Theme 3E - Market Failure

1/18

Earn XP

Description and Tags

Evaluation

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

19 Terms

Explain how to evaluate policies through effectiveness and appropriateness

Effectiveness of measure | Appropriateness of measure |

| (broader criteria) Measure must be effective then it can be appropriate

|

State the possible evaluations of taxes

1. Data constraints

PED

Responsiveness of firms

Targeting root cause

Worsens inequity

Adverse effects on consumers and firms

Cost of implementation - production vs pollution tax

Provide government with a source of revenue

Describe data constraints and PED of tax

Data constraints | The government does not have perfect information and may not be able to accurately estimate the MEC of…If the government over-estimates the MEC, there will be an over-tax. For example, if the government provides a per unit tax which causes the SS=MPC to fall by a larger extent to SS’’ (MPC’’), there would now be an underconsumption of Q*Q’’ units, leading to a welfare loss of Area B. Should the welfare loss from the over-subsidy (Area B) exceed the original welfare loss (Area A), there would be an overall fall in society’s welfare and hence, the measure would not be effective in ensuring efficient allocation of skills upgrading courses. |

PED |

|

Describe responsiveness of firms and target root cause of tax

Responsiveness of firms |

|

Targeting root cause |

|

Describe how tax worsens inequity and its adverse effects on consumers and firms

Worsens inequity |

Impact:

|

Adverse effects on consumers and firms |

|

Describe cost of implementation of production vs pollution tax and how tax provide government with a source of revenue

Cost of implementation - production tax vs pollution tax |

|

Provide governments with a source of revenue |

|

Describe sunk cost fallacy

Costs that have already been incurred by economic agents and cannot be recovered

Not considered in economic decision-making as they are irrelevant for both present and future economic decisions

However, human’s tendency to continue a behaviour or on an endeavour due to previously invested resources (time, money or effort) whether or not the marginal costs outweigh the marginal benefits

Eg. High COE prices and Additional Registration Fee (ARF)

Raise the fixed costs of owning a car in Singapore

Once the car has been purchased, these are sunk costs, and should not impact on a driver’s decision on whether to drive to a location

Drivers tend to utilise their cars more often to make the COE price paid ‘worthwhile’ as they take into account the high COE prices paid when making their decisions on car usage

Even though controlling car ownership through COE is meant to reduce congestion on the roads, sunk cost fallacy committed by the car owners has led to increased car usage

Describe loss aversion and salience bias

Loss aversion (Prospect theory) |

|

Salience bias |

Eg. ERP

|

Describe evaluations of subsidy

Data constraints

Improve equity

Require government finance

Describe data constraints of subsidy with graph pls

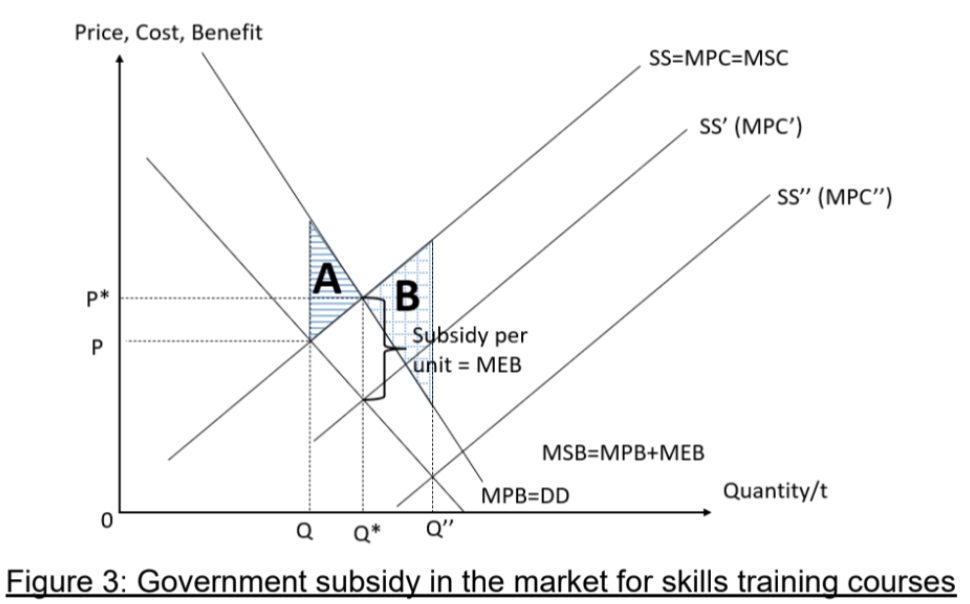

The government does not have perfect information and may not be able to accurately estimate the MEB of attending skills training courses. If the government over-estimates the MEB, there will be an over-subsidy. For example, if the government provides a per unit subsidy which causes the SS=MPC to fall by a larger extent to SS’’ (MPC’’), there would now be an overconsumption of Q*Q’’ units, leading to a welfare loss of Area B. Should the welfare loss from the over-subsidy (Area B) exceed the original welfare loss (Area A), there would be an overall fall in society’s welfare and hence, the measure would not be effective in ensuring efficient allocation of skills upgrading courses.

Describe how subsidy improve equity and it require government funds to finance

Improve equity |

|

Direct provision, subsidies, grants and vouchers require government funds to finance |

|

State possible evaluations of direct provision

Data constraints

Result in productive and dynamic inefficiency

minimal data constraints

public good is a necessity

Describe data constraints and productive inefficiency of direct provision

Data constraints |

|

Result in productive & dynamic inefficiency |

|

Describe minimal data constraints and public good necessity of direct provision

Minimal data constraints

Even if the government supplies the wrong quantity, society is better off having some quantity of the public good produced by the government as opposed to none at all under the free market-> society’s welfare is likely to increase significantly

Public good may be a necessity (Eg. National service)

It is a non-negotiable good and is crucial for a countries survival no matter how much it costs

State possible evals of public education

Responsiveness of consumers

Target one group of people

Cognitive bias

Target root cause

Describe the evals of public education

Responsiveness of consumers |

|

Does it target one group of people only? | Eg. Healthy eating campaign

|

Cognitive bias |

|

Targets root cause |

|

Describe evals of regulations

Responsiveness |

|

Cost of implementation - taxes vs regulation |

|

Describe cost efficiency of policy measures

Pollution tax and tradable permits (more cost effective)

Firms seek to lower pollution in least costly manner to improve its profitability

Encourages the lowering of pollution at a lower overall cost across firms

Regulations

Regulations are government-imposed rules that require all firms to reduce pollution by the same amount, regardless of how costly it is for each firm to do so.

This lack of flexibility means that firms with high pollution reduction costs are forced to spend more than necessary -> leading to a higher overall cost to achieve the same environmental outcome.

In contrast, market-based policies like pollution taxes or tradable permits allow firms to decide how much to reduce based on their individual costs, encouraging the most cost-effective pollution reduction across the economy

Describe eval for responsiveness of consumers public education

Eval: Depends on Level of Trust in Government

Eg. In UK, level of trust at all-time low due to previous mishaps such as public perception of poor political integrity, poor impact of Brexit and dissatisfaction with public services like NHS (National Health Service)