BUS 312 - M2 formulas

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

37 Terms

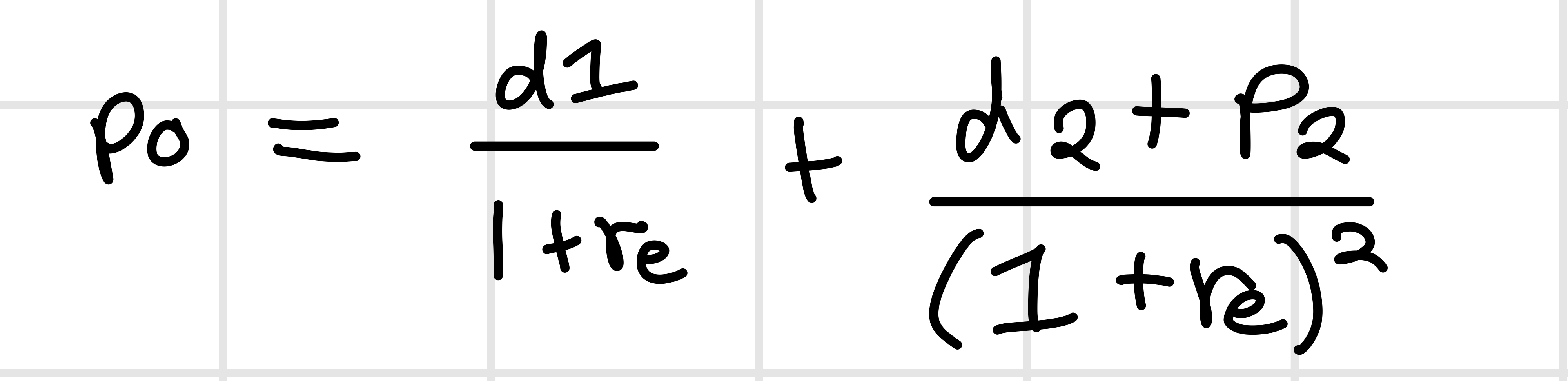

Selling after 1 year

P0 = (d1+P1)/(1+re)

