Chapter 10 - Stockholders' Equity

1/38

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

39 Terms

retained earning’s calculation

beg. retained earning

+net income

-dividend

=ending retained earning

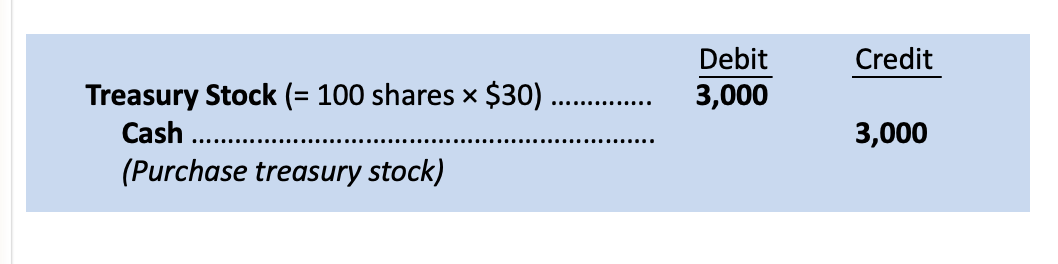

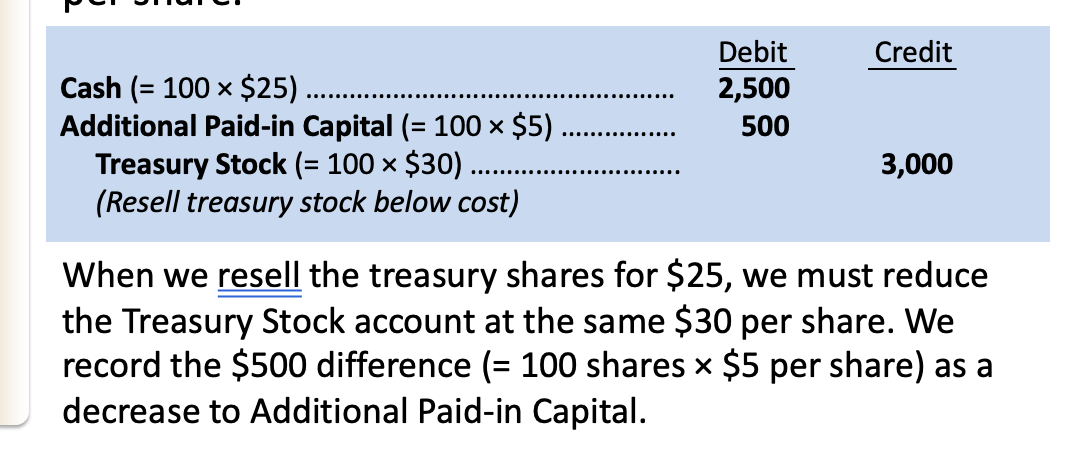

treasury stock

contra equity account - BS & SE

advantages of corporation

limited liability

ability to raise capital and transfer ownership

disadvantages of corporation

additional taxes

more paperwork

only pay dividends to _____

outstanding stocks

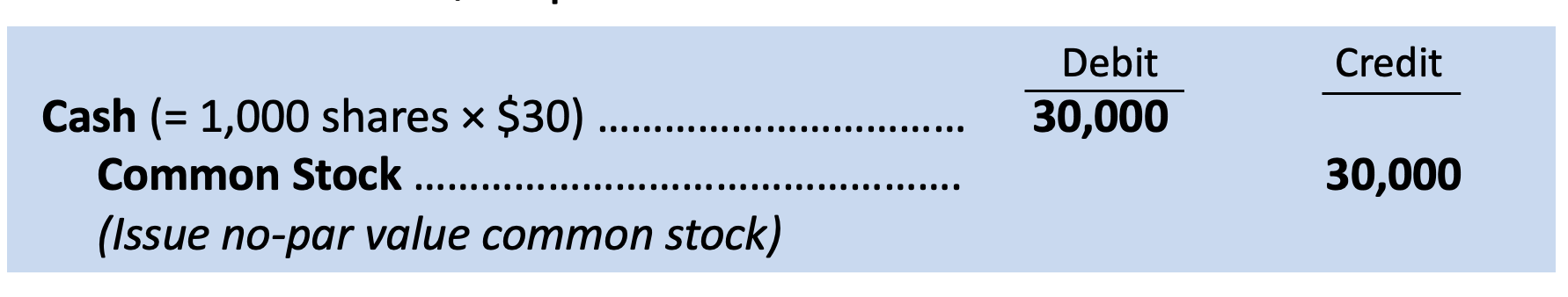

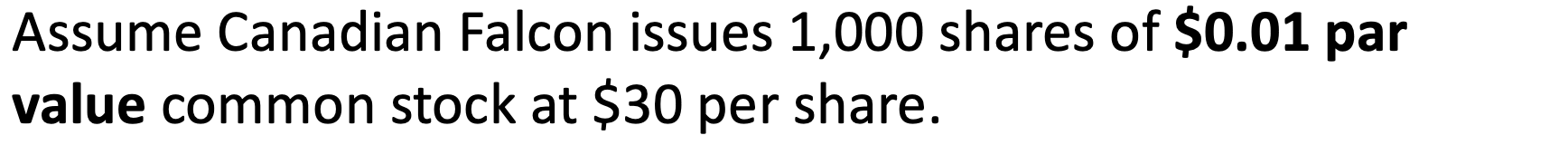

legal capital per share of stock that’s assigned when the corporation is first established

par value

right to vote

right to receive dividends

right to share in the distribution of assets

stockholder rights

_____ stock do not have a right to vote

preferred

Preferred stockholders usually have first rights to a specified amount of dividends.

Preferred stockholders receive preference over common stockholders in the distribution of assets in the event the corporation is dissolved.

Preferred stock is “preferred” over common stock in these two ways.

Features of Preferred Stock: Shares can be exchanged for common stock.

convertible

Features of Preferred Stock: Shares can be returned to the corporation at a fixed price.

redeemable

Features of Preferred Stock: Shares receive priority for future dividends if dividends are not paid in a given year.

