4.1 international economics

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

11 Terms

4.1.2 specialisation and trade

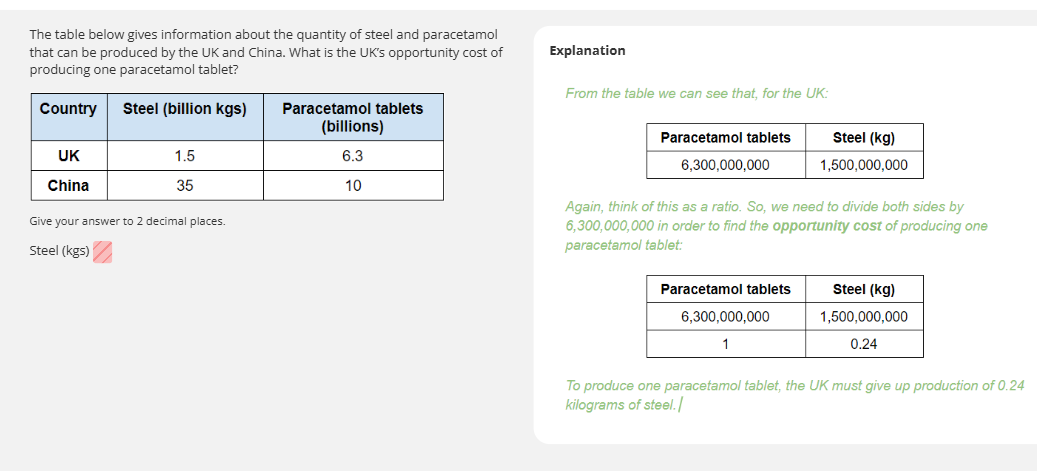

comparative advantage- if a country can produce at a lower opportunity cost, they have a comparative advantage.

absolute advantage- when a country can produce more of a good than another country, it has an absolute advantage in the production of a good.

Production possibility frontier shows the maximum potential output of the economy, using all resources efficiently.

theory of comparative advantage states that global output will increase if countries produce the goods which they have comparative advantage.

theory of comparative advantage assumes:

-average cost of production is constant

-no trade barriers

-no transport costs.

limitations of comparative advantage

average cost of production:

-firms grow, specialise, experience diseconomies of scale, workers become alienated, productivity falls, increases the average cost. introduce more bureaucracy (admin, processes), which increases average cost. as company grows bigger, communication can break down, increasing costs. push up prices, make it less available.

-trade barriers might distort comparative advantage. tarrifs

-transport costs might distort comparative advantage real life transport costs when trading.

ADVANTAGES AND DISADVANTAGES OF SPECIALISATION AND TRADE.

WORLD OUTPUT

comparative advantage, total world output increases, increase real world GDP, improve living standards.

however, based on unrealistic assumptions. increased production costs or if trade barriers placed, increase price of imports. less demand, total output reduces, real world gdp decrease, living standards decrease.

SELL TO INTERNATIONAL MARKETS-

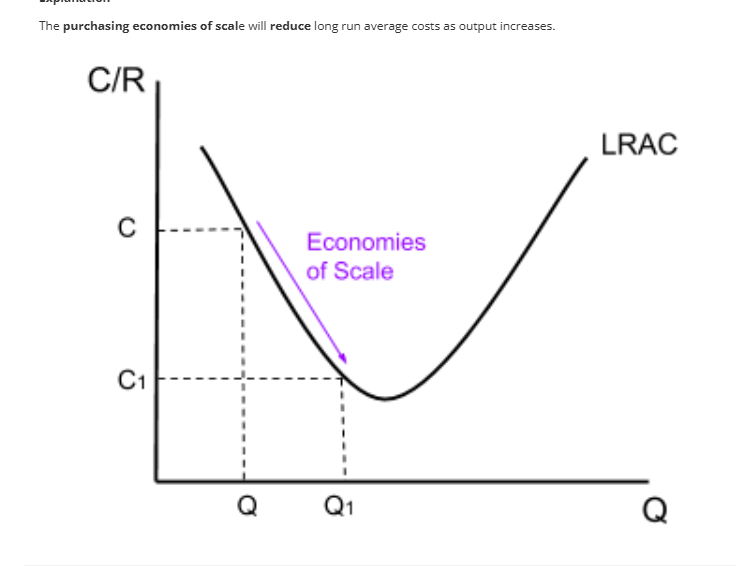

create economies of scale, decrease in LRAC as output increases, increase profit, Saudi oil production, reinvested into the economy, increase real GDP.

however, may lead to overdependence on imports and exports. Saudi oil and gas sector accounts to 50% of their real GDP. economy is not diversified and vulnerable. saudi already into recession with unemployment rising and real GDP falling. Saudi vision 2030 reduce dependence on oil will be slow and difficult process.