The next buyer sells after 1 year

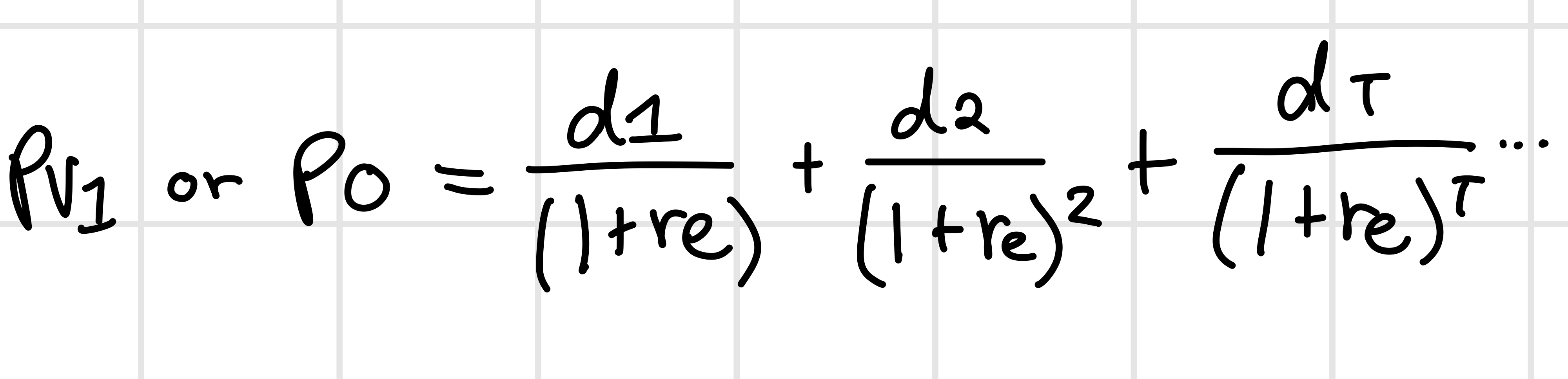

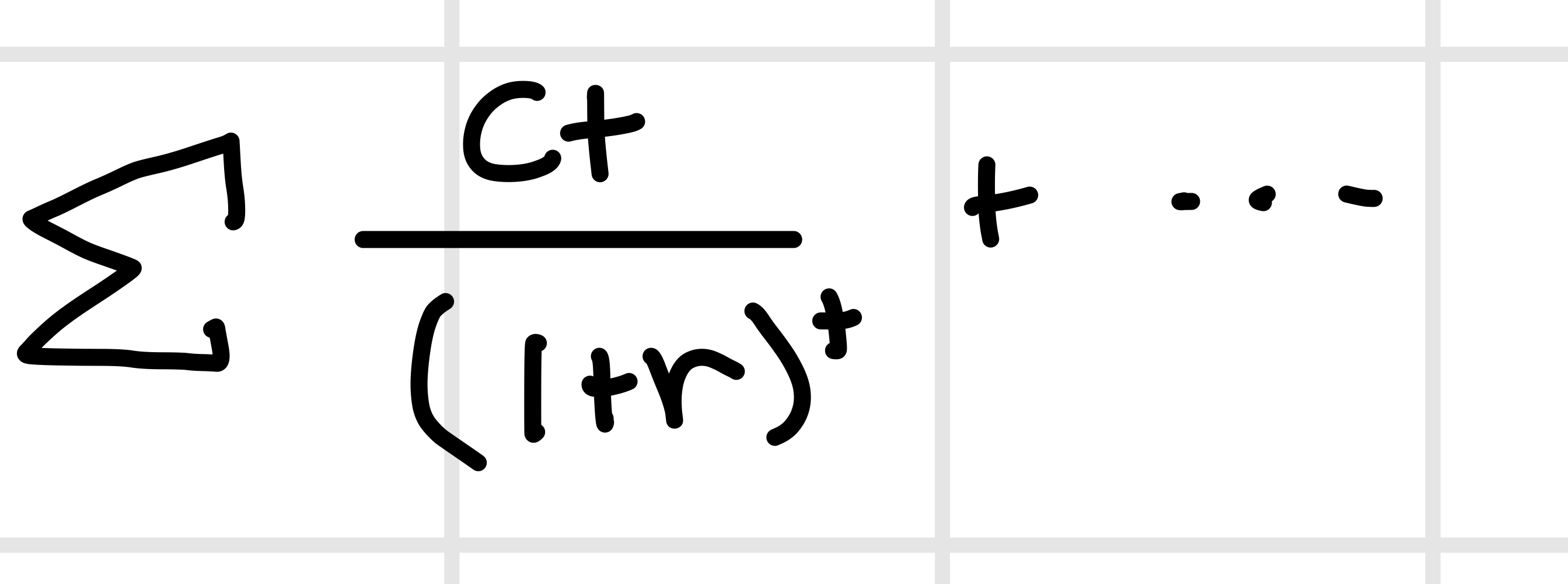

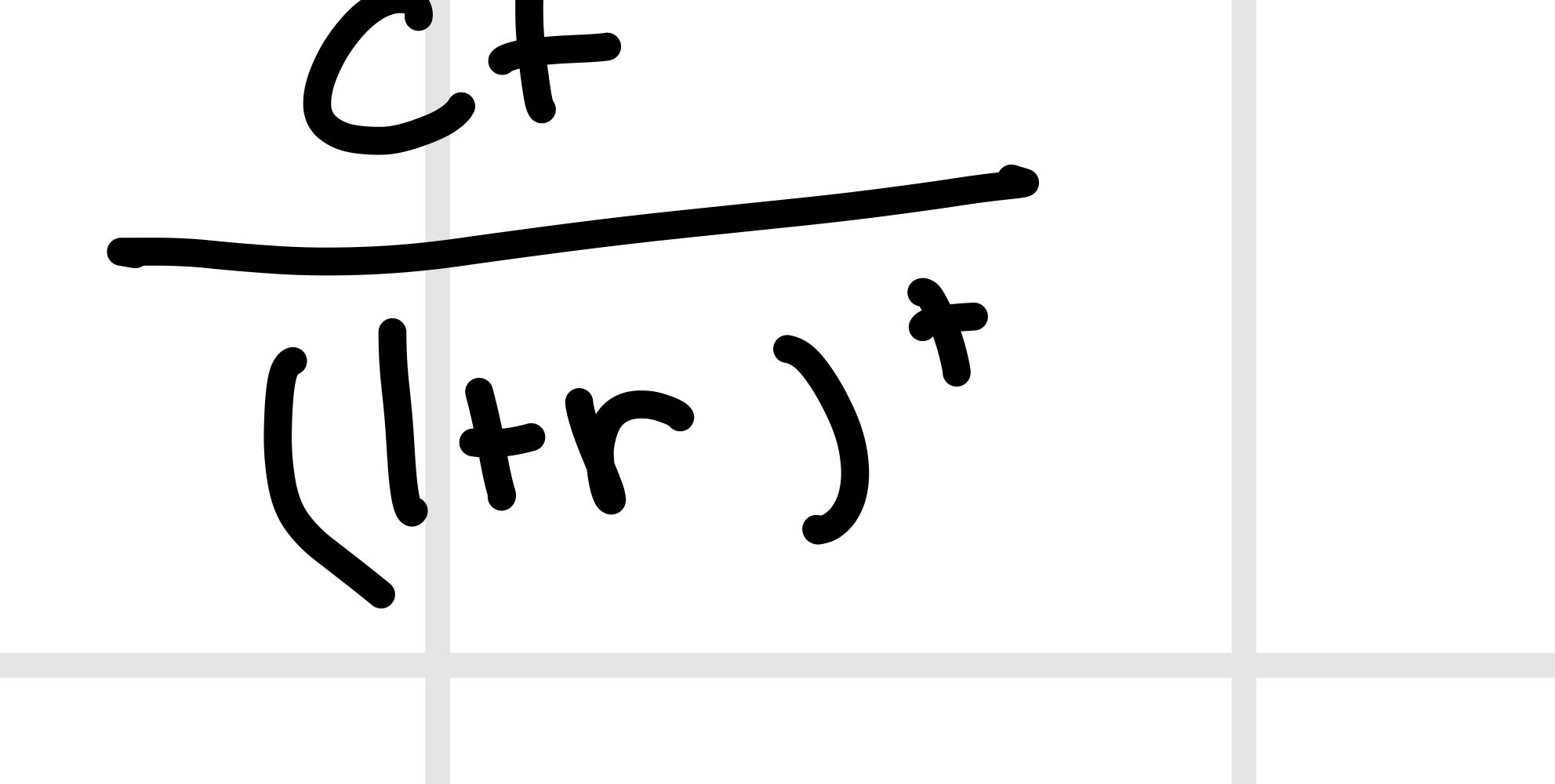

Multiple Cash flow discounting

perpetuity for constant dividend

P0 = d/re

or

re = d/P0

