FT6

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

minimize idiosyncratic risk.

The primary purpose of portfolio diversification is to…

Thirty random stocks; portfolio beta unknown

Which of the following portfolios might be expected to exhibit less unsystematic risk?

Total assets

On a common-size balance sheet, which line item must have a value of 100%?

the compensation of the chief executive officer (CEO) mainly consists of fixed annual salary.

Agency theory would imply that conflicts are more likely to occur between management and shareholders when…

Primary market

When a corporation uses the financial markets to raise new funds, the sale of securities is made in the…

present value of the cash flows expected to be received from the asset.

In a general sense, the value of any asset is the…

Investors trade a company's stocks among themselves during an IPO

Which of the following statements about IPO is false?

with large cash inflows in late years

Firms that make investment decisions based on the payback rule may bias against projects…

It’s NPV is $20,000

If a project has a cost of $50,000 and a profitability index of 0.4, then…

an outflow at the beginning and an equal inflow at the end of the project.

In capital budgeting analysis, an increase in working capital can be shown as…

Greater than the cost of capital

If an investment project has a positive net present value, then the internal rate of return is…

accelerated depreciation leads to higher NPV than straight-line depreciation.

Which of the following statements about depreciation is true regarding its impact on the project NPV? (hint: project cost of capital is greater than zero)

This is not possible with positive interest rates

Under which of the following conditions will a future value calculated with simple interest exceed a future value calculated with compound interest at the same rate?

Project C with the highest net present value

The financial manager at IBFM, a farm implement distributor, is contemplating the following three mutually exclusive projects. IBM's required rate of return is 9.5%. Based on the information provided, which should the financial manager select and why? | ||||

Project | Investment at t = 0 | Cash Flow at t = 1 | IRR | NPV @ 9.5% |

A | $10,000 | $11,300 | 13.00 | $320 |

B | $25,000 | $29,000 | 16.00 | $1,484 |

C | $35,000 | $40,250 | 15.00 | $1,758 |

1.165

You hold a diversified portfolio worth $10,000. The portfolio consists of 20 different common stocks. The portfolio beta is equal to 1.2. You have decided to sell one of your stocks that has a beta equal to 1.4. You plan to use the proceeds to purchase another stock that has a beta equal to 0.7. What can possibly be the beta of the new portfolio?

1.5%

Your friend is asking you for help. He would like to know the standard deviation of the returns of his portfolio. However, a couple of daily returns are missing, as shown below…

Day | Returns |

1 | 3% |

2 | -2% |

3 | ?? |

4 | 1% |

5 | 3% |

6 | ?? |

7 | 1.5% |

8 | -4% |

9 | ?? |

10 | 0.5% |

Based on the given information, which of the following might be the return standard deviation of your friend's portfolio over the 10-day period? | |

Required return = 8.6%, plots above the SML

Datem Corp. has an expected return of 11%. With a risk-free rate of 3%, a market risk premium of 7% and a beta of 0.8, you can estimate its required return. What is the required return, and would Datem plot above or below the security market line (SML)?

