Unit 6: Open Economy—International Trade and Finance

1/30

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

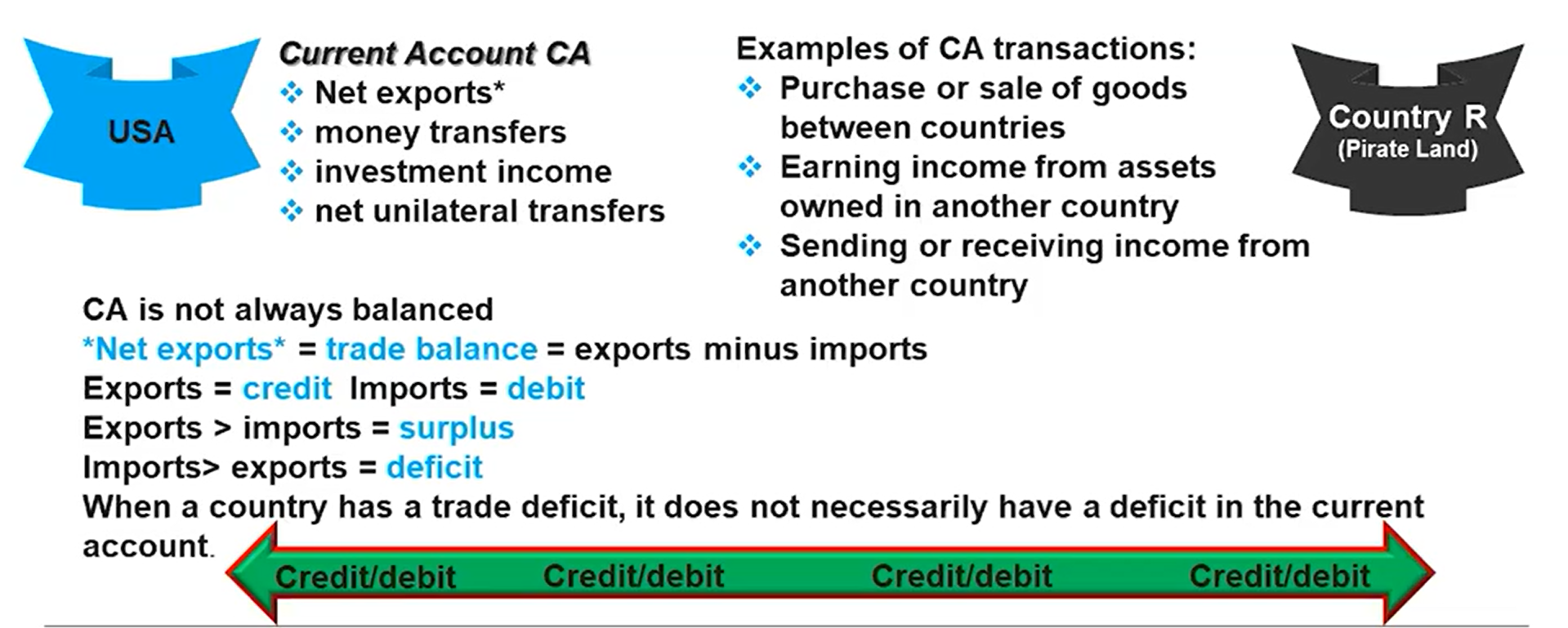

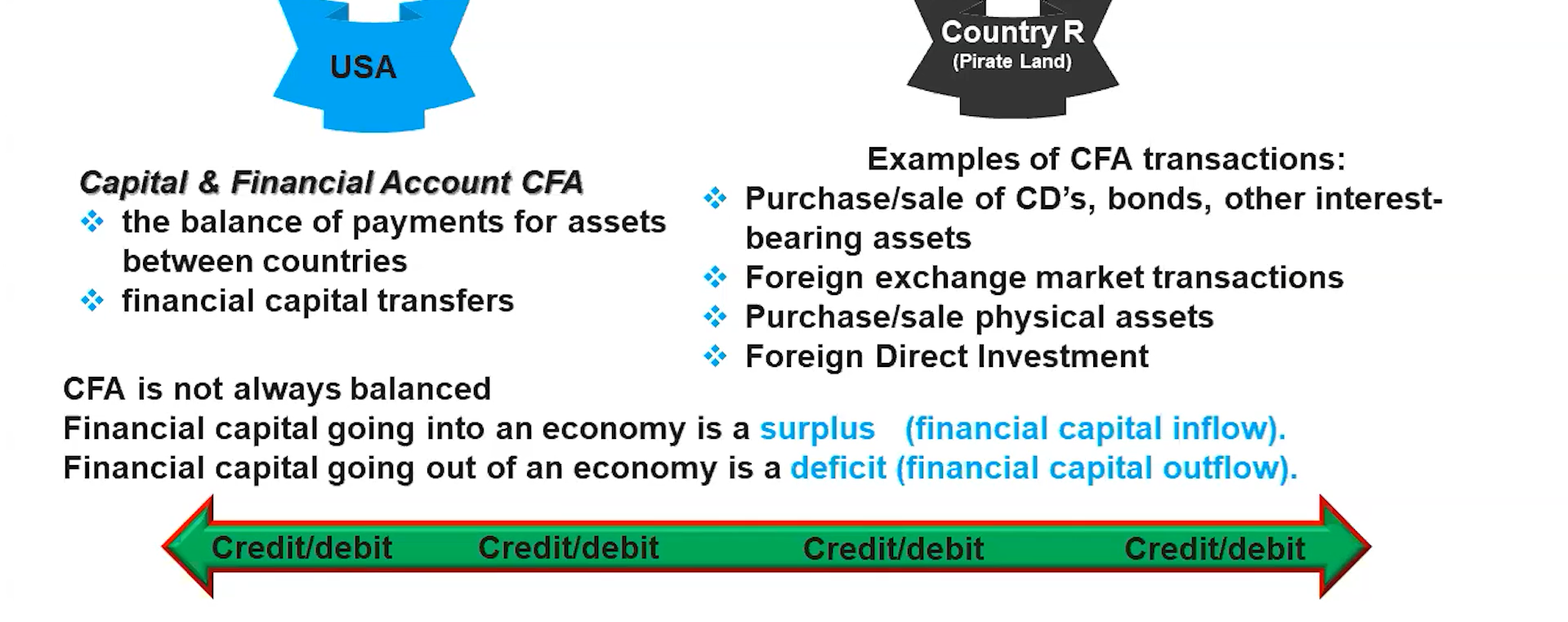

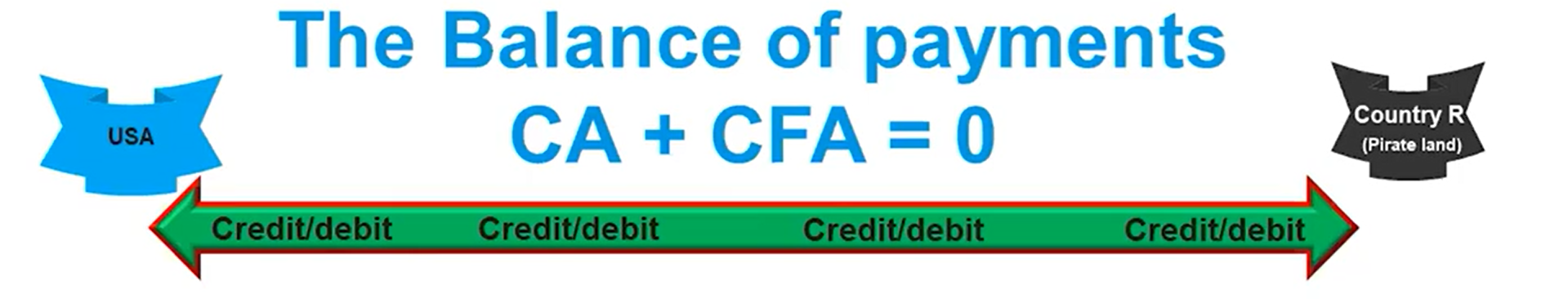

Balance of Payments (BOP)

is an accounting system to keep track of transactions between countries over a period of time. It is made up of two accounts, the Currect Account (CA) and the Capital and Financial Account (CFA)

