Unit 3 AP Econ (and Phillips Curve)

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

Aggregate Demand

All goods and services that buyers are willing and able to purchase at different price levels (demand for everything by everyone in the US

AD=GDP=C+I+G+Xn

**So it is basically real GDP

Inverse relationship between price level and quantity demanded similar to normal demand

The Wealth Effect

Higher price levels reduce the purchasing power of money - decreases the quantity of expenditures (spending)

** Lower price levels increase purchasing power

Interest Rate Effect

When price level increases, lenders need to charge higher interest rates to get a REAL return on their loans

**Higher interest rates discourage consumer spending and business investment

Foreign Trade Effect

When price level rises, foreign buyers purchase fewer US goods and Americans buy more foreign goods

**Exports decrease an imports increase, causing real GDP demanded to fall (Xn)

Shifters of Aggregate Demand

Any change in

Consumer Spending

Investment spending

Government spending

Net exports

The Multiplier Effect

An initial change in spending will set off a spending chain that is magnified in the economy

Ex: Bobby spends $100 on Jason’s product, now Jason has more income so he buys Nancy’s product then Nancy has more income to spend and so on…

**Shows how spending is magnified in the economy

Marginal Propensity to Consume (MPC)

How much people CONSUME rather than save when there is a change in disposable income

MPC= Change in consumption/Change in disposable income

**Always expressed as a fraction

Marginal Propensity to Save (MPS)

How much people SAVE rather than consume when there is a change in disposable income

MPS= Change in savings/Change in disposable income

Spending Multiplier

1/MPS or 1/1-MPC

Calculating TOTAL CHANGE IN GDP (Spending)

Multiplier x Initial change in spending

Tax Multiplier (also Transfer Payments)

Always is 1 less than the spending multiplier

MPC/MPS

Calculating TOTAL CHANGE IN GDP (Taxes)