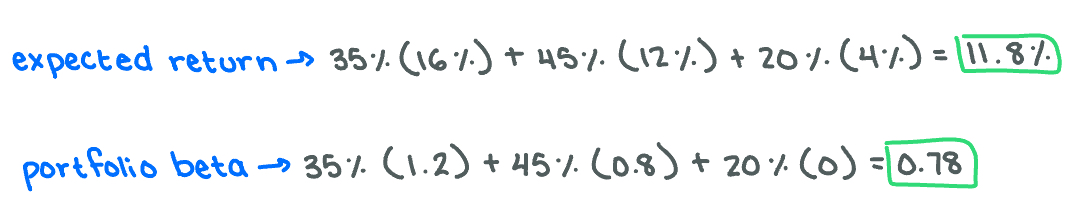

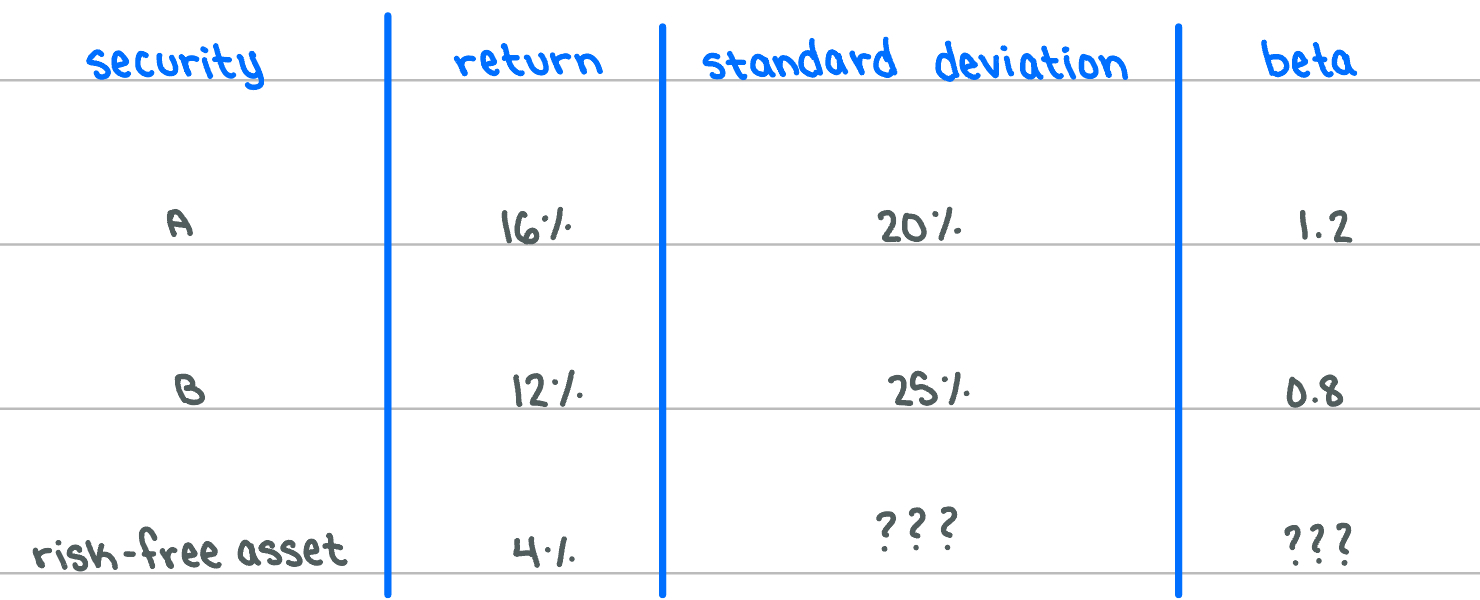

11.8%; 0.78

What is the portfolio Expected return and the portfolio beta if you invest 35% in A, 45% in B, and 20% in the risk-free asset?

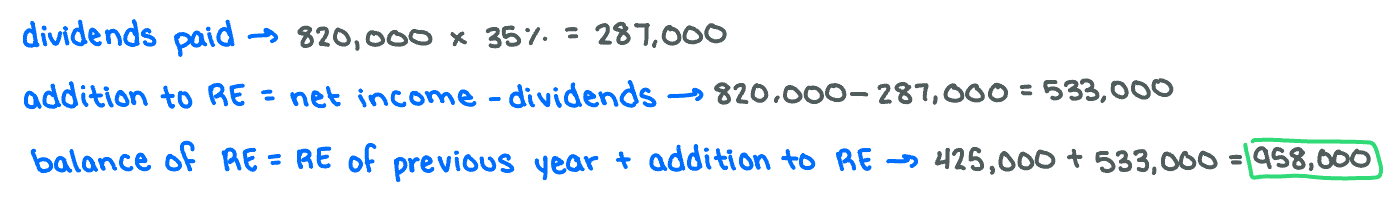

$958,000

The West Hanover Clay Co. had, at the beginning of the fiscal year, November 1, 2021, retained earnings of $425,000. During the year ended October 31, 2022, the company generated a net income after taxes of $820,000 and paid out 35 percent of its net income as dividends. Compute the year-end balance of retained earnings in the balance sheet.