PRICE LEVEL:

trading with other countries, lower prices, more choice for consumers, increase output, EOS, reduce production costs, right shift of SRAS.

However, lead to demotivation, decrease in productivity, increase in prices.

4.1.1 Globalisation

Globalisation- increased integration of different economies.

CHARACTERISTICS OF GLOBALISATION:

increased international movement of labour

increased movement of financial capital.- massive increase in FDI.

Foreign direct investment: when a company in one country establishes operations in another country or when it acquires assets or a stake in an overseas company.

increased specialisation.

Increased international trade

FACTORS CONTRIBUTING TO GLOBALISATION:

Improvement in transport- easier to transfer goods across international borders. some developing countries have cost advantage of cheaper labour, MNC’s move their production abroad.

Improvement in IT and communication- easier to communicate, led to word being more interconnected.

Trade liberalisation

IMPACTS ON GLOBALISATION ON:

CONSUMER:

more choice, lower prices. however can reduce consumer happiness.

WORKER:

more international opportunities, increase in remittances $600B 2015 total. TNCs create new jobs

remittances: transfer of money by a foreign worker to an individual in their home country.

however, structural unemployment

PRODUCERS

reduced costs through relocation, larger economies of scale like Mcdonalds, quantity sold increase, cost of beef decrease. LRAC decrease , lower prices

firms source products from multiple countries reducing risk

firms can employ low skilled workers for cheaper in developing countries.

however, only advantage for TNCs, high barriers to entry

GOVERNMENT:

may receive higher tax due to TNCs paying tax.

Transfer pricing- tax avoidance.

Environment:

increased demand for raw materials, increased emission.

4.1.3 patterns of trade

COMPARATIVE ADVANTAGE-

can produce the good at a lower opportunity cost- they should export more of that good. trade will increase in that country and reduce in the other.

EMERGING ECONOMIES-

import and export far more goods from emerging countries.

BRICS- Brazil. Russia, India, China, South Africa.

TRADING BLOCS:

Trade blocs will cause countries to join together so more trade happens between them than before they were together. can happen in two ways trade creation and trade diversion.

EXCHANGE RATES:

If a currency appreciates, country will see a fall in demand for exports and increase in demand for imports.

If a currency depreciates, a country will see a fall in demand for imports and an increase in demand for exports.

4.1.4 terms of trade learnt.

Terms of trade: relationship between the price of exports and the price of imports.

terms of trade formula: index of export prices/ index of import prices x 100

What causes a deterioration in terms of trade?

Improvement- export prices rise or import prices fall

Deterioration- export prices fall or import prices rise.

FACTORS INFLUENCING A COUNTRY’S TERMS OF TRADE:

PRICE OF RAW MATERIALS:

Developing countries usually export raw materials. See a deterioration in their terms of trade as cost of raw materials decrease.

Developed countries import raw materials. See an improvement in terms of trade as cost of raw material decreases.

Change in tariffs

An increase in tariffs will lead to a deterioration in terms of trade.

CHANGES IN EXCHANGE RATES:

Depreciation of a country’s exchange rate will increase price of imports, decrease price of exports, -terms of trade deteriorates.

Appreciation of a country’s exchange rate, increase price of exports, decrease price of imports, cause terms of trade to improve.

INFLATION RATE:

If a country’s inflation rate is higher than that of its trading partners, its index of export prices will be rising more than its index of import prices. Therefore its terms of trade will improve.

Country inflation rate lower than trading partner then its index of import prices rising more than index of export prices. terms of trade deteriorate.

IMPACTS OF CHANGES IN A COUNTRY’S TERMS OF TRADE

COMPETITIVENESS:

An improvement in terms of trade, lead to decrease in competitiveness as exports become more expensive relative to imports. Lead to decrease in exports, decrease in AD, less derived demand for labour, decrease employment, reduce current account deficit decrease in real gdp, - decline in living standards.

PED of exports elastic- worsen current account on balance of payment.

PED of imports inelastic- improve current account of BoP.

Beneficial only if export revenue lise.

4.1.5 trading blocs and the world trade organisation

Trading bloc- a trading bloc is where countries join together and agree to remove all trade barriers such as tariffs, quotas, subsidies to domestic producers and non-tarrif barriers.

free trade area- trade barriers are removed between member countries, however.

Customs union- all trade barriers are removed between member countries + common external tariff on imports from non member countries.- EU

Common market- trade barriers remove between member countries, common external tariff, factors of production can move freely between member countries.

monetary union - all trade barriers removed from member countries, common external tariff from non-member countries. common currency.

common external tariff- tariffs placed on countries outside a bloc that all members must adopt.

Trading blocs divert trade away from non-members. common external tariffs raise price of imports from non member countries.

key functions of Eurozone:

European central bank ECB issues euro notes and coins.

sets interest rates (monetary policy)

maintains financial stability

manage foreign reserves.

