Trade Protection

1/13

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

Trade Protection

Involves government intervention in international trade through the imposition of trade barriers to prevent the free entry of imports into a country. This is done to protect domestic firms and the domestic economy, from foreign competition

Tariffs

They are taxes on imported goods and are the most common form of trade restriction. They have 2 purposes: generating government revenue and protecting domestic firms.

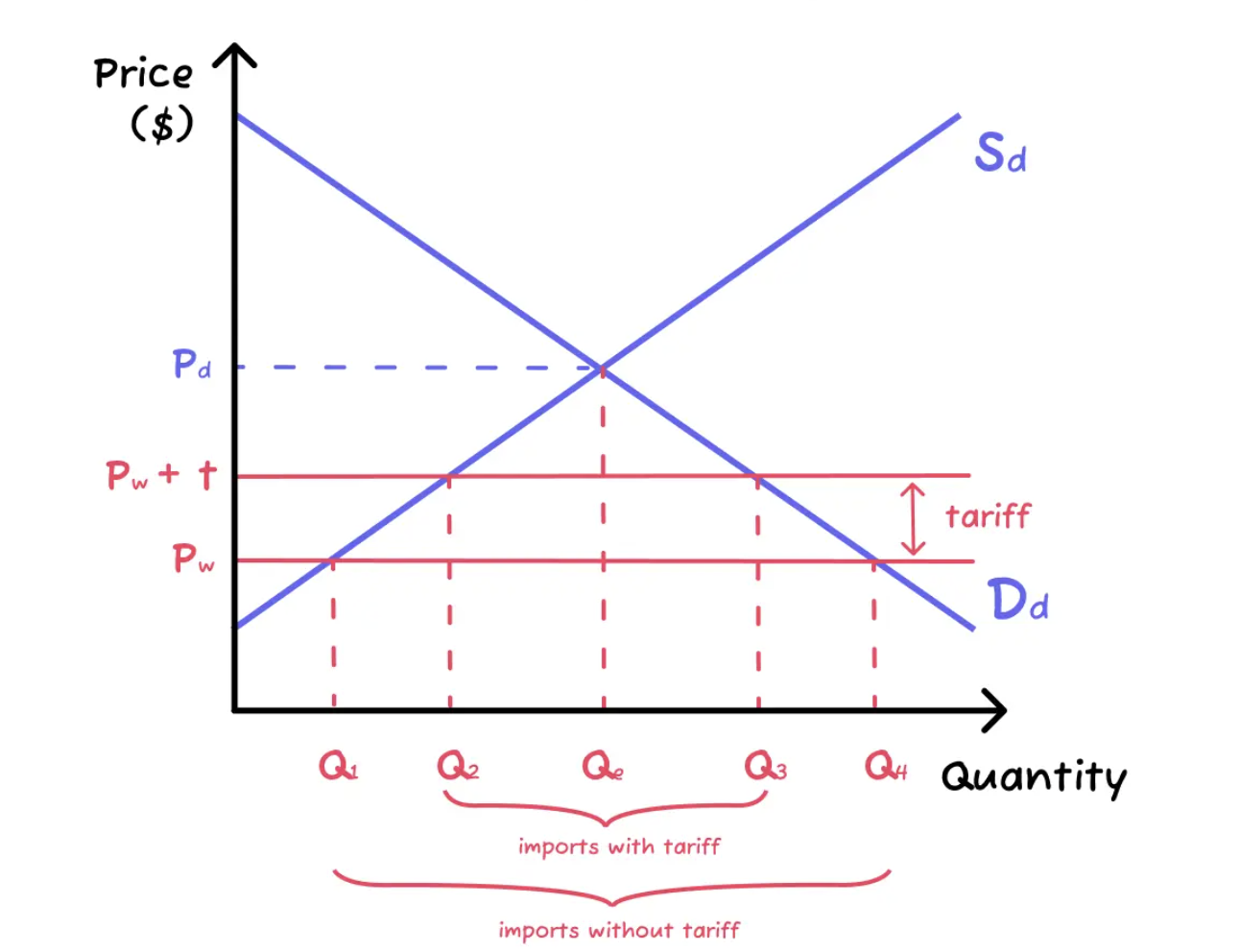

Tariffs Graph

Tariffs Winners

Domestic producers: They are now supplying at a higher quantity and a higher price. Producer surplus increases

Workers: As producers now supply a larger quantity, this increases employment and protects the industry.

Government: Generating government revenue.

