Chapter 9: Forming and Operating Partnerships

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

Flow-Through Entities

Income earned by flow-through entities is not taxed at the entity level

Owners of flow-through entities are taxed on the entity-level share of income allocated to them

Income from flow-through entities is taxed only once—when it “flows through” to owners of these entities

Flow-through entities include general partnerships, LLC, limited partnerships – treated as partnerships (Subchapter K)

Also, corporations can elect to be treated as flow-through (Subchapter S) – S-corporations

Aggregate and Entity Concepts

The entity approach is a theory of taxing partnerships that treats tax partnerships as entities separate from their partners

The aggregate approach is a theory of taxing partnerships that treats tax partnerships as an aggregation of partners’ separate interests in the assets and liabilities of the partnership

Ignores partnerships as entities and taxes partners as if they directly owned partnership net assets

In the end, Congress decided to apply both concepts in formulating partnership tax law

Entity approach: partnerships make tax elections

Aggregate approach: partnerships do not pay tax, instead individual partners are taxed

Acquiring Partnership Interests When Partnerships Are Formed

When a partnership is formed, and afterwards, partners may transfer cash, other tangible or intangible property, and services to the partnership in exchange for an equity interest called a partnership interest

Partnership interests represent the bundle of economic rights granted to partners under the partnership agreement

Capital interest: the right to receive a share of the partnership net assets if the partnership is liquidated

Profits interest: the right or obligation to receive a share of future profits or future losses

It is quite common for partners contributing property to receive both capital and profits interests in the exchange

Partners who contribute services instead of property frequently receive only profits interests

Contributions of Property

Upon contributing property to partnership, partners do not recognize gain or loss upon contribution

Similar to C Corp, realized gains or losses from exchange of contributed property for partnership interest are either fully or partially deferred for tax purposes

Rationale is to assist taxpayers setting up business from having to pay tax

Partners will own a % of the property contributed to the partnership

Gain and Loss Recognition

Generally, neither partnerships nor partners recognize gain or loss when they contribute property to partnerships (at formation or even later)

Property includes a wide variety of both tangible and intangible assets but not services

General rule facilitates contributions of property with built-in gains (FMV > tax basis)

General rule discourages contributions of property with built-in losses (FMV < tax basis)

Taxpayers with built in losses may be better off selling the property, recognizing losses, and then contributing cash to the partnership

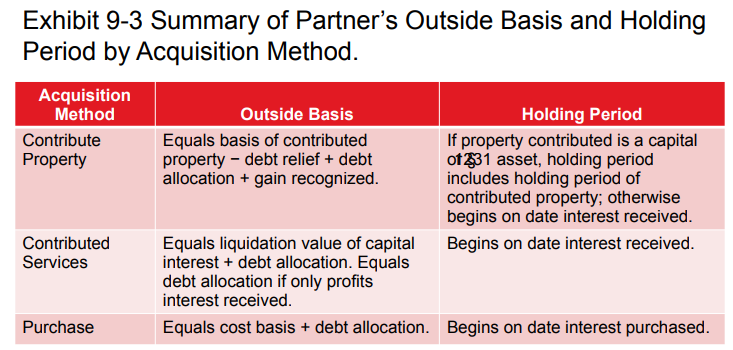

Partner’s Initial Tax Basis in Partnership Interest

Among other things, partners need to determine the tax basis in their partnership interest to properly compute their taxable gains and losses when they sell their partnership interest

Outside basis is a partner’s tax basis in a partnership interest is referred to as that partner’s

Inside basis is the partnership’s basis in its assets

Does Not Have Liabilities

Partner’s initial tax basis when partnership does not have any debt = tax basis of property + cash contributed by partners

Does Have Liabilities

Each partner must include their share of the partnership’s debt in calculating the tax basis in their partnership interest

Outside basis of partner contributing property must also reflect partner’s debt relief and any gain recognized from debt relief

