3.2 - models, AD, SRAS, LRAS, deflationary and inflationary gaps

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

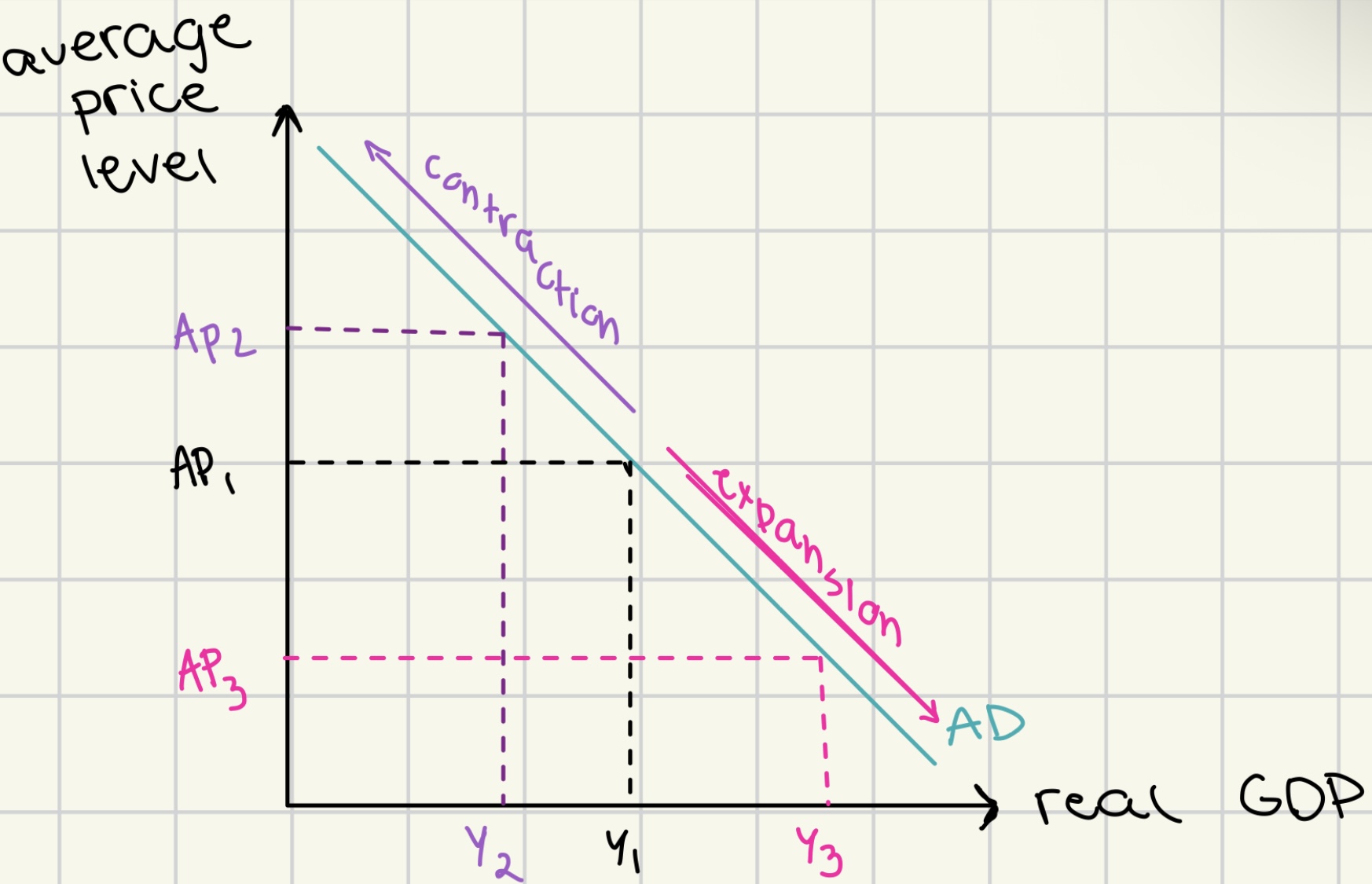

aggregate demand AD

total demand for goods and services in an economy at a given average price level and in a given time period

AD = C + I + G + (X-M)