cumulative

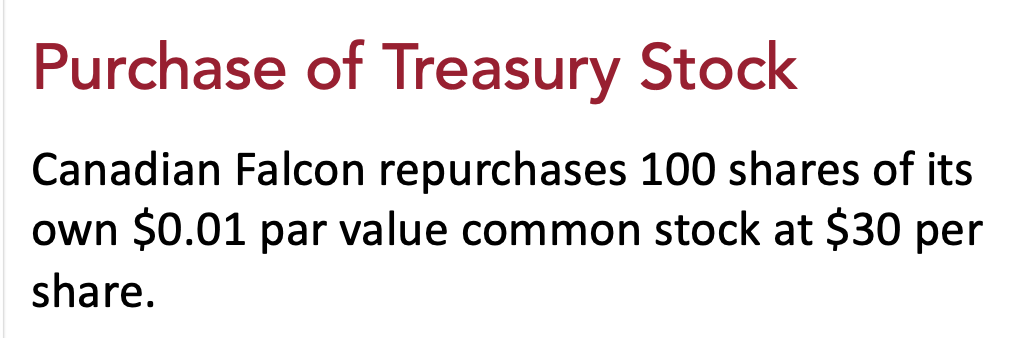

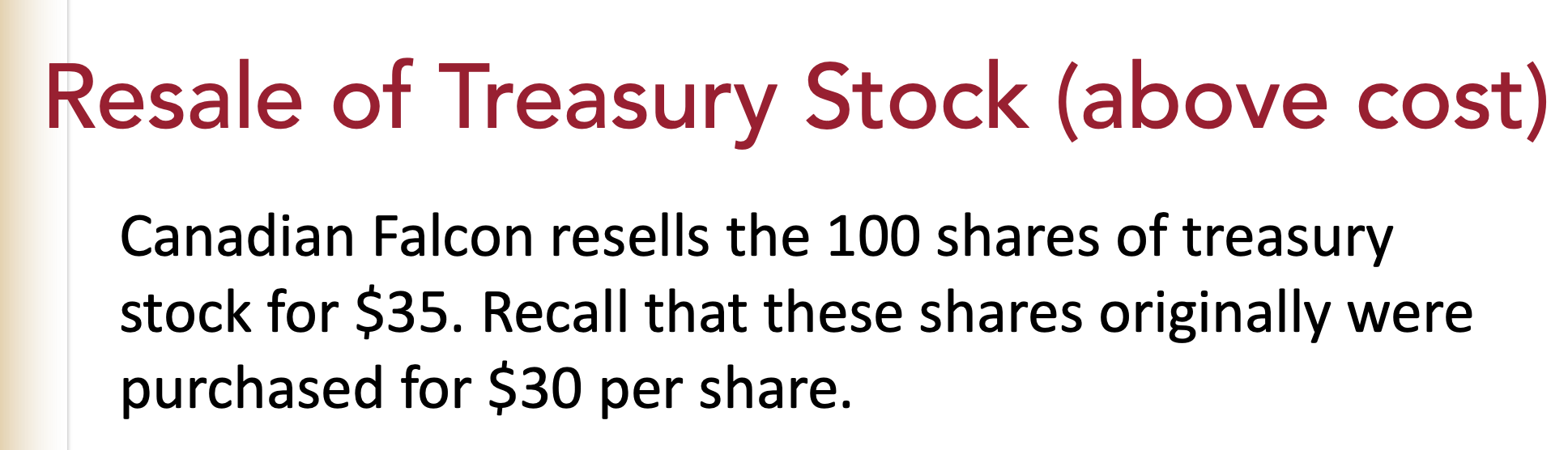

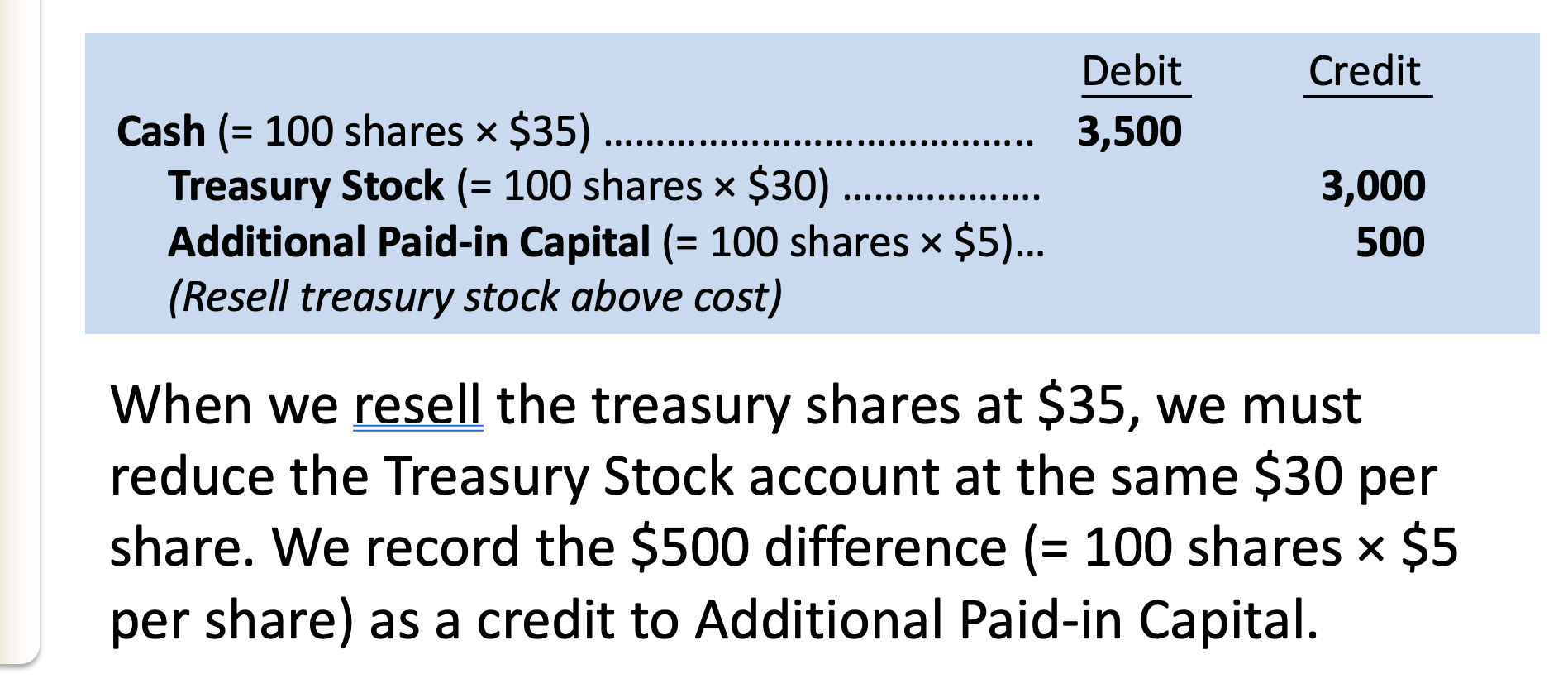

To boost underpriced stock

To distribute surplus cash without paying dividends

To boost earnings per share

To satisfy employee stock ownership plans

reasons why companies buy back their own stock

Treasury stock is the purchase of a corporation’s own stock, and we record it as a _____ in stockholders’ equity. It is not an asset; a company cannot invest in itself.

reduction

Earnings retained in the corporation and not paid out as dividends

Equals all net income less all dividends, since the company began operations