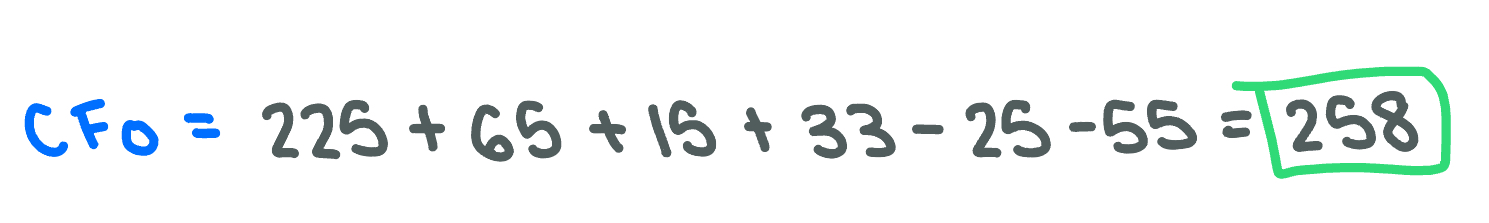

Increase in cash of $258

Use the following financial data for Moose Printing Corporation to calculate the cash flow from operations (CFO).

Net income: $225

Increase in accounts receivable: $55

Decrease in inventory: $33

Depreciation: $65

Decrease in accounts payable: $25

Increase in wages payable: $15

Purchases of new equipment: $65

Dividends paid: $75

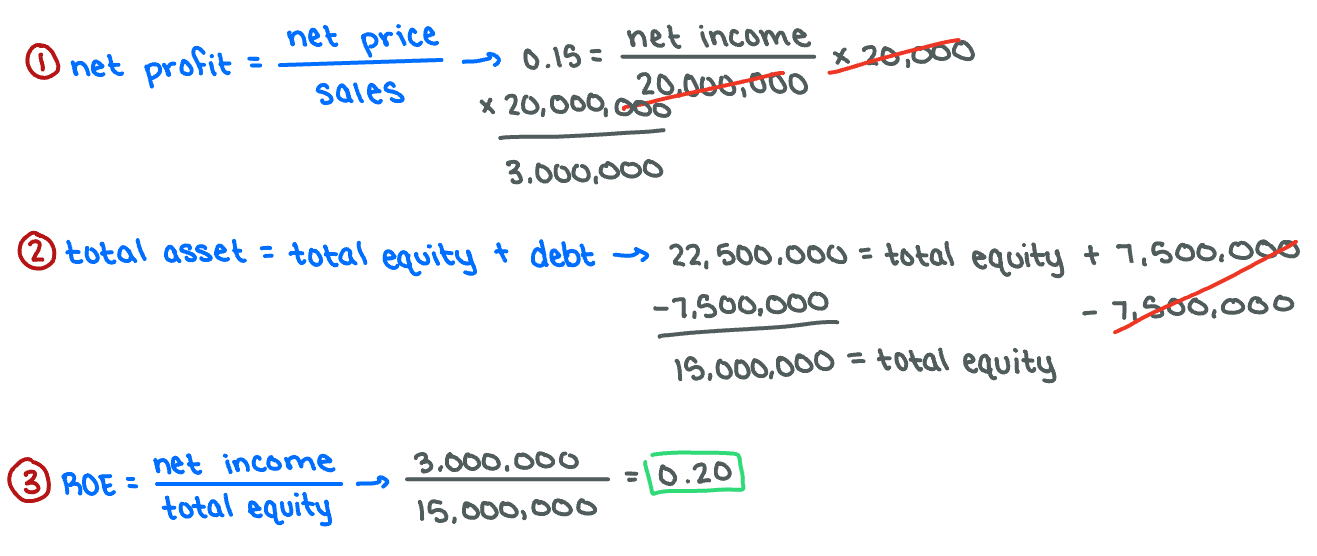

20.0%

A firm has a net profit margin of 15 percent on sales of $20,000,000. If the firm has debt of $7,500,000, total assets of $22,500,000, and an after-tax interest cost on total debt of 5 percent, what is the firm's ROE?

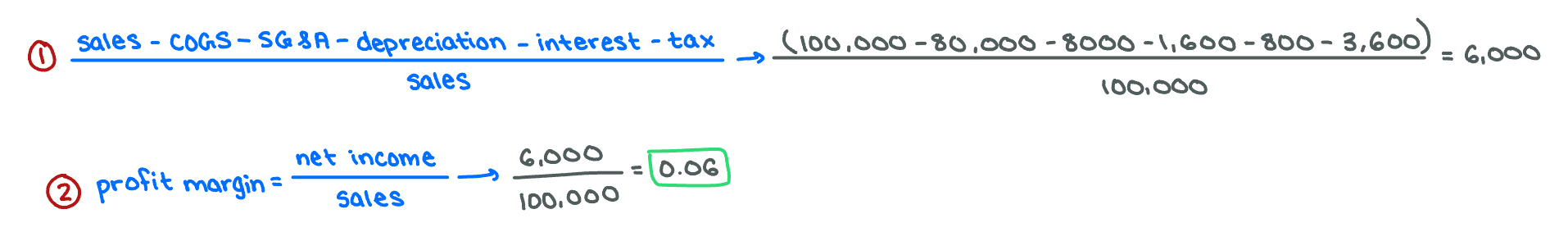

6%

Below are items in company ABC's income statement. There is no other income or expense.