AD ↑ = economic growth

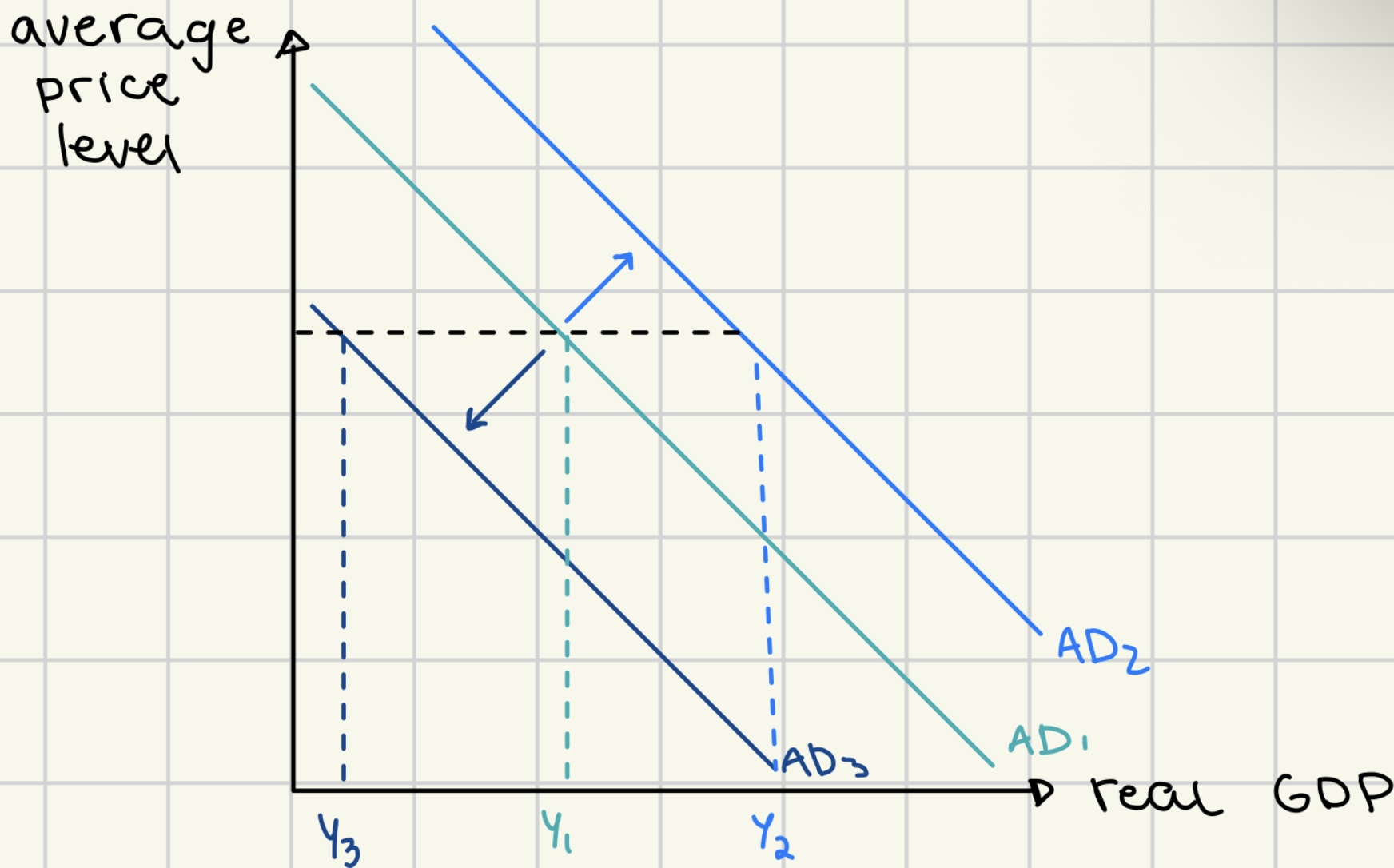

AD curve shifts

right shift → increase of any determinants of AD

left shift → decrease of any determinants of AD

factors influencing consumption of AD

consumer confidence ↑ = c↑

interest rates↑ = c↓

wealth ↑= c↑

income tax ↑= c↓

level of household indebtedness ↑ = c↓

factors influencing investment of AD

business confidence ↑= i ↑

interest rates ↑ = i ↓

technology ↑= i↑

business taxes ↑= i↓

level of corporate indebtedness↑ = i ↓

factors influencing government spending of AD

political priorities

economic priorities

factors influencing net exports of AD

income of trading partners ↑= x ↑

exchange rates (domestic currency↑ = m↑ / x↓

trade policies↑ = m ↓

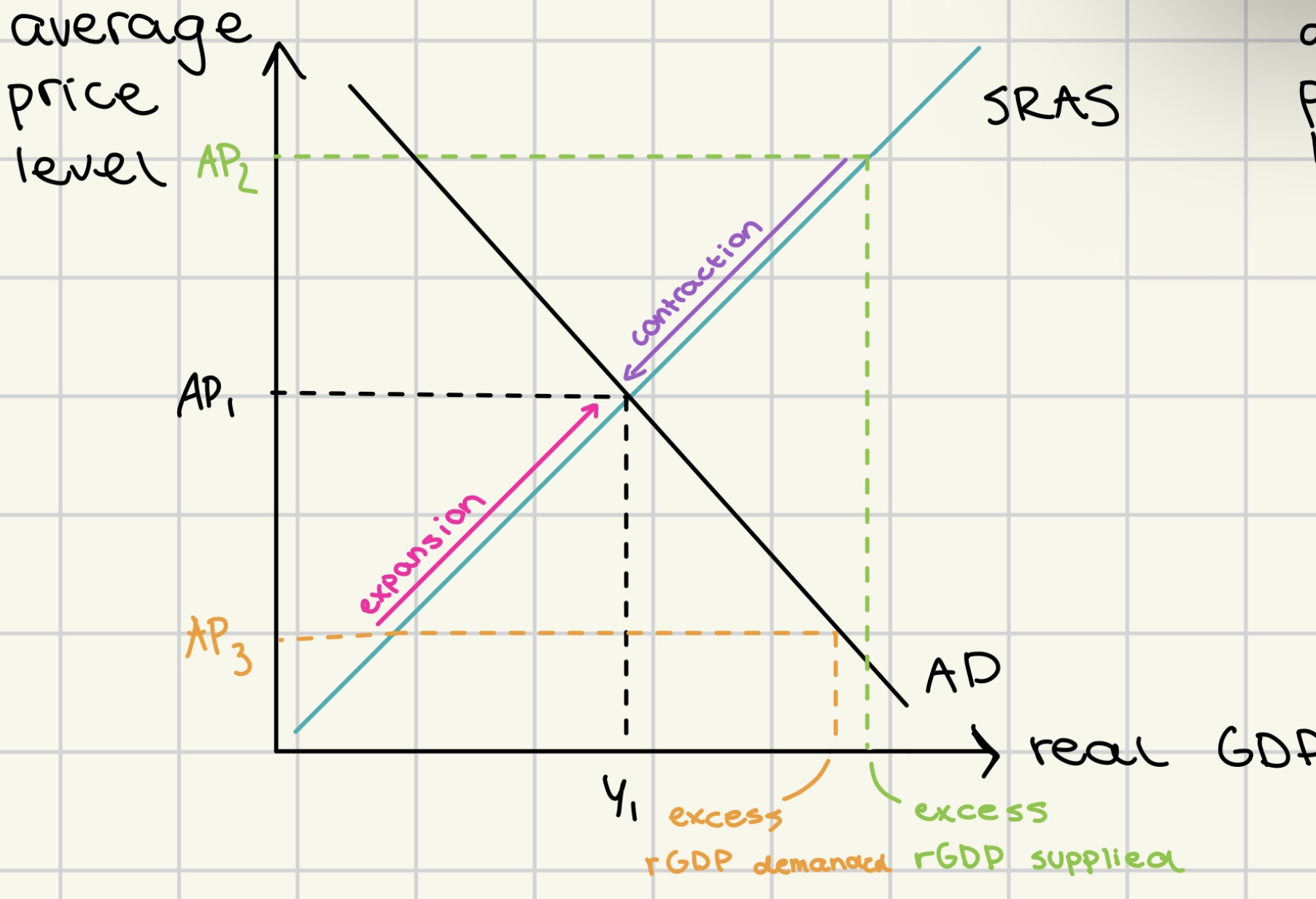

short- run aggregate supply SRAS

total supply of goods/services produced within an economy at an average price level at a given time