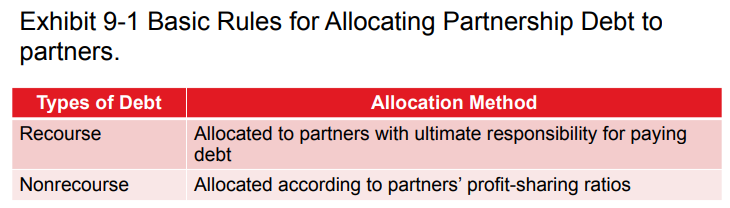

Partnership may have recourse debt, debts for which at least one partner has economic risk of loss and is responsible legally to pay debt with own funds

Allocate liability to partner with responsibility for paying liability

Partnership may have nonrecourse debt, a liability for which no partner bears any economic risk of loss

Nonrecourse liabilities such as mortgages are typically secured by real property and only give lenders the right to obtain the secured property in the event the partnership defaults on the liability

Partners are responsible for paying nonrecourse debt only to extent the partnership has profits

Liabilities are allocated in accordance with profit sharing ratios

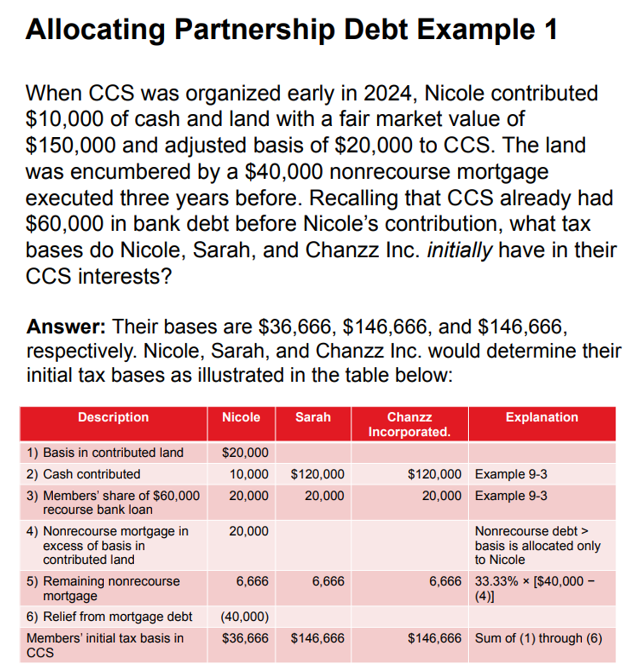

What if partnership assumes liability of the property the partner contributes to a partnership

This is treated as a reduction of contributing partner’s basis

Think of it as a cash distribution of the partnership to pay for liabilities of partnership

If liability securing contributed property is nonrecourse, amount that liability exceeds basis of contributed property is assigned to the contributing partner and the rest is allocated according to profit sharing ratios

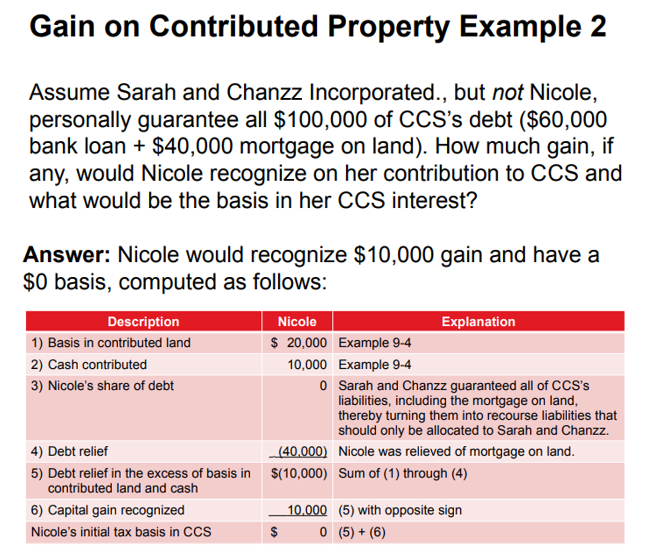

Although in many instances partners do not recognize gains on property contributions, there is an important exception to the general rule that may apply when property secured by a liability is contributed to a partnership

In these situations, the contributing partner recognizes gain only if the cash deemed to have been received from a partnership distribution exceeds the contributing partner’s tax basis in the partnership interest prior to the deemed distribution

Any gain recognized is generally treated as capital gain

Partner contributing property secured by debt recognizes gain when debt relief exceeds the partner’s basis in her partnership interest before debt relief