The firm's profit margin is….

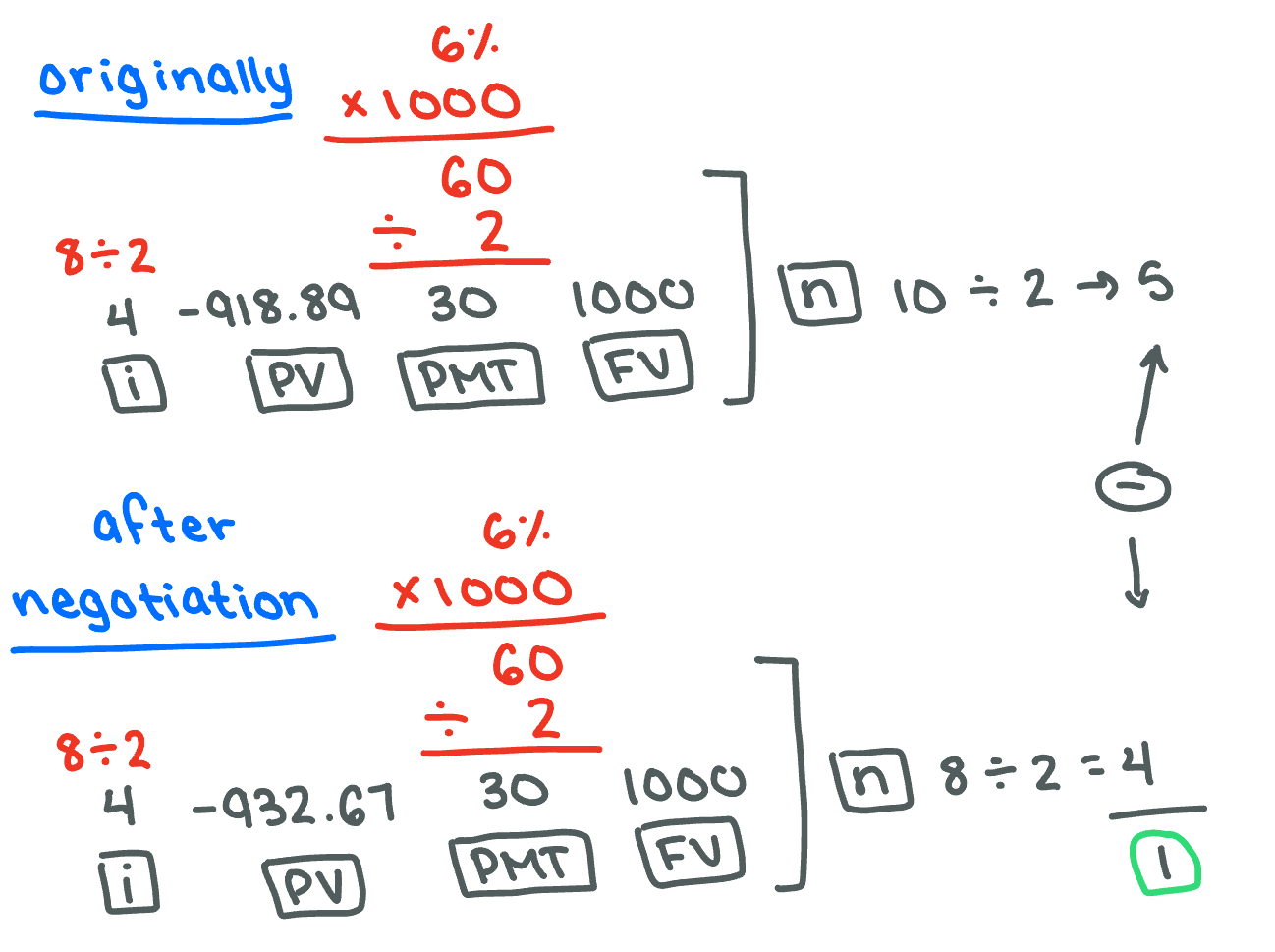

The maturity of the bond decreased by 1 year.