FISCAL RULES:

fiscal deficit must not exceed 3% of GDP.

National debt must not exceed 60% of GDP.

Give two benefits of regional trade agreements:

free trade encourage specialisation, increase output according to comparative advantage, economies of scale, lower prices and costs, dynamic advantage.

removal of trade barriers lead to more competition, encourage innovation and lower prices, leading to improvements in allocative and productive efficiency.

Give 2 costs of regional trade agreements:

reduction in competition as inefficiency firms driven out the market - more oligopolistic. '

distribute the gains from trade unequally, developed countries often gaining the most and developing being impacted very little.

trade creation - decrease in price, contraction in domestic supply, extension in domestic demand, increase, increase in imports, quantity of goods increase, higher consumer welfare, more healthy goods like fruits, standards of living increase.

trade diversion - trade is diverted from low cost producers to high cost producers inside a trading bloc.- due to common external tariffs. consumers pay higher prices, reduction in quantity demanded, reduce living standards. low cost producers loose out on trade, loose revenue, less profit and unemployment, multiplier effect.

4.1.5 WORLD TRADE ORGANISATION.

WTO- To bring about trade liberalisation and ensure countries act according to the trade agreements they have signed.

POSSIBLE CONFLCITS BETWEEN WTO and regional trade agreements:

WTO’s principles may be violated by customs unions and free trade areas as not all trading partners are treated equally,

Some may argue that WTO is too powerful so they may ignore developing countries that need help to trade.

4.1.6 restrictions on free trade

Reasons for restrictions:

Protection from dumping ( when firm sells their surplus goods at very low prices to other countries, harming the domestic producers)

Infant industry argument : to ensure the small firm can grow.

4 types of restrictions on free trade:

tariffs

quotes

subsidies for domestic producers

non-tariff producers.

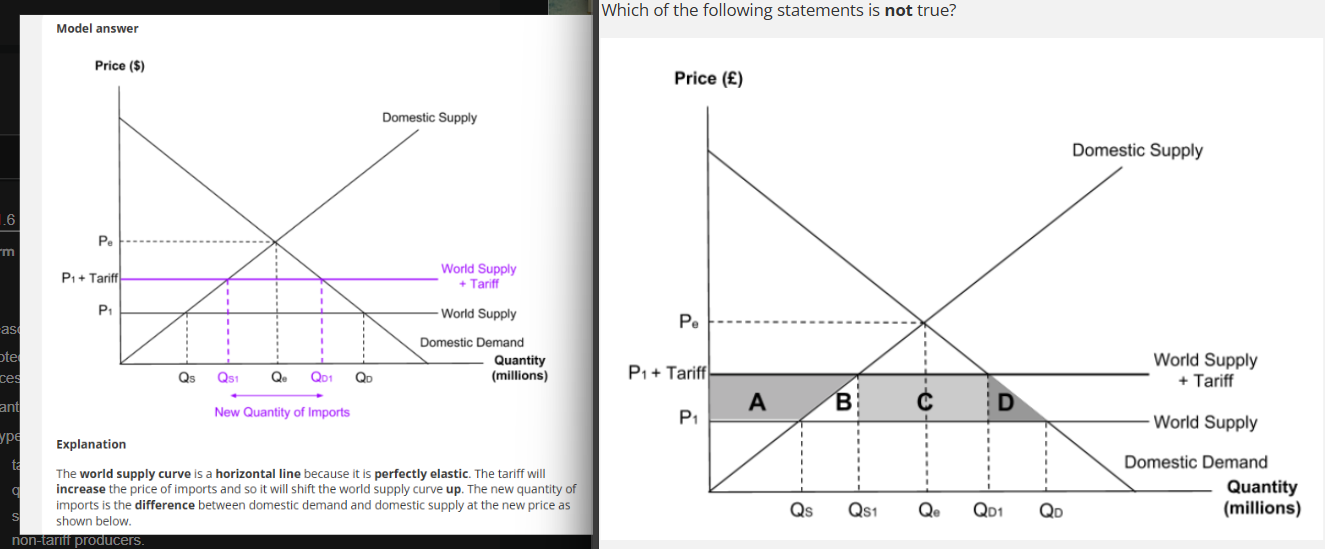

TARIFFS:/ also known as import duties/ customs duties.

Tariff is a tax paid on imports which makes them more expensive to buy so people are more likely to buy domestic goods.

Tariff. lead to an extension (increase) in domestic supply as domestic producers are willing to sell more at a higher price. Contraction (decrease) in domestic demand, consumers do not want to pay a higher price. Reduction in imports.

Area A represents gain in producer surplus. (supply more at a higher price.

Area B and D represent welfare loss, reduce imports make consumers worse off.

Area C represents government tax revenue from the tariff. It is the government that receives this money rather than the producer.