Initial Basis With Debt [Examples]

Partner’s Holding Period in Partnership Interest

Because a partnership interest is a capital asset, the holding period determines whether gains or losses are short-term or long term

Contributing partner’s holding period in a partnership interest depends on the type of property contributed

When partners contribute capital or §1231 assets (assets used in a trade or business and held for > 1 year) receive a “tacked on” holding period

Otherwise, holding period begins on date the partnership interest is acquired

Partner’s Tax Basis and Holding Period in Contributed Property

Required to measure partnership’s inside basis of the assets, for computing gain or loss on sales or property

To ensure the built-in gains and losses from contributed property are recognized if property is sold, contributing partner’s tax basis and holding period in contributed property carries over to the partnership

Partnership does not carry over the character of the property since it really depends on how it used the property in its operation

Partner’s Capital Account

Unlike entities taxed as corporations, entities taxed as partnerships track the equity of their owners using a capital account for each owner

GAAP capital accounts

Tax capital accounts

Tax basis (partnership tax return has a tax basis reporting requirement)

§704(b) capital accounts

Uses FMV versus tax basis of contributed assets (helpful to have up-to-date valuations)

Contribution of Services

Partners may also receive partnership interests in exchange for services they provide to the partnership

Unlike property contributions, services contributed in exchange for partnership interests may create immediate tax consequences to both the contributing partner and the partnership, depending on the nature of the partnership interest received

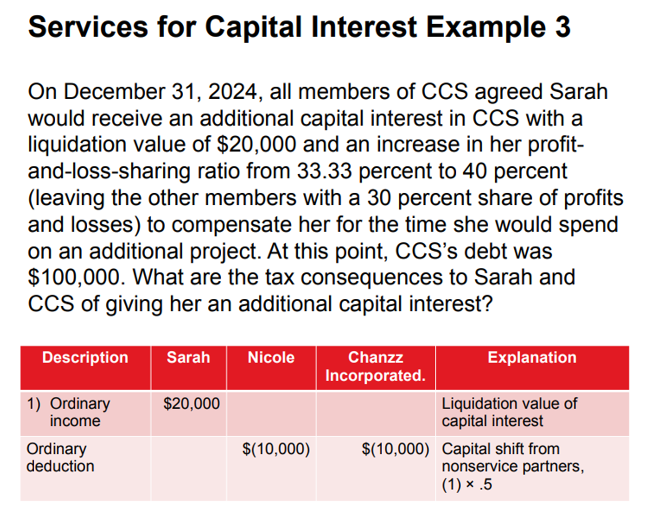

Capital Interests

Capital interest represents a current economic entitlement amenable to measurement

Service partners receiving capital interests report ordinary income

Service partner’s tax basis in the capital interest = amount of ordinary income recognized

The partnership either deducts or capitalizes the value of the capital interest, depending on the nature of the services the partner provides

Capitalize if compensating for some type of asset

Deducting if compensating for services (the deduction is allocated across other partners as they are transferring capital to the new partner)

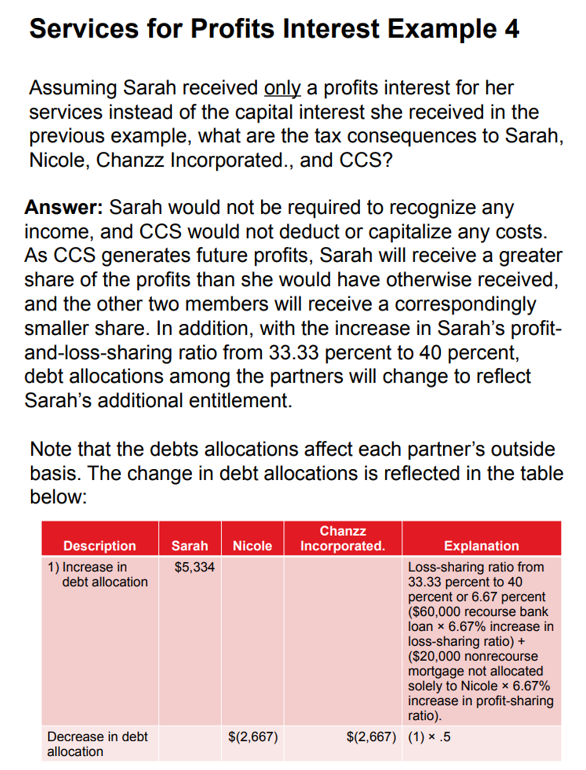

Profits Interests

No liquidation value when received

Service partner will not recognize income and nonservice partners will not receive deductions