wages and other factors are inflexible

only shifted by change in costs of

raw materials

energy

indirect taxes

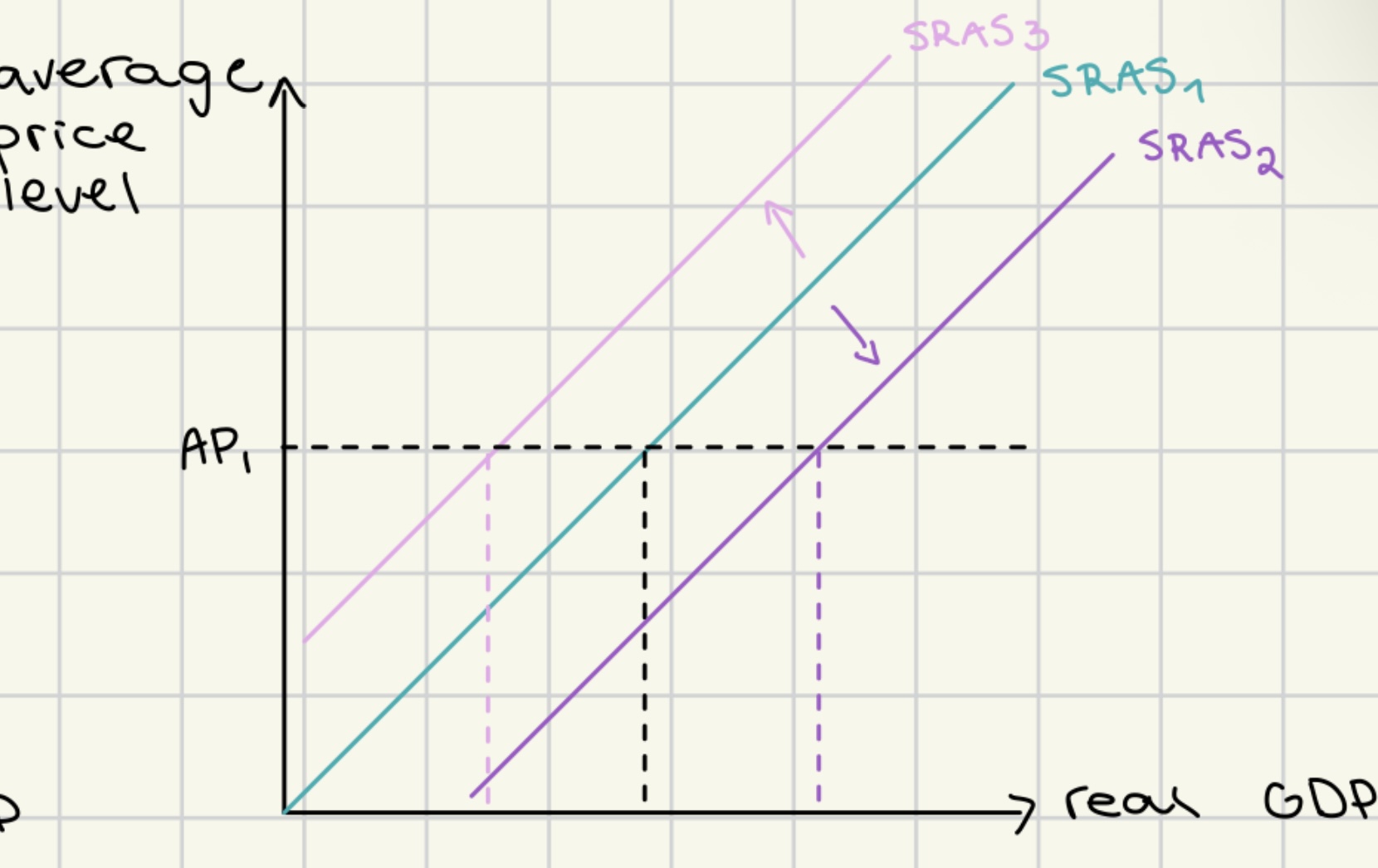

SRAS curve shifts

left shift → increase in costs/ decrease in SRAS

right shift → decrease in costs/ increase in SRAS

factors shifting SRAS curve

input costs (wages, costs of resources) ↑ = SRAS ↓ = left

