AQA GCSE Business Unit 6 - Finance (WIP)

1/19

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

20 Terms

Reasons for needing finance

start up capital

to cover outflows

to expand

Short Term Sources of Finance

Government grants - strict critera but dont need to be repaid

Trade Credit - not paying immediately for purchased resources, with a large fee if not paid in time

Overdrafts - allow the firm to go into the negatives in their bank account. Higher interest rates than loans

Long Term Sources Of Finance

Loans

Bank loans easy to take out but repaid with interest over a set period of time

Mortgages - loans used to finance purchasing property, with the property being used as collateral if the firm were to default on their payments

Hire purchases - when a firm purchases something buy paying a deposit then paying the rest in instalments

Sources of Finance for Established Businesses

Retained Profits - profits that the owners have put into the business after theyve paid themselves a dividend

Fixed assets - the selling of asstes thay a business has kept long term, such as machinery

Share Issue - a Public limited company can issue and sell shares, shares are parts of the business which means selling shares reduces control of the business

Investments

an investment is something a business outs money into in order to make profit

some examples of investments are

new machinery

new buildings

new vehicles

spending money is risky because if there isnt a ROI (Return On Investment) the business may lose lots of money

Average Rate of Return

Average annual Profit

ARR(%)= —————————— X100

Initial Investment

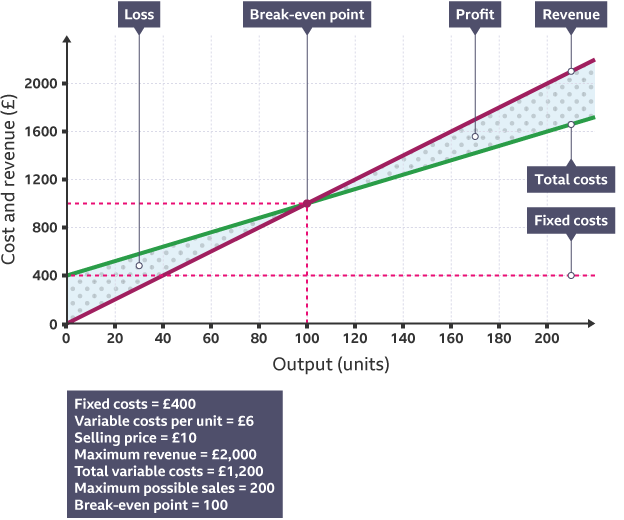

Break even Analysis

Breaking even is when your total revenue = your total costs

When total costs are higher than revenue the busmess is making a Loss

when revenue is higher than total costs, a business is making rpofit

Margin of Safety

The margin of safety is how many less units a business could produce and sell and still break even.

If the break even output for a business was at 1000 Units, and the business was producing 1800 Units, the margin of safety would be 800 Units (1800-1000=800)

Advantages of Break even analysis

easy to work out

allows business to predict how changes in output may affect revenue costs and profit

