International Trade and Finance

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

Why do countries trade?

Divergent opportunity costs, where countries can focus resources on G+S they have a comparative advantage on, such that they can increase production and GDP

When does a country have a comparative advantage over another country?

When they can produce a good at a lower opportunity cost than any other country

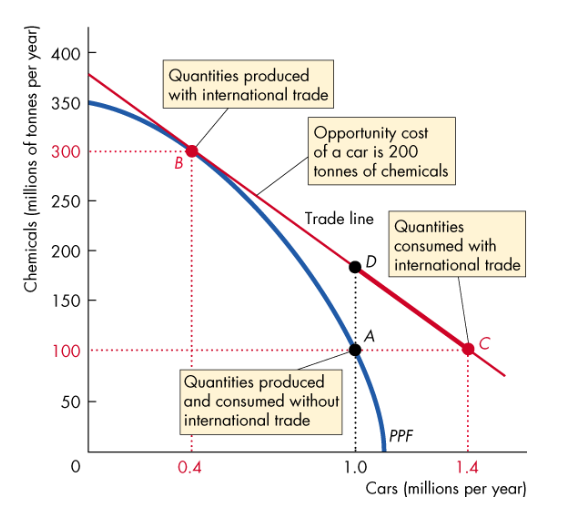

How does international trade create gains for countries?

It’s Cheaper to buy than to produce

E.g. if the rest of the world buys UK chemicals, which is has a CA on, then countries can decrease their production of chemicals, move along their PPF, and be able to buy more chemicals for the same number of cars

Note: UK can now consume at any point along the trade line

What are some other advantages of international trade?

Permits exploitation of economies of scale, supporting small countries who may not have a large enough domestic market

Increases choice, through the proliferation of differentiated products

Promotes competition by breaking down local monopolies

Leaning by doing decreases costs due to the large scale of production

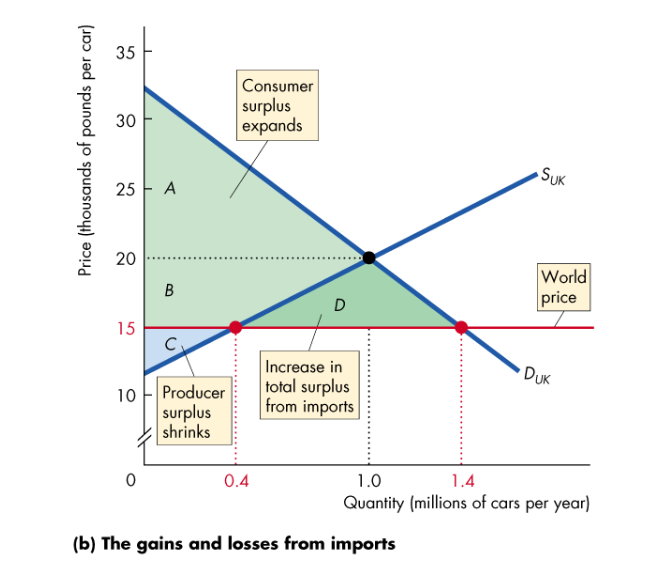

Who are the winners and losers of international trade for an importing country

Price decreases after trade

Consumers gain as the pay less and buy more, increasing CS

Producers lose as the receive less, produce less and have a smaller PS

Consumers’ gain exceeds producers’ loss, so total surplus increases

Who are the winners and losers of international trade for an exporting country?

Price increases after trade

Producers gain as they receive a higher price, produce more and receive a larger PS

Consumers lose as they pay more and buy less, decreasing CS

Gain in PS exceeds loss in CS, so total surplus increases

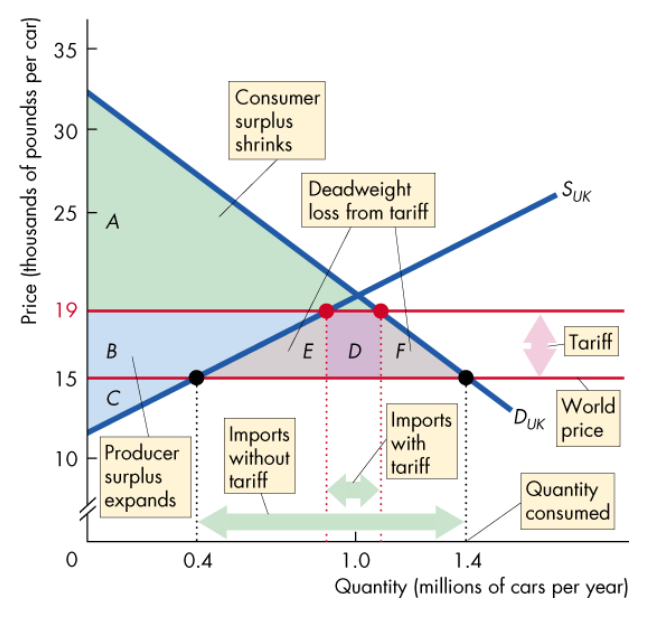

What is a tariff, and how does it work?