Has a normal credit balance

retained earnings

_____ represent all net income, less all dividends, since the company began operations.

retained earnings

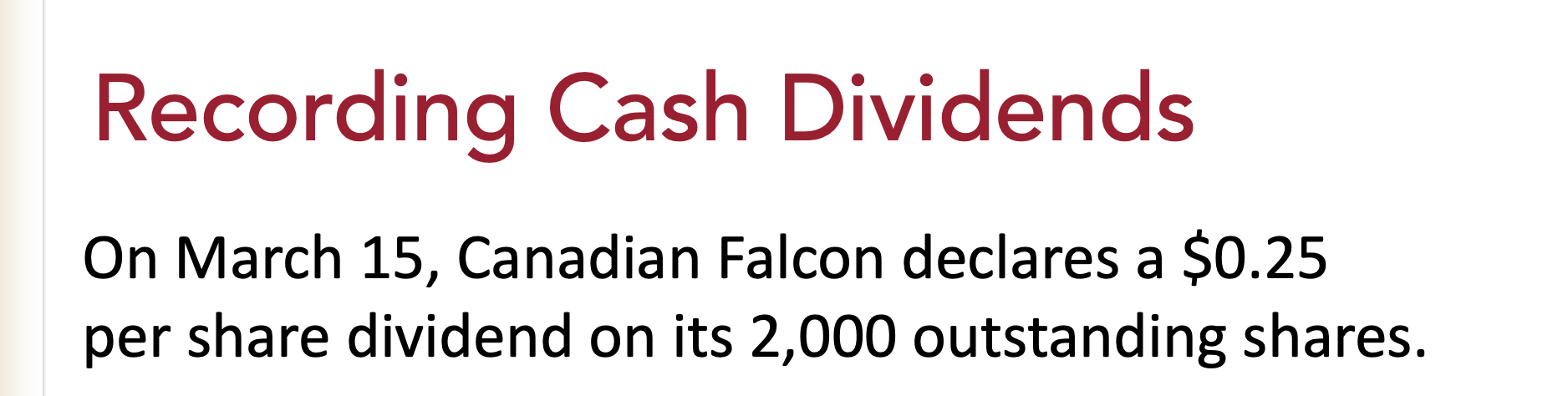

Distributions by a corporation to its stockholders

A change in a quarterly or annual cash dividend paid by a company can provide useful information about future prospects

Not all companies pay dividends; for example, growth companies prefer to reinvest earnings rather than distribute them

cash dividends

Dividend Dates: Date on which board of directors announces the next dividend to be paid.