Future profit and losses attributable to profits interest are allocated to service partner as they are generated

This creates a capital interest for the service partner of undistributed profits

Partnership must adjust liability allocations based on profit and loss sharing ratios to reflect the service partner’s new or increased share of profits and losses

Contribution of Services [Examples]

Organization, Start-Up, and Syndication Costs

For benefit of the partnership and for tax purposes, some costs must be capitalized rather than expensed

Organizational expenditures: expenses that are (1) connected directly to the creation of a corporation or partnership, (2) chargeable to a capital account, and (3) generally amortized over 180 months (limited immediate expensing may be available)

Ex: attorney and accountant fees

Syndication costs: costs partnerships incur to promote the sale of partnership interests to the public

Not deductible

Start-up costs: expenses that would be classified as business expenses except that the expenses are incurred before the business begins

Generally capitalized and amortized over 180 months, but limited immediate expensing may be available

Acquisitions of Partnership Interests after Formation

After a partnership has been formed and begins operating, new or existing partners can acquire partnership interests in exchange for contributing property and/or services, in which case the tax rules discussed above in the context of forming a partnership still apply

Or new partners may purchase partnership interests from existing partners

Partners who purchase their partnership interests do not have to be concerned with recognizing taxable income when they receive their interests

However, in each of these scenarios, they must still determine the initial tax basis and holding period in their partnership interests

Tax basis of purchased partnership interest = purchase price + partnership liability allocated to partner (holding period begins on date of purchase)

Tax Elections

New partnerships determine their accounting periods and make tax elections:

Election of overall accounting method

Election to expense a portion of organization and startup costs

Election to expense tangible personal property

Partnership makes most tax elections

Elections are in conjunction with filing first tax return

Changes to methods can be made on form 3115

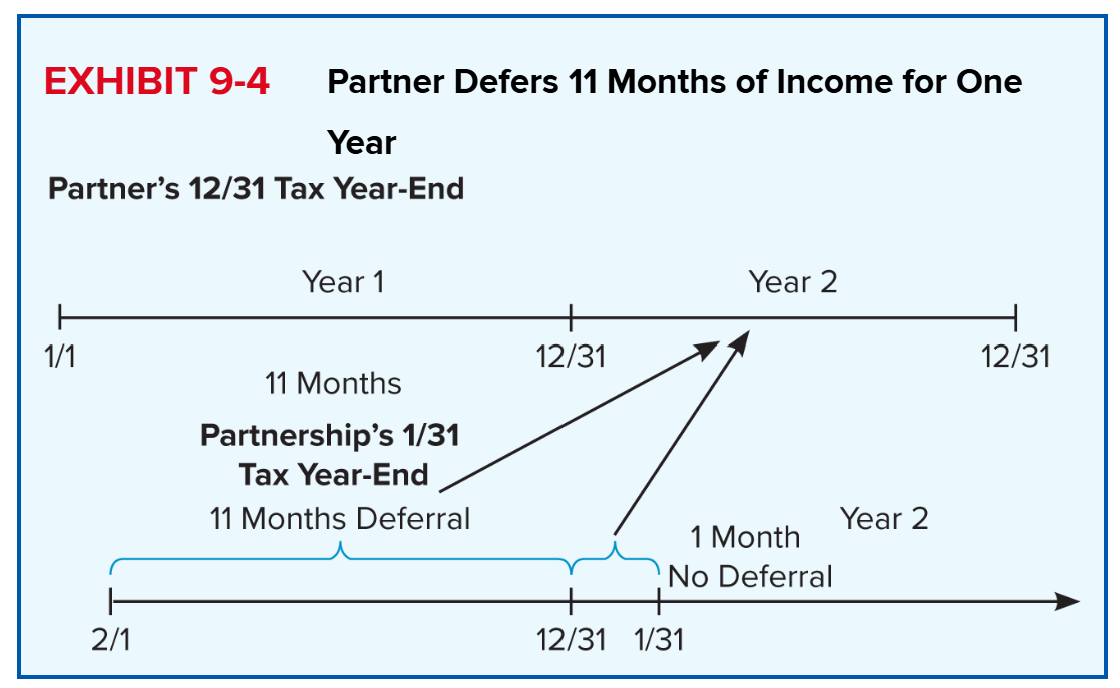

Accounting Periods

If partnership’s year end differs from the partner’s year end, there will be some degree of tax deferral