Growing perpetuity for dividend growth model

Pt = dT/(re - g)

or

re = (dT/Pt) + g

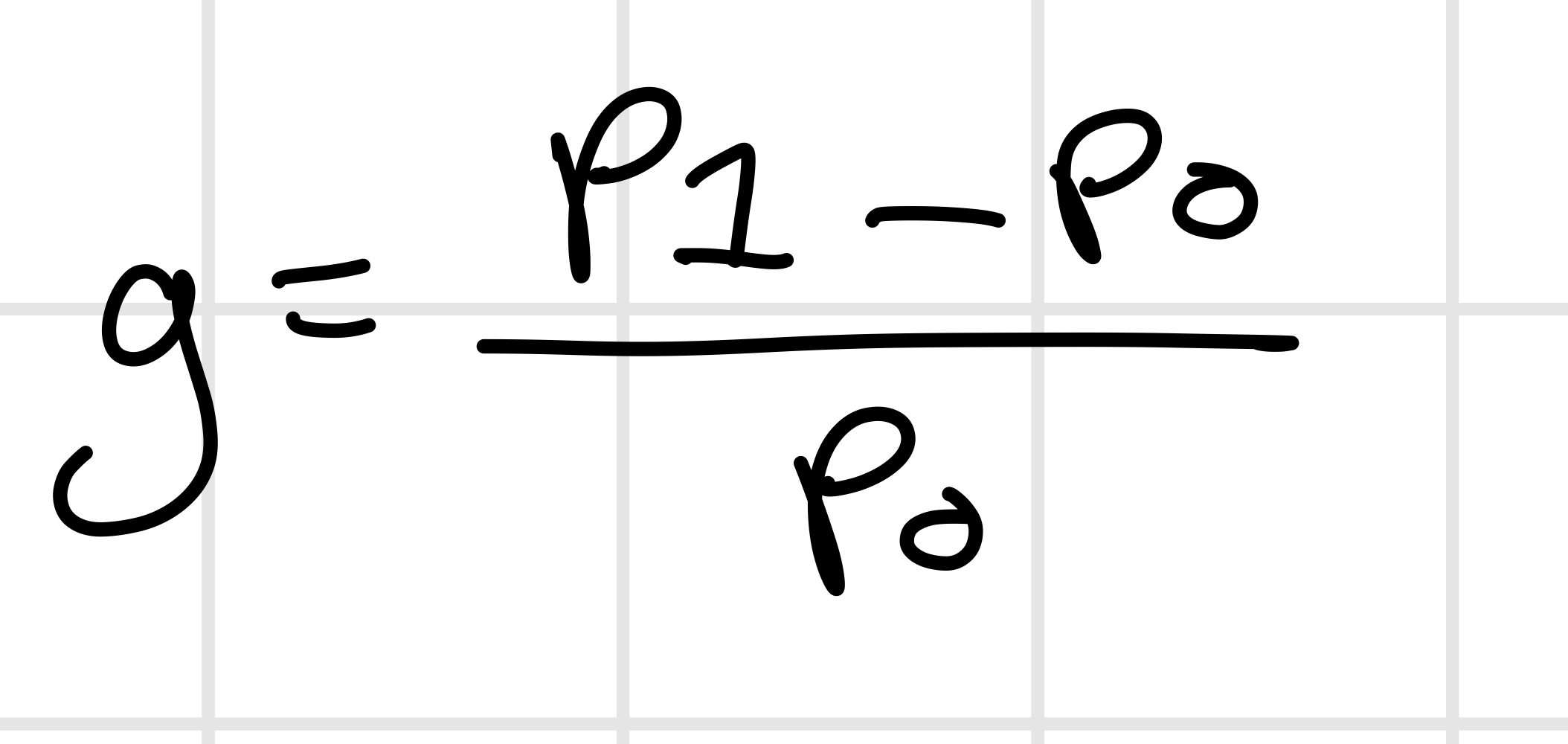

Capital gain rate

Payout ratio

d1/E1

Forward price earning ratio

P0/E1

Expected dividends

dt + 1 = d0 x (1+g)^T

P(Total)