declaration date

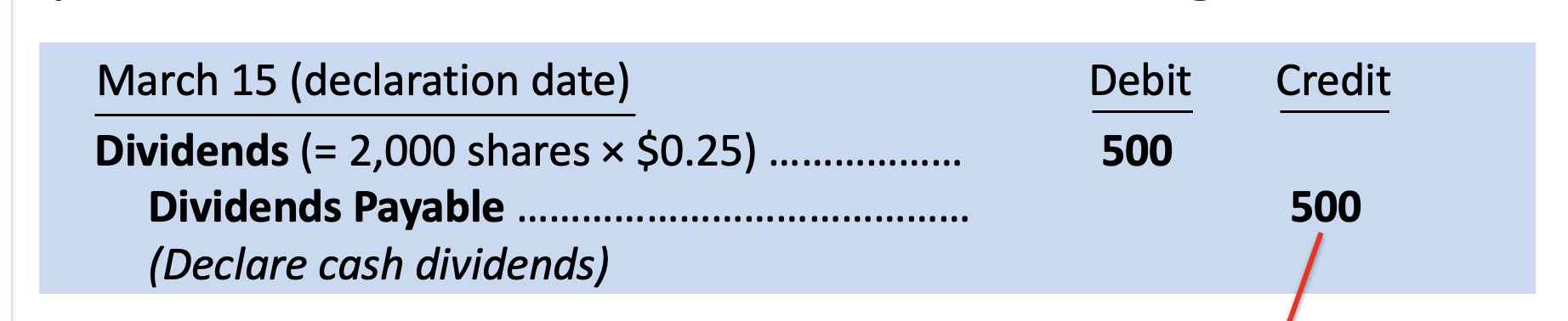

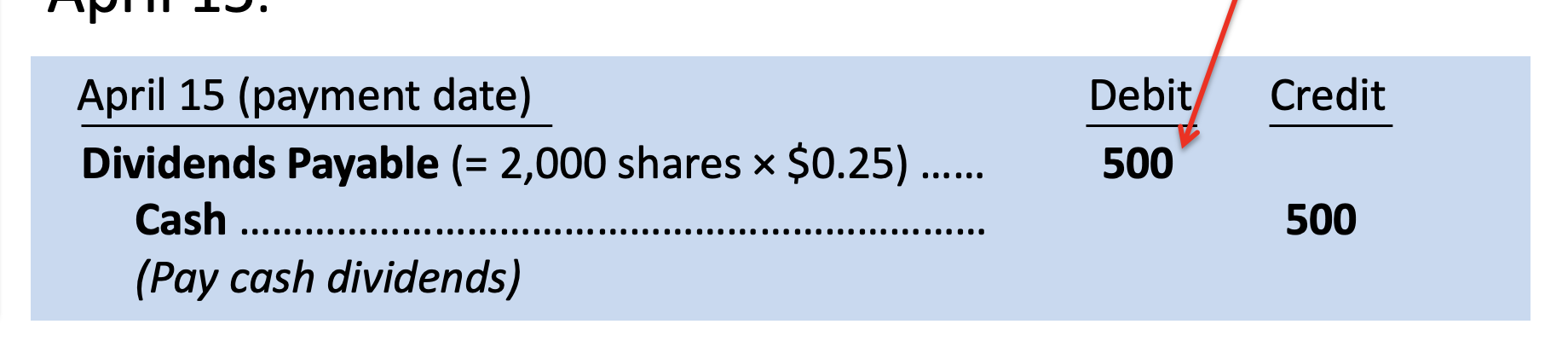

Dividend Dates: The date on which the company looks at its records to determine who the stockholders of the company are.

record date

Dividend Dates: The date of the actual distribution of dividends.

payment date

Dividends are based on the number of _____ shares since dividends are not paid on treasury stock.

outstanding

has no journal entries

record date

How does the stockholders’ equity section of the balance sheet differ from the statement of stockholders' equity?