Government’s desire is to reduce the aggregate tax deferral of partners

A partnership’s taxable year is the majority interest taxable year, the common taxable year of the principal partners, or the taxable year providing the least aggregate deferral to the partners

Majority Interest Taxable Year

Majority interest taxable year is the common tax year of a group of partners who jointly hold > 50% of the profits AND capital interests in the partnership

However, there may not be a majority interest taxable year when several partners have different year-ends

Example If a partnership has two partners with 50 percent capital and profits interests and each has a different tax year, there will be no majority interest taxable year. In that case, the partnership next applies the principal partners test to determine its year-end.

Principal Partners’ Taxable Year

Under the principal partners test, the required tax year is the taxable year the principal partners ALL have in common

Principal partners are those who have ≥ 5% interest in the partnership profits and capital

Least Aggregate Deferral

Least aggregate deferral is an approach to determine a partnership’s required year-end if a majority of the partners do not have the same year-end and if the principal partners do not have the same year-end

Look at the aggregate deferral of tax by weighting each partner’s months of deferral by profits %

Accounting Methods

Partnerships may use accrual method freely, but they may not use cash under certain conditions as it facilitates deferral of income and acceleration of deductions

Cannot use cash method unless average gross receipts for 3 prior years < $30 million (for 2024)

Partnerships with C corps as partners are generally not eligible to use the cash method of accounting for tax purposes

Reporting the Results of Partnership Operations

The first section in the Internal Revenue Code dealing with partnerships states emphatically that partnerships are flow-through entities: “A partnership as such shall not be subject to the income tax imposed by this chapter

Persons carrying on business as partners shall be liable for income tax only in their separate or individual capacities

File returns annually

Distribute to partners’ information about their share of income and loss flowing through the partnership