PV1 + PV2

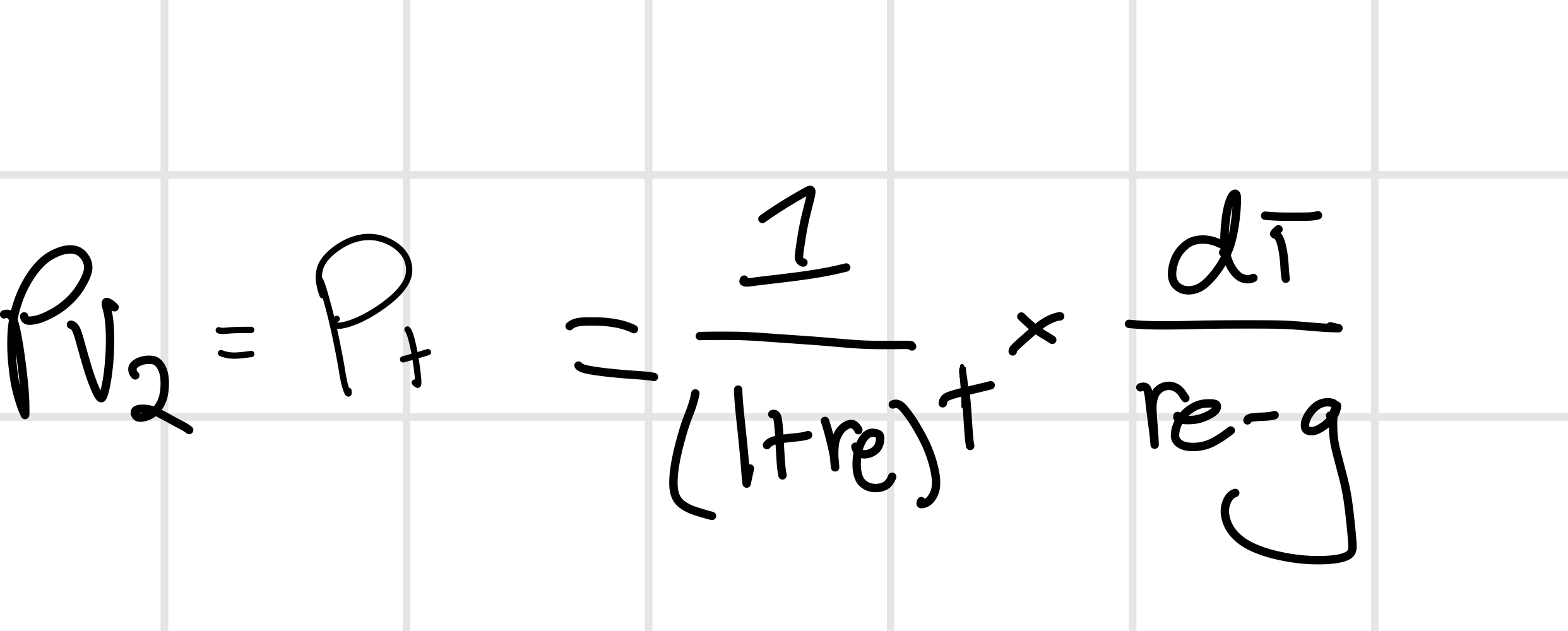

Delayed growing perpetuity (second stage)

Stock price

ESP x P/E ratio

P/E ratio

Price to earnings per share share

NPV

PV(benefits) - PV(costs)

PV (multiple)