Tax imposed by the importing country when an imported good crosses int’l boundaries

By imposing a tariff, it increases producer surplus whilst decreasing consumer surplus, reducing imports but creating a DWL in the process

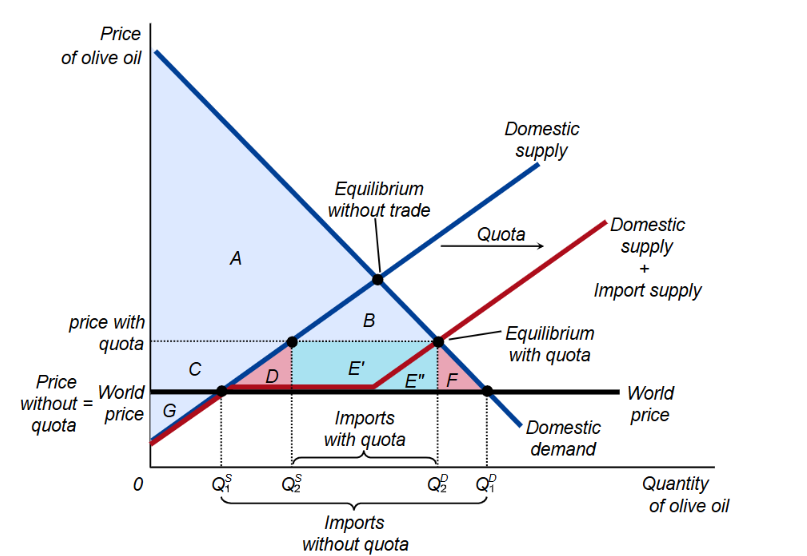

What is a quota, and how does it work?

It’s a limit of the quantity of a good that can be imported

By putting a limit on imports, it shifts the domestic supply curve right, meaning new equilibrium is at a higher quantity and lower price, increasing CS and decreasing PS, but imposing a DWL in the process

What are the arguments for protectionist policies?

National security argument

Infant-industry argument (e.g. post WW2 Japan)

Saves jobs

What are the arguments against protectionist policies?

Consumers pay higher prices

Resources moved from an efficient to inefficient use

Can’t export if we don’t import

Protection could invite retaliation

What is the Balance of Payments, Credit and Debit?

Balance of Payments = Record of a country’s transactions (Trading, borrowing and lending) with the rest of the world

Credit = Payments by foreigners

Debit = Payments to foreigners

What is a current account, and what does it include?

It records transactions in G+S

Includes:

Payments for imports

Receipts for exports

Net interest paid abroad

Net transfers

Current account balance = X - M + Net interest income + Net Transfers

When is the current account in deficit or surplus, and what must it do to rectify it?

Deficit when X - M < 0

Must borrow from foreigners or sell assets

Surplus when X - M > 0

Must make loans to foreigners or buy some of their assets

What does the capital account show, and what happens when a country is a net borrower/lender?

Capital account = S - I (Net capital outflow)

Net borrower (S<I):

Capital inflow needed: Purchase of domestic assets by foreigners

Net lender (S>I):

Capital outflow needed: UK purchases foreign assets

What is a key condition of the balance of payments, and what must be done in order to maintain this state?

BOP must always balance

Sum of current and capital accounts must always equal zero

Any difference needs to be compensated by a change in foreign currency reserve holdings

Countries with current account surplus acquire foreign assets

Countries with current account deficit sell assets

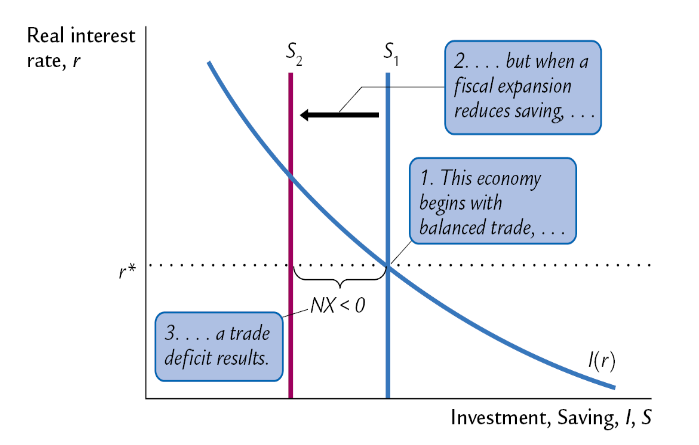

What happens to the investment and savings curves when an expansionary FP is pursued at home?