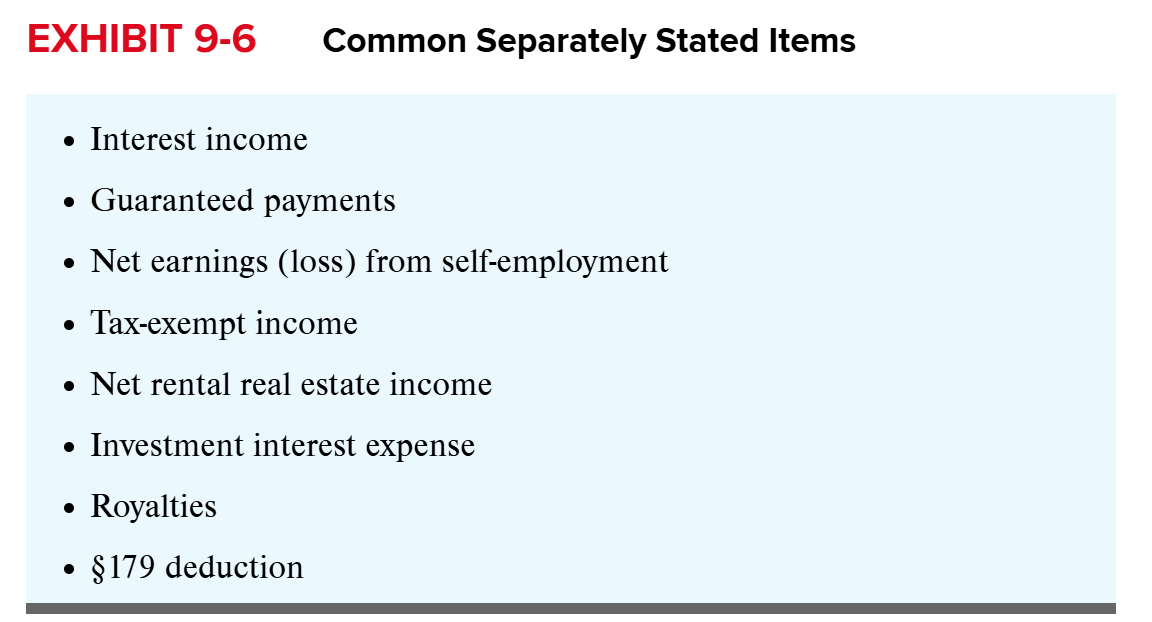

Ordinary Business Income (Loss) and Separately Stated Items

Partnership ordinary business income (loss) is all partnership income (loss) exclusive of any separately stated items of income (loss)

Separately stated items change partners’ tax liabilities according to each partner’s unique situation

Separately stated items share one common characteristic: they are treated differently from a partner’s share of ordinary business income (loss) for tax purposes

Guaranteed Payments

Guaranteed payments are fixed amounts paid to partners regardless of profit or loss earned by partnership

Treated as ordinary income by partners receiving them

Generally deducted in computing a partnership’s ordinary income or loss for the year

Separately stated to the partners receiving them

Self-Employment Tax

Individual partners, like sole proprietors, may be responsible for paying self-employment taxes in addition to income taxes on their share of business income from partnerships

The degree to which partners are responsible for self-employment taxes depends on their legal status as general partners, limited partners, or LLC members and their business activities

Shares of ordinary business income (loss) are always treated as self-employment income (loss) by general partners

Shares of ordinary business income (loss) are always not treated as self-employment income (loss) by limited partners

Shares of ordinary business income (loss) may or may not be treated by LLC members as self-employment income (loss), depending on the extent of their involvement with the LLC

LLC members that should be classified as general partners and treated as self-employment income (loss) when applying the self-employment tax rules are the members who have:

Personal liability for the debts of the LLC by reason of being an LLC member,

Authority to contract on behalf of the LLC, or

Participated in more than 500 hours in the LLC’s trade or business

Limitation on Business Interest Expense

A partnership’s deduction for business interest is limited to its business interest income plus 30% of its adjusted taxable income (ATI) for the year

Any disallowed interest is:

Allocated to partners, reducing their tax basis in their partnership interest

Available to partners as a deduction at the partner level to the extent the partnership allocates them any excess business interest expense limitation in future years

This limitation only applies to partnerships with average annual gross receipts for the prior three years > $30 million (indexed for inflation)

Deduction for Qualified Business Income (QBI)

Noncorporate partners may generally deduct 20% of qualified business income allocated to them from a partnership

QBI does not include a partner's:

Share of income from certain service trade or businesses and investment income

Guaranteed payments

Partnerships must disclose information relevant to partner’s calculation of QBI deduction for each qualified trade or business

First, the partnership must disclose each partner’s share of qualified business income for the separate qualified trade or businesses within the partnership

Further, the partnership must also disclose for each qualified trade or business within the partnership any additional information required for the partners to calculate the limitations on the deduction applied at the partner level

Net Investment Income Tax

NII tax includes:

Individual partner’s share of interest, dividends, annuities, royalties, rent

Individual partner’s share of income from a trade or business that is a passive activity

Individual partner’s share of gains from the disposition of property not used in an active trade or business

Separately stated to the partners receiving them

Allocating Partners’ Shares of Income and Loss

Generally follow profit sharing ratios of the partnership agreement

Special allocations in some cases; for example, allocation of built-in gains on contributed property to respective partner

Partnership Compliance Issues

Although partnerships do not pay taxes, they are required to file Form 1065, U.S. Return of Partnership Income, with the IRS by March 15 for a calendar year-end partnership

Partnerships may receive an automatic 6 month (November 15) extension to file

Page 1 of Form 1065 shows details of calculation of the partnership’s ordinary business income (loss) for the year

Page 3, Schedule K, lists the partnership’s ordinary business income (loss) and separately stated items

Schedule K-1s are included with Form 1065 when it is filed, and Schedule K-1s are also separately provided to all partners

K-2 and K-3 if income earned outside the U.S.