Current Account (CA)

Capital and Financial Account (CFA)

Credit or Debit

Money in is a credit, and money out is a debit

Ex. A citizen of the USA makes a payment to a citizen of country R, the USA has a debit, and country R has a credit

The sum of all credit entries should match the sum of all debit entries

An increase in the CA balance must be offset by a decrease in the CFA balance

An increase in the CFA balance must be offset by a decrease in the CA balance

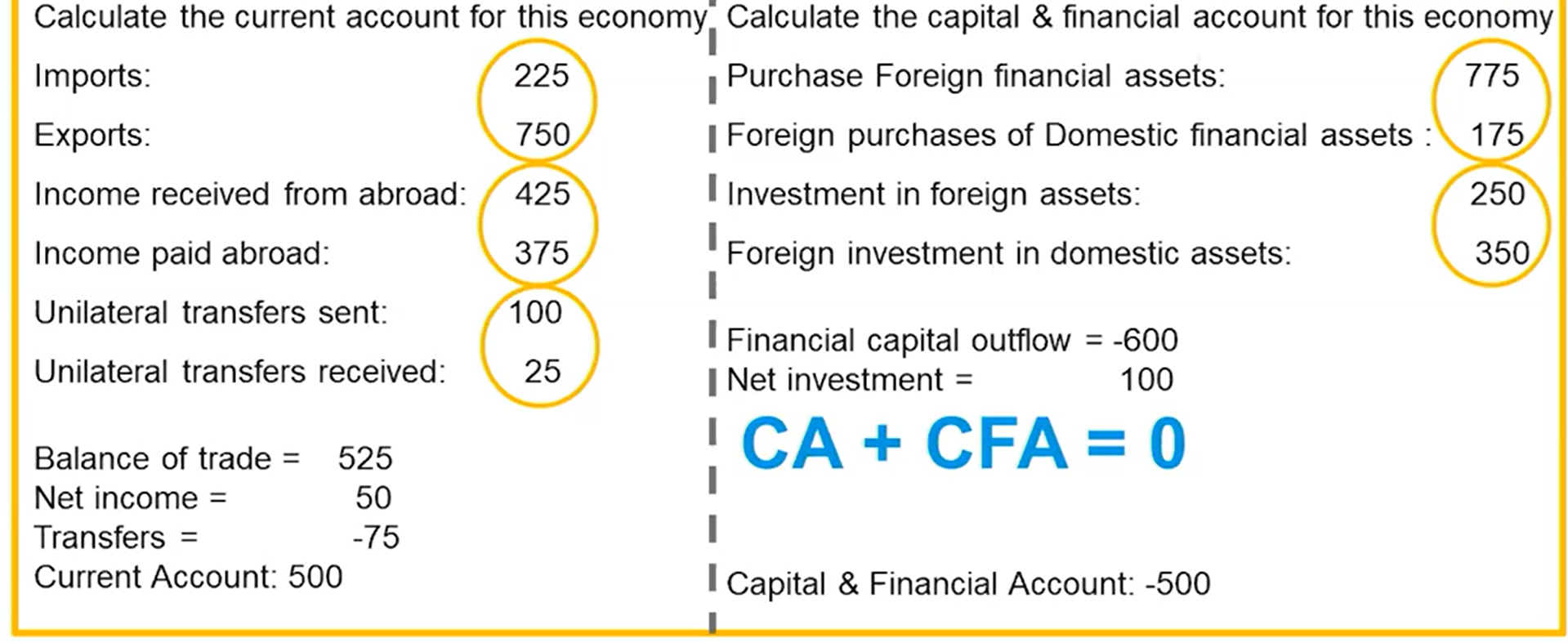

Balance of Payments Accounts (Calculations)