Firm ABC has a bond outstanding with a market price of $918.89 and a yield to maturity of 8%. Bond coupons are paid semi-annually, and the annual coupon rate is 6%. Due to the changing need of financing, the firm renegotiated the bond term with bond investors, and the two parties agreed to change the maturity date of the bond. After the news announcement, the price of the bond increased to $932.67. Assume the yield to maturity and coupon rate on the bond remain unchanged. Which of the following must be true?

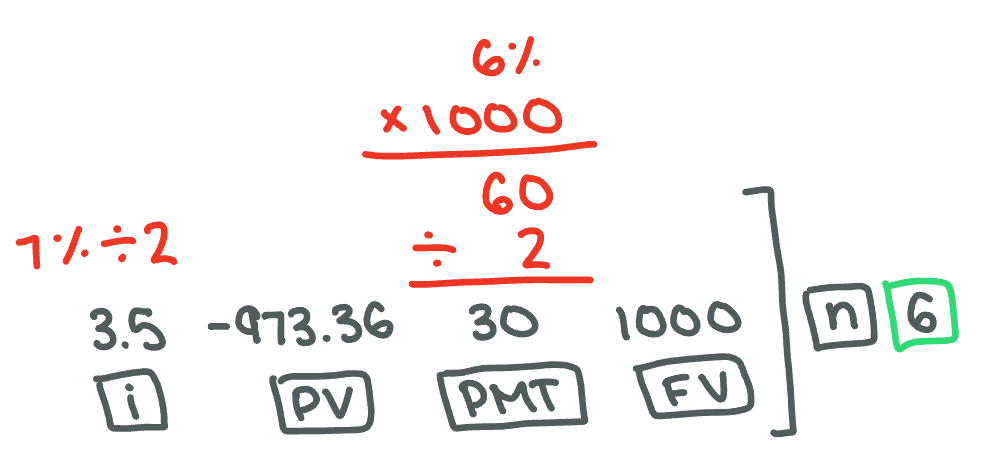

6

You are interested in a corporate bond with the current market price of $973.36 and yield to maturity of 7%. The bond carries a coupon rate of 6%, paid semi-annually. If you buy the bond today, how many semi-annual coupon payments will you receive until the final maturity?

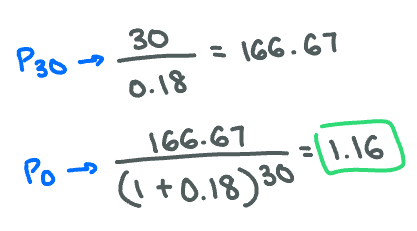

$1.16

Biogenetics, Inc. plans to retain and reinvest all of their earnings for the next 30 years. Beginning in year 31, the firm will begin to pay a $30 per share dividend. The dividend will not subsequently change. Given a required return of 18%, what should the stock sell for today?

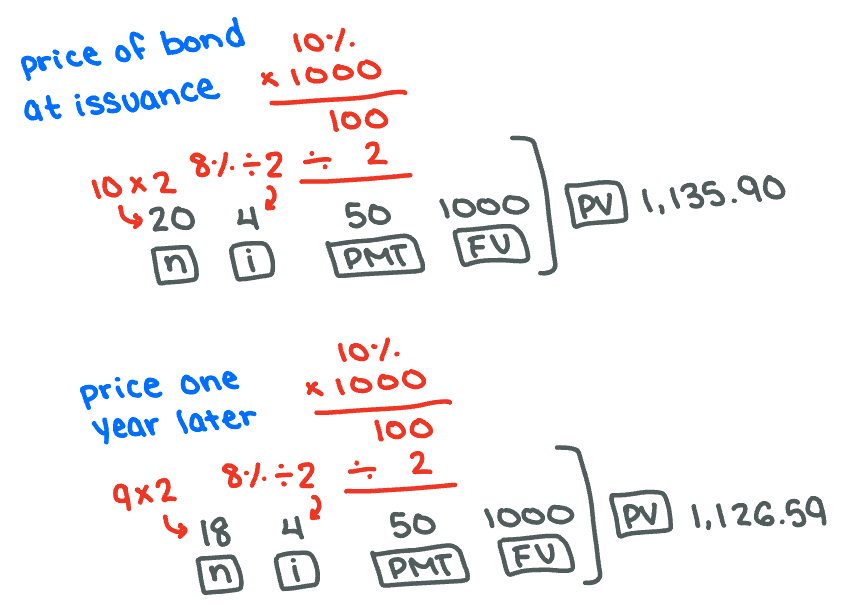

It will have decreased

Consider a 10%, 10-year bond sold to yield 8%. One year passes and interest rates remained unchanged at 8%. What will have happened to the bond's price during this period? Assume the bond pays coupons semi-annually