Starts with balanced trade, but a fiscal expansion reduces savings, resulting in a trade deficit occurring

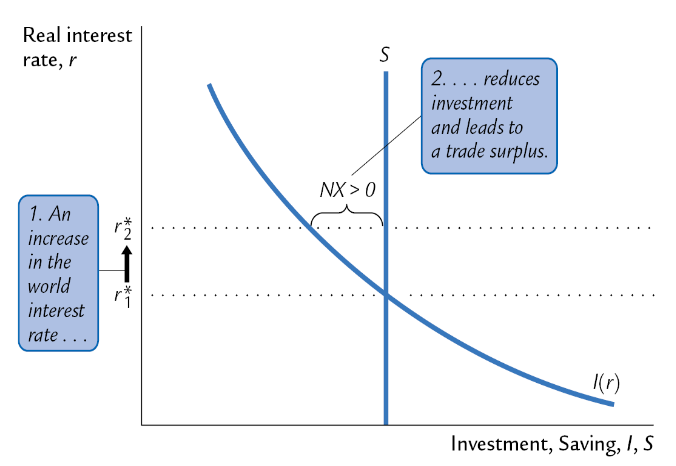

What happens when an expansionary FP is pursued abroad?

It leads to an increase in the world interest rate, reducing investment and leading to a trade surplus

What happens when the government decreases regulation?

Leads to an increase in investment demand, increasing interest rates and leading to a trade deficit

When is being a net borrower a problem or not?

Not a problem when borrowed funds are used for investments which boost national income

It is a problem when borrowed funds are used to finance consumption

What is an exchange rate?

The price of a foreign currency in terms of its domestic currency

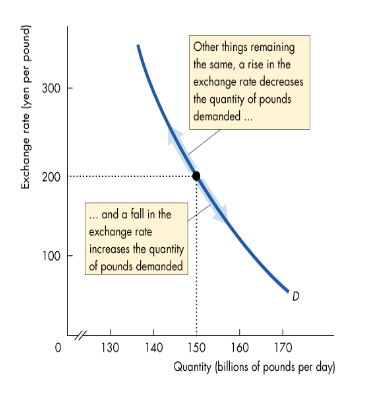

What determines the SR exchange rate?

The quantity of pounds demanded in the foreign exchange market

Higher the ER, the lower the quantity of £s demanded

Lower the ER, the higher the quantity of £s demanded

Explain the demand curve for pounds

Negatively sloped due to exports and expected profits

Moving down the vertical axis, the pound is worth fewer dollars, so it depreciates

Moving up the vertical axis, the pound is worth more dollars, so it appreciates

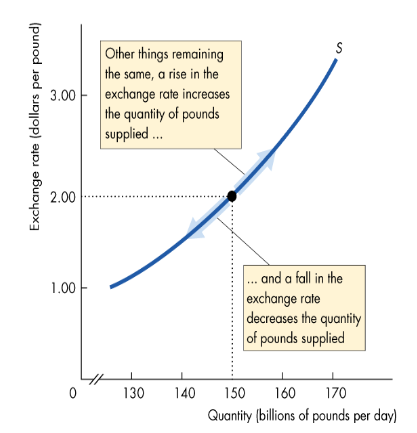

What determines the supply of foreign exchange?

Quantity of £s supplied depends on the exchange rate

The higher the ER, the larger the quantity of £s supplied

The lower the ER, the lower the quantity of £s supplied

Explain the supply curve for pounds

Positively sloped due to imports and the expected profits effect

Moving down the vertical scale, the pound is worth fewer dollars, so it depreciates

Moving up the vertical scale, the pound is worth more dollars, so it appreciates

Explain how foreign exchange market equilibrium is found

Occurs when the supply of pounds = demand of pounds

If exchange rate is too high, a surplus of pounds drives it down

If exchange rate is too low, a shortage of pounds drives it up

What causes a shift in the demand curve?

A change in the influence on the quantity of pounds that people plan to buy, other than exchange rate

Demand for pounds increases if:

World demand for UK exports increases

UK interest rate differential increases

Expected future exchange rate rises

Demand for pounds decreases if:

World demand for UK exports decreases

UK interest rate differential decreases

Expected future exchange rate falls

What causes a shift in the supply curve?