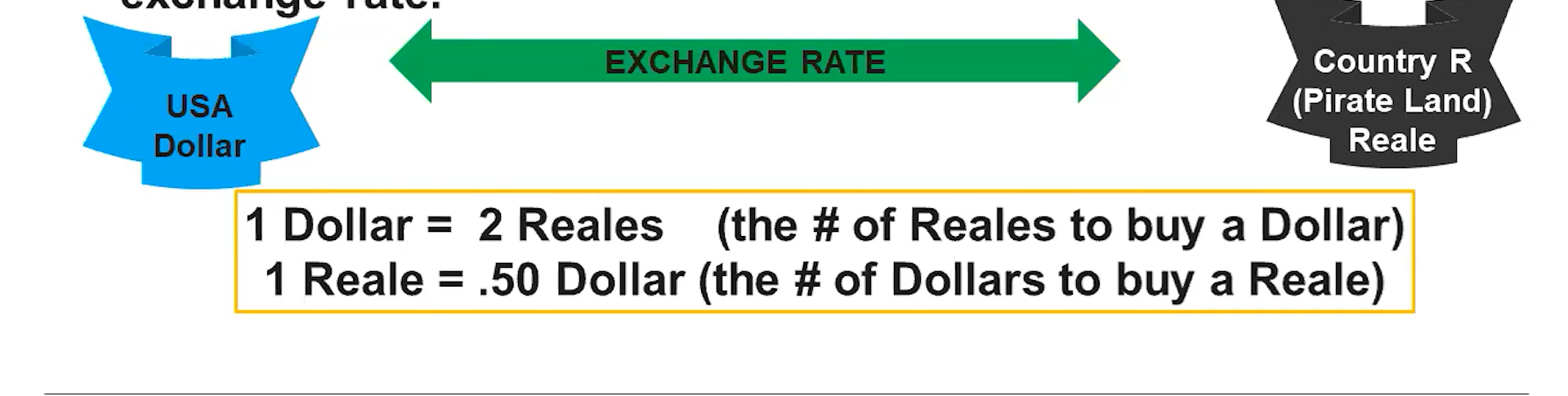

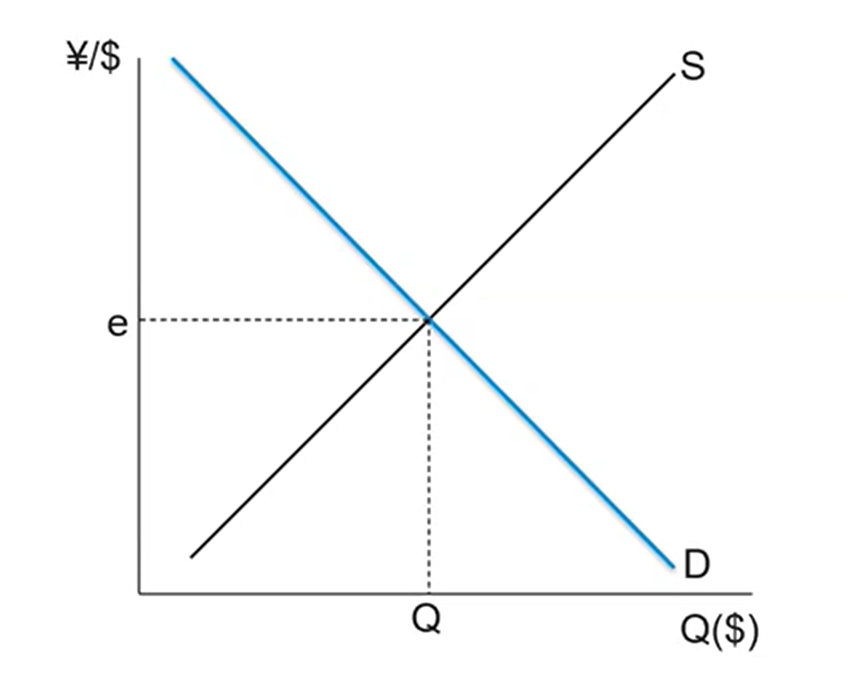

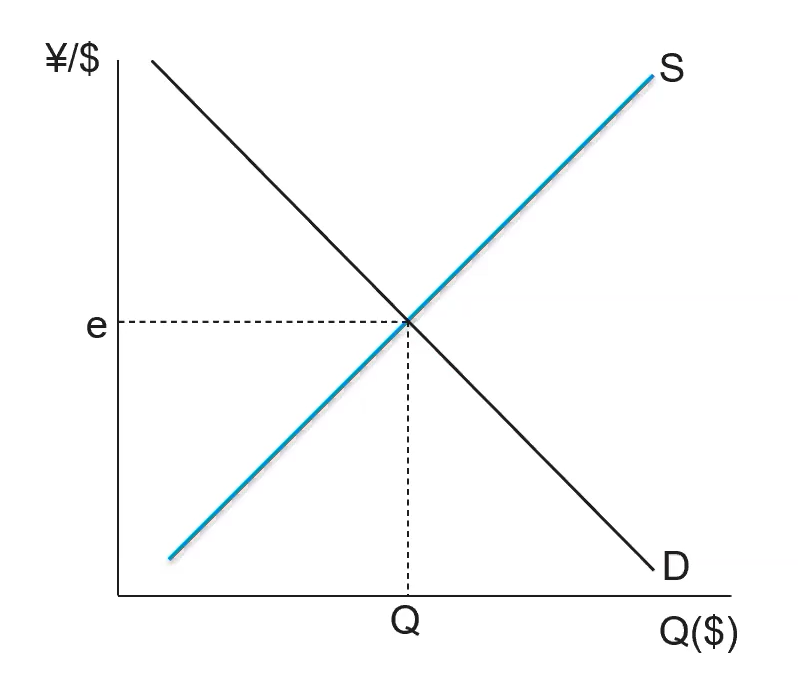

The Exchange Rate

The price of one currency in terms of another

In the foreign exchange market, one currency is exchanged for another; the price of the currency is the exchange rate