PV

Payback year T+1

Year T cashflow + Year T+1 cashflow

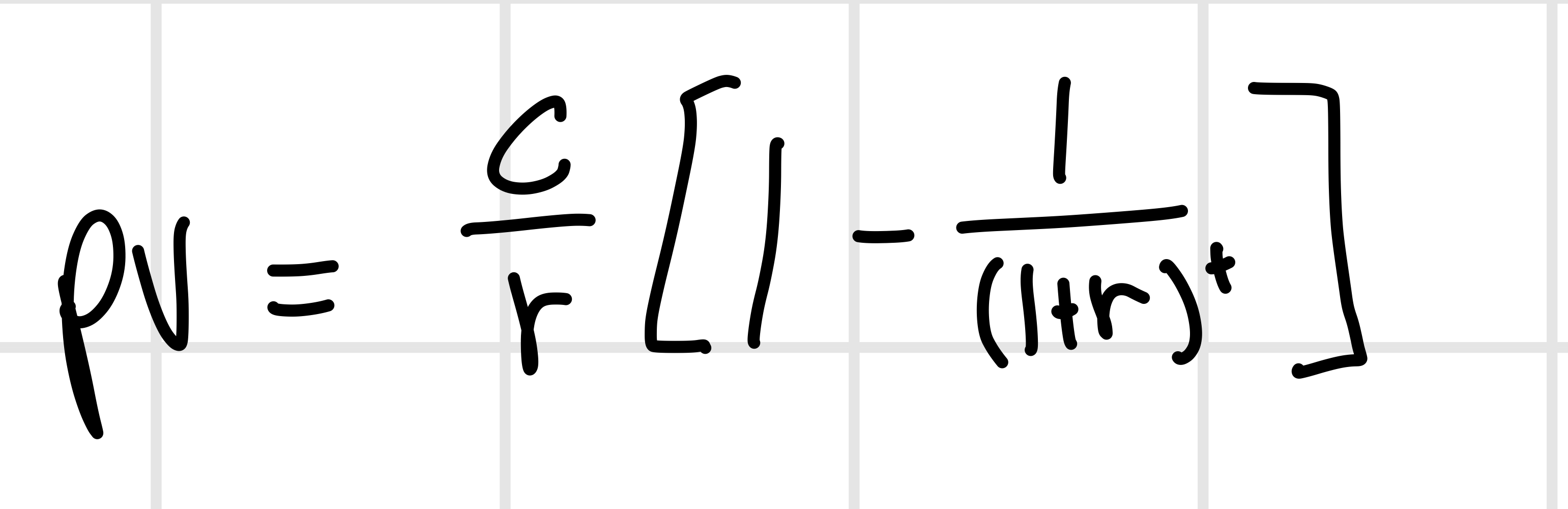

Annuity

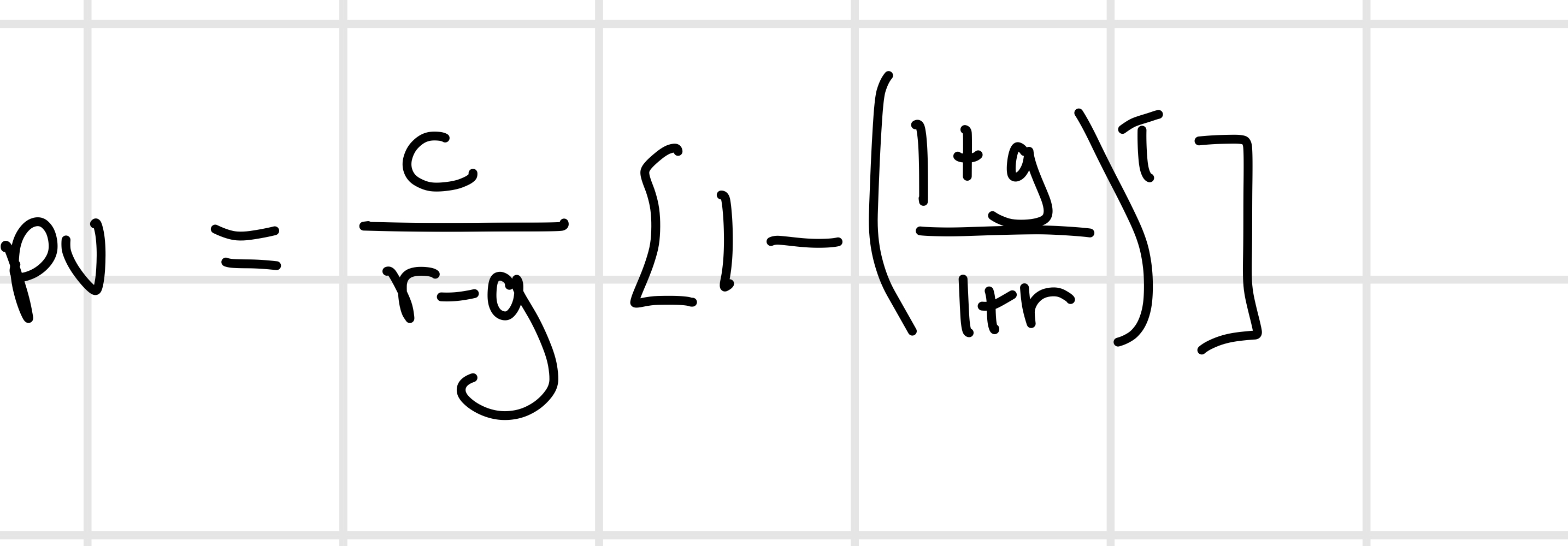

Growing annuity

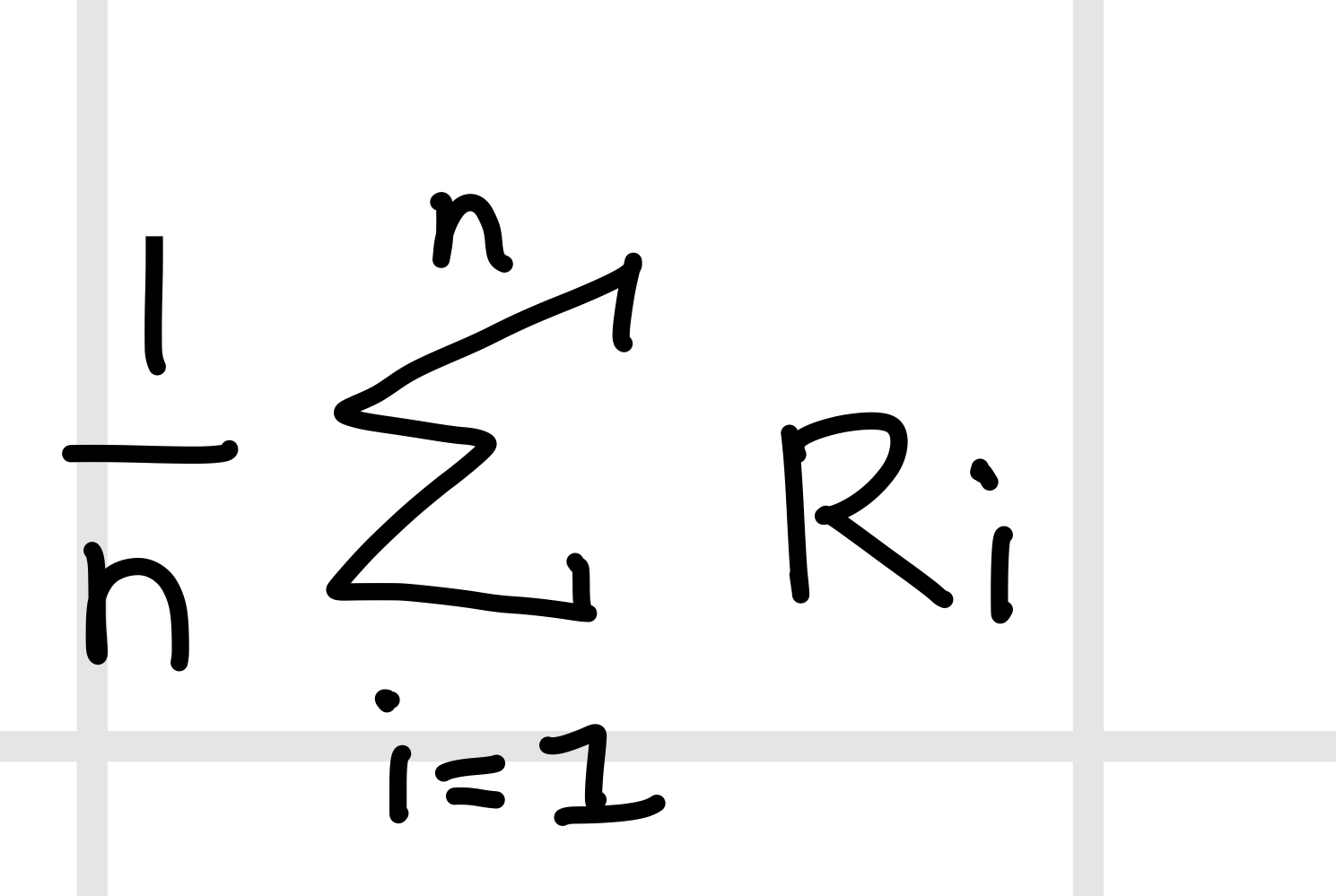

Average Return

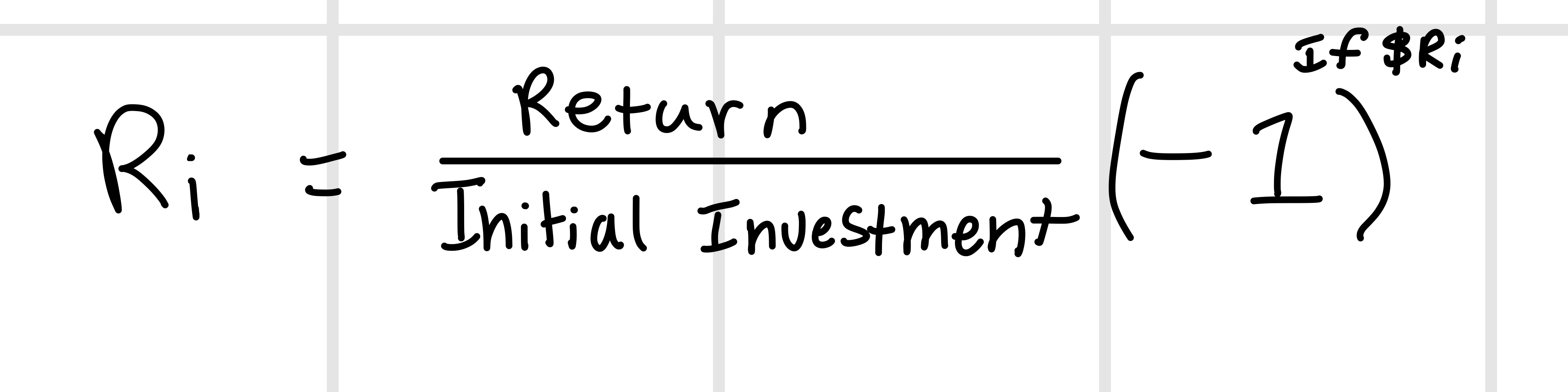

If $Ri do -1 (before 1/n)

