agec5001 sustainable development

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

29 Terms

Earth Summit 1992

Rio de Janeiro, June 1992

1878 represented countries

a UN conference on environmental development (focused on sustainable dev!)

sustainable dev

a type of dev that meets the need of the present population without compromising the ability of future generations to meet their own needs

key components of sustainable dev:

intergenerational equity

meeting current needs

preserving future capacity

balancing between dev & conservation

strengths of the definition of “sustainable dev”

broad appeal

flexible framework

unifying concept

adaptable to contexts

weaknesses of the definition of “sustainable dev”

lack of precision

difficult of operationalize

can mean different things

hard to measure

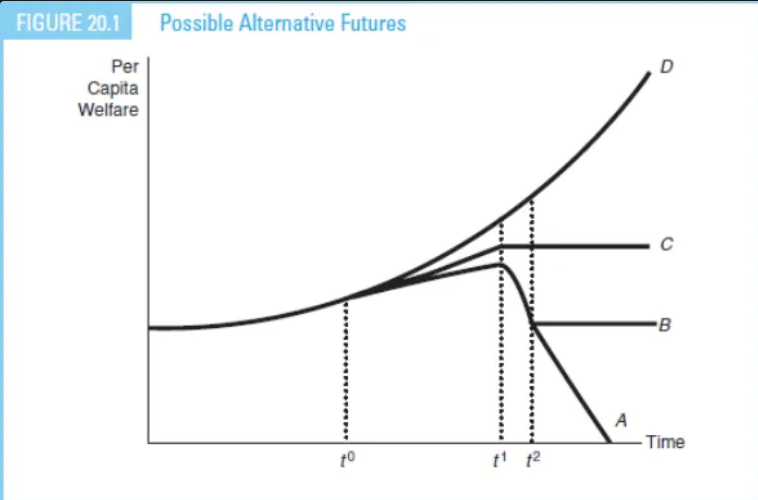

4 potential scenarios of human welfare:

A. decline to zero welfare

B. initial growth, then decline to a steady state

C. growth to a steady state (sustainable)

D. continued to exponential growth

3 key dimensions of sustainability

the existence of positive sustainable welfare levels

the magnitude of sustainable welfare vs. current levels

sensitivity to current actions

market imperfections that threaten sustainability

open-access resources

intertemporal externalities

market power (ex: climate change)

efficiency vs. sustainability — key finding

restoring efficiency is neither necessary nor sufficient for sustainability

3 scenarios for efficiency vs. sustainability

inefficient but sustainable

already sustainable w/out efficiency

ex: traditional fishing villages using low-impact methods

inefficient and unsustainable

quotas makes the market more efficient → efficiency achieves sustainability

ex: an overfished, open-access fishery

inefficient and unsustainable

efficiency can maximize profits, however it’s not sustainable long-term

ex: oil fracking

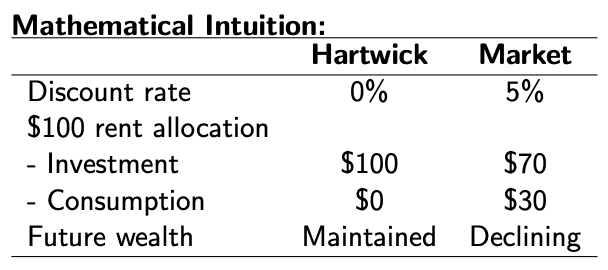

the Hartwick rule (1977)

sustainable constant consumption requires investing ALL scarcity rent from depletable resources in capital

implications of the Hartwick rule

zero net savings from resource depletion

build capital to offset resource decline

markets with positive discount rates violate this rule

additional policies needed beyond efficiency

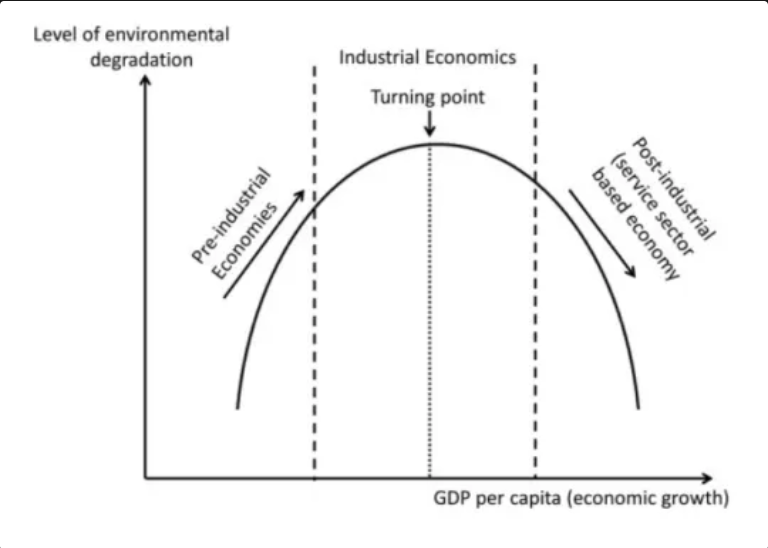

the environmental Kuznets curve (EKC)

initial phase: growth increases pollution

later phase: growth reduces pollution

**mixed results: only applies to some pollutions

potential problems to trade & envi

pollution havens

a “race to the bottom”