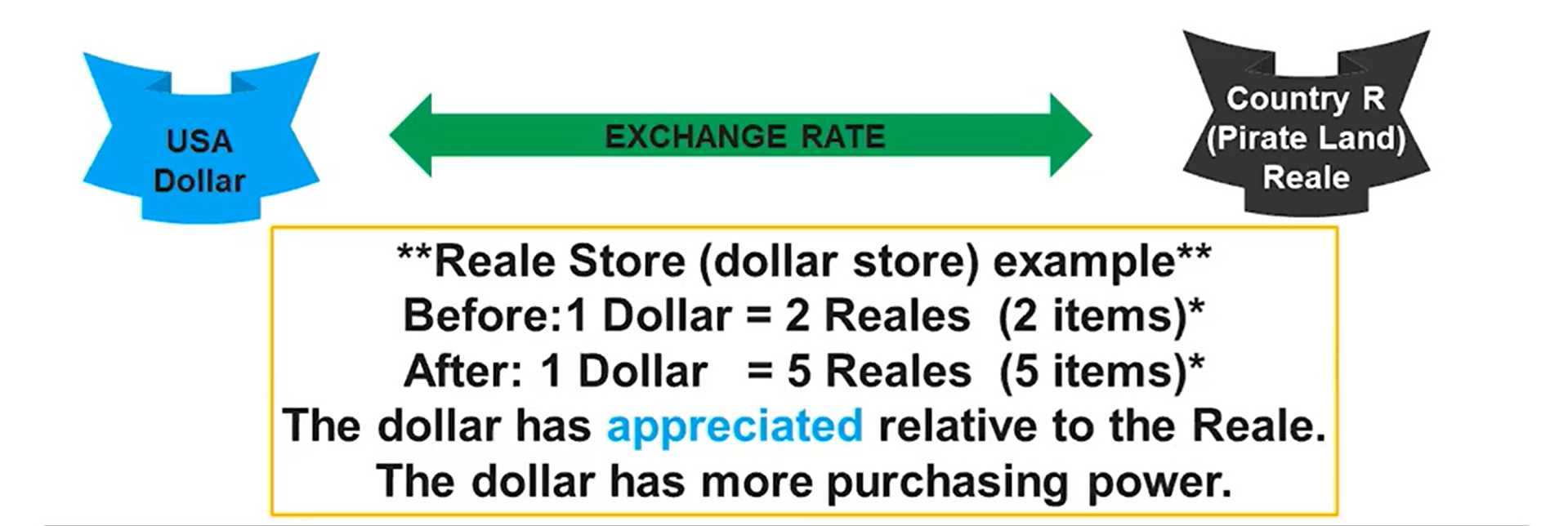

Currency Appreciation

When a currency becomes more valuable in terms of other currencies

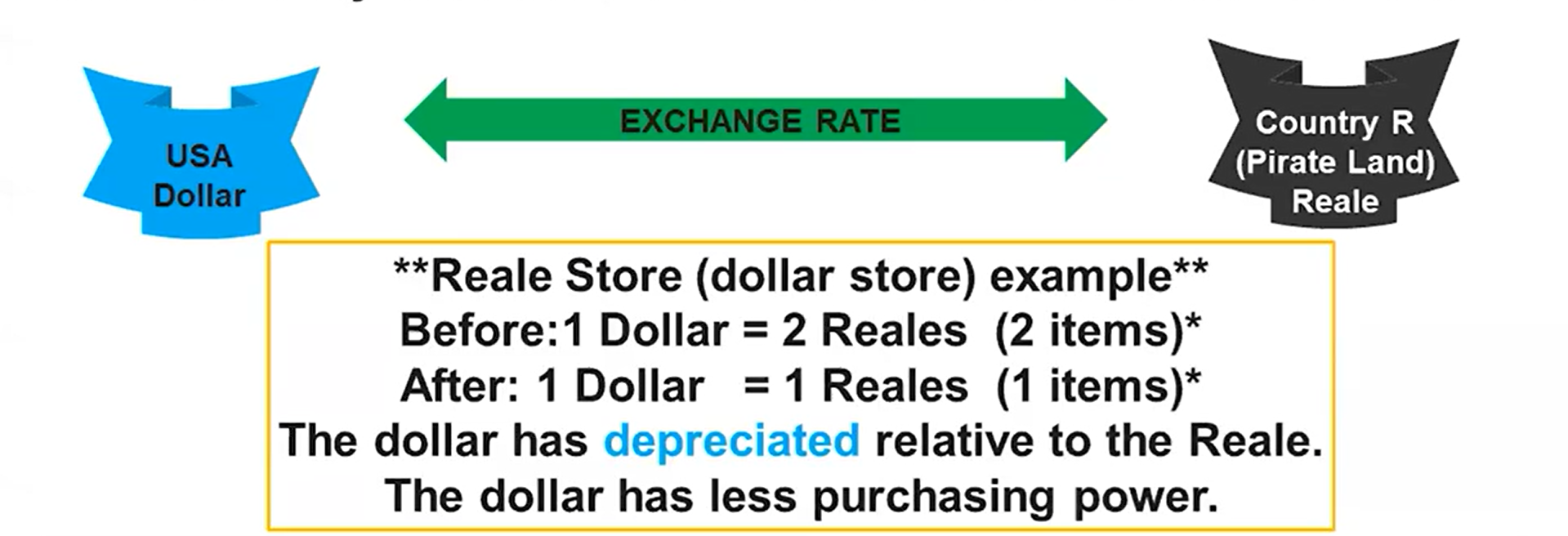

Currency Depreciation

When a currency becomes less valuable in terms of other currencies

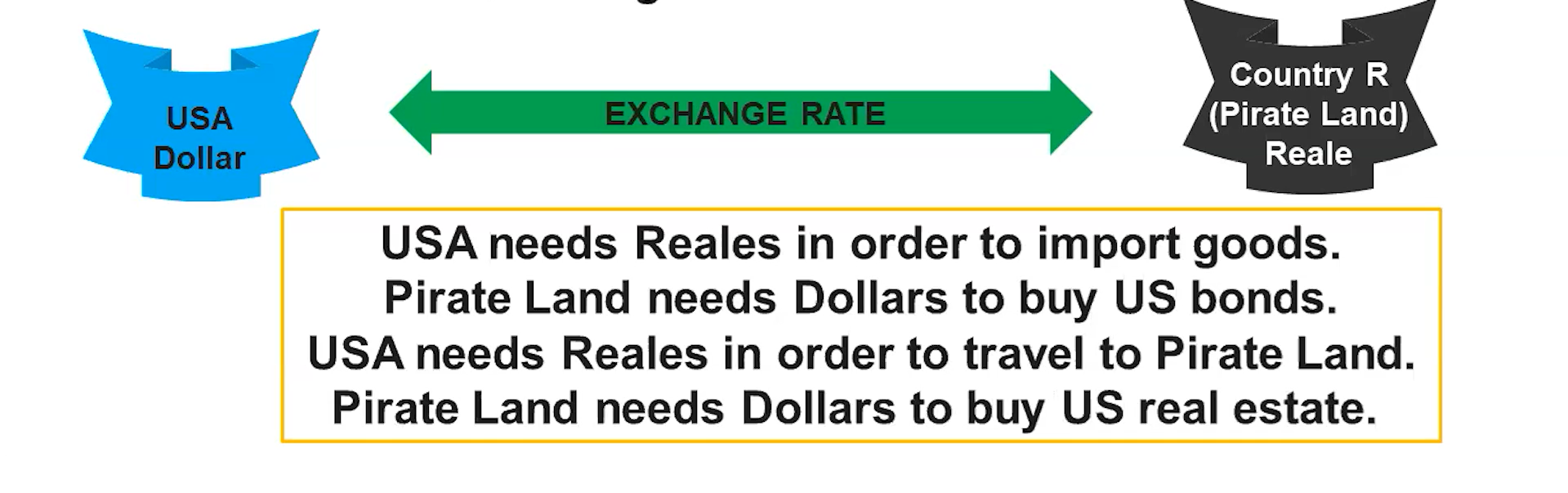

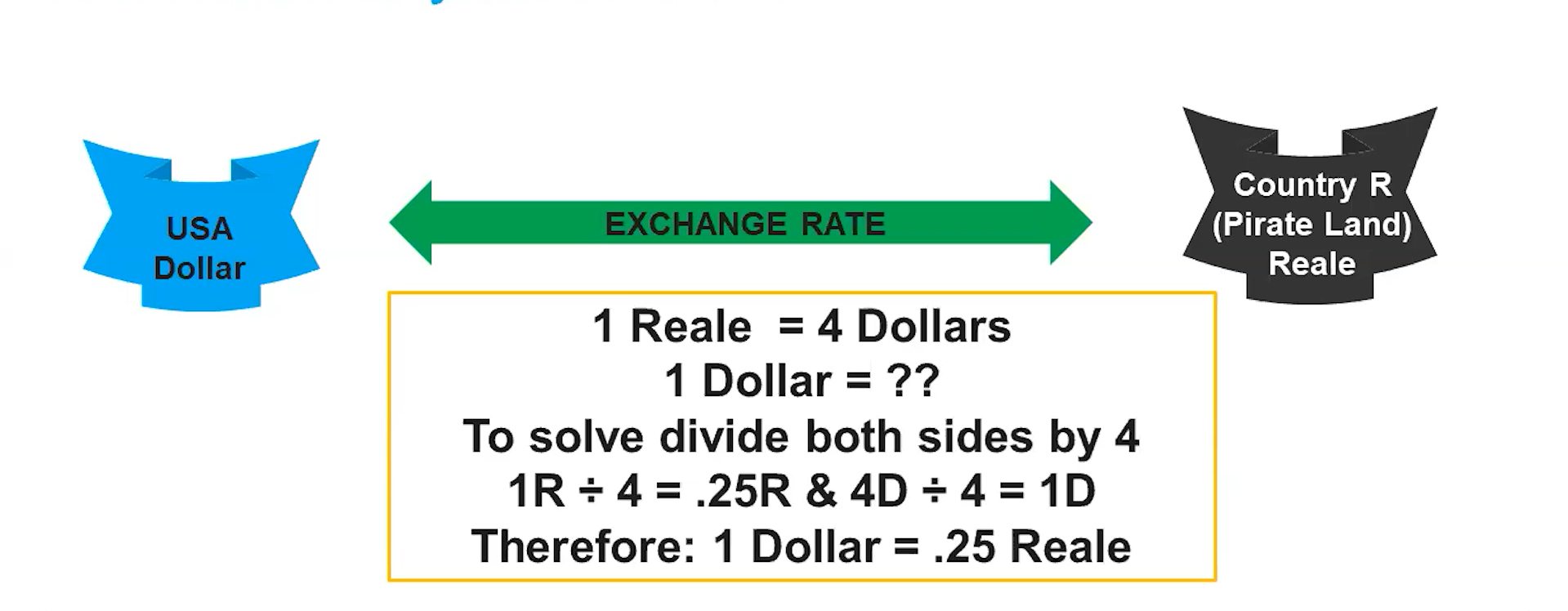

Value of Exchange Rates

In order for any transaction to occur between countries, currencies must be exchanged

Calculate Currency One to Another

What is the Foreign Exchange Market

The interaction of buyers and sellers exchanging the currency of one country for the currency of another.

This determines the equilibrium exchange rate in a flexible exchange market and influences the flow of goods, services, and financial capital between countries.