Tax multiplier x Initial change in taxes

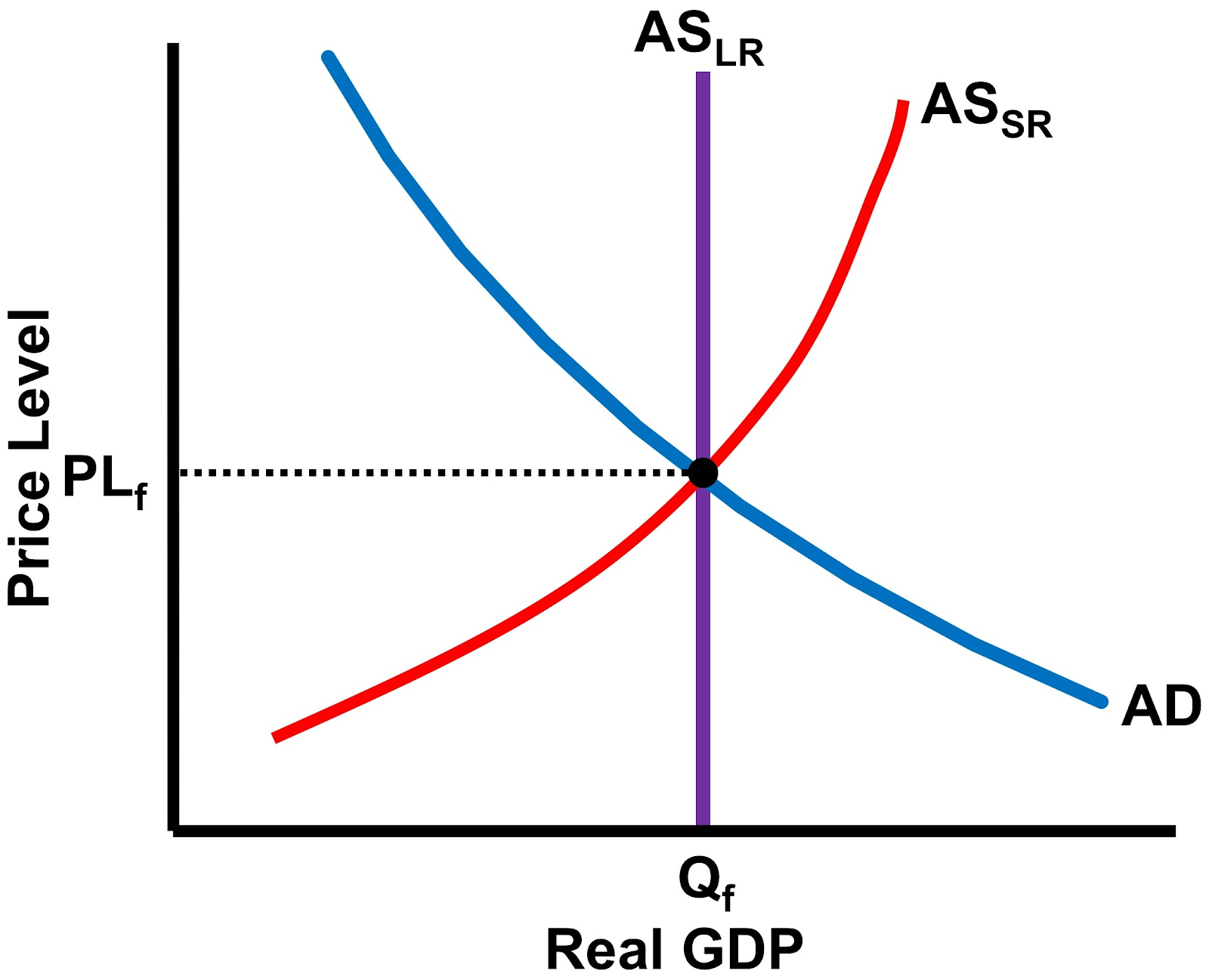

Aggregate Supply

2 different graphs (long and short)

Amount of goods and services that firms will PRODUCE in an economy at different price levels

The supply for everything by all firms

Short-Run Aggregate Supply

Wages/resource prices are sticky and WILL NOT change as price levels change

Long-Run Aggregate Supply

Wages/resource prices are flexible and WILL change as price levels change

**Firms don’t have incentive to make more because real profit is same since wages rose

Shifters of Aggregate Supply

An increase/decrease in national production can shift the curve LEFT or RIGHT

Change in resource prices

Change in actions of gov. (taxes on producers etc.)

Change in productivity (tech.)

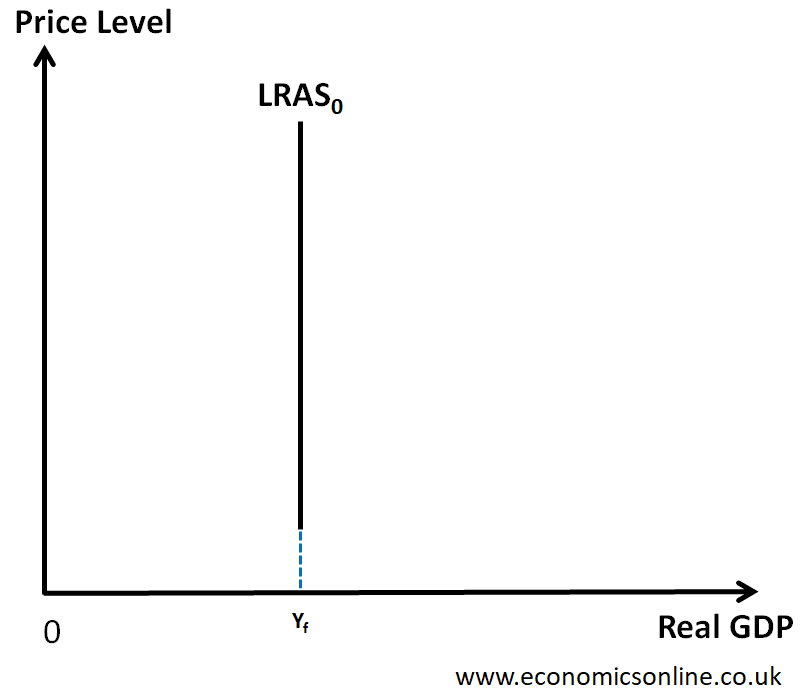

Long-Run Aggregate Supply Curve

Isn’t related to price level

Curve is a vertical line

Shifters of LRAS

Permanent change in production possibilities of an economy

Change in resource quantity/quality

Change in technology

AD-AS Model Showing Economy at Full Employment

Full employment = Long run equilibrium

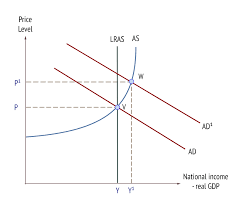

AD-AS Model Showing Economy in an Inflationary Gap (Positive Output gap)