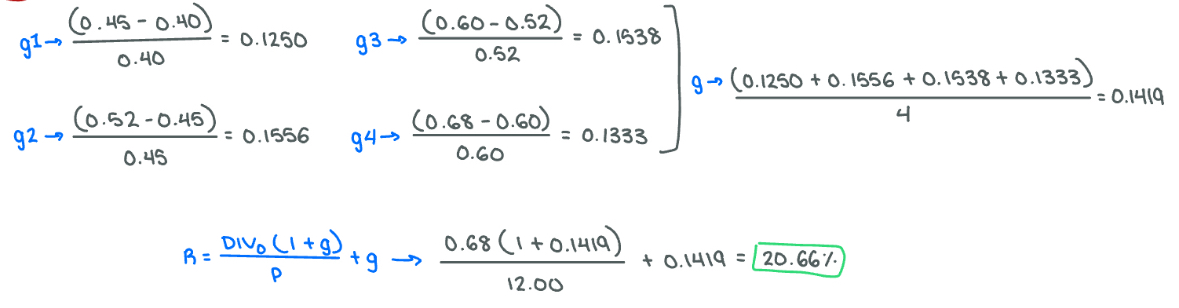

20.66%

Suppose Massey Ltd. just issued a dividend of S.68 per share on its common stock. The company paid dividends of $.40, $.45, $.52 and $.60 per share in the last four years. If the stock currently sells for $12, what is your best estimate of the company's cost of equity capital? Round your answer to the nearest basis point, or hundredth of percent. (NOTE: enter your answer as percent without the percentage sign. For example, if your answer is 5.45%, enter 5.45).

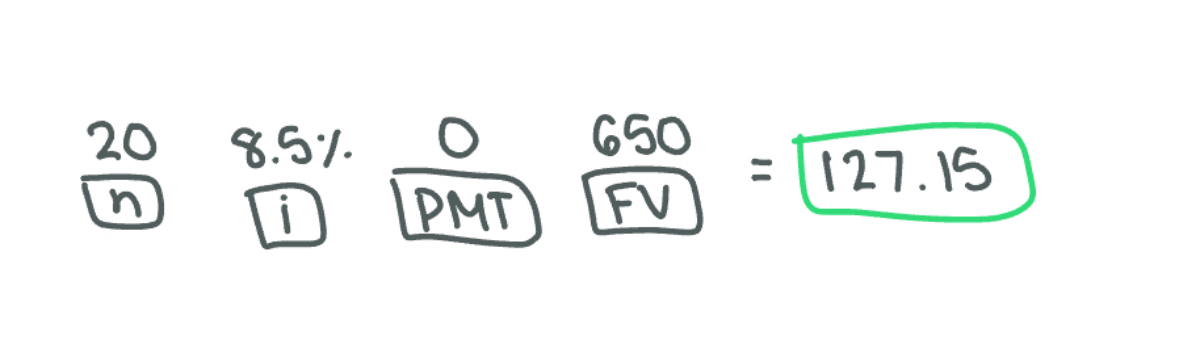

$ 127.15 million

Imprudential, Inc., has an unfunded pension liability of $650 million that must be paid in 20 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. If the relevant discount rate is 8.5%, what is the present value of this liability? (round to the nearest ten thousand dollar).