Tariffs Losers

Consumers: They are now paying a higher price for a lower quantity, which leads to a decrease in consumer surplus.

Income distribution: As the tax is on goods and services, it's regressive since it takes up a higher proportion of income from low-income individuals and households. This increases the disparity between incomes.

Inefficiency of production: The increase in domestic output represents an increase in production by relatively inefficient domestic producers, resulting in a waste of scarce resources

Foreign producers: They receive world price but export a smaller quantity since the quantity of imports decreases.

Import Quotas

A legal limit to the quantity of a good that can be imported over a particular period of time. Unlike tariffs, the do not generate government revenue.

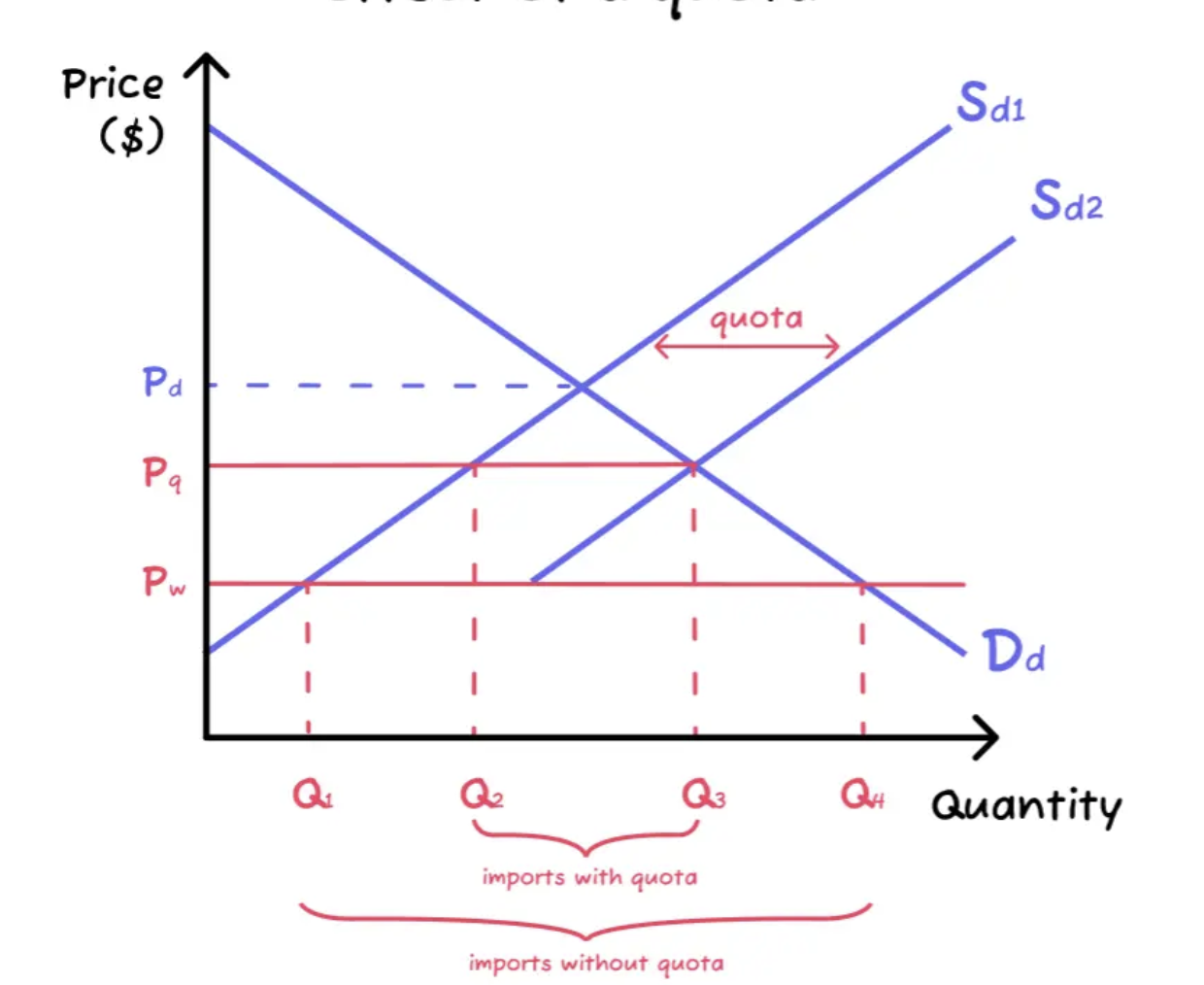

Quota Graph

Subsidy

Monetary help (direct or indirect payment) offered by the government to firms (sometimes households) to aid in lowering costs of production.