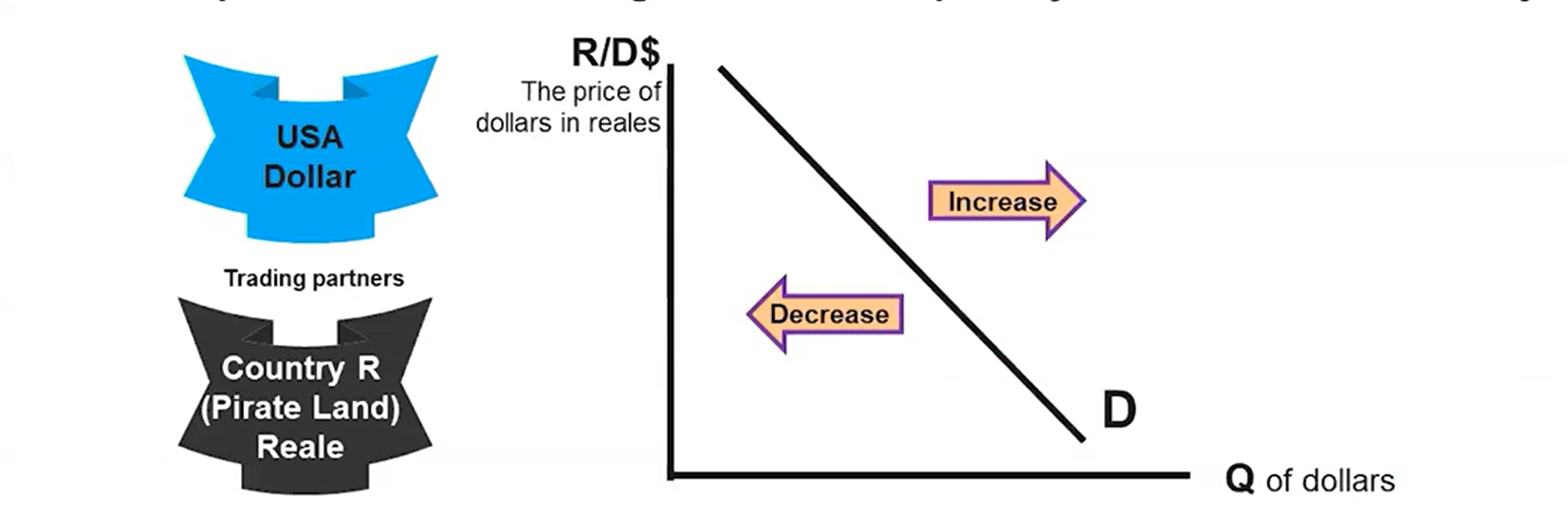

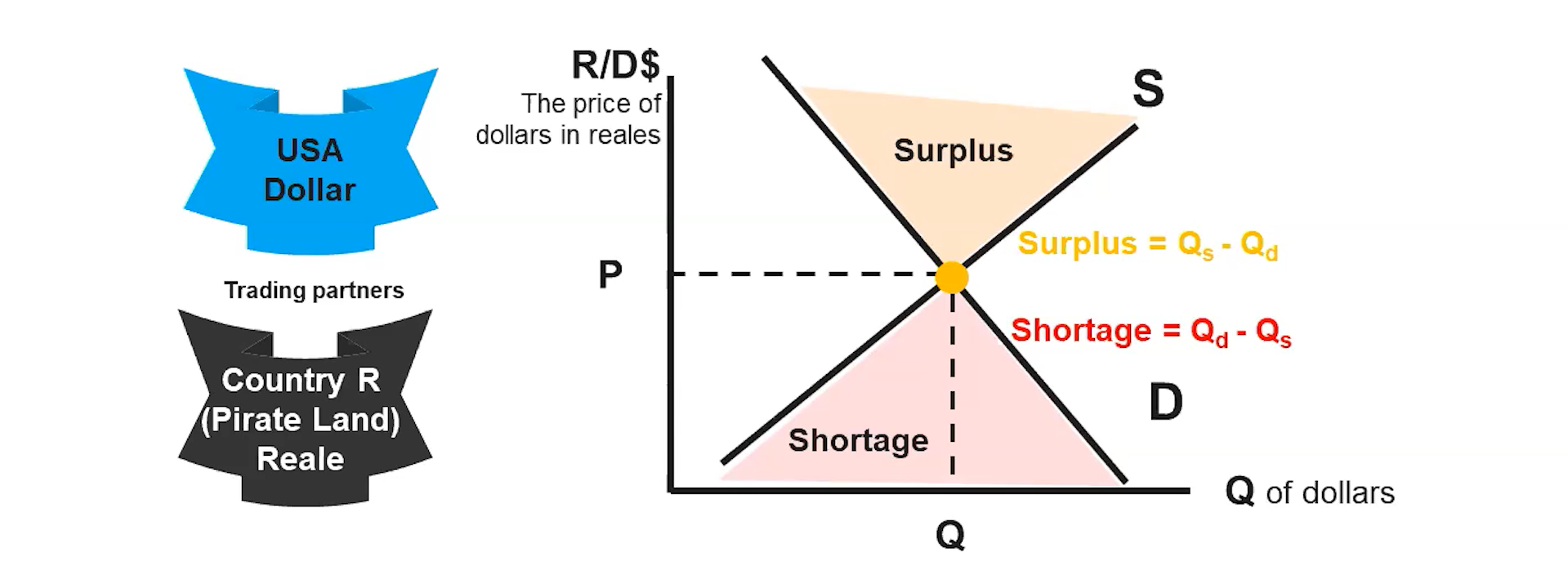

Demand for Currency

The demand for a currency in a foreign exchange market arises from the demand for the country’s goods, services, and financial assets and shows the inverse relationship between the exchange rate and the quantity demanded of a currency

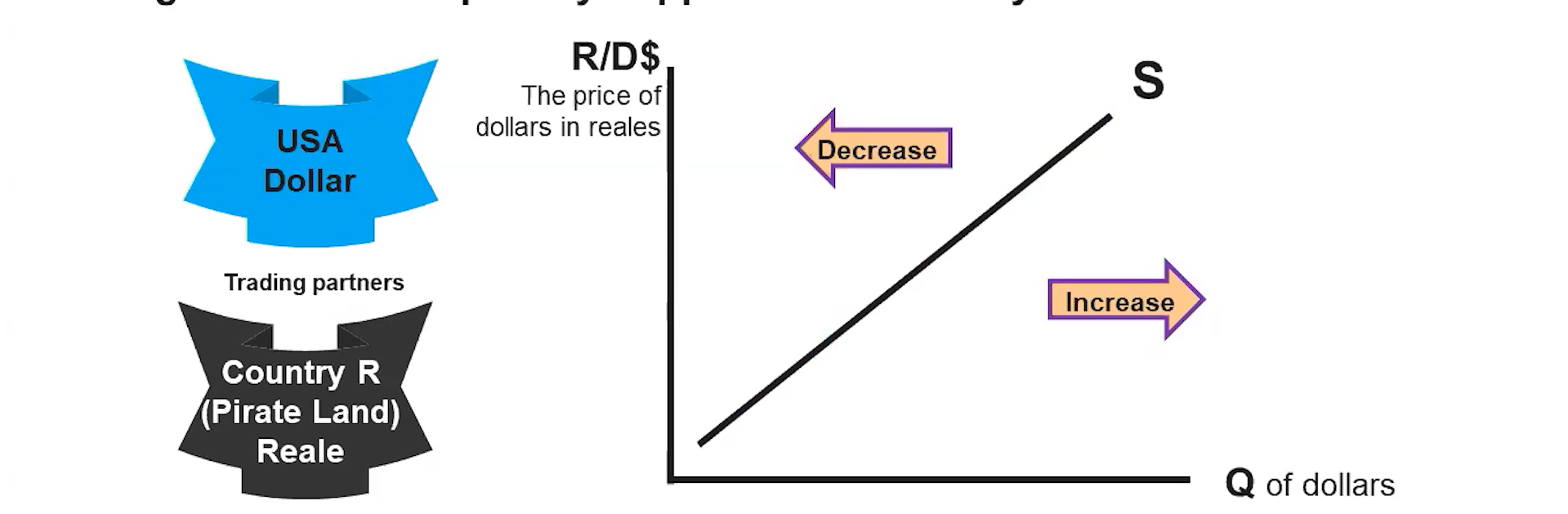

Supply of Currency

The supply of a currency in a foreign exchange market arises from making payments in other currencies and shows the positive relationship between the exchange rate and the quantity supplied of a currency