A change in any influence on the quantity of pounds that people plan to sell, other than the exchange rate

Supply of pounds increases if:

UK demand for imports increases

UK interest rate differential falls

Expected future exchange rate falls

Supply of pounds increases if:

UK demand for imports decreases

UK interest rate differential rises

Expected future exchange rate rises

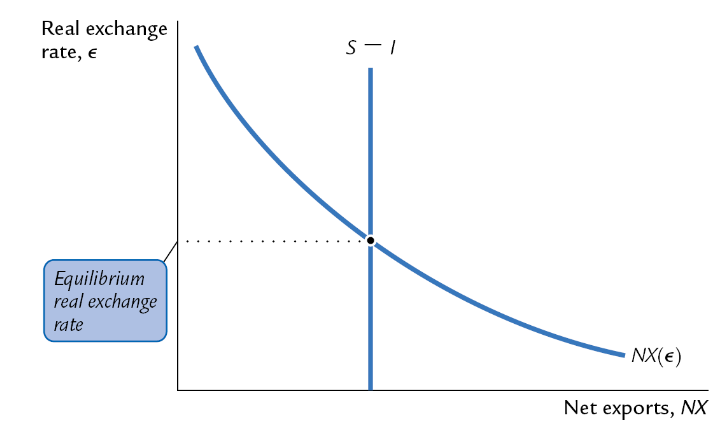

What is the real exchange rate?

The rate at which a person can trade the G+S of one country for the G+S of another

Real ER = (Nominal ER x Domestic Price)/Foreign Price

Changes in RER change demand for imports and exports

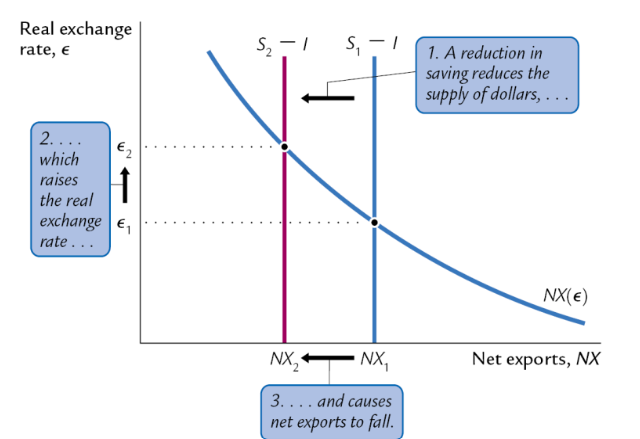

What’s the effect of a domestic expansionary FP on the RER?

A reduction in savings reduces supply of dollars, raising the real ER, causing net exports to fall

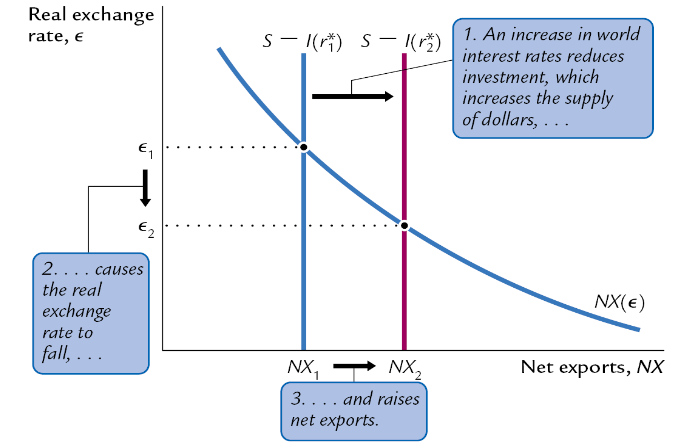

What’s the effect of a foreign expansionary FP on the RER?

An increase in world interest rates reduces investment, increasing the supply of dollars, which causes the RER to fall, raising net exports

What’s the effect of protectionist policies on the RER?

They raise the demand for net exports, raising the exchange rate, but leaving net exports unchanged

What factors determine the LR values of the exchange rate?

Determined by the relatives prices in 2 countries

Purchasing Power Parity (PPP) occurs when 2 quantities of money can buy the same amount of G+S as one another

What happens when an ER is fixed?

The govt or CB maintains the rate by buying/selling its currency using foreign currency reserves. This shifts the supply curve and keeps the equilibrium at the desired rate

However, if the markets think the fixed value is unsustainable, they can force a revolution

What are some alternative exchange rate regimes?

Floating/Flexible

No intervention. ER adjusts so that supply = demand

Fixed/Pegged

CB/govt buys or sells reserves to fix the ER

Managed Float/Crawling Pegged

CB or govt intervenes only if the ER fluctuates too much