The stockholders' equity section shows the balances at a point in time and the statement of stockholders' equity shows activity over time.

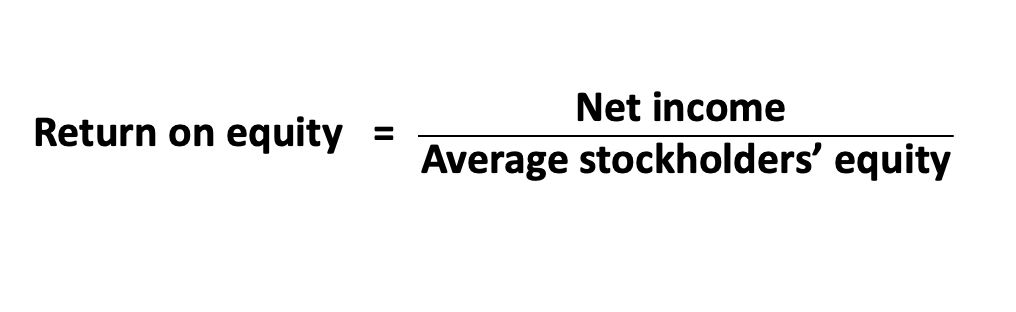

Measures the ability of company management to generate earnings from the resources that owners provide.

return on equity

return on equity formula

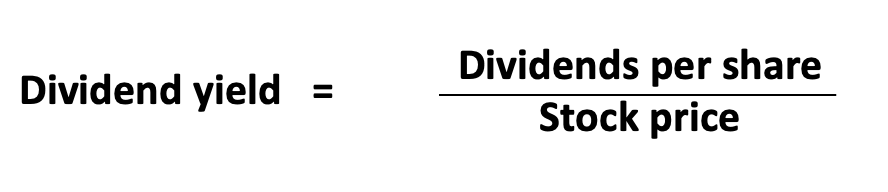

Measures how much a company pays out in dividends relative to its share price.

dividend yield

dividend yield formula

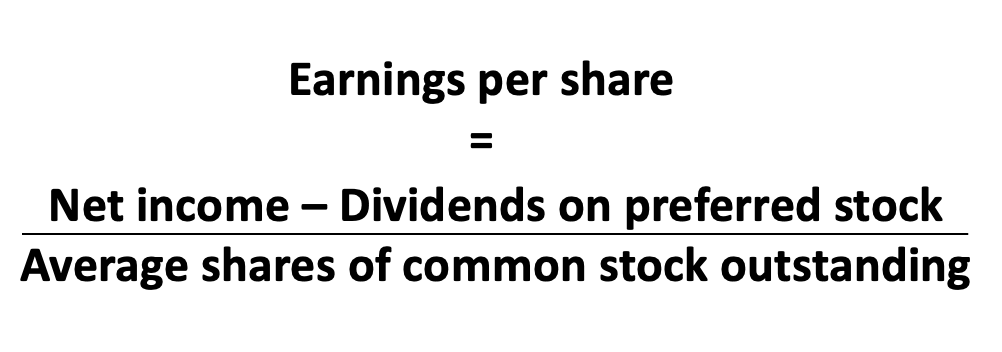

Measures net income earned per share of common stock.

earnings per share

earnings per share formula

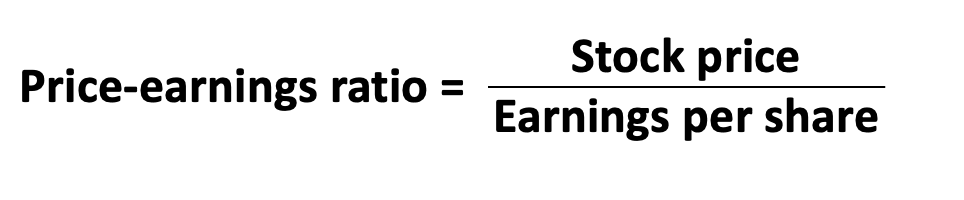

Indicates how the stock is trading relative to current earnings.

Price-Earnings Ratio (PE Ratio)

PE ratio formula