Partner’s Adjusted Tax Basis in Partnership Interest

Partners first adjust their outside bases for items that increase basis, then for distributions, then by nondeductible expenses, and then by deductible expenses and losses to the extent any basis remains after prior adjustments

Basis adjustments that decrease basis may never reduce a partner’s tax basis below 0

Increase Adjustments

Contributions

Share of ordinary business income

Separately stated gains/income

Share of tax-exempt income

Decrease Adjustments

Cash distributions

Share of nondeductible expenses (fines, penalties, etc.)

Share of ordinary business loss

Separately stated expenses/losses

Share of disallowed business interest expense

Cash Distributions in Operating Partnerships

Partners are taxed on income when partnership earns it but not when distributed

If cash is distributed when partners have a positive tax basis in their partnership interests, the distribution effectively represents

Distribution of profits that have been previously taxed

Return of capital previously contributed by the partner to the partnership

Distribution of cash the partnership has borrowed, or some combination of the three

Cash distributions (deemed or actual) in excess of a partner’s basis are taxable and are generally treated as capital gains

Loss Limitations

While partners generally prefer not to invest in partnerships with operating losses, these losses generate current tax benefits when partners can deduct them against other sources of taxable income

Unlike capital losses, which are of limited usefulness if taxpayers do not also have capital gains, ordinary losses from partnerships are deductible against any type of taxable income

However, they are deductible on the partner’s tax return only when they clear three separate hurdles: (1) tax-basis, (2) at-risk amount, and (3) passive activity

Losses clearing these three hurdles are deductible up to the amount of the excess business loss limitation

(1) Tax-Basis Limitation

In a sense, partner’s basis represents the amount a partner has invested in a partnership or may have to invest to satisfy her debt obligations

Partners may not utilize partnership losses in excess of their outside basis in their partnership interests

Losses allocated in excess of their basis must be suspended and carried forward indefinitely until partners have sufficient basis to utilize the losses

Partners may create additional tax basis by

Making capital contributions

Guaranteeing more partnership liability

Helping their partnership to become profitable

(2) At-Risk Amount Limitation

More restrictive when compared to tax-basis limitation

Adopted to limit the ability of partners to use nonrecourse debt as a means of creating tax basis

Limits partners’ losses to their at-risk amount

Only nonrecourse debt considered to be at-risk is nonrecourse real estate mortgages from commercial lenders called “qualified nonrecourse financing”

Partners are considered to be at risk for:

Amount equal to cash and the tax basis of property contributed to the partnership, and

Recourse debt and qualified nonrecourse financing allocated to them

Remaining losses are further reduced by partner’s share of nonrecourse liabilities not secured by real property (at risk is cash, property, recourse liabilities) suspended are carried forward

(3) Passive Activity Loss Limitation

The passive activity loss (PAL) limitation is a tax rule designed to limit taxpayers’ ability to deduct losses from activities in which they do not “materially participate” against income from other sources

Participants in all other activities are passive unless their involvement in an activity is “regular, continuous, and substantial”

Enacted as a backstop to the at-risk rules and are applied after the tax-basis and at-risk limitations

Limits the ability of partners in rental real estate partnerships and other partnerships they do not actively manage from using their ordinary losses from these activities to reduce other sources of taxable income

Applies primarily to individuals and also to estates, trusts, closely held C corporations, and personal service corporations