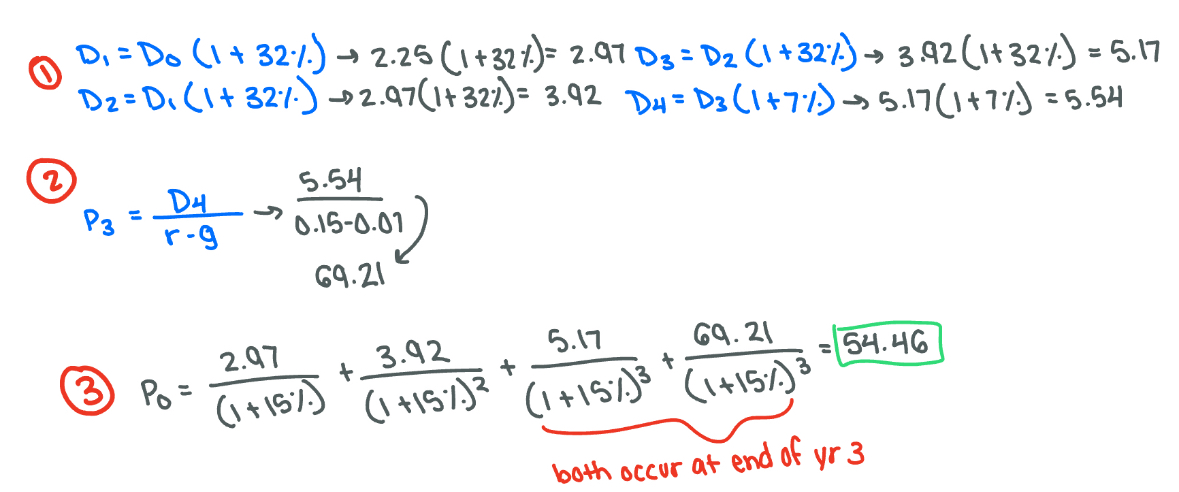

$54.46

Super Growth Co. is growing quickly. Dividends are expected to grow at a 32 percent rate for the next three years, with the growth rate falling off to a constant 7 percent thereafter. If the required return is 15 percent and the company just paid a $2.25 dividend, what is the current share price? Round your answer to the nearest dollar. (NOTE: do NOT include the dollar sign in your answer).

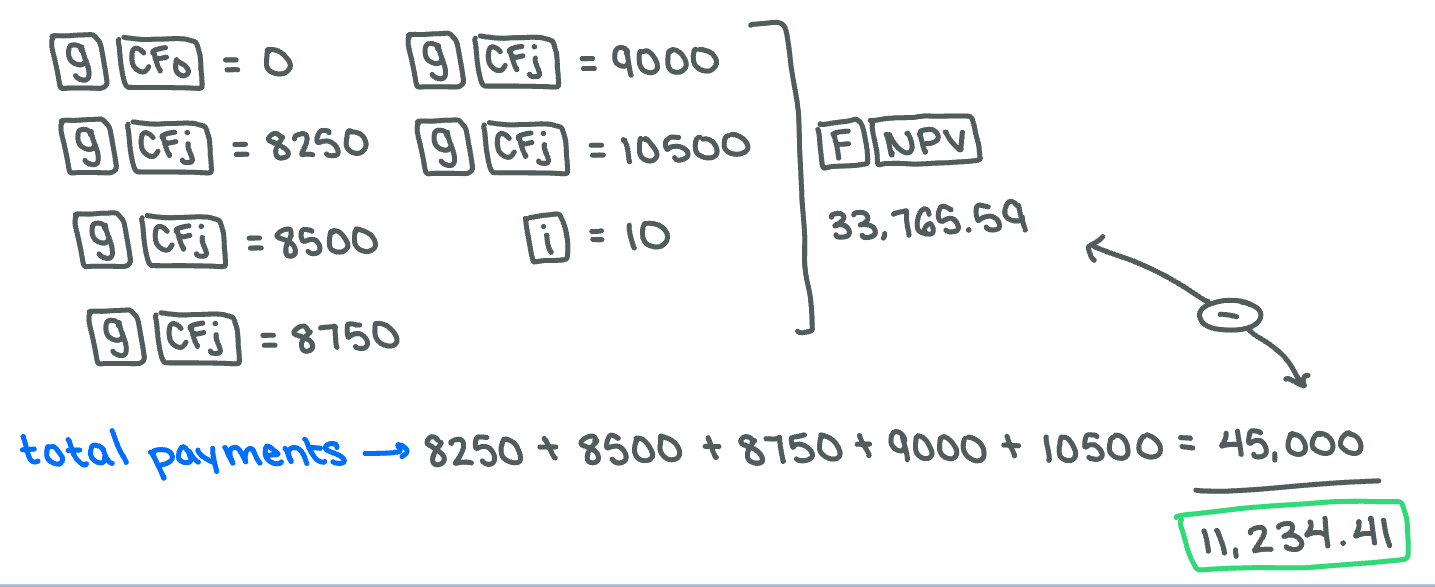

$11,234

Jane Bryant has just purchased some equipment for her beauty salon, financed by the equipment maker. To pay off the equipment loan, Jane must make the following payments at the end of the next five years: $8,250, $8,500, $8,750, $9,000, and $10,500. If the loan interest rate is 10 percent, how much interest will Jane pay in total? (round your answer to the nearest dollar).