Ri ($) = (Potential Return/Investment ) -1

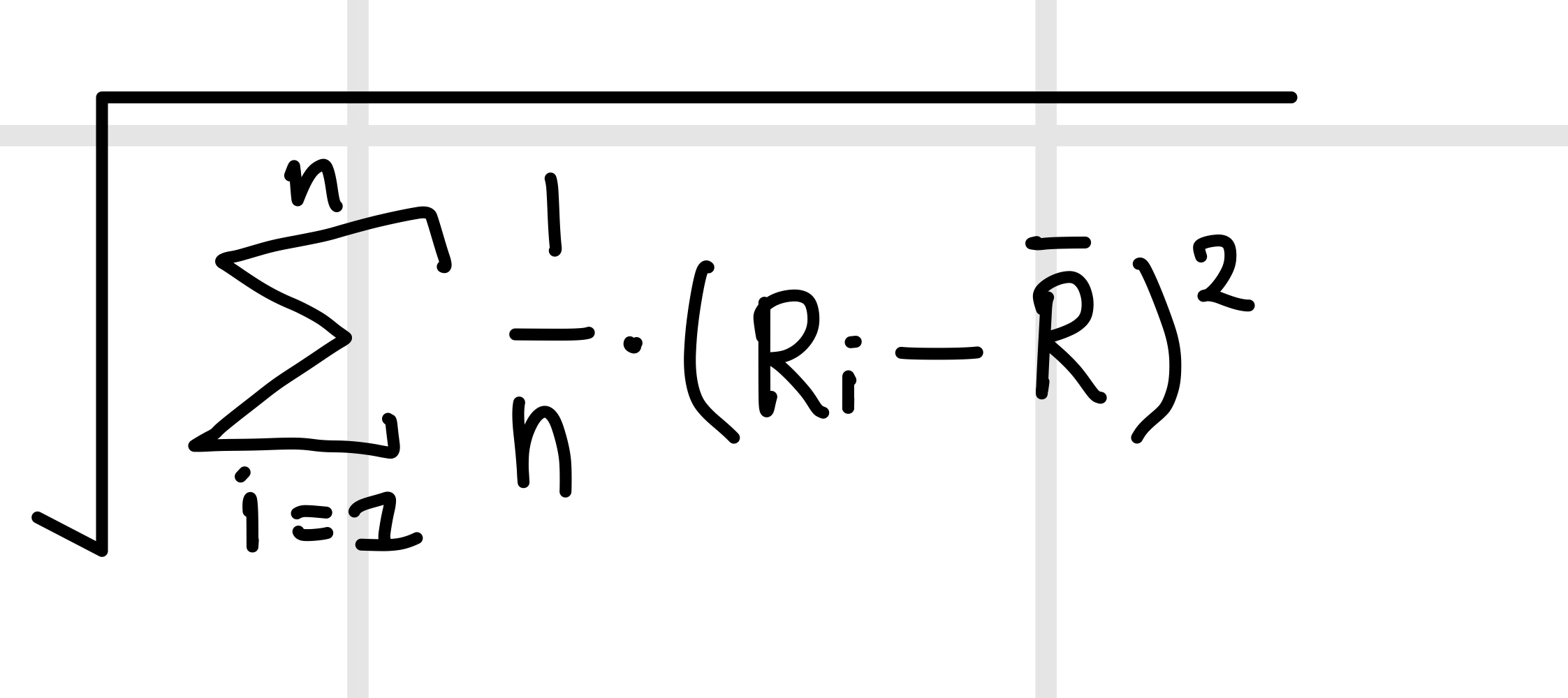

Standard Deviation

Subtract Average from all %s

Square sums

Sum all sums

Do sum/n → then √sum

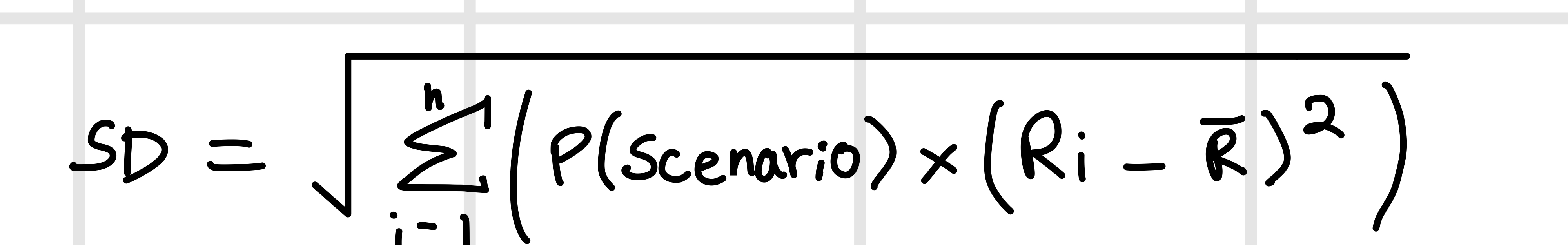

Standard Deviation when probabilities are given

Ri

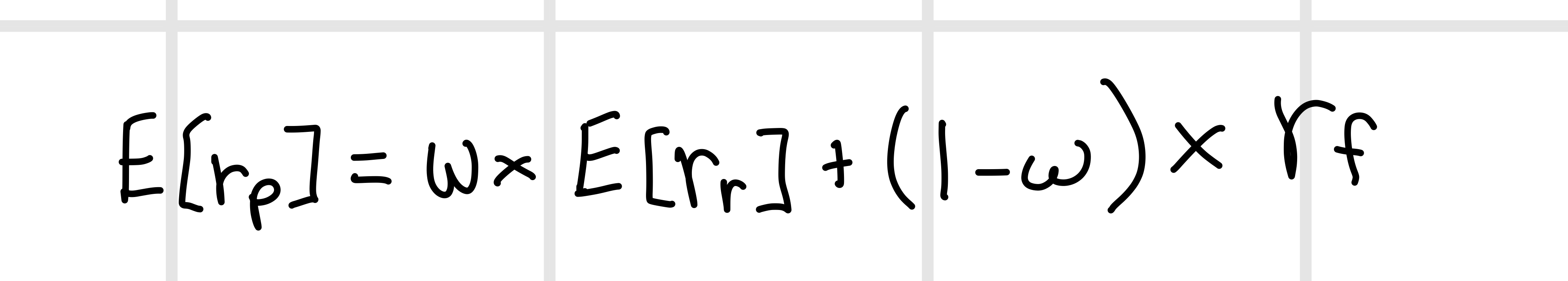

w =