indirect taxes ↓ = costs ↓= SRAS ↑ = right

subsidies ↑ = costs ↓ = SRAS ↑ = right

supply shocks = output ↓ = SRAS ↓ = left

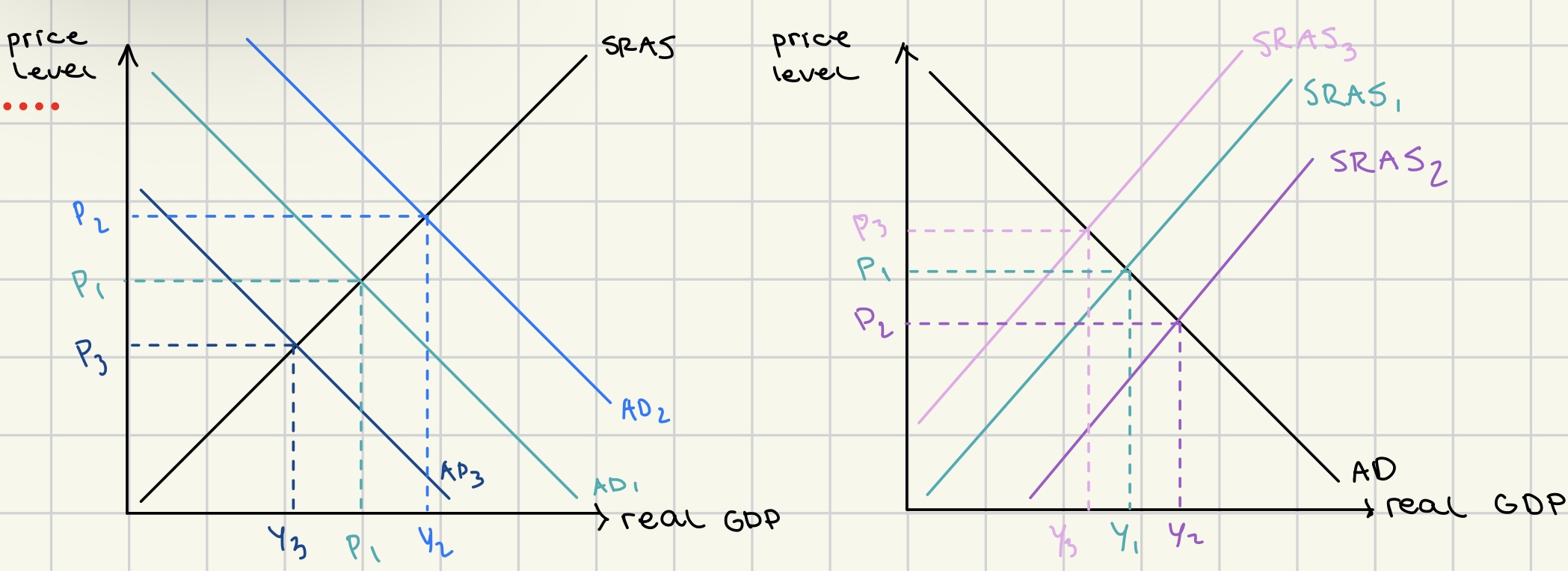

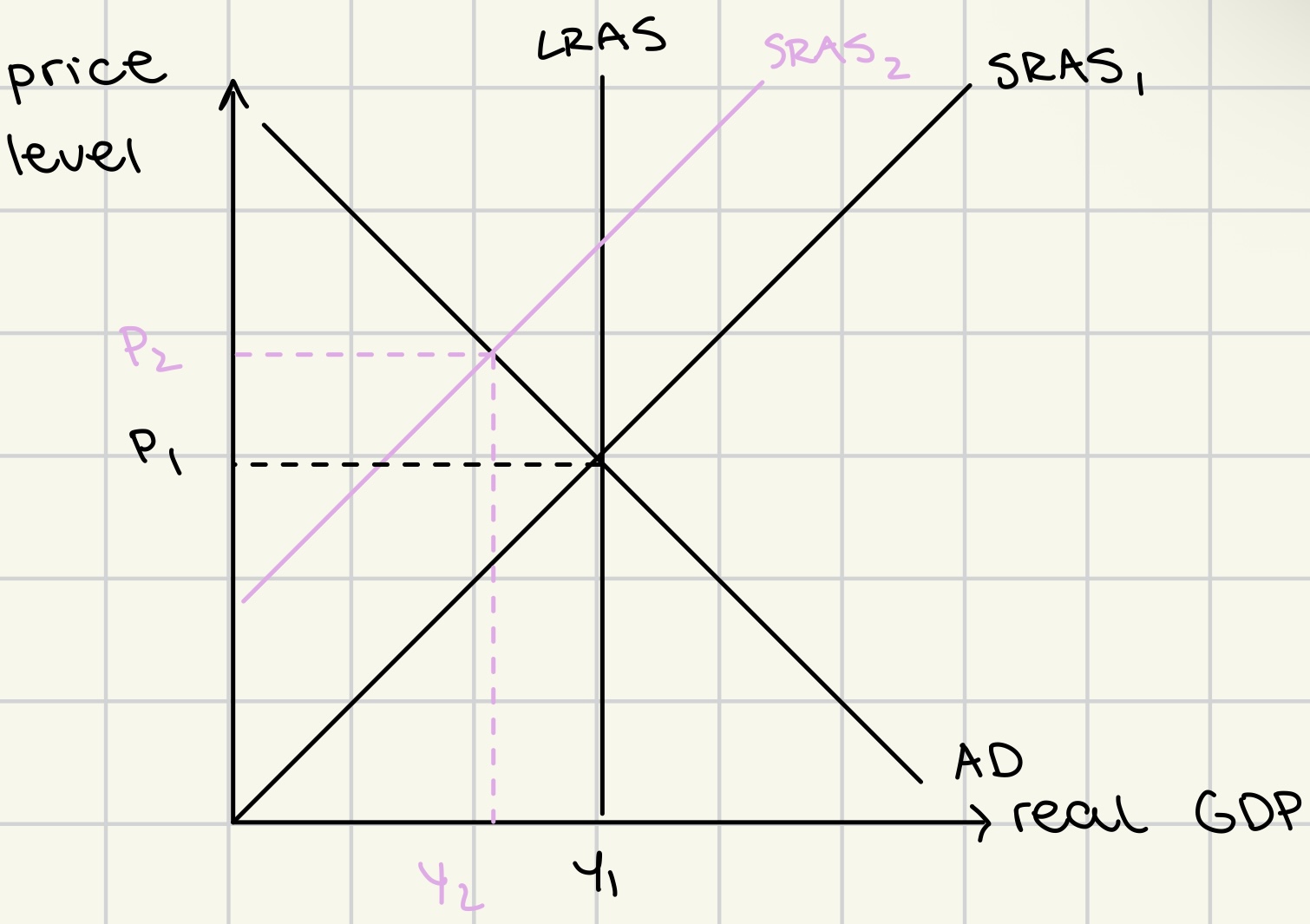

impacts of changes of SRAS and AD on short run equilibrium

long run aggregate supply LRAS (monetarist view)

all factors of production are utilized efficiently.