exploitation for weak regulations

pressure on resources

potential benefits to trade & envi

tech transfer

economic growth → envi protection

efficiency gains

the North American Free Trade Agreement (NAFTA)

took effect in 1994

lowered tariff barriers & promoted the free flow of goods & capital

integrated the US, CA & MX into a single, giant market

findings & surprises of the NAFTA

findings:

no pollution haven effect

industry shifts away from pollution-intensive sectors

scale effect dominated (doubled emissions)

surprises:

envi spending fell 45%

income reached the EKC turning point

no policy response materialized

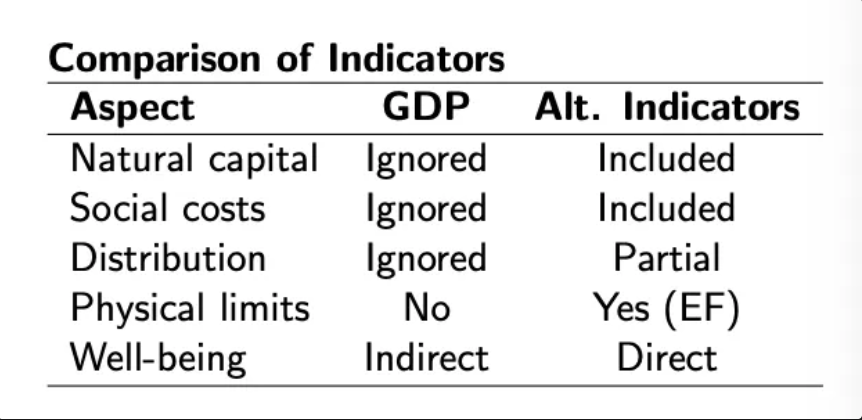

problems with GDP as a measure of welfare

includes depreciation (use net domestic product instead)

affected by inflation (uses real values)

ignores distribution

treats natural capital depletion as income

Hicksian income

the max value one can consume during a period of time, and still be as well off at the end compared to the beginning

alternative indicators to using GPD to measure human welfare

physical & adjusted economic measures (ecological footprint & GPI) and human dev focus (HDI)

GDP alternative, physical & adjusted economic measures: ecological footprint

definition: a physical measure of how much of the Earth’s resources we use, expressed in “global acres” (ie. shows how many Earths we would need if everyone lived in a given country); highlights physical limits to growth

6 tracked components: carbon footprint, cropland, grazing land, forest land, fishing grounds, built-up land

global status: humanity currently uses resources at a rate of 1.7 Earths = we’re overshooting

GDP alternative, physical & adjusted economic measures: genuine progress indicators (GPIs)

definition: an adjusted economic indicator that measures personal consumption, while adding benefits & subtracting costs that GDP ignores; measures real welfare and not just economic activity

adds: value of unpaid work, benefits from public infrastructure

subtracts: envi degradation costs, costs of crime & inequality

key takeaway: since the 1970s, GDP growth has not translated to genuine well-being progress for humanity as a whole

GDP alternative, human dev focus: human dev index (HDI)

definition: a composite index measuring average achievement in 3 basic dimensions of human dev (life expectancy at birth, education & GNI per capita) on a scale of 0-1

top: Norway (0.954) → high health, education, & income

bottom: Niger (0.377) → low health, education, & income

limitations: HDI doesn’t capture inequality within a country, envi sustainability & political freedom

key insight: HDI moves beyond GDP to measure capabilities & opportunities, but not wealth

Bhutan’s approach to gross national happiness

9 dimensions: psychological well-being, time use, community vitality, culture, health, education, envi diversity, living standards & governance

findings: 49% of men were happy vs. 33% of women

results: education & time are key barriers to happiness

Kahneman & Deaton (2010) case study

2 types of well-being:

emotional well-being

definition: day-to-day happiness (how often you experience positive & avoid negative emotions)

findings: plateaus at an annual income of $75000

reasoning: once basic needs are met, extra money won’t significantly improve daily moods

life evaluation

definition: overall satisfaction with your life

findings: continues to rise with income, even beyond $75000

reasoning: high income provides status, comfort, opportunities & a sense of achievement

the Hartwick rule when converting resource wealth to sustainable capital

key idea: if a country extracts non-renewable resources, it should invest the profit (ie. scarcity rent) into long-lasting productive assets (factories, education, tech)

in practice:

year 1: $1M profit from oil fracking, invest all $1M into factories & education

year 2: less oil left, however factories are now producing income (total wealth unchange)

year 3: maintain the same level of consumption even after oil runs out

scarcity rent

the additional profit earned from controlling a scarce & finite resource (ex: oil from oil fracking)

the discount rate problem

discount rate: how much we value money today vs. the future

markets use a positive discount rate (5%), meaning that $1 today is work more than $1 next year

leads to people consuming more money today instead of investing it for the future

how the discount rate problem violates Hartwick’s rule

Hartwick’s rule assumes r = 0% (future generations’ welfare = present), while markets use r = 5% (future generations’ welfare < present)

→ results in markets under-investing resource rents

ex: Norway (a success, only spends returns & preserves wealth) vs. Nigeria (a failure, consumes revenue & invests very little)