w = Value of risky asset / total value of portfolio

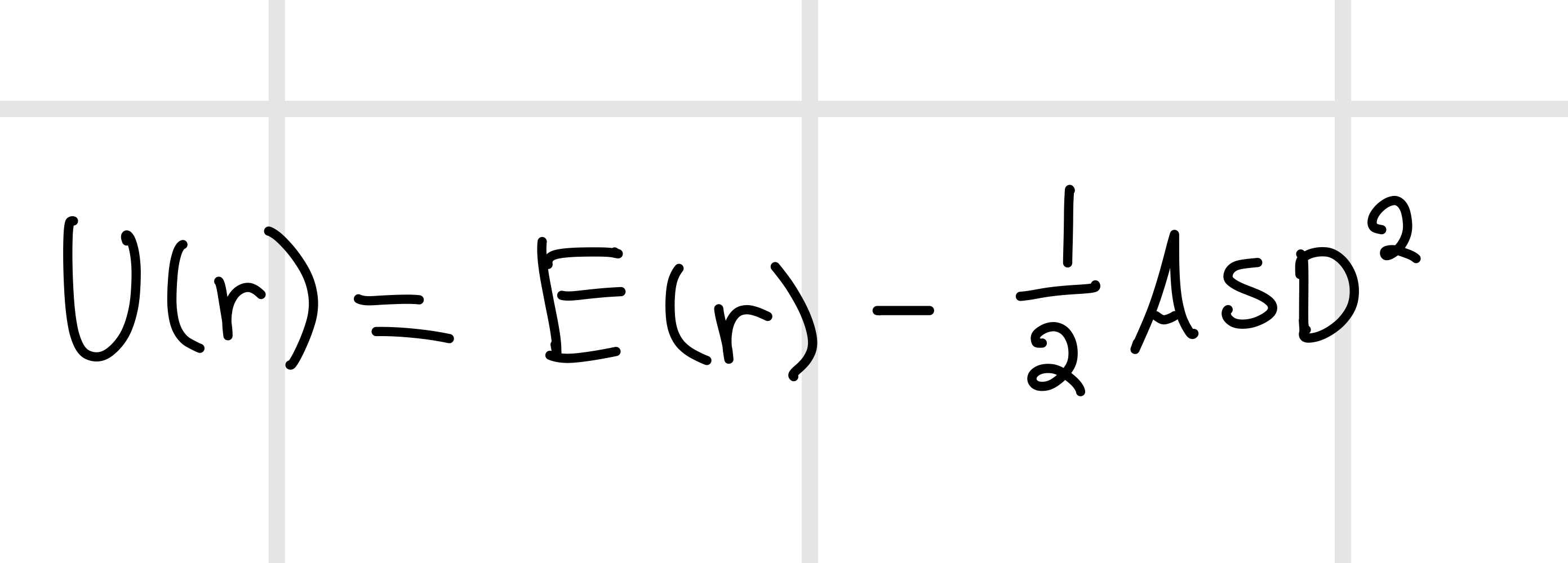

Utility Function

1-w =

1-w = Value of safe asset / total value of portfolio

Portfolio Expected return

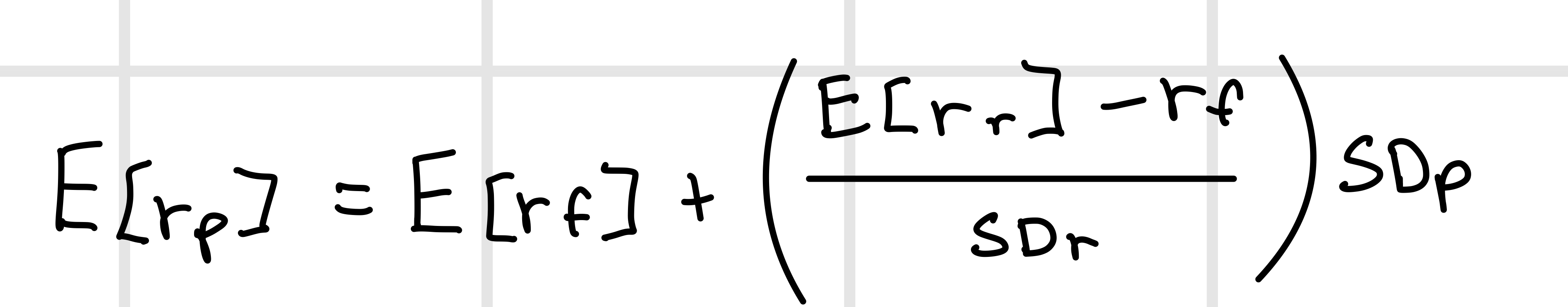

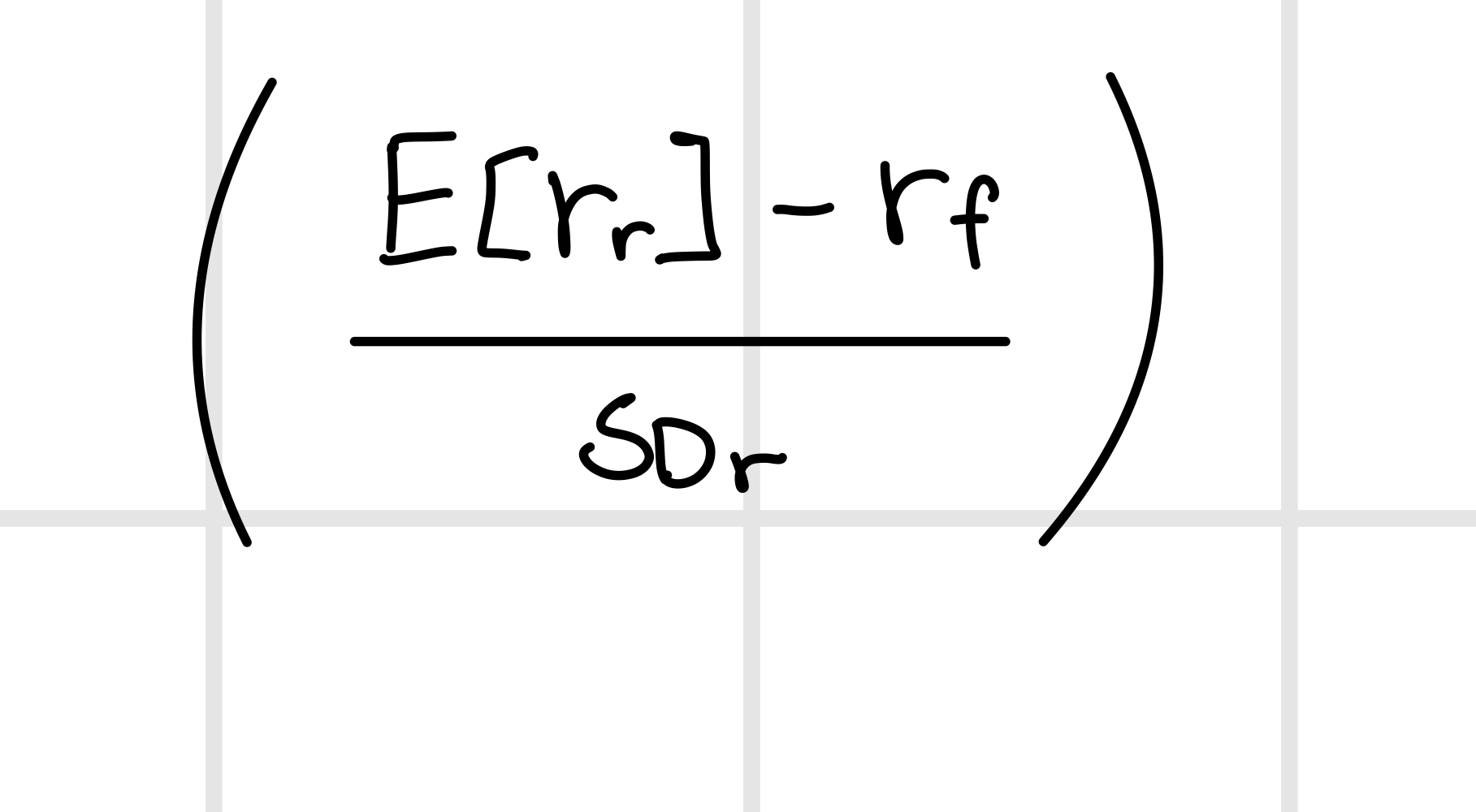

CAL Slope

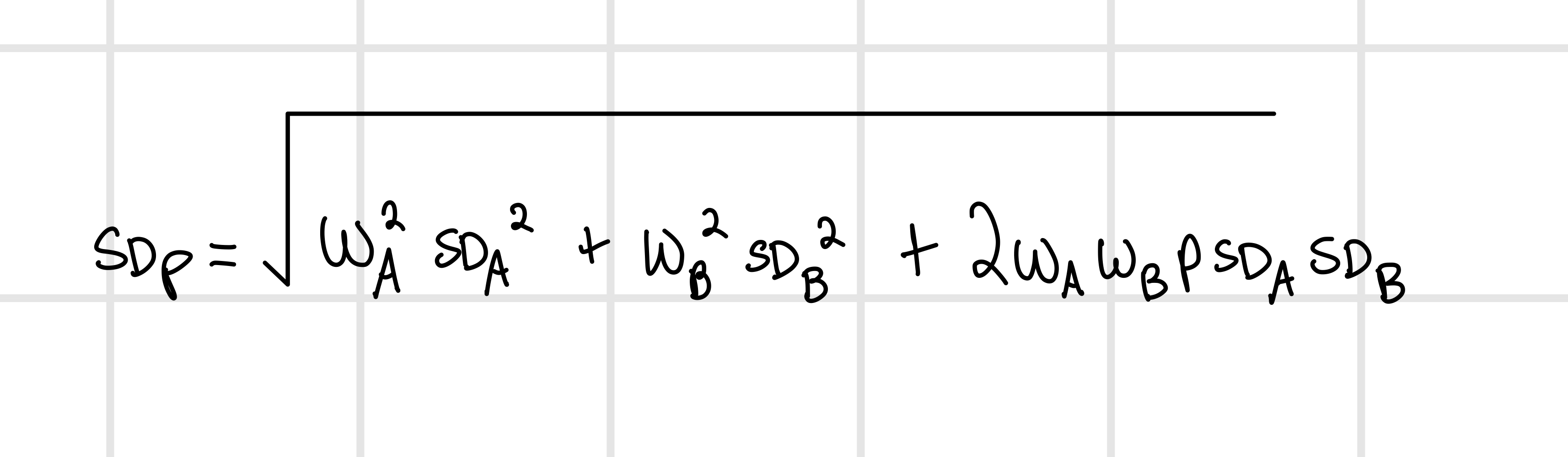

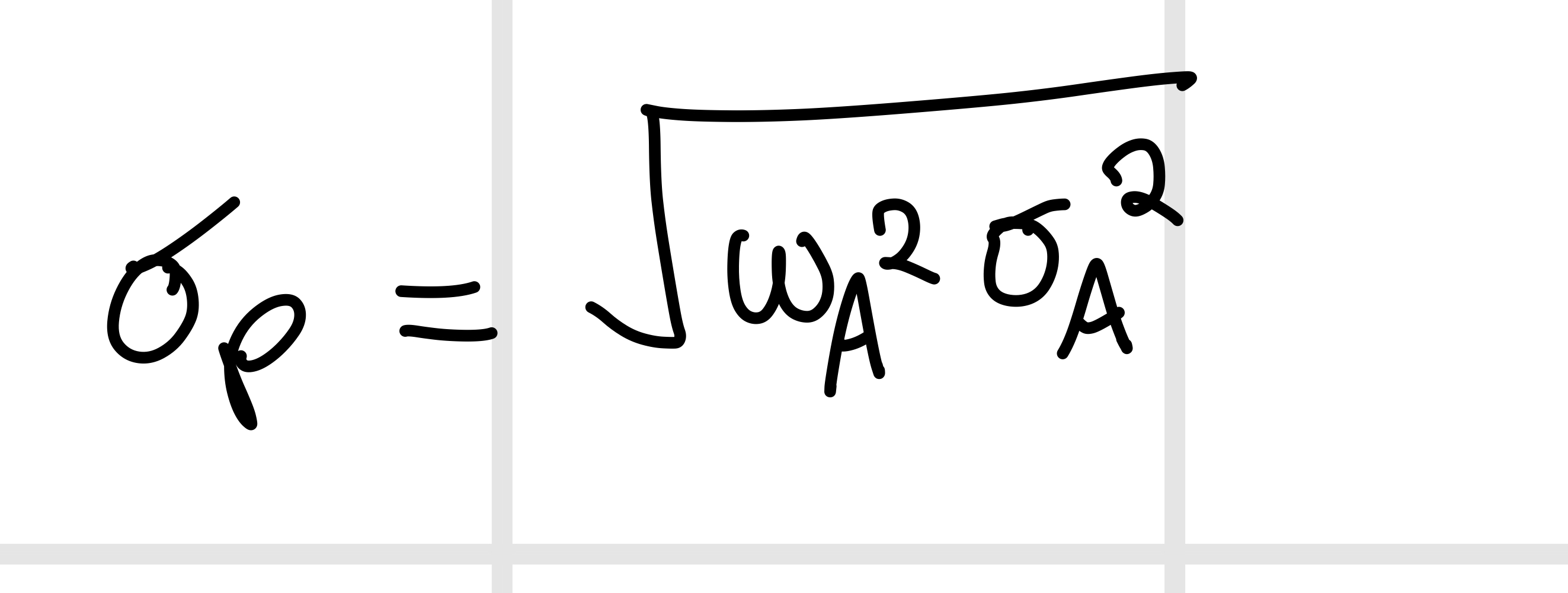