QUOTA- strict limit on the quantity of imports. If consumers want to buy a good but have used up their quota, they have to purchase domestic goods.

4.1.6 restrictions on free trade

TYPES OF RESTRICTIONS ON TRADE:

tariff- tax paid on imports

quotas- strict limit on the quantity of imports.

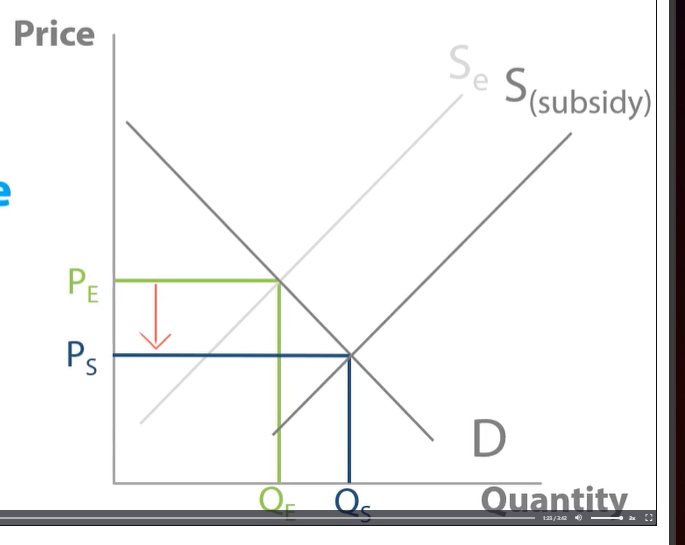

SUBSIDIES TO DOMESTIC PRODUCERS-

subsidy - government gives a grant to producer in order to increase supply.

Subsides to domestic producers are grants given to reduce cost of production, increase quantity supplied. makes domestic goods more competitive, reduce demand for imports, trade decreases.

Non-tariff barriers include- regulations regarding health and safety, environmental regulations and correct labelling of products to show a best before date. - prevent specific items from being imported, causing them to be brought domestically.

IMPACT OF PROTECTIONIST POLICIES:

CONSUMERS:

higher prices form consumers, unable to buy imports at cheaper prices, suffer from less choice.

PORDUCERS:

more goods at higher price, sell more goods at higher price due to reduced competition.

however foreign producers loose out as where they can sell their goods.

GOVERNMENTS:

short run, benefit from increased revenue from tariff revenue

-however, lead to inefficient economy which reduces growth

living standards

-deadweight welfare loss.

-can cause retaliation because of trade wars due to restrictions like the US-China war where each country imposes more tariffs on other goods causing reduction in trade and growth.

Equity:

regressive effect on the distribution of income as rise of prices affects poorer members of society more than well of as no longer able to afford the products.

4.1.7 balance of payments.

The balance of payments is a record of all financial transactions between one country and the rest of the world.

two main accounts in the balance of payments are the current account and the capital and financials account.

4 parts of the current account: trade in goods, trade in services, investment income, current transfers.

two components of the current account

4 components of current account: trade in goods, services, investment income, current transfers.

trade in goods- such as wine

trade in services- such as accounting.

Imports are a withdrawal from the circular flow because they involve money leaving the economy. As money leaves the circular flow, UK current account decrease.

Exports are an injection into the circular flow because they involve money entering the economy. As money enters the circular flow, UK current account will increase.

When investment income is received by UK investors, it will appear as a positive number on the UK Current account, which will increase.

When investment income is paid by UK companies to foreign investors, it will appear as a negative number on the UK current account, which will decrease.

Current transfers are when money is transferred abroad without getting any goods or services back in exchange. e.g. workers wages are sent home called remittances.

current account surplus- more more in flowing into the country than flowing out

current account deficit- more money if flowing out of the country than flowing in.

In the UK, the current account is in deficit as more money is leaving than entering it. However, this means that the capital and financial account must be in surplus as this money is reinvested back into the UK.

The capital and financial accounts:

mainly records transfer of immigrants and emigrants taking money abroad and bringing to the UK.

Financial account:

made up of FDI, portfolio, and other investments. FDI is flow of money to purchase part of a foreign firm buy mine 10% of company, portfolio less than 10%, other investments include loans and bank deposits.

4.1.7 balance of payments.

CAUSES OF BENEFITS AND SURPLUS:

exchange rate depreciates, import price increase, fewer import, decrease import expenditure, exports cheaper, sell more export, increase export revenue, more money enters, current account increases- current account improve.

If country’s inflation rate is lower relative to other countries, exports will become relatively cheap, foreign consumers buy more exports, export revenue increase, improve current account

A negative trade balance means that import expenditure is greater than export revenue and so more money is leaving the economy than entering it. This means that AD is decreasing. trade balance decreases then X-M part of AD formula will decrease. decrease AD overall. shift AD left, lower living standards, higher unemployment.