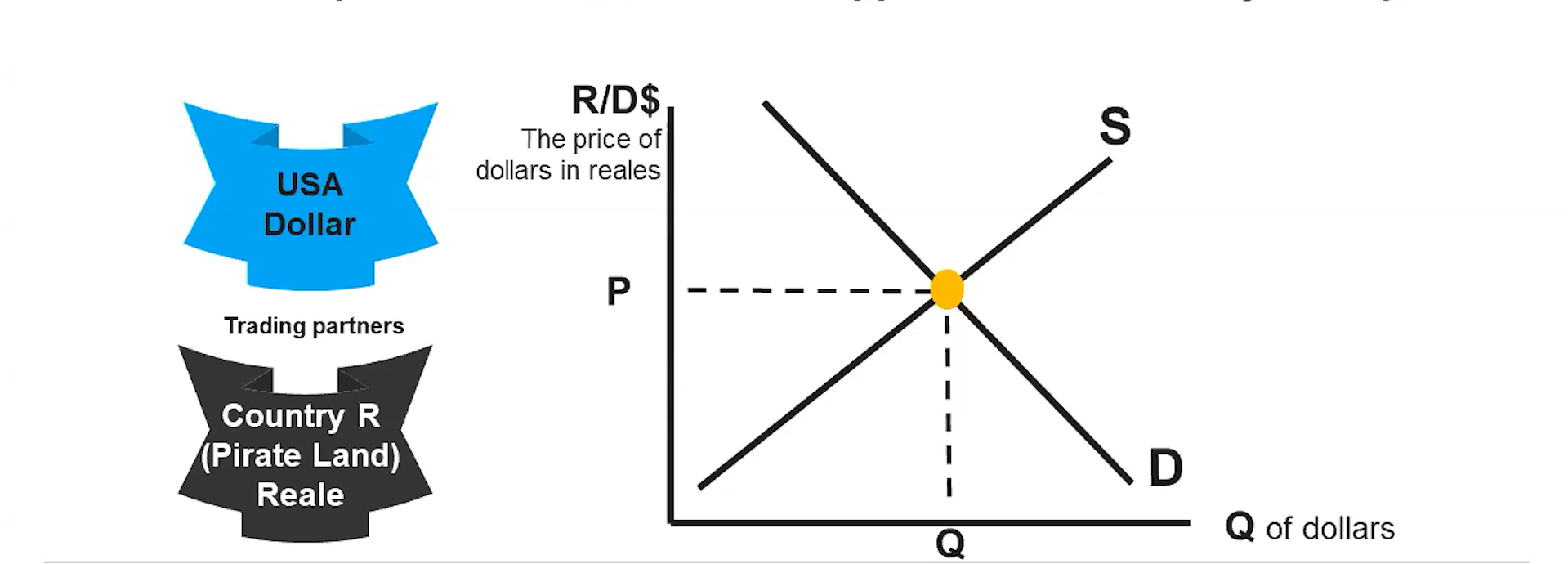

Equilibrium in the Foreign Exchange Market

In the foreign exchange market, equilibrium is achieved when the exchange rate is such that the qauntities demanded and supplied of the currency are equal

Disequilibrium in the Foreign Exchange Market

Disequilibrium exchange rates create surpluses and shortages in the foreign exchange market. Market forces drive exchange rates toward equilibrium.

Determinants of Currency Supply/Demand

Demand for a country’s exports or imports within the country

Interest rate changes affect both the supply and demand for currencies

Expectations of future exchange rates may affect both the supply and demand for currencies

Who Participates in the Foreign Exchange Market?

Those looking to purchase goods from another country (Buyers of foreign goods and services)

Those looking to earn income from another country (Income earners in foreign economies)

The actions of these individuals cause changes in the supply and demand of currencies, resulting in changes in exchange rates.

Determinants of Currency Demand

Foreign demand for the country’s goods and services

Foreign demand for the country’s assets

Fiscal Policy

Monetary Policy

Determinants of Currency Supply

Domestic demand for other country’s goods and services

Domestic demand for other country’s assets

Protectionist policies (tariffs, quotas) imposed on other country’s goods and services