Production Subsidy

Subsidies where government gives payments to domestic firms competing with imports in order to encourage them to produce more and protect them.

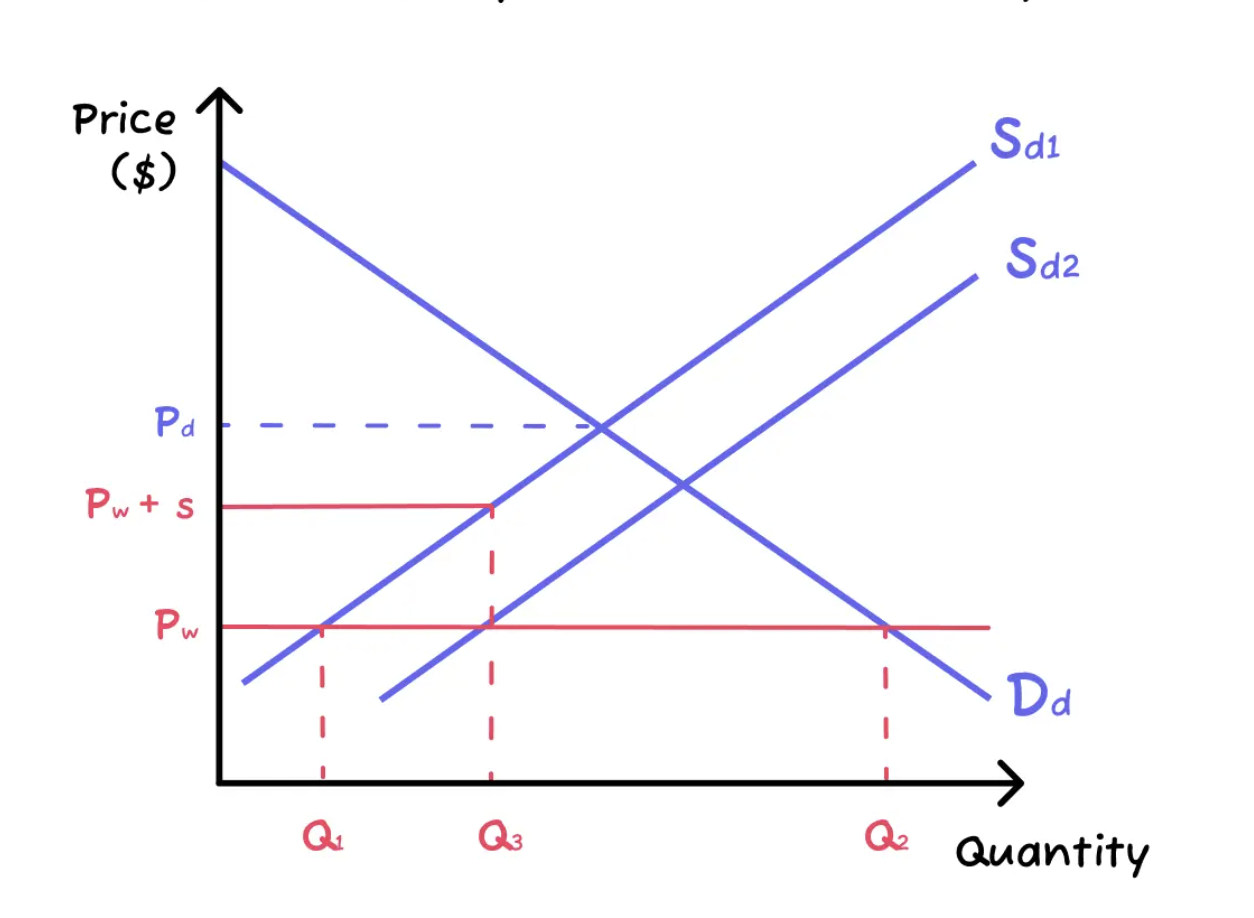

Production subsidy graph

Production Subsidy Winners

Domestic producers are supplying more at a higher price, earning higher revenues. Producer surplus increases, indicating the gain from the new prices and trade restrictions.

Wokers: As domestic producers now produce and sell a larger quantity, the employment in the industry would be protected and increase as well.

Neutral: Consumers: Unlike the restrictions before, consumers don't face a higher price since they still purchase at Pw and the same quantity Q2.