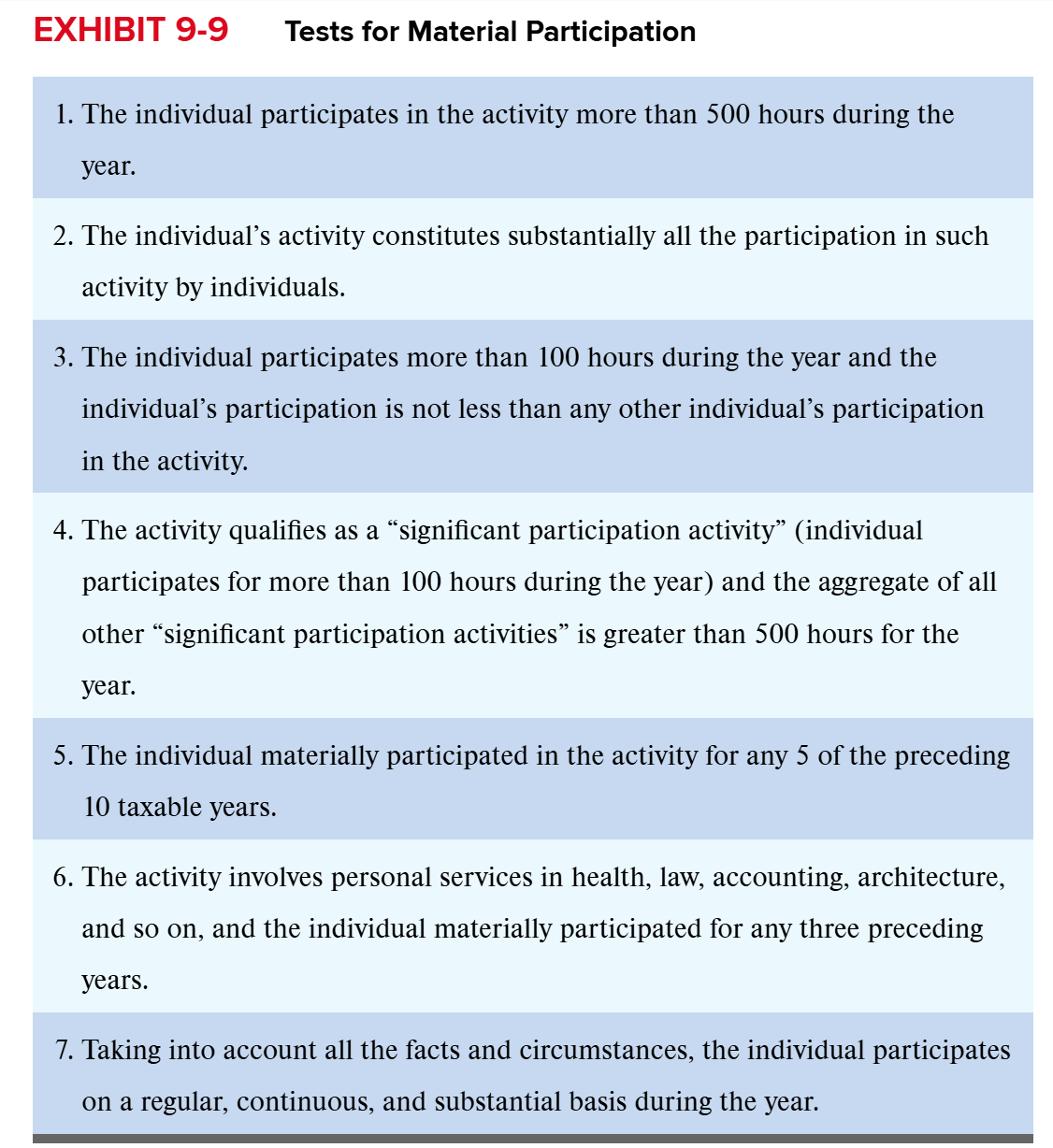

An individual, other than a limited partner, can be classified as a material participant in activities, other than rental activities, by meeting any one of the seven tests:

Income and Loss Brackets [Passive Activity Loss Limitation]

Under the passive activity loss rules, each item of a partner’s income or loss from all sources for the year is placed in one of three categories, or “baskets”

The three baskets are:

Passive Activity Income/Loss: income or loss from an activity, including partnerships, in which the taxpayer is not a material participant

Losses from the passive basket are not allowed to offset income from other baskets

Portfolio Income/Loss: income from investments, including capital gains and losses, dividends, interest, annuities, and royalties

Active Business Income/Loss: income from sources, including partnerships, in which the taxpayer is a material participant

For individuals, this includes salary and self-employment income

Excess Business Loss Limitation

Excess business loss is excess of aggregate business deductions for the year over aggregate business gross income or gain of an individual taxpayer plus a threshold amount depending on filing status

Applied after the tax-basis, at-risk, and passive loss limitations to losses that are not passive

Applies to noncorporate partners

The threshold amount is a function of filing status and is indexed for inflation

For 2024: $305,000 everyone; $610,000 MFJ