Inflationary Gap=Above/beyond full employment

Output: High

Unemployment: Less than NRU

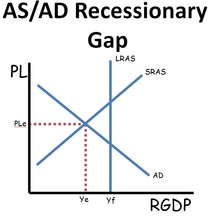

AD-AS Model Showing Economy in a Recessionary Gap (Negative Output gap)

Recessionary Gap: Below/Less than full employment

Output: Low

Unemployment: Greater than NRU

Actual GDP is lower than potential GDP

Stagflation

High inflation and high unemployment

Demand-Pull Inflation (AD Increase)

Demand pulls up prices, consumers want goods and services so they bid up prices

Cost-Push Inflation (SRAS Decrease)

Higher production costs increase prices

A NEGATIVE SUPPLY SHOCK

A rise in the costs of production forces producers to increase prices

The Difference Between Short-Run and Long-Run

In the long run: wages and resources costs go up, so it ultimately makes AS decrease

**Have to have a short run before you have a long run

Economic Growth

**Investment increases— LRAS increase, AD increase, AS increase

ONLY INVESTMENT causes ECONOMIC GROWTH

The Role of Consumers in the Economy

Consumers: Most important part of the economy

Autonomous Consumption

Consumers will spend a certain amount no matter what, regardless of income (usually to pay for nesseities)

Disposable Income

Income after taxes

Dissaving

(Negative savings)

Incomes are less than autonomous spending

Tools of Fiscal Policy

Actions by congress to stabilize (slow up/speed down) the economy

Discretionary Fiscal Policy

Government actions that involve deliberate changes to taxes or spending, requiring a conscious decision by policymakers to influence the economy

Problem: lag times

Takes time for congress to act

Ex: In recession, Congress increases spending

Non-Discretionary Fiscal Policy

Automatically adjust based on the current economic state

**AKA: AUTOMATIC STABILIZERS

Permanent spending or taxation laws enacted to work counter cyclically to stabilize the economy

When GDP goes down, government spending automatically goes up and taxes automatically drop

Ex: Welfare, unemployment, income tax

Contractionary Fiscal Policy

THE BRAKE

Laws that reduce inflation, decrease GDP, close inflationary gap

Decrease government spending

Increase taxes (reducing disposable income)

Expansionary Fiscal Policy

THE GAS

Laws that reduce unemployment and increase GDP (closing a recessionary gap)

Increase government spending

Decrease taxes (increasing disposable income)

Fiscal Policy Time Lags

TAKES TIME TO GO INTO EFFECT

Recognition lag

Congress must react to economic indicators before it’s too late

Administrative Lag

Congress takes time to pass legislation

Operational Lag

Spending/planning takes time to organize and execute

Progressive Income Tax System

AUTOMATIC STABILIZER

Acts counter-cyclically to stabilize economy

When GDP is low: tax burden on consumers is low, promotion of consumption and attempts to increase AD

Vice versa when GDP is high

Unemployment Benefits and Social Service Programs

AUTOMATIC STABILIZER

Acts counter-cyclically to stabilize economy

When GDP is low: unemployment is higher and more benefits will be paid out to help increase AD

Vice versa when GDP is high

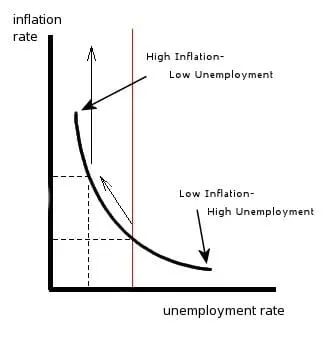

The Phillips Curve

Shows trade offs between inflation and unemployment (inverse relationship)

Short run

When the economy is overheating, there is low unemployment but high inflation

Long run - mimics LRAS

No tradeoff between inflation and unemployment

LRPC is vertical at the NRU

The Phillips Curve Graph

Mirror to SRAS

The Phillips Curve and changes to AD and AS

Change in AD: movement ALONG the SRPC

Change in AS: SHIFT of SRPC mirrored to what the AS moved