negative and positive output gaps will self-correct

only average price level will change

economy will always return to this full employment in long run

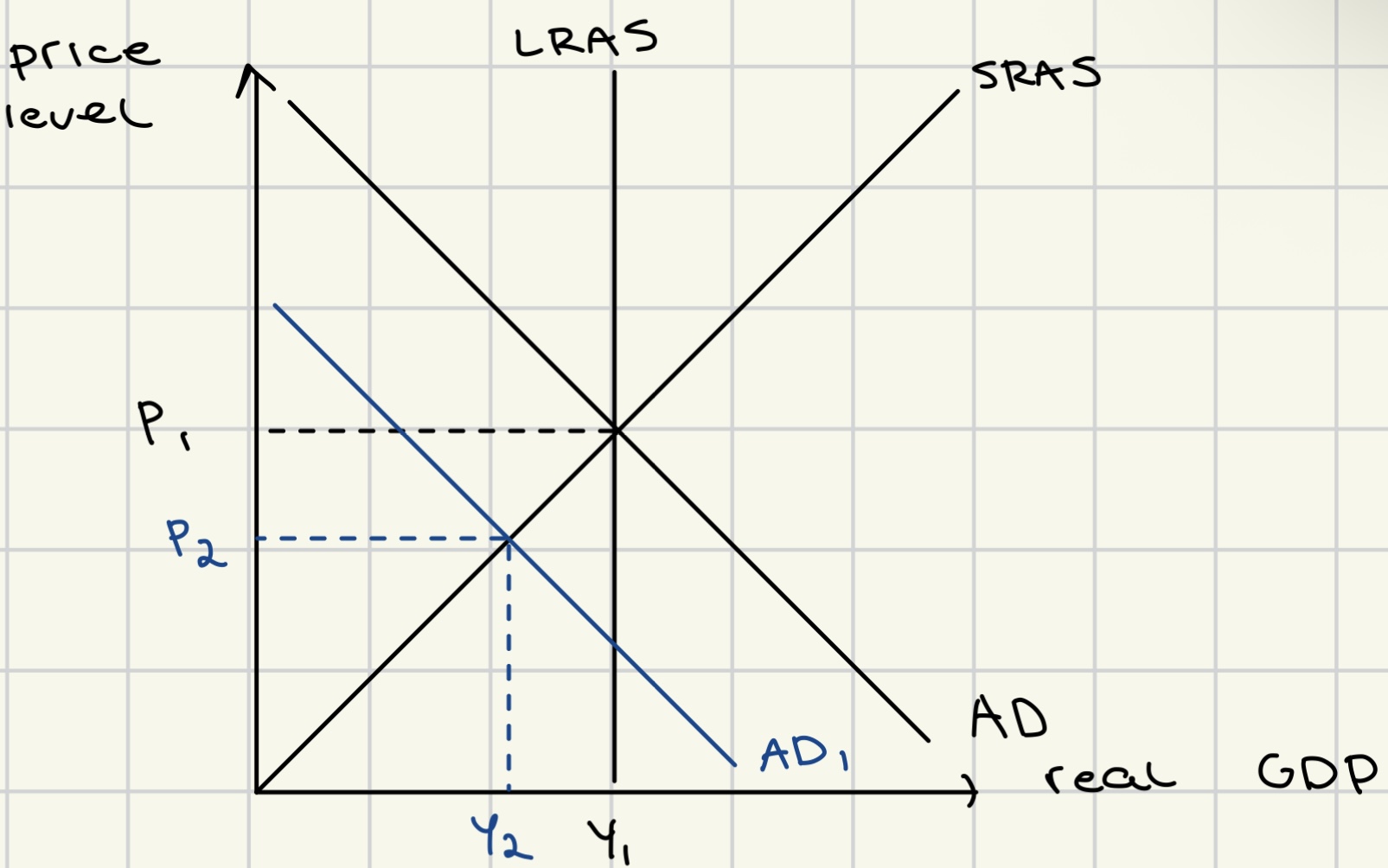

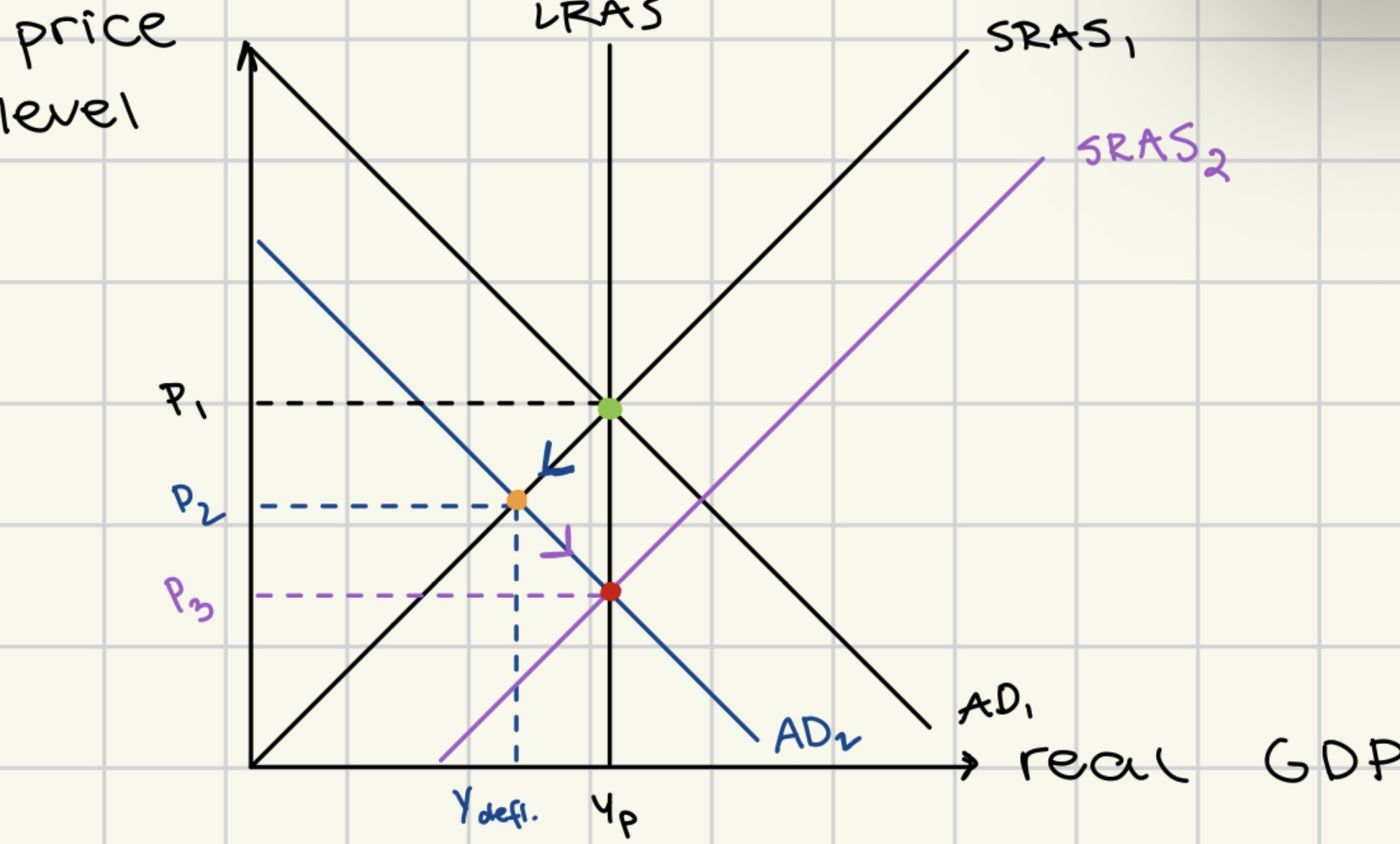

deflationary gap → fall in AD

real GDP < potential GDP

unemployment> natural rate of unemployment

not enough demand in the economy to make it worthwhile produce potential GDP

caused by decrease (left shift) in AD

decreased price level

decreased real GDP

solving deflationary gap → rise in SRAS

real GDP > potential GDP

unemployment < natural rate of unemployment

caused by increase (right shift) in SRAS

decreased price level

increased real GDP

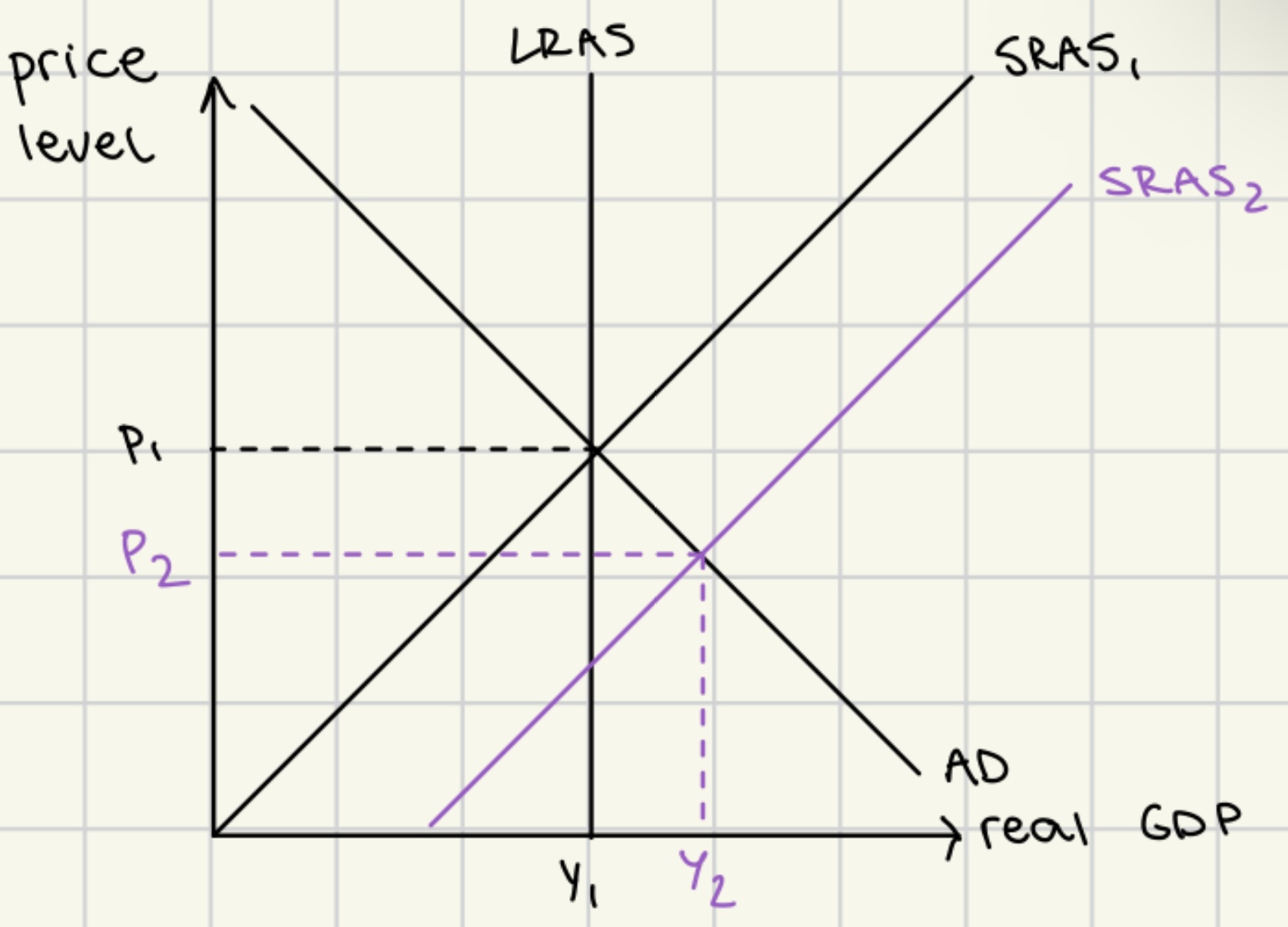

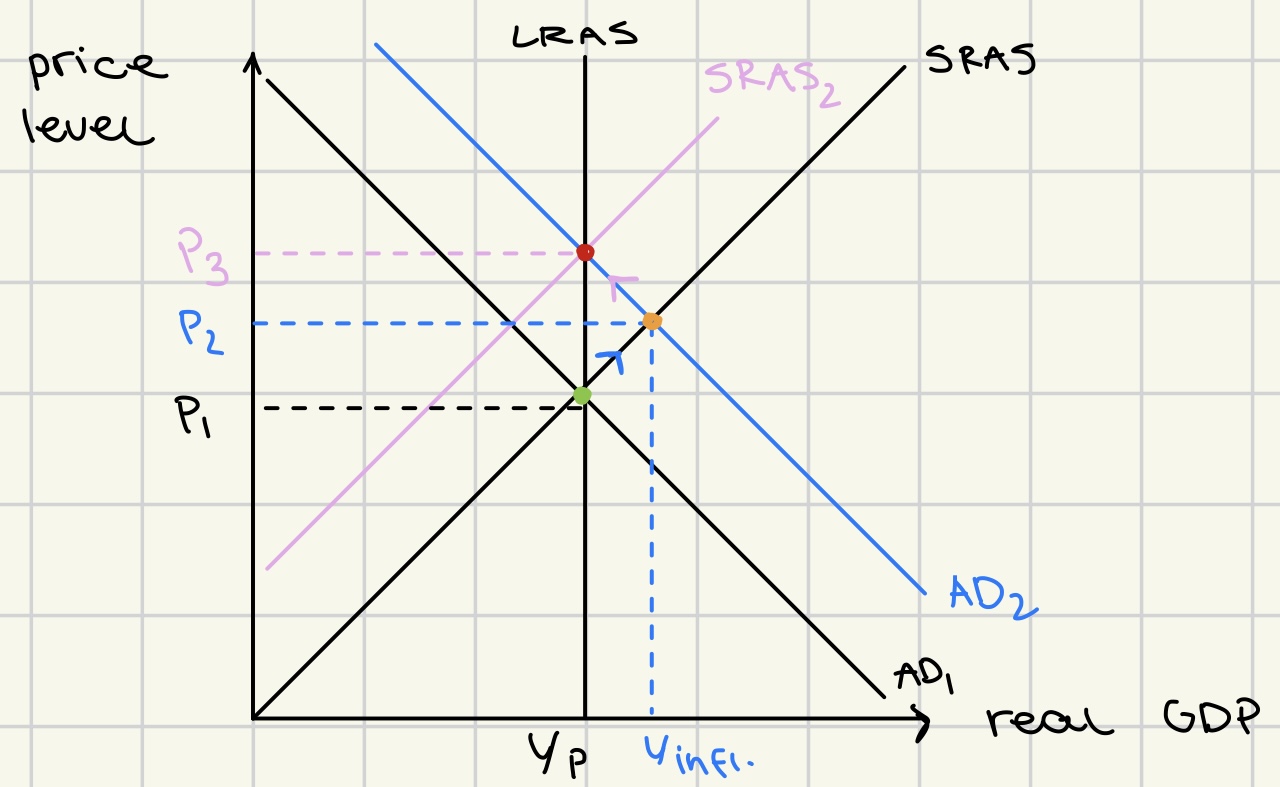

inflationary gap → rise in AD

real GDP > potential GDP

unemployment < natural rate of unemployment

to too much demand in the economy

caused by increase (right shift) in AD

higher price level

higher real GDP

solving inflationary gap → fall in SRAS

real GDP < potential GDP

unemployment > natural rate of unemployment

caused by decrease (left shift) in SRAS

stagflation

increased price level

decrease in real GDP

deflationary gap creation + correction & result

creation:

fall (left shift) in AD

decreased price level

decreased real GDP

deflationary gap

correction:

increase (right shift) in SRAS

decrease in production costs

good supply shock

result:

economy is back at LRAS curve at point *

fall in price level

assumptions:

wage and price flexibility in the long run

allowed economy to shift back to full employment of output

inflationary gap creation + correction & results

creation:

rise (right shift) in AD

increased price level

increased real GDP

inflationary gap

correction:

decrease (left shift) in SRAS

increase in production costs

bad supply shock

result:

economy is back at LRAS curve at point *

rise in price level

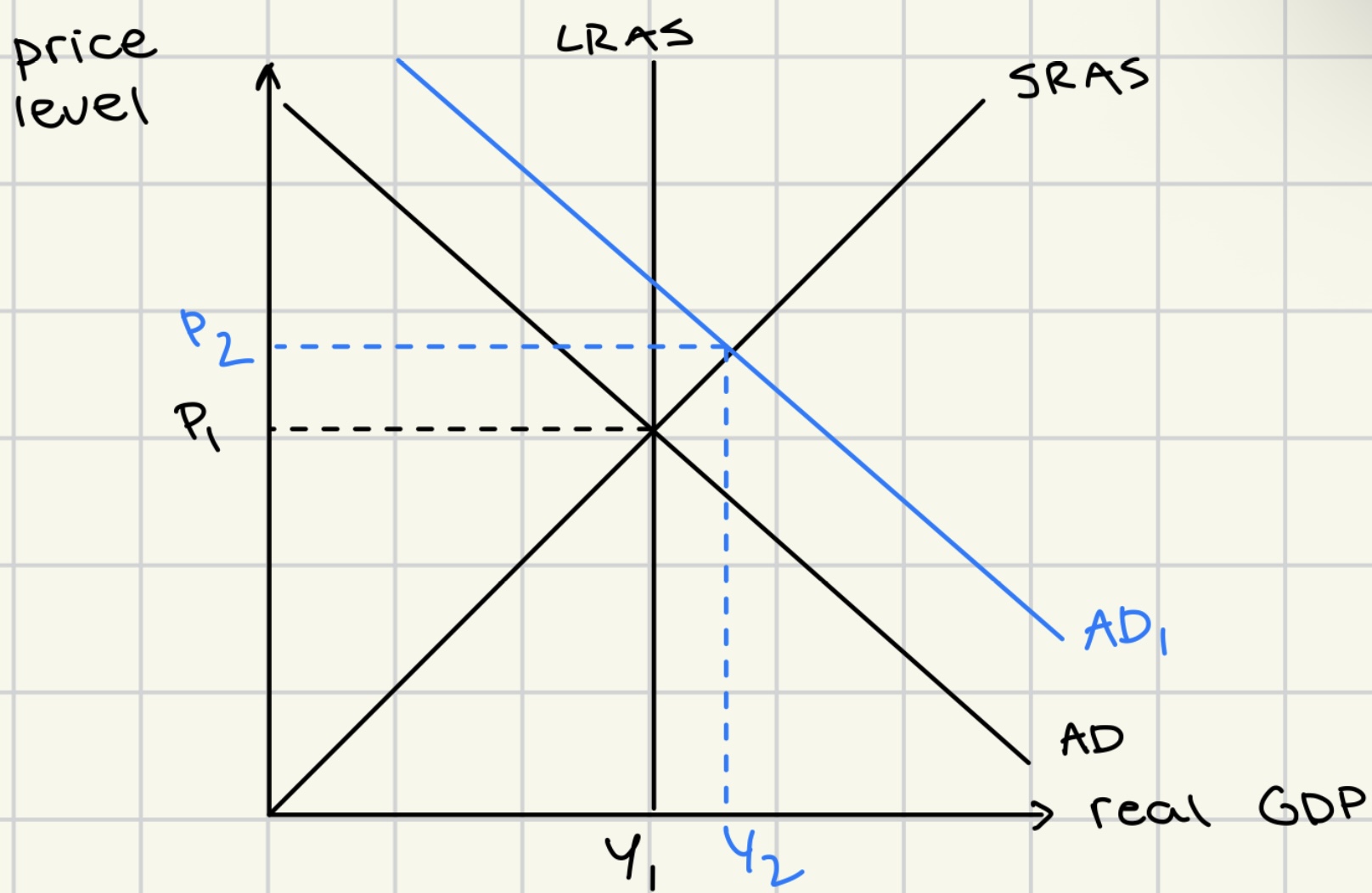

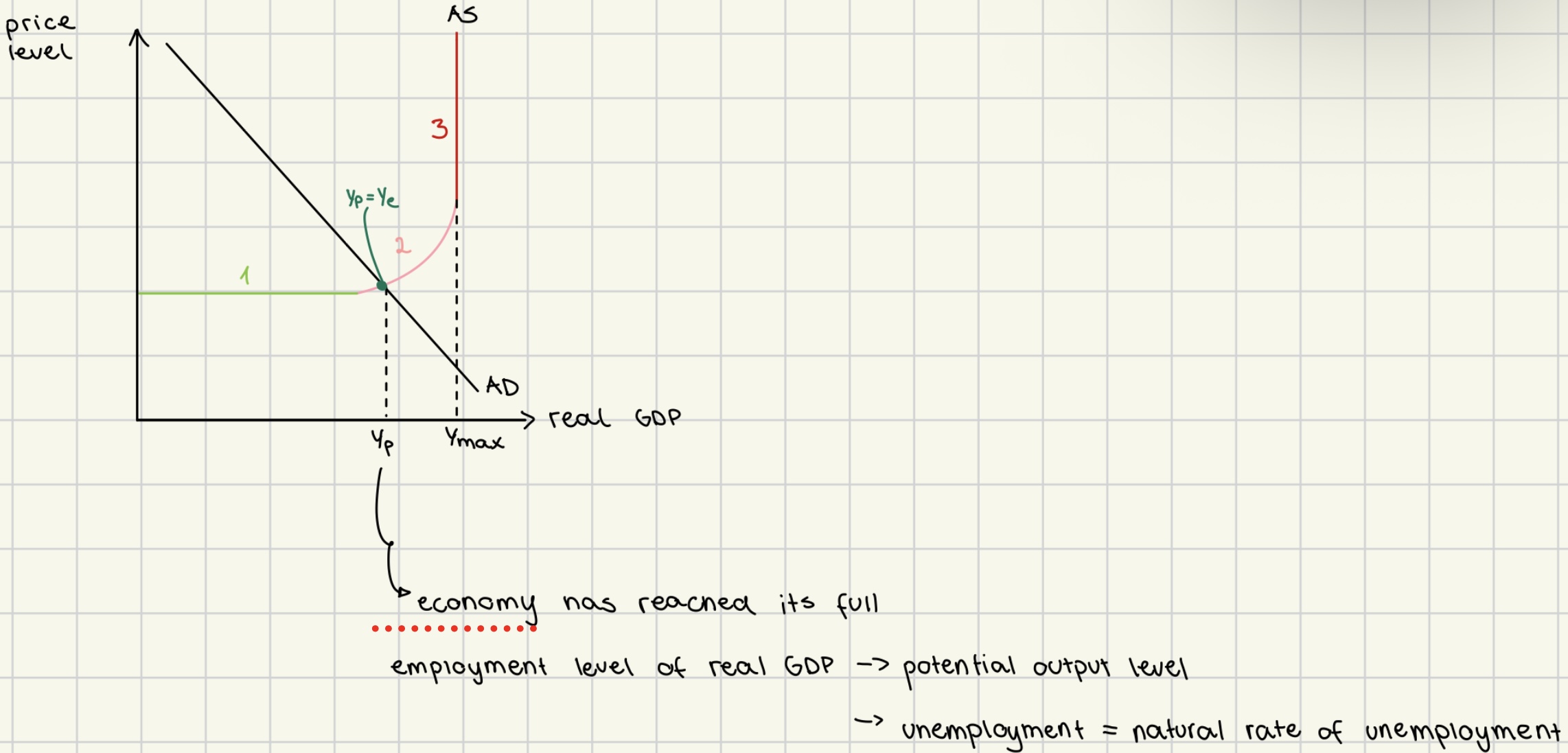

Keynesian model

LRAS is L shaped with 3 distinct sections

elastic supply section

relatively elastic supply section

perfectly inelastic supply section

will not always self-correct

may get stuck below potential GDP

needs government intervention to aid it

increase in AD may not necessarily result in increase in price level

elastic supply section

unemployment of resources & spare capacity

easy to increase output without rising prices

relatively elastic supply section

spare capacity begins to run out

output (rGDP) increases

resources’ price increase

higher costs of production

increased selling prices

perfectly inelastic supply section

full employment of all available resources

real GDP can no longer increase

any effort to increase output results in higher price

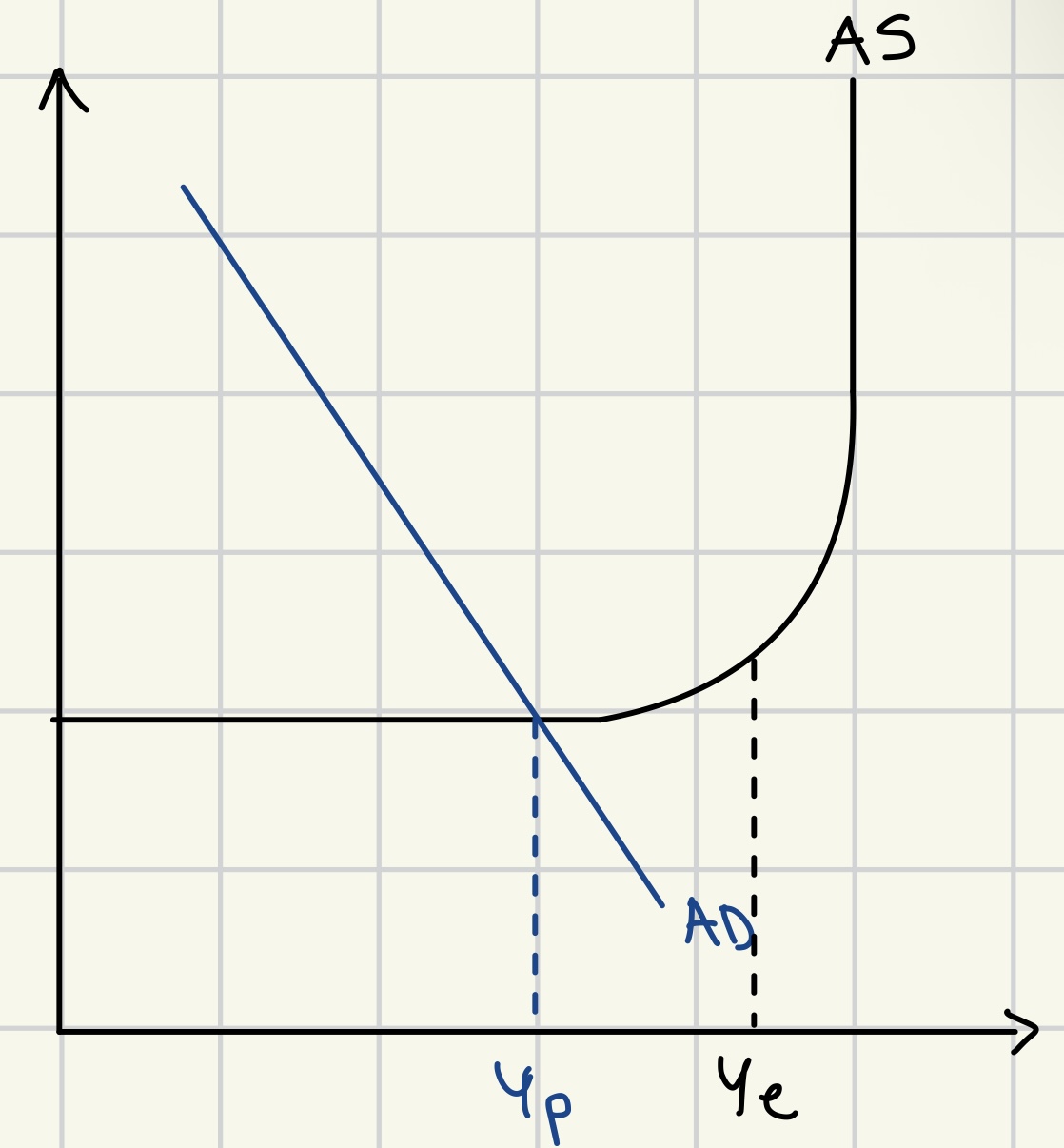

deflationary gap Keynesian model

Ye < Yp

unemployment > natural rate of unemployment

AD is too weak to induce firms to produce at Yp

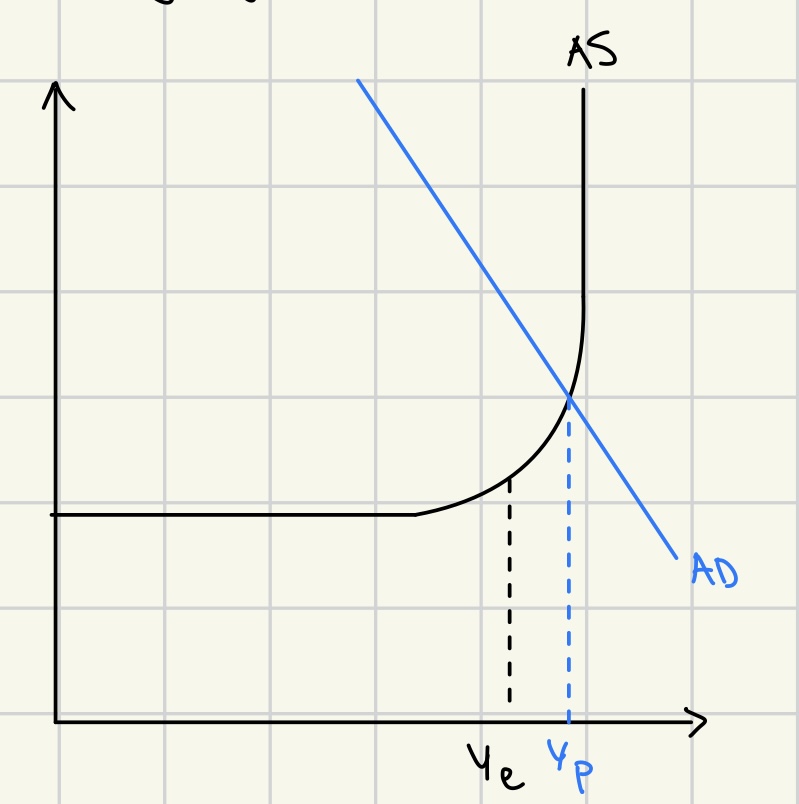