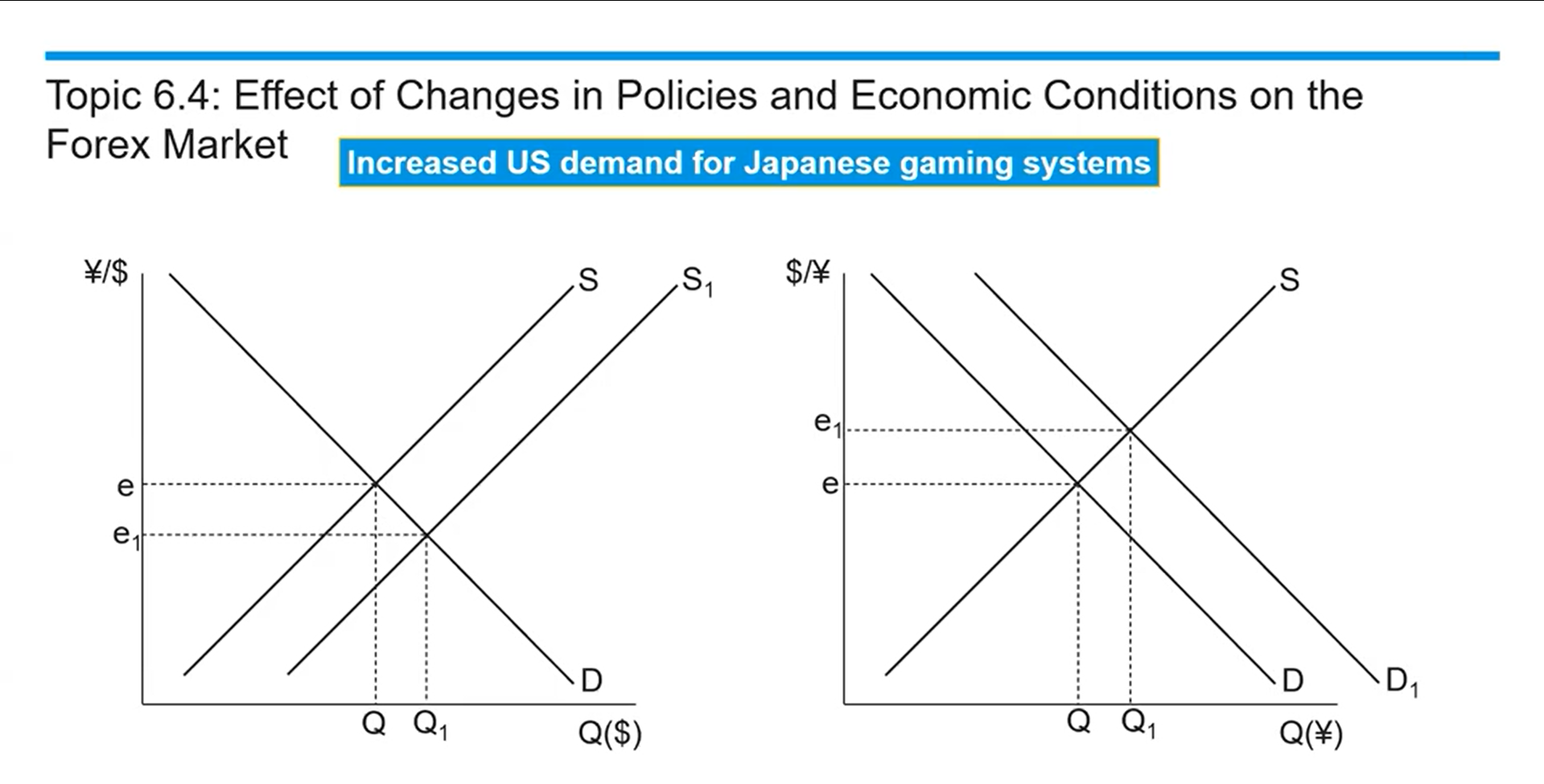

Increased US Demand for Japanese Gaming Systems

US demands more yen so they will supply more dollars

USD depreciates because there are more of them out in the market

Yen appreciates as a result of that increase in demand

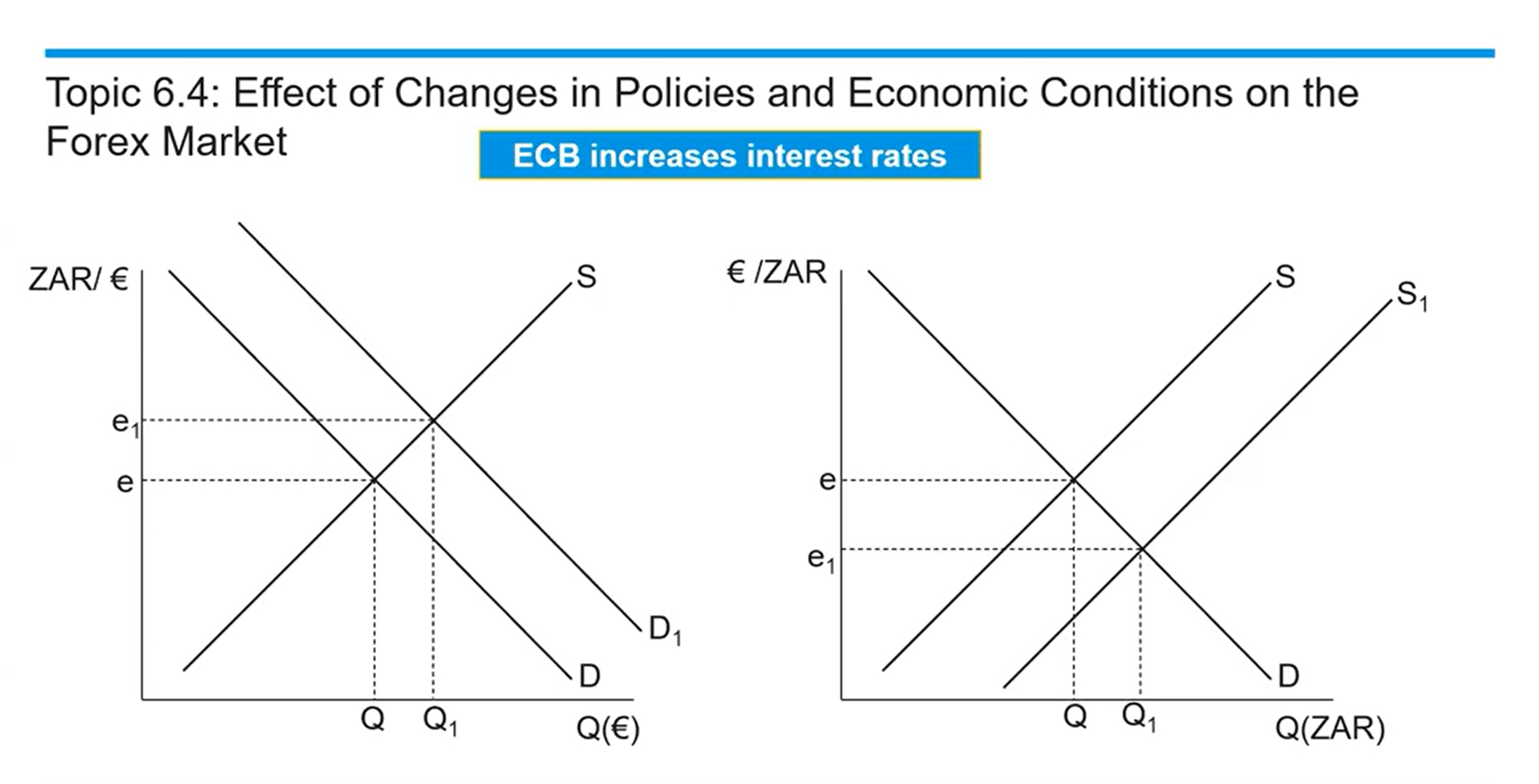

The European Central Bank Increases Interest Rates

A signal to potential investors that now you can get a higher rate of return on financial assets in Europe, on interest-bearing assets in Europe

Demand for the Euro increases as a result of investors wanting to take advantage of these higher interest-bearing assets

The exchange rate goes up, which means an appreciation of the Euro

By increasing the demand for the Euro, this will increase the supply of Rand on the foreign exchange market

The exchange rate due to the higher supply of Rand will make it depreciate

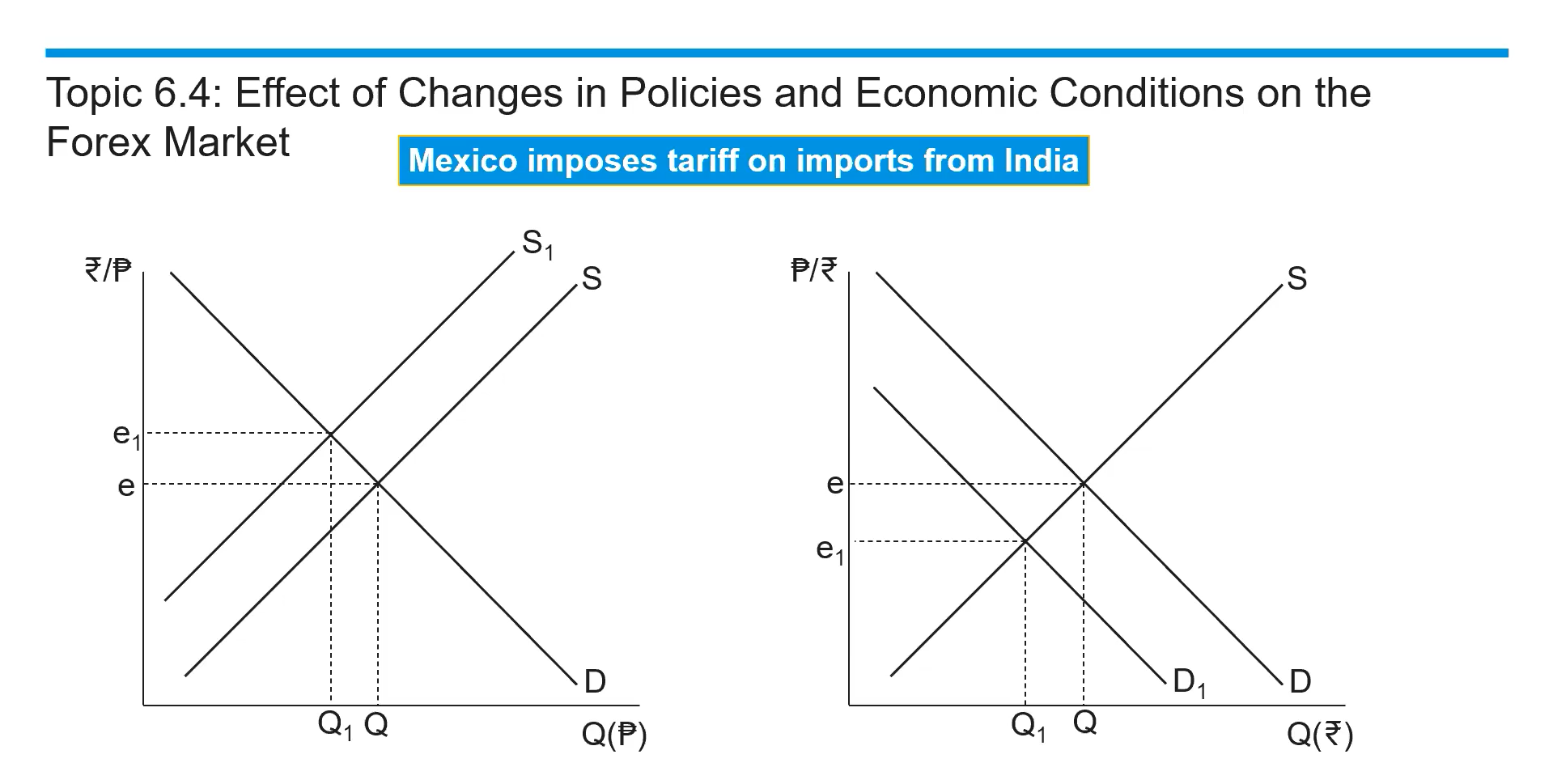

Mexico Imposes Tariff on Imports from India

Tariff restricts trade because people in Mexico don’t want to buy the now more expensive imported goods from India

Limits and decreases trade

With that increased tariff/price of imported goods, you see a reduction in trade, which leads to a decrease in the supply of pesos in the forex market

They are no longer demanding as many rupees because they’re not buying as many Indian goods with the tariff imposed

Which leads to a decreased demand for rupees

The peso appreciates

The rupee depreciates

Effect of Changes in Policies and Economic Conditions on the Forex Market

In a flexible exchange rate regime, exchange rates fluctuate due to changes in currency demand and supply.

