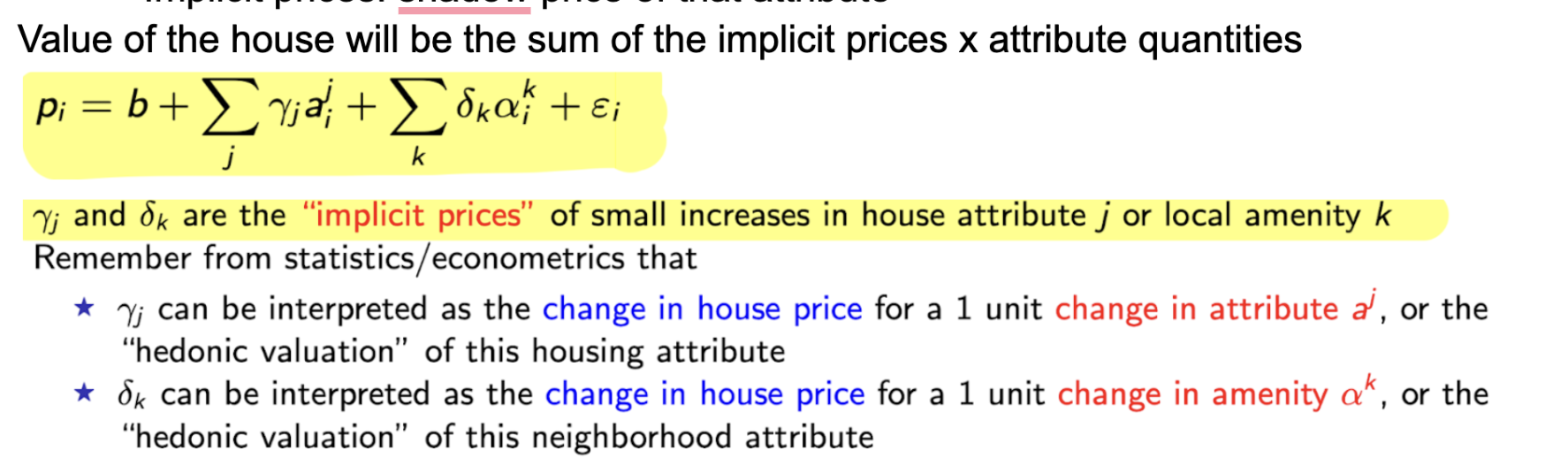

Hedonic Pricing –

A more data-driven way to value any house based on any theoretical set of characteristics

Goal here is to find an efficient way to adjust the price of observed sales to account for differences in attributes of houses we hope to value

1) Determine the price of various housing attributes

2) Apply these prices to the house we are trying to value.

What did Rosen Agrue?

Rosen argued that housing price or rent differences must capture differences in a and α across homes, such that identical individuals are indifferent across homes.

Hedonic Price Methology

Using Log in Hedonics

Helps put everything in percents or percent changes

If P(a) = 0.07, a home with 1 more unit of a is has a price that is 7% higher, on average, holding other factors fixed.

Difficulties with Hedonic Pricing

Data may not include some a and α (marble countertops, nice view)

These could be correlated with attributes and amenities that are observed (coefficients estimated incorrectly: correlation # causation!)

Information is on the marginal value of attributes, and may not apply to large changes in attributes

Example: shadow price of 1 garage may not be same as 10 garage.