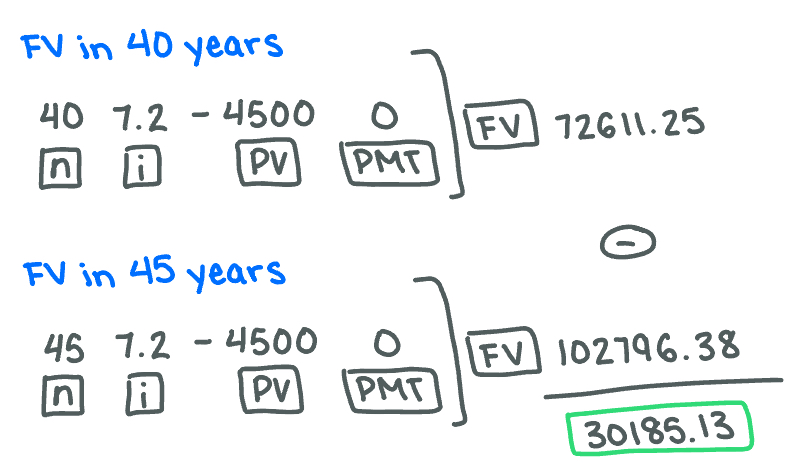

$30,185

You are depositing $4,500 today at an interest rate of 7.2%, compounded annually. How much additional interest will you earn if you leave the money invested for 45 years instead of 40 years? (Round your answer to the nearest dollar).

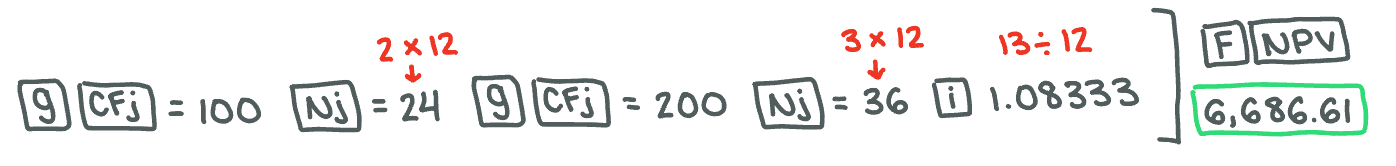

$6,687

What is the present value of receiving $100 monthly for two years, followed by $200 monthly for the next three years, payments? Assuming that the annual interest rate is 13%, compounded monthly. (round to the nearest dollar)

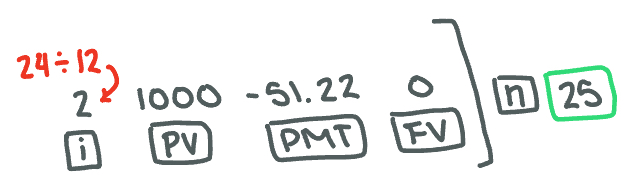

25 months

Your credit card has a balance of $1,000 and the bank requires a minimum monthly payment of $51.22. The annual interest rate on the credit card is 24%. If you only make minimum payment every month and do NOT make additional charges on the card, how long will it take to pay off the balance (round it to the whole month)?

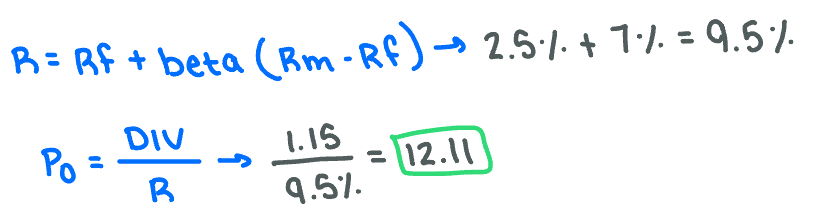

About $12.11

A firm pays an annual dividend of $1.15 today. The risk-free rate (Rf) is 2.5%, and the risk premium for the stock is 7%. What is the value of the stock, if the dividend is expected to remain constant?