inflationary gap Keynesian model

Ye > Yp

unemployment < natural rate of unemployment

strong AD

output gaps definition

the difference between

actual level of output (rGDP)

maximum potential level of output (Yp)

difficulty with measuring output gaps

hard to know the exact maximum productive potential

due to factors like

changes in technology

labor force participation

variations in consumer demand.

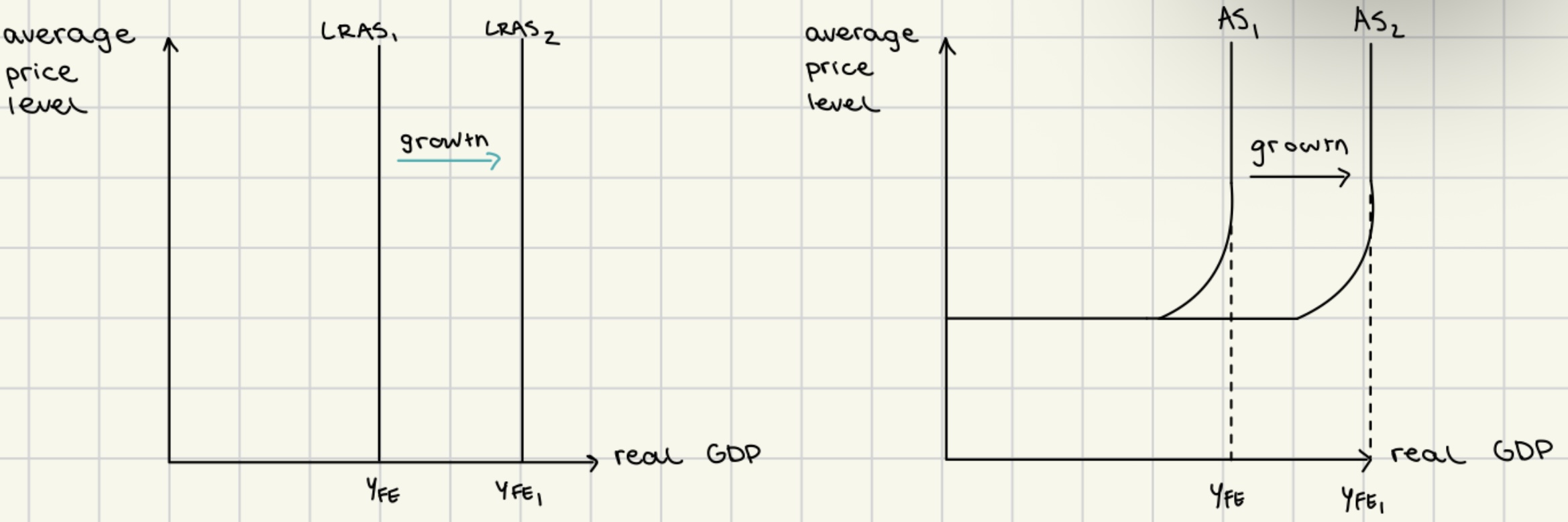

factors affecting AS and LRAS

(economic growth/fall & Yp increase/ fall)

changes in quality + quantity of:

land

labor

capital

enterprise

classical model

wages are flexible

natural rate of unemployment

gaps are automatically corrected

resources are free to change as price level changes

markets should work as freely as possible

AD changes result in change in price level

(demand side policies <supply side) are better in generating economic growth

Keynesian model

sticky prices

sticky wages

severe recessionary gaps

requires government intervention to stimulate demand and reduce unemployment.

gaps can persist over long time

increase/ decrease in AD don’t need to result in change of price level