One currency will appreciate while the other depreciates

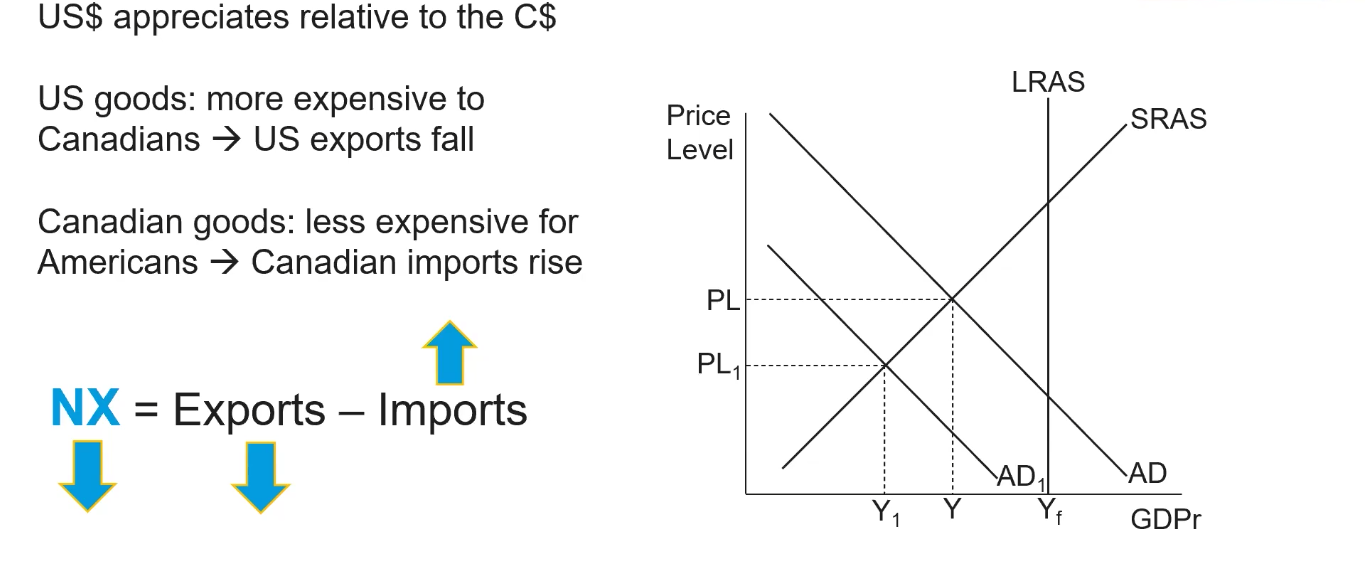

Essential Knowledge About the Changes in the Forex Market and Net Exports

Factors that cause a currency to appreciate cause that country’s exports to decrease and its imports to increase. As a result, net exports will decline.

An appreciated currency leads to more expensive exports and decreased Aggregate Demand.

Factors that cause a currency to depreciate cause that country’s exports to increase and its imports to decrease. As a result, net exports will increase.

A depreciated currency leads to less expensive exports and increased Aggregate Demand.

Consider trade between the US and Canada. Assume interest rate in the US rise, cause an appreciated US $.

Higher interest rates attract Canadian investors to purchase financial capital (capital inflows) due to a higher rate of return.

They will demand more dollars in the forex market to purchase this financial capital.

As a result, the supply of Canadian dollars will increase in the forex market.

Unemployment also increases

Real Interest Rates and International Capital Flows Essential Knowledge

In an open economy, differences in real interest rates across countries change the relative values of domestic and foreign assets. Financial capital will flow toward the country with the relatively higher interest rates. Central banks can influence the domestic interest rate in the short run, which in turn will affect net capital inflows.

Capital Flows on the Supply of Loanable Funds

Capital Flows are reflected by shifts of the supply of loanable funds

Capital inflow: Supply shifts right

Capital flight (outflow): Supply shifts left

Shifters of Capital Flows

Changes in interest rates:

Monetary policy

Expansionary: Decrease rates

Contractionary: Increase rates

Demand for money

Increase: Increase rates

Decrease: Decrease rates

Budget Balance

Deficit: Increase rates

Surplus: Decrease rates

Household savings behavior

Increase: Decrease rates

Decrease: Increase rates

Financial Capital in Relation to Interest Rates

Financial capital chases high interest rates

Investors comparing financial assets in multiple countries will gravitate towards those with the highest returns, as signaled by prevailing interest rates

Capital flows are, therefore, influenced by relative interest rates

Financial capital will flow toward the nation with higher interest rates

The supply of loanable funds reflects these changes in capital flows

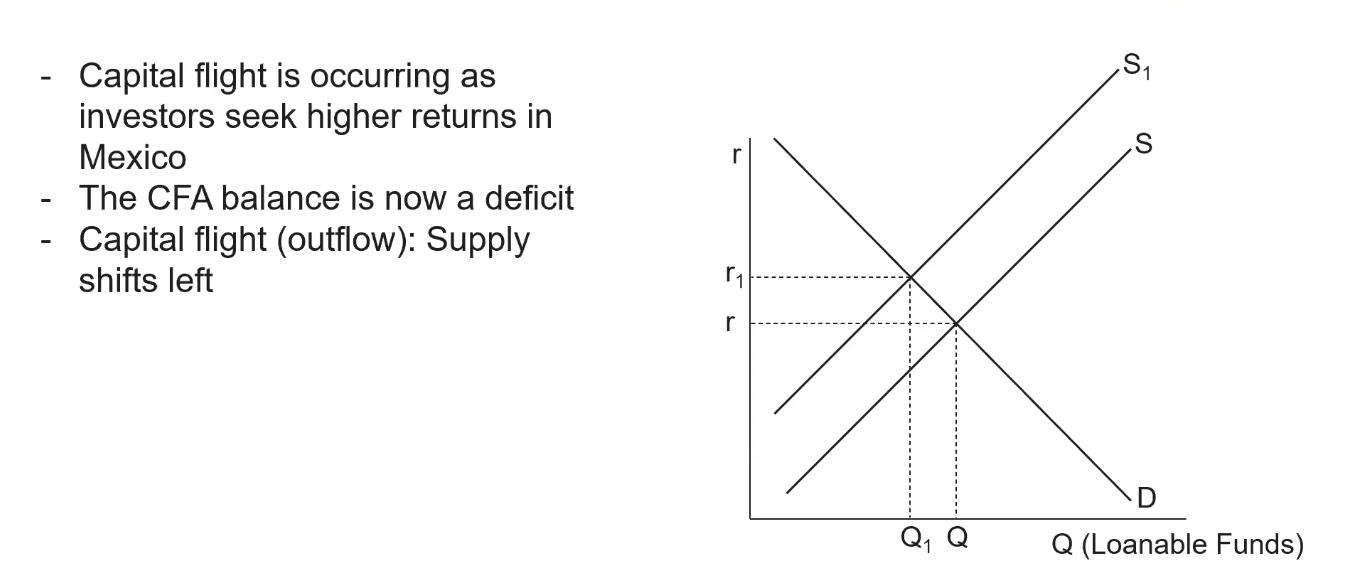

Example: Consider trade between Canada and Mexico where the real interest rates are 5%. Assume Canada has a CFA balance of zero.

An increase in national savings causes real interest rates in Canada to fall to 3.5%

Will financial capital flow from Canada to Mexico or from Mexico to Canada? Explain.

Financial capital will flow from Canada to Mexico because the higher real interest rates signal higher rates of return on financial assets in Mexico.

How will the CFA balance in Canada change? Explain.

The CFA will no longer be balanced; Canada’s CFA is now at a deficit because the capital flight (outflows) from Canada is recorded as a debit on the CFA.

How do we show this on a graph of the loanable funds market of Canada?

Capital outflow is illustrated as a leftward shift of the supply of loanable funds. Financial capital is leaving the economy, resulting in higher real interest rates.

Financial Capital Chases High Interest Rates

This movement of financial capital is reflected by:

A changing balance on the CFA

A shift of the supply of loanable funds