Corporate Issuers/FSA Formulas

1/88

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

89 Terms

Cash Conversion Cycle

Days of inventory on hand + Days Sales outstanding - Days payable outstanding

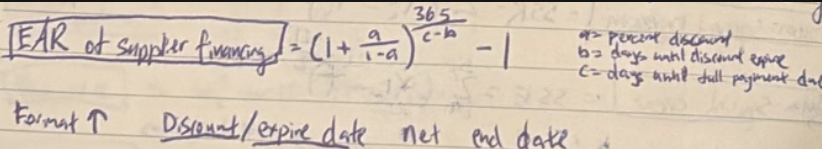

EAR of Supplier Financing and FORMAT

Total Working Capital (TWC)

Current Assets - Current Liabilities

Net Working Capital

Current Assets - Current Liabilities

CA exclude (cash and marketable securities)

CL exclude (short term and current debt)

Current Ratio

Current Assets/Current liabilities

Quick Ratio

(Cash and Marketable Securities + receivables)/Current Liabilities

Cash Ratio

(Cash and Marketable Securities)/Current Liabilities

NPV

sum CF/(1+r)^t

Return on Invested Capital

NOPAT/(average book value of total capital)

(NOPAT/sales)(sales/average invested capital)

Weighted Average Cost of Capital

[Wdebt * pretax cost of debt * (1 - t)] + (Wequity x cost of equity)

NPV w/ real options

NPV(no options) - option costs + option value

cost of equity formula

r0 + (D/E)(r0 - rd)(1-t)

r0 = cost of equity with no debt

rd = cost of debt

MM prop w/ distress

VL = VU + tD - PV(cost of financial distress)

VL = value of firm leveraged

VU = unleveraged

Basic EPS

(Net Income - Pfd dividends)/ weighted avg common shares outstanding

Diluted EPS

adjusted income for common shares/ weight average common and potential shares

Preferred Stock Diluted EPS

($Par * %PS)/possible shares

Convertible Debt Diluted EPS

convert debt interest(1-t)/convert debt shares

Stock Option Diluted EPS

ALWAYS DILUTIVE

N x [ (AMP - EP) / AMP]

gross profit margin

gross profit/ revenue

Net Profit Margin

net income/ revenue

Long term debt to equity ratio

long term debt/equity

total debt to equity ratio

total debt/equity

financial leverage ratio

total assets/total equity

current ratio

CA/CL

quick ratio

cash + market sec. + receivables/CL

cash ratio

cash + market sec./CL

cash collection

Beginning AR (BS) + Sales (IS) - cash collect (CF) = End AR (BS)

Cash collect = Beginning AR (BS) + Sales (IS) - End AR (BS)

Indirect CFO

CFO = NI + NCC - increase in WC

Free cash Flow to Firm (FCFF)

NI + NCC + [int*(1-t)] - Fixed capital investment - WC investment

CFO + [int *(1-t)] - FC inv

Free Cash Flow to Equity (FCFE)

CFO - FC inv + net borrowing

net borrowing = debt issued – debt repaid

Cash Flow to revenue

CFO/revenue

Cash return on assets

CFO / average total assets

Cash return on Equity

CFO/ avg total equity

Cash to income

CFO/operating income

Cash flow per share

(CFO - pfd dividends) / weighted average # of common shares

Cash debt coverage

CFO/total debt

Cash interest coverage

(CFO + interest paid + taxes paid)/interest paid

Cash debt payment ratio

CFO/cash long term debt repayment

Cash reinvestment ratio

CFO/ cash paid for long term assets

Cash Dividend payment ratio

CFO/dividend paid

Cash investing and financing ratio

CFO/cash outflow from investing and financing

Net Realizable Value IFRS

NRV = Expected Selling Price - total selling cost

Market Value GAAP

Ceiling = NRV

Floor = NRV - Normal Profit Margin

Asset Turnover

Revenue/avg total asset

Average Age

accumulated depreciation/annual depreciation expense

Total useful life

historical cost/annual depreciation expense

Remaining useful life

ending net PPE/annual depN expense

Inventory Turnover

COGS/avg inventory

Days of inventory on hand

365/Inventory TO

Impairment IFRS

Impairment = CV - high of vv

Higher of: FV - Selling costs & Value in Use(PVCF)

Impairment GAAP

Recoverability test: CV > Undiscounted CF

→ Impairment = CV - FV (or PVCF)

Gross P/L for lease

Revenue - Cost of Sale

Rev = PV of Lease Payments

Cost of Sale = CV - PV(residual value)

Fair Value of Lease

sum of the present value of lease payments and the salvage value

= asset’s FV

Tax Expenses

Tax Expense is tax on IS

TE = TP + change in DTL - change in DTA

Effective tax rate

income tax expense/Pre tax income

Cash Tax Rate

Cash Taxes Paid/Pretax income

Double Declining Balance

2 x (1/useful life) x BV@ Beg of year

Change in DTL

(Tax Return depreciation - acctg DepN) * TR

Timing Difference: Tax Return depreciation - acctg DepN

EOY DTL

(Carrying Value - Tax Base) * TR

Receivables TO

annuals sales/avg receivables

Days of Sales Outstanding

365/Receivable TO

Payable turnover

COGS/avg trade payables

Days of Payables

365/payables turnover

Total asset TO

revenue/avg total assets

Total Fixed asset TO

revenue/avg fixed asset

working capital TO

revenue/avg working capital

Defensive interval + meaning

cash + market sec. + receivables/avg daily expenditure

how many days to last if no rev

Debt-to-Equity + meaning

total debt/total EQ

reliance on debt

Debt-to-Capital + meaning

total debt/(total debt + total EQ)

proportion of debt in structure

Debt-to-asset + meaning

total debt/total asset

% of debt if liquidate assets

Financial leverage + meaning

avg total assets/avg total equity

Use of debt for financing

If use of RE for assets→Financial leverage = 1

Interest Coverage + meaning

EBIT/interest payments

safety ratio

Debt-to-EBITDA + meaning

total debt/EBITDA

number of years to pay off debt

Fixed change coverage + meaning

(EBIT + Lease Payments)/ (interest payments + lease payments)

ability to cover its fixed financial obligations, including interest and lease payments, using its operating earnings.

Net profit margin

NI/revenue

Gross Profit Margin

gross profit/revenue

Operating Profit Margin

EBIT/revenue

Pretax Margin

EBT/revenue

Return on Asset

NI/avg total asset

NI + interest expense(1-t)/ avg total asset

Operating ROA

EBIT/avg total assets

Return on invested capital

NOPAT/avg long term capital

NOPAT = EBIT(1-t) = after-tax operating profit

Return on Equity

Net income/ avg total equity

Return on Common Equity

(NI - pfd dividend)/avg common equity

DuPont 2 stage

(NI/avg total asset)(avg total asset/avg shareholder EQ)

DuPont 3 stage

(NI/rev)(rev/avg total asset)(avg total assets/ avg EQ)

Extend DuPont

(NI/EBT)(EBT/EBIT)(EBIT/rev)(rev/avg assets)(avg asset/avg EQ)

CV sales

std of sales/mean sales

CV operating income

std operating income/mean operating income

CV net income

std of net income/mean net income