can be used in cohesion with a business plan to get a loan

Disadvantages of Break even analysis

break even analysis assumes all products sre sold and there are no returns

can be complicated with more than one product

doesnt predict how much a business WILL sell

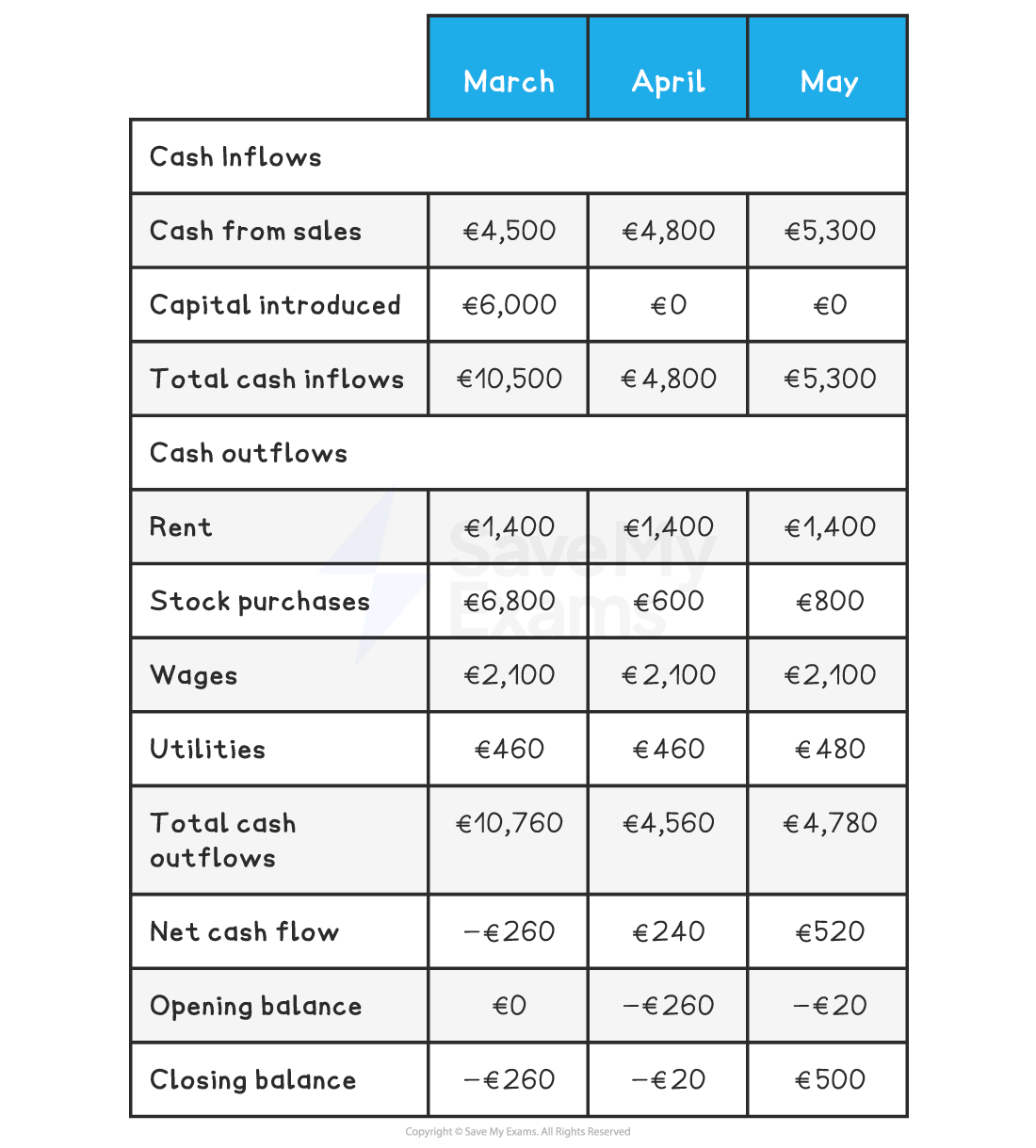

Cash Flow Forecasts

a cashflow forecast is a way of predicting when a firm my face a liquidity problem

the firm will see when or if they are scheduled to go into the red

the forecast needs to be monitored to see the impact of unexpected cash flows

Cash Flow - Credit

credit terms tell you how long after a purchase a customer has to pay

if a business gives two months credit, customers must pay within two months of purchase

this changes cash flow diagrams as even though the sals may be registered in a certain month the inflows are only marked at the end of the credit term

Poor Cash Flow

Having poor cash flow is one of the major problems that can kill a business

The main reasons for poor cashflow are

Poor sales - lack of demand from consumers

Overtrading - taking on too many orders and not being able to fulfill them

Poor business descisions - e.g. expanding into a new market which doesnt give the revenue forcasted

Improving Cash Flow

Rescheduling payments

giving customers less time to pay

Reducing cash outflow

laying off worker or selling their retained surplus of products

arranging an overdraft

finding new sources of finance

increasing inflows e.g. increasing selling price

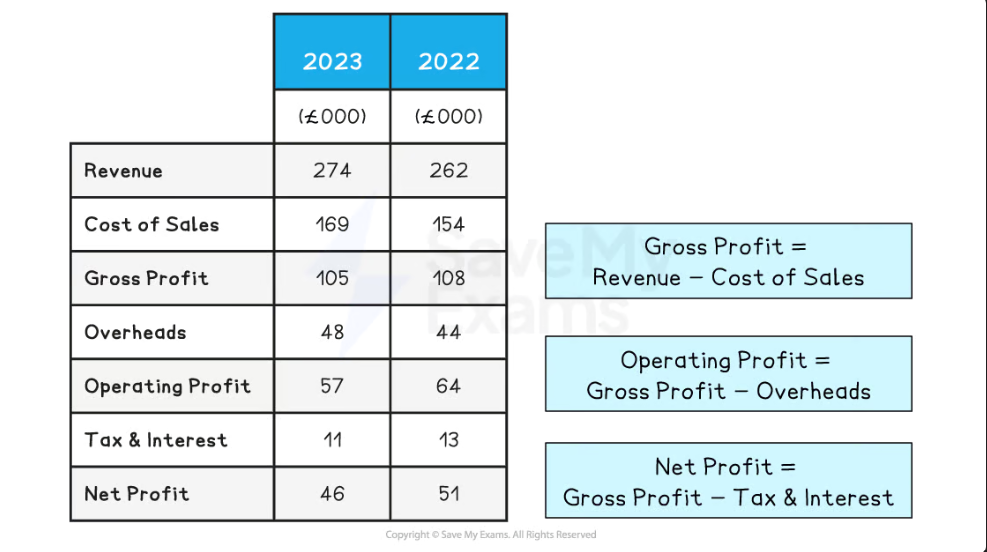

Income Statements

an income statement is a financial statement showing how income has changed over time

There are three parts to an Income statement

Trading account

Profit and Loss account

Appropriation account

Parts of an Income Statement

The trading account shows the gross profit/loss, the revenue and the cost of sales

the Profit and Loss Account shows the indirect costs of running a business, such as wages or rent. it also coveres depreciation, which is how much the value of an asset decreases

The appropriation account is unique to Limited companies and records where the profit has gone e.g. to the government, to shareholders or being kept as retained profit

Profit Margins

Gross profit margin is the fraction of every pound spent by customers that doesnt go directly towards making a product and it ignores indirect costs

Gross Profit Margin + gross profit / sales revenue * 100