Portfolios Standard Deviation

SDp = w x SDr

or

w = SDp/SDr

Sharpe Ratio

Portfolio Variance

SDp² = w² x SDr²

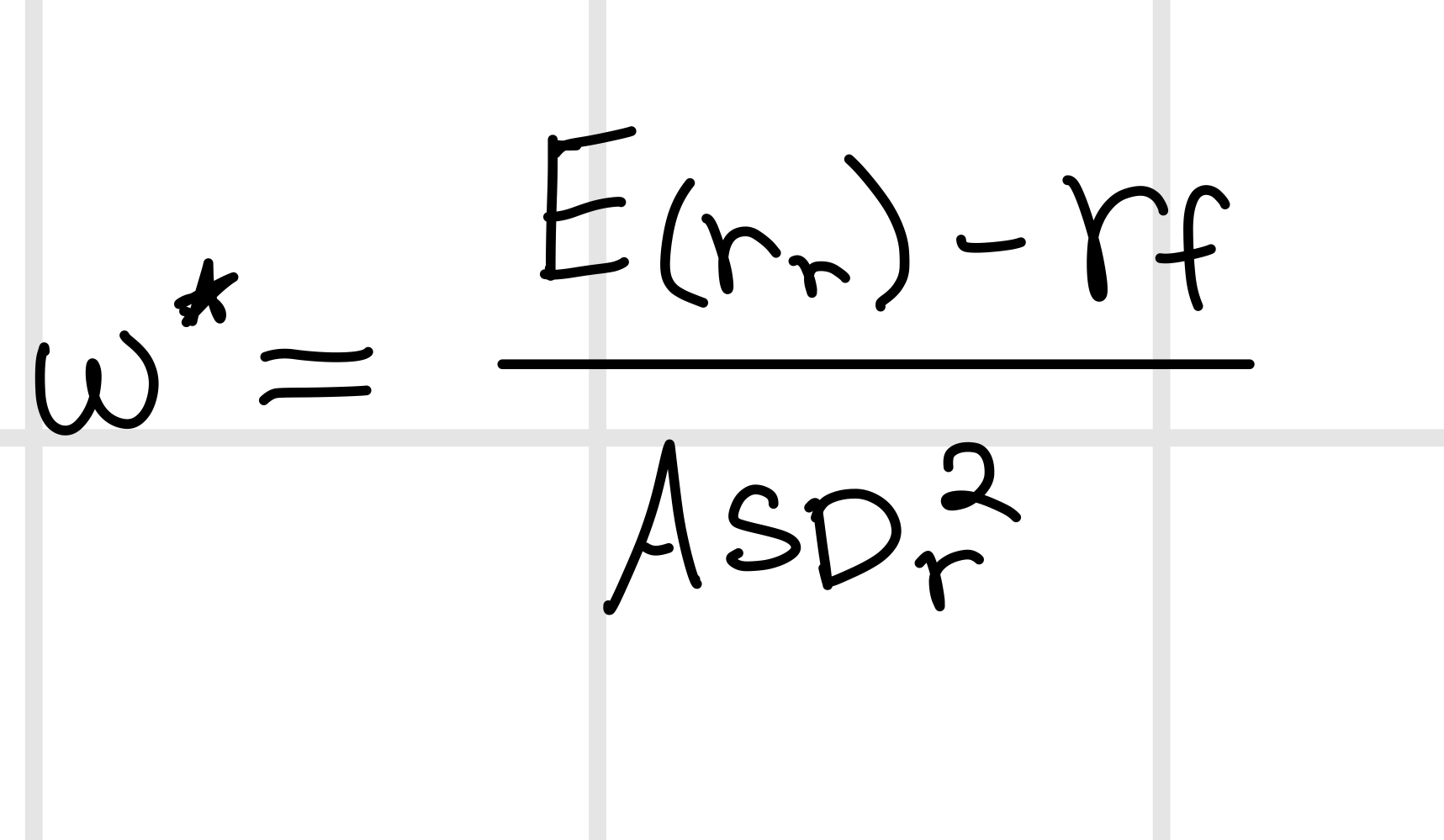

Optimal Allocation

Basic formula

When one asset is risk free

If WA, WB > 0

SDp ≤ Wa x SDa + Wb x SDb

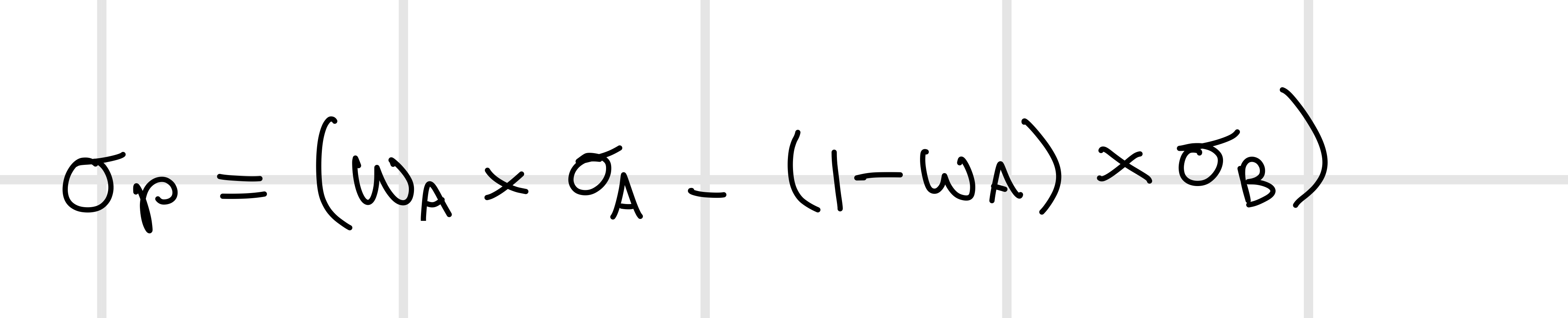

When P = -1

Two portfolio

Wa+ Wb = 1