Ch 22 - Economic inequality and poverty

Equity: fairness in opportunities given to people despite their differences

Equality: disparities in incomes and wealth given to people

- Inequality is inevitable since it influences productivity

Inequality is not determined by the level of national income

- Result of national policies and industries that do not cater for economic growth → fair and inclusive

- The failing of these policies causes economic growth not to generate higher income and better opportunities

Types of inequality:

- Inequality in outcomes: inequalities in income and wealth

- Inequalities of opportunities: when a person isn't earning as much, meaning they cant afford to buy assets

- Raising levels of inequality in income, wealth, and opportunity reflect a lack of equity \n

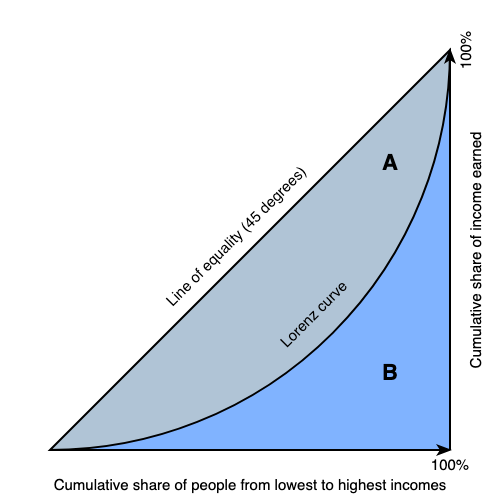

How to measure inequality using a Lorenz curve:

- Used to compare two or more countries in terms of economic distribution

- Compare change in income distribution for a single country over time

- A lorenz curve is constructed using cumulative share of income

Difference between income inequality and wealth inequality:

- Wealth: also known as net worth, value of all a person’s total assets minus total liabilities. This includes large assets such as real estate, stocks, and so on.

- Income: all the money people can earn from wages and every source of earning.

- liabilities: all the debt a personal owes. This is deducted from wealth as it does not contribute to their amount of money.

PPP, purchasing power parity: means that it will buy approximately the same amount of goods and services in any country

- Multidimensional Poverty Index (MPI): people who are in extreme poverty and lack the three dimensions: education, healthy, and standard of living. These methods of identifying poverty are called indicators.

- Absolute poverty: occurs when a person’s income isn’t enough to sustain their basic needs of survival

- Relative poverty: is a comparative measure based on the living standards in a country

- Means that a person is poor relative to the other in a country

Causes of inequality and poverty:

- inequality of opportunities

- discrimination

- difference in human capital

- different levels of ownership

- globalisation and tech progress

- market oriented, supply side policies

- government tax and benefits policies

- unequal status and power

Consequences of inequality and poverty:

- Harms economic growth

- Decreased quantity of living standards and social stability

Role of taxation in reducing poverty and income inequality:

- Taxes can be composed to reduce consumption on producers, goods and services that create negative externalities

- Direct taxes may be raised or lowered to change the level of AD in the economy to achieve macroeconomic goals. Households pay direct tax in the form of income taxes

- Businesses pay taxes on their profits, known as corporate taxes

How are taxes calculated:

- Percentage of tax = Tax paid / total income * 100

Indirect taxes are regressive, meaning that they take a larger share of income from lower income people than from higher income

- Indirect taxes care an important source of revenue for governments, and can be used to discourage the consumption of goods that create negative externalities. since they are regressive, they worsen income inequality

An income tax structure is progressive if it taxes a larger percentage of a larger income and a smaller percentage of a smaller income. Most direct tax structures are progressive.

- Progressive income tax structure which makes the distribution of income more equal will offset to some extent by the country’s indirect taxes

- Gives the government the funds to finance its necessary expenditures and allows for distributive policies

Transfer payments: governments use tax revenues to redistribute income and provide different types of assistance to groups in the economy to improve their living standards and opportunities

- Their assistance represents income that is transferred

Policies which promote equal opportunities through investments in human capital:

- Governments need to apply policies which ensure equal opportunities for people of all income tax. This can be done using targeted government subsidies, transfers, and programs supporting lower income households.

- Increase opportunities available to those who may have been denied opportunities for their race, gender, age..

Minimum wage: minimum amount of remuneration that an employer can legally pay a worker

- Can be an element of a policy to overcome poverty and reduce inequality

- Increasing minimum wage helps:

- Higher wages encourage people to join the labour market and reduce unemployment

- Increased consumption by low wage workers

- Higher paying jobs help them expand their skills

- Reduction of inequality and poverty